Global Sulfur Fertilizer Market Size, Share, And Business Benefits By Type (Sulfate Fertilizers (Ammonium Sulfate, Potassium Sulfate, Calcium Sulfate (Gypsum), Single Superphosphate), Elemental Sulfur (Micronized Sulfur, Prilled/Pastilled Sulfur), Sulfate of Micronutrients (Zinc Sulfate, Magnesium Sulfate, Others), Others), By Form (Dry, Liquid), By Crop Type (Cereals and Grains, Oilseeds and Pulses, Fruits and Vegetables, Others), By Application (Soil, Foliar, Fertigation, Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: August 2025

- Report ID: 155744

- Number of Pages: 271

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

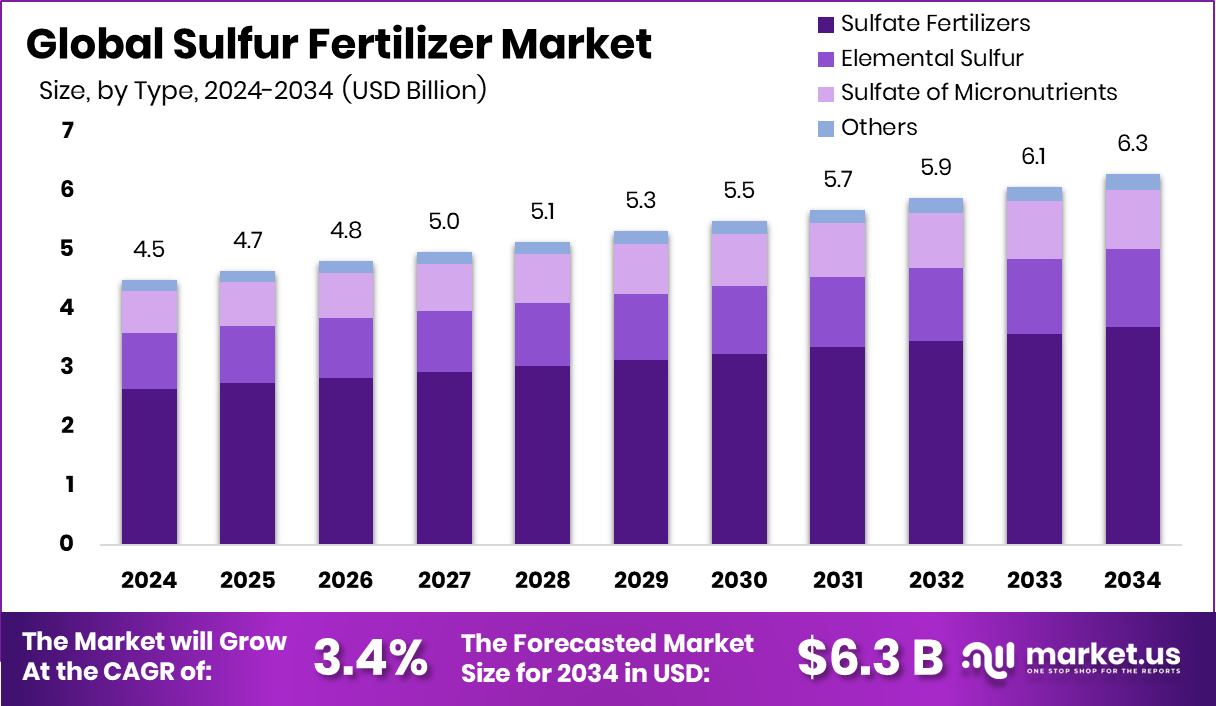

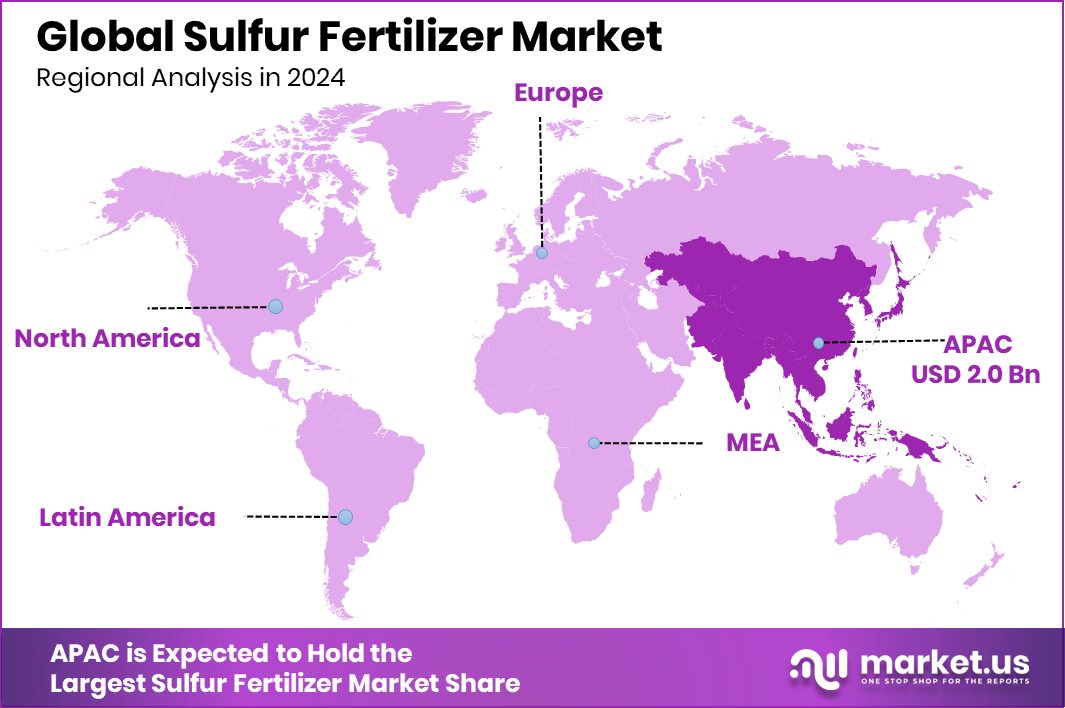

The Global Sulfur Fertilizer Market is expected to be worth around USD 6.3 billion by 2034, up from USD 4.5 billion in 2024, and is projected to grow at a CAGR of 3.4% from 2025 to 2034. Asia Pacific’s USD 2.0 Bn dominance reflects growing crop needs and widespread sulfur deficiency across farmlands.

Sulfur fertilizer is a type of crop nutrient that provides essential sulfur, which is vital for protein formation, enzyme activity, and chlorophyll development in plants. Since many soils are naturally low in sulfur due to leaching and reduced atmospheric deposition, applying sulfur-based fertilizers helps improve crop yield, oil content in oilseeds, and overall plant health.

Farmers often use it in granular, liquid, or blended forms depending on soil conditions and crop needs. In this direction, Spain has requested €391 million from the European Commission to support fruit and vegetable producers, ensuring better nutrient availability through effective fertilization practices.

The sulfur fertilizer market refers to the global trade and usage of these fertilizers across agriculture. It is shaped by rising demand for high-yield and quality crops, especially in cereals, oilseeds, and pulses. With soil sulfur deficiency becoming more common, the market has been expanding steadily as farmers recognize its role in balanced nutrient management. To complement this, Tesco will invest £4 million in a new program to provide schoolchildren with daily fruit and vegetables, indirectly boosting demand for nutrient-rich farming supported by fertilizers.

The main growth driver is the increasing depletion of sulfur in soils. Intensive farming practices and low use of organic manure have left many farmlands sulfur-deficient, pushing farmers to rely on sulfur fertilizers to maintain productivity. In parallel, the USDA will allocate $2 billion to specialty crop growers to expand markets and address natural disasters, which strengthens overall input demand, including fertilizers.

Demand is rising from crops such as wheat, rice, maize, and oilseeds, where sulfur plays a key role in protein synthesis and oil content. With the global push for higher agricultural productivity, the consumption of sulfur fertilizers is climbing steadily. However, challenges exist, as food banks brace for the impact of a $1 billion funding cut from the USDA, which could affect food distribution systems and create indirect pressure on farming economics.

A major opportunity lies in the adoption of sustainable farming practices. As farmers move toward balanced fertilization and precision farming, the use of sulfur fertilizers is gaining importance.

Emerging economies with sulfur-deficient soils present strong growth potential for wider adoption in the coming years. Supporting this, the CalFresh Fruit and Vegetable Pilot restarts with $10 million in fresh funding, aligning with the broader agenda of healthier diets and sustainable crop production.

Key Takeaways

- The Global Sulfur Fertilizer Market is expected to be worth around USD 6.3 billion by 2034, up from USD 4.5 billion in 2024, and is projected to grow at a CAGR of 3.4% from 2025 to 2034.

- In the Sulfur Fertilizer Market, sulfate fertilizers dominate with 58.9% due to widespread agricultural use.

- Dry form fertilizers lead the Sulfur Fertilizer Market, capturing 73.5% share owing to easy handling.

- Cereals and grains drive the Sulfur Fertilizer Market, accounting for 49.2% of consumption in global farming.

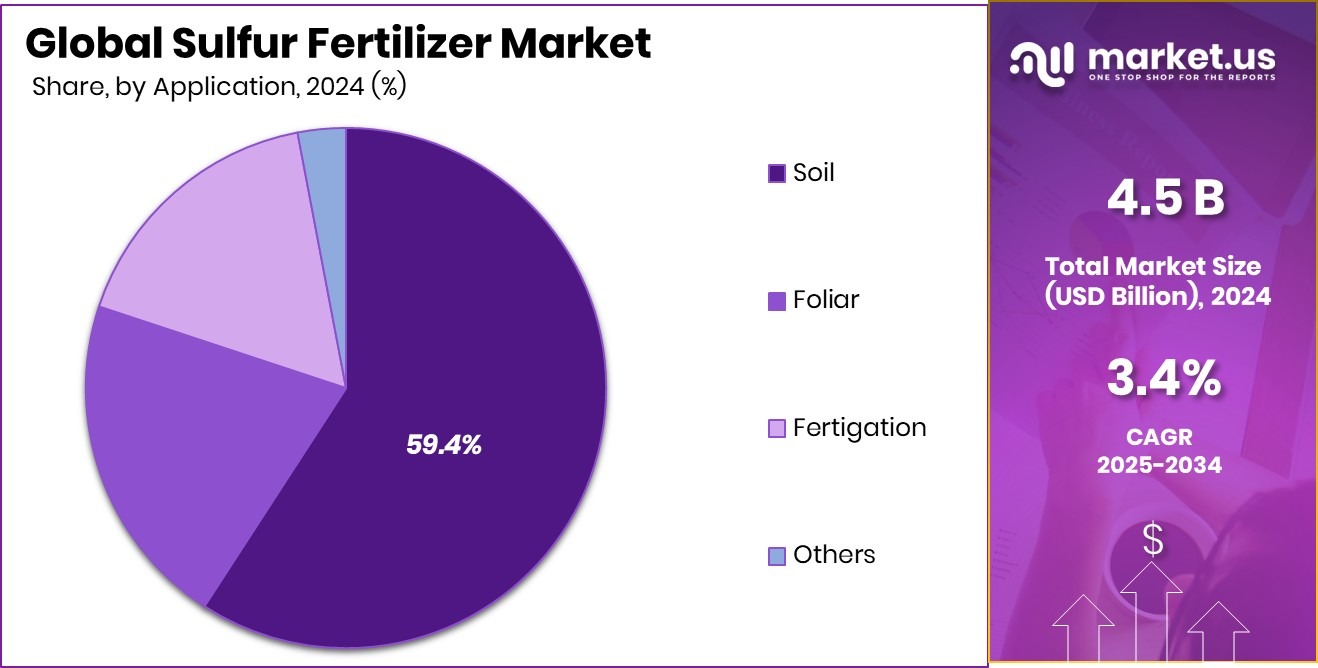

- Soil application remains most common in the Sulfur Fertilizer Market, holding 59.4% share worldwide.

- The Asia Pacific market value reached USD 2.0 Bn, driven by strong agricultural demand.

By Type Analysis

Sulfate fertilizers dominate the sulfur fertilizer market, holding 58.9% of the global share.

In 2024, Sulfate Fertilizers held a dominant market position in the By Type segment of the Sulfur Fertilizer Market, with a 58.9% share. This dominance reflects their widespread use in global agriculture due to their dual role in supplying both sulfur and essential nutrients like calcium, magnesium, or potassium, depending on the specific sulfate form.

Farmers prefer sulfate fertilizers as they dissolve easily, making sulfur readily available to crops in sulfate form, which is directly absorbable by plant roots. Their compatibility with a wide range of crops, including cereals, pulses, fruits, and oilseeds, further supports their large market share.

The prominence of sulfate fertilizers is also linked to the rising sulfur deficiency in soils across major agricultural regions. With intensive cultivation and reduced atmospheric sulfur deposits, sulfate fertilizers have become an essential input to maintain soil fertility and crop yield. Their use is particularly significant in oilseeds such as rapeseed and soybean, where sulfur boosts oil content and quality.

Moreover, sulfate fertilizers are well-suited for precision farming and integrated nutrient management systems, aligning with the growing trend of sustainable agriculture. Their strong market hold in 2024 highlights their critical role in supporting balanced crop nutrition and long-term agricultural productivity.

By Form Analysis

Dry form leads strongly in the sulfur fertilizer market, capturing 73.5% usage share.

In 2024, Dry held a dominant market position in the By Form segment of the Sulfur Fertilizer Market, with a 73.5% share. This strong preference is driven by the ease of handling, longer shelf life, and cost-effectiveness of dry fertilizers compared to other forms.

Dry sulfur fertilizers are widely used in agriculture because they can be applied using conventional spreading equipment and are adaptable for both large-scale farming and smallholder operations. Their ability to blend seamlessly with other nutrient formulations also makes them highly versatile in meeting diverse crop requirements.

The dominance of dry sulfur fertilizers is further supported by their slower release properties, which ensure a steady supply of nutrients to plants over time. This characteristic helps improve nutrient use efficiency, reduces leaching losses, and enhances overall soil fertility. Farmers in major crop-producing regions prefer dry fertilizers for staple crops like wheat, maize, and rice, where consistent nutrient delivery is essential for maximizing yields.

Additionally, the widespread availability and relatively lower logistics cost of dry fertilizers compared to liquid forms have reinforced their market leadership. Their 73.5% share in 2024 underscores their vital role in addressing sulfur deficiencies and supporting sustainable farming practices on a global scale.

By Crop Type Analysis

Cereals and grains drive the sulfur fertilizer market, accounting for 49.2% of consumption.

In 2024, Cereals and Grains held a dominant market position in the By Crop Type segment of the Sulfur Fertilizer Market, with a 49.2% share. This leadership is attributed to the extensive global cultivation of staple crops such as wheat, rice, maize, and barley, which form the backbone of food security and demand consistent nutrient support.

Sulfur plays a vital role in protein synthesis and chlorophyll formation, making it particularly important for cereals and grains that require high nutrient efficiency to achieve maximum yields. Farmers in both developed and developing regions prioritize sulfur application for these crops to enhance grain quality, increase yield, and improve resistance against environmental stress.

The prominence of cereals and grains in the sulfur fertilizer market is also linked to rising population growth and the corresponding surge in food demand. With the global push to ensure stable food supply chains, governments and farmers alike are focusing on optimizing the nutrient balance of these essential crops.

Sulfur fertilizers not only boost yield but also improve the nutritional profile of cereals, particularly in terms of protein and amino acid content. Holding a 49.2% share in 2024, cereals and grains represent the largest consumer group, reflecting their critical role in sustaining agricultural output worldwide.

By Application Analysis

Soil application remains primary in the sulfur fertilizer market, representing 59.4% of the global share.

In 2024, Soil held a dominant market position in the By Application segment of the Sulfur Fertilizer Market, with a 59.4% share. This dominance is largely because soil application is the most direct and widely adopted method for delivering sulfur nutrients to crops. When applied to soil, sulfur fertilizers release nutrients in a form that plants can absorb efficiently, ensuring consistent availability throughout the growth cycle. This approach is particularly effective in addressing widespread sulfur deficiencies in agricultural soils, which have become more common due to intensive farming practices and reduced atmospheric sulfur deposits.

Farmers prefer soil application because it allows for uniform distribution across large areas, improving root development, protein formation, and chlorophyll synthesis in crops. The method is especially valuable for staple crops such as wheat, maize, rice, and oilseeds, which demand higher nutrient uptake for maximizing yields. Furthermore, soil application offers flexibility in the use of both granular and powdered sulfur fertilizers, aligning with modern mechanized farming practices.

The 59.4% share in 2024 highlights the soil application’s critical role in enhancing crop productivity, improving nutrient use efficiency, and ensuring sustainable agricultural practices. Its dominance underscores its reliability as the preferred mode of sulfur fertilizer utilization across global farmlands.

Key Market Segments

By Type

- Sulfate Fertilizers

- Ammonium Sulfate

- Potassium Sulfate

- Calcium Sulfate (Gypsum)

- Single Superphosphate

- Elemental Sulfur

- Micronized Sulfur

- Prilled/Pastilled Sulfur

- Sulfate of Micronutrients

- Zinc Sulfate

- Magnesium Sulfate

- Others

- Others

By Form

- Dry

- Liquid

By Crop Type

- Cereals and Grains

- Oilseeds and Pulses

- Fruits and Vegetables

- Others

By Application

- Soil

- Foliar

- Fertigation

- Others

Driving Factors

Rising Soil Sulfur Deficiency Boosting Fertilizer Demand

One of the biggest driving factors for the sulfur fertilizer market is the rising sulfur deficiency in soils worldwide. Over the years, modern farming practices, high-yield crop cultivation, and reduced use of organic manure have caused significant nutrient imbalances, with sulfur being one of the most depleted elements.

At the same time, air pollution control measures have lowered sulfur deposits from the atmosphere, which once naturally enriched soils. As a result, farmers are now depending more on sulfur fertilizers to restore soil health and maintain productivity. Crops such as wheat, rice, maize, and oilseeds need sulfur for protein and oil content, making its role critical. This deficiency-driven demand is a key force behind market growth.

Restraining Factors

High Application Costs Limiting Wider Farmer Adoption

A major restraining factor for the sulfur fertilizer market is the high cost of application and product affordability issues for farmers, especially in developing regions. Many sulfur fertilizers, such as sulfate or elemental forms, require careful handling, proper equipment, and multiple applications to ensure effectiveness, which increases farming expenses.

Small and marginal farmers often avoid using them due to budget constraints, relying instead on cheaper but less effective alternatives. Additionally, transportation and storage costs for dry or bulk fertilizers add to the overall burden.

These economic challenges limit the widespread adoption of sulfur fertilizers, slowing market expansion. Unless cost-effective solutions and subsidies are made available, affordability will remain a strong barrier to growth.

Growth Opportunity

Expanding Sustainable Farming Practices: Creating Market Opportunity

A key growth opportunity for the sulfur fertilizer market lies in the global shift toward sustainable farming practices. Farmers are increasingly adopting balanced nutrient management and precision agriculture to improve soil health and crop yields while reducing environmental harm.

Sulfur fertilizers fit well into this trend because they not only replenish nutrient-deficient soils but also enhance protein content, oil quality, and overall crop resilience. Governments and agricultural agencies are promoting eco-friendly fertilizers through training programs and subsidies, encouraging farmers to use them more widely.

As demand for organic and residue-free crops continues to grow, sulfur fertilizers will gain stronger adoption, positioning them as an essential tool for future sustainable and productive agriculture worldwide.

Latest Trends

Rising Use of Controlled-Release Sulfur Fertilizers

One of the latest trends in the sulfur fertilizer market is the rising use of controlled-release formulations. Unlike traditional fertilizers that release nutrients quickly and may cause leaching, controlled-release sulfur fertilizers deliver nutrients slowly over time, matching the crop’s growth cycle.

This not only improves nutrient use efficiency but also reduces wastage and environmental pollution. Farmers are increasingly attracted to these advanced products because they save on repeated applications and ensure more consistent crop performance.

With modern farming focusing on precision and sustainability, the adoption of controlled-release fertilizers is expanding. This trend highlights the shift from basic inputs toward more efficient and eco-friendly nutrient solutions, making sulfur fertilizers more valuable in global agriculture.

Regional Analysis

In 2024, the Asia Pacific led the Sulfur Fertilizer Market with a 46.2% share.

The sulfur fertilizer market shows varied regional trends, with the Asia Pacific emerging as the clear leader. In 2024, the Asia Pacific held a dominant position, accounting for 46.2% of the global share, valued at USD 2.0 billion. This dominance is mainly driven by the region’s vast agricultural base and rising demand for staple crops such as rice, wheat, and maize, which require balanced nutrient inputs.

Countries like China and India, with large farming populations and sulfur-deficient soils, have significantly increased their adoption of sulfur fertilizers to boost yield and crop quality. Supportive government initiatives promoting sustainable farming and efficient fertilizer usage have further fueled market expansion in this region.

North America and Europe follow as important markets, supported by advanced farming practices and a growing focus on high-quality crop output. Meanwhile, Latin America is gaining traction due to the rising cultivation of soybean and maize, while the Middle East & Africa show potential with expanding agricultural activities despite challenging soil conditions.

However, it is the Asia Pacific that continues to dominate the overall landscape, reflecting its central role in meeting global food security needs and driving future opportunities in the sulfur fertilizer market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Yara International maintains a strong position by focusing on premium-quality sulfur-based fertilizers tailored for both large-scale farms and precision agriculture. The company’s wide distribution network and sustainability-focused initiatives ensure it remains a trusted supplier in developed and emerging markets alike.

Nutrien Inc., with its extensive production capacity, leverages its integrated model spanning fertilizer production and retail distribution, giving it a distinct advantage in serving diverse crop needs. Its sulfur fertilizer offerings support balanced nutrient management, especially in high-demand crops such as cereals and oilseeds.

The Mosaic Company continues to strengthen its position by emphasizing nutrient efficiency and innovative product formulations that combine sulfur with other key nutrients. This approach aligns with global demand for higher yields while promoting soil health.

ICL, on the other hand, differentiates itself through its specialty fertilizers and solutions designed for both conventional and modern farming systems. By focusing on research-driven advancements, ICL addresses sulfur deficiencies in diverse soil types and climates.

Top Key Players in the Market

- Yara International

- Nutrien Inc

- The Mosaic Company

- ICL

- Koch Industries Inc.

- Nutri-Tech Solutions Pvt Ltd.

Recent Developments

- In January 2024, Yara teamed up with Pursell Agri‑Tech to introduce PurMidas, a controlled‑release fertilizer for turf that has a balanced 7:1 ratio of nitrogen to sulfur. This granular product ensures uniform spreading, improves nutrient uptake, and helps turf handle stress better.

- In 2024, Mosaic purchased approximately 3.0 million long tons of sulfur, primarily from oil and natural gas refiners in North America. This significant procurement underscores the critical role sulfur plays in their fertilizer production—especially for making sulfuric acid, which is used in processing P₂O₅ (phosphoric acid) for phosphate fertilizers.

Report Scope

Report Features Description Market Value (2024) USD 4.5 Billion Forecast Revenue (2034) USD 6.3 Billion CAGR (2025-2034) 3.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Sulfate Fertilizers (Ammonium Sulfate, Potassium Sulfate, Calcium Sulfate (Gypsum), Single Superphosphate), Elemental Sulfur (Micronized Sulfur, Prilled/Pastilled Sulfur), Sulfate of Micronutrients (Zinc Sulfate, Magnesium Sulfate, Others), Others), By Form (Dry, Liquid), By Crop Type (Cereals and Grains, Oilseeds and Pulses, Fruits and Vegetables, Others), By Application (Soil, Foliar, Fertigation, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Yara International, Nutrien Inc, The Mosaic Company, ICL, Koch Industries Inc., Nutri-Tech Solutions Pvt Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Sulfur Fertilizer MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

Sulfur Fertilizer MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Yara International

- Nutrien Inc

- The Mosaic Company

- ICL

- Koch Industries Inc.

- Nutri-Tech Solutions Pvt Ltd.