Global Goat Milk Replacer Market Size, Share, And Industry Analysis Report By Source Type (Whole Milk-Based, Skim Milk-Based, Whey-Based, Plant-Based), By Form (Powder, Liquid Concentrate, Ready-to-Feed Liquid), By Application (Animal Feed, Kids and Toddlers, Infant Formula, Adult Nutrition, Goat Milk Replacer), By End Use (Veterinary and Animal Nutrition, Human Nutrition, Pediatric, Geriatric, Commercial Livestock), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 170779

- Number of Pages: 322

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

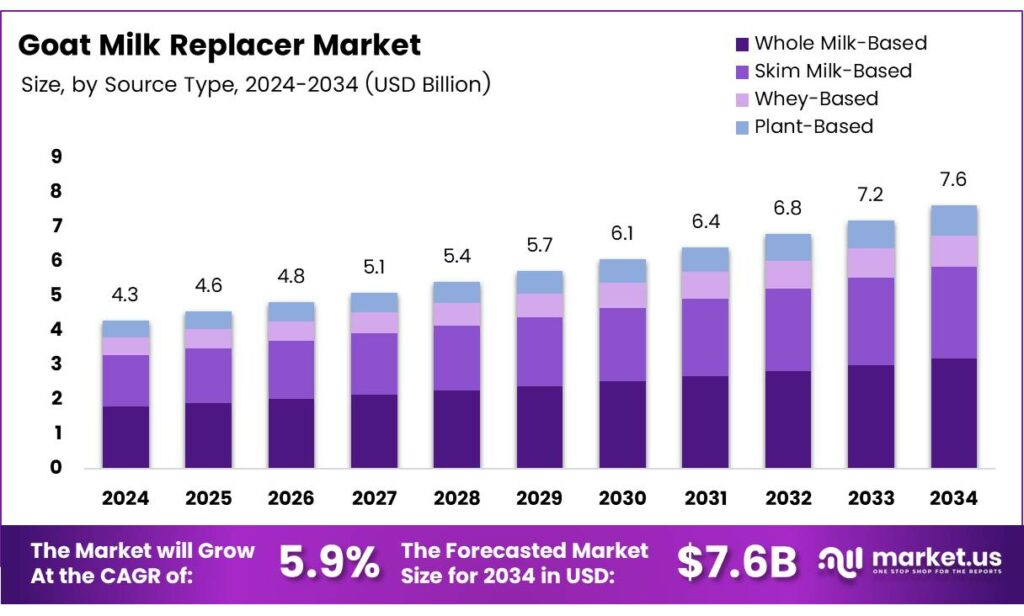

The Global Goat Milk Replacer Market size is expected to be worth around USD 7.6 billion by 2034, from USD 4.3 billion in 2024, growing at a CAGR of 5.9% during the forecast period from 2025 to 2034.

The Goat Milk Replacer Market refers to nutritionally balanced powder or liquid formulations designed to substitute natural goat milk for young animals. These products support early-life feeding when maternal milk is unavailable or insufficient. From a market perspective, goat milk replacers improve survival rates, feeding consistency, and farm-level productivity across livestock and companion animal segments.

Goat milk replacers are positioned as functional nutrition inputs rather than basic feed commodities. Therefore, demand growth is driven by rising herd management awareness, structured breeding programs, and professionalized dairy goat farming. Producers increasingly prioritize replacers offering digestibility, immune support, and predictable nutritional outcomes.

- Adoption momentum is supported by farm education and extension programs, although perception barriers persist. Surveys among 311 Kenyan goat keepers showed 85% farmer-group participation and 7+ annual training visits, strengthening replacer awareness. In South Africa, 41.7% of 151 farmers avoided goat milk due to taste (20.8%) and smell (64.5%), yet 93.1% expressed willingness after nutrition education.

Goat milk replacers are increasingly used in companion animal nutrition, expanding overall demand beyond livestock. Veterinary feeding guidelines emphasize precise dosing to ensure healthy growth outcomes. Newborn kittens typically receive 30 mL daily per 115 g body weight, divided every 3–4 hours, while supplements scale by 2 g–4 g based on weight, reinforcing structured feeding adoption.

Government investment and regulatory frameworks indirectly support the goat milk replacer market through livestock development, extension services, and animal health programs. Training-led productivity initiatives and disease monitoring programs improve acceptance of formulated feeds. Thus, replacers gain traction as governments encourage scientific feeding to reduce mortality and improve farm incomes.

Key Takeaways

- The Global Goat Milk Replacer Market is projected to grow from USD 4.3 billion in 2024 to USD 7.6 billion by 2034, registering a 5.9% CAGR.

- Whole milk-based formulations dominate the market by source type, accounting for a 43.8% share due to closer nutritional similarity to natural goat milk.

- Powder form leads the market with a 59.2% share, supported by ease of storage, transport, and flexible feeding usage.

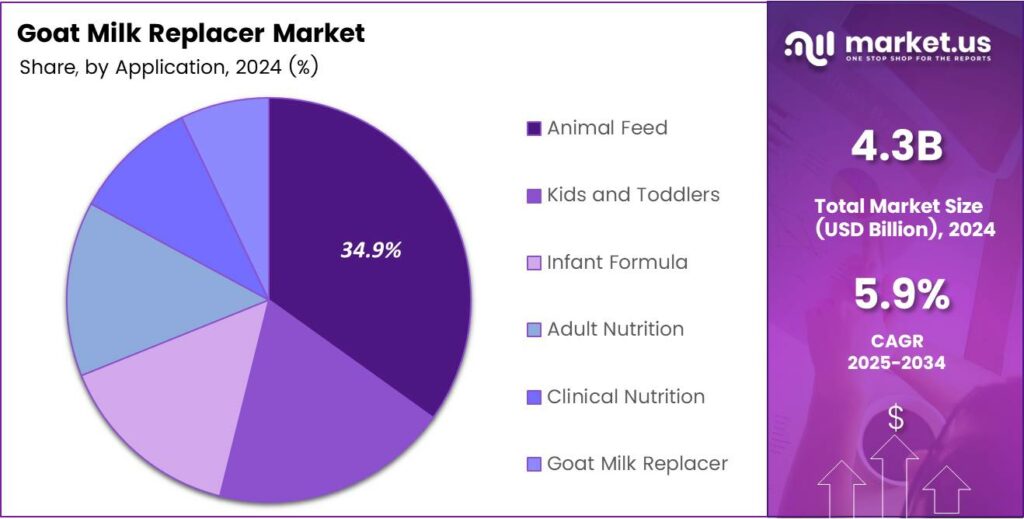

- Animal feed remains the largest application segment, contributing around 34.9% of total demand in 2024.

- Veterinary and animal nutrition is the leading end-use segment, holding a market share of 35.6% driven by professional feeding practices.

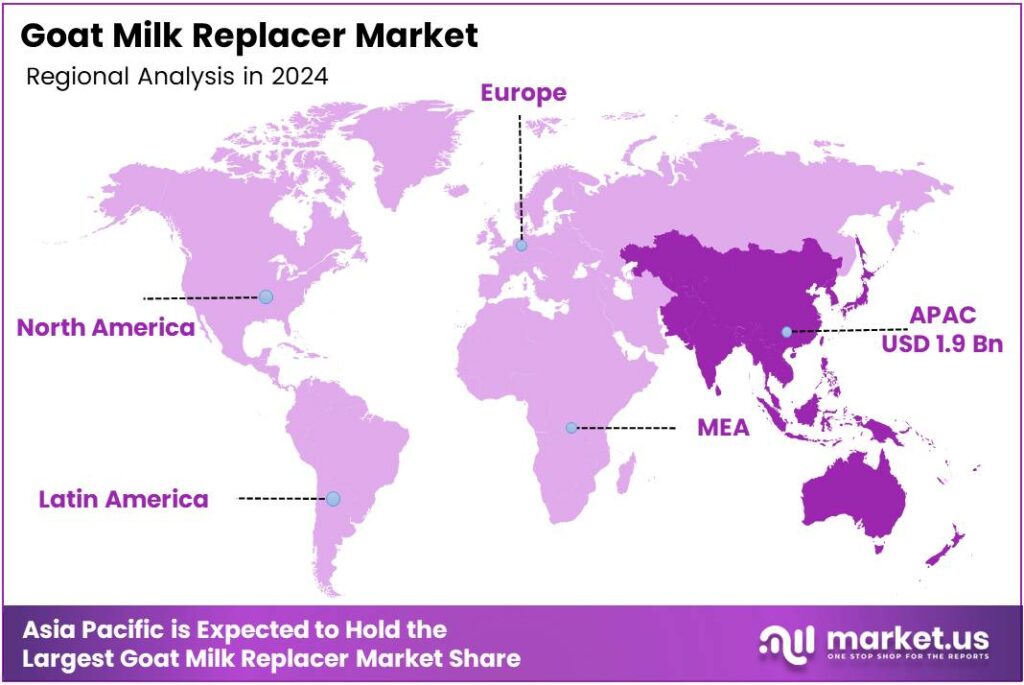

- Asia Pacific is the dominant regional market with a 45.9% share, valued at approximately USD 1.9 billion.

By Source Type Analysis

Whole Milk-Based dominates with 43.8% due to its closer nutritional resemblance to natural goat milk.

In 2024, Whole Milk-Based held a dominant market position in the By Source Type Analysis segment of the Goat Milk Replacer Market, with a 43.8% share. This dominance is supported by its balanced fat and protein profile. As a result, farmers increasingly prefer it for early-stage feeding. Moreover, it supports steady growth and digestion.

Skim Milk-Based replacers continue to gain attention due to their lower fat composition. These products are often used where controlled energy intake is needed. Consequently, they are favored in structured feeding programs. In addition, their longer shelf life improves handling convenience for small and medium farms.

Whey-based goat milk replacers are valued for their digestibility and cost efficiency. Since whey proteins are easily absorbed, they support immune development. Therefore, this segment finds use in transitional feeding phases. Also, whey availability supports a consistent supply across regions.

Plant-based replacers are gradually emerging due to sustainability concerns. These formulations appeal to farms exploring alternative protein sources. While adoption remains selective, innovation is improving acceptance. As awareness grows, plant-based options may complement traditional replacers.

By Form Analysis

Powder dominates with 59.2% due to storage ease and flexible usage.

In 2024, Powder held a dominant market position in the By Form Analysis segment of the Goat Milk Replacer Market, with a 59.2% share. Powdered replacers are widely used due to easy transportation. Additionally, they allow precise mixing. Hence, farmers value consistency and reduced wastage.

Liquid Concentrate replacers are preferred where quick preparation is required. These products reduce mixing errors and save labor time. As a result, larger farms often adopt them. Moreover, concentrates ensure uniform nutrition when diluted correctly.

Ready-to-Feed Liquid replacers support convenience-focused feeding practices. They eliminate preparation steps and reduce contamination risk. Therefore, they are useful in intensive operations. However, higher logistics needs limit broader adoption compared to powder formats.

By Application Analysis

Animal Feed dominates with 34.9% driven by farm-level feeding demand.

In 2024, Animal Feed held a dominant market position in the By Application Analysis segment of the Goat Milk Replacer Market, with a 34.9% share. This reflects its primary use in livestock nutrition. Farmers rely on replacers to stabilize feeding schedules. Thus, demand remains consistent.

Kids and Toddlers’ applications focus on controlled nutritional intake. These products are designed for early growth stages. Consequently, they emphasize digestibility and safety. Adoption is supported by veterinary guidance and farm training. Infant Formula usage remains niche and regulated.

These formulations follow strict quality standards. Therefore, growth is steady but selective. Adult Nutrition applications support supplemental dietary use. Clinical Nutrition focuses on therapeutic feeding under supervision. Goat Milk Replacer applications also exist for targeted feeding programs, supporting diversified usage across nutrition segments.

By End Use Analysis

Veterinary and Animal Nutrition dominates with 35.6% due to professional feeding practices.

In 2024, Veterinary and Animal Nutrition held a dominant market position in the By End Use Analysis segment of the Goat Milk Replacer Market, with a 35.6% share. Veterinary recommendations strongly influence usage. As a result, structured feeding improves survival and growth outcomes.

Human Nutrition applications remain selective and regulated. These products are used where goat milk benefits are recognized. Pediatric usage supports controlled dietary needs. Hence, quality and formulation accuracy remain critical. Geriatric and General Health applications focus on digestibility.

Goat milk replacers serve as gentle nutrition options. Meanwhile, Commercial Livestock use supports herd management efficiency. Companion Animals represent a growing end-use area. Replacers are used for young or recovering pets. This segment benefits from rising awareness and veterinary-supported feeding practices.

Key Market Segments

By Source Type

- Whole Milk-Based

- Skim Milk-Based

- Whey-Based

- Plant-Based

By Form

- Powder

- Liquid Concentrate

- Ready-to-Feed Liquid

By Application

- Animal Feed

- Kids and Toddlers

- Infant Formula

- Adult Nutrition

- Clinical Nutrition

- Goat Milk Replacer

By End Use

- Veterinary and Animal Nutrition

- Human Nutrition

- Pediatric

- Geriatric

- General Health

- Commercial Livestock

- Companion Animals

Emerging Trends

Shift Toward Scientifically Balanced and Easy-to-Use Nutrition Solutions Trends Upward

One key trend in the goat milk replacer market is the shift toward scientifically balanced nutrition. Farmers increasingly prefer products backed by veterinary guidance and clear feeding instructions. Convenience is another trending factor. Ready-to-mix powders and stable formulations reduce preparation time and feeding errors.

- Goat milk itself holds a small but meaningful share of global milk production — roughly 2–2.4% of total world milk output, as tracked by the Food and Agriculture Organization (FAO) and related nutrition sources — with the rest dominated by cow and buffalo milk.

Clean labeling and transparency are also gaining attention. Buyers look for clear ingredient lists, protein sources, and fat content to ensure kid safety and growth performance. Digital awareness plays a role as well. Online videos, mobile advisory services, and social media farming communities spread practical knowledge about replacer benefits and usage methods.

Drivers

Rising Focus on Kid Health and Farm Productivity Drives Market Growth

The goat milk replacer market is mainly driven by the growing focus on improving kid survival and overall herd health. Farmers increasingly aim to reduce early-stage mortality through controlled and balanced feeding. Goat milk replacers offer consistent nutrition when a natural milk supply is limited or uneven.

- The Food and Agriculture Organization (FAO), raw milk from non-bovine livestock, which includes goat milk, increased from about 29 million tonnes to around 35 million tonnes, showing a real shift in production focus toward non-cow dairy sources like goats.

Veterinary awareness also supports market growth. Extension programs and training sessions highlight the role of replacers in managing disease risks linked to poor nutrition. Farmers are learning how replacers help during weaning stress, illness recovery, and multiple births.

Restraints

High Product Cost and Limited Awareness Restrain Market Expansion

One major restraint in the goat milk replacer market is the higher cost compared to traditional feeding practices. Small and marginal farmers often hesitate to invest in replacers due to tight farm budgets and uncertain short-term returns. Concerns about ingredient quality and digestibility create hesitation.

Limited awareness is another challenge. In many rural areas, farmers are unfamiliar with correct mixing ratios, feeding schedules, and storage practices. Cultural preferences also act as a restraint. Many farmers strongly trust natural feeding methods passed down through generations.

This mindset slows acceptance of commercial alternatives, even when replacers show clear nutritional benefits. Supply chain gaps further restrict growth. Poor availability, short shelf life concerns, and lack of local distributors reduce adoption.

Growth Factors

Expansion of Commercial Goat Farming Creates New Growth Opportunities

The growing shift toward commercial and semi-commercial goat farming creates strong opportunities for the goat milk replacer market. Larger farms need reliable feeding solutions to manage higher kid populations efficiently. Opportunities also emerge from government-supported livestock development programs.

Training initiatives, subsidy schemes, and rural extension services help educate farmers about modern feeding practices, indirectly boosting replacer adoption. Product innovation offers another growth path. Improved formulations that closely match natural goat milk, enhanced digestibility, and easy-mix powders increase farmer confidence and repeat purchases.

The rising role of goat farming in livelihood improvement programs, especially in developing regions, further supports demand. Milk replacers fit well into projects focused on reducing mortality and improving farmer income stability. In addition, the expanding use of goat milk replacers in companion animal and specialty nutrition segments opens new revenue streams.

Regional Analysis

Asia Pacific Dominates the Goat Milk Replacer Market with a Market Share of 45.9%, Valued at USD 1.9 billion

Asia Pacific represents the leading regional market for goat milk replacers, driven by rising goat population density, smallholder farming expansion, and growing awareness of structured kid nutrition. In value terms, the region accounts for 45.9% of global demand, translating to approximately USD 1.9 billion, supported by improving rural feed distribution networks and government-backed livestock productivity programs.

North America shows steady adoption of goat milk replacers due to the commercialization of dairy goat farming and growing interest in precision animal nutrition. Farms increasingly use replacers to manage labor efficiency and ensure consistent feeding during seasonal milk shortages. Strong veterinary guidance and established feed quality standards continue to support controlled market growth across the region.

Europe’s goat milk replacer market is shaped by strict animal welfare regulations and a focus on disease prevention in young livestock. Farmers are increasingly using replacers to improve traceability and maintain uniform growth rates. Demand is further supported by the region’s emphasis on sustainable livestock practices and controlled feeding protocols within organized dairy systems.

The U.S. market benefits from advanced farm management practices and the widespread availability of formulated animal feeds. Goat milk replacers are commonly adopted to improve operational efficiency, particularly in commercial dairy goat farms. Strong extension services and veterinary oversight continue to reinforce consistent usage patterns across the country.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Meyenberg Goat Milk Products sits close to the consumer end of the value chain, so its 2024 advantage is brand trust and repeat purchase behavior. From an analyst lens, the company is well-positioned to benefit from premiumization in goat-based nutrition, where buyers look for consistent taste, digestibility cues, and clear feeding directions. Packaging clarity and steady availability can be a quiet but real differentiator.

Hoegger Supply Company operates with a strong proximity to smallholders and homestead-style buyers, making it relevant in 2024 as backyard and micro-farm goat keeping stays resilient. The opportunity here is less about mass scale and more about customer education—mixing guidance, storage practices, and troubleshooting. A service-led approach can lift conversion and reduce “first-bag failure” drop-offs.

Savencia Fromage and Dairy brings dairy processing depth that can translate into tighter quality control, formulation discipline, and supply reliability—important themes in 2024 as buyers demand predictability in young-animal feeding. Strategically, the company can use its broader dairy expertise to refine ingredient sourcing, traceability narratives, and product performance consistency. That combination can support premium pricing where compliance and quality assurance matter.

Denkavit Group is typically assessed as performance-and-outcomes outcomes-oriented, with a practical focus on feed efficiency, health support, and on-farm usability. In 2024, its best lever is technical selling: clear protocols, farmer training, and consistent results across seasons. If it strengthens advisory support alongside distribution, it can deepen loyalty in professional livestock systems that prioritize measurable kid growth and lower setbacks.

Top Key Players in the Market

- Meyenberg Goat Milk Products

- Hoegger Supply Company

- Savencia Fromage and Dairy

- Denkavit Group

- Land O’Lakes Inc.

- Others

Recent Developments

- In 2025, Meyenberg is the leading U.S. brand for goat milk products intended for human consumption, including whole goat milk, low-fat goat milk, evaporated goat milk, powdered whole goat milk, goat butter, and goat yogurt. Their products are marketed as easy-to-digest, high-protein alternatives to cow’s milk.

- In 2025, Savencia Fromage & Dairy is a global dairy group focused primarily on cheese specialties, butters, creams, and dairy ingredients for human consumption. Through its Elvor brand (listed under worldwide presence and described as part of the group), it is involved in young animal nutrition, offering a range of milk replacers and feeding products for calves, lambs, kids, piglets, puppies, and kittens.

Report Scope

Report Features Description Market Value (2024) USD 4.3 Billion Forecast Revenue (2034) USD 7.6 Billion CAGR (2025-2034) 5.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source Type (Whole Milk-Based, Skim Milk-Based, Whey-Based, Plant-Based), By Form (Powder, Liquid Concentrate, Ready-to-Feed Liquid), By Application (Animal Feed, Kids and Toddlers, Infant Formula, Adult Nutrition, Clinical Nutrition, Goat Milk Replacer), By End Use (Veterinary and Animal Nutrition, Human Nutrition, Pediatric, Geriatric, General Health, Commercial Livestock, Companion Animals) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Meyenberg Goat Milk Products, Hoegger Supply Company, Savencia Fromage and Dairy, Denkavit Group, Land O’Lakes Inc., Others Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Goat Milk Replacer MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Goat Milk Replacer MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Meyenberg Goat Milk Products

- Hoegger Supply Company

- Savencia Fromage and Dairy

- Denkavit Group

- Land O'Lakes Inc.

- Others