Global Gypsum Board Market By Product Type (Ceiling Board, Wallboard, Pre-Decorated Board, Other Product Types), By Application (Institutional, Pre-engineered Buildings, Industrial, Residential, Commercial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 32298

- Number of Pages: 205

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Global Gypsum Board Market size is expected to be worth around USD 144.9 Billion by 2033, from USD 51.5 Billion in 2023, growing at a CAGR of 10.9% during the forecast period from 2024 to 2033.

Gypsum board, commonly known as drywall, plasterboard, or wallboard, is a building material composed of gypsum a naturally occurring mineral sandwiched between layers of paper. Known for its versatility, gypsum board is widely used in the construction industry for creating walls, ceilings, and partitions due to its ease of installation, fire resistance, sound insulation, and cost-effectiveness.

Its non-combustible core also makes it a popular choice for meeting building safety regulations, and advancements in design have led to specialized products that are mold, moisture, and impact-resistant. These qualities make gypsum board a fundamental material for residential, commercial, and industrial construction.

The gypsum board market refers to the global industry surrounding the production, distribution, and sale of gypsum boards across various construction applications. This market encompasses a diverse array of product types, including regular gypsum board, fire-resistant boards, moisture-resistant boards, and soundproofing options, catering to different building needs and regulatory standards.

Geographically, the market includes major regions such as North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, each driven by distinct construction trends and economic factors. Market players range from large manufacturers to regional suppliers, all of whom operate in a highly competitive landscape marked by continual innovation, regulatory compliance, and shifts in construction activity across both developed and emerging economies.

The growth of the gypsum board market is primarily driven by rapid urbanization, a surge in construction activities, and an increasing emphasis on energy-efficient building solutions. Globally, residential and commercial construction is expanding due to population growth and rising urbanization, especially in emerging markets such as Asia-Pacific and Latin America. In developed economies, the trend towards remodeling and renovating older structures also spurs demand for gypsum board.

Demand for gypsum board is closely tied to construction sector performance, which fluctuates with economic conditions, government policies, and infrastructure development projects. Regions experiencing a construction boom, notably in Asia-Pacific and the Middle East, showcase strong demand for gypsum boards.

Additionally, heightened awareness around sustainable building materials and green certification standards, such as LEED (Leadership in Energy and Environmental Design), has increased demand for eco-friendly gypsum products.

The push towards fast-paced construction methods, especially prefabricated and modular building, further boosts gypsum board consumption, as these materials support efficient, scalable building processes that can meet the growing demand for housing and commercial spaces quickly and economically.

Several opportunities exist for gypsum board manufacturers and suppliers, primarily in product innovation and market expansion. As green building initiatives continue to gain momentum worldwide, there is significant opportunity in developing eco-friendly gypsum boards that incorporate recycled materials or offer superior thermal performance, helping buildings achieve better energy efficiency ratings.

Additionally, emerging economies with extensive infrastructure needs, such as India, Brazil, and several countries in Africa, present untapped growth potential for market players.

Developing customized products that cater to specific regional needs such as higher moisture resistance in humid climates or enhanced fire resistance in densely populated urban areas can further unlock growth.

Digitalization in construction, from BIM (Building Information Modeling) to smart building technologies, also offers new avenues for gypsum board manufacturers to integrate with advanced construction methodologies, thereby enhancing their value proposition in modern construction projects.

According to USGS Publications Warehouse (.gov), the U.S. gypsum board market remains a pivotal segment within the construction sector, showing resilience and growth in response to industry demands. In 2023, U.S. crude gypsum production was estimated at 22 million tons, valued at approximately $264 million.

Notably, primary gypsum-producing states included California, Iowa, Kansas, Nevada, Oklahoma, and Texas. Domestic consumption reached 45 million tons, primarily driven by agriculture, cement production, and wallboard manufacturing. U.S. wallboard sales were estimated at 27 billion square feet in 2023, supported by a robust production capacity of 34 billion square feet per year.

The sector also observed increased efficiency in sustainability practices, with approximately 700,000 tons of gypsum scrap recycled onsite. In line with construction demand, U.S. gypsum imports rose by 18%, reflecting a 3% increase in apparent consumption over 2022, while exports, though low relative to imports, increased by 15%. Synthetic gypsum contributed to around 33% of the U.S. gypsum supply, underscoring ongoing efforts to diversify sources.

Key Takeaways

- The global gypsum board market is poised for substantial expansion, projected to grow from USD 51.5 billion in 2023 to USD 144.9 billion by 2033 at a CAGR of 10.9%, driven by construction demand, urbanization, and sustainable building trends.

- Wallboard dominates the product segment with a 47.9% market share in 2023, underpinned by its versatility and ease of installation in residential and commercial spaces.

- The residential application segment leads with a commanding 50.1% market share, fueled by rising housing demand and urbanization in emerging markets.

- North America holds the largest regional share at 36.5%, driven by robust demand for energy-efficient construction materials and a high renovation rate.

By Product Analysis

Wallboard Dominates Gypsum Board Market, Holding 47.9% Share in 2023

In 2023, Wallboard held a dominant market position in the Gypsum Board Market by product type, capturing more than a 47.9% share. The segment’s widespread adoption in residential and commercial applications is driven by its versatility, ease of installation, and fire-resistant properties, making it the preferred choice for interior walls and ceilings.

The demand for wallboard continues to grow, especially in emerging economies, where urbanization and infrastructure expansion are accelerating. This high market penetration solidifies wallboard as the leading segment within the gypsum board market.

The Ceiling Board segment captured approximately 23.4% of the market share in 2023, driven by increased applications in commercial and institutional buildings where acoustic control and aesthetic appeal are paramount. Ceiling boards are often preferred for their soundproofing and decorative qualities, contributing to their consistent demand.

Growth in office construction and healthcare facilities, particularly in developed markets, is anticipated to further propel this segment’s expansion.

Pre-decorated Board accounted for around 15.2% of the total market in 2023. This segment appeals to consumers seeking faster, aesthetically appealing solutions that minimize on-site finishing work. Demand is primarily driven by residential renovations and remodeling projects, as well as the growing DIY trend in Western markets.

However, the segment’s growth remains limited by its higher cost compared to traditional wallboard and ceiling board options. The Other Product Types segment, encompassing specialty gypsum boards such as moisture-resistant and fire-rated options, held a 13.5% market share in 2023.

These specialized boards cater to specific use cases in areas requiring enhanced durability or fire safety, such as kitchens, bathrooms, and industrial spaces. Although a smaller segment, it is witnessing steady growth due to rising safety regulations and increased adoption in industrial and commercial settings.

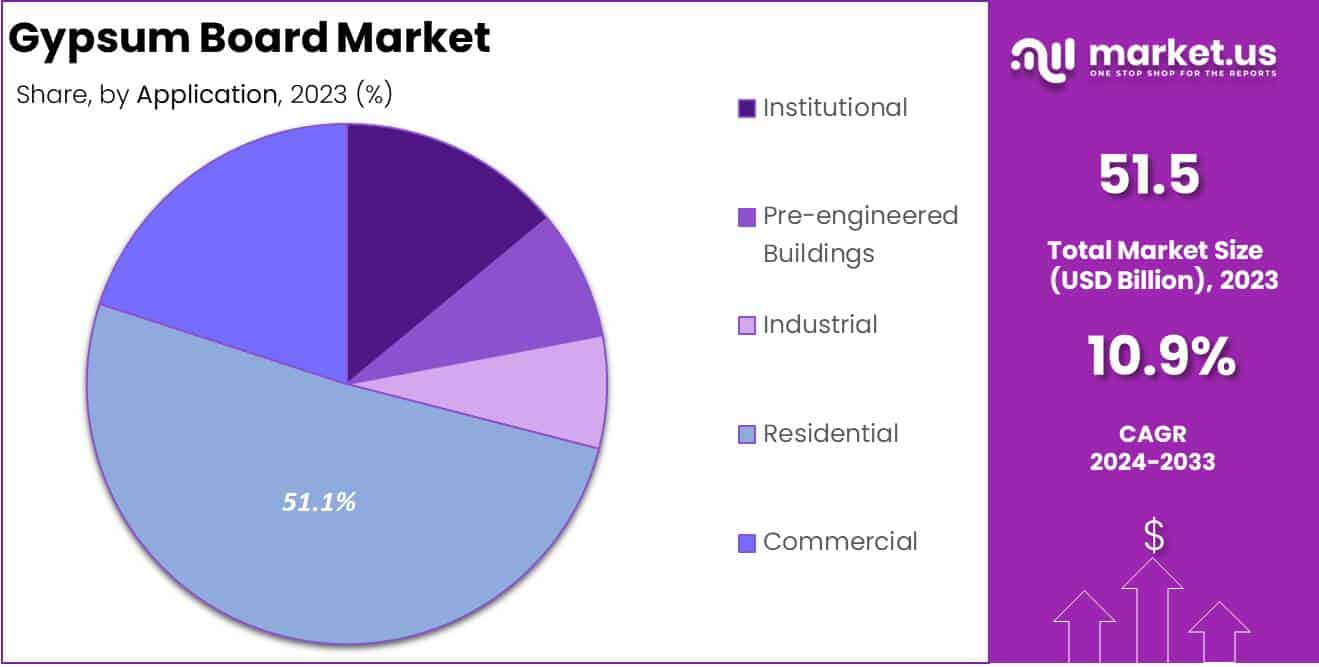

By Application Analysis

Residential Segment Leads Gypsum Board Market by Application, Holding 50.1% Share in 2023

In 2023, the Residential segment held a dominant market position in the Gypsum Board Market by application, capturing over a 50.1% share. This commanding presence is fueled by rapid urbanization and increasing housing demand, particularly in emerging markets.

The growing trend toward modern, sustainable home construction, coupled with rising consumer awareness about energy-efficient building materials, has significantly boosted gypsum board adoption in residential projects. This trend is expected to continue as global housing projects expand.

The Commercial segment accounted for around 20.3% of the total market in 2023, driven by increasing investments in office spaces, retail facilities, and hospitality construction. The commercial sector’s need for aesthetic, durable, and fire-resistant wall and ceiling solutions makes gypsum board an ideal choice.

As the commercial real estate sector continues to grow post-pandemic, particularly in urban areas, demand for gypsum boards in this segment is projected to remain strong.

Capturing approximately 14.2% of the market in 2023, the Institutional segment benefits from steady demand in educational, healthcare, and government infrastructure projects. The need for durable, safe, and cost-effective construction materials in schools, hospitals, and public buildings underpins this segment’s growth. Increased government spending on infrastructure and social projects, especially in developing regions, is expected to bolster gypsum board use in institutional settings.

The Pre-engineered Buildings segment held an 8.1% market share in 2023, reflecting the rising popularity of modular and prefabricated structures. Gypsum boards are increasingly used in pre-engineered buildings due to their lightweight, fire-resistant, and easy-to-install properties, which align well with the construction needs of this segment. Growth in this area is particularly notable in industrial and commercial projects, where speed and cost efficiency are paramount.

The Industrial segment accounted for 7.3% of the market in 2023. Gypsum board adoption in industrial facilities is mainly driven by its fire-resistant and thermal insulation properties, which are essential in manufacturing and processing plants.

Although a smaller market segment, industrial applications are anticipated to grow as more manufacturers incorporate gypsum boards into warehouse, production, and storage facilities, where durability and safety are key considerations.

Key Market Segments

By Product Type

- Ceiling Board

- Wallboard

- Pre-decorated Board

- Other Product Types

By Application

- Institutional

- Pre-engineered Buildings

- Industrial

- Residential

- Commercial

Driver

Rising Demand from the Construction Industry

The global gypsum board market is witnessing robust growth driven by escalating demand from the construction industry. Gypsum boards, or drywall, have become indispensable in modern construction due to their efficiency, cost-effectiveness, and versatility in a variety of building types. With rapid urbanization, particularly in emerging economies, there is a surging need for residential, commercial, and infrastructure projects.

These developments drive the demand for gypsum boards as they offer swift installation, sound insulation, and fire resistance. The residential sector, in particular, is a significant contributor, with high demand for affordable housing solutions that require fast turnaround times. The growing adoption of gypsum boards as a primary building material underscores their role in meeting these efficiency and sustainability goals.

Moreover, the construction industry’s shift toward sustainable building materials has favored gypsum boards, as they have a comparatively low environmental impact. Gypsum boards are recyclable, lightweight, and reduce the need for heavy masonry work, which contributes to the lowering of construction costs and environmental footprints. The trend toward green building standards and certifications further enhances the appeal of gypsum boards.

As sustainability becomes a key consideration in construction practices, gypsum boards, which are both eco-friendly and durable, are increasingly preferred. This industry alignment with green construction standards is likely to maintain strong growth momentum in the gypsum board market, positioning it as a critical material in the ongoing wave of global construction activity.

Restraint

Fluctuations in Raw Material Prices and Supply Chain Disruptions

A significant restraint impacting the global gypsum board market is the volatility in raw material prices and recurring supply chain disruptions. Gypsum boards require materials such as gypsum rock and paper, both of which are subject to price fluctuations due to factors like transportation costs, mining limitations, and global market instability.

These costs are often passed onto manufacturers, impacting production expenses and thereby affecting the pricing structure of gypsum boards. This price volatility makes it challenging for manufacturers to maintain stable pricing, which can ultimately hinder adoption, especially in price-sensitive regions where cost-efficiency is paramount.

In addition, recent global supply chain disruptions, largely due to events such as the COVID-19 pandemic and geopolitical tensions, have intensified the challenges in sourcing and transporting gypsum and other essential materials.

Freight costs, labor shortages, and port congestion issues have led to delays and increased costs across the supply chain, disrupting manufacturers’ ability to meet demand consistently. For construction projects operating on tight timelines and budgets, these supply chain inefficiencies make gypsum boards less appealing as an option.

Addressing these supply chain complexities will require manufacturers to explore more localized sourcing or invest in inventory management strategies, but until such solutions are widely implemented, price and supply volatility are likely to remain a restraining factor for the gypsum board market’s growth.

Opportunity

Growth in Renovation and Remodeling Activities in Developed Markets

The surge in renovation and remodeling activities across developed markets presents a notable growth opportunity for the global gypsum board market. As developed economies like North America and Europe see a shift in housing preferences toward refurbishment rather than new builds, there is heightened demand for construction materials suitable for interior remodeling.

Gypsum boards, due to their adaptability, easy installation, and cost-effectiveness, are highly favored for such applications. This trend is largely driven by homeowners’ desire to modernize aging properties, improve energy efficiency, and enhance indoor aesthetics without undertaking extensive structural changes, making gypsum boards a preferred material.

Furthermore, government incentives supporting energy-efficient upgrades and sustainable building practices are catalyzing the demand for materials like gypsum boards in renovations. For instance, regulations encouraging better insulation and soundproofing have led to increased use of gypsum boards in wall and ceiling improvements.

The growing popularity of DIY projects in developed regions also boosts the demand, as gypsum boards are manageable for small-scale installations and meet quality standards for home improvements.

As a result, the renovation and remodeling sector represents a sustained and lucrative opportunity for gypsum board manufacturers, offering a pathway for revenue growth that complements new construction demand. The industry’s response to this opportunity will likely involve developing even more user-friendly, innovative gypsum board products tailored to the renovation market.

Trends

Technological Advancements Driving Innovative Product Development

Technological advancements in manufacturing and product development are shaping new trends in the gypsum board market, fostering innovation and expanding applications. Advanced manufacturing techniques now allow for gypsum boards with enhanced properties, such as greater resistance to fire, moisture, and impact, catering to diverse and high-performance needs in various construction projects.

These specialized gypsum boards are increasingly sought after in sectors like healthcare and hospitality, where enhanced safety and durability are critical. This drive toward innovation has enabled manufacturers to differentiate their products and capture niche segments, contributing to overall market growth.

Additionally, automation in gypsum board manufacturing has improved production efficiency, quality consistency, and cost management. The integration of automated systems and IoT solutions allows for real-time monitoring of production processes, reducing waste and optimizing raw material use.

Such improvements not only lower production costs but also align with sustainability goals, as reducing waste is a significant consideration in the eco-conscious construction industry.

Smart gypsum boards with acoustic insulation and energy-efficient properties are also entering the market, providing added value for modern buildings.

As these advanced gypsum boards meet increasingly stringent building codes and consumer expectations, technological progress will continue to be a driving trend, enhancing product variety and furthering the market’s appeal across diverse applications.

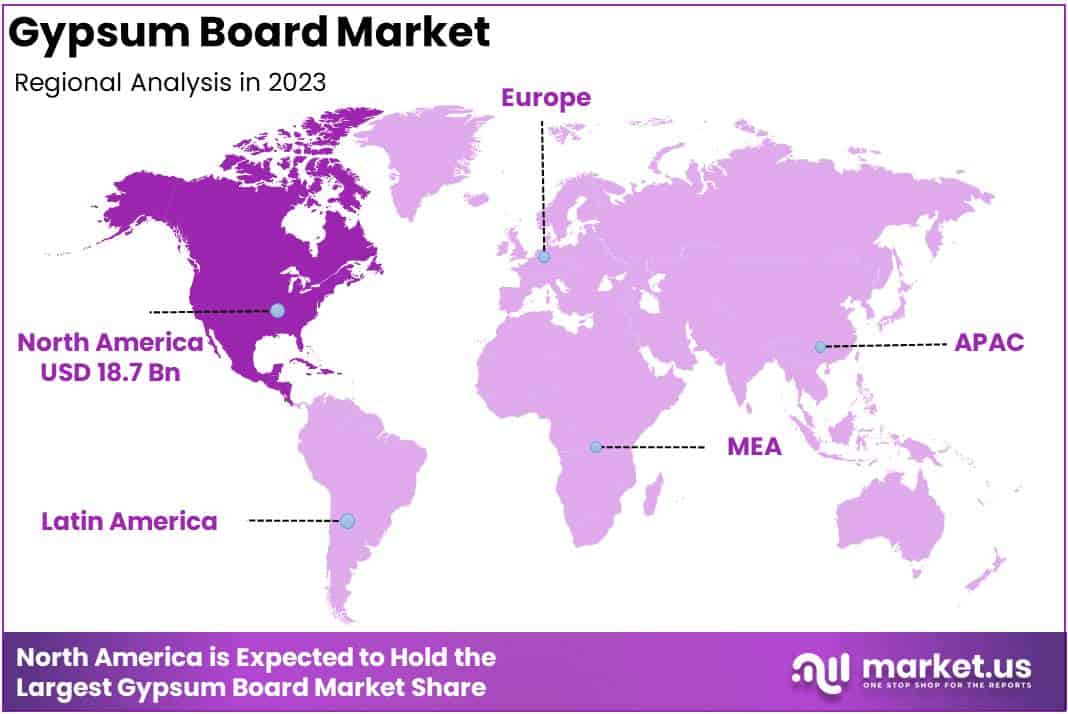

Regional Analysis

North America Leads Gypsum Board Market with Largest Market Share at 36.5%

In 2023, North America led the global gypsum board market, capturing a dominant share of 36.5%, driven by a robust construction and real estate sector, particularly in the United States. With a market value of approximately USD 18.7 billion, North America benefits from high demand in both residential and commercial construction, supported by stringent building codes focused on fire-resistant and energy-efficient materials.

The growing trend of remodeling and renovation across the U.S. and Canada further fuels gypsum board sales, while advanced technological integrations in manufacturing enhance product quality and sustainability.

North America’s market is also characterized by increased investments in green building materials, in line with rising consumer awareness regarding eco-friendly construction options. This proactive stance on sustainable construction materials continues to position North America as the leading region in the gypsum board market.

Asia Pacific Gaining Traction in Gypsum Board Market Through Rapid Urbanization and Infrastructure Development

Asia Pacific is experiencing the fastest growth in the gypsum board market, driven by rapid urbanization, expanding residential and commercial construction, and large-scale infrastructure projects across key markets such as China, India, and Southeast Asia. The region’s increasing population and supportive government policies aimed at affordable housing developments bolster demand for gypsum board products.

China stands as a major contributor due to its high volume of construction activities, making the region a critical growth area for the industry. Additionally, rising awareness around energy-efficient building materials and adoption of new construction technologies are expected to sustain Asia Pacific’s expansion in this market, positioning it as a formidable growth engine.

Europe holds a significant share in the global gypsum board market, supported by strong demand for eco-friendly building materials aligned with EU regulations on energy efficiency and carbon emissions.

The market in Europe is concentrated in Western Europe, with Germany, the United Kingdom, and France as major consumers, driven by stringent building standards and a mature construction industry.

Renovation projects aimed at enhancing energy efficiency in residential and commercial properties also contribute to sustained gypsum board demand in the region. With increasing investments in green building certifications and the European Union’s commitment to carbon neutrality by 2050, Europe’s gypsum board market is anticipated to experience steady growth.

The Middle East and Africa (MEA) is emerging as a promising region in the gypsum board market, spurred by substantial infrastructure investments and urban expansion in Gulf Cooperation Council (GCC) countries, particularly the United Arab Emirates and Saudi Arabia.

Major regional construction projects, such as NEOM in Saudi Arabia, and extensive urban developments are driving demand for high-quality, fire-resistant building materials like gypsum board.

Additionally, rising awareness of energy-efficient materials and advancements in sustainable construction techniques are gradually influencing market dynamics. Although the MEA region currently holds a modest share, its market potential remains strong due to continued urbanization and government initiatives in infrastructure.

Latin America is witnessing a moderate yet consistent growth in the gypsum board market, supported by ongoing residential and commercial construction activities, especially in Brazil and Mexico. Government-led housing initiatives to address urban housing deficits, alongside economic recovery efforts, are bolstering demand in the region.

The market is further supported by an increasing trend towards sustainable and energy-efficient construction materials in major urban areas. Although Latin America’s market share remains smaller compared to North America and Asia Pacific, these trends are expected to create steady opportunities for gypsum board manufacturers over the coming years.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

The global gypsum board market in 2024 is highly competitive, driven by the diverse strategies and market positioning of key players. Compagnie de Saint-Gobain S.A., a market leader, leverages its extensive distribution network and continuous innovation in sustainable building materials, enabling it to meet rising demand for eco-friendly construction products.

Knauf Digital GmbH, another significant player, focuses on digitizing construction processes and enhancing operational efficiency, which aligns well with the industry’s shift towards digital transformation and smart building solutions.

Etex Group emphasizes sustainable and lightweight construction materials, leveraging its strong R&D to innovate new products that align with sustainability goals and regulatory standards.

National Gypsum Company is well-positioned in North America, offering a comprehensive product line that caters to residential and commercial segments, supported by significant investments in product quality and brand reliability.

Georgia-Pacific LLC continues to reinforce its position by integrating gypsum board production with other building materials, creating synergies across its product portfolio.

Eagle Materials Inc. capitalizes on its vertically integrated operations, ensuring cost efficiency and consistency in product supply, a strategic advantage in managing fluctuating raw material costs. Yoshino Gypsum Co., Ltd. dominates in Asia-Pacific, emphasizing technological advancements and high-quality gypsum board production to cater to rapid urbanization in the region.

Beijing New Building Materials Public Limited Company leverages China’s construction boom with a strong domestic presence and growing international footprint. James Hardie Europe GmbH and Global Gypsum Board Co LLC also play crucial roles, expanding product offerings and investing in strategic markets to enhance their market share.

Top Key Players in the Market

- Compagnie de Saint-Gobain S.A.

- Knauf Digital GmbH

- Etex Group

- National Gypsum Company

- Georgia-Pacific LLC

- Eagle Materials Inc.

- Yoshino Gypsum Co., Ltd.

- Beijing New Building Materials Public Limited Company

- James Hardie Europe GmbH

- Global Gypsum Board Co LLC

- Other Key Players

Recent Developments

- In 2024, TRE Holdings, the joint venture between Takeei Corporation and River Holdings, reported a 17% increase in sales year-on-year, reaching US$175 million in the first quarter of the 2025 financial year. The company’s pre-tax profit rose significantly by 82% to US$16.7 million. However, its gypsum recycling subsidiaries, Green Arrows and Gypro, saw a dip in sales and profit due to lower order volumes. For the full 2025 financial year, TRE Holdings projects sales to reach US$673 million, a 7% increase, with a pre-tax profit of US$53.7 million, reflecting a steady 2% rise in line with prior estimates.

- In 2023, Chiyoda-Ute launched Chiyoda Circular Gypsum, a gypsum board made from 100% recycled material collected from construction sites. This product is manufactured using a carbon-neutral process, showcasing Chiyoda-Ute’s commitment to sustainability.

- In 2023, GMS Inc. expanded its North American operations by acquiring EMJ in Chicago and Blair Building Materials in Ontario, Canada. GMS also opened a new greenfield yard in Ontario, along with two additional AMES store locations, broadening its distribution footprint.

- In 2023, Etex acquired the lightweight building materials division from Australia’s BGC, including gypsum and fiber cement products. This acquisition strengthens Etex’s presence in the Australian market, enhancing its product range and market accessibility.

Report Scope

Report Features Description Market Value (2023) USD 51.5 Billion Forecast Revenue (2033) USD 144.9 Billion CAGR (2024-2033) 10.9% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Ceiling Board, Wallboard, Pre-Decorated Board, Other Product Types), By Application (Institutional, Pre-engineered Buildings, Industrial, Residential, Commercial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Compagnie de Saint-Gobain S.A., Knauf Digital GmbH, Etex Group, National Gypsum Company, Georgia-Pacific LLC, Eagle Materials Inc., Yoshino Gypsum Co., Ltd., Beijing New Building Materials Public Limited Company, James Hardie Europe GmbH, Global Gypsum Board Co LLC, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Compagnie de Saint-Gobain S.A.

- Knauf Digital GmbH

- Etex Group

- National Gypsum Company

- Georgia-Pacific LLC

- Eagle Materials Inc.

- Yoshino Gypsum Co., Ltd.

- Beijing New Building Materials Public Limited Company

- James Hardie Europe GmbH

- Global Gypsum Board Co LLC

- Other Key Players