Global Transparent Ceramics Market By Type (Monocrystalline, Polycrystalline, Others), By Material (Sapphire, Yttrium Aluminum Garnet (YAG), Spinel, Aluminum Oxynitride, Others), By End-use (Optics And Optoelectronics, Aerospace Defense, And Security, Mechanical Goods, Electronics, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151245

- Number of Pages: 358

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

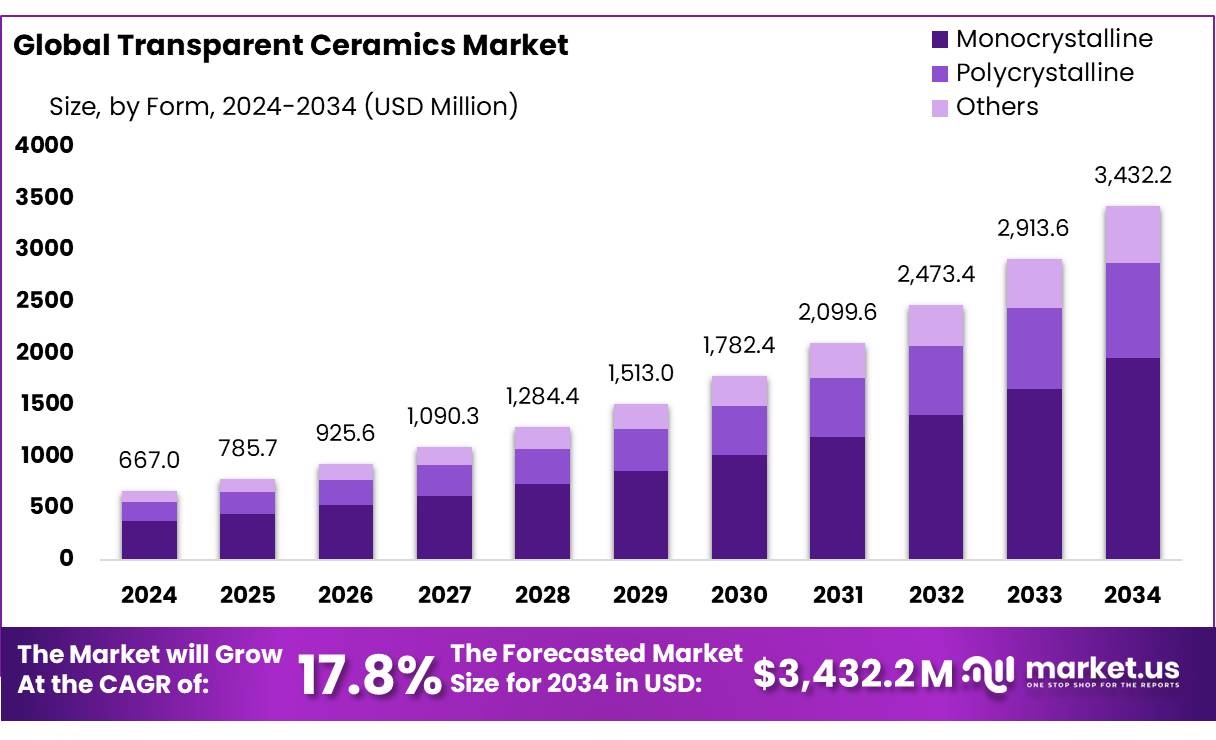

The Global Transparent Ceramics Market size is expected to be worth around USD 3432.2 Million by 2034, from USD 667.0 Million in 2024, growing at a CAGR of 17.8% during the forecast period from 2025 to 2034.

Transparent ceramics—materials such as sapphire, aluminium oxynitride (ALON), yttrium aluminum garnet (YAG), and spinel—are crystalline polycrystalline or monocrystalline materials that combine optical transparency with exceptional mechanical, thermal, and chemical resilience. ALON, for instance, offers ≥80% transmission across the UV–midIR spectrum and unrivalled hardness (~4× that of fused silica, ~85% of sapphire). These concentrates serve as feedstock for lasers, armor, sensor windows, and optical components.

The primary drivers include expanding applications in aerospace/defense (e.g., domes, sensor windows, armor), and healthcare and optoelectronics (laser systems, medical imaging). Government funding is accelerating R&D and scale up capacities: for example, the U.S. Department of Energy’s advanced ceramics segment reached USD 97 billion in 2019, backed by additive manufacturing initiatives for energy applications.

Similarly, U.S. supply-chain resilience initiatives—like EO 14017 and the White House’s 100 Day Review—focus on critical industrial bases including ceramics within the energy and defense value chains. On the innovation front, the U.S. Innovation and Competition Act (2021) endowed the National Science Foundation with regional technology hubs aimed at discovering materials like advanced ceramics

Government data for concentrates is limited, European defence R&D funding for transparent armour under the Horizon Europe programme was recently allocated €50–70 million for 2024–2027. Similarly, national science agencies in the U.S. and Germany have committed substantial grants (over USD 20 million and EUR 15 million, respectively) toward transparent ceramic R&D for sensor, space, and defence applications. In Asia, government–industry consortia in Japan and South Korea have launched multi-million dollar programs to develop sapphire based components for laser and semiconductor photolithography systems.

Key Takeaways

- Transparent Ceramics Market size is expected to be worth around USD 3432.2 Million by 2034, from USD 667.0 Million in 2024, growing at a CAGR of 17.8%.

- Monocrystalline held a dominant market position, capturing more than a 56.9% share of the transparent ceramics market.

- Sapphire held a dominant market position, capturing more than a 51.4% share in the transparent ceramics market.

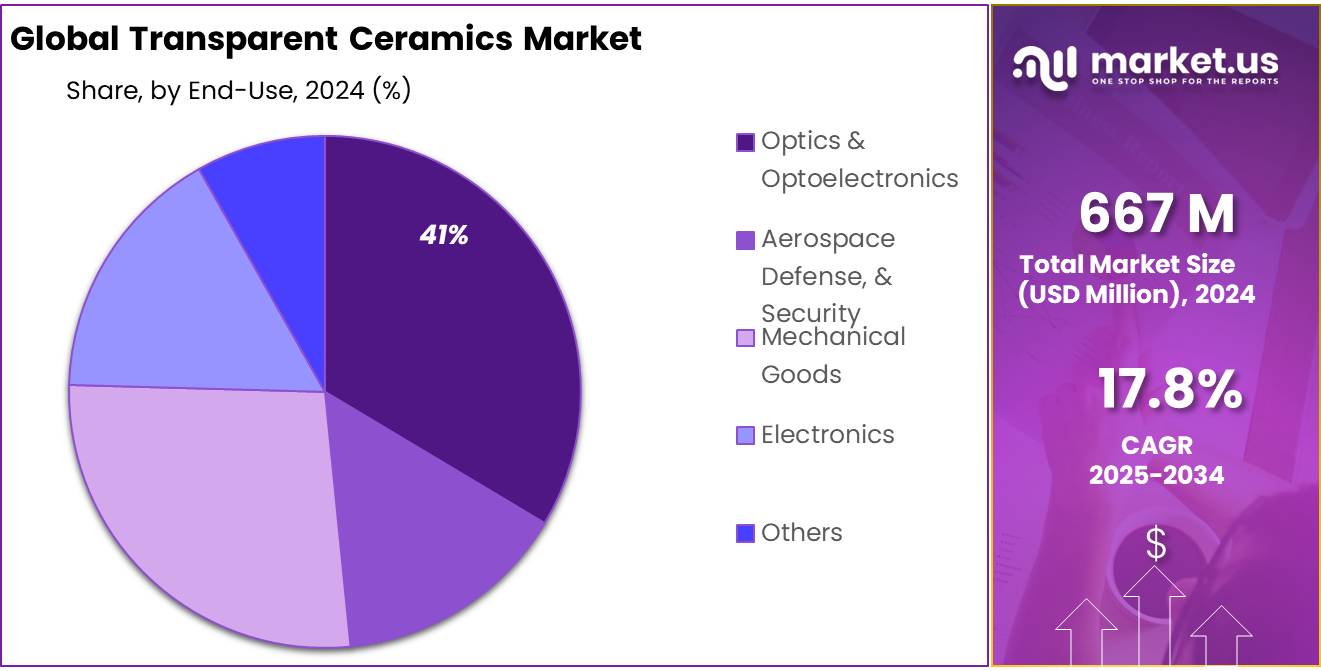

- Optics & Optoelectronics held a dominant market position, capturing more than a 41.3% share of the transparent ceramics market.

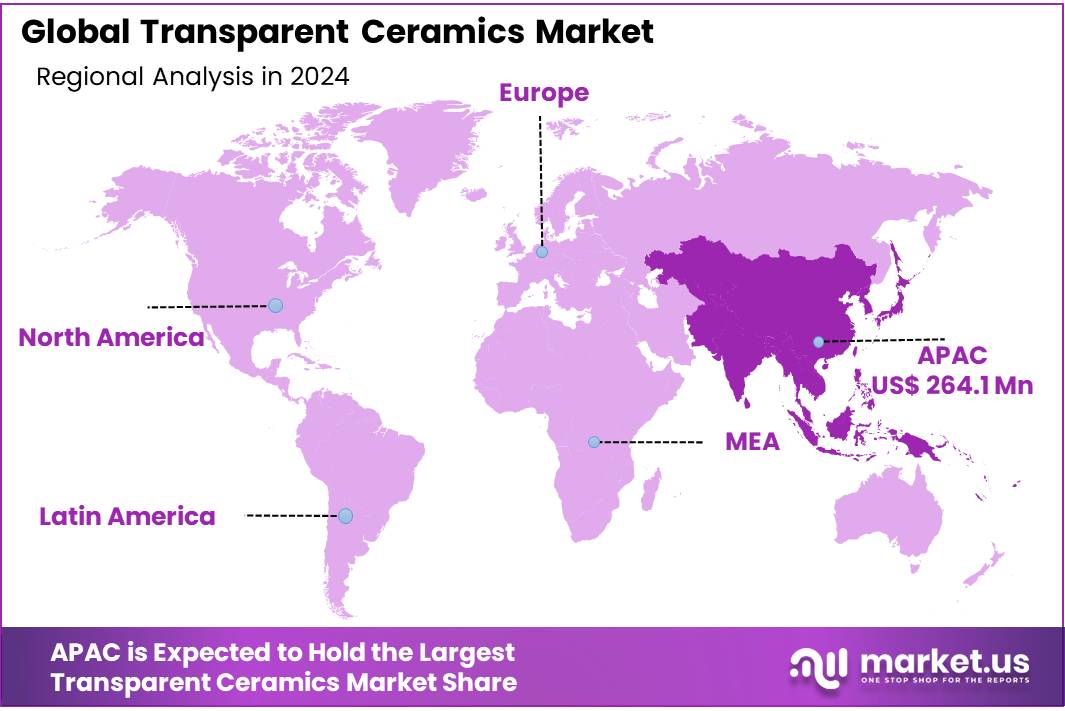

- Asia-Pacific (APAC) held a dominant position in the global transparent ceramics market, accounting for 39.6% of the total market share and reaching a market value of approximately USD 264.1 million.

By Type

Monocrystalline dominates with 56.9% due to its exceptional clarity and mechanical strength.

In 2024, Monocrystalline held a dominant market position, capturing more than a 56.9% share of the transparent ceramics market by type. This strong lead can be attributed to its superior optical transparency, high hardness, and excellent thermal stability, which make it ideal for demanding applications such as laser systems, infrared windows, and high-temperature sensor covers. Monocrystalline materials like sapphire and yttrium aluminum garnet (YAG) are preferred in aerospace, defense, and electronics sectors due to their consistent crystal structure and minimal scattering loss.

The year 2024 saw continued investments in laser-based defense systems and precision optical components, where monocrystalline ceramics remain a core material. Their durability under extreme conditions and long-term performance have positioned them as the material of choice in high-precision environments. As global demand grows in these sectors, monocrystalline ceramics are expected to maintain their lead in 2025, supported by rising adoption across both government-funded defense programs and industrial laser manufacturing initiatives.

By Material

Sapphire dominates with 51.4% due to its strength, clarity, and wide use in defense and optics.

In 2024, Sapphire held a dominant market position, capturing more than a 51.4% share in the transparent ceramics market by material. This dominance is mainly due to sapphire’s exceptional hardness, second only to diamond, and its high optical transparency across a wide spectral range, including visible and infrared. These qualities have made sapphire the preferred choice for military armor windows, optical lenses, and semiconductor substrates.

Its resistance to thermal shock and chemical corrosion also supports its increasing use in harsh environments, such as in aerospace sensor covers and laser system components. Throughout 2024, demand was especially strong from the defense sector, where sapphire is extensively used in infrared missile domes and protective optics. In 2025, this trend is expected to continue, with sapphire maintaining its lead as new defense programs and high-end optical applications expand globally, particularly in North America and Asia-Pacific.

By End-use

Optics & Optoelectronics leads with 41.3% due to growing use in lasers, sensors, and imaging systems.

In 2024, Optics & Optoelectronics held a dominant market position, capturing more than a 41.3% share of the transparent ceramics market by end-use. This segment’s strong performance was mainly driven by the rising demand for high-performance optical components in lasers, photonic devices, and infrared imaging systems. Transparent ceramics, particularly sapphire and YAG, are used in precision optics because of their excellent transmission properties, thermal resistance, and mechanical durability. In 2024, global demand for laser optics in industrial cutting, medical procedures, and defense targeting systems significantly boosted the consumption of these materials.

Moreover, transparent ceramics found increasing application in optoelectronic sensors used in consumer electronics and autonomous vehicle technologies. As industries continue to shift toward miniaturized, high-efficiency optical devices, the use of advanced ceramics in this sector is expected to rise steadily in 2025, further strengthening the position of Optics & Optoelectronics in the overall market landscape.

Key Market Segments

By Type

- Monocrystalline

- Polycrystalline

- Others

By Material

- Sapphire

- Yttrium Aluminum Garnet (YAG)

- Spinel

- Aluminum Oxynitride

- Others

By End-use

- Optics & Optoelectronics

- Aerospace Defense, & Security

- Mechanical Goods

- Electronics

- Others

Drivers

Rising Defense R&D Spending Fuels Transparent Ceramics Demand

A key factor driving growth in the transparent ceramics market is the expanding investment in defense research and development. In 2024, agencies such as the U.S. Department of Defense awarded grants of up to $1.5 million per project to explore advanced ceramic materials, including transparent variants for use in infrared domes, missile windows, and sensor protection. These funds are typically channelled through initiatives such as the Multidisciplinary University Research Initiative (MURI), which supports cutting‑edge materials research at the intersection of optics, thermal resilience, and mechanical strength.

The practical impact of this funding is tangible. Projects backed by MURI have accelerated the development of transparent ceramics like aluminum oxynitride (ALON) and yttria-based compositions, offering the durability and optical clarity required in next-generation military systems. As of FY 2025, this type of defense-led research has led to prototypes capable of withstanding high-speed airborne environments while maintaining infrared transparency—a combination once thought difficult to achieve.

Government programs also support scaling up advanced production processes. In the United States, funding extends to pilot manufacturing facilities where transparent ceramics are being processed using hot isostatic pressing (HIP) and additive manufacturing techniques. These efforts align with broader defense objectives to deploy lightweight, resilient materials for stealth aircraft windows, armored vehicle visors, and space sensor covers.

Restraints

High energy demand and carbon emissions increase production cost

A major challenge restraining the transparent ceramics market is the substantial energy required during manufacturing. In 2024, it was noted that energy expenses can constitute nearly 30 % of total production costs for advanced ceramics. This high share of energy cost makes scaling up production difficult without significantly raising prices for end-users.

The ceramic industry is also a considerable emitter of carbon dioxide. According to the International Energy Agency (IEA), the sector, including transparent ceramics, contributes over 400 million tonnes of CO2 annually, stemming from fuel combustion and intensive energy use. As governments worldwide tighten regulations on emissions, producers are compelled to invest in cleaner, but more expensive, energy systems or pay for carbon credits—both options increase operational costs.

In India, the government has implemented ambitious programs under the National Action Plan for Climate Change (NAPCC), specifically the National Mission on Enhanced Energy Efficiency. While these initiatives aim to improve sustainability, they require manufacturers to retrofit equipment, adopt energy-efficient processes, and comply with stricter efficiency standards. Such transitions involve high upfront capital expenditures, which can deter smaller firms from upgrading and delay market expansion.

Opportunity

Expansion of Clean Energy Partnerships to Lower Carbon Footprint

One promising growth opportunity in the transparent ceramics market lies in the shift towards sustainable manufacturing through clean energy integration and energy efficiency initiatives. Across energy-intensive industries, similar strategies have delivered significant gains. For instance, food and drink manufacturers have successfully lowered costs by dedicating approximately 15% of their operating expenses to energy tracking and optimization—an effort tied to improved sustainability and reduced waste. The transparent ceramics sector can learn from these practices by implementing better energy oversight and process improvements.

In 2024, food service facilities in the United States were identified as being nearly four times more energy-intensive than average commercial buildings, using about 263 MBtu per square foot, compared with 70 MBtu. This stark difference highlights the opportunity: if ceramics producers adopt rigorous energy audits, investment in cogeneration systems, and waste heat recovery, they too could see dramatic reductions in energy consumption and carbon emissions—while also trimming costs.

Government programs are already fostering such transitions. India’s National Mission for Enhanced Energy Efficiency (NMEEE) continues to support industries in adopting cleaner technologies, with tax credits and subsidized loans aimed specifically at energy-intensive production. The result is a two-fold benefit: transparent ceramics manufacturers gain lower energy costs and reduced carbon footprints, aligning with global climate goals outlined under the Paris Agreement.

Trends

Rising Adoption of Clean-Minded Production in Ceramic Making

In transparent ceramics, manufacturers are embracing similar energy-smart techniques: real-time energy monitoring, process automation, and waste heat recovery. These shifts are guided by government initiatives like India’s National Mission for Enhanced Energy Efficiency (NMEEE), which offers subsidy programs and low-interest loans to energy-intensive manufacturers . Such support encourages ceramic plants to pilot combined heat and power systems, deploy optimized furnace controls, and implement AI-based energy management, mirroring cost and sustainability gains seen in food processing.

With energy costs often accounting for more than 30% of total manufacturing expenses, adopting these clean-energy measures helps reduce costs while lowering carbon emissions. For transparent ceramics, this is a welcome development—growth in laser, defense, aerospace, and optoelectronics markets relies not only on material quality but also on eco-conscious credentials.

By focusing on clean production, transparent ceramic producers demonstrate both economic and environmental responsibility—appealing to customers and regulators alike. As energy and sustainability concerns become critical in global supply chains, transparent ceramics firms can strengthen their market position by aligning with proven energy efficiency practices from related sectors such as food and beverage manufacturing.

Regional Analysis

In 2024, Asia-Pacific (APAC) held a dominant position in the global transparent ceramics market, accounting for 39.6% of the total market share and reaching a market value of approximately USD 264.1 million. This regional leadership is strongly supported by the growing demand from defense, electronics, and optical sectors across countries like China, Japan, South Korea, and India.

China remains a key driver due to its large-scale investments in aerospace and defense technology, as well as its rapidly expanding optoelectronics manufacturing base. According to the Chinese Ministry of Industry and Information Technology, the country increased funding for advanced material research by over 18% year-on-year in 2023, directly benefiting high-performance ceramics development.

Japan and South Korea also play a crucial role in the region, particularly in producing precision optical components for use in semiconductors and high-end consumer electronics. The Japanese government has designated transparent ceramics as a strategic material under its Advanced Material Innovation Program, providing financial assistance to local firms working on optical-grade ceramics. Meanwhile, India has ramped up its defense procurement under the “Make in India” initiative, with a growing focus on indigenizing critical materials such as infrared domes and sensor windows made from transparent ceramics.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

American Elements is a leading global producer of transparent ceramics, offering materials such as aluminum oxynitride (ALON) and yttrium aluminum garnet (YAG) in powder and crystal forms. The company supports a wide array of applications—from optics and aerospace to defense—with customizable grades and grain sizes. Its extensive online catalog and manufacturing scale ensure rapid material availability. Backed by deep research capabilities, American Elements continues to innovate in optical ceramics aimed at demanding industrial uses.

CeramTec GmbH, a European pioneer, became the first company to produce transparent ceramics like PERLUCOR® at series-production scale. Its PERLUCOR® maintains over 90% transparency and offers hardness three to four times that of conventional glass, making it ideal for industrial windows, protective armor, and monitoring panels. With a century of expertise and global manufacturing facilities, CeramTec supports sectors ranging from heavy industry to electronics, emphasizing durability and clarity.

CoorsTek Inc. utilizes over a century of ceramics expertise and has developed polycrystalline YAG and translucent ceramics, serving applications in laser technology, optical sensors, and automotive systems. Its transparent materials combine optical clarity with high thermal resistance and strength, tailored for precision devices. With advanced forming methods and R&D infrastructure, CoorsTek ensures scalable quality production across diverse end-use sectors, reinforcing its reputation in engineered technical ceramics.

Top Key Players in the Market

- American Elements

- CeramTec GmbH

- CeraNova Corporation

- Compagnie de Saint-Gobain S.A.

- CoorsTek Inc.

- Philips N.V.

- Konoshima Chemical Co. Ltd.

- KYOCERA Fineceramics Europe GmbH

- Murata Manufacturing Co., Ltd.

- Schott AG

- Surmet Corporation

Recent Developments

In 2024 CeramTec GmbH recorded a solid €746 million revenue (about USD 810 million) and employs 3,750 people across 16 production sites.

CeramTec GmbH, a German-based leader in high-performance and transparent ceramics, posted €746 million revenue in 2024 with around 3,750 employees worldwide, offering solutions in medical devices, electronics, aerospace, and industrial machinery.

Report Scope

Report Features Description Market Value (2024) USD 667.0 Mn Forecast Revenue (2034) USD 3432.2 Mn CAGR (2025-2034) 17.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Monocrystalline, Polycrystalline, Others), By Material (Sapphire, Yttrium Aluminum Garnet (YAG), Spinel, Aluminum Oxynitride, Others), By End-use (Optics And Optoelectronics, Aerospace Defense, And Security, Mechanical Goods, Electronics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape American Elements, CeramTec GmbH, CeraNova Corporation, Compagnie de Saint-Gobain S.A., CoorsTek Inc., Philips N.V., Konoshima Chemical Co. Ltd., KYOCERA Fineceramics Europe GmbH, Murata Manufacturing Co., Ltd., Schott AG, Surmet Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Transparent Ceramics MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Transparent Ceramics MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- American Elements

- CeramTec GmbH

- CeraNova Corporation

- Compagnie de Saint-Gobain S.A.

- CoorsTek Inc.

- Philips N.V.

- Konoshima Chemical Co. Ltd.

- KYOCERA Fineceramics Europe GmbH

- Murata Manufacturing Co., Ltd.

- Schott AG

- Surmet Corporation