Global Hard Kombucha Market, By Product (Plain and Flavoured), By Category (Conventional and Organic), By Distribution Channel (Online Platforms, and Offline Stores), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 100049

- Number of Pages: 254

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

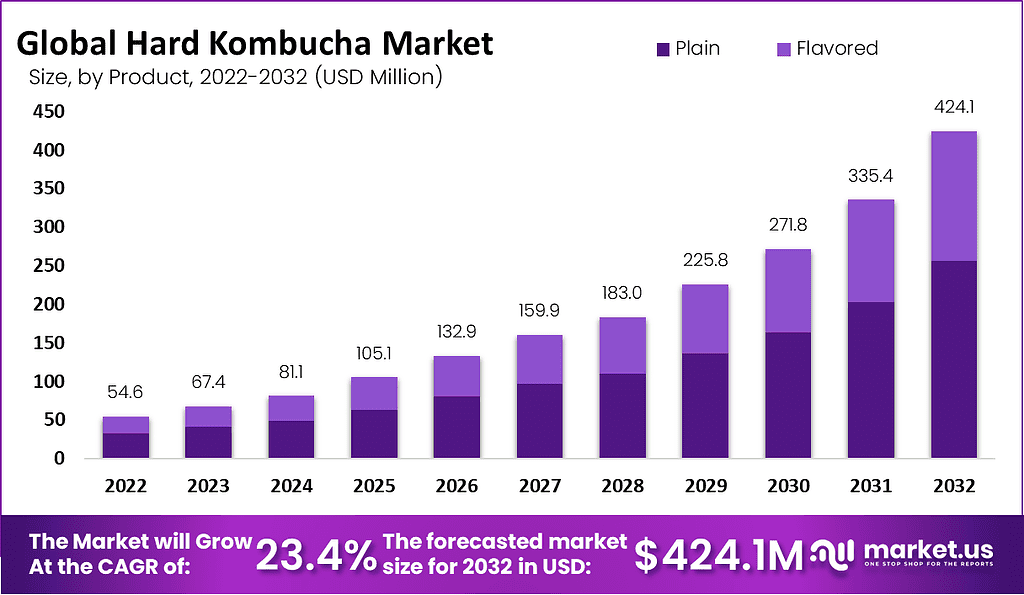

The Global Hard Kombucha Market size is expected to be worth around USD 424.1 million by 2032 from USD 54.6 million in 2023, growing at a CAGR of 23.4% during the forecast period from 2022 to 2032.

Hard kombucha is made with a few basic components, including bacteria, yeast, sugar, and tea. The market demand is being driven by consumers’ increasing consumption of beverages with a moderate alcohol level, particularly millennials and the younger generation.

A symbiotic culture of bacteria and yeast (SCOBY) is added to a sugar and tea solution to produce the fermented tea beverage kombucha. A naturally carbonated beverage with a slightly sweet-sour flavor, produced by the cultures during the week-long fermentation process, contains healthful ingredients like antioxidants, B vitamins, organic acids, and traces of alcohol.

Key Takeaways

- Market Growth: The Hard Kombucha Market is set to experience significant growth, with a projected CAGR of 23.4% from 2023 to 2032. The market value is expected to surge from USD 54.6 million in 2023 to a substantial USD 424.1 million by 2032.

- Health-Conscious Consumers: The rising trend of health consciousness among consumers is driving the demand for healthier alcoholic beverages. Hard kombucha, with its probiotic content and lower calorie and sugar levels compared to traditional beer and wine, is considered a healthier alternative.

- Flavor Variety: Hard kombucha comes in a wide range of flavors, catering to consumers who seek variety in their beverages. This diversity in flavor options is a key driver of market growth.

- Distribution Channels: The availability of hard kombucha is expanding, with both online platforms and offline stores offering it. This includes health food stores, specialized shops, and even traditional outlets like liquor stores and online retailers.

- Challenges in Adoption: The high cost of hard kombucha, compared to traditional beer and wine, may deter some consumers from making regular purchases. Additionally, limited consumer awareness and competition with other alcoholic beverages could pose challenges to market expansion.

- Product Segmentation: The market for hard kombucha is divided into two main product segments: plain and flavored. In 2022, plain kombucha held the largest market share, driven by consumer preferences for fermented drinks with a health focus.

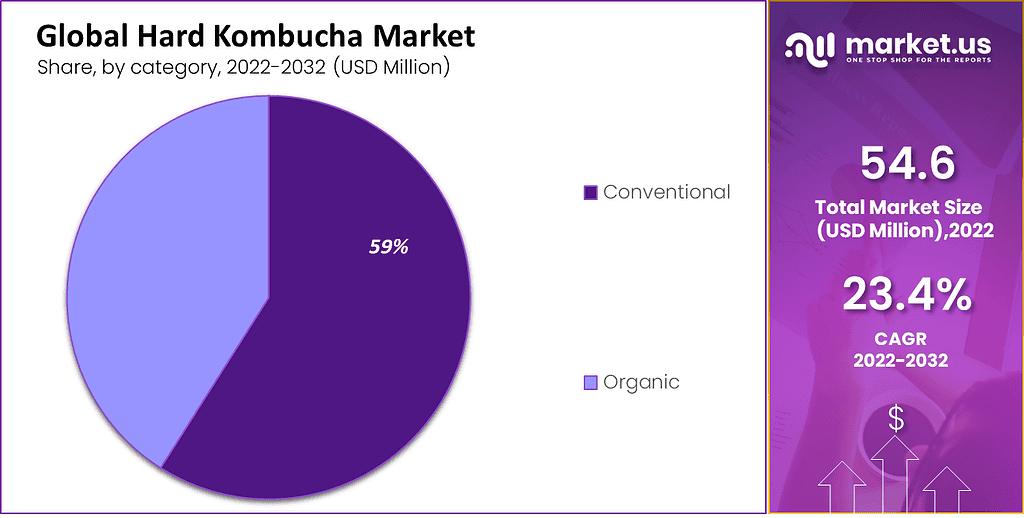

- Category Preferences: The market also distinguishes between conventional and organic hard kombucha. Conventional products dominate due to their lower cost and easy availability of common ingredients.

- Distribution Channels: Offline stores, providing physical visibility and accessibility, hold the highest revenue share. However, online platforms are also gaining traction as e-commerce and online shopping grow.

- Global Expansion Opportunities: While the hard kombucha market has been primarily concentrated in North America, there is potential for expansion in regions like Europe and Asia. Manufacturers have an opportunity to enter new markets and offer innovative products.

- Premium Positioning: Hard kombucha can be positioned as a premium beverage, attracting consumers with its high-end image, premium ingredients, distinctive packaging, and pricing strategies.

- Trends: Health and wellness, as well as flavor innovation, are significant trends in the hard kombucha market. The probiotic and lower-calorie content make it a healthier alternative, while manufacturers continually experiment with new flavors.

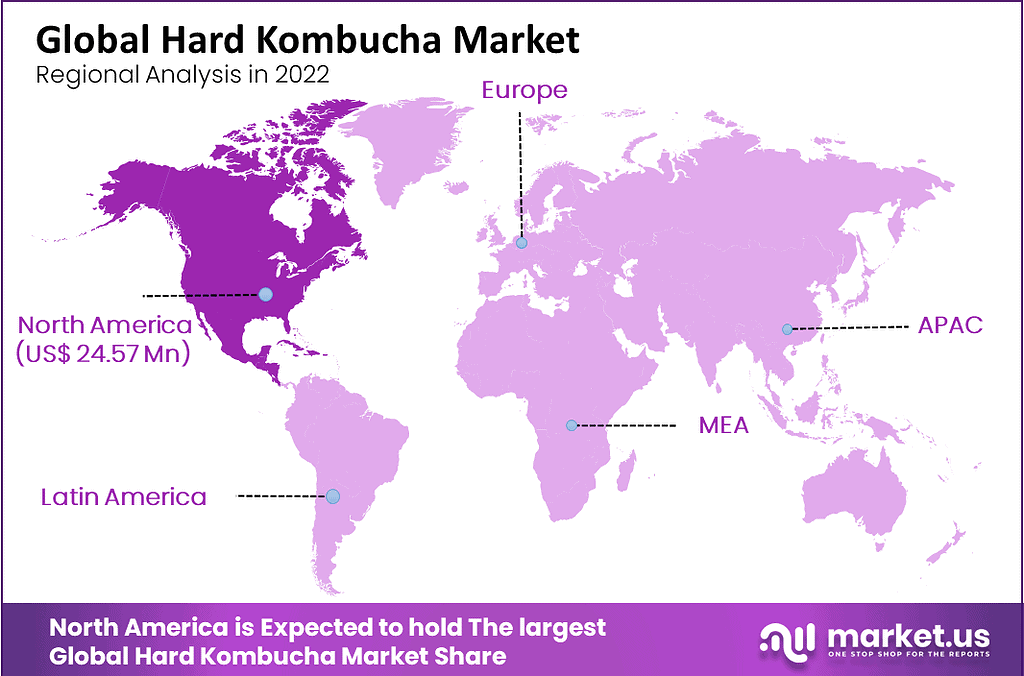

- Regional Dominance: In 2022, North America held the largest market share, driven by the demand from baby boomers, millennials, and Gen Z consumers. However, the Asia Pacific market is expected to grow at a faster rate from 2022 to 2030.

- Key Players: The market features several key players, including Remedy Drinks, Jiant, Flying Embers, June Shine, Boochcraft, Kyla, Unity Vibration, and many others. The competition and market dynamics are expected to evolve.

Driving Factors

Increasing demand for healthier alcoholic beverages:

As consumers become aware of their health, they are looking for healthier options for alcoholic drinks. Because of its probiotic content and lower calorie and sugar content than regular beer and wine, hard kombucha is viewed as a healthier choice.

Availability of a wide range of flavors:

Hard kombucha is offered in many tastes, which appeals to customers who want variety.

Increasing availability and distribution:

Hard kombucha is becoming more widely available and is being sold through both online and offline distribution channels, including health food stores, specialized shops, and traditional outlets like liquor stores and internet retailers.

Restraining Factors

High cost: Traditional beer and wine are sometimes less expensive than hard kombucha, which may discourage some consumers’ decisions for regular purchases.

Limited consumer awareness: Hard kombucha competes with a variety of other alcoholic beverages even though it is a healthier alternative to typical beer and wine. The possibility of hard kombucha gaining market share may be constrained by the size and stability of the market for these beverages.

Product Analysis

Based on product, the market for hard kombucha is segmented into plain and flavored. In 2022, the plain kombucha segment accounted for the largest market share. A shift in consumer preference towards fermented drinks/beverages with a health focus is expected to drive demand for this product.

These beverages contain probiotic microorganisms that help consumers treat illnesses like inflammation and digestion. Major market players are consequently launching new products to meet these needs.

Category Analysis

Based on category, the market for hard kombucha is segmented into conventional and organic. The conventional segment has the highest revenue share. Hard kombucha made with regular ingredients is less expensive than organic kombucha.

Common ingredients are widely available. The conventional industry is consequently predicted to obtain the biggest proportion of hard kombucha due to low prices and simple access to components.

Distribution Channel Analysis

Based on the distribution channel, the market for hard kombucha is segmented into offline stores and online platforms. The offline store segment has the highest revenue share. Offline stores are important distribution platforms for hard kombucha brands since they provide physical visibility and accessibility for consumers who prefer to purchase products personally.

However, as e-commerce and online shopping grow at a high growth rate, many hard kombucha businesses are also putting their attention towards establishing their online presence and providing direct-to-consumer sales through their own websites or online marketplaces.

Key Market Segments

Based on Product

- Plain

- Flavored

Based on Category

- Conventional

- Organic

Based on the Distribution Channel

- Online Platforms

- Offline Stores

Growth Opportunity

The hard kombucha market has primarily been concentrated in North America, but there is potential for expansion in other areas, including Europe and Asia. Hard kombucha manufacturers have a chance to expand their customer base and get into new markets as consumer demand and awareness for healthy alcoholic beverages rise globally. The hard kombucha industry offers an opportunity for product innovation, notably in the creation of new and distinctive flavors.

Offering new items that appeal to customers looking for fresh and fascinating options is one way for producers to set themselves apart from the competition. Collaboration with other food and beverage businesses can help in extending the hard kombucha market and distribution. Partnerships with specialty food stores or craft breweries, for instance, can help to improve the product’s accessibility and visibility.

Hard kombucha has a chance to boost its market share as customers look for better options in the alcoholic beverage sector because of the rising emphasis on health and wellness. Use of kombucha’s health advantages, like better immunity and gut health, to draw in health-conscious customers.

Producers of hard kombucha have a chance to reach a larger audience and boost sales due to the expansion of e-commerce and online sales. A useful strategy for customers to order hard kombucha and have it delivered right to their homes through online sales.

There is a chance to promote hard kombucha as a premium beverage in the market because it is viewed as a high-end product. This can be accomplished by utilizing premium ingredients, distinctive packaging, and price techniques.

Latest Trends

The growing focus on health and wellness is one of the greatest trends in the hard kombucha market. Hard kombucha is viewed as a healthier alternative to standard alcoholic beverages due to its probiotics and lower calorie content. Customers are increasingly looking for healthier beverage options. Flavor innovation is another popular trend in the hard kombucha market.

Hard kombucha comes in various flavors, ranging from more unusual ones like ginger and turmeric to more common fruit flavors like raspberry and blueberry. To create fresh and distinctive products, manufacturers constantly experiment with new flavor pairings and ingredients. Hard kombucha frequently has a higher cost point than ordinary beer and wine because it is marketed as a premium product.

Regional Analysis

In 2022, North America was dominating the market, with more than 45.00% of the global revenue share. Baby boomers, millennials, and Gen Z customers are among those driving up demand in the region. The major participants in the market are cleverly promoting their goods. Colony, for example, advertised its hard kombucha in November 2020 by creating a brand identity and packaging system that effectively and rapidly communicated product qualities.

Also, these drinks have gained acceptance among both male and female customers due to their widespread appeal, which will probably lead to an increase in consumption of these drinks in the years to come. From 2022 to 2030, the Asia Pacific market is anticipated to develop at a faster rate among all regions. Consumers in countries such as China, Japan, and Australia are becoming more aware of the products, and this is projected to boost market expansion in the region.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

The market for hard kombucha is anticipated to expand rapidly, with North America continuing to have the largest market share. The market share of different regions and players is subject to change based on various factors including shifting customer preferences, market competition, and governmental rules.

Due to the growing trend of e-commerce and the convenience of home delivery, the analysis forecasts that the online sales channel would experience significant development during the projected period.

Top Key Players

- Remedy Drinks

- Jiant

- Flying Embers

- June Shine

- Boochcraft

- Kyla

- Unity Vibration

- Hops

- Ventura Brewing

- Allkind

- GTs Living Foods LLC.

- Buddha’s Brew, Inc.

- Kombrewcha

- Odell Brewing Co.

- Ummi kombucha

- Other Market Players

Recent Developments

- Hooch Booch, a hard kombucha brand with a base in Denver, Col., launched in Minnesota in April 2022.

- In June 2021, Sierra Nevada Brewery Co. increased the variety of “Strange Beast” hard kombuchas it offers, including flavors such as ginger, lemon, and hibiscus.

- In May 2021 Lucky Booch, a new brand of alcoholic kombucha, was introduced by North KC’s Brewery. It comes in four flavors: lavender lemon (4% ABV), peach flower (4% ABV), hops & passion (7% ABV), and tart raspberry (7% ABV).

Report Scope

Report Features Description Market Value (2022) US$ 54.6 million Forecast Revenue (2032) US$ 424.1 million CAGR (2023-2032) 23.4% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Plain and Flavored), By Category (Conventional and Organic), By Distribution Channel (Online Platforms and Offline Stores) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Remedy Drinks, Jiant, Flying Embers, June Shine, Boochcraft, Kyla, Unity Vibration, Dr Hops, Ventura Brewing, Allkind, GTs Living Foods LLC., Buddha’s Brew, Inc., Kombrewcha, Odell Brewing Co., Ummi kombucha, Other Market Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the projected CAGR at which the Hard Kombucha Market is expected to grow at?The Hard Kombucha Market is expected to grow at a CAGR of 23.4% (2023-2032).

What is the size of the Hard Kombucha Market in 2023?The Hard Kombucha Market size is USD 54.6 Billion in 2023.

Which region is more appealing for vendors employed in the Hard Kombucha Market?In 2022, North America was dominating the market, with more than 45.00% of the global revenue share.

Name the key business areas for the Hard Kombucha Market.The US, Canada, China, India, Brazil, South Africa, Singapore, Indonesia, Portugal, etc., are leading key areas of operation for the Hard Kombucha Market.

List the segments encompassed in this report on the Hard Kombucha Market?Market.US has segmented the Hard Kombucha Market by geography (North America, Europe, APAC, South America, And Middle East and South Africa). The market has been segmented Based on Product Plain, and Flavored. Based on Category Conventional and Organic. Based on Distribution Channel Online Platforms and Offline Stores.

-

-

- Remedy Drinks

- Jiant

- Flying Embers

- June Shine

- Boochcraft

- Kyla

- Unity Vibration

- Hops

- Ventura Brewing

- Allkind

- GTs Living Foods LLC.

- Buddha's Brew, Inc.

- Kombrewcha

- Odell Brewing Co.

- Ummi kombucha

- Other Market Players