Global Robotics and Automation Actuators Market Size, Share, Growth Analysis By Actuation (Electric, Pneumatic, Hydraulic), By Type (Linear Actuators, Rotary Actuators), By Design Characteristic (Load, Torque), By Application (Food & Beverages, Oil & Gas, Metal Mining & Machinery, Power Generation, Chemicals, Paper & Plastics, Pharmaceutical & Healthcare, Automotive, Aerospace & Defense, Marine, Electronics & Electricals, Logistics, Inspection, Maintenance & Cleaning, Agriculture & Forestry, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 73132

- Number of Pages: 331

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

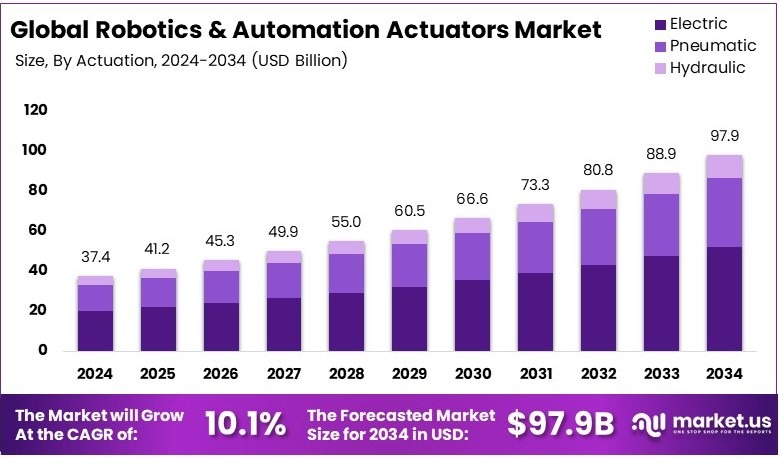

The Global Robotics and Automation Actuators Market size is expected to be worth around USD 97.9 Billion by 2034, from USD 37.4 Billion in 2024, growing at a CAGR of 10.1% during the forecast period from 2025 to 2034.

Robotics and automation actuators are devices used in robots and automated machinery. They convert electrical, hydraulic, or pneumatic energy into mechanical motion. Actuators allow robots to move arms, legs, or other parts precisely. Common examples include electric motors, hydraulic cylinders, and pneumatic actuators for various manufacturing tasks.

The robotics and automation actuators market covers all sales of actuator devices used in robots and automated equipment. This includes manufacturers and suppliers providing electric, hydraulic, and pneumatic actuators. Industries using these products include automotive, electronics manufacturing, healthcare, and logistics, helping automate processes to increase efficiency and accuracy.

According to recent market trends, robotics and automation actuators are growing fast due to demand across industries. Companies seek these devices to make robots move precisely and quickly. For example, BMW introduced humanoid robots from Figure Robotics, leading to a 400% faster operation and accurately placing 1,000 auto parts each day.

Similarly, the robotics and automation actuators market has become highly competitive. Companies compete to create advanced, reliable actuators for various robot types. For instance, logistics firm GXO adopted Agility Robotics’ Digit robots, helping solve labor shortages. Currently, the U.S. manufacturing industry faces 622,000 unfilled job positions, boosting automation demand.

Furthermore, this market is expanding quickly due to clear growth factors. Labor shortages push companies toward automation, increasing actuator sales. Robots performing repetitive tasks, like moving boxes, free humans for complex jobs. As a result, actuators become essential components, ensuring efficient and accurate robot movements in factories and warehouses.

However, the global market is still not saturated, especially in developing countries. Many businesses have not fully adopted automation technology yet. Consequently, companies supplying actuators have opportunities to expand. On the contrary, developed markets like Europe and the U.S. see intense competition among major brands, making expansion more challenging.

Key Takeaways

- The Robotics and Automation Actuators Market was valued at USD 37.4 Billion in 2024 and is expected to reach USD 97.9 Billion by 2034, with a CAGR of 10.1%.

- In 2024, Electric Actuators led the actuation segment with 53.3%, owing to their energy efficiency and precision control.

- In 2024, Linear Actuators dominated the type segment with 62.3%, driven by widespread applications in automation systems.

- In 2024, Load was the leading design characteristic with 56.3%, reflecting its critical role in industrial automation.

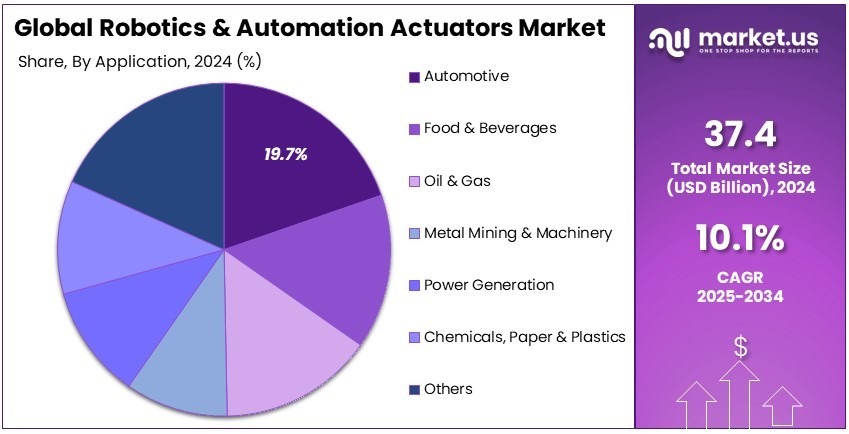

- In 2024, Automotive emerged as the dominant application segment with 19.7%, supported by advancements in electric and autonomous vehicles.

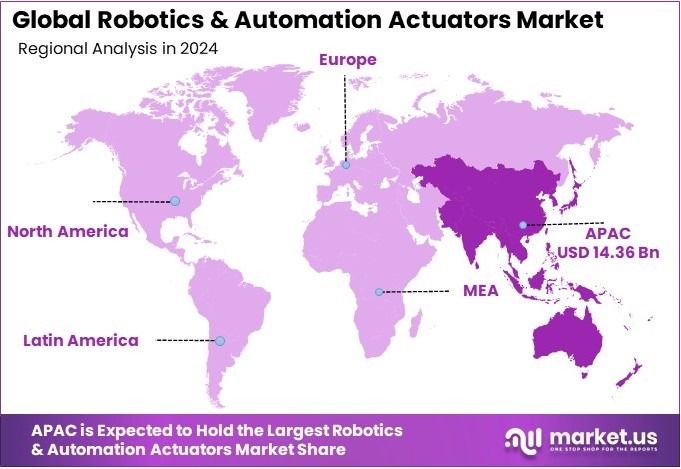

- In 2024, APAC held the largest regional share at 38.4% + USD 13.9 Bn, fueled by strong manufacturing and industrial automation growth.

Actuation Analysis

Electric Actuators dominate with 53.3% due to their high efficiency and adaptability across multiple industries.

The Robotics and Automation Actuators market is segmented by the method of actuation, where Electric Actuators emerge as the dominant sub-segment with a 53.3% share. This prominence is attributed to their efficiency, precision, and the increasing shift towards automation and cleaner energy sources across industries. Electric actuators offer significant advantages in terms of energy consumption and maintenance costs, making them a preferred choice in sectors striving for sustainability and operational efficiency.

Pneumatic and Hydraulic actuators also play essential roles within the market. Pneumatic actuators are favored for their simplicity and high-speed capabilities, often employed in applications requiring rapid movements.

Hydraulic actuators are unmatched in their ability to exert large forces and are commonly used in heavy-duty industrial applications. Each of these sub-segments contributes to market diversity and addresses specific operational needs across various industry sectors.

Type Analysis

Linear Actuators lead with 62.3% owing to their versatility and reliability in precise movement control.

In the Type category of this market, Linear Actuators hold the majority with a 62.3% share, underlining their critical role in providing reliable and precise control of movements in various applications. Linear actuators are extensively used due to their ability to offer precise positioning and ease of integration into different environments, making them invaluable in both industrial and consumer product applications.

Rotary Actuators, while smaller in share, are essential for applications requiring rotational motion, such as robotic arms or rotating platforms. Their role in facilitating complex movements and their adaptability in automation setups ensure that they remain a vital component of the automation actuators market.

Design Characteristic Analysis

Load dominates with 56.3% as it is crucial for determining the operational capabilities of actuators in heavy-load industries.

Focusing on Design Characteristics, Load takes precedence with a 56.3% share, highlighting its importance in applications where handling significant weights is necessary. Actuators designed to bear high loads are integral to industries such as construction, mining, and any sector where heavy materials need precise manipulation.

Torque, the capacity to apply rotational force, is another vital characteristic, especially valued in automotive and aerospace sectors. Understanding the torque requirements is essential for ensuring performance and safety in applications where rotational force is a critical factor.

Application Analysis

Automotive applications dominate with 19.7% due to the sector’s rapid automation and increasing incorporation of advanced robotics.

In the Application segment, the Automotive sector leads with a 19.7% market share. The automotive industry’s drive towards automation for enhanced production efficiency and the growing adoption of electric vehicles have significantly fueled the demand for advanced actuators.

Robotics and automation actuators in this sector are crucial for assembling, welding, and painting processes, where precision and reliability directly impact production quality and throughput.

Other important applications include Aerospace & Defense, which relies on actuators for safety-critical systems, and Electronics & Electricals, where miniaturization trends demand highly precise actuation solutions.

Food & Beverages, Chemicals, Paper & Plastics, and Pharmaceuticals also benefit from automation actuators, each sector leveraging unique properties of different actuator types to enhance their operational workflows.

Key Market Segments

By Actuation

- Electric

- Pneumatic

- Hydraulic

By Type

- Linear Actuators

- Rotary Actuators

By Design Characteristic

- Load

- Torque

By Application

- Food & Beverages

- Oil & Gas

- Metal Mining & Machinery

- Power Generation

- Chemicals, Paper & Plastics

- Pharmaceutical & Healthcare

- Automotive

- Aerospace & Defense

- Marine

- Electronics & Electricals

- Logistics

- Inspection, Maintenance & Cleaning

- Agriculture & Forestry

- Others

Driving Factors

Collaborative Robots and Medical Robotics Drive Market Growth

The adoption of collaborative robots (cobots) is transforming industrial automation. These robots work alongside humans in manufacturing, logistics, and assembly lines, improving productivity and workplace safety.

Unlike traditional industrial robots, cobots are designed with advanced sensors and precision actuators, allowing them to perform delicate and repetitive tasks with high accuracy. Companies like Universal Robots and ABB are leading the shift towards human-robot collaboration, reducing labor-intensive work while enhancing operational efficiency.

Medical robotics is another key driver of market expansion. The demand for high-precision actuators is rising in robotic-assisted surgeries and healthcare automation. Robotic surgical systems like the Da Vinci Surgical System rely on micro-actuators to enable precise movements, improving surgical outcomes.

In addition, agricultural automation is gaining momentum, with robots being used for crop harvesting, soil monitoring, and pesticide application. These systems rely on advanced actuators to navigate fields and handle delicate crops with minimal waste.

Government initiatives are also fueling the growth of robotics by funding AI-driven automation projects. Countries like Japan and Germany are investing in robotic research to enhance industrial competitiveness, further boosting market demand. Collectively, these factors drive advancements in robotics and automation actuators.

Restraining Factors

High Costs and Technical Barriers Restrain Market Growth

The high initial investment required for robotic actuation systems is a major market constraint. Businesses must allocate significant capital to purchase, install, and maintain advanced robotics solutions. For small and mid-sized manufacturers, the cost of acquiring high-precision actuators and automation technologies remains prohibitive. Maintenance costs further add to the financial burden, especially in industries requiring continuous upgrades and system repairs.

Technical challenges also limit market expansion. Developing energy-efficient and miniature actuators for compact robotic systems is complex. Industries such as medical robotics and wearables require lightweight, low-power actuators, but achieving this balance without compromising performance remains a challenge.

Additionally, limited interoperability between different robotics and automation platforms complicates integration. Many robotic systems operate on proprietary software, making cross-platform compatibility difficult. This restricts scalability and increases implementation complexity.

Another concern is workforce displacement due to automation. As robots replace manual labor in industries such as manufacturing, logistics, and agriculture, concerns over job losses are rising. While automation improves efficiency, businesses must balance technological adoption with workforce reskilling programs to mitigate social and economic impacts. Addressing these challenges is crucial for sustainable market growth.

Growth Opportunities

Soft Actuators and AI Integration Provide Opportunities

The development of soft actuators is creating new possibilities for robotics. These flexible, muscle-like actuators enhance human-robot interaction and are widely used in wearable robotics and assistive technologies. Industries such as healthcare and rehabilitation are adopting soft robotics for prosthetics and exoskeletons, improving mobility for individuals with disabilities. Soft actuators also enable safer robotic applications in delicate environments, such as food handling and lab automation.

AI-powered actuators are another major growth area. Autonomous vehicles and drones are integrating AI-driven actuators for enhanced motion control and real-time decision-making. Tesla, for instance, incorporates AI-enhanced actuators in its electric vehicles to optimize braking and steering functions.

Similarly, defense and space applications are witnessing increased adoption of high-speed electric actuators. These advanced systems ensure precise control in satellites, robotic arms, and unmanned aerial vehicles (UAVs), driving market demand.

Furthermore, smart sensors and IoT-enabled actuators are revolutionizing automation. By incorporating real-time monitoring and predictive maintenance, IoT-connected actuators enhance efficiency and reduce downtime. In industries like manufacturing and logistics, smart actuators streamline operations, enabling data-driven decision-making. These technological advancements present significant opportunities for the robotics and automation actuators market.

Emerging Trends

Piezoelectric and 3D-Printed Actuators Are Latest Trending Factors

Piezoelectric actuators are gaining traction due to their precision motion control capabilities. These actuators generate movement through electric stimulation, making them ideal for applications requiring ultra-fine adjustments. Industries such as aerospace, optics, and nanotechnology are adopting piezoelectric actuators to enhance accuracy in micro-positioning systems. This trend is driving further innovation in compact and high-speed actuator designs.

Another significant trend is the use of 3D printing for actuator development. Custom-designed actuators created through additive manufacturing enable faster prototyping and reduced production costs. Companies are leveraging 3D printing to develop lightweight and application-specific actuators for robotics, automation, and prosthetics. This approach enhances design flexibility while improving overall performance.

The demand for hygienic actuators is also rising in food processing and pharmaceutical industries. Robotics used in these sectors must comply with strict hygiene standards, requiring corrosion-resistant and easy-to-clean actuators.

Additionally, advancements in self-healing and self-lubricating actuators are improving durability and reducing maintenance needs. These innovations enhance the lifespan of robotic systems, making them more cost-effective and efficient. As these trends evolve, they will shape the future of the robotics and automation actuators market.

Regional Analysis

Asia Pacific Dominates with 38.4% Market Share

Asia Pacific leads the Robotics and Automation Actuators Market with a 38.4% share, totaling USD 14.36 billion. This prominent market position is propelled by the region’s aggressive adoption of automation technologies in manufacturing and assembly operations.

Key factors include the integration of collaborative robots in industrial sectors and the rising implementation of high-precision actuators in medical robotics. These technologies are particularly prevalent in countries like Japan and South Korea, which are pioneers in robotic innovation. Additionally, the expansion of robotics into agriculture for tasks such as automated harvesting and soil monitoring contributes to the region’s dominance.

The future prospects for Asia Pacific in the Robotics and Automation Actuators Market look increasingly robust. With ongoing advancements in AI and robotics, coupled with substantial government investments in technology, the region is poised to not only maintain but increase its market share. This growth is expected to be driven further by the increasing adoption of automation across various industries, including healthcare and agriculture.

Regional Mentions:

- North America: North America is a significant player in the Robotics and Automation Actuators Market, thanks to its advanced technological base and strong governmental support for innovation. The region’s focus on enhancing manufacturing automation and defense capabilities keeps it at the forefront of market development.

- Europe: Europe maintains a competitive edge in the market due to its strong emphasis on innovation and safety in robotics. The region’s advanced engineering capabilities and substantial investments in automotive and aerospace sectors fuel its growth in the actuators market.

- Middle East & Africa: The Middle East and Africa are gradually expanding their presence in the market, with investments aimed at diversifying economies and enhancing manufacturing capabilities. Technological partnerships and industrial modernization initiatives are key to the region’s growth in this sector.

- Latin America: Latin America’s market is growing, driven by industrial automation and modernization efforts. As the region continues to adopt more advanced manufacturing technologies, its market share in robotics and automation actuators is expected to rise.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

In the rapidly evolving Robotics and Automation Actuators Market, four companies, ABB, Rockwell Automation, Emerson Electric Co., and Altra Industrial Motion, stand out as key players. ABB is renowned for its innovative solutions in robotics and automation, providing a wide range of actuators that are integral to manufacturing and production processes across various industries. Their products are known for reliability and precision, making them a favorite in sectors like automotive and electronics.

Rockwell Automation excels in integrating control systems with robotic actuators to enhance industrial productivity and efficiency. Their expertise in smart manufacturing processes and data-driven automation solutions positions them as a leader in the field. Emerson Electric Co. focuses on precision in fluid control and movement technologies, which are crucial for process automation in industries such as oil and gas and chemical manufacturing.

Altra Industrial Motion specializes in motion control and power transmission solutions, offering products that are vital for the mechanical functioning of robots and automated systems in heavy industrial environments. Their robust design and engineering capabilities ensure high performance and durability of their actuators.

These companies drive innovation in the robotics and automation actuators market by developing advanced technologies that improve the speed, accuracy, and efficiency of automated systems, making them indispensable partners in the industrial automation sector.

Major Companies in the Market

- ABB

- Altra Industrial Motion

- Cedrat Technologies

- Curtis Wright

- DVG Automation

- Emerson Electric Co.

- Harmonic Drive LLC

- Macron Dynamics

- MISUMI Group Inc.

- Moog

- Nook Industries Inc.

- Rockwell Automation

- SKF

- SMC

- Tolomatic

Recent Developments

- Hitachi and MA micro automation GmbH: On September 2024, Hitachi finalized the acquisition of MA micro automation GmbH, a German provider of robotic and automation technology. This acquisition is aimed at enhancing Hitachi’s capabilities in the global advanced automation market, particularly across Europe, North America, and Southeast Asia, with MA micro automation operating under JR Automation Technologies.

- Ashtead Technology Holdings and Seatronics/J2 Subsea: On November 2024, Ashtead Technology Holdings agreed to acquire Seatronics and J2 Subsea from Acteon Group for £63 million. This acquisition expands its robotics and surveying operations by adding 110 staff and 7,000 pieces of equipment.

Report Scope

Report Features Description Market Value (2024) USD 37.4 Billion Forecast Revenue (2034) USD 97.9 Billion CAGR (2025-2034) 10.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Actuation (Electric, Pneumatic, Hydraulic), By Type (Linear Actuators, Rotary Actuators), By Design Characteristic (Load, Torque), By Application (Food & Beverages, Oil & Gas, Metal Mining & Machinery, Power Generation, Chemicals, Paper & Plastics, Pharmaceutical & Healthcare, Automotive, Aerospace & Defense, Marine, Electronics & Electricals, Logistics, Inspection, Maintenance & Cleaning, Agriculture & Forestry, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ABB, Altra Industrial Motion, Cedrat Technologies, Curtis Wright, DVG Automation, Emerson Electric Co., Harmonic Drive LLC, Macron Dynamics, MISUMI Group Inc., Moog, Nook Industries Inc., Rockwell Automation, SKF, SMC, Tolomatic Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Robotics and Automation Actuators MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Robotics and Automation Actuators MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB

- Altra Industrial Motion

- Cedrat Technologies

- Curtis Wright

- DVG Automation

- Emerson Electric Co.

- Harmonic Drive LLC

- Macron Dynamics

- MISUMI Group Inc.

- Moog

- Nook Industries Inc.

- Rockwell Automation

- SKF

- SMC

- Tolomatic