Global Vegetable Chips Market Size, Share, And Business Benefits By Source (Root Vegetable Chips, Leafy Vegetable Chips), By Type (Vegetable Chips, Extruded Vegetable Chips, Others), By Flavour (Classic Salty, Cheese and Onion, Barbecue, Salt and Pepper, Jalapeno, Others), By End-Use (Household, Food Service), By Distribution Channel (Supermarket and Hypermarket, Convenience Stores, Specialty Stores, Online Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 157497

- Number of Pages: 255

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

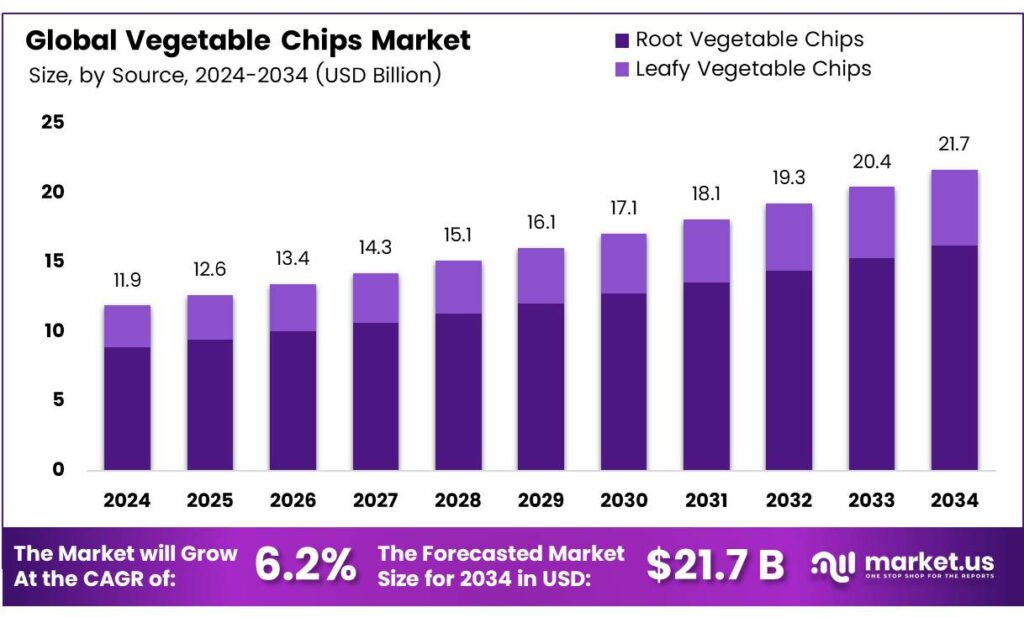

The Global Vegetable Chips Market size is expected to be worth around USD 21.7 billion by 2034, from USD 11.9 billion in 2024, growing at a CAGR of 6.2% during the forecast period from 2025 to 2034.

Vegetable chips, crafted from thinly sliced vegetables like sweet potatoes, beets, carrots, or kale, offer a nutritious twist on traditional potato chips. Baked or fried and seasoned with salt, herbs, or spices, they deliver savory flavors with higher fiber, vitamin, and mineral content. While potentially high in sodium or fat based on preparation, they’re a healthier snack option when enjoyed in moderation within a balanced diet.

The snacking industry continues to expand as consumer behavior evolves toward more frequent and diverse eating occasions. According to SNAC International, the salty snacks category recorded 6.9% growth, reaching USD 31.1 billion in dollar sales. At the same time, social interest in snacks has surged, with conversations rising by 24.67% over the past year, reflecting the cultural importance of snacking.

Snacking Consumer Trend report revealed that 75% of Americans snacked at least once daily in 2024, and 52% reported snacking twice a day. Further, Circana’s research showed that 48.8% of Americans snack three or more times a day, a 2.7% increase year-over-year, with younger demographics between 18–44 years driving this trend. Consumer purchasing habits also highlight the strength of this category.

Flavor exploration is a defining characteristic of modern snacking. Mondelez International’s State of Snacking report notes that 75% of consumers feel excitement when discovering new snacks, while Shopkick found that 59% of snackers favor salty items such as chips, crackers, and popcorn, compared to 20% preferring sweet options. Flavor preferences are diverse, with 72% choosing salty, 63% sweet, 44% cheesy, 40% fruity, and 26% spicy.

Key Takeaways

- The Global Vegetable Chips Market is expected to grow from USD 11.9 billion in 2024 to USD 21.7 billion by 2034, with a CAGR of 6.2%.

- Root vegetable chips led in 2024, holding a 74.8% share due to demand for healthier snacks like sweet potato and beet chips.

- Vegetable chips captured a 68.4% share of the overall chips market in 2024, driven by a preference for plant-based options.

- Classic salty flavor dominated the vegetable chips market in 2024 with a 33.7% share, appealing across various snacking occasions.

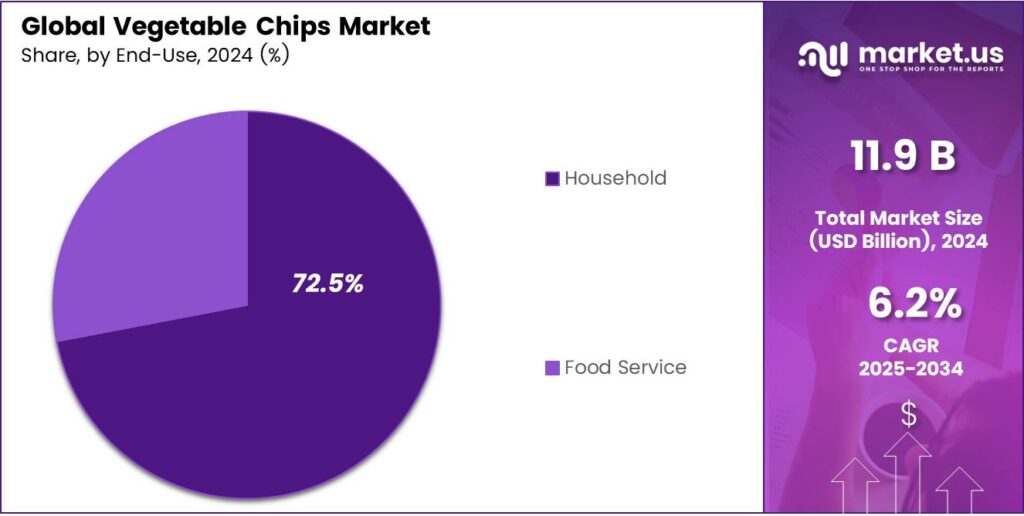

- Household end-use accounted for 72.5% of the vegetable chips market in 2024, fueled by at-home snacking trends.

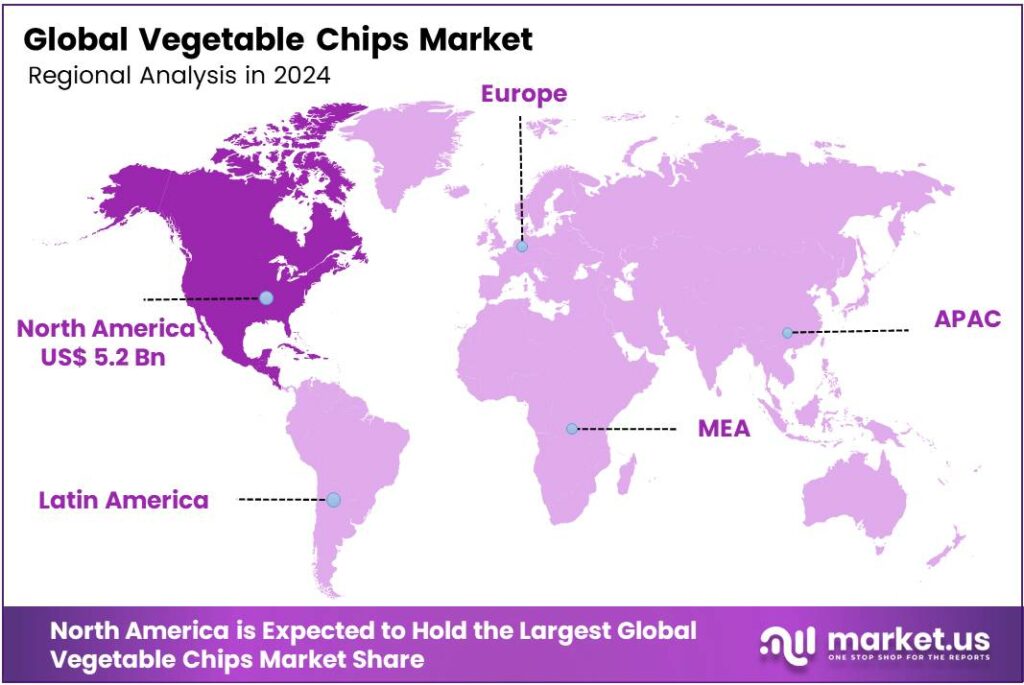

- North America held a 43.8% share of the vegetable chips market in 2024, valued at USD 5.2 billion, due to health-conscious consumers.

Analyst Viewpoint

The vegetable chips market is ripe with opportunity for investors looking to tap into the growing demand for healthier snack options. Consumers are increasingly gravitating toward plant-based, nutrient-rich alternatives to traditional potato chips, driven by a desire for wellness and sustainability. This shift creates a fertile ground for brands innovating with organic, non-GMO, and low-calorie offerings, particularly in regions like North America and Europe, where health-conscious eating is a strong trend.

Small and medium-sized enterprises can find niches by focusing on unique vegetable combinations or exotic flavors, while larger players can scale through partnerships with retailers or e-commerce platforms. However, risks loom large high production costs for quality ingredients and processing that can squeeze margins, and competition is fierce from both established snack giants and new entrants.

Consumers are the heartbeat of this market, and their preferences are clear: they want snacks that taste great but align with their health goals. Young professionals and families are drawn to veggie chips for their perceived nutritional benefits, higher fiber, vitamins, and lower fat content, while still satisfying that craving for crunch. Social media and influencer marketing are amplifying this trend, with visually appealing packaging and bold flavors like sriracha beet or rosemary kale catching attention online.

By Source

Root Vegetable Chips Lead the Market with 74.8% Share

In 2024, Root Vegetable Chips held a dominant market position, capturing more than a 74.8% share in the vegetable chips market. This strong lead reflects the growing consumer preference for healthier snack options made from familiar staples such as sweet potatoes, beets, carrots, and parsnips.

Consumers are increasingly shifting toward snacks that balance taste with nutritional value, and root vegetables provide a natural source of fiber, vitamins, and antioxidants. Their earthy flavors and crunchy textures have made them a preferred alternative to traditional potato chips.

Root vegetable chips are expected to maintain their dominance as awareness around plant-based and nutrient-dense snacking continues to rise. With consumers actively seeking minimally processed and clean-label products, this category is likely to expand its reach across both retail shelves and foodservice channels.

By Type

Vegetable Chips Capture 68.4% Market Share

In 2024, Vegetable Chips held a dominant market position, capturing more than a 68.4% share in the overall chips market by type. This strong performance highlights the growing demand for healthier snacking alternatives, as consumers continue to move away from traditional fried snacks toward plant-based and baked options.

Vegetable chips, made from ingredients such as kale, zucchini, beetroot, and carrots, have gained wide acceptance due to their natural taste, nutritional value, and lower-fat appeal compared to conventional potato chips. Vegetable chips are expected to sustain this leadership as health awareness grows stronger across different consumer groups.

Their popularity is further supported by the introduction of new flavors and seasoning blends, catering to evolving taste preferences. The rising influence of fitness-conscious millennials and Gen Z consumers will continue to push this category forward, ensuring vegetable chips maintain a significant edge in the snacking sector in the coming year.

By Flavour

Classic Salty Leads with 33.7% Share

In 2024, Classic Salty held a dominant market position, capturing more than a 33.7% share in the vegetable chips market by flavour. Its lead reflects simple, familiar taste profiles that work across age groups and occasions, lunchboxes, quick work breaks, and casual at-home snacking.

Brands leaned into clean labels and lighter oil usage while keeping the salt-forward crunch people expect, helping Classic Salty stay the safe choice for first-time buyers and repeat shoppers alike. Classic Salty is set to retain its strong pull as retailers expand shelf space for core flavours and consumers continue to seek dependable, everyday snacks.

Limited-edition twists (sea salt with herbs, mineral salt, or lightly salted baked formats) are likely to orbit around the same core taste, keeping variety fresh without drifting from the flavour that anchors the category. This balance of comfort and small innovations should keep Classic Salty firmly at the center of purchase decisions through the next year.

By Distribution Channel

Supermarket and Hypermarket Leads with 39.2% Share

In 2024, Supermarket and Hypermarket held a dominant market position, capturing more than 39.2% share in the global vegetable chips market. This channel remained the first choice for consumers due to its wide assortment of brands, frequent promotional offers, and strong visibility of healthier snacking alternatives like vegetable chips.

Large retail chains provided both premium and private-label options, making it easier for buyers to compare price and quality under one roof. The convenience of bulk buying and attractive in-store displays further boosted sales through supermarkets and hypermarkets in 2024.

This segment is expected to maintain its leadership, supported by expanding organized retail networks in both urban and semi-urban regions. The push for healthier lifestyles and rising awareness of plant-based snacks will keep driving supermarket footfall, where shoppers often make impulse purchases of packaged snacks like vegetable chips, and the hypermarket channel will likely continue to dominate the vegetable chips distribution landscape in the coming years.

By End-Use

Household End-Use Dominates with 72.5% Share

In 2024, Household held a dominant market position, capturing more than a 72.5% share in the vegetable chips market by end-use. The strong presence of this segment reflects the way consumers are increasingly stocking up on vegetable chips for daily snacking at home, family gatherings, and casual occasions.

Rising health awareness and the preference for baked or low-fat options have pushed households to view vegetable chips as a healthier alternative to conventional fried snacks. The convenient packaging sizes and availability in retail stores and online platforms have also made them a frequent part of household purchases.

Household consumption is expected to continue leading the market, as busy lifestyles and the habit of at-home snacking remain central to consumer behavior. The rise of work-from-home patterns and the trend of mindful eating are further boosting demand for vegetable chips as an everyday snack. Families with children are especially driving the appeal of this category, given its balance of taste and nutrition.

Key Market Segments

By Source

- Root Vegetable Chips

- Carrot Chips

- Turnip Chips

- Sweet Potato Chips

- Others

- Leafy Vegetable Chips

- Kale Chips

- Spinach Chips

- Others

By Type

- Vegetable Chips

- Extruded Vegetable Chips

- Others

By Flavour

- Classic Salty

- Cheese and Onion

- Barbecue

- Salt and Pepper

- Jalapeno

- Others

By End-Use

- Household

- Food Service

By Distribution Channel

- Supermarket and Hypermarket

- Convenience Stores

- Specialty Stores

- Online Stores

- Others

Drivers

Growing Health Awareness and Labeling Initiatives Drive Demand

One powerful driver behind the growing popularity of vegetable chips is rising health awareness, reinforced by government-backed labeling initiatives that guide people toward better snack choices. In India, a noteworthy step is underway: the Food Safety and Standards Authority of India (FSSAI), alongside the National Institute of Nutrition (NIN), is working on a front-of-pack nutrition label (FOPNL) system.

Expected to be finalized by October 2025, this aims to put clear, easy-to-understand information on the front of packaged foods showing when a product is high in salt, sugar, or fat. For everyday consumers, especially those who might struggle with detailed nutrition facts, these labels will make it straightforward to spot healthier snacks.

That clarity gives vegetable chips, often lower in oil and made from nutrient-rich veggies, a real edge when people shop. Meanwhile, health concerns are already shaping what Indians reach for when snacking. A recent study found that 72% of Indians say health influences their snack choices.

Restraints

High Sodium Content: A Real Snag for Vegetable Chips

One important restraint holding back the popularity of vegetable chips is their often high sodium content. While we might think of these snacks as healthier, many varieties pack more salt than expected, and that’s a real concern, especially when public health bodies are encouraging us to eat less sodium.

According to the World Health Organization, savoury snacks like vegetable and potato chips have a global sodium benchmark of 500 mg per 100 grams. Yet, it’s common to find many products exceeding this level, meaning a single serving can edge uncomfortably close to or even surpass daily recommended limits.

To put it in perspective, in the U.S., the average daily sodium intake is roughly 3,400 mg, while health authorities advise capping it at 2,300 mg per day. That means one snack serving can quietly use up a big chunk of, if not all, your ideal daily limit. And for people watching their blood pressure or aiming for a heart-healthy diet, that’s a red flag.

Opportunity

School Nutrition Programs Help Veggie Chips Grow

One major growth driver for vegetable chips is the rise of healthier school snack standards and nutrition programs. These government-backed efforts are encouraging schools and institutions to offer baked or low-fat snacks like vegetable chips over traditional fried options.

For instance, in the United States, the USDA’s proposed school nutrition standards include healthier snack choices such as baked tortilla chips, reduced-fat corn chips, and baked potato chips. These changes aim to make lunchrooms healthier.

Meanwhile, the USDA’s Fresh Fruit and Vegetable Program (FFVP) has made a tangible impact. It provides fresh fruits and vegetables as snacks during school hours and has improved children’s diets without increasing total calorie intake. Teachers report that students are better focused in the evenings, and hunger is reduced.

Trends

Plant-Based Protein Boost Gives Veggie Chips a Fresh Edge

One exciting emerging factor shaping the vegetable chips market is the growing demand for plant-based protein snacks. People are increasingly looking for snacks that do more than fill; they nourish. Snacking isn’t just about taste anymore; it’s become an opportunity to sneak in extra protein the plant-forward way.

Take protein labeling in India. The Food Safety and Standards Authority of India (FSSAI) introduced a Source of Protein logo for packaged foods, including snacks, if they contain at least 15% of the daily value of protein per serving. This simple symbol helps shoppers quickly spot products that go beyond empty calories while staying naturally plant-based.

Meanwhile, global food agencies highlight this shift in people’s eating habits. The Food and Agriculture Organization (FAO) has noted that in recent years, the share of the world population choosing plant-based protein sources has risen by 8% a sign that more and more consumers trust plant-based alternatives for their protein needs.

Regional Analysis

North America leads with a 43.8% share and a USD 5.2 Billion market value.

In 2024, North America emerged as the leading region in the vegetable chips market, holding a dominant 43.8% share, which translated to an estimated value of USD 5.2 billion. The region’s leadership can be attributed to strong consumer awareness about healthy eating habits, coupled with the rising preference for plant-based and low-fat snack alternatives.

The United States continues to be the primary contributor to this market growth, supported by the high penetration of health-conscious snack brands and widespread retail availability across supermarkets, convenience stores, and online platforms. The growing emphasis on incorporating vegetables into daily diets has encouraged manufacturers to innovate with vegetable-based snacking formats, further expanding the category’s appeal.

Canada is also witnessing a steady rise in demand, as its urban population increasingly adopts clean-label and gluten-free snack products. North America is expected to sustain its dominance, fueled by ongoing flavor innovations, growing acceptance of vegan and organic products, and government-backed nutrition initiatives promoting healthier food consumption.

The region’s consumers are showing strong loyalty toward premium and functional snacks, ensuring that vegetable chips remain a significant driver of the better-for-you snacking trend. This combination of health awareness, innovation, and robust retail infrastructure solidifies North America’s role as the central hub for vegetable chips market expansion.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Camel Nuts is a significant player, often recognized for its diverse snack portfolio that includes vegetable chips. The brand focuses on delivering a crunchy, flavorful experience using a variety of vegetables like sweet potato, beetroot, and carrot. Its strategy often involves targeting health-conscious consumers seeking alternatives to traditional potato chips. By leveraging existing distribution networks for its nut products, Camel Nuts effectively places its vegetable chips in broad retail channels, competing on both taste and accessibility.

The Hain Celestial Group is a major natural and organic food conglomerate and a powerhouse in the healthy snack sector. Through its renowned brands like Terra, it offers a premium, exotic range of vegetable chips, from blue potato to taro. Its strength lies in its established reputation for quality, non-GMO ingredients, and gluten-free options. Targeting health-aware and gourmet consumers, Hain Celestial leverages its extensive distribution to dominate shelf space in natural food stores and major supermarkets globally.

GoPure positions itself as a dedicated health and wellness brand within the snack aisle. Its approach to vegetable chips emphasizes minimal processing, simple ingredients, and baked, not fried, options to appeal to the most health-conscious consumers. GoPure often highlights benefits like being low in fat, gluten-free, and free from artificial additives. This niche strategy focuses on consumers seeking truly nutritious snack alternatives, typically found in health food stores, online markets, and select retailers prioritizing clean-label products.

Top Key Players in the Market

- Camel Nuts

- Hain Celestial

- GoPure

- Hunter Foods

- Jagdish Farshan Pvt. Ltd

- Kiwa Natural Life

- PepsiCo, Inc.

- Popchips, Inc.

- Rivera Foods

- Scrubbys

Recent Developments

- In 2025, Camel Nuts, a Cyprus-based company known for nuts and snacks, launched a new line of vegetable chips featuring organic sweet potato and kale varieties. These chips are marketed as gluten-free and non-GMO, targeting health-conscious consumers in the European market.

- In 2025, GoPure, a brand focused on organic snacks, introduced a vegetable chip line with functional ingredients like chia seeds and turmeric, marketed for their antioxidant properties. The launch saw strong online sales through platforms like Amazon and the company’s e-commerce site.

Report Scope

Report Features Description Market Value (2024) USD 11.9 Billion Forecast Revenue (2034) USD 21.7 Billion CAGR (2025-2034) 6.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Root Vegetable Chips, Leafy Vegetable Chips), By Type (Vegetable Chips, Extruded Vegetable Chips, Others), By Flavour (Classic Salty, Cheese and Onion, Barbecue, Salt and Pepper, Jalapeno, Others), By End-Use (Household, Food Service), By Distribution Channel (Supermarket and Hypermarket, Convenience Stores, Specialty Stores, Online Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Camel Nuts, Hain Celestial, GoPure, Hunter Foods, Jagdish Farshan Pvt. Ltd, Kiwa Natural Life, PepsiCo., Inc., Popchips, Inc., Rivera Foods, Scrubbys Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Vegetable Chips MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample

Vegetable Chips MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Camel Nuts

- Hain Celestial

- GoPure

- Hunter Foods

- Jagdish Farshan Pvt. Ltd

- Kiwa Natural Life

- PepsiCo, Inc.

- Popchips, Inc.

- Rivera Foods

- Scrubbys