Global Thin-Film Amorphous Silicon Solar Cell Market Size, Share, And Industry Analysis Report By Type (Single Junction, Multi Junction), By Installation (Rooftop, Ground-mounted, Building-integrated), By Application (Residential, Commercial, Industrial, Utility-scale, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 171150

- Number of Pages: 268

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

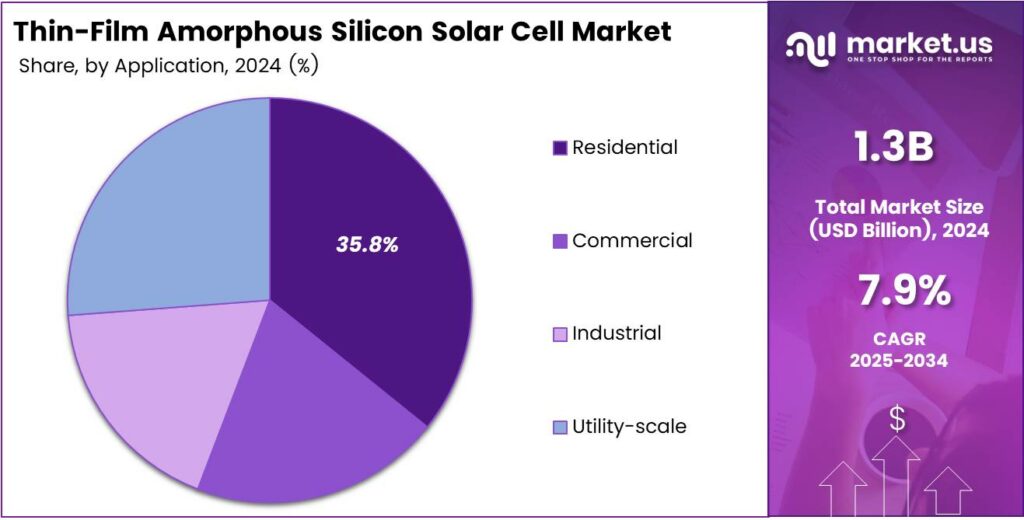

The Global Thin-Film Amorphous Silicon Solar Cell Market size is expected to be worth around USD 2.8 billion by 2034, from USD 1.3 billion in 2024, growing at a CAGR of 7.9% during the forecast period from 2025 to 2034.

The Thin-Film Amorphous Silicon Solar Cell Market covers the commercial use of a-Si photovoltaic modules, materials, and deployment services, mainly serving cost-sensitive applications that value lightweight design, flexible substrates, and reliable performance under diffuse light. These solar cells absorb light efficiently at low thickness, enabling reduced material use, scalable manufacturing, and a practical balance between cost, performance, and deployment flexibility.

Therefore, project developers often consider a-Si solutions for building-integrated photovoltaics, facades, and utility rooftops where aesthetics, temperature tolerance, and predictable output remain important. Market growth is supported by global renewable targets and supportive regulations. Governments continue to expand solar procurement through auctions, rooftop mandates, and green building codes.

The U.S. National Renewable Energy Laboratory, amorphous silicon features a direct bandgap of around 1.75 eV, enabling strong light absorption even in thin layers. Monolithic integration within PV modules and the use of low-cost substrates reduce manufacturing complexity, while a reported maximum single-junction efficiency of 10.2% supports limited but viable commercial deployment.

- However, efficiency trade-offs influence adoption decisions. IEEE-cited PV studies indicate thin-film modules typically achieve 12–15% generation efficiency, lower than crystalline silicon alternatives. Engineering simulations under standard conditions of 25 °C and 1000 W/m² show a required module area of 11.086 m²/kW, helping investors realistically size systems and assess performance expectations.

Agencies such as the International Energy Agency highlight solar PV as a core decarbonization pillar, which indirectly supports thin-film adoption through diversified technology acceptance and long-term policy certainty. Thin-film a-Si modules perform steadily under partial shading and high temperatures, lowering lifetime performance risks. EPC firms and asset owners view them as complementary solutions rather than direct substitutes for crystalline technologies.

Key Takeaways

- The Global Thin-Film Amorphous Silicon Solar Cell Market is projected to grow from USD 1.3 billion in 2024 to USD 2.8 billion by 2034, at a CAGR of 7.9%.

- Single Junction technology dominates the market by type, accounting for a 67.3% share in 2024 due to lower cost and simpler manufacturing.

- Rooftop installations lead the market by installation type with a 49.1% share, driven by lightweight and flexible module demand.

- Residential applications hold the largest application share at 35.8%, supported by affordable and space-efficient solar adoption.

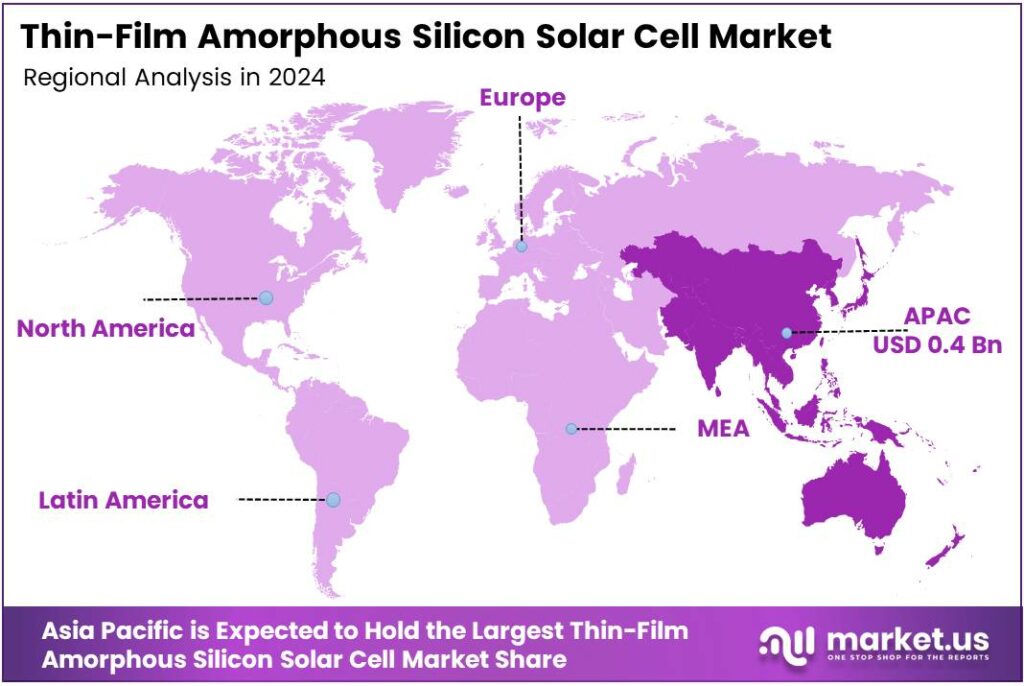

- Asia Pacific is the leading regional market, capturing a 36.9% share and valued at USD 0.4 billion in 2024.

By Type Analysis

Single Junction dominates with 67.3% due to its simpler structure, lower production cost, and stable performance under diffuse light conditions.

In 2024, Single Junction held a dominant market position in the By Type Analysis segment of the Thin-Film Amorphous Silicon Solar Cell Market, with a 67.3% share. This dominance is driven by cost-sensitive buyers seeking reliable output, easier manufacturing, and suitability for large-area installations with moderate efficiency expectations.

The Multi Junction segment plays a supportive role by offering improved energy capture through layered absorption. However, higher fabrication complexity and cost limit its wider adoption. Still, it attracts interest in applications where enhanced performance under varied light conditions justifies the additional investment.

By Installation Analysis

Rooftop installation leads with 49.1% as users prefer flexible, lightweight modules for space-efficient urban energy generation.

In 2024, Rooftop held a dominant market position in the By Installation Analysis segment of the Thin-Film Amorphous Silicon Solar Cell Market, with a 49.1% share. Growth is supported by residential and small commercial users valuing low structural load, easy integration, and consistent performance under partial shading.

Ground-mounted systems remain relevant for open-area projects where land availability offsets lower efficiency. These installations benefit from simplified maintenance and scalability, especially in rural or semi-urban regions focused on cost control rather than maximum power density.

Building-integrated solutions are gradually emerging as architects adopt solar façades and flexible designs. Although adoption is slower, this segment benefits from aesthetic integration and multifunctional building materials that align with sustainable construction goals.

By Application Analysis

Residential applications dominate with 35.8% as households prioritize affordable solar solutions with steady energy output.

In 2024, Residential held a dominant market position in the By Application Analysis segment of the Thin-Film Amorphous Silicon Solar Cell Market, with a 35.8% share. Demand is driven by homeowners seeking low upfront costs, flexible installation, and reliable performance in varying weather conditions.

The Commercial segment adopts these cells for warehouses and retail roofs, where lightweight panels reduce structural upgrades. Businesses value predictable energy generation and lower installation complexity, even if efficiency remains secondary to cost stability.

Industrial applications use thin-film modules in large roof areas and auxiliary power systems. Durability and tolerance to heat play an important role, supporting operational continuity without major infrastructure changes. The Utility-scale segment remains selective, mainly using amorphous silicon where land is abundant and diffuse-light performance adds value, despite lower efficiency compared to crystalline alternatives.

Key Market Segments

By Type

- Single Junction

- Multi Junction

By Installation

- Rooftop

- Ground-mounted

- Building-integrated

By Application

- Residential

- Commercial

- Industrial

- Utility-scale

Emerging Trends

Increasing Focus on Lightweight and Flexible Solar Technologies Shapes Trends

One major trend in the Thin-Film Amorphous Silicon Solar Cell Market is the growing focus on lightweight solar modules. Industries such as logistics, construction, and mobility prefer solutions that add minimal structural load. Thin-film amorphous silicon meets this requirement effectively.

- Rising adoption in indoor and low-energy applications. These cells work efficiently under artificial light, supporting use in sensors, calculators, and smart devices. This expands demand beyond traditional outdoor solar systems. The IEA’s report shows that global photovoltaic capacity surpassed 2.2 TW in 2024, with more than 600 GW of new PV systems added in a single year.

Sustainability trends are also influencing the market. Manufacturers are emphasizing lower material consumption and reduced energy use during production. This aligns with global goals for cleaner manufacturing. Digital monitoring integration is gaining attention. Thin-film modules are increasingly paired with smart energy management systems to improve performance tracking and maintenance planning.

Drivers

Rising Demand for Cost-Effective and Flexible Solar Solutions Drives Market Growth

The Thin-Film Amorphous Silicon Solar Cell Market is mainly driven by the need for affordable solar technologies. Compared to crystalline silicon, amorphous silicon uses less raw material, which helps reduce overall module costs. This makes it suitable for price-sensitive projects in developing and emerging economies.

- Thin-film amorphous silicon cells can generate electricity even in cloudy weather or indoor lighting, supporting stable energy output in diverse climates. The International Energy Agency’s Photovoltaic Power Systems Programme (IEA-PVPS), global cumulative installed PV capacity grew from around 1.6 terawatts (TW) in 2023 to more than 2.2 TW by the end of 2024. This means solar now supplies over 10% of the world’s electricity demand.

Lightweight and flexible module designs also support market growth. These cells can be installed on curved surfaces, lightweight roofs, and temporary structures where traditional panels are not practical. As a result, adoption is increasing in commercial rooftops and portable solar applications. Subsidies, rooftop solar programs, and clean-energy targets encourage utilities and building owners to adopt cost-efficient thin-film technologies.

Restraints

Lower Conversion Efficiency Compared to Crystalline Silicon Limits Adoption

The main restraint in the Thin-Film Amorphous Silicon Solar Cell Market is lower efficiency. Amorphous silicon modules generally convert less sunlight into electricity than crystalline silicon panels. This means larger installation areas are required to achieve the same power output.

- The Production Linked Incentive (PLI) Scheme for National Programme on High-Efficiency Solar PV Modules was designed to build gigawatt-scale PV manufacturing capacity with a total outlay of USD 2.9 billion. Under this programme, solar manufacturers have been selected to build nearly 39.6 GW of fully or partially integrated solar PV production capacity as part of the PLI Scheme Tranche-II alone.

Space limitations create challenges, especially in residential and commercial rooftop projects. Many buyers prefer high-efficiency modules to maximize energy generation from limited roof space. Thin-film solutions are often considered a secondary option. Amorphous silicon cells experience light-induced degradation, which can reduce output after initial exposure to sunlight.

Growth Factors

Expansion of Building-Integrated Solar Creates New Growth Opportunities

Growth opportunities in the Thin-Film Amorphous Silicon Solar Cell Market are strongly linked to building-integrated photovoltaics. Flexible and semi-transparent modules can be embedded into windows, façades, and roofs without altering building design. This opens new revenue streams beyond traditional solar farms.

Urban infrastructure development supports this opportunity. Cities are promoting energy-efficient buildings, encouraging the use of integrated solar materials. Thin-film amorphous silicon fits well into modern architectural designs. Off-grid and remote power applications also present strong potential.

These solar cells perform reliably in low-light conditions, making them suitable for rural electrification, telecom towers, and emergency power systems. Advances in manufacturing processes create further upside. Improvements in deposition techniques and module stability can enhance performance while keeping costs low. This supports broader adoption.

Regional Analysis

Asia Pacific Dominates the Thin-Film Amorphous Silicon Solar Cell Market with a Market Share of 36.9%, Valued at USD 0.4 billion

Asia Pacific leads the global Thin-Film Amorphous Silicon Solar Cell Market, supported by strong renewable energy deployment across China, India, Japan, and Southeast Asia. In this region, the market reached a dominant share of 36.9%, with a total value of USD 0.4 billion, driven by large-scale solar installations and cost-sensitive power projects. Government-backed solar capacity additions, rapid urbanization, and rising electricity demand continue to favour thin-film solutions due to their lower material usage and performance in high-temperature conditions.

North America shows steady adoption of thin-film amorphous silicon solar cells, particularly in utility-scale and commercial projects. The region benefits from long-term clean energy targets, grid modernization programs, and supportive federal and state-level solar policies. Thin-film modules are gaining attention for applications where temperature resilience and stable output under diffuse light are critical.

Europe represents a mature yet evolving market for thin-film amorphous silicon solar cells. Strong decarbonization goals, net-zero commitments, and building-integrated solar initiatives are key demand drivers. The region favours thin-film technology for urban rooftops and architectural applications where lightweight and flexible modules are required. Policy alignment under climate frameworks and rising electricity prices further support adoption across residential and commercial segments.

The Middle East and Africa market is gradually expanding as countries invest in solar power to diversify energy sources. High solar irradiance levels and growing off-grid electrification projects support thin-film solar adoption. Amorphous silicon modules are considered suitable for harsh climatic conditions, including high heat and dust exposure. Government-led solar programs and international funding initiatives continue to create long-term opportunities.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Sharp Corporation remains relevant in 2024 because its broader electronics and solar manufacturing discipline supports stable, bankable thin-film module programs. From an analyst’s lens, Sharp’s advantage lies in execution, including quality control, long product cycles, and the ability to align thin-film offerings with building and commercial buyers who value lightweight form factors and predictable output under diffuse light.

Solar Frontier is best viewed as a thin-film specialist brand whose know-how in thin-film process engineering can still shape market direction, even when the sector is crowded by crystalline silicon. In 2024, its strategic value lies in manufacturing learning curves—how to achieve uniformity, yield, and long-term reliability—capabilities that can translate into niche wins where rooftops, heat, and low-light performance are critical.

Kaneka Corporation stands out for materials and device-engineering depth, which matters in amorphous silicon, where layer quality and stable performance are commercial make-or-break factors. In 2024, Kaneka’s strongest angle is technology credibility: it can compete on durability, module consistency, and application fit, rather than chasing the lowest price per watt in commoditized channels.

Mitsubishi Electric Corporation plays a different role: it benefits from power electronics, energy management, and systems integration strength that can lift the value of thin-film deployments. In 2024, the opportunity is bundling—pairing thin-film modules with inverters, controls, and building or industrial energy solutions—so buyers evaluate total operating performance, not just panel efficiency alone.

Top Key Players in the Market

- Sharp Corporation

- Solar Frontier

- Kaneka Corporation

- Mitsubishi Electric Corporation

- Panasonic Corporation

- Trony Solar Holdings Co., Ltd.

- Hanergy Thin Film Power Group Limited

- Ascent Solar Technologies, Inc.

- Heliatek GmbH

- Solopower Systems, Inc.

Recent Developments

- In 2025, Sharp Corporation has been focusing on advanced solar technologies, particularly for specialized applications. Sharp exhibited at the Space Tech Expo Europe in Bremen, Germany, showcasing three types of space-use compound solar cells suitable for applications ranging from low Earth orbit to deep space missions.

- In 2025, Solar Frontier, known for its CIGS thin-film solar cells (related to the thin-film sector), shifted away from thin-film production. The U.S. Department of Energy’s critical materials assessment, Solar Frontier abandoned its CIGS thin-film operations amid a declining market share for thin-film technologies and transitioned fully to monocrystalline silicon panels.

Report Scope

Report Features Description Market Value (2024) USD 1.3 Billion Forecast Revenue (2034) USD 2.8 Billion CAGR (2025-2034) 7.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Single Junction, Multi Junction), By Installation (Rooftop, Ground-mounted, Building-integrated), By Application (Residential, Commercial, Industrial, Utility-scale) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Sharp Corporation, Solar Frontier, Kaneka Corporation, Mitsubishi Electric Corporation, Panasonic Corporation, Trony Solar Holdings Co., Ltd., Hanergy Thin Film Power Group Limited, Ascent Solar Technologies, Inc., Heliatek GmbH, Solopower Systems, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Thin-Film Amorphous Silicon Solar Cell MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Thin-Film Amorphous Silicon Solar Cell MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Sharp Corporation

- Solar Frontier

- Kaneka Corporation

- Mitsubishi Electric Corporation

- Panasonic Corporation

- Trony Solar Holdings Co., Ltd.

- Hanergy Thin Film Power Group Limited

- Ascent Solar Technologies, Inc.

- Heliatek GmbH

- Solopower Systems, Inc.