Global Fire-resistant Glass Market; By Product Type(Wired, Ceramic, Gel-Filled, Tempered, Other Product Types), By Application(Building and Construction, Marine, Other Applications) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast: 2023-2033

- Published date: Dec 2023

- Report ID: 28437

- Number of Pages: 253

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

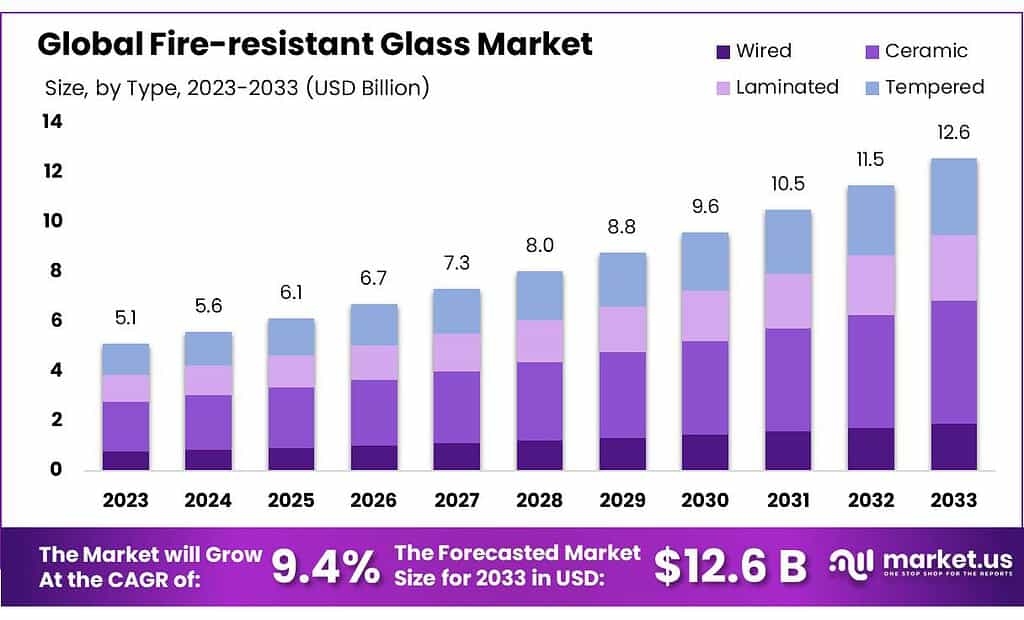

The Fire-resistant Glass Market size is expected to be worth around USD 12.6 billion by 2033, from USD 5.12 Bn in 2023, growing at a CAGR of 9.4% during the forecast period from 2023 to 2033.Fire-resistant Glass Market growth can be primarily attributed to an increase in the number of fire incidents, as well as the expansion of the construction sector. This has led to respective governments increasing their spending to improve fire safety in accessible buildings.

A growing demand for residential housing and high-rise buildings in urban areas, resulting from the shift to urban economic centers, has led to the need for various residential projects to meet fire building safety standards. These factors are expected to drive market growth prospects for this industry over the forecast period.

Actual Numbers Might Vary in the Final Report

Key Takeaways

- Market Growth Projection: The fire-resistant glass market is anticipated to witness substantial growth, reaching a value of approximately USD 12.6 billion by 2033, soaring from USD 5.12 billion in 2023, at a robust CAGR of 9.4%.

- Primary Drivers: The surge in fire incidents coupled with expanding construction activities are major catalysts for market growth. Governments worldwide are augmenting spending to enhance fire safety standards in buildings, stimulating market demand.

- Product Demand: Tempered glass and gel-filled variants are gaining significant traction. Tempered glass finds extensive use in fire doors for its ability to reflect heat, while gel-filled glass, known for its reaction to temperature changes, benefits from regulatory support, fostering its adoption.

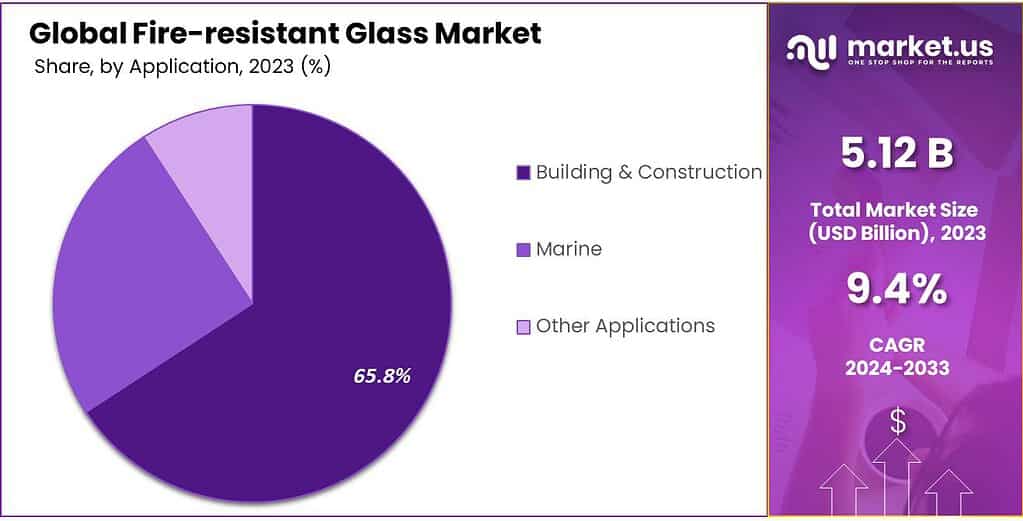

- Application Significance: The building and construction sector dominated the market, accounting for over 65.8% in 2023. Emphasis on adhering to fire safety regulations and codes contributes to this segment’s growth.

- Market Challenges: Fluctuating raw material prices due to geopolitical tensions and pandemic-induced disruptions pose challenges. The volatility impacts production costs, creating an unpredictable landscape for manufacturers.

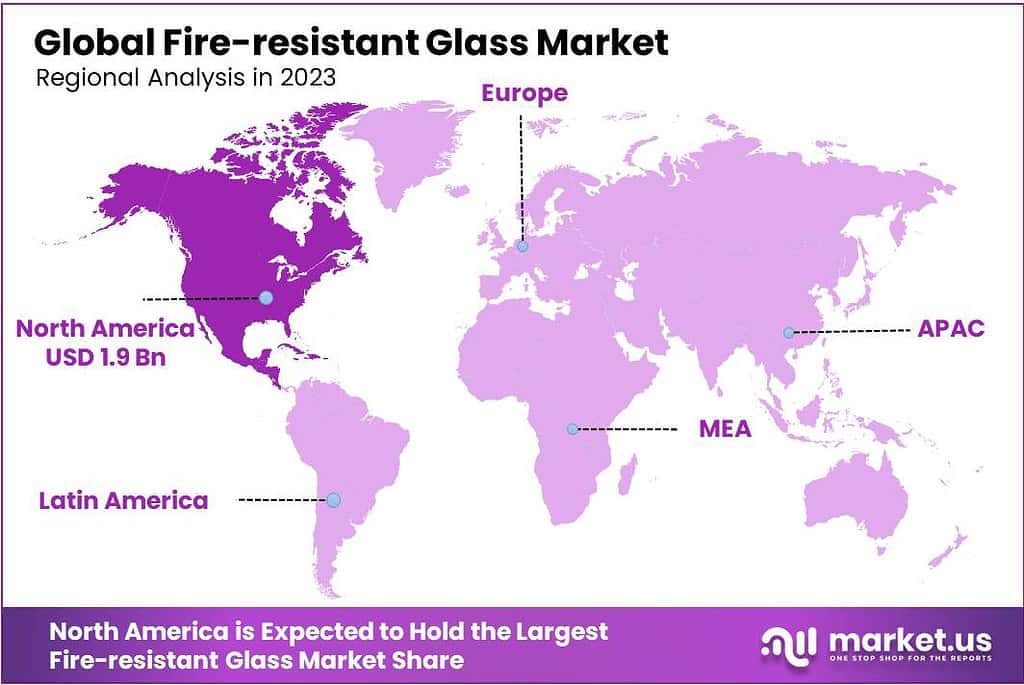

- Regional Dynamics: North America held the highest revenue share in 2023, driven by infrastructure investments and regulatory focus on fire safety. Asia-Pacific is expected to witness the fastest growth due to increased construction and fire incidents.

- Opportunities: Escalating construction activities in developing nations present a promising opportunity. Governments’ heightened focus on safety standards in building projects is driving the demand for fire-resistant glass solutions.

- Key Players and Strategies: Major industry players are engaging in mergers, acquisitions, and expansions to adapt to post-pandemic shifts, aiming for resilience and sustained growth.

Product Type Analysis

In 2023, chemicals were the big leader in the market, grabbing over 39.5% of it. They’re a major part of making fire-resistant glass. Wired glass is one type that’s commonly used. It has wires inside to hold it together when it gets hot. It’s been around for a while and it’s quite popular in places where people need to stay safe during fires.

Tempered glass is in high demand worldwide due to its extensive use in fire doors that protect a building from fire. A distinct coating is added to the glass’ outside layer to reflect heat and decrease heat loss. Significant investments in commercial and residential projects are also likely to drive the demand for fire-resistant glass market products.

According to forecasts, the revenue growth of the ‘gel-filled’ segment is expected to grow at 4.8% CAGR over the forecast period. Gel-filled glass is composed of several glass layers. In this type of glass, a colorless gel is used to fill the gaps. This gel reacts with certain temperatures. Gel-filled fire resistance is boosted by regulatory support that promotes inert fire products. This is expected to increase the use of gel-based lightweight fire-resistant glass, in conjunction with passive fire protection, over the projected timeline.

Application Analysis

Concerning ‘Application,’ the Building & Construction segment accounted for the highest revenue share at more than 65.8% in 2023. Due to its toughness and strength, architectural-type glass is used extensively in various construction projects. This segment is also driven by the growing emphasis being placed by regulatory bodies on building fire safety principles and adherence to standard codes.

There is a higher chance of fire explosions in ‘Marine’ settings, particularly offshore vessels. This is because they are more vulnerable to severe weather conditions like strong waves, wind, extreme temperatures, and heat. Increasing safety concerns concerning the possible sinking of container vessels in the event of a fire breakout have led to the increased use of the fire-resistant glass market in the Marine segment.

The ‘Others’ segment includes automotive, aerospace, and defense applications. The automotive industry is likely to index a surge in demand due to strict flammability and structural airworthiness requirements of safety glass. Safety glass can be used for windows, cabin partitions, and screens.

Actual Numbers Might Vary in the Final Report

Key Market Segments

By Product Type

- Wired

- Ceramic

- Gel-Filled

- Tempered

- Other Product Types

By Application

- Building & Construction

- Marine

- Other Applications

Drivers

The rising frequency of fire incidents is closely linked to the accelerated pace of climate change, ushering in extreme weather patterns. Record-breaking temperatures, both in extreme heat and cold, have become more frequent, creating an environment prone to uncontrollable fire outbreaks.

This shift has notably contributed to a surge in devastating wildfires, encroaching upon populated areas and resulting in significant property damage and loss of life. Additionally, a lack of widespread knowledge about fire safety practices further exacerbates these incidents, as preventive measures and actions during fires remain insufficiently understood by many.

Inadequate fire safety infrastructure and personnel have created difficulties for fire departments to quickly control and address fire outbreaks. Hospitals, especially, face significant fire risks due to subpar maintenance of essential equipment operating extensively under strain – increasing the risk of avoidable destruction.

Likewise, poor implementation of fire safety protocols and an absence of accountability measures has contributed to an alarming rise in fire accidents that has become all too frequent over time.

This escalation in fire incidents, stemming from various factors such as climate-induced conditions, inadequate safety knowledge, infrastructure shortcomings, and accountability gaps, is anticipated to be a significant driver propelling the demand for fire safety measures and solutions in the market.

Restraints

Fluctuating prices of raw materials have emerged as a significant restraint for the fire-resistant glass industry. The onset of the pandemic brought about extensive lockdowns, halting economic activities and disrupting the movement of goods and people.

These constraints led to supply-side disruptions, sluggish market demand, and escalated production costs due to material scarcities. Even with the pandemic subsiding, China’s sustained zero-COVID-19 policy, as the global manufacturing epicenter, continues to impede smooth operations.

Additionally, the Russia-Ukraine conflict has further exacerbated the situation by causing spikes in energy prices and creating bottlenecks within supply chains, directly impacting the manufacturing of fire-resistant glass.

These economic and geopolitical conditions have created a highly volatile landscape for raw material prices within the fire-resistant glass manufacturing sector. The lingering effects of the pandemic, coupled with ongoing geopolitical tensions, have led to unpredictable price fluctuations in crucial manufacturing materials.

This volatility poses a significant challenge to the fire-resistant glass market’s growth trajectory, as the uncertain and fluctuating costs of raw materials directly impact production expenses and overall market stability.

Opportunities

The escalating pace of building and construction activities, particularly in developing nations, stands as a promising opportunity for the fire-resistant glass market. Rapid urbanization has fueled a surge in demand for various structures like residential homes, shopping centers, schools, hospitals, and essential infrastructure.

Moreover, industrialization has amplified the need for commercial spaces, manufacturing units, and office complexes. Governments have increasingly allocated capital to provide essential amenities, further boosting construction projects in recent years.

This heightened construction activity is regulated and overseen by national authorities, emphasizing safety and security standards for these structures. The uptick in fire incidents has underscored the deficiencies in current fire safety norms and the sluggish implementation of regulations.

Consequently, governments are empowering regulatory bodies with increased resources and authority to enhance national fire safety infrastructure. This shift is driving the revision of fire safety standards and guidelines, aiming to elevate the safety measures for both existing and upcoming infrastructural projects.

The evolution of revised fire safety standards presents a lucrative opportunity for the fire-resistant glass market. With the growing demand for enhanced safety measures in the building and construction sector, there’s a heightened need for fire-resistant glass solutions.

The increased adoption of fire-resistant glass to meet upgraded safety standards in both existing and new constructions is poised to be a significant driver of market growth, offering substantial opportunities for the industry.

Challenges

The stringent regulations imposed by government bodies significantly challenge the growth of the fire-resistant glass market. Manufacturing fire-resistant glass involves adherence to multiple rules and standards set forth by national regulatory agencies or government ministries tasked with safeguarding consumer interests.

These regulations serve to verify manufacturers’ claims regarding product features and assess potential side effects to determine safety hazards.

The rigorous scrutiny and compliance requirements imposed by these government bodies pose a considerable challenge to the market’s expansion. Adhering to these stringent regulations demands significant investments in research, development, and compliance measures for manufacturers.

Moreover, the rigorous approval processes and compliance assessments often extend the time required to bring new fire-resistant glass products to the market.

Navigating through these stringent government regulations becomes a substantial hurdle for market players. It necessitates substantial financial investments and extensive efforts to ensure conformity with safety standards, potentially impeding the market’s growth trajectory due to the complexity and resource-intensive nature of compliance.

Regional Analysis

North America held the highest revenue share at over 36.7% in 2023. The projected timeline is slated to index a steady increase in CAGR. Several key factors driving this market include a surge in infrastructure investments, growing consumer spending ability, and an increased focus by regulators and governments on improving fire safety standards for commercial apartments and buildings.

The Asia-Pacific region is expected to grow the fastest over the forecast timeline. This region’s spike in construction activity and a higher incidence of fire accidents are likely to increase product consumption, particularly in emerging economies.

According to the International Trade Administration, the U.S. Department of Commerce in China, China is a major construction market that generated revenues of US$440 million in 2020.

Europe accounted for the 2nd highest revenue share in 2021. industrial growth here can be attributed to a growing number of innovative manufacturing facilities for automobiles, increasing investments toward the glass development of new products, and the overall expansion of end-user operations.

The Dellner Bubenzer Group, which specializes in manufacturing specialist glass products, has expanded its U.K. operations. Over the forecast period, the MEA region is projected to grow at a 4.1% CAGR. The regional market growth rate is driven by growing product future demand due to increasing commercial and residential infrastructure within this region.

Actual Numbers Might Vary in the Final Report

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

Leading industry major players are now more focused on mergers and acquisitions, high-profit margins, and regional expansion endeavors. AGC Glass bought Etex in November 2020. Pyroguard, India’s prominent producer of fire safety windows, increased its presence in India in November 2019. Companies aim to be resilient and survive to maintain financial permanency after the onset of the COVID-19 pandemic.

The temporary suspension of construction industry activities brought about by this event caused a significant drop in product demand. Market dynamics were also affected by disruptions in respective supply chains. Companies are changing and reconfiguring business models to cater to expected growth in the demand for these products.

Market Key Players

- AGC Inc.

- Saint-Gobain

- GlasTrösch

- Nippon Sheet Glass Co., Ltd.

- POLFLAM sp. z o.o.

- Shandong Hengbao Fireproof Glass Factory Co., Ltd.

- Diamond Glass

- Pyroguard

- Safti First

- Schott AG

- CGI International

- Others

Recent Developments

In May 2022, Saint-Gobain signed acquisition agreements with Portuguese companies Falper and Fibroplac as part of its “Grow & Impact” strategy. This move has proven very successful on the Portuguese market.

In May 2022, AGC Inc. recently unveiled expansion plans for AGC Vinythai Public Company Limited located in Thailand, estimated to cost more than 100 billion yen in total investment.

Report Scope

Report Features Description Market Value (2023) US$ 3.4 Bn Forecast Revenue (2033) US$ 6.8 Bn CAGR (2023-2032) 7.2% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type(Wired, Ceramic, Gel-Filled, Tempered, Other Product Types), By Application(Building & Construction, Marine, Other Applications) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, & Rest of MEA Competitive Landscape AGC Inc., Saint-Gobain, GlasTrösch, Nippon Sheet Glass Co., Ltd., POLFLAM sp. z o.o., Shandong Hengbao Fireproof Glass Factory Co., Ltd., Diamond Glass, Pyroguard, Safti First, Schott AG, CGI International, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is fire-resistant glass?Fire-resistant glass is specially designed to withstand high temperatures and prevent the spread of fire or smoke. It's used in buildings to create barriers and maintain safety during fires.

Where is fire-resistant glass used?It's used in buildings, especially in areas requiring fire protection such as stairwells, fire doors, windows, and facades, to help contain fires and protect escape routes.

What makes fire-resistant glass important?It provides a critical safety measure by slowing the spread of fire, allowing people more time to evacuate buildings and preventing fire from entering certain areas.

Fire-resistant Glass MarketPublished date: Dec 2023add_shopping_cartBuy Now get_appDownload Sample

Fire-resistant Glass MarketPublished date: Dec 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- AGC Inc.

- Saint-Gobain

- GlasTrösch

- Nippon Sheet Glass Co., Ltd.

- POLFLAM sp. z o.o.

- Shandong Hengbao Fireproof Glass Factory Co., Ltd.

- Diamond Glass

- Pyroguard

- Safti First

- Schott AG

- CGI International

- Others