Global Specialty Fertilizers Market Size, Share Analysis Report By Type (Blends of NPK, Urea Ammonium Nitrate (UAN), Calcium Ammonium Nitrate (CAN), Monoammonium Phosphate (MAP), Sulfate of Potash (SOP), Potassium Nitrate, Urea Derivatives, Others), By Technology (Water-soluble Fertilizers, Controlled-release Fertilizers, Liquid Fertilizers, Micronutrients, Others), By Form (Dry, Liquid), By Application Methods (Fertigation, Foliar, Soil), Ву Сгор Туре (Cereals and Grains, Oilseeds and Pulses, Fruits and Vegetables, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 155329

- Number of Pages: 346

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

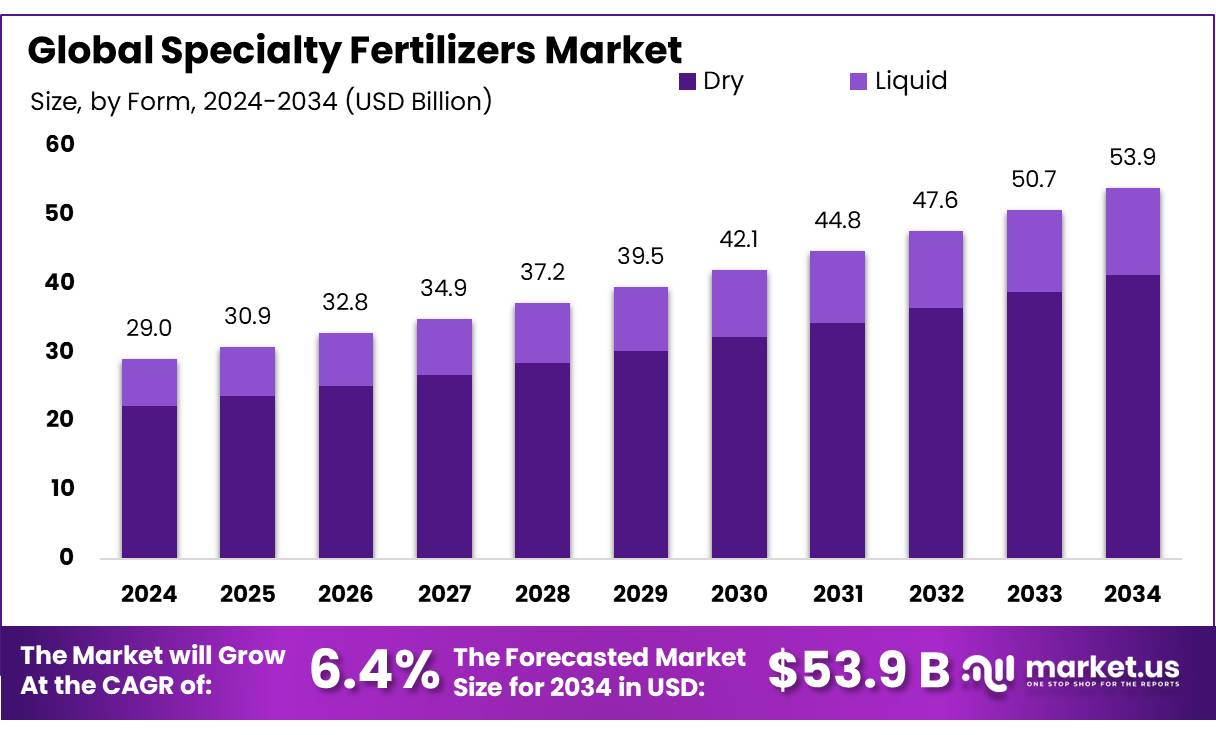

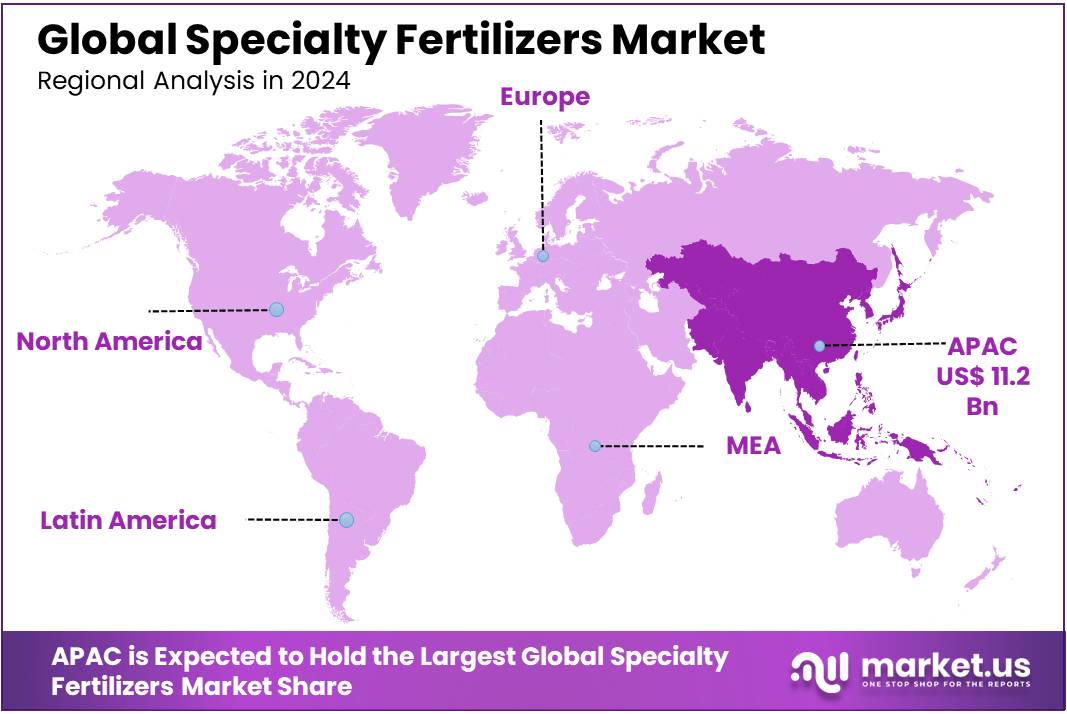

The Global Specialty Fertilizers Market size is expected to be worth around USD 53.9 Billion by 2034, from USD 29.0 Billion in 2024, growing at a CAGR of 6.4% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific held a dominant market position, capturing more than a 38.9% share, holding USD 11.2 Billion revenue.

Specialty fertilizer concentrates are high-analysis, often water-soluble or controlled-release inputs (e.g., NPK blends, chelated micronutrients, coated CRF, and nano-formulations) engineered for precision delivery via fertigation, foliar sprays, or targeted soil application. Their rise sits against a backdrop of recovering global fertilizer use: the International Fertilizer Association (IFA) projects total consumption to reach ~205 Mt nutrients in FY2025, surpassing the 2019/20 record, after rebounds of 4.3% (FY2023), 2.5% (FY2024), and 2.2% (FY2025).

The Indian government has significantly increased its support for the fertilizer sector. For the fiscal year 2024–25, the Department of Fertilizers received a revised budget of ₹1,91,836 crore, up from ₹1,68,131 crore, reflecting a strong commitment to the sector. Additionally, the Nutrient Based Subsidy (NBS) scheme allocation for phosphatic and potassic fertilizers was raised to ₹54,310 crore, ensuring sustained support for these essential nutrients.

The government’s “One Nation, One Fertilizer” initiative aims to standardize fertilizer quality and branding across the country, promoting transparency and ease of access for farmers. Furthermore, international collaborations are enhancing India’s fertilizer supply chain. In July 2025, long-term agreements were signed between Saudi Arabia’s Maaden and Indian companies IPL, KRIBHCO, and CIL to supply 3.1 million metric tonnes of Diammonium Phosphate (DAP) annually for five years, starting from the financial year 2025–26.

Government initiatives play a crucial role in the development of the specialty fertilizer sector. For instance, the Nutrient Based Subsidy (NBS) scheme, introduced in 2010, provides fixed subsidies for phosphatic and potassic fertilizers based on their nutrient content, encouraging the use of balanced fertilizers . Additionally, the SIGHT Programme under the National Green Hydrogen Mission aims to produce 7.5 lakh tonnes per annum of green ammonia, a sustainable alternative to traditional ammonia, thereby promoting environmentally friendly fertilizer production .

The adoption of specialty fertilizers is further supported by state-level programs promoting organic and bio-based inputs. For instance, Andhra Pradesh’s initiative aims to reduce chemical fertilizer usage by 11%, equivalent to 4 lakh metric tonnes, by encouraging the use of bio-fertilizers like Nitrobacteria, Phosphobacteria, and nano-fertilizers such as Nano Urea and Nano DAP. Similarly, Chhattisgarh’s Godhan Nyay Yojana incentivizes organic farming by purchasing cow dung from farmers, which is then processed into vermicompost and sold as organic manure, promoting sustainable agricultural practices.

Key Takeaways

- Specialty Fertilizers Market size is expected to be worth around USD 53.9 Billion by 2034, from USD 29.0 Billion in 2024, growing at a CAGR of 6.4%.

- Blends of NPK held a dominant market position, capturing more than a 27.4% share.

- Water-soluble Fertilizers held a dominant market position, capturing more than a 34.2% share.

- Dry held a dominant market position, capturing more than a 76.5% share.

- Fertigation held a dominant market position, capturing more than a 49.8% share.

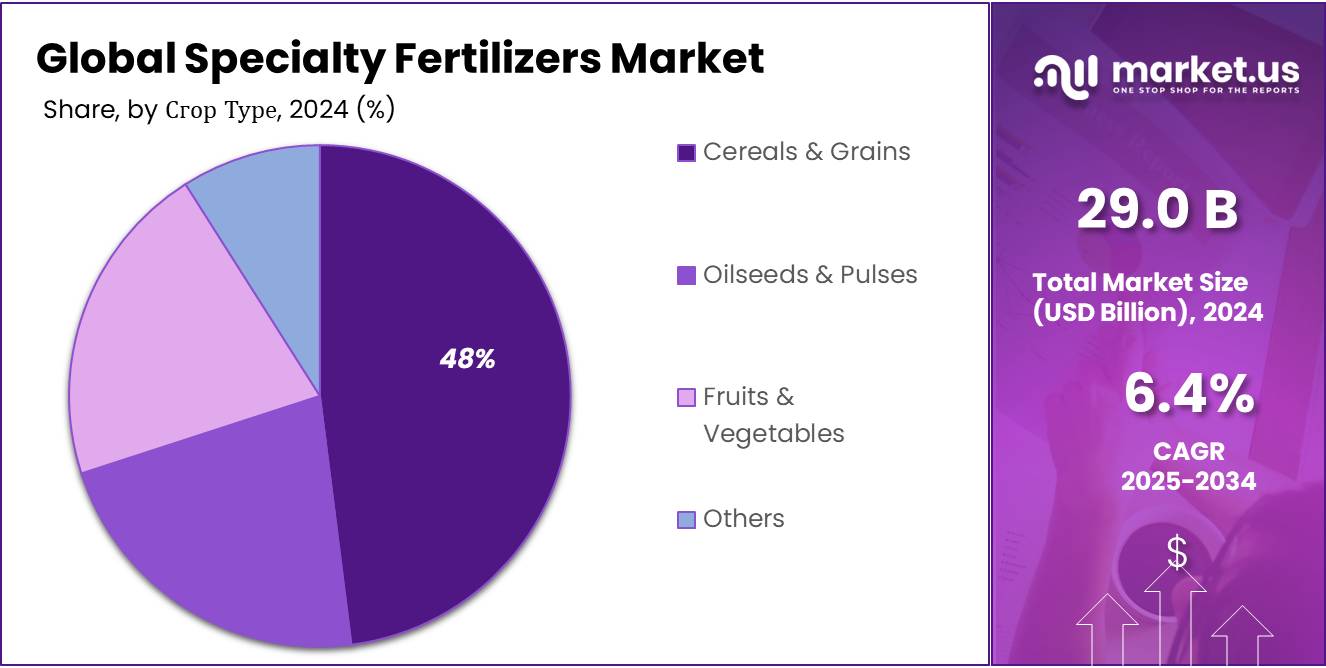

- Cereals & Grains held a dominant market position, capturing more than a 48.9% share.

- Asia Pacific held a dominant position in the global specialty fertilizers market, capturing 38.9% of total revenue, valued at USD 11.2 billion.

By Type Analysis

Blends of NPK lead the market with 27.4% share in 2024

In 2024, Blends of NPK held a dominant market position, capturing more than a 27.4% share, supported by their balanced nutrient profile that addresses both macro and micro crop requirements in a single application. These blends—customized combinations of nitrogen, phosphorus, and potassium—offer flexibility in nutrient ratios, making them adaptable for different soil types, crop stages, and regional climatic conditions. Their role has expanded with precision agriculture practices, where farmers aim to maximize nutrient use efficiency (NUE) and reduce application frequency, thereby lowering labor and operational costs. Government-backed soil health initiatives and integrated nutrient management programs have also boosted adoption, as blends fit into recommended nutrient application schedules while supporting yield stability.

By Technology Analysis

Water-soluble Fertilizers dominate with 34.2% market share in 2024

In 2024, Water-soluble Fertilizers held a dominant market position, capturing more than a 34.2% share, driven by their high nutrient-use efficiency and compatibility with modern irrigation systems. These fertilizers dissolve completely in water, enabling uniform nutrient delivery through drip or sprinkler systems, which is essential for precision farming and high-value crop cultivation. Their demand has surged in regions investing heavily in micro-irrigation, supported by government programs such as India’s “Per Drop More Crop,” which expanded coverage to over 9.56 million hectares by December 2024. The ability to apply them via fertigation also helps reduce labor costs and allows timely nutrient application in line with crop growth stages, improving yields and quality.

By Form Analysis

Dry fertilizers lead with 76.5% market share in 2024

In 2024, Dry held a dominant market position, capturing more than a 76.5% share, supported by their ease of handling, long shelf life, and cost-effectiveness in bulk application. Dry specialty fertilizers, available as granules, prills, or powders, are widely favored in both broadacre and horticultural farming due to their stability during storage and transport. They are particularly suitable for pre-plant and top-dress applications, ensuring steady nutrient release over time. Adoption has been reinforced by mechanized spreading equipment, which allows uniform coverage across large areas, reducing labor requirements and improving field efficiency.

By Application Methods Analysis

Fertigation dominates with 49.8% market share in 2024

In 2024, Fertigation held a dominant market position, capturing more than a 49.8% share, driven by its ability to deliver nutrients directly through irrigation systems with high precision and minimal wastage. This method ensures that crops receive the right nutrient mix at the right growth stage, improving nutrient-use efficiency (NUE) and boosting yields while conserving water. Its adoption has been strongly supported in regions facing water scarcity, where integration with drip and sprinkler systems offers both economic and environmental benefits. Programs like India’s “Per Drop More Crop” under the Pradhan Mantri Krishi Sinchayee Yojana, which expanded micro-irrigation coverage to over 9.56 million hectares by December 2024, have significantly contributed to fertigation growth.

Ву Сгор Туре Analysis

Cereals & Grains dominate with 48.9% market share in 2024

In 2024, Cereals & Grains held a dominant market position, capturing more than a 48.9% share, supported by their extensive cultivation area and essential role in global food security. Crops such as wheat, rice, maize, and barley require consistent nutrient supply to achieve optimal yields, making them major consumers of specialty fertilizers. The segment’s growth has been reinforced by government-backed food production initiatives, such as India’s nutrient management programs and the U.S. 4R Nutrient Stewardship adoption across millions of cereal acres, which focus on applying the right source, rate, time, and place for fertilizers. These measures encourage the use of controlled-release, fortified, and water-soluble fertilizers to improve nutrient efficiency while reducing losses.

Key Market Segments

By Type

- Blends of NPK

- Urea Ammonium Nitrate (UAN)

- Calcium Ammonium Nitrate (CAN)

- Monoammonium Phosphate (MAP)

- Sulfate of Potash (SOP)

- Potassium Nitrate

- Urea Derivatives

- Others

By Technology

- Water-soluble Fertilizers

- Controlled-release Fertilizers

- Liquid Fertilizers

- Micronutrients

- Others

By Form

- Dry

- Liquid

By Application Methods

- Fertigation

- Foliar

- Soil

Ву Сгор Туре

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Others

Emerging Trends

Government Initiatives Accelerating the Adoption of Specialty Fertilizers in India

India’s agricultural sector is undergoing a significant transformation, with a growing emphasis on sustainable farming practices. A pivotal aspect of this shift is the increased adoption of specialty fertilizers—products designed to enhance nutrient delivery, improve crop yields, and promote environmental sustainability. Government initiatives are playing a crucial role in accelerating this transition.

The Indian government has introduced several initiatives to bolster the agricultural sector’s growth and sustainability. One such initiative is the Prime Minister Dhan-Dhaanya Krishi Yojana, launched in July 2025. This six-year program, with an annual outlay of ₹24,000 crore, aims to enhance crop yields and farmers’ income in 100 low-performing districts. The scheme focuses on crop diversification, sustainable practices, irrigation, storage infrastructure, and improved access to credit, benefiting approximately 1.7 crore farmers through the convergence of 36 existing schemes across multiple ministries.

Infrastructure development plays a pivotal role in ensuring the effective distribution and accessibility of specialty fertilizers. The establishment of new fertilizer plants and the expansion of existing facilities are critical to meeting the growing demand. For instance, the proposed ₹10,000 crore fertilizer plant in Nagpur district, Maharashtra, aims to produce 12.7 lakh tonnes annually, thereby enhancing fertilizer availability in the region and generating rural employment.

Furthermore, states like Andhra Pradesh are leading the way in promoting sustainable agricultural practices. The state has initiated a transition from chemical to bio-fertilizers, aiming to reduce chemical fertilizer usage by 11%, equivalent to 4 lakh metric tonnes. This shift includes promoting bio-fertilizers like Nitrobacteria, Phosphobacteria, Neem cake, and nano-fertilizers such as Nano Urea and Nano DAP, which enhance soil health, crop immunity, and water retention.

Drivers

Government Initiatives Driving the Adoption of Specialty Fertilizers

One of the primary factors propelling the adoption of specialty fertilizers in India is the government’s robust support through subsidies and policy reforms aimed at enhancing agricultural productivity and sustainability. In the 2024–25 fiscal year, the Indian government allocated ₹1,91,836.29 crore to the Department of Fertilizers, marking a significant increase from the ₹1,68,130.81 crore initially estimated. This funding underscores the government’s commitment to ensuring the availability and affordability of fertilizers for farmers.

A cornerstone of this support is the Nutrient Based Subsidy (NBS) scheme, introduced in 2010, which provides fixed subsidies for phosphatic and potassic fertilizers based on their nutrient content. In March 2025, the Union Cabinet approved revised subsidy rates for the 2025 Kharif season, amounting to ₹37,216.15 crore, approximately ₹13,000 crore more than the previous Rabi season, ensuring sustained support for specialty fertilizers.

Additionally, to mitigate the impact of geopolitical factors on fertilizer procurement, the government extended a one-time special subsidy of ₹3,500 per metric tonne for Di-Ammonium Phosphate (DAP) from April 2024 to March 2025. This measure aims to maintain the affordability and availability of DAP, a critical component in specialty fertilizers.

Furthermore, the “One Nation One Fertilizer” (ONOF) scheme was introduced to standardize fertilizer branding across the country, promoting transparency and ensuring that all subsidized fertilizers are sold under the unified ‘Bharat’ brand. This initiative simplifies the distribution process and enhances the reach of specialty fertilizers to farmers nationwide.

Restraints

Challenges in Fertilizer Subsidy Management

In the fiscal year 2024–25, the Indian government allocated approximately ₹1.68 lakh crore for fertilizer subsidies. This allocation was later revised to ₹1.91 lakh crore to accommodate rising global fertilizer prices and increased domestic consumption. Despite these adjustments, the subsidy burden remains substantial. For instance, the Nutrient Based Subsidy (NBS) scheme, which supports phosphatic and potassic fertilizers, saw its allocation increase from ₹45,000 crore in the Budget Estimate to ₹54,310 crore through Supplementary Demands for Grants passed by Parliament. This indicates a significant rise in subsidy expenditure to maintain fertilizer affordability for farmers.

The financial strain is compounded by factors such as fluctuating international fertilizer prices and exchange rates, which affect import costs. Additionally, the rising cost of natural gas, a key input in fertilizer production, further escalates expenses. These variables make it challenging for the government to predict subsidy requirements accurately, leading to either shortfalls or excess allocations.

Moreover, the extensive subsidy system can sometimes lead to overuse or misuse of fertilizers, as farmers may apply them without considering soil health or crop-specific needs. This over-reliance on subsidized fertilizers can degrade soil quality over time, affecting long-term agricultural productivity.

To address these issues, the government has been promoting balanced fertilizer use and encouraging the adoption of alternative fertilizers like organic and bio-based products. For example, the Fertiliser Control Order, 1985, has been amended to include organic fertilizers, bio-fertilizers, de-oiled cake, organic carbon enhancers, and nano fertilizers, aiming to diversify nutrient sources and reduce dependency on chemical fertilizers.

Opportunity

Strategic Government Initiatives Fueling Growth in India’s Specialty Fertilizer Sector

India’s agricultural landscape is undergoing a significant transformation, with a pronounced shift towards sustainable and efficient farming practices. A pivotal element in this evolution is the adoption of specialty fertilizers—products designed to enhance nutrient delivery, improve crop yields, and promote environmental sustainability. The government’s proactive policies and support mechanisms are playing a crucial role in accelerating this transition.

The Indian government has introduced several initiatives to bolster the agricultural sector’s growth and sustainability. One such initiative is the Prime Minister Dhan-Dhaanya Krishi Yojana, launched in July 2025. This six-year program, with an annual outlay of ₹24,000 crore, aims to enhance crop yields and farmers’ income in 100 low-performing districts. The scheme focuses on crop diversification, sustainable practices, irrigation, storage infrastructure, and improved access to credit, benefiting approximately 1.7 crore farmers through the convergence of 36 existing schemes across multiple ministries.

Additionally, the National Mission for Sustainable Agriculture (NMSA) promotes the adoption of organic and integrated farming systems. This mission encourages the use of bio-fertilizers and organic inputs, aligning with the growing trend towards sustainable agriculture. The government’s emphasis on these initiatives underscores its commitment to fostering an environment conducive to the growth of specialty fertilizers.

The specialty fertilizer market in India is experiencing robust growth, driven by the increasing demand for high-efficiency fertilizers and sustainable farming practices. In 2024, the market size was estimated at ₹75 billion (approximately $9 billion USD), with projections indicating a compound annual growth rate (CAGR) of 6.50% from 2025 to 2033 . This growth trajectory reflects the escalating adoption of specialty fertilizers such as controlled-release fertilizers, water-soluble fertilizers, and micronutrient blends.

Infrastructure development plays a pivotal role in ensuring the effective distribution and accessibility of specialty fertilizers. The establishment of new fertilizer plants and the expansion of existing facilities are critical to meeting the growing demand. For instance, the proposed ₹10,000 crore fertilizer plant in Nagpur district, Maharashtra, aims to produce 12.7 lakh tonnes annually, thereby enhancing fertilizer availability in the region and generating rural employment.

Regional Insights

Asia Pacific leads with 38.9% share, valued at USD 11.2 billion

In 2024, Asia Pacific held a dominant position in the global specialty fertilizers market, capturing 38.9% of total revenue, valued at USD 11.2 billion. The region’s leadership is driven by its vast agricultural base, high crop diversity, and growing emphasis on precision farming to meet the demands of a rising population.

Major producers such as China, India, and Australia are increasingly adopting advanced fertilizer technologies, including water-soluble blends, controlled-release formulations, and micronutrient-enriched products, to boost nutrient-use efficiency and maintain soil health. China remains the largest consumer in the region, supported by government programs aimed at cutting chemical fertilizer usage by 20% by 2030 while improving yields through balanced nutrition strategies. India’s agricultural policy framework, including the “Per Drop More Crop” initiative, has also expanded micro-irrigation coverage to 9.56 million hectares by December 2024, creating a strong foundation for fertigation-ready specialty fertilizers.

The demand surge is further fueled by the cultivation of high-value crops such as fruits, vegetables, and plantation crops, where quality and uniformity are critical for domestic and export markets. The region’s expanding greenhouse farming sector, particularly in Japan, South Korea, and Southeast Asia, is also accelerating the use of soluble and tailored nutrient formulations.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Nutrien Ltd. is a global leader in the production of potash, nitrogen, and phosphate fertilizers. In 2025, the company reported net earnings of $1.2 billion, with adjusted EBITDA of $2.5 billion, driven by strong demand in North America. Despite challenges in South America, Nutrien anticipates increased fertilizer use by North American farmers in the upcoming fall season, supported by a robust corn planting season and improved weather conditions.

ICL Group is an Israeli multinational corporation specializing in specialty minerals and fertilizers. In 2024, ICL delivered an adjusted EBITDA of $1,469 million, with its specialties-driven businesses contributing 70% of that amount. The company continues to focus on cash generation while increasing market share across its Industrial Products, Phosphate Solutions, and Growing Solutions segments.

The Mosaic Company is a leading producer of concentrated phosphate and potash crop nutrients. In 2024, the company experienced a significant stock decline due to disruptions caused by recent hurricanes, with earnings per share of $0.38 and a revenue decline of 21% year-over-year. Despite these challenges, Mosaic remains a key player in the specialty fertilizers market, focusing on recovery and long-term growth strategies.

Top Key Players Outlook

- Nutrien Ltd.

- Yara

- ICL

- The Mosaic Company

- CF Industries and Holdings, Inc.

- Nufarm

- SQM SA

- OCP Group

- Kingenta

- K+S Aktiengesellschaft

Recent Industry Developments

In 2024 Nutrien Ltd, achieved net earnings of $700 million and adjusted EBITDA of $5.4 billion, reflecting a strategic focus on enhancing operational efficiency and expanding its upstream fertilizer sales volumes. The retail segment, Nutrien Ag Solutions, contributed significantly with an adjusted EBITDA of $1.7 billion, driven by higher product margins and streamlined expenses.

In 2024, Yara’s EBITDA excluding special items was USD 519 million, slightly below analysts’ expectations due to lower nitrogen upgrading margins and a strong U.S. dollar, which led to a net foreign currency exchange loss of USD 260 million.

Report Scope

Report Features Description Market Value (2024) USD 29.0 Bn Forecast Revenue (2034) USD 53.9 Bn CAGR (2025-2034) 6.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Blends of NPK, Urea Ammonium Nitrate (UAN), Calcium Ammonium Nitrate (CAN), Monoammonium Phosphate (MAP), Sulfate of Potash (SOP), Potassium Nitrate, Urea Derivatives, Others), By Technology (Water-soluble Fertilizers, Controlled-release Fertilizers, Liquid Fertilizers, Micronutrients, Others), By Form (Dry, Liquid), By Application Methods (Fertigation, Foliar, Soil), Ву Сгор Туре (Cereals and Grains, Oilseeds and Pulses, Fruits and Vegetables, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Nutrien Ltd., Yara, ICL, The Mosaic Company, CF Industries and Holdings, Inc., Nufarm, SQM SA, OCP Group, Kingenta, K+S Aktiengesellschaft Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Specialty Fertilizers MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Specialty Fertilizers MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Nutrien Ltd.

- Yara

- ICL

- The Mosaic Company

- CF Industries and Holdings, Inc.

- Nufarm

- SQM SA

- OCP Group

- Kingenta

- K+S Aktiengesellschaft