Global Electronic Design Automation Software Market By Type (Computer-aided Engineering (CAE), IC Physical Design and Verification, and Services), By Application (Communication, Consumer Electronics, and Others Applications), By Region and Companies - Industry Segment Outlook, Trends, and Forecast 2023-2032

- Published date: Nov. 2022

- Report ID: 102913

- Number of Pages: 313

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

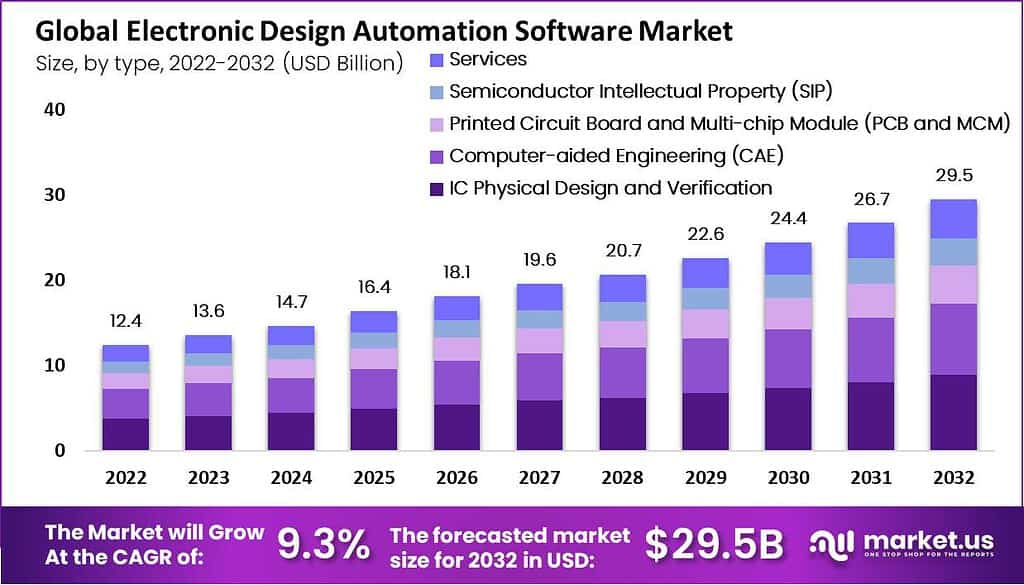

In 2023, the global electronic design automation software market accounted for USD 13.6 billion. This market is estimated to reach USD 29.5 billion in 2032 at a CAGR of 9.3% between 2023 and 2032.

A variety of software tools are available in the constantly expanding global electronic design automation (EDA) software market that is used in the development, design, and analysis of electronic systems. Automating the design process as well as improving the performance of the electronic circuit and systems are accomplished with EDA software. The need for the design process as well as improving the performance of the electronic circuit also system is accomplished with EDA software. The demand for sophisticated as well as high-performance electronic items like smartphones, tablets, wearable and IoT devices is driving the growth of the market.

Note: Actual Numbers Might Vary In The Final Report

EDA Software gives engineers the resources they need to precisely, accurately also quickly design and analyze these sophisticated electronic systems. The introduction of new technologies like artificial intelligence(AI), machine learning and the Internet of Things also stimulates the market. To create cutting-edge products using these technologies, complex and cutting-edge design tools are needed.

Key Takeaways

- Market Growth Projection: The global electronic design automation software market is projected to increase from USD 12.4 billion in 2022 to an estimated USD 29.5 billion in 2032, at a Compound Annual Growth Rate (CAGR) of 9.3% between 2023 and 2032.

- By Type Analysis: The IC Physical Design and Verification segment held the largest revenue share in the market, accounting for approximately 30% of the total market, highlighting the significance of this segment in the electronic design automation software industry.

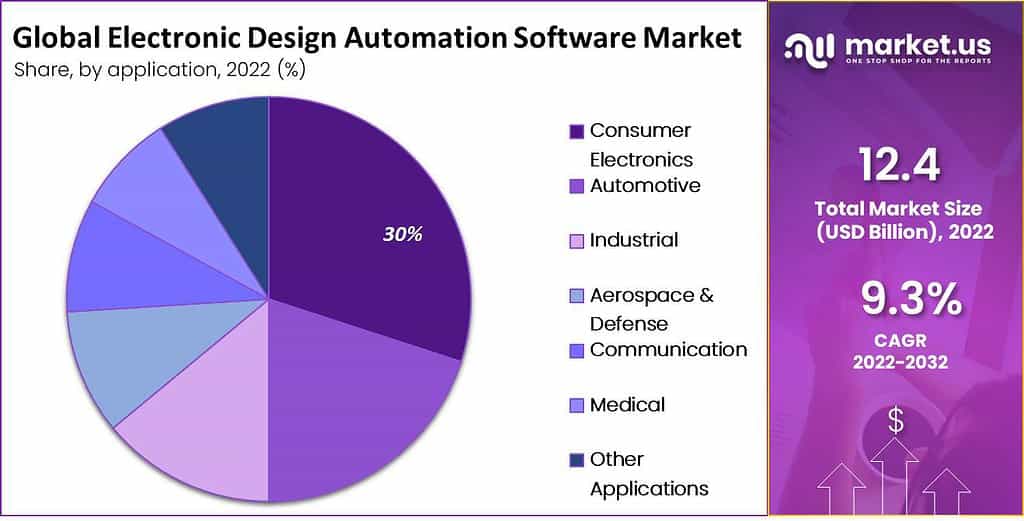

- By Application Analysis: The consumer electronics segment dominated the market, representing around 26% of the total market share. This emphasizes the pivotal role of electronic design automation software in the development and enhancement of consumer electronic products like smartphones, laptops, and various other devices.

- Driving Factors: The market is primarily driven by factors such as the increasing demand for design automation to expedite time-to-market and enhance product quality. Additionally, the development of new innovative products resulting from technological breakthroughs is contributing significantly to the market growth.

- Restraining Factors: The complexity and high cost associated with EDA software act as significant constraints for small and medium-sized businesses. Moreover, the absence of standards in the EDA sector and the growing adoption of cloud-based design tools are also impeding factors.

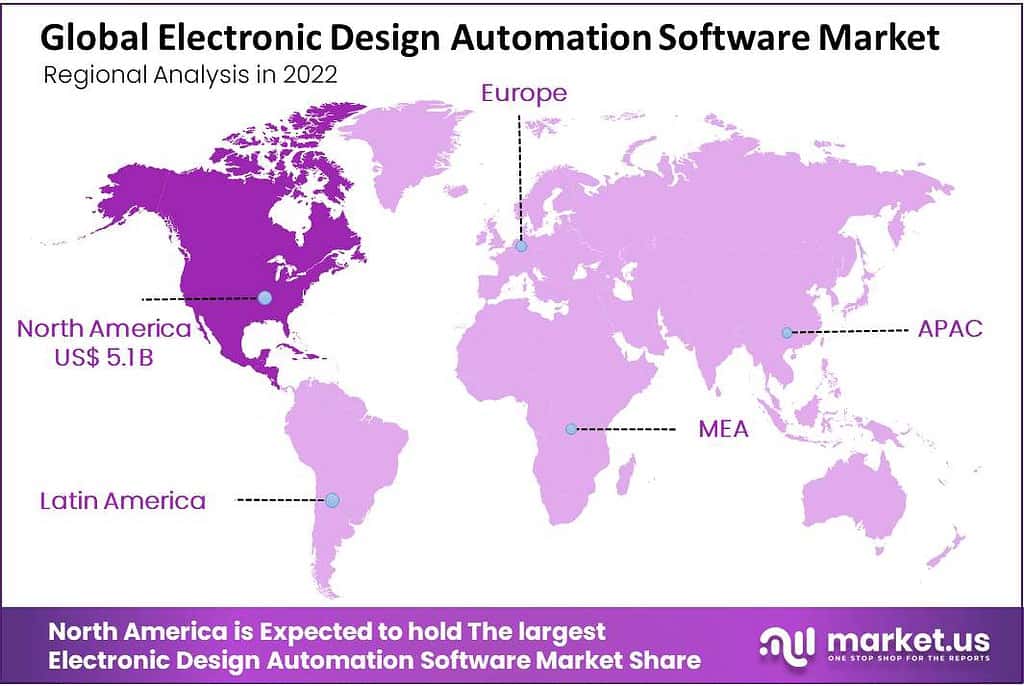

- Regional Analysis: North America held the largest revenue share in the global electronic design automation software market in 2022, with the early adoption of technologies such as 5G, machine learning, and artificial intelligence. Asia Pacific is expected to be the fastest-growing region, driven by the increase in the number of electronics manufacturing enterprises and rising consumer device demand.

- Key Market Players: Some of the key players in the EDA software market include Werner Enterprises, Oracle Corp, SAP, BluJay Solutions, Cadence Design Systems Inc, Synopsys Inc, Siemens, ANSYS Inc, Keysight Technologies Inc, Xilinx Inc, eInfochips, Altium Limited, Zuken Inc, and Silvaco Inc, among others.

- Recent Trends: Recent developments within the industry are witnessing an increased use of artificial intelligence and machine learning technology, an emphasis on security and IP protection, and an increase in demand for cloud-based solutions that offer greater flexibility, affordability, and scalability than traditional on-premise software solutions.

Driving Factors

The increasing demand for design automation to advance time to market as well as enhance product quality

The electronic design automation software market is driven by various factors. The market for EDA software is primarily driven by the rising demand for the system-on-chips also the increasing complexity of integrated circuits. The increasing demand for design automation to advance time to market as well as enhance product quality is another factor driving the market expansion.

The anther development of new inventive items as a result of technological breakthroughs is another important factor in the growing market for Electronic design automation software. The market for EDA is anticipated to develop due to the increasing adoption of artificial intelligence (AI) as well as machine learning(ML). This technology’s accuracy, as well as the effectiveness of the designing process, are increased and leading to better product quality and shorter design Time.

The increasing adoption of EDA software in the automotive, defense, and aerospace industries is also a major factor in the market. Another factor like the increased need for high-performance computing as well as the increasing adoption of the Internet of Things. Furthermore, the market for EDA software is expanding as a result of the growing popularity of virtual prototyping as well as simulation. Before beginning the real fabrication process this approach enables designers to test and confirm their concept in a virtual setting. This helps in the cost and duration of the physical prototyping process while simultaneously raising the general design quality

Restraining Factors

EDA software is too complex in nature, it requires high expertise and significant investment

One of the major restraining factors is the high cost associated with the development as well as maintenance of this software. This software is so complex in nature that this software requires high expertise and significant investment in research and development. Due to the high cost of the software license as well as maintenance expenses, small and medium-sized businesses may difficult to implement EDA software.

The absence of standards in the EAD sector is still another restraining factor. The usage of several file formats by EDA software suppliers can make it challenging for engineers to share design files as well as work together on a project. Owing to inefficiencies in the design process project may take longer to complete and the cost was more than expected.

The growing adoption of cloud-based design tools is another factor that could impede the growth of the EDA software market. Several benefits such as cheaper cost, simpler collaboration as well as more scalability are provided by cloud-based design tools They also bring up issues with data security and intellectual property protection which can prohibit some businesses from adopting them.

By Type Analysis

The Circuit (IC) Physical Design and verification Segment Accounted for the Largest Revenue Share in Global Electronic Design Automation Software Market in 2022.

The integrated circuit (IC) physical design & verification segment dominates the market with a 30% market share. Throughout the anticipated term, in the total market for software for electronic design automation. This is related to the increase in IC design complexity and the rise in demand for semiconductor devices with high accuracy and precision. Additionally, the placement and routing of circuits on an IC or application-specific integrated circuit are increasingly being carried out automatically by end users using IC design and verification EDA tools (ASIC).

By Application Analysis

Consumer electronics Holds a Significant Share of the Global Electronic Design Automation Software Market

Based on application, the consumer electronics segment Dominates the market with a 26% market share. This is attributable to ongoing developments in consumer electronics, including smartphones, laptops, desktop computers, tablets, cameras, and a host of other devices. The unmet need for methodologies, models, and tools that would allow for quicker and more accurate design and verification of microelectronic systems and circuits, which is driving the expansion of this market, is also anticipated to be satisfied by the EDA software.

Note: Actual Numbers Might Vary In The Final Report

Key Market Segments

Based on Type

- Computer-aided Engineering (CAE)

- IC Physical Design and Verification

- Printed Circuit Board and Multi-Chip Module (PCB and MCM)

- Semiconductor Intellectual Property (SIP)

- Services

Based on Application

- Communication

- Consumer Electronics

- Automotive

- Industrial

- Aerospace & Defense

- Medical

- Others Application

Growth Opportunity

Demand for electronic devices across various sectors, including consumer electronics, aerospace, automotive as well as defense.

The electronic design automation software market is expanding quickly as a result of the rising demand for electronic devices across many sectors, including consumer electronics, aerospace, automotive as well as defense. While designing and testing electrical systems also circuits, designers and engineers use EDA software which is crucial for guaranteeing dependability.

The electrical device is effective as well as efficient. The increasing use of machine learning also artificial intelligence technology is another driver boosting the demand for EDA software. The capability of EDA software is being improved by the application of AI and ML including automating the design process and optimizing the design for performance and efficiency, spotting and correcting design flaws

Latest Trends

The increased use of artificial intelligence and machine learning technology in the EDA software market

With the development of new technologies as well as shifting consumer preferences, the electronic design automation software industry is continually changing. The increasing demand for cloud-based solutions is one of the most recent developments in the software market. In comparison to conventional on-premise software, cloud-based EDA software has more flexibility, affordability as well as scalability. Engineers can access design information and tool from anywhere in the globe due to cloud-based EDA software, which makes collaboration simpler also more effective.

The increased use of artificial intelligence and machine learning technology in the EDA software market is another trend. These technologies are being-related tasks including circuit synthesis layout as well as design rule validation. Overall AI and ML are being utilized to increase simulation accuracy and also decrees the time and money needed for design verification.

The market for EDA software is experiencing a third trend, which is a growing emphasis on security as well as IP protection. Protecting integrity and guaranteeing data security have elevated in relevance due to the increasing importance of electronic systems in vital sectors including aerospace, defense as well as healthcare. Vendors of EDA software are now providing tools as well as solutions to safeguard intellectual property also stop unwanted access to confidential design data.

Regional Analysis

North America Accounted for the Largest Revenue Share in Global Electronic Design Automation Software Market in 2022.

North America Dominates the market with a 41% market share due to the Early technological adoption, which includes, among other things, the introduction of 5G, machine learning, and artificial intelligence. The growth of the regional market is also aided by the increasing utilization of the number of businesses including the automobile sector as well as consumer electronics among others. Also, the area benefits from strong government support and a solid wireless network, both projected to promote growth during the forecast period.

Asia Pacific Is Expected as Fastest Growing Region in Projected Period in Global Electronic Automation Software Market.

Asia Pacific is expected as the fastest growing region in the forecast period in the global electronic automation software market Although not yet the largest market for EDA software, Asia Pacific is predicted to experience rapid growth over the coming few years. An increase in the number of electronics manufacturing enterprises is thought to be the cause of this robust expansion. Additionally, throughout the course of the forecast period, regional growth will be further supported by rising consumer device demand and facility expansion to satisfy it.

Note: Actual Numbers Might Vary In The Final Report

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the EDA software market, many big players are including they providing similar products. This can lead to pricing pressure and may limit the profit margin of EDA software vendors. Few numbers of major businesses dominate the industry making it challenging for smaller sellers to compare.

The existence of numerous manufacturing firms in the nation has led to a highly fragmented global market for electronic design automation software. By incorporating cutting-edge technology into their products, investing in R&D, and providing improved products for customers, market leaders maintain their dominance. There are other strategies used, such as strategic alliances, contracts, mergers, and partnerships.

Market Key Players

- Werner Enterprises

- Oracle corp

- SAP

- BluJay Solutions

- Cadence Design Systems Inc

- Synopsys Inc

- Siemens

- ANSYS Inc

- Keysight Technologies Inc

- Xilinx Inc

- eInfochips

- Altium Limited

- Zuken Inc

- Silvaco Inc

- Other Key Players

Recent Developments

- In May 2021, Phoenix Integration was purchased by US-based engineering simulation software Ansys for an unknown sum. Ansys will be able to help customers connect with numerous engineering tools in multi-tool workflows for comprehensive and model-based solid engineering as a result of this purchase, which will increase its solution portfolio.

- In August 2021, Using the Virtuoso Design Platform and integrated EM analysis, Cadence Design Systems, Inc. and Tower Semiconductor (US) announced the silicon-validated SP4T RF SOI switch reference flow. The process illustrates the advantages of having a single design environment for the simulation and co-design of chips and packages. As the solution satisfies the requirements of the complicated systems, the new development from the cooperation helps their clients.

Report Scope

Report Features Description Market Value (2023) USD 13.6 Bn Forecast Revenue (2032) USD 29.5 Bn CAGR (2023-2032) 9.3% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Computer-aided Engineering (CAE), IC Physical Design and Verification, Printed Circuit Board and Multi-Chip Module (PCB and MCM), Semiconductor Intellectual Property (SIP), and Services) By Application (Communication, Consumer Electronics, Automotive, Industrial, Aerospace & Defence, Medical and Other Application) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Werner Enterprises, Oracle Corp, SAP, BluJay Solutions, Cadence Design Systems Inc, Synopsys Inc, Siemens, ANSYS Inc, Keysight Technologies Inc, Xilinx Inc, eInfochips, Altium Limited, Zuken Inc, Silvaco Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the value of the global Electronic Design Automation Software Market?In 2022, the global Electronic Design Automation Software Market was valued at USD 12.4 Billion.

What will be the market size for Electronic Design Automation Software Market in 2032?In 2032, the Electronic Design Automation Software Market will reach USD 29.5 Billion.

What CAGR is projected for the Electronic Design Automation Software Market?The Electronic Design Automation Software Market is expected to grow at 9.3% CAGR (2023-2032).

List the segments encompassed in this report on the Electronic Design Automation Software Market?Market.US has segmented the Electronic Design Automation Software Market Market by geographic (North America, Europe, APAC, South America, and MEA). By Type, market has been segmented into Computer-aided Engineering (CAE), IC Physical Design and Verification, Printed Circuit Board and, Multi-Chip Module (PCB and MCM), Semiconductor Intellectual Property (SIP) and Services. By Application, the market has been further divided into Communication, Consumer Electronics, Automotive and Others Application.

Which segment dominate the Electronic Design Automation Software industry?With respect to the Electronic Design Automation Software industry, vendors can expect to leverage greater prospective business opportunities through the IC Physical Design and Verification segment, as this dominate this industry.

Name the major industry players in the Electronic Design Automation Software Market.Werner Enterprises, Oracle corp, SAP, BluJay Solutions, Cadence Design Systems Inc, Synopsys Inc, Siemens and Other Key Players are the main vendors in this market.

Electronic Design Automation Software MarketPublished date: Nov. 2022add_shopping_cartBuy Now get_appDownload Sample

Electronic Design Automation Software MarketPublished date: Nov. 2022add_shopping_cartBuy Now get_appDownload Sample -

-

- Werner Enterprises

- Oracle corp

- SAP

- BluJay Solutions

- Cadence Design Systems Inc

- Synopsys Inc

- Siemens

- ANSYS Inc

- Keysight Technologies Inc

- Xilinx Inc

- eInfochips

- Altium Limited

- Zuken Inc

- Silvaco Inc

- Other Key Players