Global Styrene Acrylonitrile Market Size, Share, And Business Benefits By Type (Emulsion, Continuous Mass Polymerization, Suspension), By End Use (Packaging, Electrical and Electronics, Medical, Automotive and Transportation, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 161146

- Number of Pages: 245

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

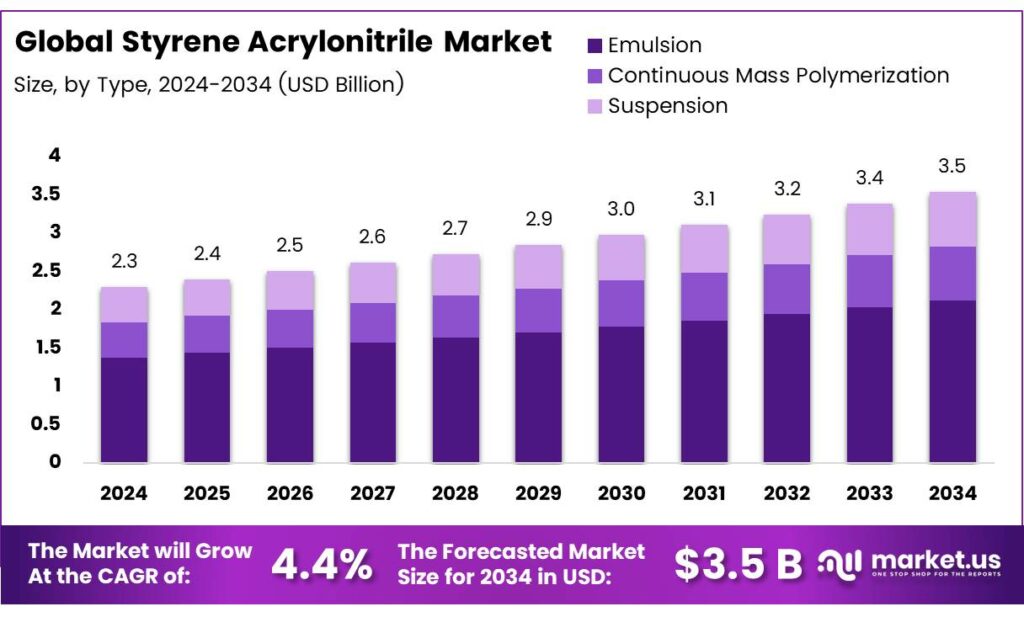

The Global Styrene Acrylonitrile Market size is expected to be worth around USD 3.5 billion by 2034, from USD 2.3 billion in 2024, growing at a CAGR of 4.4% during the forecast period from 2025 to 2034.

Styrene acrylonitrile (SAN) is a copolymer composed of styrene and acrylonitrile monomers, combining the clarity and rigidity of polystyrene with improved chemical resistance and thermal stability from the acrylonitrile component. SAN finds wide use in applications demanding transparent, dimensionally stable, and chemically inert thermoplastics, such as in consumer goods, electronics housings, medical devices, and automotive interior parts.

Styrene-acrylonitrile (SAN) copolymers, containing approximately 20–30% acrylonitrile, are specialized and relatively costly engineering plastics derived from styrene. The polar acrylonitrile component enhances their resistance to hydrocarbons, oils, and greases compared to polystyrene (PS). SAN copolymers also exhibit a higher softening point, improved resistance to stress cracking and crazing, and greater impact strength while maintaining the transparency of polystyrene.

Higher acrylonitrile content increases toughness and chemical resistance but complicates molding and increases the risk of yellowness. SAN, or styrene-acrylonitrile copolymer, is defined as a solid polymer composed of approximately 25-30% acrylonitrile and 70-75% styrene, with a weight average molecular mass ranging from 165,000 to 185,000. It is commonly used in applications such as cassette cases, containers, and industrial components due to its desirable physical properties.

SAN copolymers offer better toughness than polystyrene but have limitations that led to the creation of acrylonitrile-butadiene-styrene (ABS) in the 1950s. ABS combines 15–35% acrylonitrile, 5–30% butadiene, and 40–60% styrene, delivering superior strength and processability. It is typically produced as a graft copolymer by polymerizing SAN in the presence of polybutadiene rubber latex, yielding a blend of SAN copolymer, SAN-polybutadiene graft polymer, and free rubber. The CAS number for ABS is 9003-56-9.

Key Takeaways

- The Global Styrene Acrylonitrile (SAN) market is projected to grow from USD 2.3 billion in 2024 to USD 3.5 billion by 2034, at a CAGR of 4.4%.

- Emulsion polymerization dominates the SAN market with a 46.8% share due to its uniform particle distribution and superior material properties.

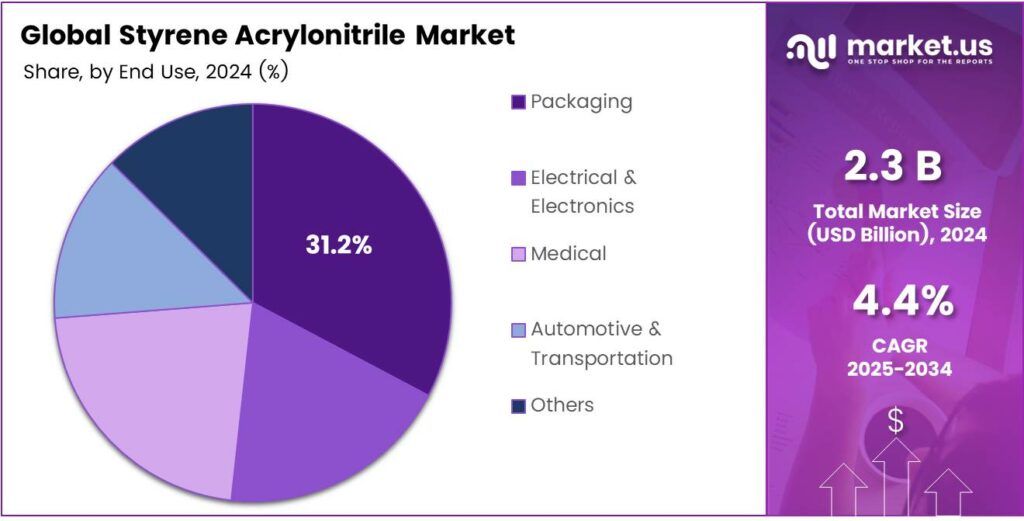

- Packaging applications lead the SAN market with a 31.2% share, driven by SAN’s clarity, chemical resistance, and rigidity for containers and films.

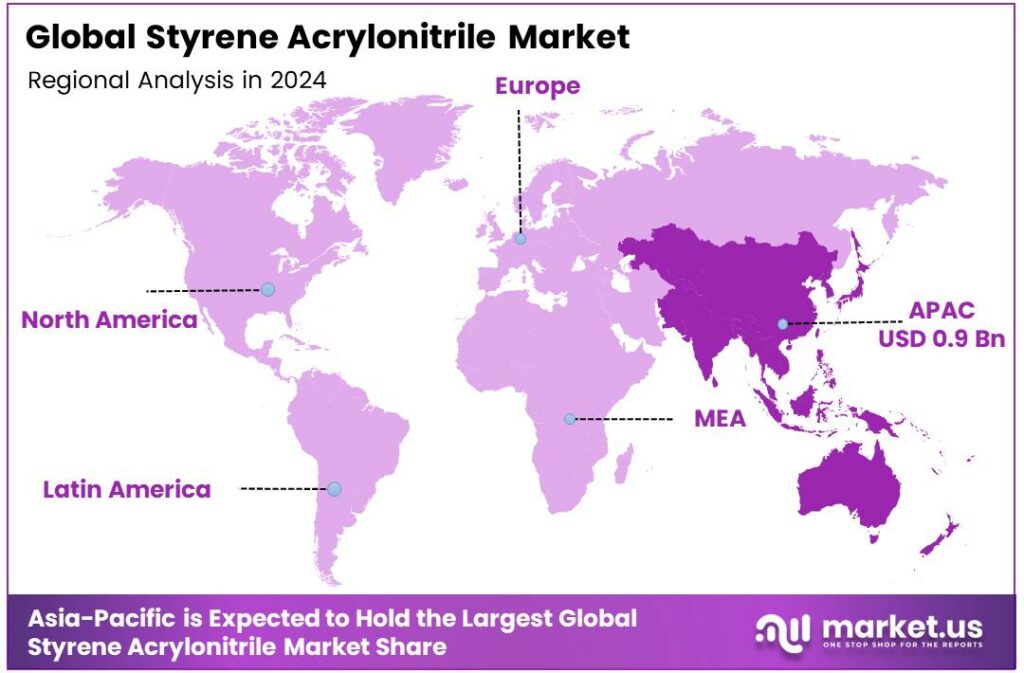

- Asia-Pacific holds a 42.8% market share, valued at USD 0.9 billion, fueled by its robust manufacturing and growing electronics and automotive sectors.

Analyst Viewpoint

Styrene Acrylonitrile (SAN) from an investor’s angle right now, it’s a material that’s quietly carving out a solid spot in everyday products without the hype of flashier plastics. We’re talking about a resin that’s tough, clear, and handles heat pretty well, think the casings on your kitchen mixer or the dashboard bits in cars that don’t crack under the sun.

The opportunities here feel real and grounded: with global shifts toward lighter, more efficient stuff in autos and gadgets, SAN’s demand could tick up nicely, especially in places like Asia, where factories are booming. Driven by its use in electronics housings and packaging that need to look good and last.

SAN strikes me as a steady eddy in the plastics pond—not a moonshot, but a reliable one if you play it patiently. Dive into the auto and electronics boom, keep an eye on those green mandates, and pair it with tech upgrades for the win. It’s the kind of investment that rewards the folks who think beyond the quarterly noise.

By Type

Emulsion Type Dominates the Styrene Acrylonitrile Market – 46.8% Share

In 2024, Emulsion held a dominant market position, capturing more than a 46.8% share in the global Styrene Acrylonitrile (SAN) market. The emulsion polymerization process enables uniform particle distribution and excellent control over molecular weight, resulting in materials with superior transparency, toughness, and chemical resistance.

These qualities make emulsion-based SAN highly preferred in applications such as automotive components, household goods, and electronic housings. Steady demand from the consumer goods and electronics sectors is expected to sustain the strong position of emulsion SAN.

Manufacturers are focusing on improving production efficiency and optimizing polymer quality to meet growing end-user expectations for durable and high-performance materials. With the increasing use of SAN in replacing polystyrene and other rigid plastics, the emulsion type continues to play a central role in driving market growth and technological advancements across industries.

By End Use

Packaging End Use Leads the Styrene Acrylonitrile Market – 31.2% Share

In 2024, Packaging held a dominant market position, capturing more than a 31.2% share of the global Styrene Acrylonitrile (SAN) market. The segment’s strength comes from SAN’s clarity, chemical resistance, and rigidity, which make it ideal for producing transparent containers, cosmetic jars, food trays, and durable packaging films.

Its ability to withstand heat and maintain form under pressure has made SAN a reliable material for both consumer and industrial packaging applications. The demand for SAN in packaging is expected to remain strong, driven by the growing shift toward lightweight, recyclable materials that ensure product safety and visual appeal.

Manufacturers are focusing on improving SAN’s recyclability and barrier performance to align with global sustainability goals. The increasing use of SAN in high-end and reusable packaging solutions highlights its continued importance in meeting modern consumer and environmental expectations.

Key Market Segments

By Type

- Emulsion

- Continuous Mass Polymerization

- Suspension

By End Use

- Packaging

- Electrical and Electronics

- Medical

- Automotive and Transportation

- Others

Drivers

Home & personal appliances are pulling Styrene Acrylonitrile forward

Styrene Acrylonitrile (SAN) rides the everyday upgrade cycle in kitchens and bathrooms. Its clarity, hot-water resistance, and chemical toughness make it a go-to for kettles, blenders, food-prep bowls, cosmetic jars, and hair-styling tools—places where glassy looks and durability matter. A very tangible signal comes from small appliances.

In France, the trade group GIFAM reported a record year for small electricals in 2024: sales value rose 8% to €4.03 billion, with 53.5 million products sold, and air-fryer purchases alone jumped 140% year-on-year (2.6 million units). That kind of category momentum reliably lifts demand for clear, heat-resistant housings and mixing components—classic SAN territory.

Under the hood, broader plastics throughput remains hefty. PlasticsEurope’s latest Fast Facts put global plastics production at 400.3 million tonnes, framing the scale at which styrenic materials—including SAN—flow into consumer and industrial uses. Europe’s share was 14%, with North America at 17% and China at 32%, underscoring where downstream processing capacity sits today.

Restraints

Health & Regulatory Pressure from Styrene’s Risks

One major restraint for Styrene Acrylonitrile (SAN) is the growing health and regulatory scrutiny around styrene, one of its monomeric components. Since styrene has been flagged for potential adverse effects, regulators are tightening rules that can slow down SAN’s adoption or increase compliance costs.

Styrene is classified by the International Agency for Research on Cancer (IARC) as probably carcinogenic to humans. In response, the European Food Safety Authority (EFSA) has proposed a specific migration limit (SML) of 40 micrograms per kilogram (µg/kg) of food for styrene migrating from food-contact materials.

That means any packaging or container made with SAN must ensure styrene leaching stays under this threshold. The Styrene Information & Research Center recommends an 8-hour limit of 20 parts per million (ppm) for worker exposure, a stricter guideline than older limits. Some regulators still allow up to 100 ppm, but industries voluntarily follow lower limits to reduce liabilities.

Opportunity

Rising Demand from Electronics & Appliance Industries

One of the major growth drivers for Styrene Acrylonitrile (SAN) is the surging demand in the electronics and home appliance sectors, where SAN’s clarity, dimensional stability, and thermal resistance make it a preferred material for housings, panels, lenses, switches, and other components.

Electronics manufacturers want to localize supply chains, reduce import costs and lead times, and SAN resin producers can find new opportunities to partner locally. As Indian electronics output rises, more plastic components (front bezels, clarity covers, and connector housings) will need to be sourced domestically.

As electronics and appliances proliferate (smartphones, IoT devices, home appliances), the push for lighter, reliable, expensive-looking plastic parts benefits SAN. That pull from downstream users, combined with favorable government programs and rising local manufacturing, is a strong growth factor for the SAN industry.

Trends

Emergence of Advanced & Circular Recycling as a Game Changer

One big emerging factor for Styrene Acrylonitrile (SAN) is the push toward advanced chemical recycling and circular plastics systems. As regulations and consumer pressure build, plastics makers are investing in recycling technologies that can break down even mixed or hard-to-recycle plastics into their molecular building blocks. This opens the door for SAN to be produced or reused in more eco-friendly ways, reducing reliance on virgin petrochemicals.

In Europe, member companies report that about 30 million tonnes of plastic waste is collected annually, but a large share is still incinerated or landfilled. The chemical industry is proposing new recycling routes like depolymerization and conversion, which can turn mixed plastic waste into feedstock useful enough to reintroduce even into engineering polymers.

Regional Analysis

Asia-Pacific leads with a 42.8% share and a USD 0.9 Billion market value.

In 2024, Asia-Pacific held a dominant market position, capturing more than a 42.8% share, valued at approximately USD 0.9 billion in the global Styrene Acrylonitrile (SAN) market. The region’s leadership is built on its strong manufacturing ecosystem, expanding electronics industry, and growing consumption of household appliances and automotive components.

Countries like China, Japan, South Korea, and India remain key growth engines, supported by rising middle-class demand and local production capacities for consumer goods, packaging, and electrical products, all major end uses for SAN due to its high transparency, rigidity, and heat resistance.

India’s expanding automotive and home appliance industries, supported by the Make in India initiative and Production-Linked Incentive (PLI) schemes, have also created a favorable environment for polymer-based component manufacturing, including SAN-based parts. Japan and South Korea’s innovation in lightweight and durable materials for automotive interiors and electronic housings further supports the regional momentum.

The region benefits from a well-established supply chain of styrene and acrylonitrile feedstocks, ensuring cost competitiveness. Regional players are also investing in advanced processing technologies and sustainable production practices to align with global circular economy goals. Together, these drivers reinforce Asia-Pacific’s position as the powerhouse of the Styrene Acrylonitrile market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

SABIC leverages its massive integrated production and diverse chemical portfolio to be a major SAN supplier. Its strength lies in strong R&D capabilities and a vast global distribution network, ensuring consistent supply to various downstream industries. SABIC focuses on developing high-performance, sustainable SAN grades to meet evolving market demands, particularly in automotive and electronics, solidifying its position as a reliable, innovation-driven force in the market.

INEOS Styrolution’s focus is its primary strength. The company is a leading force in SAN and other styrene-based copolymers, offering a wide range of specialty grades. Its strategy emphasizes application development and technical expertise, providing tailored solutions for demanding sectors like automotive, medical, and household appliances. This deep specialization and customer-centric innovation make it a key technical partner and a dominant player in the styrenics market.

BASF SE brings immense R&D resources and a vast global production footprint to the SAN market. Its strength is in developing advanced material solutions, including high-heat, high-gloss, and UV-stable SAN grades. As a leader in sustainability, BASF is actively pioneering mechanically recycled and bio-based SAN alternatives. This commitment to innovation and its extensive customer base across multiple industries secures its role as a technology leader and a key, influential supplier.

Top Key Players in the Market

- SABIC

- INEOS Styrolution

- LG Chem

- BASF SE

- Trinseo

- Chi Mei Corporation

- Asahi Kasei Corporation

- ENI

- INEOS Group

- Ravago Group

Recent Developments

- In 2024, LG Chem’s sustainability Report emphasized expanding bio-attributed SAN and ABS lines, targeting recycled content. The company plans commercialization of biodegradable alternatives like PBAT and PLA by 2024, complementing SAN’s role in cosmetics containers and refrigerator shelves.

- In 2024, INEOS Styrolution agreed to sell its ABS and SAN production site in Map Ta Phut, Thailand (100% equity interest) to Styrenix Performance Materials Limited. The transaction, valued for its strategic realignment toward higher-growth regions, allows INEOS to focus on the Americas and EMEA operations.

Report Scope

Report Features Description Market Value (2024) USD 2.3 Billion Forecast Revenue (2034) USD 3.5 Billion CAGR (2025-2034) 4.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Emulsion, Continuous Mass Polymerization, Suspension), By End Use (Packaging, Electrical and Electronics, Medical, Automotive and Transportation, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape SABIC, INEOS Styrolution, LG Chem, BASF SE, Trinseo, Chi Mei Corporation, Asahi Kasei Corporation, ENI, INEOS Group, Ravago Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Styrene Acrylonitrile MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample

Styrene Acrylonitrile MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- SABIC

- INEOS Styrolution

- LG Chem

- BASF SE

- Trinseo

- Chi Mei Corporation

- Asahi Kasei Corporation

- ENI

- INEOS Group

- Ravago Group