Global Graphene Electronics Market Size, Share, Statistics Analysis Report By Type (Graphene Oxide (GO), Reduced Graphene Oxide (rGO), Mono-layer & Bi-layer Graphene, Few-layer Graphene (FLG), Others (Multi-layer Graphene (MLG), Graphene NanoPlatelets (GNP))), By Application (Transistors, Sensors, Flexible Electronics, Energy Storage Devices, Integrated Circuits, Others (Photonic Devices, etc.)), By End-User (Consumer Electronics, Automotive, Healthcare, Aerospace & Defense, Industrial, Others (Telecom, etc.)), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 143571

- Number of Pages: 223

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Analysts’ Viewpoint

- Key Government Initiatives

- China Graphene Electronics Market

- Type Analysis

- Application Analysis

- End-User Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Emerging Trends

- Business Benefits

- Key Player Analysis

- Top Opportunities Awaiting for Players

- Recent Developments

- Report Scope

Report Overview

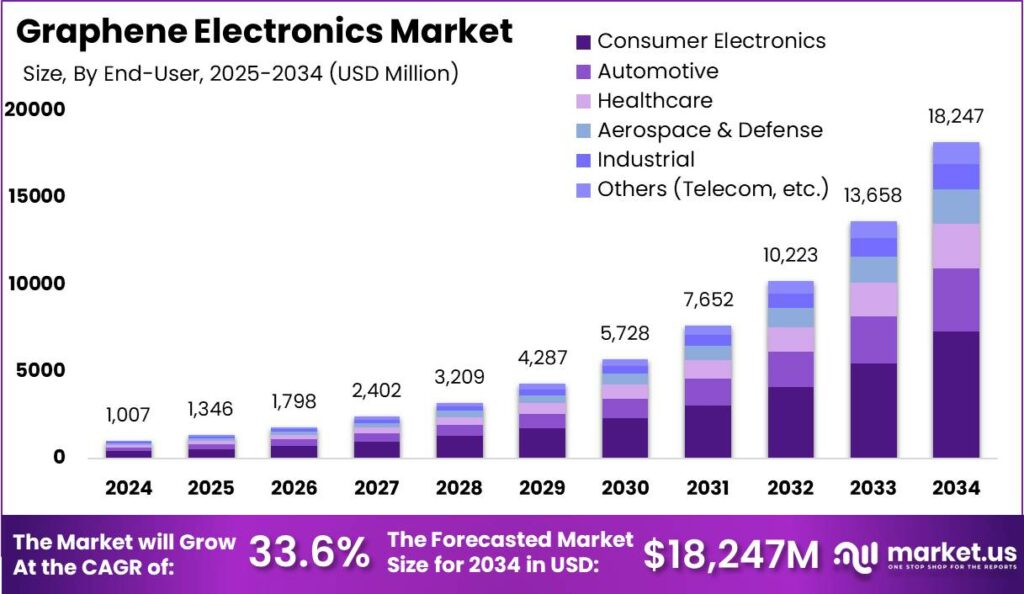

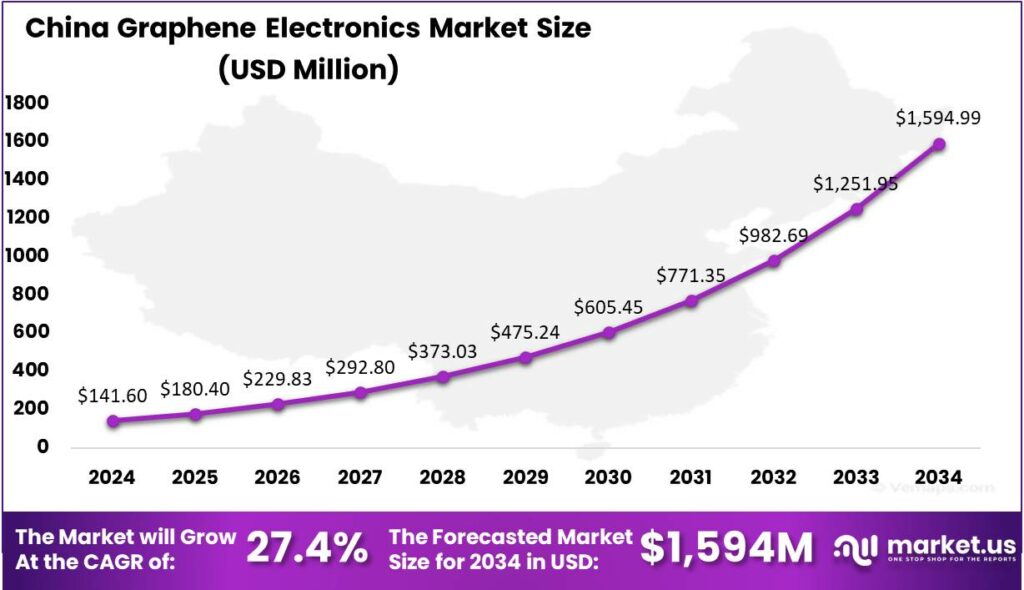

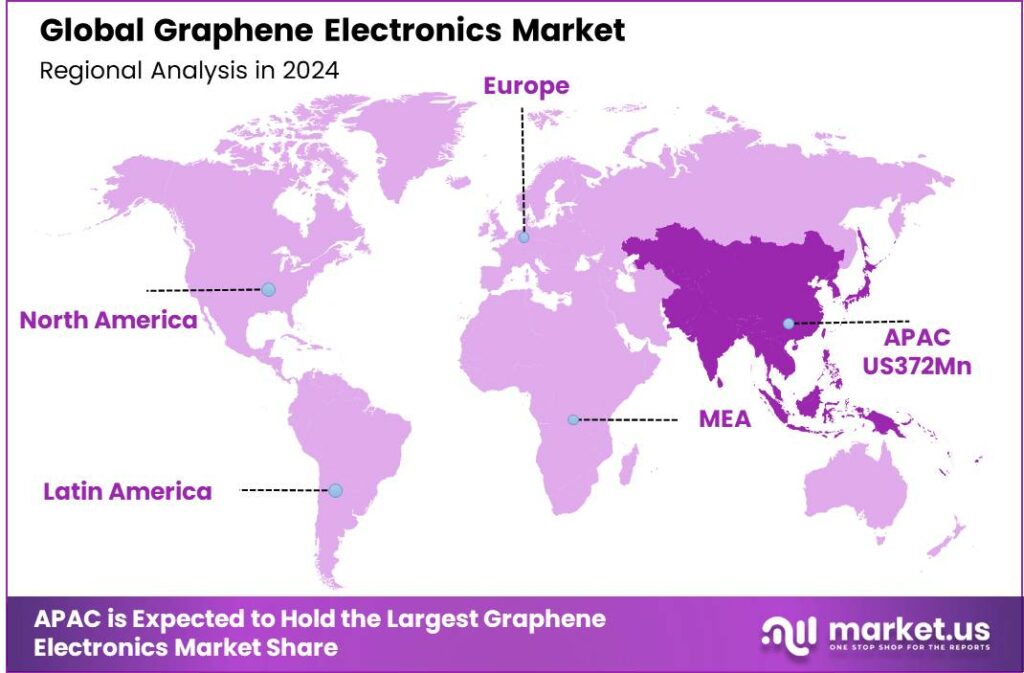

The Global Graphene Electronics Market size is expected to be worth around USD 18,247 Million By 2034, from USD 1,007.25 Million in 2024, growing at a CAGR of 33.60% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific led the graphene electronics market with over 37% of the share, generating $372 million in revenue. The China market was valued at $141.6 million, expected to grow at a CAGR of 27.4%.

The market for graphene electronics is expanding significantly, driven by its unique applications in enhancing electronic device performance across several sectors. Graphene’s superior properties such as exceptional electrical conductivity, thermal management, and mechanical strength are pivotal in this growth. These attributes allow for the development of innovative products like high-speed transistors, flexible electronics, and energy-efficient displays.

The market’s evolution is supported by increasing investments in research and development of graphene-based technologies, which are set to transform the electronics landscape by offering smaller, faster, and more durable electronic components. This trend is expected to continue, fostering further integration of graphene into mainstream electronics applications.

The growth of the graphene electronics market is driven by the demand for faster, smaller, and more efficient devices, with graphene offering superior performance over materials like silicon. Increased investment in research and development by tech companies, alongside government support for graphene projects, also contributes to its expansion.

Environmental sustainability concerns also play a crucial role, as graphene-based devices typically exhibit higher energy efficiency and potentially lower environmental impact compared to their conventional counterparts. These dynamics are expected to propel the market forward, as industries seek advanced materials to meet evolving technological and environmental standards.

According to estimates from Digital Silk, 2 out of 5 users of wearable devices express that they feel “naked” without their device, highlighting the deep connection and dependency formed with such technology. Interestingly, about 25% of users even sleep with their wearables on, indicating the extent to which these devices have become a constant presence.

Approximately 43% of people believe that smartphones will eventually be replaced by wearables, pointing to a potential shift in how individuals interact with technology. Moreover, 40% of smartwatch users report a reduction in smartphone usage due to their wearable devices, suggesting that wearables are not just complementary gadgets but could become primary devices in the future.

One of the key trends in the graphene electronics market is the integration of graphene in flexible electronic devices. As the demand for wearable technology and flexible displays grows, graphene is increasingly favored for its flexibility and strength.This trend is revolutionizing device design and manufacturing, driving innovation and creating more user-friendly formats.

Technological breakthroughs in graphene electronics continue to emerge, including the development of graphene-based transistors that significantly outperform traditional silicon counterparts. Researchers are also making progress in graphene sensors, which are highly sensitive and respond quickly, making them ideal for environmental monitoring and medical diagnostics.

Key Takeaways

- The Global Graphene Electronics Market is projected to reach a value of USD 18,247 Million by 2034, up from USD 1,007.25 Million in 2024, growing at a CAGR of 33.60% during the forecast period from 2025 to 2034.

- In 2024, the Mono-layer & Bi-layer Graphene segment dominated the market, holding more than a 34% share.

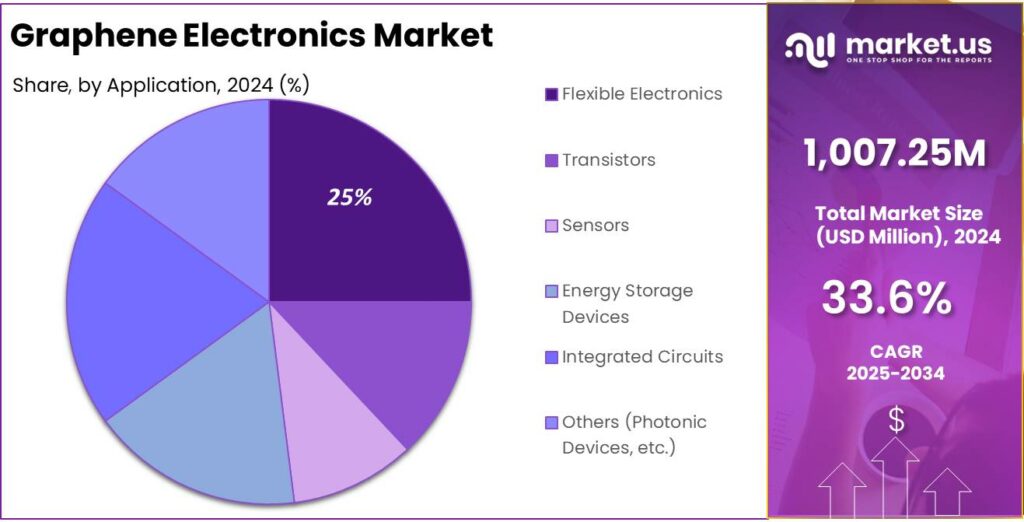

- The Flexible Electronics segment also held a leading position in 2024, capturing over 25% of the market share.

- The Consumer Electronics segment was the largest in 2024, accounting for more than 40% of the market share.

- Asia-Pacific dominated the graphene electronics market in 2024, capturing more than 37% of the share, with revenues totaling approximately $372 million.

- In 2024, the graphene electronics market in China was valued at $141.6 million, and it is expected to grow at a CAGR of 27.4%.

Analysts’ Viewpoint

Investment in graphene electronics is deemed highly promising due to the technology’s potential to revolutionize the electronics market. The growing applications in consumer electronics and the automotive industry provide fertile ground for new investments.

Ongoing innovations in graphene production and application methods are vital for market growth. Developments in chemical vapor deposition and other synthesis techniques are crucial for scaling up production and reducing costs.

The regulatory landscape for graphene electronics is still forming, with significant focus on standards and safety for new technologies. As graphene becomes more prevalent in consumer products, regulatory frameworks are expected to evolve to address these new challenges.

Key factors influencing the graphene electronics market include technological advancements in material science, growing integration with AI and IoT devices, and environmental regulations driving the need for sustainable technologies.

Key Government Initiatives

- India Graphene Engineering and Innovation Centre (IGEIC)(2024): Launched by the Ministry of Electronics and Information Technology (MeitY) as part of the Viksit Bharat@2047 vision, IGEIC is a not-for-profit organization focused on creating a hub for graphene technology. It aims to facilitate advancements in applications such as electronics, energy storage, healthcare, and sustainable materials.

- India Innovation Centre for Graphene (IICG): Established at Maker Village in Kochi, Kerala, IICG focuses on R&D and product innovation within the graphene sector. It aims to build capacity and foster collaboration among startups, academia, and industry.

- UAE Initiatives: The government of the United Arab Emirates has been active in promoting graphene technology. In April 2024, it partnered with Levidian Nanosystems Limited for a project focused on producing clean hydrogen and carbon-negative graphene through waste decarbonization. This initiative reflects the UAE’s commitment to advancing sustainable technologies while leveraging graphene’s potential.

- Kerala’s Graphene Production Park: The Government of Kerala is investing approximately ₹237 crores to establish a Graphene Production Park through a public-private partnership model. This facility aims to enhance local production capabilities and support the growing demand for graphene in various sectors.

China Graphene Electronics Market

In 2024, the market for graphene electronics in China was estimated to be valued at $141.6 million. It is projected to grow at a compound annual growth rate (CAGR) of 27.4%. The robust growth in China’s graphene electronics market can be attributed to several key factors.

Firstly, the increasing investment in research and development by major Chinese corporations and government initiatives aimed at enhancing the advanced materials sector plays a significant role. Graphene, known for its exceptional electrical conductivity and mechanical strength, is becoming a cornerstone in various applications including semiconductors, sensors, and flexible electronics.

The growing demand for high-performance, miniaturized electronic devices has accelerated graphene adoption in China’s electronics industry. Its exceptional properties, like high electron mobility and thermal conductivity, make it a highly sought-after material for innovation. This trend is expected to drive continued market growth and solidify China’s leadership in the global graphene electronics sector.

In 2024, Asia-Pacific held a dominant market position in the graphene electronics market, capturing more than a 37% share, with revenues amounting to approximately $372 million. China’s prominent position is driven by rapid technological advancements and significant investments in novel materials and electronics technologies.

Asia-Pacific’s leadership in the graphene electronics market is driven by strong government support in countries like South Korea, China, and Japan for nanotechnology and materials science R&D. Strategic collaborations between academia and industry, along with significant funding for graphene projects, are accelerating innovations and its integration into electronic applications.

The presence of major electronics manufacturers in Asia-Pacific strengthens the adoption of graphene. The push for enhanced device performance and smaller, more efficient components has increased graphene use, particularly in wearable technology, displays, and sensors, where its high conductivity and flexibility offer significant advantages.

Furthermore, Asia-Pacific’s vast production capabilities and advanced supply chain networks enable efficient scaling of new technologies like graphene. Combined with a favorable regulatory environment and a competitive industrial landscape, these factors position the region as a leader in the growing graphene electronics market, a trend expected to continue as technological adoption and innovation advance.

Type Analysis

In 2024, the Mono-layer & Bi-layer Graphene segment held a dominant market position within the graphene electronics market, capturing more than a 34% share. This segment’s leadership can be attributed to its critical role in high-end applications that demand the purest form of graphene with the best electrical and thermal conductivities.

The exceptional properties of Mono-layer & Bi-layer graphene, such as high transparency and flexibility, make it particularly suitable for use in wearable technology and flexible electronics. These applications are rapidly growing fields within the consumer electronics sector, driven by demand for smarter, more integrated personal devices.

Additionally, the development of manufacturing techniques that can produce high-quality Mono-layer & Bi-layer graphene at a reduced cost has contributed to its leading position. Innovations in chemical vapor deposition (CVD) processes and other synthesis techniques have enabled more scalable production, making it feasible for wider adoption in mainstream electronics manufacturing.

Moreover, the segment’s growth is supported by significant investments from both public and private sectors in graphene research and development. These investments are aimed at exploring new applications and overcoming existing barriers in commercialization, which in turn fuels the demand for Mono-layer & Bi-layer graphene in cutting-edge electronic applications.

Application Analysis

In 2024, the Flexible Electronics segment held a dominant position in the graphene electronics market, capturing more than a 25% share. This segment benefits significantly from graphene’s inherent flexibility and strength, which are ideal for the next generation of wearable devices and rollable displays.

The prominence of the Flexible Electronics segment is fueled by innovations in design and integration. Manufacturers are using graphene to create products like smart clothing and bendable smartphones, driven by its versatility and ability to enhance product features. This makes graphene a top choice for businesses focused on user-centric products.

The push for sustainable and energy-efficient technologies enhances the market position of flexible graphene electronics. Graphene’s eco-friendliness and its ability to improve energy efficiency align with global sustainability goals, driving greater adoption of graphene-based flexible electronics across various industries.

Improved production techniques have made graphene more accessible and cost-effective, boosting its use in commercial applications. This economic feasibility has driven growth in the flexible electronics segment, and as production processes evolve, graphene’s cost-effectiveness will further strengthen its market leadership.

End-User Analysis

In 2024, the Consumer Electronics segment held a dominant market position in the graphene electronics market, capturing more than a 40% share. This segment leads due to the widespread use of graphene in consumer electronics like smartphones, wearables, and flexible displays, all of which benefit from graphene’s superior electrical and thermal properties.

Graphene’s high electrical conductivity, flexibility, and strength make it ideal for consumer electronics, where demand for lighter, efficient, and durable products is growing. It helps manufacturers meet consumer expectations for high-performance gadgets with longer battery life and better display quality, offering advantages over traditional materials.

Ongoing innovations in graphene production have lowered costs and improved quality, making it more accessible for consumer electronics. This development is key to sustaining the segment’s growth, enabling manufacturers to incorporate graphene more widely into product designs and driving broader adoption in everyday devices.

The Consumer Electronics segment’s dominance is strengthened by strategic partnerships between graphene suppliers and electronics manufacturers. These collaborations tailor graphene applications to specific product needs, boosting functionality and driving growth, solidifying the segment’s leadership in the graphene electronics market.

Key Market Segments

By Type

- Graphene Oxide (GO)

- Reduced Graphene Oxide (rGO)

- Mono-layer & Bi-layer Graphene

- Few-layer Graphene (FLG)

- Others (Multi-layer Graphene (MLG), Graphene NanoPlatelets (GNP))

By Application

- Transistors

- Sensors

- Flexible Electronics

- Energy Storage Devices

- Integrated Circuits

- Others (Photonic Devices, etc.)

By End-User

- Consumer Electronics

- Automotive

- Healthcare

- Aerospace & Defense

- Industrial

- Others (Telecom, etc.)

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Advancements in Graphene Production Techniques

The rapid advancement in graphene production techniques has significantly propelled the growth of the graphene electronics market. Innovations in methods such as chemical vapor deposition (CVD) and epitaxial growth have enhanced the quality and scalability of graphene production, making it more feasible for commercial applications.

These techniques have overcome challenges related to material defects, resulting in more reliable and efficient electronic components. For example, advancements in CVD processes have enabled the creation of large, high-quality graphene sheets, crucial for flexible displays and high-frequency transistors.

The development of cost-effective production methods has lowered manufacturing costs, making graphene-based electronics more accessible. This has boosted adoption in existing applications and opened new opportunities in wearables, sensors, and energy storage, driving the growth and diversification of the graphene electronics market.

Restraint

High Production Costs and Scalability Challenges

Despite its remarkable properties, the widespread adoption of graphene in electronics is hindered by high production costs and scalability challenges. Producing high-quality graphene suitable for electronic applications requires sophisticated equipment and processes, leading to substantial initial investments. Moreover, achieving consistent quality at a large scale remains a significant obstacle.

These factors contribute to the high cost of graphene materials, making them less competitive compared to traditional materials like silicon. Additionally, the lack of standardized production methods results in variability in graphene quality, further impeding its integration into mainstream electronic manufacturing. Addressing these challenges is crucial for the graphene electronics market to realize its full potential.

Opportunity

Increasing need for energy storage.

The unique properties of graphene, such as high electrical conductivity and large surface area, present significant opportunities in energy storage applications. Graphene-based materials are being explored to enhance the performance of batteries and supercapacitors, offering faster charging times and higher energy densities.

This is particularly relevant in the context of electric vehicles and portable electronics, where efficient energy storage is critical. Graphene-based electrodes can improve the durability and lifespan of batteries and supercapacitors by reducing wear and tear during charge and discharge cycles.

The increasing focus on renewable energy sources and the need for efficient energy storage solutions further amplify this opportunity, positioning graphene as a key material in the advancement of next-generation energy technologies.

Challenge

Absence of standards in the graphene industry.

The graphene industry faces the significant challenge of a lack of standardization, which hampers its commercial adoption. Variations in graphene quality, thickness, and purity across different suppliers lead to inconsistencies in performance, making it difficult for manufacturers to rely on graphene for large-scale production.

This inconsistency not only affects the material’s reliability but also undermines confidence among end-users and investors. Establishing industry-wide standards and quality controls is essential to overcome this challenge and facilitate the integration of graphene into mainstream electronic applications. Another challenge is the limited scalability of production methods, with most techniques being costly or hard to scale for mass production.

Emerging Trends

One significant trend is the development of flexible and wearable electronics. Graphene’s inherent flexibility and high conductivity make it ideal for creating electronic devices that can bend and stretch without compromising performance. Researchers have demonstrated that graphene-coated copper structures can endure extensive folding cycles, enhancing the durability of flexible electronics.

In the realm of energy storage, graphene is making notable advancements. Its application in supercapacitors has led to devices with higher energy densities and faster charging capabilities compared to traditional counterparts. This improvement is crucial for the advancement of electric vehicles and portable electronics.

Another emerging trend is the integration of graphene in biomedical devices. Graphene’s biocompatibility and conductivity enable ultrathin brain implants that can differentiate healthy from cancerous tissue, improving neurosurgical precision. Graphene’s unique light interaction makes it a key material for advanced photodetectors and modulators, driving faster, more efficient optical communication systems.

Business Benefits

- Enhanced Performance: Graphene exhibits exceptional electrical conductivity, allowing for faster electron flow compared to traditional materials like silicon. This property enables the development of high-speed transistors and processors, which can improve the overall performance of electronic devices.

- Flexibility in Design: The lightweight and flexible nature of graphene makes it ideal for creating bendable and foldable electronics. This opens up new possibilities for innovative products such as wearable devices and flexible displays, catering to consumer demand for more versatile gadgets.

- Improved Energy Efficiency: Graphene’s superior thermal conductivity helps in efficient heat dissipation, which is crucial for maintaining the performance and longevity of electronic devices. This characteristic also helps develop energy-efficient products, especially in the fast-growing electric vehicle (EV) market.

- Durability and Longevity: Graphene’s strength and resistance to wear make it an ideal material for long-lasting electronics. Devices made with graphene are less prone to damage, reducing maintenance costs and enhancing customer satisfaction.

- Sustainability: As industries move towards greener technologies, graphene offers a sustainable alternative due to its potential in energy storage solutions like supercapacitors and batteries. These advancements can help meet the increasing demand for renewable energy sources and electric vehicles.

Key Player Analysis

As Graphene Electronics Market continues to grow, several key players are leading the development of graphene-based products.

Graphene Frontiers is a leading player in the graphene electronics market. Known for its cutting-edge technology, the company specializes in producing high-quality graphene films for electronic applications. Their proprietary methods enable scalable production of graphene-based materials that can be integrated into a wide range of devices, such as touchscreens, sensors, and batteries.

Graphene Laboratories, Inc. is another significant player in the graphene electronics market. The company is focused on developing and commercializing graphene and other nanomaterials for use in a variety of industries, including electronics. Graphene Laboratories offers high-quality graphene materials and specializes in the production of custom graphene-based solutions for specific applications.

Graphene Square is a rapidly growing company in the graphene electronics sector, known for its commitment to delivering high-performance graphene materials for various electronic applications. The company focuses on providing superior graphene products that cater to the needs of industries such as wearable electronics, energy storage, and sensors.

Top Key Players in the Market

- Graphene Frontiers

- Graphene Laboratories, Inc.

- Graphene Square

- Grafoid, Inc.

- Graphenea S.A.

- Skeleton Technologies

- Samsung Electronics Co.

- SanDisk Corporation

- Galaxy Microsystems Ltd.

- IBM Corporation

- AMG Advanced Metallurgical Group

- Other Key Players

Top Opportunities Awaiting for Players

The graphene electronics market offers substantial growth potential, driven by graphene’s exceptional electrical and thermal conductivity, mechanical strength, and flexibility.

- Enhanced Consumer Electronics: The growing demand for high-performance, energy-efficient consumer electronics is driving the adoption of graphene in products like smartphones, wearables, and flexible displays. Innovations in graphene-based transistors and semiconductors are poised to revolutionize these devices by enabling faster, more efficient operations and improved thermal management.

- Advanced Energy Storage Solutions: Graphene’s exceptional conductivity and surface area are being harnessed to develop superior energy storage devices, such as batteries and supercapacitors. These graphene-enhanced batteries offer higher energy densities and faster charging times, crucial for applications ranging from electric vehicles to portable electronics.

- Automotive and Aerospace Applications: The integration of graphene into automotive and aerospace components is a promising avenue, especially for enhancing the structural strength and durability of materials while reducing their weight. This application not only supports the performance improvement of vehicles and aircraft but also contributes to greater fuel efficiency and lower emissions.

- Medical Technologies and Biosensors: Graphene is being explored for its potential in medical applications, including biosensors and medical implants. Graphene-based biosensors provide real-time disease detection and monitoring, enhancing healthcare diagnostics. Its biocompatibility also makes it ideal for medical implants, offering improved performance and longevity.

- Photonic and Optoelectronic Devices: Due to its ability to conduct electricity and interact with light, graphene is increasingly important in the development of photonic and optoelectronic devices. These include applications in telecommunications, such as light detectors and modulators, which are essential for high-speed data transmission and advanced communication systems.

Recent Developments

- In January 2024, Scientists have unveiled the world’s first operational graphene semiconductor, marking a breakthrough that could transform electronics and computing. Graphene, known for its strength, flexibility, lightweight properties and high resistance, now paves the way for a new era in semiconductor technology.

- In October 2024, Graphene Square, a South Korean company, introduced an innovative cooking device utilizing graphene,a highly thermally conductive material composed of carbon atoms. This rechargeable, battery-powered cooker operates at 600 watts, consuming half the power of traditional ovens.

Report Scope

Report Features Description Market Value (2024) USD 1,007.25 Mn

Forecast Revenue (2034) USD 18,247 Mn CAGR (2025-2034) 33.60% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Graphene Oxide (GO), Reduced Graphene Oxide (rGO), Mono-layer & Bi-layer Graphene, Few-layer Graphene (FLG), Others (Multi-layer Graphene (MLG), Graphene NanoPlatelets (GNP))), By Application (Transistors, Sensors, Flexible Electronics, Energy Storage Devices, Integrated Circuits, Others (Photonic Devices, etc.)), By End-User (Consumer Electronics, Automotive, Healthcare, Aerospace & Defense, Industrial, Others (Telecom, etc.)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Graphene Frontiers, Graphene Laboratories, Inc., Graphene Square, Grafoid, Inc., Graphenea S.A., Skeleton Technologies, Samsung Electronics Co., SanDisk Corporation, Galaxy Microsystems Ltd., IBM Corporation, AMG Advanced Metallurgical Group, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Graphene Electronics MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Graphene Electronics MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Graphene Frontiers

- Graphene Laboratories, Inc.

- Graphene Square

- Grafoid, Inc.

- Graphenea S.A.

- Skeleton Technologies

- Samsung Electronics Co.

- SanDisk Corporation

- Galaxy Microsystems Ltd.

- IBM Corporation

- AMG Advanced Metallurgical Group

- Other Key Players