Global Solar Silicon Wafer Market Size, Share Analysis Report By Product (Monocrystalline Wafer, Polycrystalline Wafer), By Application (PV Modules, Inverter, Solar Cell, Solar Racking System, Solar Battery, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169912

- Number of Pages: 348

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

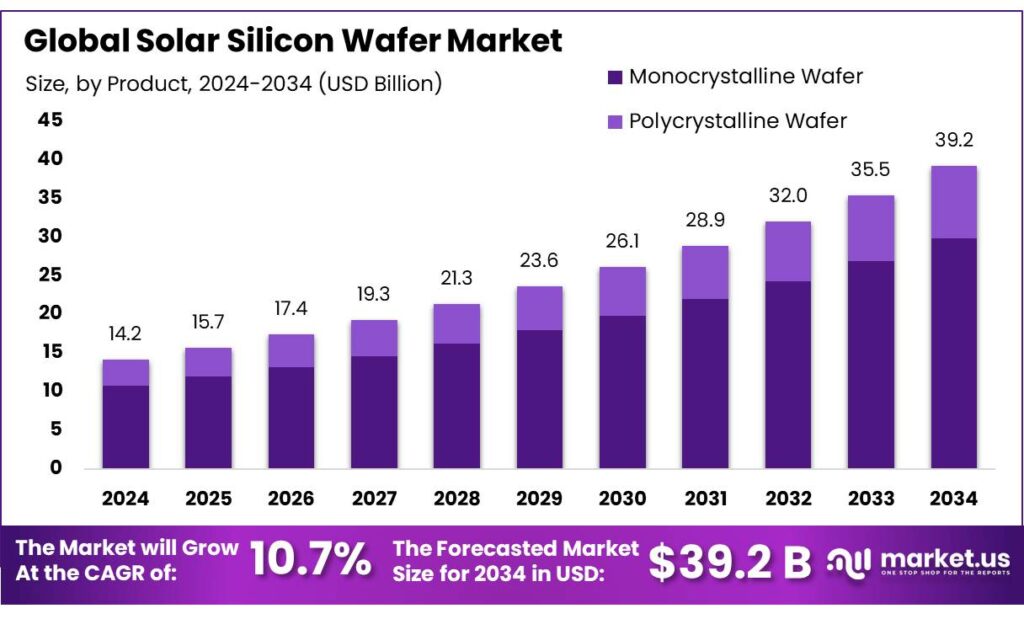

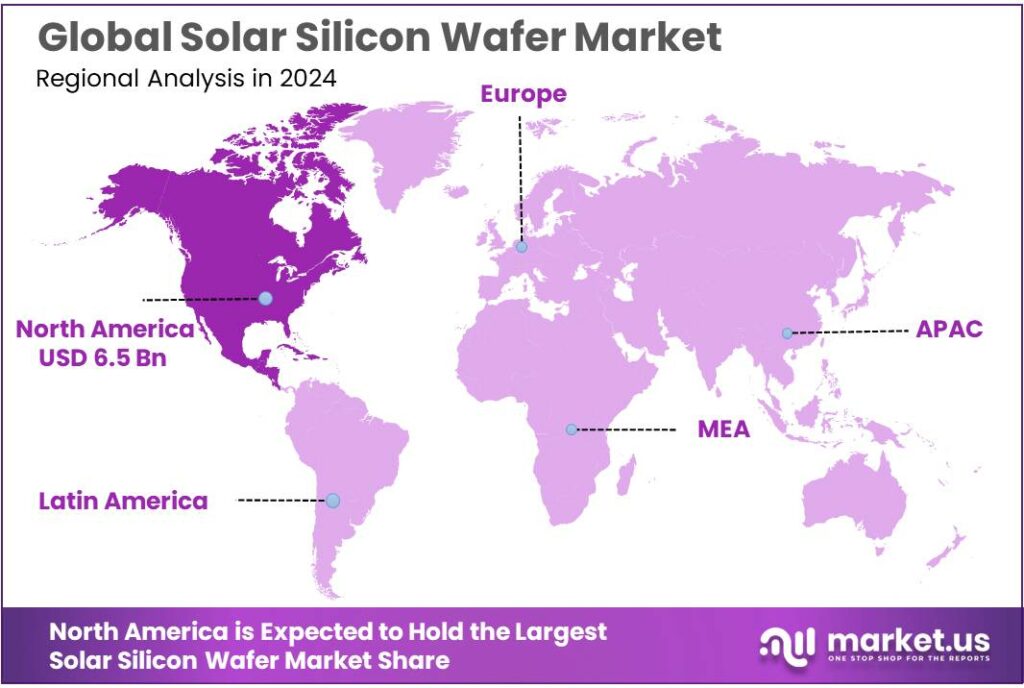

The Global Solar Silicon Wafer Market size is expected to be worth around USD 39.2 Billion by 2034, from USD 14.2 Billion in 2024, growing at a CAGR of 10.7% during the forecast period from 2025 to 2034. In 2024, North American held a dominant market position, capturing more than a 46.30% share, holding USD 6.5 Billion revenue.

Solar silicon wafers sit at the heart of the photovoltaic (PV) value chain, converting purified polysilicon into precisely sliced substrates on which cells are manufactured. The strength of this industry is tied directly to global solar deployment. In 2024, the world commissioned over 600 GW of new PV systems, taking cumulative installed capacity to well above 2.2 TW, according to IEA PVPS and IRENA. Solar PV alone contributed roughly 452 GW of added capacity in 2024, representing the vast majority of new solar power additions and underlining a structural, not cyclical, demand base for wafers.

- Industrial production of solar wafers is extremely concentrated. EnergyTrend data show that silicon wafer production capacity in mainland China reached about 953.6 GW by the end of 2023, accounting for 97.9% of global capacity. Academic analysis suggests a similar picture, estimating that around 98% of global wafer output is produced in China, giving Chinese suppliers near-monopoly control over this critical intermediate. By 2024, global wafer manufacturing capacity rose further to about 1,395 GW per year, with China alone responsible for roughly 1,349 GW, intensifying concerns over oversupply and price volatility along the chain.

The main demand-side driver for wafer producers is the rapid expansion of renewables in power systems. IEA projects that global renewable capacity additions will rise from about 666 GW in 2024 to almost 935 GW in 2030, with solar PV and wind accounting for around 95% of these additions due to their cost advantage.

IRENA’s 1.5°C pathway goes even further, indicating annual renewable power additions of roughly 1,066 GW per year between now and 2050, implying sustained multi-hundred-gigawatt annual demand for wafers for decades. Continued declines in PV generation costs, documented by IRENA’s tracking of falling levelised costs alongside a record 473 GW of renewable capacity additions in 2023, reinforce the economic pull for wafer-based solar technologies in both mature and emerging markets.

- Government industrial policy is reshaping the wafer landscape by pushing new, geographically diversified capacity. In India, the Production-Linked Incentive (PLI) scheme for high-efficiency PV modules, with an outlay of ₹24,000 crore and a targeted 48.3 GW of manufacturing capacity, has already supported a domestic module capacity of 121.68 GW as of late 2025 and explicitly encourages upstream integration into ingots and wafers.

India’s clean energy ministry has warned banks about financing excessive stand-alone module lines, noting that module capacity may rise to 200 GW and cell capacity to 100 GW, and urging preference for fully integrated polysilicon-ingot-wafer-cell facilities to reduce import dependence and overcapacity risk.

Key Takeaways

- Solar Silicon Wafer Market size is expected to be worth around USD 39.2 Billion by 2034, from USD 14.2 Billion in 2024, growing at a CAGR of 10.7%.

- Monocrystalline Wafer held a dominant market position, capturing more than a 76.3% share.

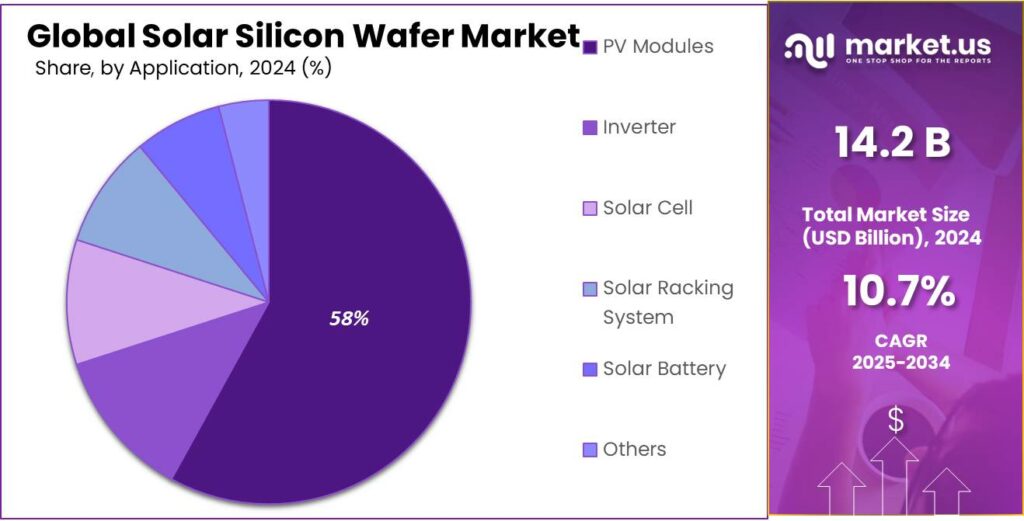

- PV Modules held a dominant market position, capturing more than a 58.7% share.

- North America emerged as the leading regional market for solar silicon wafers, accounting for 46.30% of regional share and an estimated USD 6.5 billion.

By Product Analysis

Monocrystalline Wafer dominates with 76.3% due to high efficiency and growing adoption in solar installations.

In 2024, Monocrystalline Wafer held a dominant market position, capturing more than a 76.3% share as demand increased for high-efficiency solar modules in residential, commercial, and utility-scale projects. The preference for monocrystalline wafers was driven by their superior energy conversion rates, durability, and space efficiency compared to other wafer types. In 2025, the segment continued to expand as manufacturers focused on upgrading production lines to meet rising global demand and governments promoted renewable energy adoption through incentives and policy support.

Technological advancements in wafer fabrication, such as improved crystal growth techniques and reduced material wastage, contributed to cost optimization and enhanced performance, strengthening the segment’s market position. The strong adoption of monocrystalline wafers was particularly notable in regions with limited installation space, where high-efficiency solutions were critical for maximizing energy output. Overall, the segment’s growth reflects a combination of technological superiority, cost-effectiveness over the product lifecycle, and increasing global emphasis on sustainable energy solutions.

By Application Analysis

PV Modules dominate with 58.7% as demand for efficient solar power generation continues to rise.

In 2024, PV Modules held a dominant market position, capturing more than a 58.7% share as global solar installations expanded across residential, commercial, and utility-scale sectors. The segment’s growth was supported by rising adoption of high-performance silicon wafers that improved module efficiency and long-term reliability. In 2025, demand remained steady due to continued government incentives, declining module costs, and wider integration of solar power in grid and off-grid systems.

Increasing investments in large solar farms and rooftop installations further strengthened the segment, as PV modules remained the primary application for silicon wafers owing to their proven durability, scalability, and compatibility with advanced manufacturing technologies. The segment’s sustained leadership reflected strong project pipelines, improving energy yields, and the shift toward clean energy across major global markets.

Key Market Segments

By Product

- Monocrystalline Wafer

- Polycrystalline Wafer

By Application

- PV Modules

- Inverter

- Solar Cell

- Solar Racking System

- Solar Battery

- Others

Emerging Trends

Shift Toward High-Efficiency N-Type Silicon Wafers

One of the clearest new trends in the solar silicon wafer world is the rapid move from older p-type technologies to high-efficiency n-type wafers, especially those used in TOPCon and other advanced cell designs. At system level, solar is already the main growth engine: the International Renewable Energy Agency (IRENA) reports that global solar PV capacity reached about 1,865 GW by the end of 2024, up by roughly 452 GW in just one year, and accounting for more than three-quarters of all renewable capacity added in 2024.

Inside that boom, the cell and wafer technology mix is shifting fast. The US National Renewable Energy Laboratory’s Spring 2024 Solar Industry Update shows that in 2023 around 98% of global PV shipments were monocrystalline silicon, up from only 35% in 2015. Even more striking, n-type mono silicon grew to about 63% of global shipments in 2023, up from just 5% in 2019.

NREL’s Spring 2025 Solar Industry Update finds that in 2024 monocrystalline still made up about 98% of PV shipments, but n-type mono grew further to around 70%, while TOPCon became the leading cell type with roughly 58% share of global shipments. That shift is only possible because ingot and wafer producers are now routinely pulling n-type crystals and slicing them into thin, large-format wafers at scale. In human terms, the “default” wafer on a modern line is now an n-type product designed for high-efficiency cells, not the older PERC architecture many engineers started their careers with.

On the manufacturing side, the International Energy Agency (IEA) notes that in 2023 global solar PV manufacturing capacity across the chain surged, with wafer capacity alone increasing by around 60%, while polysilicon capacity reached roughly 850 GW. Much of that new capacity is specifically configured for high-throughput n-type ingot growth and wafering. This scaling effort is not just about volume; it is also about quality and consistency, because TOPCon and other advanced cells demand tighter wafer tolerances, lower defect levels, and very uniform resistivity.

Drivers

Global Solar Build-Out Fuels Wafer Demand

The biggest force driving the solar silicon wafer market is the sheer speed at which the world is adding new solar power. Solar wafers are the base on which almost every crystalline silicon cell is built, so every gigawatt of new PV capacity translates directly into wafer demand. According to REN21’s Global Status Report, global installed solar PV capacity reached about 2.25 TW by the end of 2024, up from roughly 1.65 TW in 2023, with annual additions hitting a record 602 GW.

This surge is part of a broader renewable boom that keeps silicon wafer lines running at very high utilization. IRENA’s 2025 Renewable Capacity Statistics show that renewables added around 585 GW in 2024, accounting for roughly 92.5% of all new power capacity worldwide and lifting total renewable capacity to about 4,448 GW. Solar PV makes up the largest slice of this expansion, so wafer makers benefit from a demand curve that is rising faster than most other energy technologies.

- Policy commitments give this demand a long-term, predictable feel rather than a short boom. At COP28, more than 100 countries signed a pledge to triple global renewable power capacity to at least 11,000 GW by 2030. Both the COP28 Presidency and the IEA highlight this 11 TW target as central to keeping the 1.5°C pathway alive, placing solar PV at the core of national energy plans.

National industrial policies add another layer of support for wafer demand. India’s Production-Linked Incentive scheme for high-efficiency solar PV modules, backed by ₹24,000 crore (around USD 2.9 billion), has awarded 48.3 GW of integrated and partially integrated module manufacturing capacity. As a result, India’s installed module manufacturing capacity has already reached about 121.68 GW, with projections that it could exceed 165 GW by 2027.

Restraints

Oversupply and Imbalanced Manufacturing Capacity

One major restraining factor for the solar-silicon wafer industry is the persistent oversupply and structural imbalance between manufacturing capacity and actual demand. While this may sound like a good problem — “we have enough wafers for everyone” — the reality is much harsher: oversupply undermines prices, erodes margins, and threatens to destabilise smaller wafer and module makers worldwide.

- According to the International Energy Agency (IEA), by the end of 2024 global solar PV manufacturing capacity — including polysilicon, ingots, wafers, cells and modules — had reached over 1,100 GW per year, which is more than double what installation projections require. Because of this imbalance, the report says many PV manufacturers have seen negative profit margins, and as a result roughly 300 GW of planned polysilicon capacity and 200 GW of wafer capacity have already been cancelled worldwide — representing a capital value of about USD 25 billion.

The same IEA report notes that for many integrated PV firms, module prices have more than halved since early 2023 because of surplus capacity and intense competition. Second, many manufacturers — especially smaller or less efficient ones — face existential risk: estimates suggest that as much as 10% of wafer manufacturing capacity globally could already be “at risk,” due to outdated processes or poor economies of scale.

The oversupply challenge is also playing out at the national level. For example, in India, the domestic module manufacturing capacity is projected to exceed 125 GW in 2025 — more than triple the country’s likely domestic solar demand (around 40 GW), according to a recent review. That suggests a potential inventory glut of close to 29 GW. What’s more, export prospects — which many manufacturers counted on to offload excess production — are shrinking because of tighter trade rules and surging protections in major importing regions.

Opportunity

High-Efficiency and Regionalized Wafers for Net-Zero

A huge growth opportunity for solar silicon wafer makers lies in upgrading to high-efficiency wafers while spreading manufacturing across more regions to support net-zero climate goals. The world is already installing solar at a breathtaking pace. REN21 notes that global installed solar PV capacity grew by about 37% between 2023 and 2024 and passed the 2 TW mark less than two years after crossing 1 TW.

Looking forward, the scale of solar needed for climate targets is far larger. Under IRENA’s 1.5°C Scenario, installed solar PV capacity would exceed 5,400 GW by 2030 and jump to around 18,200 GW by 2050. Another IRENA analysis on global hydrogen trade suggests that almost 14 TW of solar PV could be needed by 2050 to support a net-zero energy system. Every extra terawatt of solar means billions of additional high-quality wafers, especially larger-format, n-type designs that deliver more power per panel.

Policy is opening a second, equally important door: regional diversification of ingot and wafer manufacturing. A 2024 study for the European Solar Initiative notes that ingot and wafer production is the most vulnerable part of the PV supply chain, and the EU’s Net-Zero Industry Act aims for at least 40% of the Union’s annual solar PV deployment to be met by EU manufacturing capacity by 2030. This target creates room for new wafer plants in Europe that can offer low-carbon, traceable products to local module makers and utility projects, reducing reliance on a single overseas source.

India offers another clear example of how industrial policy is creating wafer-level opportunities. The country’s Production-Linked Incentive (PLI) scheme for high-efficiency solar PV modules carries an outlay of INR 24,000 crore and has already awarded 48.3 GW of integrated and partially integrated manufacturing capacity, generating roughly 43,000 jobs across nine states. Official statements indicate that domestic module capacity is expected to exceed 165 GW by March 2027, with clear encouragement to integrate upstream into cells, ingots and wafers.

Regional Insights

North America leads with 46.3% and a market value of USD 6.5 Bn.

In 2024, North America emerged as the leading regional market for solar silicon wafers, accounting for 46.30% of regional share and an estimated USD 6.5 billion in market value; this leadership was underpinned by rapid expansion of module manufacturing, supportive policy incentives, and sizeable utility-scale project pipelines. Strong downstream demand from large PV module and cell manufacturers accelerated procurement of high-quality monocrystalline wafers, while rising domestic capacity additions reduced dependence on imports and shortened supply chains.

Investment in new ingot-to-wafer lines and improvements in crystal growth and wafer slicing helped raise wafer output and improve wafer quality, contributing to better module conversion efficiency and lower levelized cost of energy for major projects. The commercial and industrial rooftop segments also supported demand growth, driven by corporate renewable procurement and community solar programs that increased installations across multiple states.

Logistics and trade dynamics influenced pricing volatility during the year, but near-term offtake agreements and long-term supply contracts moderated exposure for large buyers. Research and development activity focused on yield improvement and material-use efficiency, further strengthening the region’s competitive position.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

LONGi reported full-year 2024 revenue of CNY 82.58 billion and disclosed silicon wafer shipments of 82.8 GW for the reporting period; wafer external sales were 35.03 GW in the prior reporting window. The company’s scale and wafer output underpin its leading role in the monocrystalline wafer supply chain.

JA Solar’s 2024 disclosures reported full-year revenue near CNY 69–70 billion and highlighted continued module and wafer production investments; annual results signalled pressure on margins but sustained production capacity for wafers and cells. The company remains a significant wafer-to-module integrator.

Trina Solar reported H1 2024 revenue of approximately USD 6.05 billion and module shipments of 34 GW in the first half; cumulative 210mm module shipments exceeded 140 GW, underpinning strong downstream demand for high-quality wafers and integrated supply chain advantage.

Top Key Players Outlook

- LONGI Green Energy Technology Co Ltd

- GCL-Poly Energy Holdings Limited

- JA Solar Holdings, Co., Ltd.

- Jinko Solar Holding Co., Ltd.

- Trina Solar

- Canadian Solar

- Hanwha Q CELLS

Recent Industry Developments

In 2024 Trina Solar reported revenue of USD 6.047 billion and module shipments of 34 GW, reflecting strong operational throughput as demand for high-efficiency, large-format modules grew.

GCL-Poly Energy (GCL Technology) reported a challenging but active 2024 as a major polysilicon and wafer-feedstock supplier: the group recorded revenue of CNY 15.1 billion and a net loss of CNY 4.75 billion for the year, reflecting severe price pressure across the polysilicon chain.

Report Scope

Report Features Description Market Value (2024) USD 14.2 Bn Forecast Revenue (2034) USD 39.2 Bn CAGR (2025-2034) 10.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Monocrystalline Wafer, Polycrystalline Wafer), By Application (PV Modules, Inverter, Solar Cell, Solar Racking System, Solar Battery, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape LONGI Green Energy Technology Co Ltd, GCL-Poly Energy Holdings Limited, JA Solar Holdings, Co., Ltd., Jinko Solar Holding Co., Ltd., Trina Solar, Canadian Solar, Hanwha Q CELLS Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- LONGI Green Energy Technology Co Ltd

- GCL-Poly Energy Holdings Limited

- JA Solar Holdings, Co., Ltd.

- Jinko Solar Holding Co., Ltd.

- Trina Solar

- Canadian Solar

- Hanwha Q CELLS