Global Wood Plastic Composites Market Size, Share Analysis Report By Product (Polyethylene, Polypropylene, Polyvinylchloride, Others), By Application (Building and Construction, Automotive Components, Industrial and Consumer Goods, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 172837

- Number of Pages: 343

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

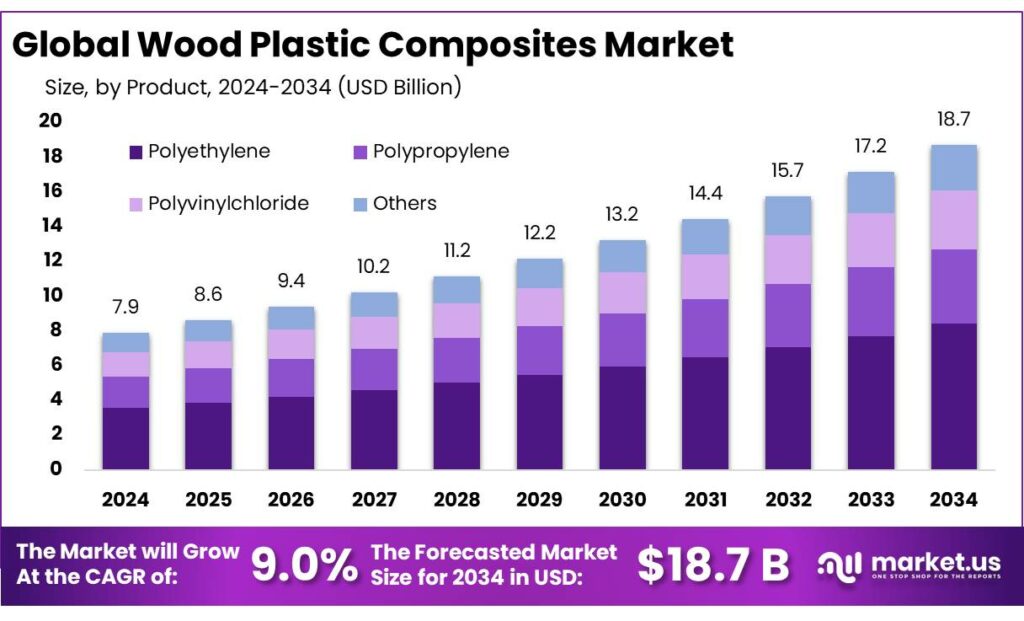

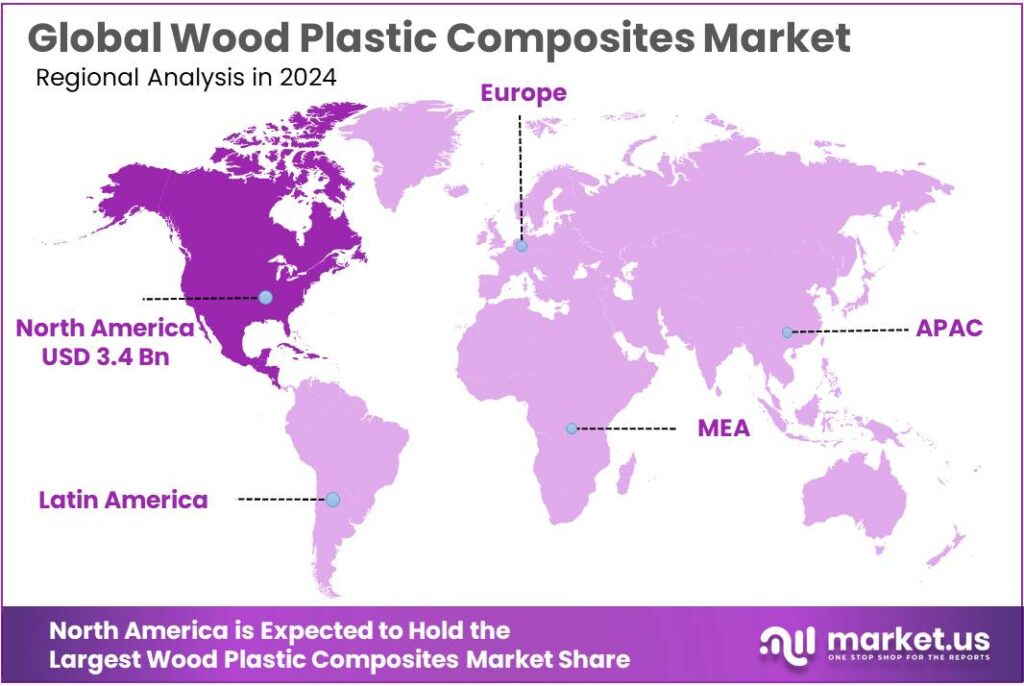

The Global Wood Plastic Composites Market size is expected to be worth around USD 18.7 Billion by 2034, from USD 7.9 Billion in 2024, growing at a CAGR of 9.0% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 43.9% share, holding USD 3.4 Billion in revenue.

Wood plastic composites (WPCs) are engineered materials made by combining wood fiber or wood flour with thermoplastics and performance additives. They are designed to look and feel like wood while behaving more like plastic in outdoor conditions—resisting rot, splintering, and many moisture-related failures that shorten the life of untreated timber.

From an industrial scenario standpoint, Wood plastic composites demand often tracks renovation and outdoor living spend, infrastructure beautification, and commercial fit-outs, while supply depends on stable streams of polymers and wood residues. A practical rule in many exterior formulations is keeping wood flour at about 50–60% by weight, balancing stiffness and processability while limiting moisture-driven performance losses. Product acceptance is also shaped by standards used for code recognition and performance rating of WPC decking and guardrail systems, such as ASTM D7032.

Demand fundamentals for Wood plastic composites are closely tied to construction and renovation cycles, particularly outdoor living upgrades and low-maintenance building envelopes. A major driver is replacement economics: property owners increasingly prefer materials that reduce repainting, staining, and board replacement costs over time. Another driver is scale: global WPC output has grown to industrial relevance, with one recent peer-reviewed analysis citing annual world production of 7.8 million tons in 2022.

Key driving factors also come from the waste and sustainability agenda. The U.S. EPA estimates 35.7 million tons of plastics were generated in the United States in 2018, equal to 12.2% of total municipal solid waste generation—signaling both the scale of the challenge and the long-term opportunity for higher-value diversion pathways like durable composites.

Policy and procurement trends reinforce the outlook. In the EU, the Ecodesign for Sustainable Products Regulation (ESPR) entered into force in July 2024, strengthening expectations around more durable and circular product design across categories. In construction, the European Commission announced a modernized Construction Products Regulation entering into force on 7 January 2025, aimed at improving the single market for construction products while supporting sustainability and innovation.

- Sustainability expectations add a second growth layer. WPCs can incorporate reclaimed wood fiber and recycled polymers, aligning with circular-economy procurement. Yet the recycling reality also creates urgency and opportunity: the U.S. EPA reports recycling rates of 29.1% for PET bottles and jars (2018) and 29.3% for HDPE natural bottles (2018)—figures that signal both existing collection capacity and significant remaining leakage that downstream material users may help address.

Key Takeaways

- Wood Plastic Composites Market size is expected to be worth around USD 18.7 Billion by 2034, from USD 7.9 Billion in 2024, growing at a CAGR of 9.0%.

- Polyethylene held a dominant market position, capturing more than a 45.7% share.

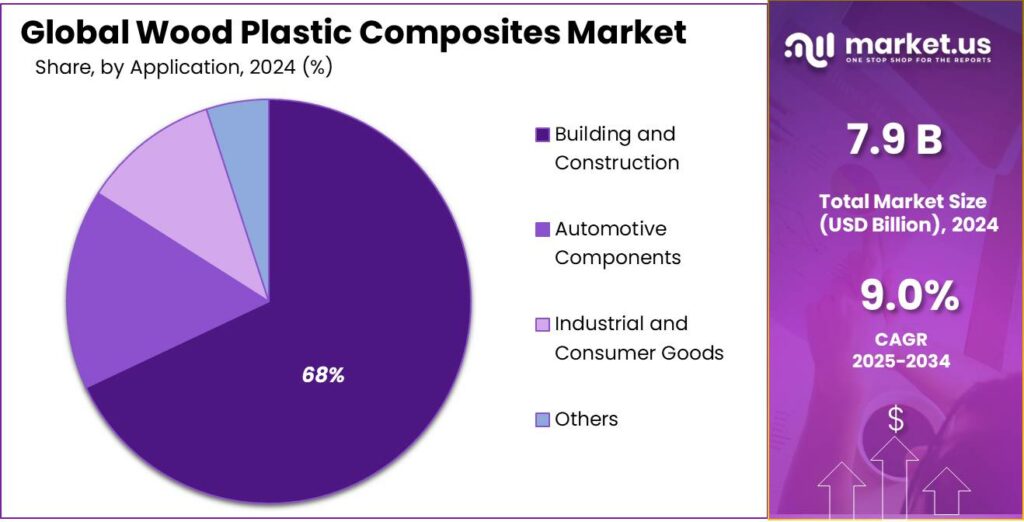

- Building and Construction held a dominant market position, capturing more than a 68.2% share.

- North America stood out as the dominating region in the wood plastic composites (WPC) market in 2024, capturing 43.9% of the global share with an estimated market value of USD 3.4 billion.

By Product Analysis

Polyethylene dominates with 45.7% driven by its durability and cost advantage

In 2024, Polyethylene held a dominant market position, capturing more than a 45.7% share, mainly because it offers a strong balance of durability, moisture resistance, and cost efficiency in wood plastic composite products. Polyethylene-based composites were widely used in decking, fencing, outdoor furniture, and landscaping applications, where long service life and low maintenance are key requirements.

The material was also preferred due to its easy processing and wide availability, which helped manufacturers maintain stable production volumes. Moving into 2025, demand remained consistent as sustainable building materials gained attention and polyethylene-based WPC products continued to replace traditional wood in exterior applications. The segment benefited from recyclability advantages and flexible formulation options, allowing producers to meet both performance and environmental expectations. These factors together reinforced polyethylene’s leading role within the wood plastic composites market.

By Application Analysis

Building and Construction dominates with 68.2% as demand rises for durable and low-maintenance materials

In 2024, Building and Construction held a dominant market position, capturing more than a 68.2% share, as wood plastic composites continued to gain wide acceptance in residential, commercial, and infrastructure projects. The segment benefited from the increasing use of WPC materials in decking, fencing, wall cladding, roofing, doors, and window frames, where resistance to moisture, termites, and weathering is essential.

Demand remained steady as urban construction activity expanded and renovation projects increased across both developed and emerging markets. Government focus on durable and eco-friendly construction materials further supported adoption in public infrastructure and housing projects. The strong role of WPC in reducing lifecycle costs and improving structural aesthetics ensured that building and construction remained the largest and most consistent application segment within the overall wood plastic composites market.

Key Market Segments

By Product

- Polyethylene

- Polypropylene

- Polyvinylchloride

- Others

By Application

- Building and Construction

- Automotive Components

- Industrial and Consumer Goods

- Others

Emerging Trends

Verified Circular Content Becomes the New Standard

The push is closely tied to government direction. In Europe, the European Commission’s Circular Economy Action Plan sets out a product-life-cycle approach: design better, prevent waste, and keep used resources in the economy for as long as possible. That message is filtering into construction and outdoor infrastructure purchasing, where durability and end-of-life thinking matter. For WPCs, it means more demand for boards and profiles that can demonstrate responsible sourcing and longer service life—especially in decking, cladding, public walkways, and street furniture where maintenance budgets are tight.

The supply-side story is getting louder. The OECD reports that plastic waste more than doubled to 353 million tonnes in 2019, and after losses during recycling, only 9% was ultimately recycled. This gap is shaping the trend: WPC producers are increasingly partnering with recyclers and compounders to secure cleaner, more consistent recycled polymer streams. Instead of treating recycled resin as an occasional input, many manufacturers now build product lines around it, with tighter quality checks so the finished boards don’t suffer from unexpected brittleness, colour shifts, or uneven surface finish.

Wood fibre availability also reinforces this trend, because WPC can upgrade wood residues into long-life products. FAO notes that global wood production is at record levels at about 4 billion m³ per year, and estimates 2.04 billion m³ of industrial roundwood was harvested in 2022. Those volumes indicate a large stream of industrial processing by-products that can be used as feedstock when properly dried and sized. More recently, FAO reported a recovery in wood-based panel activity, with global wood-based panel production up 5% to 393 million m³ in 2024, and trade up 6% to 90 million m³.

Drivers

Growing Demand for Low-Maintenance and Sustainable Building Materials

One of the strongest driving forces behind the growth of Wood Plastic Composites (WPC) is the rising preference for low-maintenance, long-lasting building products that also support sustainability goals. Homeowners, builders, and public agencies are increasingly choosing materials that do not require frequent repairs, repainting, or replacement. In simple terms, people want building products that work well and stay looking good without extra effort.

Across many parts of the world, outdoor living spaces and home renovations have become priorities for property owners. This shift gained even more momentum in the last few years as more people spent time at home and invested in upgrades that bring comfort, beauty, and durability. Traditional wood decking and trim can look great at first, but it often needs regular staining, sealing, or sanding to keep it in good shape. In contrast, WPC products offer a “set-it-and-forget-it” appeal.

- Public agencies and governments have set recycling goals and waste reduction targets that influence material choices. In the United States, the Environmental Protection Agency (EPA) reported that recycling rates for key plastic packaging streams were 29.1% for PET bottles and jars and 29.3% for HDPE natural bottles in 2018. These figures show existing capacity to collect and reuse plastics, which is important for WPC manufacturers seeking verified recycled content in their products.

Government policies also create headwinds that work in favour of durable, low-waste materials like WPCs. In the European Union, the Circular Economy Action Plan adopted in March 2020 sets out measures to keep materials in use longer and reduce waste from products and packaging. When governments and institutional buyers prefer materials that stay in service for decades rather than years, products like WPC have a clear advantage.

Restraints

Inconsistent Recycled Feedstock Supply Limits WPC Scaling

A major restraining factor for wood plastic composites (WPCs) is the uneven supply and quality of the two inputs that make them work at scale: plastic resin (often targeted as recycled) and wood fibre. On paper, WPCs look like a perfect circular-economy product. In real production, they behave more like a precision recipe—if the ingredients vary too much, the board can warp, fade faster, lose strength, or show visible defects. That risk makes large builders and public buyers cautious, because a deck, fence, or cladding job is expected to look uniform and perform for years, not just at installation.

- The biggest pressure point is recycled plastic availability and consistency. Globally, plastic waste volumes are huge, but only a small share becomes high-quality recycled material. The OECD reports that plastic waste more than doubled to 353 million tonnes in 2019, and after accounting for losses, only 9% was ultimately recycled. This gap matters for WPC producers because “recycled-content” targets are rising, while reliable recycled resin that meets tight specs is still limited.

Even in mature collection systems, the bottle-grade streams that are most available do not automatically translate into steady WPC feedstock. The U.S. EPA’s material-specific data shows recycling rates of 29.1% for PET bottles and jars (2018) and 29.3% for HDPE natural bottles (2018). Those numbers show meaningful collection, but they also imply that roughly seven in ten bottles are not captured for recycling, which limits the scale of recycled resin supply.

Wood fibre supply can be sizable, but it is not immune to disruption either. FAO reports global industrial roundwood removals of 2.04 billion m³ in 2022—a level that supports large volumes of sawdust and wood residues. However, residue quality varies by species, moisture, and particle size, and it can shift with changes in sawmill operations and trade cycles. FAO also noted that in 2023 industrial roundwood removals declined to 1.92 billion m³ and global trade fell 13% to 100 million m³, showing that upstream volatility can ripple into downstream material availability.

Opportunity

Circular Construction Policies Open New WPC Demand

A major growth opportunity for wood plastic composites (WPCs) is the fast-rising push for circular construction—where governments and institutional buyers prefer materials that keep resources in use longer, reduce waste, and deliver durable performance with less upkeep. This shift is not just a “green” idea; it is becoming a practical purchasing rule in many public projects, from parks and waterfronts to schools and housing upgrades. WPC fits these needs because it can be engineered for long service life in outdoor environments, while also using wood residues and, in some formulations, recycled plastics.

The size of the available “inputs” creates a clear runway for this opportunity. On the wood side, FAO points out that global wood production is around 4 billion m³ per year, and industrial roundwood harvested reached 2.04 billion m³ in 2022. That scale matters because industrial wood processing generates large volumes of by-products that can be upgraded into WPC instead of being treated as low-value residue. At the same time, FAO’s sector update shows wood-based panel production expanding 5% to 393 million m³ in 2024, with trade in panels up 6% to 90 million m³—a useful signal that wood-based building materials are already seeing renewed activity across regions.

Policy support strengthens the demand side. The European Commission notes the Circular Economy Action Plan (adopted March 2020) targets the full life cycle of products—how they are designed, preventing waste, and keeping resources in the economy “as long as possible.” That direction tends to reward materials that last longer and reduce repainting, replacement, and disposal.

On the plastics side, the “problem scale” is also the opportunity scale. The OECD reports plastic waste more than doubled to 353 million tonnes in 2019, and after losses during recycling, only 9% was recycled. This gap is exactly where WPC producers can expand—by designing products that safely and reliably use suitable recycled polymers and by partnering with recyclers to secure cleaner, steadier feedstock. The opportunity is not about claiming “100% recycled” everywhere; it is about using recycled content in the right product lines and proving it with documentation that large buyers trust.

Regional Insights

North America leads with 43.90% share and USD 3.4 billion market size

North America stood out as the dominating region in the wood plastic composites (WPC) market in 2024, capturing 43.90% of the global share with an estimated market value of USD 3.4 billion. The region’s strong position was driven by robust construction activities, increasing renovation projects, and elevated demand for sustainable and low-maintenance materials across residential and commercial sectors. In 2024, the United States and Canada accounted for the majority of this regional demand as builders and developers adopted WPC products for decking, siding, fencing, and outdoor furniture, valuing their durability, weather resistance, and eco-friendly profile.

The transportation sector in North America also contributed significantly to market growth in 2024, with manufacturers incorporating WPCs in interior and exterior components to reduce vehicle weight and improve fuel efficiency. Consumer awareness about sustainability and rising preferences for recyclable and wood alternative materials further supported adoption. In 2025, growth continued steadily as flooring solutions, interior décor, and landscaping segments expanded their use of wood plastic composites, driven by ongoing investments in housing and infrastructure.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Beologic is a Belgian company focusing on bio-based wood plastic composites that combine recycled wood fibres with polymers to create eco-friendly building and industrial materials. Its products serve sustainable construction and automotive lightweighting needs, offering up to 85% bio-content in automotive-grade composites and contributing to reduced carbon intensity in applications. Beologic’s innovative formulations aim to reduce environmental impact while meeting performance requirements in outdoor and structural uses.

Guangzhou Kindwood Co. Ltd. is a major Chinese WPC manufacturer producing over 300,000 tons annually of cost-competitive composite boards, wall panels, and architectural wood products. Its advanced co-extrusion technology and focus on large-volume supply support rapid urbanisation and infrastructure growth in Asia, while maintaining international certification standards for quality and durability.

PolyPlank AB from Sweden focuses on cold-climate WPC products engineered to withstand extreme temperatures down to -40°C, making them well-suited for Nordic and northern European markets. Using patented additives and tailored formulations, PolyPlank delivers long-lasting decking, fencing, and exterior panels with superior frost resistance and UV stability, appealing to builders in harsh environments.

Top Key Players Outlook

- Beologic

- Fiberon

- FKuR

- Guangzhou Kindwood Co. Ltd.

- JELU-WERK J. Ehrler GmbH & Co. KG

- PolyPlank AB

- RENOLIT SE

- TAMKO Building Products LLC

- Trex Company, Inc.

- UFP Industries, Inc.

- Hardy Smith Designs Private Limited.

- Oakio Plastic Wood Building Materials Co. Ltd.

Recent Industry Developments

In 2024 and 2025, Guangzhou Kindwood Co. Ltd. operated as a prominent wood plastic composites manufacturer based in Guangzhou, China, focusing on outdoor WPC decking, flooring, fencing, and related building products with an emphasis on cost-effective solutions. The company, established in 2003, employed 101–500 staff and generated annual revenues in the range of USD 5,000,001–10,000,000, reflecting its small but stable presence in the Asia-Pacific WPC supply chain.

In the fiscal year 2024, PolyPlank AB reported annual revenue of SEK 23.11 million, although this marked a -33.7% decline from prior periods, reflecting challenging market conditions and lower sales volumes.

Report Scope

Report Features Description Market Value (2024) USD 7.9 Bn Forecast Revenue (2034) USD 18.7 Bn CAGR (2025-2034) 9.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Polyethylene, Polypropylene, Polyvinylchloride, Others), By Application (Building and Construction, Automotive Components, Industrial and Consumer Goods, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Beologic, Fiberon, FKuR, Guangzhou Kindwood Co. Ltd., JELU-WERK J. Ehrler GmbH & Co. KG, PolyPlank AB, RENOLIT SE, TAMKO Building Products LLC, Trex Company, Inc., UFP Industries, Inc., Hardy Smith Designs Private Limited., Oakio Plastic Wood Building Materials Co. Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Wood Plastic Composites MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Wood Plastic Composites MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Beologic

- Fiberon

- FKuR

- Guangzhou Kindwood Co. Ltd.

- JELU-WERK J. Ehrler GmbH & Co. KG

- PolyPlank AB

- RENOLIT SE

- TAMKO Building Products LLC

- Trex Company, Inc.

- UFP Industries, Inc.

- Hardy Smith Designs Private Limited.

- Oakio Plastic Wood Building Materials Co. Ltd.