Global Hand Care Market Size, Share, Growth Analysis By Ingredient Type (Natural, Synthetic), By Product (Hand Creams/Moisturizers, Hand Wash, Hand Sanitizer), By End Use (Men, Women), By Distribution Channel (Supermarket & Hypermarket, Drugstore/Pharmacy, Online, Specialty Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 158706

- Number of Pages: 300

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

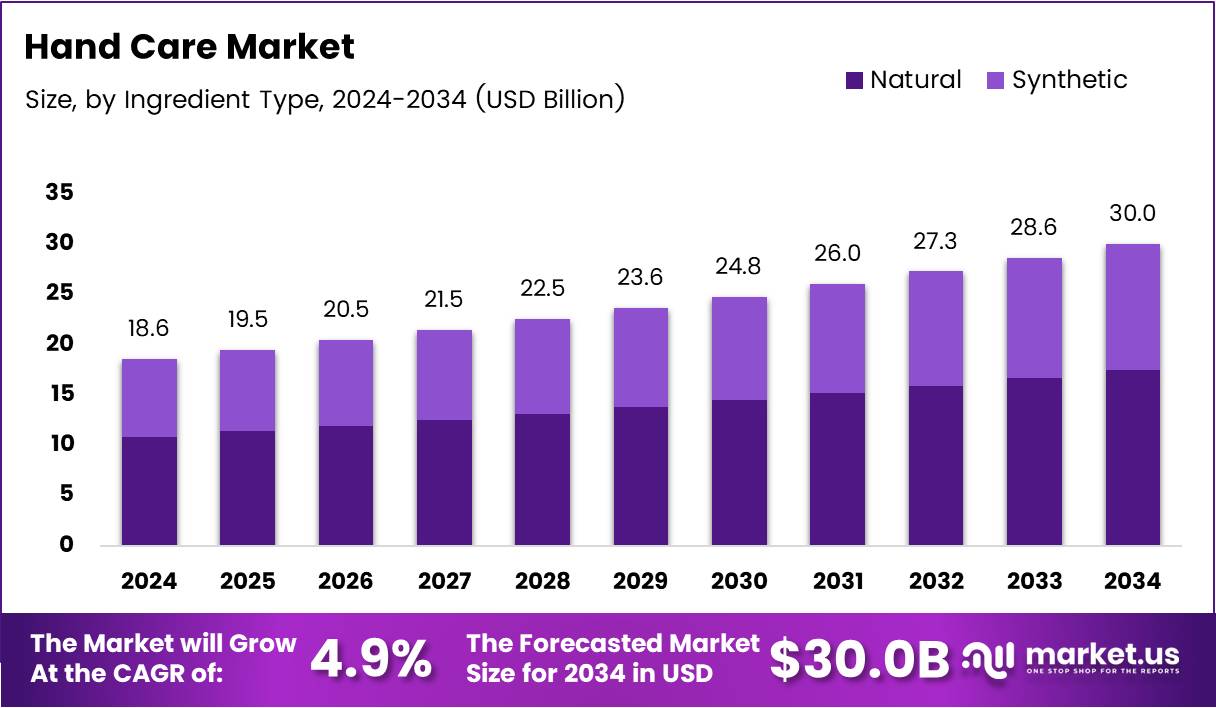

The Global Hand Care Market size is expected to be worth around USD 30.0 Billion by 2034, from USD 18.6 Billion in 2024, growing at a CAGR of 4.9% during the forecast period from 2025 to 2034.

The hand care market is a dynamic segment of the beauty and personal care industry, driven by rising consumer awareness of skin health and hygiene. Consumers are becoming more conscious about maintaining healthy and moisturized hands, especially with the increased use of hand sanitizers and washing during the pandemic. The market is expected to see steady growth as individuals prioritize hand care routines.

In recent years, there has been a noticeable increase in demand for hand care products, including moisturizers, sanitizers, and hand creams. This shift is largely attributed to growing consumer interest in personal wellness and self-care. As awareness of the importance of hand hygiene grows, brands are expanding their product lines to cater to diverse consumer preferences.

Government initiatives and regulations play a significant role in shaping the hand care market. With stricter hygiene protocols in place globally, regulations regarding the safety and efficacy of hand sanitizers and other skin care products have become increasingly important. The formulation and labeling of these products are now more regulated to ensure consumer safety, further boosting confidence in these products.

There are significant growth opportunities in the hand care market, especially with the rising trend of clean beauty. Brands focusing on natural and organic ingredients are becoming increasingly popular among consumers. Additionally, with the rise of e-commerce, consumers can easily access a variety of hand care products at their convenience, further expanding the market reach.

A recent survey revealed that 70% of respondents consider hand care a very important part of their beauty routine, with 22% viewing it as somewhat important. Among beauty enthusiasts, 50% perform hand care routines daily. These statistics highlight the strong consumer interest in hand care and the potential for continued market expansion.

Government investment in wellness initiatives also supports market growth, with several countries promoting public health campaigns that include hand hygiene. As the market continues to evolve, consumer preferences will guide brands toward more targeted and effective hand care solutions. With increasing demand for convenience and quality, the hand care market is poised for further development.

Key Takeaways

- The Global Hand Care Market size is expected to reach USD 30.0 Billion by 2034, from USD 18.6 Billion in 2024, growing at a CAGR of 4.9% from 2025 to 2034.

- Natural ingredient type dominated the Hand Care Market in 2024, holding a 58.3% share.

- Hand Creams/Moisturizers led the By Product Analysis segment in 2024, with a 41.2% market share.

- The Women segment held the dominant position in the By End Use Analysis segment in 2024.

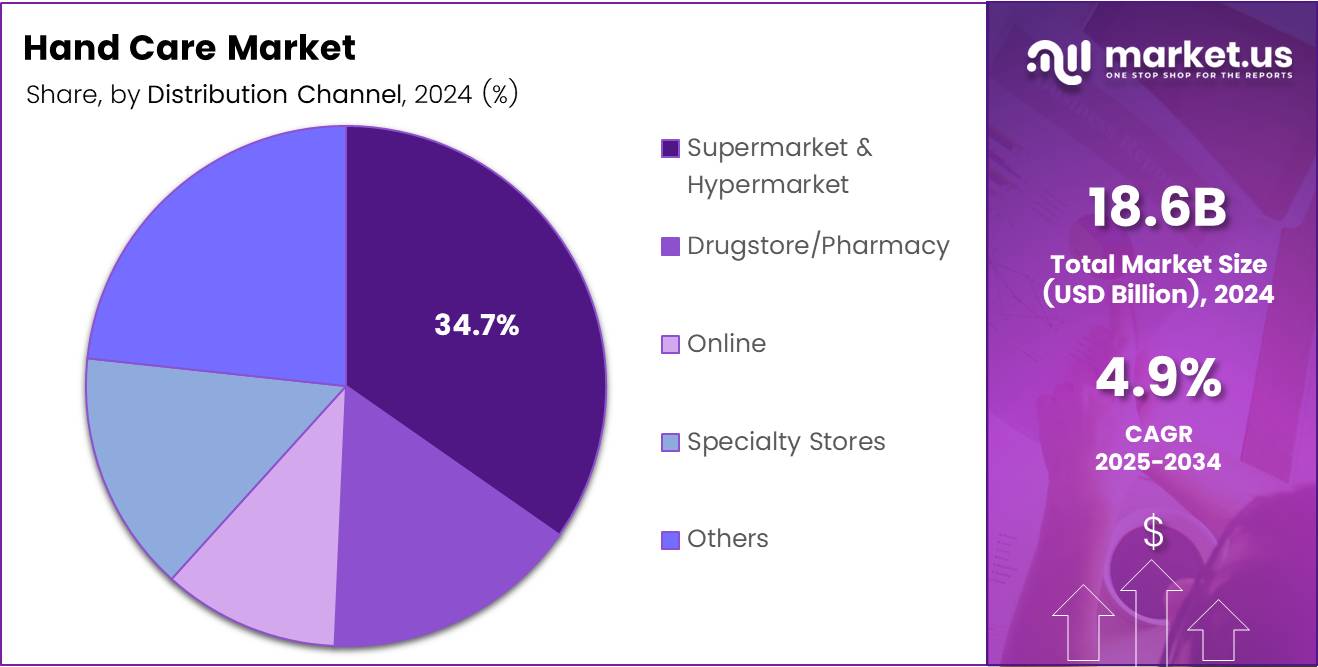

- Supermarket & Hypermarket was the leading distribution channel in 2024, holding a 34.7% share.

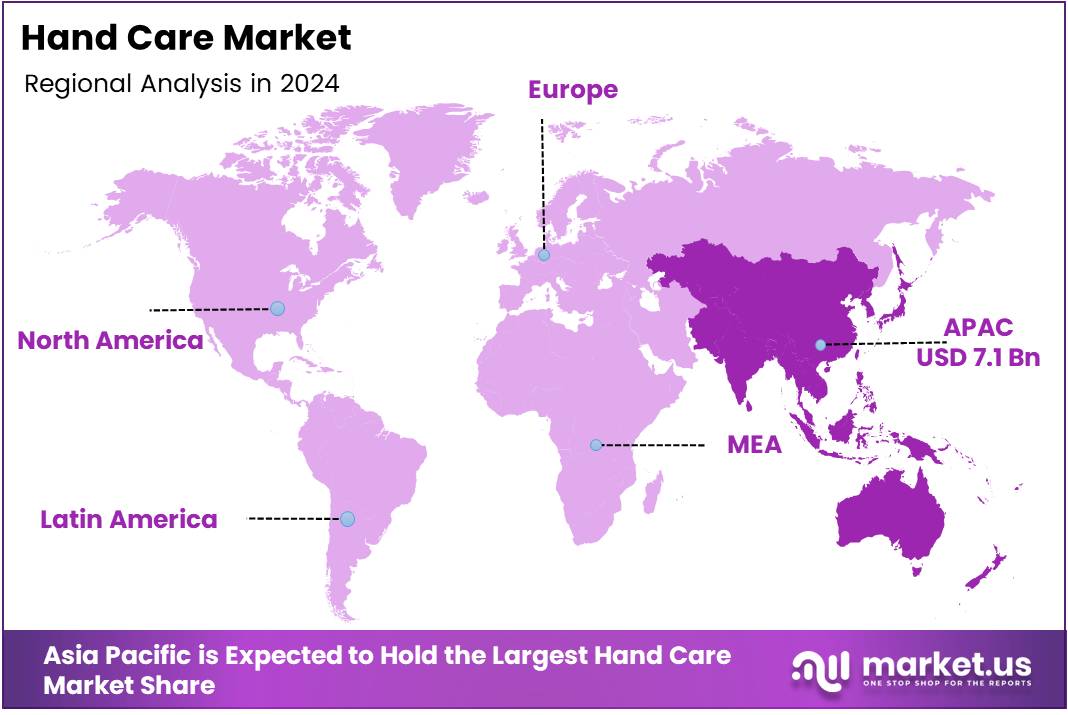

- Asia Pacific dominated the regional market in 2024 with 38.4% market share, valued at USD 7.1 Billion.

By Ingredient Type Analysis

Natural dominates with 58.3% due to consumers’ growing preference for organic and eco-friendly formulations.

In 2024, Natural held a dominant market position in the By Ingredient Type Analysis segment of Hand Care Market, with a 58.3% share. This dominance reflects consumers’ growing preference for organic and eco-friendly formulations that minimize harsh chemicals and potential skin irritation.

Natural ingredients have gained significant traction as consumers become increasingly health-conscious and environmentally aware. These formulations typically incorporate botanical extracts, essential oils, and plant-based moisturizers that appeal to users seeking gentle yet effective hand care solutions.

Conversely, synthetic ingredients maintain their market presence through advanced formulations that offer consistent performance and longer shelf life. Synthetic products often provide enhanced antimicrobial properties and cost-effective manufacturing, making them attractive for budget-conscious consumers and institutional buyers.

The shift toward natural ingredients represents a fundamental change in consumer behavior, driven by increased awareness of ingredient transparency and sustainability concerns. This trend continues to shape product development strategies across the hand care industry.

By Product Analysis

Hand Creams/Moisturizers dominate with 41.2% due to universal appeal and year-round necessity.

In 2024, Hand Creams/Moisturizers held a dominant market position in the By Product Analysis segment of Hand Care Market, with a 41.2% share. This category’s leadership stems from universal appeal and year-round necessity for maintaining skin hydration and protection against environmental factors.

Hand creams and moisturizers represent the cornerstone of hand care routines, offering deep hydration and barrier protection. These products cater to diverse skin types and concerns, from anti-aging formulations to sensitive skin variants, ensuring broad market appeal.

Hand wash products constitute another significant segment, driven by heightened hygiene awareness and daily usage patterns. These products range from basic cleansing formulations to premium antibacterial variants that combine cleansing with moisturizing benefits.

Hand sanitizers complete the product portfolio, experiencing substantial growth due to increased health consciousness. These products offer convenience and portability, making them essential for on-the-go hygiene maintenance and professional environments requiring frequent hand disinfection.

By End Use Analysis

Women dominate due to traditional beauty and personal care purchasing patterns.

In 2024, Women held a dominant market position in the By End Use Analysis segment of Hand Care Market. Women’s segment dominance reflects traditional beauty and personal care purchasing patterns, with female consumers typically investing more in comprehensive skincare routines and premium formulations.

Women consumers demonstrate higher engagement with hand care products, often seeking multi-functional formulations that address aging, moisturization, and aesthetic concerns. This segment drives innovation in packaging, fragrance, and specialized ingredients targeting specific skin concerns and preferences.

The men’s segment represents a growing market opportunity, driven by evolving grooming habits and increased awareness of personal care importance. Male consumers increasingly recognize hand care as essential for professional appearance and overall hygiene maintenance.

Market expansion in the men’s segment reflects broader cultural shifts toward comprehensive male grooming. Brands are developing targeted formulations with masculine packaging and marketing approaches to capture this emerging consumer base effectively.

By Distribution Channel Analysis

Supermarket & Hypermarket dominate with 34.7% due to convenient one-stop shopping experiences and competitive pricing.

In 2024, Supermarket & Hypermarket held a dominant market position in the By Distribution Channel Analysis segment of Hand Care Market, with a 34.7% share. This channel’s dominance reflects convenient one-stop shopping experiences and competitive pricing strategies that attract diverse consumer demographics.

Supermarkets and hypermarkets offer extensive product variety and promotional opportunities, making hand care products easily accessible during routine shopping trips. These venues provide physical product examination and immediate purchase satisfaction that many consumers prefer.

Drugstores and pharmacies represent trusted healthcare-oriented retail environments where consumers seek professional recommendations and therapeutic formulations. This channel particularly appeals to consumers with specific skin conditions or those seeking premium, medically-endorsed products.

Online channels continue expanding rapidly, offering convenience, detailed product information, and competitive pricing. Digital platforms enable subscription services and personalized recommendations, particularly attracting younger consumers and busy professionals seeking hassle-free purchasing experiences.

Specialty stores provide expert consultation and curated product selections, appealing to discerning consumers seeking premium or niche formulations. These venues often feature exclusive brands and personalized service that justify higher price points.

Other distribution channels include direct sales, beauty salons, and institutional suppliers, each serving specific market segments with tailored approaches and specialized product offerings targeting unique consumer needs and preferences.

Key Market Segments

By Ingredient Type

- Natural

- Synthetic

By Product

- Hand Creams/Moisturizers

- Hand Wash

- Hand Sanitizer

By End Use

- Men

- Women

By Distribution Channel

- Supermarket & Hypermarket

- Drugstore/Pharmacy

- Online

- Specialty Stores

- Others

Drivers

Increasing Awareness of Skin Health and Hygiene Drives Market Growth

The hand care market is experiencing significant growth driven by multiple key factors that are reshaping consumer behavior and market dynamics.

Consumer awareness about skin health and hygiene has reached new heights, particularly following the global pandemic. People now understand that hands are the primary contact point for germs and bacteria. This awareness has made regular hand care a daily necessity rather than an occasional luxury. Consumers are actively seeking products that not only clean but also protect and nourish their hands.

The demand for natural and organic hand care products is rising rapidly as consumers become more conscious about chemical ingredients. People prefer products with botanical extracts, essential oils, and plant-based formulations. This shift reflects a broader trend toward clean beauty and wellness, where consumers scrutinize ingredient lists and choose safer alternatives.

Anti-aging hand care solutions are gaining popularity as consumers recognize that hands show signs of aging prominently. Products containing retinol, peptides, and moisturizing agents are increasingly sought after. This trend is particularly strong among middle-aged consumers who want to maintain youthful-looking hands.

Retail distribution channels are expanding significantly, making hand care products more accessible. From traditional pharmacies to online platforms, specialty beauty stores, and even grocery chains, consumers can now find hand care products everywhere. This widespread availability has contributed to increased sales and market penetration across different demographic segments.

Restraints

Limited Awareness in Rural Regions Restrains Market Expansion

Despite positive growth trends, the hand care market faces several significant challenges that limit its full potential and create barriers to widespread adoption.

Limited awareness in rural and underdeveloped regions remains a major constraint for market growth. Many consumers in these areas lack access to information about hand care benefits and proper hygiene practices. Traditional habits and limited exposure to modern skincare concepts prevent market penetration. Additionally, affordability concerns and priority given to basic necessities over cosmetic products further restrict demand in these regions.

Allergic reactions and skin sensitivity concerns pose another significant challenge for the industry. Many consumers experience adverse reactions to fragrances, preservatives, or active ingredients commonly found in hand care products. This has led to increased scrutiny of product formulations and demand for hypoallergenic alternatives. Manufacturers must invest heavily in research and testing to develop gentler formulations that minimize sensitivity risks.

Environmental impact of packaging materials used in hand care products is becoming a growing concern among environmentally conscious consumers. Plastic tubes, bottles, and non-recyclable packaging create sustainability issues that conflict with eco-friendly values. This concern is particularly pronounced among younger consumers who prioritize environmental responsibility. Companies face pressure to redesign packaging using sustainable materials, which often increases production costs and complexity.

These restraints require strategic solutions from industry players to overcome market barriers and achieve sustainable growth across all consumer segments.

Growth Factors

Emergence of Eco-Friendly Products Creates New Growth Opportunities

The hand care market presents numerous exciting growth opportunities that forward-thinking companies can capitalize on to expand their market presence and revenue streams.

The emergence of eco-friendly and sustainable hand care products represents a massive untapped opportunity. Consumers increasingly demand products with biodegradable formulations, recyclable packaging, and minimal environmental footprint. Brands that successfully develop and market sustainable alternatives can capture the growing segment of environmentally conscious consumers and command premium pricing for their products.

Rising adoption of premium hand care solutions in developed markets offers significant revenue potential. Affluent consumers are willing to pay higher prices for luxury hand care products with advanced formulations, elegant packaging, and superior performance. This trend includes products with rare ingredients, sophisticated textures, and premium brand positioning that appeal to discerning customers seeking indulgent experiences.

Innovations in hand sanitizers and antimicrobial hand care products continue to drive market expansion. The ongoing focus on hygiene has created sustained demand for products that combine cleaning, protection, and moisturizing benefits. Advanced formulations with long-lasting antimicrobial effects, non-drying ingredients, and pleasant textures present opportunities for differentiation and market share growth.

The expanding market for hand care solutions targeting elderly consumers represents an underserved segment with specific needs. Aging hands require specialized care for issues like dryness, age spots, and decreased elasticity. Products designed specifically for mature skin with targeted ingredients and easy-to-use packaging can capture this growing demographic segment.

Emerging Trends

Integration with Wellness Routines Shapes Current Market Trends

Current market trends in the hand care industry reflect evolving consumer preferences and lifestyle changes that are reshaping product development and marketing strategies.

Integration of hand care solutions with wellness and self-care routines has become a dominant trend. Consumers now view hand care as an essential component of their overall wellness regimen rather than a standalone activity. Products that promote relaxation, stress relief, and mindful moments through aromatherapy, luxurious textures, and ritualistic application are gaining significant traction in the market.

The surge in demand for hand creams with SPF protection reflects increased awareness about sun damage prevention. Consumers recognize that hands are frequently exposed to harmful UV rays and require dedicated protection. Products combining moisturizing benefits with broad-spectrum sun protection are becoming essential items for daily skincare routines, particularly among health-conscious consumers.

Growth of DIY and at-home hand care kits represents a shift toward personalized beauty experiences. Consumers enjoy creating spa-like experiences at home with complete hand care systems including scrubs, masks, serums, and moisturizers. This trend has been accelerated by social media content showing hand care routines and has created opportunities for bundled product offerings.

The rising influence of beauty influencers and social media on hand care trends cannot be overlooked. Platforms like Instagram and TikTok showcase hand care routines, product reviews, and before-and-after transformations that drive consumer interest and purchasing decisions. Influencer partnerships and user-generated content have become powerful marketing tools that shape consumer preferences and brand loyalty.

Regional Analysis

Asia Pacific Dominates the Hand Care Market with a Market Share of 38.4%, Valued at USD 7.1 Billion

Asia Pacific is the leading region in the global hand care market, holding a significant market share of 38.4% valued at USD 7.1 Billion. The region’s dominance can be attributed to growing consumer awareness about personal care and hygiene, coupled with increasing disposable income in emerging markets like China and India. Additionally, the growing demand for premium hand care products and innovations in formulations are contributing to the growth in this region.

North America Hand Care Market Trends

North America holds a strong position in the hand care market, driven by increasing consumer preference for advanced skincare products and organic hand care solutions. The rising awareness about hand hygiene, especially post-pandemic, has led to a surge in demand for hand sanitizers and moisturizers. Moreover, the presence of key players and a well-established distribution network support market expansion in this region.

Europe Hand Care Market Trends

Europe exhibits steady growth in the hand care market, propelled by the growing inclination towards natural and eco-friendly products. Countries such as the UK, Germany, and France are seeing an increased focus on dermatologically tested products and hand creams formulated with sustainable ingredients. The demand for luxury hand care products is also witnessing an upward trend, contributing to the region’s market growth.

Latin America Hand Care Market Trends

The Latin American hand care market is experiencing growth, driven by the rising middle-class population and increasing awareness about skincare. The market in this region is also supported by the growing demand for affordable hand care solutions that cater to local preferences, with an emphasis on moisturizing and anti-aging products. Brazil, Mexico, and Argentina are key markets in the region.

Middle East and Africa Hand Care Market Trends

The Middle East and Africa region is witnessing a gradual increase in the demand for hand care products, primarily due to the region’s growing focus on personal grooming and hygiene. The rise in disposable income, along with an expanding retail sector, is helping to fuel the market’s growth. Additionally, the region’s hot and dry climate drives the need for moisturizing products, particularly in countries like the UAE and Saudi Arabia.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Hand Care Company Insights

In 2024, The Clorox Company continues to make strides in the hand care market, particularly with its strong portfolio of cleaning and sanitizing products. Its innovation in sanitizing wipes and disinfectants has positioned the company as a key player in the increasing demand for hygiene-related hand care products, especially in the post-pandemic era.

Colgate-Palmolive Company is expanding its reach in hand care with its renowned line of soaps and hand sanitizers. Leveraging its expertise in personal care, the company is emphasizing sustainability in its product formulations, which resonates well with consumers’ growing preference for eco-friendly products.

Solenis is diversifying its portfolio by incorporating sustainable and performance-driven solutions into the hand care segment. Known for its advanced chemical formulations, Solenis’ products focus on enhancing the efficacy of hand cleaning products, contributing to the overall growth of the hand care industry.

Unilever PLC stands out in the market with its broad range of hand care products under popular brands like Dove and Lifebuoy. The company is investing heavily in sustainability initiatives and social impact campaigns, which are expected to drive growth, particularly in emerging markets where hand hygiene awareness is on the rise.

Top Key Players in the Market

- The Clorox Company

- Colgate-Palmolive Company

- Solenis

- Unilever PLC

- Bath & Body Works, Inc.

- The Procter & Gamble Company

- Reckitt Benckiser Group plc

- Kimberly-Clark Corporation

- Henkel AG & Co. KGaA

- GOJO Industries, Inc.

Recent Developments

- In May 2025, Church & Dwight acquires Touchland for up to US$880M. This strategic acquisition aims to expand Church & Dwight’s portfolio in the personal care segment, enhancing its market presence with Touchland’s innovative hand sanitizers.

- In September 2025, VERTESS announces the acquisition of Helping Hands Home Care Services. This acquisition will strengthen VERTESS’s position in the home care sector, providing high-quality services to an expanding aging population.

- In July 2025, Hanger announces its impending acquisition of Point Designs. The deal is set to enhance Hanger’s prosthetic and orthotic offerings, expanding its ability to provide more innovative solutions for patients with limb loss.

Report Scope

Report Features Description Market Value (2024) USD 18.6 Billion Forecast Revenue (2034) USD 30.0 Billion CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Ingredient Type (Natural, Synthetic), By Product (Hand Creams/Moisturizers, Hand Wash, Hand Sanitizer), By End Use (Men, Women), By Distribution Channel (Supermarket & Hypermarket, Drugstore/Pharmacy, Online, Specialty Stores, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape The Clorox Company, Colgate-Palmolive Company, Solenis, Unilever PLC, Bath & Body Works, Inc., The Procter & Gamble Company, Reckitt Benckiser Group plc, Kimberly-Clark Corporation, Henkel AG & Co. KGaA, GOJO Industries, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- The Clorox Company

- Colgate-Palmolive Company

- Solenis

- Unilever PLC

- Bath & Body Works, Inc.

- The Procter & Gamble Company

- Reckitt Benckiser Group plc

- Kimberly-Clark Corporation

- Henkel AG & Co. KGaA

- GOJO Industries, Inc.