Global Gluten-Free Alcoholic Drinks Market Report By Product Type (Beer, Wine, Distilled Spirits, Others), By Packaging Type (Bottles, Cans, Others), By Distribution Channel (On Trade, Off Trade), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: June 2024

- Report ID: 121686

- Number of Pages: 387

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

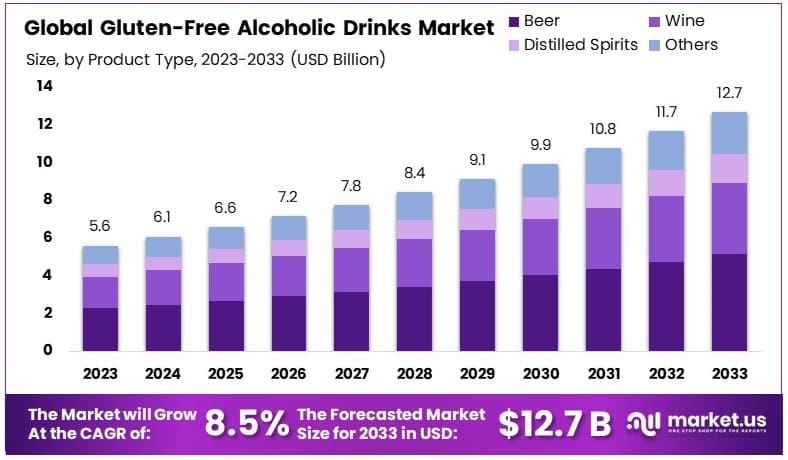

The Global Gluten-Free Alcoholic Drinks Market size is expected to be worth around USD 12.7 Billion by 2033, from USD 5.6 Billion in 2023, growing at a CAGR of 8.5% during the forecast period from 2024 to 2033.

The Gluten-Free Alcoholic Drinks Market encompasses beverages produced without gluten-containing grains such as wheat, barley, and rye. This market caters to consumers with celiac disease or gluten intolerance, as well as those choosing a gluten-free lifestyle.

Products range from beers and spirits to wines, all crafted to eliminate gluten while maintaining flavor and quality. The growing health consciousness and dietary preferences are driving demand, offering substantial opportunities for innovation and market expansion.

The gluten-free alcoholic drinks market is experiencing significant growth, driven by increasing consumer awareness and the rising prevalence of gluten-related disorders. The global prevalence of wheat allergy is estimated at 0.5-1%, with specific rates in European regions at 0.12% and in the Western Pacific regions at 0.01%.

These statistics highlight a critical segment of the population requiring gluten-free options. Additionally, Non-Celiac Gluten Sensitivity (NCGS) affects up to 6% of the U.S. population, making it the most common gluten-related disorder, with prevalence rates ranging from 0.5-13% globally.

Consumers are becoming more health-conscious, and the demand for gluten-free products is expanding beyond those with medical needs to include lifestyle choices. The trend towards natural and organic products also supports the market’s growth. Manufacturers are responding with innovative products that meet these consumer demands, offering gluten-free beers, wines, and spirits.

Moreover, the market’s growth can be attributed to the increasing availability of gluten-free products in mainstream retail channels and the rise of dedicated gluten-free brands. This accessibility encourages broader consumer adoption, further driving market expansion.

Investment in marketing and awareness campaigns by key players is also crucial. These efforts educate consumers about the benefits of gluten-free alcoholic drinks, thereby boosting demand. Additionally, advancements in brewing and distilling technologies have improved the quality and taste of gluten-free beverages, making them more appealing to a wider audience.

In conclusion, the gluten-free alcoholic drinks market is poised for continued growth. The combination of health trends, increased availability, and technological advancements creates a favorable environment for market expansion. Companies that innovate and effectively market their products will likely capture significant market share in this burgeoning industry.

Key Takeaways

- Market Value: The Gluten-Free Alcoholic Drinks Market was valued at USD 5.6 billion in 2023 and is expected to reach USD 12.7 billion by 2033, with a CAGR of 8.5%.

- Product Type Analysis: Beer dominated with 40.5%; it is popular due to increasing consumer preference for gluten-free options.

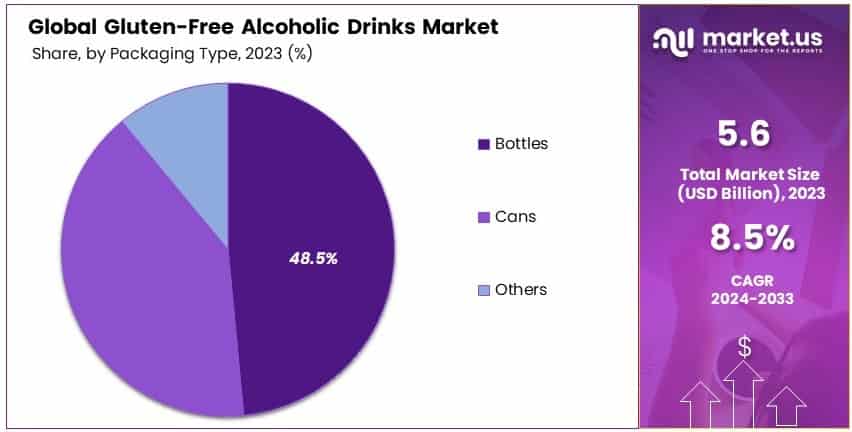

- Packaging Type Analysis: Bottles led with 48.5%; they are preferred for their traditional appeal and convenience.

- Distribution Channel Analysis: On Trade dominated with 65.8%; it is significant due to high consumption in bars and restaurants.

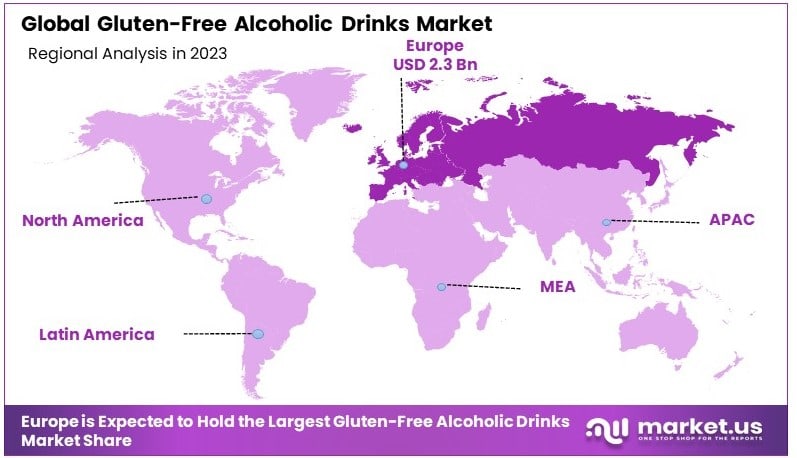

- Dominant Region: Europe dominated with 41.7%; driven by a large celiac population and growing health awareness.

- High Growth Region: North America shows promising growth; rising health consciousness and demand for gluten-free products fuel the market.

- Analyst Viewpoint: The market is rapidly growing with high competition. Future trends indicate a rise in premium and craft gluten-free alcoholic beverages.

- Growth Opportunities: Key players can focus on expanding product portfolios, leveraging health trends, and enhancing distribution networks to capture market share.

Driving Factors

Increasing Health Consciousness Drives Market Growth

The surge in health consciousness is a primary driver for the growth of the Gluten-Free Alcoholic Drinks Market. Statistics show that approximately 1% of the global population has celiac disease, with many more reporting gluten sensitivities. This has led to a heightened demand for gluten-free products, including alcoholic beverages.

Breweries are responding by developing drinks using gluten-free grains such as sorghum, rice, and buckwheat. For instance, sales of gluten-free beer have seen an uptick, with a projected CAGR of 13.5% from 2021 to 2026. This shift is not merely a trend but a reflection of changing consumer preferences towards healthier lifestyle choices, influencing the alcoholic beverage industry at large.

Rising Demand from Millennials and Gen Z Drives Market Growth

Millennials and Gen Z have emerged as influential cohorts in the Gluten-Free Alcoholic Drinks Market. These demographics are known for their health-oriented and experimental consumption habits, significantly impacting market dynamics. They are more likely to adopt gluten-free diets, driving demand for suitable alcoholic options.

For example, a survey indicated that 23% of millennials prefer gluten-free products, aligning their dietary choices with their purchasing behaviors. This preference has prompted craft distilleries and wineries to innovate, leading to an increase in market offerings and potential growth in consumer base and revenue streams.

Product Innovation and Variety Drives Market Growth

Innovation and an expanded product range are key to the proliferation of the Gluten-Free Alcoholic Drinks Market. Manufacturers are venturing beyond traditional offerings to include a wider variety of gluten-free beers, ciders, wines, and spirits.

Dedicated gluten-free breweries like Omission Brewing Co. and Ghostfish Brewing Co. are at the forefront, catering to nuanced consumer tastes and dietary requirements. This diversification in product portfolios not only meets the demand for variety but also enhances competitive advantage. Market analysis predicts that the availability of multiple gluten-free alcoholic beverage options will continue to attract a broader consumer base, fostering market growth at a steady rate.

Restraining Factors

Higher Costs Restrains Market Growth

The increased production costs of gluten-free alcoholic drinks significantly hinder market expansion. Specialized ingredients like gluten-free grains are often more expensive, and the processes to avoid cross-contamination add additional costs. These expenses are usually transferred to the consumer, making gluten-free options pricier than traditional alcoholic beverages.

For example, gluten-free beers can be up to 30% more expensive than their regular counterparts. This price disparity makes them less attractive to cost-conscious consumers, restricting the market’s growth potential, particularly in economically sensitive regions.

Limited Awareness and Education Restrains Market Growth

Although the demand for gluten-free products is rising, limited consumer awareness and education about gluten-free alcoholic drinks pose substantial barriers. Many consumers remain uninformed about the availability and benefits of these options, which curtails trial and adoption.

Misconceptions about taste and quality also prevail, leading potential customers to stick with familiar traditional products. Enhancing consumer knowledge through targeted education and marketing campaigns is crucial to overcoming these obstacles and expanding the market reach of gluten-free alcoholic drinks.

Product Type Analysis

Beer dominates with 40.5% due to its widespread popularity and accessibility.

The gluten-free beer segment holds a significant share of 40.5% in the Gluten-Free Alcoholic Drinks Market, primarily driven by its popularity and the growing availability of gluten-free grains such as sorghum and rice. Consumers with gluten intolerances or celiac disease have increasingly turned to gluten-free beer as a safe and enjoyable option, boosting its market presence. Breweries have responded to this demand by expanding their gluten-free product lines, enhancing both the variety and accessibility of these beers.

Apart from beer, other significant sub-segments include wine and distilled spirits, each contributing to market diversity. Gluten-free wines, made from naturally gluten-free ingredients, offer a safe alternative for those avoiding gluten, while distilled spirits, though typically gluten-free by nature of their distillation process, have also seen innovation with clear labeling to reassure consumers. The segment of other gluten-free alcoholic drinks, such as ciders and alcoholic ginger beers, also plays a crucial role in market expansion by catering to niche consumer preferences, further diversifying the product offerings and supporting overall market growth.

Packaging Type Analysis

Bottles dominate with 48.5% due to consumer preferences for premium packaging and ease of consumption.

Bottles are the preferred packaging type in the Gluten-Free Alcoholic Drinks Market, accounting for 48.5% of the segment. This dominance can be attributed to consumer perception of bottled beverages as being of higher quality and more conducive to preservation of flavor and carbonation, factors that are highly valued in alcoholic drinks. Additionally, the reusability and recyclability of glass bottles appeal to environmentally conscious consumers, aligning with the sustainability trends in packaging.

While bottles lead, cans and other forms of packaging also hold significant portions of the market. Cans are favored for their convenience, portability, and increasing acceptance among younger demographics who prioritize ease of transport and chill retention. The segment labeled as “others,” which includes kegs and mini-kegs, appeals primarily to on-trade venues like bars and restaurants, offering bulk purchasing options and efficiency in serving multiple patrons. These alternative packaging forms complement the dominance of bottles by fulfilling varied consumer needs and occasions, thereby supporting the broader growth of the market.

Distribution Channel Analysis

On Trade dominates with 65.8% due to consumer preference for consuming gluten-free drinks in social settings.

The on-trade distribution channel, encompassing bars, restaurants, and other hospitality venues, dominates the Gluten-Free Alcoholic Drinks Market with a 65.8% share. This channel’s success is largely due to the social nature of alcohol consumption, where consumers prefer to explore new drink options in social settings. The on-trade channel provides a platform for consumers to sample various gluten-free alcoholic drinks without committing to a full purchase, a significant driver for trial and adoption among hesitant first-time buyers.

Conversely, the off-trade channel, which includes retail outlets like supermarkets and liquor stores, plays a vital role by making gluten-free alcoholic drinks more accessible to a broader audience. This channel allows consumers to purchase these products for home consumption, catering to the growing trend of home-based social gatherings and the increased consumer preference for drinking at home, seen particularly during the COVID-19 pandemic. Together, these distribution channels create a comprehensive ecosystem that facilitates the availability and consumption of gluten-free alcoholic drinks, supporting sustained market growth.

Key Market Segments

By Product Type

- Beer

- Wine

- Distilled Spirits

- Others

By Packaging Type

- Bottles

- Cans

- Others

By Distribution Channel

- On Trade

- Off Trade

Growth Opportunities

Expansion into Emerging Markets Offers Growth Opportunity

The demand for gluten-free products is not only a trend confined to developed nations but is expanding globally. Emerging markets present a fertile ground for growth, particularly as awareness and diagnosis of gluten-related disorders improve.

For example, regions like Asia and Latin America, which are experiencing increased health awareness, offer significant opportunities for market entry and expansion. The global gluten-free products market is projected to grow at a high CAGR, with emerging markets playing a crucial role in this expansion. By tapping into these regions, gluten-free alcoholic drink manufacturers can broaden their market base and meet the rising demand where traditional offerings may lack.

Premiumization and Craft Offerings Offers Growth Opportunity

Consumer trends show a growing preference for premium, craft-style products, especially in the alcoholic drinks sector. Gluten-free brands have the opportunity to capitalize on this by offering high-quality, unique beverages that cater to a niche market.

Statistics indicate that the craft beer market alone is expected to grow by 10.6% annually through 2033. By positioning their products as both premium and gluten-free, brands can attract consumers willing to pay a higher price for artisanal quality and safety assurance. This approach not only drives sales but also enhances brand prestige and loyalty among consumers looking for both quality and dietary compatibility.

Trending Factors

Rise of Gluten-Free Diets Are Trending Factors

The popularity of gluten-free diets continues to rise, driven by increasing awareness of celiac disease, gluten sensitivity, and general health trends. As more people adopt gluten-free lifestyles, the demand for all types of gluten-free products, including alcoholic drinks, naturally increases.

The gluten-free food and beverage market is projected to reach USD 6.43 billion by 2027, growing at a CAGR of 7.6%. This trend highlights the growing segment of consumers seeking gluten-free alcoholic beverages, creating a robust market opportunity for manufacturers to innovate and cater to this expanding audience.

Social Media and Influencer Marketing Are Trending Factors

Social media and influencer marketing have become indispensable tools for reaching and engaging consumers, particularly in niche markets like gluten-free products. By utilizing these platforms, gluten-free alcoholic drink brands can effectively raise awareness, share detailed product information, and tap into communities dedicated to gluten-free living.

Influencer partnerships can also lend credibility and appeal, particularly among younger demographics who highly value authenticity and peer recommendations. This strategy not only boosts visibility but also helps in building a loyal customer base, leveraging the power of digital word-of-mouth to enhance brand reach and consumer trust.

Regional Analysis

Europe Dominates with 41.7% Market Share

Europe’s gluten-free alcoholic drinks market is valued at USD 2.3 billion, representing a dominant 41.7% market share. This leadership is driven by high awareness of gluten-related health issues and a strong demand for specialty foods and beverages. Regulatory support for gluten-free labeling and widespread availability of gluten-free products in retail stores further bolster this market.

The region’s developed healthcare infrastructure and high consumer health consciousness drive demand for gluten-free options. European consumers’ preference for premium and craft beverages also supports market growth. The presence of major players and innovative start-ups in the gluten-free alcoholic beverage sector strengthens market dynamics.

Europe’s dominance is expected to continue, with a projected CAGR of 8.2% through 2026. Continued innovation and consumer demand will likely sustain growth, with potential for further expansion into Eastern Europe and emerging markets within the region. The strong market foundation in Europe suggests sustained leadership in the global market.

North America

North America holds a significant portion of the gluten-free alcoholic drinks market, with a 30.5% share. The market in this region is valued at $1.68 billion. Factors such as increasing gluten intolerance diagnoses and a strong trend towards health and wellness drive this market. The region is expected to grow at a CAGR of 7.5%, supported by robust consumer demand and innovation in product offerings.

Asia Pacific

Asia Pacific accounts for 15.3% of the global market share, with a market value of $840 million. Rising health consciousness and increasing disposable incomes are key growth drivers. The market is expected to grow at a CAGR of 9.6%, indicating significant future potential. Growing urbanization and expanding retail networks are also contributing to this growth.

Middle East & Africa

The Middle East & Africa region holds a 6.7% market share, valued at $368 million. Growth in this region is driven by increasing health awareness and a growing expatriate population seeking gluten-free products. The market is forecasted to grow at a CAGR of 6.8%, with rising consumer education and improved availability of gluten-free products enhancing market expansion.

Latin America

Latin America represents 5.8% of the global market share, valued at $320 million. Factors such as improving healthcare awareness and the influence of Western dietary trends drive market growth. The region is expected to grow at a CAGR of 7.2%, with increasing availability of gluten-free products and growing consumer demand for healthier beverage options supporting this trend.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Gluten-Free Alcoholic Drinks Market is shaped by the strategic positioning and market influence of several key players. Companies such as William Grant & Sons Ltd, Diageo plc, and Anheuser-Busch Companies are leading the charge with their extensive portfolios and strong market presence. These industry giants leverage their established distribution networks and brand recognition to introduce gluten-free options, thus expanding their consumer base and enhancing market penetration.

Smaller, specialized brands like Glutenberg, Ghostfish Brewing Company, and Estrella Damm Daura focus on innovation and quality, catering specifically to the gluten-free segment. These companies have carved out niche markets by offering high-quality, dedicated gluten-free products that meet stringent dietary requirements and taste preferences. Their emphasis on craft and premium products aligns well with consumer trends towards artisanal and health-oriented choices.

Captain Morgan and Cabo Wabo contribute by introducing gluten-free versions of their popular spirits, appealing to a broader audience seeking gluten-free alternatives in the spirits category. This diversification helps in capturing market share within the expanding gluten-free segment.

Overall, the strategic moves of these companies, from innovation and product diversification to leveraging strong brand portfolios, significantly impact the growth and development of the gluten-free alcoholic drinks market.

Market Key Players

- William Grant & Sons Ltd

- Cabo Wabo

- Captain Morgan

- Diageo plc

- Glutenberg

- Estrella Damm Daura

- Ghostfish Brewing Company

- Anheuser-Busch Companies

- Others

Recent Developments

- January 2023: Wild Drum introduces a new line of vegan and guilt-free hard seltzer drinks, available in four flavors with varying ABV levels. The beverages are low-calorie, fat-free, and free from preservatives, catering to health-conscious consumers.

- August 2022: SUNBOY Spiked Coconut Water launches its first variety pack, featuring eight cans with over two pounds of real fruit. The pack includes a new Mango flavor and existing favorites, offering a convenient and trial-friendly format.

- March 2021: Arctic Blue Beverages introduces a liqueur that combines the taste of blueberries with a hint of citrus. The product is designed to be versatile, suitable for cocktails, desserts, and even as a mixer for other beverages.

Report Scope

Report Features Description Market Value (2023) USD 5.6 Billion Forecast Revenue (2033) USD 12.7 Billion CAGR (2024-2033) 8.5% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Beer, Wine, Distilled Spirits, Others), By Packaging Type (Bottles, Cans, Others), By Distribution Channel (On Trade, Off Trade) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape William Grant & Sons Ltd, Cabo Wabo, Captain Morgan, Diageo plc, Glutenberg, Estrella Damm Daura, Ghostfish Brewing Company, Anheuser-Busch Companies, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the projected market size of the global gluten-free alcoholic drinks market by 2033?The market is expected to reach USD 12.7 billion by 2033, growing at a CAGR of 8.5% from USD 5.6 billion in 2023.

What types of products are included in the gluten-free alcoholic drinks market?The market includes gluten-free beers, wines, distilled spirits, and other beverages produced without gluten-containing grains like wheat, barley, and rye.

Which region holds the largest market share in the gluten-free alcoholic drinks market?Europe holds the largest market share at 41.7%, driven by high awareness of gluten-related health issues and demand for specialty foods and beverages.

What are the growth opportunities in emerging markets for gluten-free alcoholic drinks?Emerging markets in Asia and Latin America present growth opportunities due to increasing health awareness and improved diagnosis of gluten-related disorders.

Gluten-Free Alcoholic Drinks MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample

Gluten-Free Alcoholic Drinks MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- William Grant & Sons Ltd

- Cabo Wabo

- Captain Morgan

- Diageo plc

- Glutenberg

- Estrella Damm Daura

- Ghostfish Brewing Company

- Anheuser-Busch Companies

- Others