Veterinary Drugs Market By Product Type (Biologics (Vaccines (Modified, Inactivated, and Others) and Other Biologics), Pharmaceuticals (Analgesics, Anti-infectives, Anti-inflammatory, Parasiticides, and Others), and Medicated Feed Additives), By Route of Administration (Oral, Topical, Injectable, and Others), By Animal Type (Production Animals (Cattle, Pigs, Poultry, Sheep & Goats, and Others) and Companion Animals (Cats, Dogs, Horses, and Others)), By Distribution Channel (Veterinary Hospitals & Clinics, Offline Retail Stores, E-commerce, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151344

- Number of Pages: 380

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

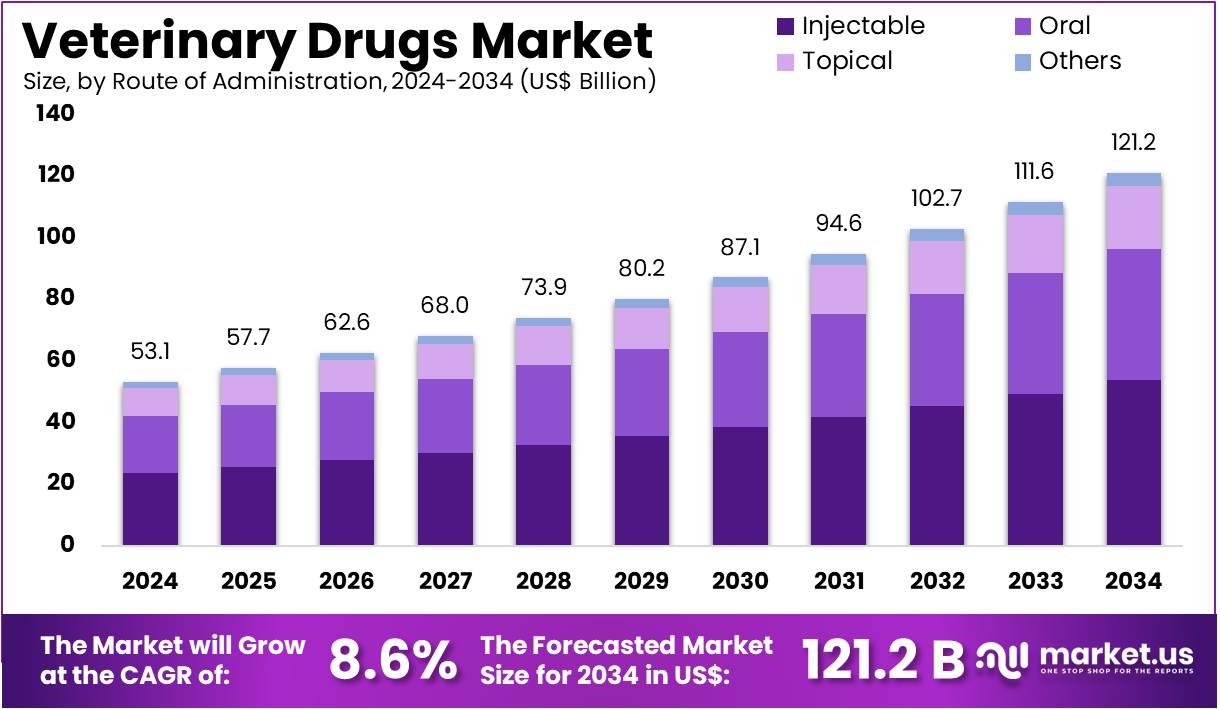

The Veterinary Drugs Market size is expected to be worth around US$ 121.2 billion by 2034 from US$ 53.1 billion in 2024, growing at a CAGR of 8.6% during the forecast period 2025 to 2034.

Growing demand for high-quality veterinary drugs is fueled by the increasing awareness of animal health and the rising prevalence of various diseases in pets and livestock. Veterinary drugs play a crucial role in treating infectious diseases, parasitic infections, chronic conditions, and improving overall animal welfare.

As the pet population continues to rise, especially among pet owners who view their pets as family members, the demand for preventive care and treatment options increases significantly. This trend creates substantial opportunities for the market, with advancements in drug formulations and delivery systems, such as vaccines, antibiotics, anti-parasitic treatments, and pain management drugs, contributing to the market’s growth. Veterinary drugs also find application in enhancing productivity in livestock farming, helping address issues like bacterial infections, reproductive health, and growth optimization.

Additionally, innovations in personalized medicine, such as targeted therapies for specific animal species and conditions, are expanding the market’s potential. In June 2024, Trupanion and Boehringer Ingelheim formed a strategic partnership aimed at improving access to advanced pet healthcare. This collaboration emphasizes early detection, disease management, and leveraging Trupanion’s fast payment system to streamline the pet care process, reflecting the increasing focus on efficient, high-quality veterinary services for pets.

Key Takeaways

- In 2024, the market for veterinary drugs generated a revenue of US$ 53.1 billion, with a CAGR of 8.6%, and is expected to reach US$ 121.2 billion by the year 2034.

- The product type segment is divided into biologics, pharmaceuticals, and medicated feed additives, with pharmaceuticals taking the lead in 2023 with a market share of 47.6%.

- Considering route of administration, the market is divided into oral, topical, injectable, and others. Among these, injectable held a significant share of 44.3%.

- Furthermore, concerning the animal type segment, the market is segregated into production animals and companion animals. The production animals sector stands out as the dominant player, holding the largest revenue share of 56.7% in the veterinary drugs market.

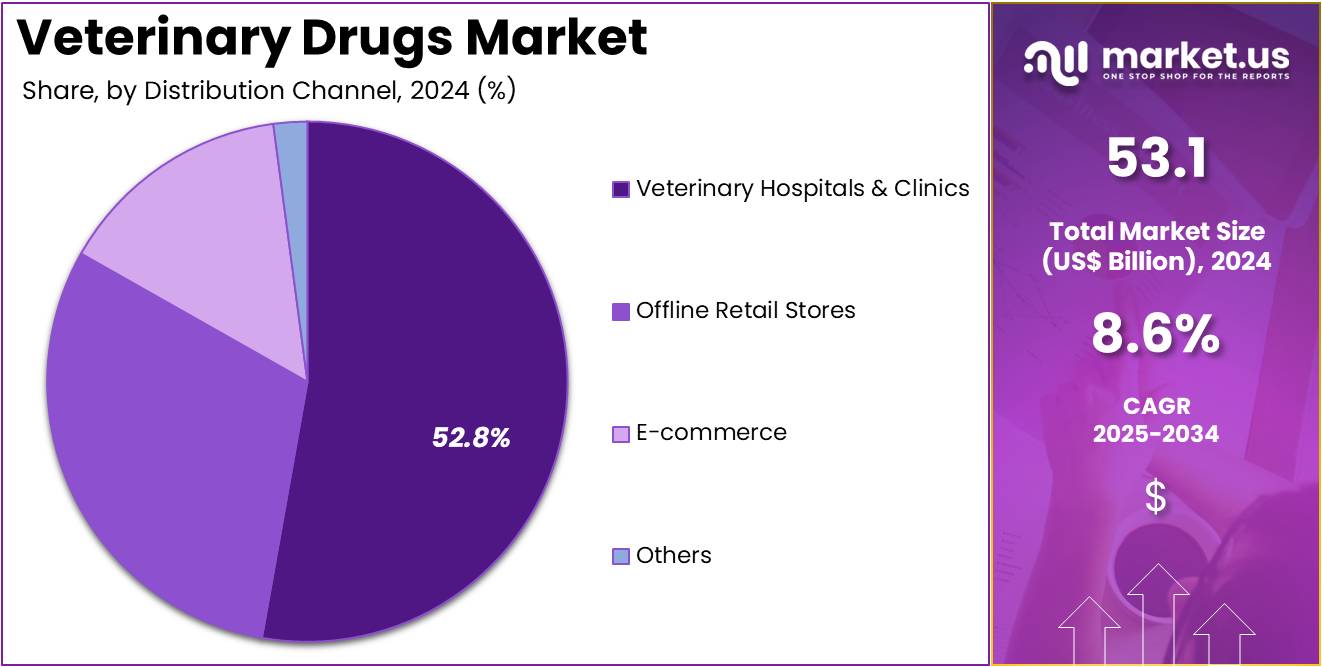

- The distribution channel segment is segregated into veterinary hospitals & clinics, offline retail stores, e-commerce, and others, with the veterinary hospitals & clinics segment leading the market, holding a revenue share of 52.8%.

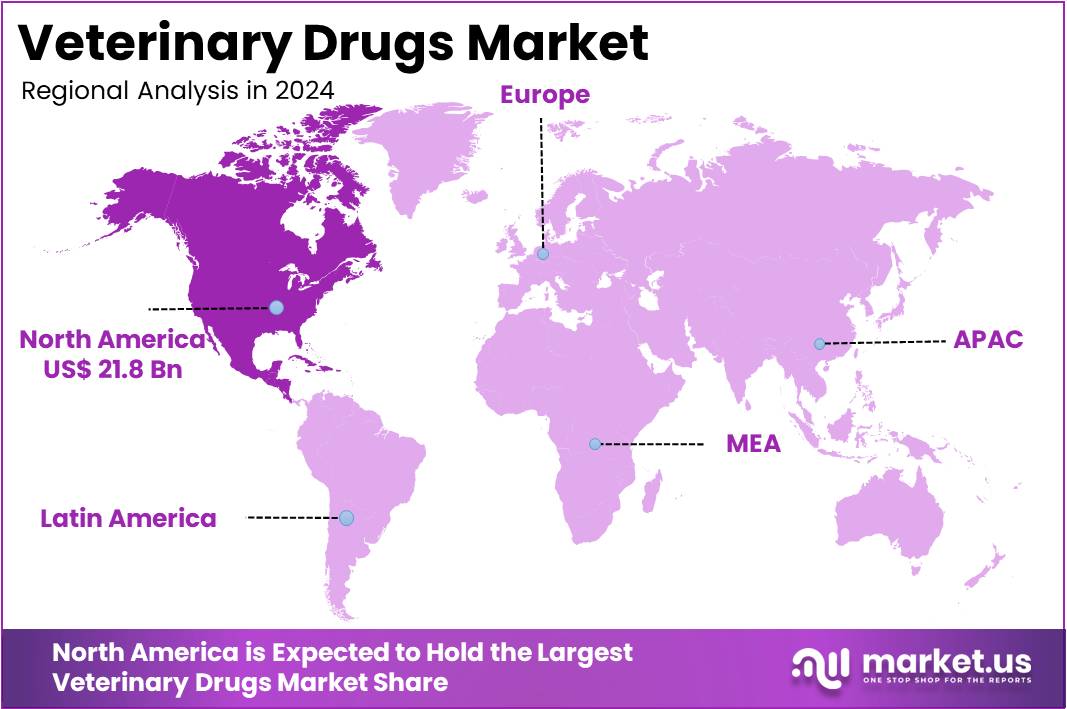

- North America led the market by securing a market share of 41.1% in 2023.

Product Type Analysis

The pharmaceuticals segment claimed a market share of 47.6% owing to their widespread application in treating a variety of animal conditions, from infections to chronic diseases. The segment’s growth is anticipated to be driven by the increasing demand for effective veterinary medicines to address the rising prevalence of zoonotic diseases and animal health concerns.

Pharmaceuticals are likely to remain the primary choice in both companion and production animals due to their proven efficacy in managing a range of health issues. As veterinarians seek more advanced and specialized treatments, the market for pharmaceutical drugs is expected to grow significantly, particularly with the development of new formulations that offer better outcomes with fewer side effects. The ongoing research into improving drug effectiveness and safety for animal care will further strengthen the pharmaceuticals segment’s dominance in the veterinary drugs market.

Route of Administration Analysis

The injectable held a significant share of 44.3% due to their fast-acting and targeted nature. Injectable veterinary drugs are expected to experience significant growth, particularly in emergency and acute care settings, where rapid drug absorption is essential for managing critical animal health conditions. The rise in the adoption of injectable vaccines and biologics, especially for livestock, is anticipated to further boost this segment.

Injectable treatments are also likely to grow in the companion animal market, as more pet owners seek timely interventions for conditions such as infections, allergies, and chronic diseases. The preference for injectables in veterinary care, combined with innovations in drug delivery systems and the increasing focus on preventive care, will continue to drive the growth of this segment.

Animal Type Analysis

The production animals segment had a tremendous growth rate, with a revenue share of 56.7% owing to the large-scale demand for animal health solutions in the agriculture sector. With the growing global population and rising demand for animal-derived food products, the need for effective veterinary care for production animals is anticipated to surge. The focus on improving animal health, productivity, and welfare will likely drive the demand for veterinary drugs in livestock.

Additionally, as the livestock industry faces increasing pressure to meet higher production standards while minimizing the risk of disease outbreaks, there will be a continued reliance on pharmaceuticals, biologics, and medicated feed additives. As regulatory frameworks around the world tighten on animal welfare and food safety, the demand for veterinary drugs in production animals is expected to increase, leading to substantial market growth.

Distribution Channel Analysis

The veterinary hospitals and clinics segment accounted for 52.8% of the total revenue, showing significant growth. This dominance is attributed to their vital role in offering specialized care to animals. Rising global pet ownership and the prioritization of animal health have increased the use of veterinary drugs in these settings. Regular health check-ups, vaccinations, and treatment of various diseases are boosting the demand. These facilities serve both companion and production animals, reinforcing their importance in the overall veterinary healthcare ecosystem.

The presence of trained professionals in hospitals and clinics ensures that animals receive proper treatment. This professional care contributes to the strong preference for hospital-based veterinary services. As infrastructure in the veterinary sector improves, these institutions are expected to see continued growth. Their advanced medical facilities, diagnostic capabilities, and adherence to treatment protocols make them preferred centers for animal care. As a result, veterinary hospitals and clinics are likely to maintain their leading position in the market.

Key Market Segments

By Product Type

- Biologics

- Vaccines

- Modified

- Inactivated

- Others

- Other Biologics

- Vaccines

- Pharmaceuticals

- Analgesics

- Anti-infectives

- Anti-inflammatory

- Parasiticides

- Others

- Medicated Feed Additives

By Route of Administration

- Oral

- Topical

- Injectable

- Others

By Animal Type

- Production Animals

- Cattle

- Pigs

- Poultry

- Sheep & Goats

- Others

- Companion Animals

- Cats

- Dogs

- Horses

- Others

By Distribution Channel

- Veterinary Hospitals & Clinics

- Offline Retail Stores

- E-commerce

- Others

Drivers

Growing Pet Ownership and Humanization Trends is Driving the Market

The increasing trend of pet ownership globally, coupled with the profound humanization of companion animals, is a primary driver for the veterinary drugs market. As pets are increasingly viewed as integral family members, owners are more willing to invest in their health and well-being, including seeking advanced medical care and pharmaceutical solutions for various conditions.

The American Pet Products Association (APPA)’s 2025 State of the Industry Report revealed a significant expansion in pet ownership, with 94 million US households now owning at least one pet in 2024, an increase from 82 million in 2023. This deep emotional bond translates into a higher demand for preventative medications, therapeutics for chronic diseases, and innovative treatments, significantly boosting the market for veterinary pharmaceuticals across various therapeutic areas.

Restraints

Stringent Regulatory Approval Processes and High R&D Costs are Restraining the Market

The veterinary drugs market faces significant restraint due to the stringent and often lengthy regulatory approval processes, coupled with the high costs associated with research and development (R&D) of new animal health products. Bringing a new veterinary drug to market requires extensive preclinical and clinical trials to demonstrate safety, efficacy, and quality, which can take many years and involve substantial financial investment.

The US Food and Drug Administration (FDA) charges various user fees under the Animal Drug User Fee Act (ADUFA) to fund the review process; for fiscal year 2024, the fee for an Animal Drug Application was US$683,673. These regulatory hurdles and the inherent financial risks of drug development can deter smaller companies from entering the market and slow the introduction of innovative therapies, thus limiting market growth.

Opportunities

Rising Prevalence of Zoonotic and Foodborne Diseases Creates Growth Opportunities

The increasing prevalence of zoonotic diseases (transmissible from animals to humans) and various foodborne illnesses originating from livestock presents a significant growth opportunity in the veterinary drugs market. Effective animal health management through vaccination and therapeutic drugs is crucial to prevent the spread of these diseases, safeguarding both animal welfare and public health.

The World Organisation for Animal Health (WOAH) reported a concerning trend in its May 2025 assessment of world animal health, indicating that outbreaks of bird flu in mammals more than doubled in 2024 compared to 2023, with 1,022 outbreaks across 55 countries, emphasizing the escalating risk of zoonotic transmission. This growing global health concern drives demand for novel vaccines, antimicrobials, and parasiticides for livestock and companion animals, making disease prevention and control a key area for pharmaceutical innovation and market expansion.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic factors significantly influence the veterinary drugs market, primarily through their impact on consumer discretionary spending, agricultural industry profitability, and global R&D investments in animal health. Periods of strong economic growth typically lead to higher household incomes, enabling pet owners to spend more on premium veterinary care and specialized medications for their companion animals.

Simultaneously, a thriving agricultural sector, boosted by stable commodity prices, allows livestock producers to invest in advanced animal health products to optimize herd health and productivity. The International Monetary Fund (IMF) projected global economic growth to be 3.2% for both 2024 and 2025, which generally supports these spending patterns. Geopolitical factors, such as trade disputes and regional conflicts, can disrupt global supply chains for active pharmaceutical ingredients (APIs) and finished veterinary products, leading to increased manufacturing costs or shortages.

The World Economic Forum’s 2025 Global Risks Report highlighted that geopolitical fragmentation remains a significant concern, potentially impacting cross-border trade and logistics. However, the essential nature of animal health for food security and public health, particularly in managing zoonotic diseases, provides a fundamental demand for these drugs, offering a degree of market resilience even amidst broader economic and political volatility.

Current US tariff policies can directly impact the veterinary drugs market by altering the cost of imported raw materials, active pharmaceutical ingredients, and finished pharmaceutical products essential for animal health. While some finished pharmaceuticals have historically enjoyed tariff exemptions, specific tariffs on key chemical intermediates or broader trade tensions can raise the input costs for manufacturers.

A March 2025 analysis noted that proposed tariffs, potentially as high as 54% on some imports, were triggering a global supply chain re-evaluation for veterinary vaccines, which are heavily dependent on international sourcing. This could translate into higher prices for veterinary medications, potentially increasing the financial burden on pet owners and livestock producers, or narrowing profit margins for drug manufacturers. The US Department of Commerce’s Bureau of Economic Analysis reported that US imports of pharmaceuticals, medical equipment, and supplies continue to be substantial, meaning any tariffs on these categories would have a broad impact.

Conversely, these tariff policies can incentivize domestic manufacturing and sourcing of veterinary drugs and their components within the US. This push towards localized production aims to create a more secure and robust domestic supply chain, reducing reliance on potentially volatile international sources and enhancing national self-sufficiency in ensuring animal health, despite the immediate challenges of cost adjustments.

Trends

Increased Adoption of Digital Technologies and Telemedicine in Veterinary Care is a Recent Trend

A prominent recent trend in the veterinary drugs market is the increased adoption of digital technologies, particularly telemedicine and remote monitoring solutions, in veterinary care. These technologies facilitate easier access to veterinary consultations, allowing for remote diagnosis, treatment recommendations, and prescription refills, which improves patient compliance and expands the reach of veterinary services.

A 2024 report on the global animal telehealth market highlighted its projected annual growth of over 17%, driven by advancements in technology and increasing pet ownership. This shift towards digital platforms streamlines the process of managing animal health conditions, often leading to earlier interventions and more consistent administration of prescribed medications, thereby positively influencing the demand and accessibility of veterinary drugs.

Regional Analysis

North America is leading the Veterinary Drugs Market

North America dominated the market with the highest revenue share of 41.1% owing to a burgeoning pet population, the ongoing humanization of companion animals, and increasing investment in animal healthcare. According to the American Veterinary Medical Association (AVMA), the dog population in the US reached a new peak of 89.7 million in 2024, up from 80.1 million in 2023, while cat populations also continued to rise.

This expanding pet demographic naturally elevates the demand for various veterinary medicines. Major players in the animal health sector reported strong performance; Zoetis’s US segment, for example, saw revenue increase by 4% in the fourth quarter of 2024 compared to the fourth quarter of 2023, driven by companion animal products, including their key dermatology portfolio and parasiticides.

Similarly, Merck Animal Health reported that its companion animal product sales grew by 10% in 2024, reflecting higher pricing and increased demand for products like the BRAVECTO line. Elanco Animal Health also showed positive trends, with its overall organic constant currency revenue growing by 3% for the full year 2024, indicating consistent performance across its diversified portfolio that includes various animal drugs. These trends collectively underscore a robust market environment where increasing pet ownership and a willingness to invest in pet health are key growth catalysts.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to increasing pet ownership rates, a growing emphasis on animal health and well-being, and continuous improvements in veterinary infrastructure. China’s pet population, for example, exceeded 121.55 million cats and dogs in 2023, indicating a vast and expanding consumer base for animal health products. India also projects a significant increase in its pet population, expected to surpass 40 million by 2026. As pet humanization trends intensify, owners are increasingly likely to seek advanced medical treatments, including pharmaceuticals, for their animals.

Major animal health companies are actively contributing to this growth; for instance, Merck Animal Health’s sales experienced growth in the Asia Pacific region, driven by higher demand for certain products. Zoetis’s international segment, which encompasses Asia Pacific, continued to be a strong contributor to its overall revenue, with its overall operational revenue increasing by 11% for full year 2024. These factors, combined with rising disposable incomes and greater accessibility to veterinary services, suggest a strong trajectory for the animal pharmaceutical market in the Asia Pacific.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the veterinary drugs market adopt various strategies to foster growth, such as expanding their product offerings through new innovations and acquisitions. They focus on increasing market penetration by enhancing distribution networks and building strong relationships with veterinary professionals. Companies also prioritize research and development to deliver effective, cutting-edge treatments for a wide range of animal health issues.

To boost visibility and sales, they employ targeted marketing campaigns aimed at both pet owners and healthcare providers. Additionally, strategic collaborations and mergers with other companies allow these players to diversify their portfolios and strengthen their position in the market. Elanco Animal Health is a prominent player in the veterinary industry. Elanco, founded in 1954, provides a wide variety of animal health products, including vaccines, parasiticides, and therapeutic drugs.

The company emphasizes improving the health and well-being of pets, livestock, and poultry. Elanco has focused on expanding its global footprint and strengthening its portfolio through strategic acquisitions, such as the merger with Bayer’s animal health division in 2020. The company is also committed to addressing the growing demand for sustainable solutions in animal farming, working to develop products that support both animal health and environmental sustainability.

Top Key Players in the Veterinary Drugs Market

- Zoetis

- Virbac

- Phibro Animal Health Corporation

- Elanco

- Dechra Pharmaceuticals PLC

- Ceva Santé Animale

- Boehringer Ingelheim International Gmbh

- Bimeda Corporate

Recent Developments

- In September 2024, Zoetis and Danone formed a strategic alliance to enhance sustainability in dairy farming. Their goal is to improve cow health and reduce environmental impact by leveraging Zoetis’ genetic tools, including the Dairy Wellness Profit Index, to support more resilient cattle.

- In August 2024, Boehringer Ingelheim India partnered with Vvaan Lifesciences Pvt Ltd in a distribution collaboration aimed at expanding its pet parasiticide offerings in India. According to Boehringer Ingelheim’s internal data, metros and Tier 1 cities account for about 60% of the country’s pet healthcare market revenue, while Tier 2 and smaller cities make up the remaining share.

Report Scope

Report Features Description Market Value (2024) US$ 53.1 billion Forecast Revenue (2034) US$ 121.2 billion CAGR (2025-2034) 8.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Biologics (Vaccines (Modified, Inactivated, and Others) and Other Biologics), Pharmaceuticals (Analgesics, Anti-infectives, Anti-inflammatory, Parasiticides, and Others), and Medicated Feed Additives), By Route of Administration (Oral, Topical, Injectable, and Others), By Animal Type (Production Animals (Cattle, Pigs, Poultry, Sheep & Goats, and Others) and Companion Animals (Cats, Dogs, Horses, and Others)), By Distribution Channel (Veterinary Hospitals & Clinics, Offline Retail Stores, E-commerce, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Zoetis, Virbac, Phibro Animal Health Corporation, Elanco, Dechra Pharmaceuticals PLC, Ceva Santé Animale, Boehringer Ingelheim International Gmbh, Bimeda Corporate. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Zoetis

- Virbac

- Phibro Animal Health Corporation

- Elanco

- Dechra Pharmaceuticals PLC

- Ceva Santé Animale

- Boehringer Ingelheim International Gmbh

- Bimeda Corporate