Global Traffic Management System Market Size, Share, Growth Analysis By Technology (Internet of Things (IoT), AI and ML, Cloud-Based, Big Data Analytics, Others), By Component (Software, Hardware, Services), By Application (Urban Traffic Management, Highway Traffic Management, Public Transportation Management, Parking Management, Incident Management, Integrated Corridor Management (ICM), Others), By Deployment Mode (Cloud, On-premises), By End Use (Government and Municipalities, Transportation Agencies, Private Organizations, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 178397

- Number of Pages: 262

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

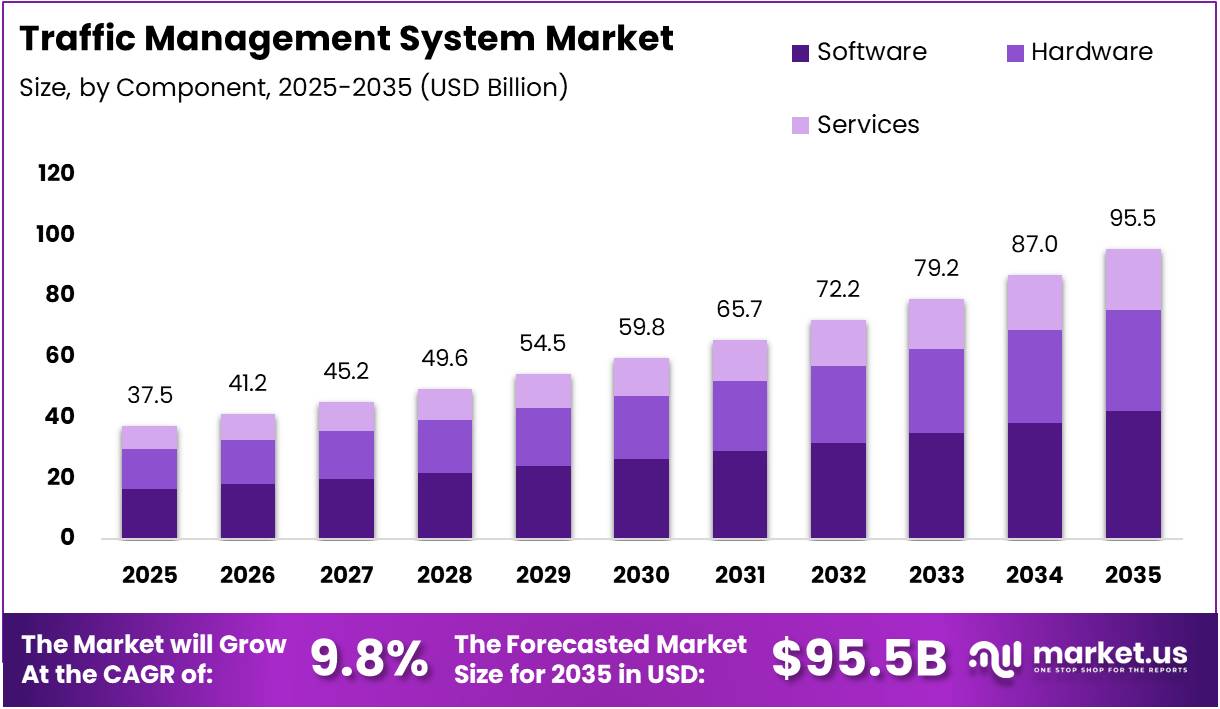

The Global Traffic Management System Market size is expected to be worth around USD 95.5 Billion by 2035 from USD 37.5 Billion in 2025, growing at a CAGR of 9.8% during the forecast period 2026 to 2035.

The traffic management system market encompasses a broad range of technologies and solutions designed to monitor, control, and optimize vehicular flow across road networks. These systems integrate hardware, software, and services to enhance mobility, reduce congestion, and improve road safety in urban and highway environments.

Rapid urbanization across global Tier I and Tier II cities is placing immense pressure on existing road infrastructure. Growing vehicle populations are creating persistent congestion, increasing the urgency for intelligent traffic control solutions. Consequently, city planners and transportation authorities are prioritizing smart traffic investments to maintain network efficiency.

Government-led smart mobility programs are accelerating adoption worldwide. Authorities are allocating dedicated budgets toward intelligent transportation infrastructure as part of broader national smart city agendas. Moreover, regulatory frameworks supporting connected transportation are creating a favorable environment for long-term market expansion.

The integration of IoT, AI, and cloud-based traffic analytics platforms is transforming how transportation networks are managed. These technologies enable real-time data collection, predictive modeling, and automated decision-making at scale. Additionally, the shift toward cloud deployment is reducing operational costs and improving system scalability for operators globally.

According to a study published on Preprints.org, AI-powered adaptive traffic signal control may cut congestion by up to 40% and reduce travel time by 20 to 30% compared to traditional techniques. Furthermore, research from SciTePress found that AI-powered intersections achieved approximately 94.7% identification accuracy using the YOLOv8 model in real-time traffic detection systems.

According to research published in Nature, big-data adaptive signals reduced peak-hour trip times by 11% and off-peak travel times by 8%, alongside a 6.65% reduction in total CO₂ emissions. Additionally, a study in Springer confirms that traffic management tools can reduce travel delay and BC emissions by up to 6% and 3% respectively.

Key Takeaways

- The Global Traffic Management System Market is valued at USD 37.5 Billion in 2025 and is projected to reach USD 95.5 Billion by 2035.

- The market is expected to register a CAGR of 9.8% during the forecast period 2026 to 2035.

- By Technology, Internet of Things (IoT) holds the dominant position with a 32.7% market share in 2025.

- By Component, the Software segment leads the market with a 44.2% share in 2025.

- By Application, Urban Traffic Management accounts for 39.6% of the total market in 2025.

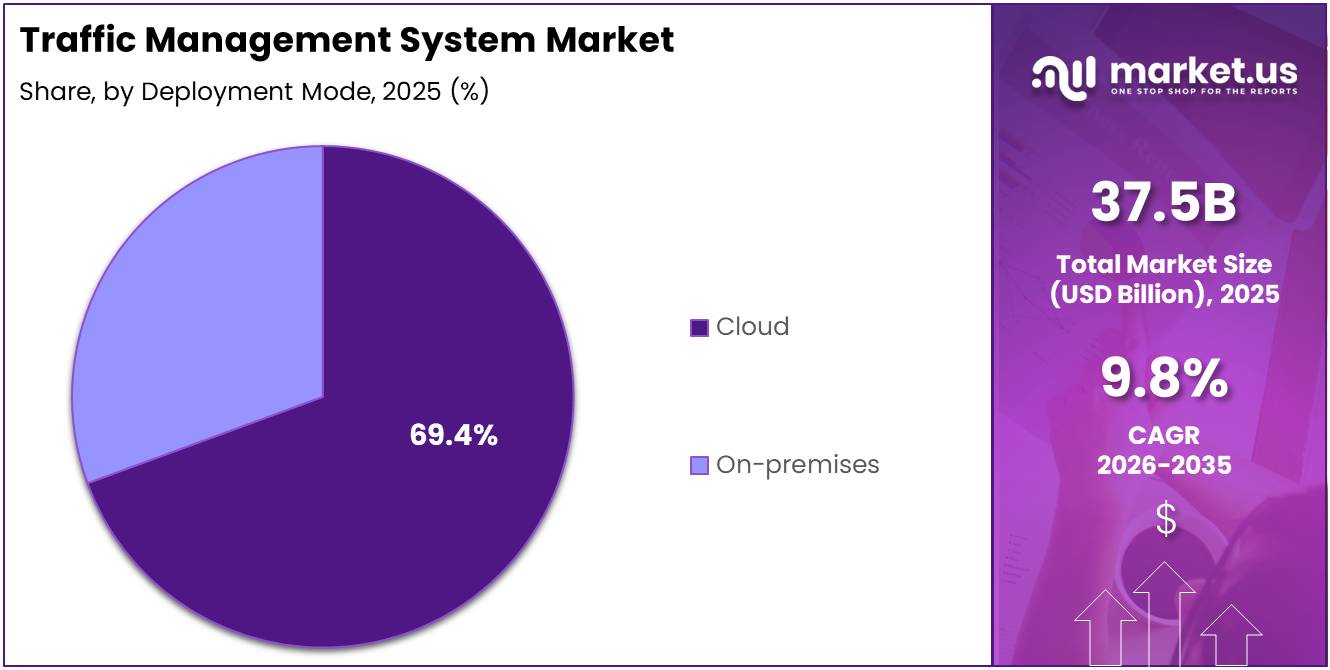

- By Deployment Mode, Cloud deployment dominates with a 69.4% share in 2025.

- By End Use, Government and Municipalities holds the largest share at 45.8% in 2025.

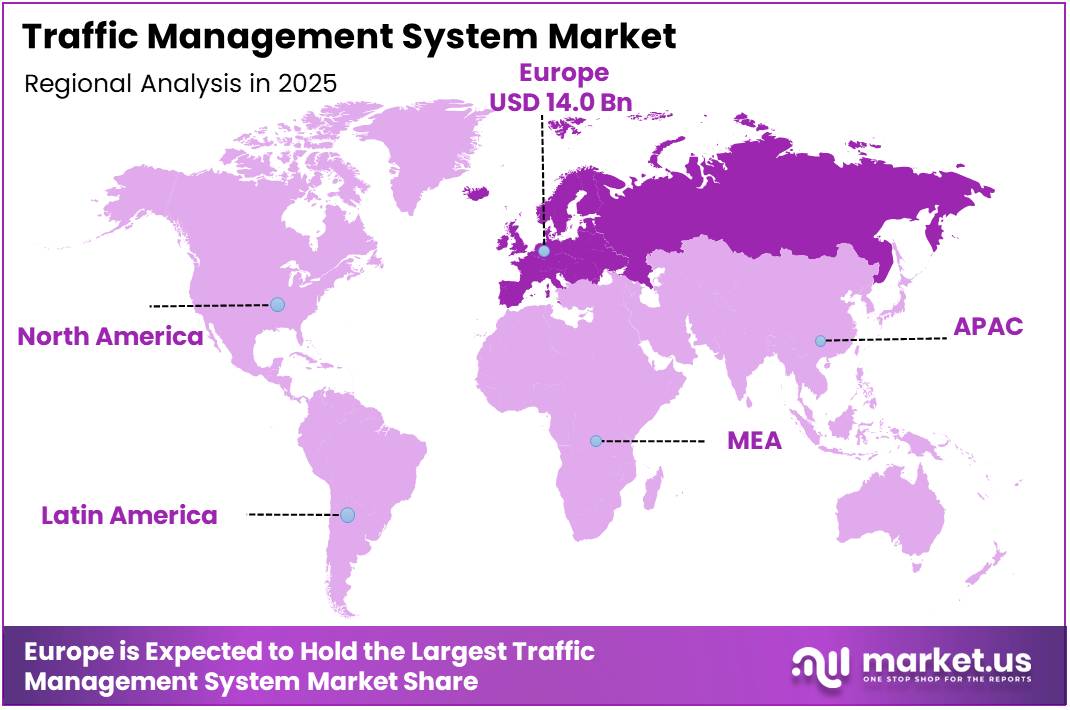

- Europe leads the regional landscape with a 37.6% market share, valued at USD 14.0 Billion in 2025.

By Technology Analysis

Internet of Things (IoT) dominates with 32.7% due to its real-time data collection and broad infrastructure connectivity capabilities.

In 2025, Internet of Things (IoT) held a dominant market position in the By Technology segment of the Traffic Management System Market, with a 32.7% share. IoT sensors and connected devices enable continuous real-time monitoring of traffic conditions across road networks. Consequently, transportation authorities rely on IoT infrastructure to improve signal coordination and reduce urban congestion effectively.

AI and ML technologies are rapidly gaining adoption as core tools in traffic management platforms. These capabilities power predictive analytics, automated signal adjustments, and real-time incident detection. Moreover, AI-driven systems help reduce response times and significantly improve overall traffic flow accuracy across complex and high-density road environments.

Cloud-Based solutions are transforming traffic management by offering scalable and cost-efficient data processing capabilities. Cloud platforms allow centralized management of traffic data from multiple distributed locations simultaneously. Additionally, they support real-time system updates and seamless integration with broader smart city and transportation network infrastructure.

Big Data Analytics plays a critical role in processing the large volumes of traffic data generated across urban and highway environments daily. These tools help authorities identify recurring congestion patterns and plan targeted infrastructure improvements. Therefore, demand for big data solutions in traffic management continues to grow at a steady pace.

Others category includes emerging technologies such as LiDAR, edge computing, and advanced communication protocols. These technologies complement existing traffic management infrastructure by enabling faster data processing and more precise vehicle detection. However, their adoption remains limited compared to mainstream technology categories in the current market landscape.

By Component Analysis

Software dominates with 44.2% due to its critical role in data processing, analytics, and system-wide traffic optimization.

In 2025, Software held a dominant market position in the By Component segment of the Traffic Management System Market, with a 44.2% share. Solutions including Traffic Analytics, Smart Signaling, Route Guidance, and Traffic Monitoring form the backbone of modern intelligent transportation management. These tools collectively enable real-time decision-making and system-wide network optimization.

Hardware components such as Traffic Signals and Controllers, Sensors, Camera and Surveillance Systems, and Variable Message Signs provide the physical infrastructure for traffic management. These elements collect field-level data and relay real-time information to central control systems. Moreover, hardware upgrades are essential for deploying next-generation intelligent transportation capabilities.

Services segment, encompassing Consulting, Deployment and Integration, and Support and Maintenance, supports the full operational lifecycle of traffic management systems. Service providers assist agencies in system design, implementation, and ongoing management. Additionally, growing system complexity is steadily increasing demand for professional integration and support services globally.

By Application Analysis

Urban Traffic Management dominates with 39.6% due to high vehicle density and large-scale smart city investments.

In 2025, Urban Traffic Management held a dominant market position in the By Application segment of the Traffic Management System Market, with a 39.6% share. Urban areas face the highest vehicle volumes globally, creating persistent congestion challenges. Consequently, municipalities prioritize intelligent signal control and real-time monitoring to reduce delays and improve commuter safety.

Highway Traffic Management focuses on monitoring and controlling traffic flow along expressways and intercity corridors. Variable message signs, speed management tools, and incident detection systems are widely deployed in this segment. Moreover, highway management platforms help reduce accident rates and improve throughput capacity during peak travel periods.

Public Transportation Management integrates traffic systems with bus, rail, and transit networks to improve scheduling reliability and reduce service delays. Real-time data sharing between agencies enhances operational coordination. Additionally, signal priority systems for public transit vehicles are expanding adoption in congested metropolitan environments.

Parking Management solutions use sensors and analytics to guide drivers toward available spaces, reducing circling traffic and associated emissions. Smart parking platforms are increasingly integrated with urban traffic management systems. Therefore, adoption is expanding in dense city centers where parking demand consistently exceeds available supply.

Incident Management systems detect, report, and coordinate responses to traffic disruptions caused by accidents, closures, or adverse weather. Automated detection tools enable faster emergency response and quicker traffic clearance. However, effective incident management requires seamless integration across multiple traffic control and emergency communication systems.

Integrated Corridor Management (ICM) coordinates multiple transportation assets along a single corridor to optimize overall network performance. This approach unifies freeway, arterial, and transit management into one operational system. Consequently, ICM is gaining traction in metropolitan areas with complex multi-modal transportation infrastructure requirements.

Others category covers niche applications such as event traffic control and border crossing management. These use cases require customized solutions tailored to specific operational conditions and traffic volumes. Moreover, ongoing smart city projects worldwide are creating new deployment opportunities for these specialized traffic management applications.

By Deployment Mode Analysis

Cloud dominates with 69.4% due to its scalability, operational flexibility, and lower infrastructure investment requirements.

In 2025, Cloud held a dominant market position in the By Deployment Mode segment of the Traffic Management System Market, with a 69.4% share. Cloud-based deployment enables centralized data storage and real-time analytics across distributed traffic networks. Moreover, it reduces on-site hardware investment requirements and supports rapid scaling of traffic management operations.

On-premises deployment remains relevant for agencies that require full data sovereignty and operate in environments with strict security or regulatory compliance requirements. These systems offer greater customization and control but involve higher upfront infrastructure costs. However, many organizations are gradually transitioning toward hybrid or cloud-first models for long-term efficiency gains.

By End Use Analysis

Government and Municipalities dominates with 45.8% due to large-scale public infrastructure investments and smart city program funding.

In 2025, Government and Municipalities held a dominant market position in the By End Use segment of the Traffic Management System Market, with a 45.8% share. Public sector agencies drive the majority of traffic management investments through national and municipal smart city programs. Consequently, government procurement remains the primary revenue contributor for market participants worldwide.

Transportation Agencies operate dedicated networks including highways, transit corridors, and intermodal hubs requiring specialized management technologies. These agencies invest in advanced monitoring and control systems to ensure efficient and safe operations. Moreover, increasing coordination between transportation agencies and municipal governments continues to expand the scope of system deployments.

Private Organizations including logistics companies, commercial real estate operators, and event managers are increasingly adopting traffic management solutions. These entities require tools to optimize fleet movements and control access across their facilities. Additionally, growing demand for operational efficiency is driving meaningful private sector investment in smart traffic technologies.

Others category covers academic institutions, research centers, and utility operators that utilize traffic data for planning and analysis purposes. Their demand is relatively smaller but growing with rising interest in urban mobility research. However, this segment contributes meaningfully to overall data generation and system utilization across the market.

Key Market Segments

By Technology

- Internet of Things (IoT)

- AI and ML

- Cloud-Based

- Big Data Analytics

- Others

By Component

- Software

- Traffic Analytics

- Smart Signaling

- Route Guidance

- Traffic Monitoring

- Hardware

- Traffic Signals and Controllers

- Sensors

- Camera and Surveillance Systems

- Variable Message Signs

- Services

- Consulting

- Deployment and Integration

- Support and Maintenance

By Application

- Urban Traffic Management

- Highway Traffic Management

- Public Transportation Management

- Parking Management

- Incident Management

- Integrated Corridor Management (ICM)

- Others

By Deployment Mode

- Cloud

- On-premises

By End Use

- Government and Municipalities

- Transportation Agencies

- Private Organizations

- Others

Drivers

Rapid Urbanization and Smart Mobility Investments Drive Traffic Management System Market Growth

Rapid urbanization across Tier I and Tier II cities is placing immense pressure on existing road infrastructure globally. Growing vehicle populations are causing persistent congestion, increasing the urgency for intelligent traffic control solutions. Consequently, city planners and transportation authorities are investing in smart traffic management systems to maintain road network efficiency.

Government-led smart mobility programs are a significant force behind market expansion worldwide. Authorities are allocating dedicated budgets to intelligent transportation infrastructure as part of broader national smart city agendas. Moreover, public-private partnerships are accelerating the deployment of advanced traffic management solutions across urban corridors and highway networks.

The increasing integration of IoT, AI, and cloud-based traffic analytics platforms is enabling more responsive and intelligent traffic systems. These technologies provide real-time monitoring, automated control, and predictive modeling capabilities at scale. Additionally, growing adoption of connected infrastructure is helping agencies reduce congestion, lower emissions, and improve overall road safety outcomes.

Restraints

Deployment Complexity and Cybersecurity Vulnerabilities Restrain Traffic Management System Market Adoption

Deploying advanced traffic management systems alongside existing legacy infrastructure presents significant technical and operational challenges. Many transportation networks rely on outdated hardware and software lacking compatibility with modern intelligent systems. Consequently, integration efforts are time-consuming, costly, and require specialized expertise that is not always readily available to agencies.

Data privacy and cybersecurity vulnerabilities represent growing concerns in connected traffic networks globally. As these systems collect and transmit large volumes of sensitive traffic data, they become attractive targets for cyberattacks. Moreover, inconsistent regulatory frameworks across regions make it difficult to enforce uniform data protection and security compliance standards.

These combined challenges slow market adoption, particularly among smaller municipalities with limited technical resources and budgets. Additionally, the risk of operational failures during integration creates hesitancy among key decision-makers. However, increasing awareness is prompting vendors to develop more secure, interoperable, and easier-to-deploy traffic management solutions for diverse end users.

Growth Factors

Connected Vehicle Ecosystems and 5G-Enabled Edge Computing Accelerate Traffic Management System Market Expansion

The rapid expansion of connected vehicle ecosystems and V2X communication networks is creating significant new opportunities for traffic management system providers. These technologies enable direct communication between vehicles and road infrastructure, improving real-time system responsiveness. Consequently, transportation authorities can optimize signal timing and reduce congestion more effectively across dynamic road environments.

Deployment of adaptive traffic signal control systems in emerging economies represents a major growth opportunity for the global market. Countries across Asia Pacific, Latin America, and Africa are investing in smart infrastructure to address rising urbanization challenges. Moreover, international development funding and government programs are supporting technology adoption in previously underserved markets.

The adoption of 5G-enabled edge computing is enabling low-latency traffic data processing directly at the network edge. This advancement supports faster automated decision-making and improves system reliability in high-density traffic environments. Additionally, edge computing reduces bandwidth demands on central servers, making traffic management systems more scalable and operationally cost-efficient overall.

Emerging Trends

AI-Powered Traffic Modeling and MaaS Integration Reshape the Traffic Management System Market Landscape

AI-powered predictive traffic flow modeling and congestion forecasting are becoming central to modern traffic management strategies globally. These tools analyze historical and real-time data to anticipate traffic patterns before congestion fully develops. Consequently, transportation agencies can proactively adjust signal timing and reroute vehicles to minimize delays across entire networks.

Smart surveillance cameras with automated incident detection are being widely deployed across urban and highway environments. These systems use AI-driven image recognition to identify accidents, stalled vehicles, and hazardous road conditions in real time. Moreover, automated alerts significantly reduce emergency response times, improving road safety and minimizing the occurrence of secondary incidents.

The integration of Mobility-as-a-Service (MaaS) platforms with urban traffic systems is emerging as a transformative industry trend. MaaS connects public transit, ride-sharing, and personal mobility services into a unified digital ecosystem. Additionally, this integration enables coordinated traffic demand management, reducing overall vehicle volumes and improving urban mobility efficiency and sustainability outcomes.

Regional Analysis

Europe Dominates the Traffic Management System Market with a Market Share of 37.6%, Valued at USD 14.0 Billion

Europe holds the leading position in the global Traffic Management System Market, commanding a 37.6% share valued at USD 14.0 Billion in 2025. The region benefits from strong government investment in smart mobility infrastructure, supportive EU-level regulations, and well-established ITS deployment programs. Moreover, high vehicle density in key markets continues to sustain strong demand for intelligent traffic management solutions.

North America Traffic Management System Market Trends

North America is a major market driven by large-scale federal and state investments in intelligent transportation systems. The United States leads adoption supported by significant infrastructure funding programs targeting connected and automated mobility. Additionally, strong demand for cloud-based and AI-enabled traffic management platforms supports consistent growth across both urban and highway network environments.

Asia Pacific Traffic Management System Market Trends

Asia Pacific is the fastest-growing region, propelled by rapid urbanization in China, India, and Southeast Asian nations. Governments across the region are deploying smart traffic systems as part of national smart city development programs. Consequently, Asia Pacific presents significant long-term growth opportunities for both global technology vendors and regional traffic management solution providers.

Latin America Traffic Management System Market Trends

Latin America is an emerging market with growing interest in intelligent transportation systems, particularly in Brazil and Mexico. Rising urban congestion and government infrastructure modernization programs are encouraging investment in traffic management technologies. However, budget constraints and limited existing technical infrastructure remain challenges that slow broader adoption across parts of the region.

Middle East and Africa Traffic Management System Market Trends

The Middle East and Africa region is experiencing growing demand for intelligent traffic management systems, driven largely by smart city initiatives in Gulf Cooperation Council states. Countries such as the UAE and Saudi Arabia are investing heavily in advanced transportation infrastructure. Moreover, major African cities are beginning to deploy foundational intelligent traffic management solutions to address urban mobility challenges.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Cubic is a global leader in intelligent transportation systems and smart city solutions, serving major urban markets across North America, Europe, and Asia Pacific. The company provides integrated fare collection, traffic management, and public transit optimization platforms. Cubic’s focus on connected mobility and data-driven urban operations has established it as a key contributor to intelligent transportation infrastructure advancement worldwide.

IBM brings deep expertise in AI, cloud computing, and data analytics to the traffic management system market. Its intelligent transportation solutions leverage advanced AI platforms to process real-time traffic data and support urban mobility optimization at scale. Moreover, IBM actively collaborates with government agencies and transportation authorities to develop smart city infrastructure that improves traffic flow and overall road safety.

Intel supports the traffic management sector through advanced computing hardware and edge processing solutions designed for high-performance transportation applications. Its processors and edge AI platforms power real-time vehicle detection, adaptive signal control, and traffic analytics systems. Additionally, Intel’s strategic investments in autonomous driving and V2X communication position it as a critical technology enabler for next-generation intelligent transportation systems.

Iteris is a dedicated provider of smart roadway technologies and traffic management software, focused exclusively on transportation performance solutions. Its ClearMobility platform integrates traffic sensors, predictive analytics, and signal management tools into a unified operating environment. Iteris continues to expand its market position through strategic acquisitions and partnerships, strengthening its adaptive traffic signal control capabilities for transportation agencies globally.

Key Players

- Cubic

- IBM

- Intel

- Iteris

- Jenoptik

- Siemens

- Swarco

- Teledyne FLIR

- Thales

- Transcore

Recent Developments

- February 2026 – TomTom and AECOM announced a strategic partnership to deliver enhanced global infrastructure planning and road traffic management solutions. The collaboration aims to combine TomTom’s mapping and traffic data capabilities with AECOM’s engineering expertise to improve transportation planning outcomes worldwide.

- November 2025 – Iteris acquired ThruGreen Technology to significantly expand the capabilities of its ClearMobility Platform. The acquisition strengthens Iteris’s position in adaptive traffic signal control and real-time intersection performance optimization for transportation agencies.

- November 2025 – Aeva announced an exclusive partnership with D2 Traffic Technologies to strengthen its portfolio of LiDAR-based smart infrastructure solutions. The collaboration targets intersections, highways, and urban corridors, expanding next-generation sensing and perception capabilities within intelligent transportation systems.

- October 2025 – Teledyne completed the acquisition of TransponderTech from Saab, adding advanced transponder technology to its portfolio. The acquisition enhances Teledyne’s capabilities in traffic monitoring and transportation identification systems across road and maritime environments.

- March 2025 – Flow Labs and Carahsoft announced a partnership to streamline access to AI-powered traffic management solutions for the public sector. The collaboration is designed to simplify procurement and accelerate deployment of intelligent traffic platforms for government agencies and municipalities across the United States.

Report Scope

Report Features Description Market Value (2025) USD 37.5 Billion Forecast Revenue (2035) USD 95.5 Billion CAGR (2026-2035) 9.8% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Technology (Internet of Things (IoT), AI and ML, Cloud-Based, Big Data Analytics, Others), By Component (Software, Hardware, Services), By Application (Urban Traffic Management, Highway Traffic Management, Public Transportation Management, Parking Management, Incident Management, Integrated Corridor Management (ICM), Others), By Deployment Mode (Cloud, On-premises), By End Use (Government and Municipalities, Transportation Agencies, Private Organizations, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Cubic, IBM, Intel, Iteris, Jenoptik, Siemens, Swarco, Teledyne FLIR, Thales, Transcore Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Traffic Management System MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Traffic Management System MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Cubic

- IBM

- Intel

- Iteris

- Jenoptik

- Siemens

- Swarco

- Teledyne FLIR

- Thales

- Transcore