Global Solar PV Market Size, Share, And Industry Analysis Report By Connectivity (On Grid, Off Grid), By Mounting Type (Ground Mounted, Roof Top), By End Use (Utility, Residential, Commercial and Industrial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 167854

- Number of Pages: 214

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

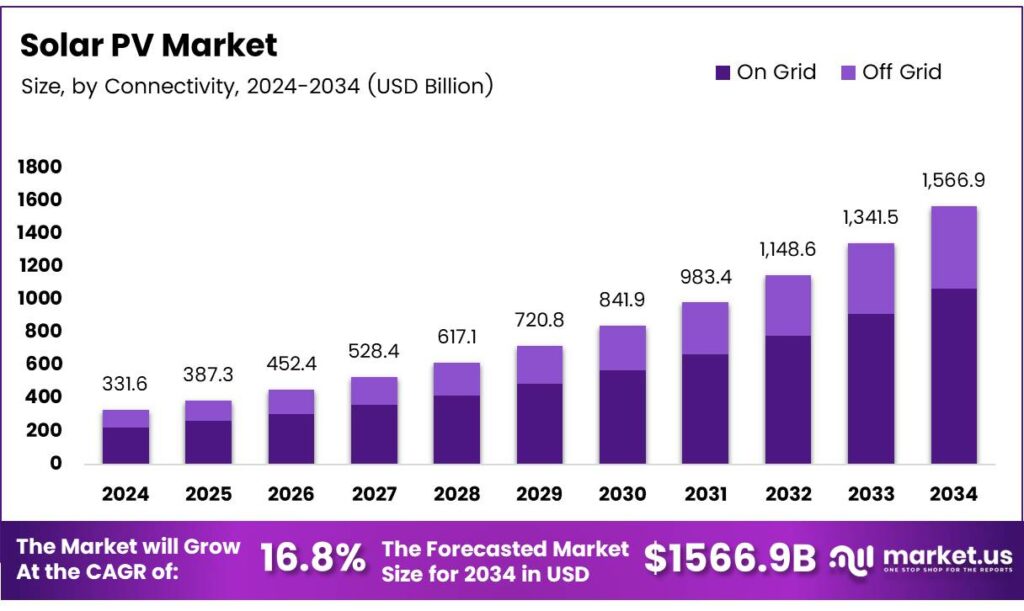

The Global Solar PV Market size is expected to be worth around USD 1566.9 billion by 2034, from USD 331.6 billion in 2024, growing at a CAGR of 16.8% during the forecast period from 2025 to 2034.

The Solar PV market refers to systems that convert sunlight into electricity using photovoltaic cells for commercial, residential, and utility use. It covers modules, inverters, mounting structures, grid energy connection, and services. Importantly, Solar PV supports clean power generation, cost stability, and long-term energy security across global power markets.

Solar PV represents a scalable energy solution aligned with decarbonization goals and rising electricity demand. As energy prices fluctuate, businesses increasingly prefer predictable generation costs. Moreover, falling installation timelines, improved system efficiency, and steady policy backing continue to strengthen Solar PV adoption across mature and emerging economies.

- The U.S. National Renewable Energy Laboratory, a utility-scale solar project, typically produces 10 MW or more of electricity. Meanwhile, the U.S. Energy Information Administration states an average American household consumes about 900 kWh, or 0.9 MWh, monthly. The Datong solar installation spans 250 acres and generates 100 MW of power. It can offset nearly 1 million tons of coal and supply electricity to about 60000 homes, demonstrating Solar PV’s measurable economic and environmental value.

The Solar PV market shows strong growth fundamentals supported by industrial electrification and renewable energy portfolio targets. Gradually, clean-energy procurement strategies are shifting toward long-term power purchase agreements. Solar PV enables utilities, industries, and municipalities to lock in energy costs while improving sustainability performance. Government investment remains a decisive force shaping the Solar PV market trajectory. Through incentives, grid-connection reforms, and renewable auctions.

Key Takeaways

- The Global Solar PV Market is projected to grow from USD 331.6 billion in 2024 to USD 1566.9 billion by 2034, registering a strong 16.8% CAGR.

- On-grid Solar PV systems dominate the connectivity segment with a leading share of 79.3%, supported by grid expansion and national energy policies.

- Ground-mounted installations hold the largest mounting share at 69.2%, driven by large-scale utility projects and cost-efficient deployment.

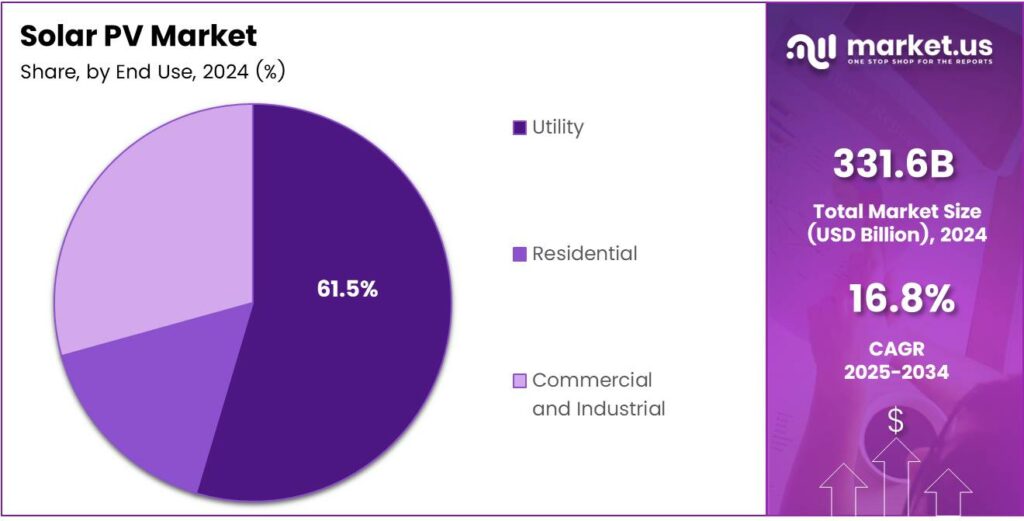

- The Utility end-use segment leads the market with a dominant share of 61.5%, reflecting high-capacity power generation and long-term contracts.

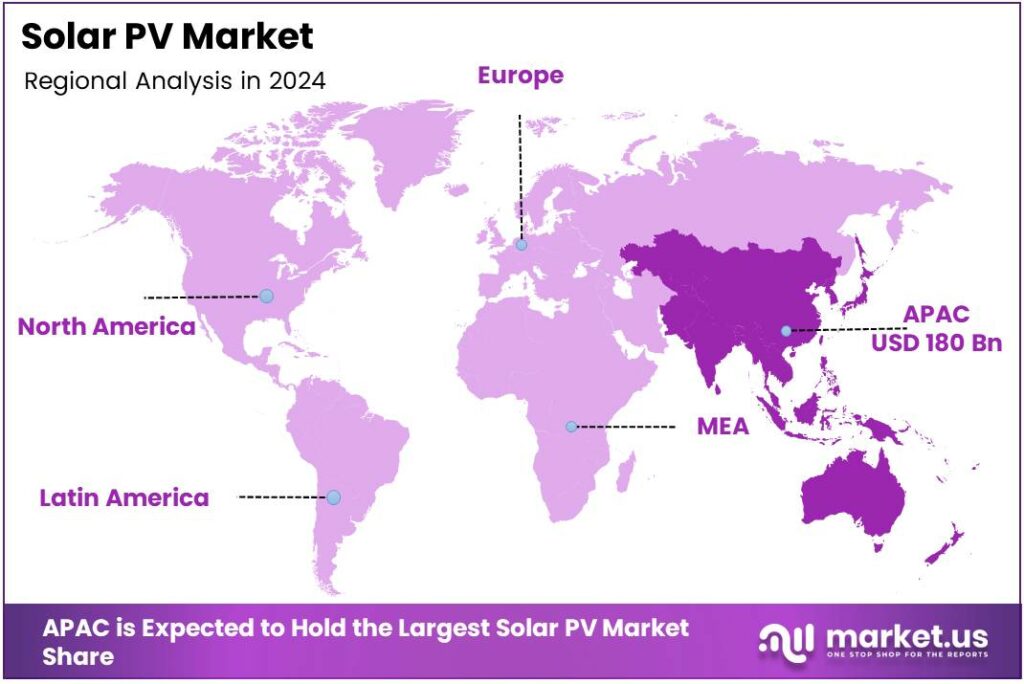

- Asia Pacific remains the dominant regional market, accounting for 54.3% of the global share, valued at USD 180.0 billion.

By Connectivity Analysis

On-grid dominates with 79.3% due to its strong alignment with national power policies and grid expansion programs.

In 2024, On Grid held a dominant market position in the By Connectivity Analysis segment of the Solar PV Market, with a 79.3% share. This dominance is driven by utility integration, stable revenue models, and long-term power purchase agreements. As grid infrastructure improves, investors increasingly prefer grid-connected solar projects.

The on-grid segment benefits from reliable power evacuation and easier financing access. Moreover, governments actively support grid-connected solar through policies promoting clean energy targets. As a result, large-scale solar parks and distributed grid systems continue to expand steadily, reinforcing this segment’s leadership across both developed and emerging solar markets.

The off-grid segment, while smaller, plays a vital role in remote and rural electrification. It supports areas lacking grid access and ensures energy independence. Additionally, off-grid systems improve energy resilience for telecom towers, agriculture, and isolated communities, maintaining steady relevance despite slower growth compared to grid-connected installations.

By Mounting Type Analysis

Ground-mounted dominates with 69.2% due to high capacity installation potential and cost efficiency.

In 2024, Ground Mounted held a dominant market position in the By Mounting Type Analysis segment of the Solar PV Market, with a 69.2% share. This leadership reflects strong adoption in utility-scale projects, where land availability allows optimal panel orientation and higher energy output.

Ground-mounted systems offer easier maintenance and scalable expansion possibilities. Consequently, developers favour them for large solar parks and long-term projects. Furthermore, these installations benefit from lower per-unit costs, making them attractive for meeting large renewable energy targets efficiently.

The Roof Top segment focuses on space optimisation in urban and semi-urban areas. It supports distributed generation and reduces transmission losses. Although smaller than ground-mounted systems, rooftop solar appeals strongly to households and businesses seeking energy savings and sustainability alignment.

By End Use Analysis

Utility dominates with 61.5% due to large-scale power generation and long-term procurement contracts.

In 2024, Utility held a dominant market position in the By End Use Analysis segment of the Solar PV Market, with a 61.5% share. This dominance stems from large-capacity installations designed to meet national electricity demand and carbon-reduction commitments.

The Utility segment benefits from economies of scale and structured bidding mechanisms. Moreover, utilities rely on solar PV to stabilise power supply and diversify energy portfolios. As grid demand rises, utility-scale solar remains central to long-term energy planning strategies.

The Residential segment supports household energy independence and lower electricity bills. It enables consumers to generate power directly at the point of use. Although on a smaller scale, residential solar adoption continues to grow steadily due to increasing clean energy awareness.

The Commercial and Industrial segment focuses on cost optimisation and sustainability targets. Businesses use solar PV to reduce operating expenses and improve energy security. Collectively, residential and commercial users complement utility installations by strengthening distributed solar growth.

Key Market Segments

By Connectivity

- On Grid

- Off Grid

By Mounting Type

- Ground Mounted

- Roof Top

By End Use

- Utility

- Residential

- Commercial and Industrial

Emerging Trends

Technological Advancements and Energy Storage Shape Solar PV Market Trends

One of the key trends in the Solar PV market is rapid improvement in panel efficiency. Manufacturers are developing advanced cell technologies that produce more power from the same area. This reduces land use and lowers overall system costs, especially for rooftop installations. Energy storage integration is another important trend.

- Solar projects combined with battery storage are becoming more common, helping manage power fluctuations. This trend supports better grid stability and increases solar usage during evening hours. The International Energy Agency (IEA) reports that globally, solar PV is expected to account for roughly 80% of the growth in renewable power capacity between 2024 and 2030.

Digital monitoring, smart inverters, and AI-based energy management are also shaping the market. These tools help operators optimise performance and reduce maintenance costs. Additionally, floating solar projects and agrivoltaics are emerging as innovative solutions. Together, these trends are making solar PV more efficient, flexible, and reliable.

Drivers

Rising Demand for Clean and Affordable Energy Drives Solar PV Market Growth

The Solar PV market is strongly driven by the global need for clean and low-cost electricity. Many countries are shifting away from coal and oil to reduce air pollution and carbon emissions. Solar PV systems help governments meet climate targets while improving energy security. Falling solar panel prices also make solar power more affordable for utilities, businesses, and households.

- Many governments offer subsidies, tax benefits, and feed-in tariffs to promote solar installations. Large public investments in solar parks and rooftop programs are accelerating adoption. Utilities are adding large-scale solar projects to meet rising power demand without increasing fuel imports. The global weighted average levelised cost of electricity (LCOE) for utility-scale solar PV fell from USD 0.417 per kWh in 2010 to just USD 0.043 per kWh by 2024.

Growing electricity consumption from urbanisation, electric vehicles, and data centres is also supporting solar growth. Solar PV is quick to install and scalable, making it suitable for both large plants and small rooftops. Together, cost reduction, policy backing, and rising power needs continue to push the Solar PV market forward.

Restraints

Intermittency and High Initial Costs Limit Solar PV Market Expansion

Despite strong growth, the Solar PV market faces several restraints. One major challenge is the intermittent nature of solar power. Electricity generation depends on sunlight, which is not available at night and varies with the weather. This creates reliability concerns for grid operators, especially in regions with weak storage systems.

High upfront installation costs also act as a barrier, especially for residential and small commercial users. Although long-term savings are attractive, the initial investment for panels, inverters, and installation can discourage buyers without financing support. In developing regions, limited access to affordable loans slows adoption.

Land availability is another issue for large solar plants. Utility-scale projects require strong grid connectivity and large land areas, which can be difficult near cities. Grid integration challenges, such as voltage fluctuations and limited transmission capacity, also restrain growth. These technical and financial barriers need solutions to unlock the full potential of solar power.

Growth Factors

Expansion of Utility-Scale and Distributed Solar Creates New Opportunities

The Solar PV market offers strong growth opportunities across both utility-scale and distributed solar segments. Many countries are planning large solar parks to meet future electricity demand. These projects provide long-term power at stable costs and attract private investment through power purchase agreements.

- Rising electricity tariffs are encouraging consumers to generate their own power. Corporate renewable energy goals are also driving rooftop and captive solar installations in industries and offices. The Global solar manufacturing capacity is expected to reach over 1,100 GW by the end of 2024. The government allocated a domestic solar-module manufacturing capacity of 39.6 GW to 11 companies, with an outlay of ₹14,007 crores.

Another major opportunity lies in combining solar PV with energy storage systems. Batteries allow solar energy to be stored and used during peak hours, improving reliability. Solar integration with green hydrogen production is also gaining attention. As technology improves and financing models expand, solar PV is expected to reach new markets and applications.

Regional Analysis

Asia Pacific Dominates the Solar PV Market with a Market Share of 54.3%, Valued at USD 180.0 Billion

Asia Pacific leads the global Solar PV market due to rapid capacity additions across China, India, Southeast Asia, and Australia. In 2024, the region accounted for a dominant 54.3% share, reaching a value of USD 180.0 billion, supported by large utility-scale projects and strong domestic manufacturing ecosystems. Favourable government policies, falling module prices, and rising electricity demand continue to accelerate solar installations across both urban and rural areas.

North America shows steady growth driven by grid decarbonization goals, rising corporate renewable procurement, and supportive tax incentives. Utility-scale solar remains the key deployment model, while rooftop adoption continues to expand in residential and commercial sectors. Investments in energy storage integration and grid modernisation further strengthen long-term regional solar demand.

Europe’s Solar PV market growth is supported by energy security concerns and aggressive climate targets. Countries across Western and Southern Europe are accelerating solar deployment to reduce dependence on fossil fuel imports. Rooftop solar, community solar projects, and repowering of older installations are key contributors to sustained market expansion.

The Middle East and Africa region is emerging as a fast-growing Solar PV market, supported by high solar irradiation and large-scale desert-based projects. Governments are increasingly adopting solar to diversify energy mixes and reduce fuel subsidies. Utility-scale auctions and public-private partnerships remain central to regional market development.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

RENESOLA remains a nimble challenger in the global photovoltaic arena, leveraging its historical strength as both a module supplier and project EPC provider. The company’s recent signing of a 1 GW framework agreement underscores its commitment to scaling into new geographies and balancing upstream module manufacturing with downstream project development. By focusing on flexible, contract-driven growth and efficient cost structures.

KYOCERA Corporation continues to leverage its broad industrial platform to support its solar-generation and PV system segments as part of its wider materials and electronics operations. As it pivots from pure module manufacturing toward integrated energy solutions (such as roof-top systems and surplus-solar procurement programmes in Japan), Kyocera is gradually building a roof-top-and-balance-of-system presence rather than just a panel supplier.

Hanwha Group is firmly positioned as a vertically integrated solar player, combining module manufacturing (via its Q CELLS business) with upstream raw-material exposure and project development globally. Its investment in a major U.S. module facility and its push into the polysilicon supply chain control provide it with a strategic cost advantage heading into a crowded market.

REC Solar, Inc. (as part of the larger REC Group) remains differentiated by its strong brand reputation for module reliability and warranties, making it a trusted name in residential and commercial PV markets. The firm’s emphasis on premium-tier module technology and sustainability credentials helps carve out a niche amid commoditised volume players — but balancing premium positioning with cost-competitiveness is increasingly challenging as module prices continue to decline and buyers demand ever-lower per-watt pricing.

Top Key Players in the Market

- RENESOLA

- KYOCERA Corporation

- Hanwha Group

- REC Solar, Inc.

- Jinko Solar

- JA SOLAR Technology Co., Ltd.

- First Solar

- Wuxi Suntech Power Co., Ltd.

- Canadian Solar

- Trinasolar

Recent Developments

- In 2025, Renesola signed a 250MW annual PV module supply framework with Serrana Solar, Brazil’s largest distributor. This deal bolsters Renesola’s Latin American presence, delivering modules tailored for regional grid integration and low-carbon energy goals.

- In 2025, Kyocera will supply non-FIT (feed-in tariff) solar power to TOPPAN Holdings sites, marking its first external commercial aggregation deal. This leverages Kyocera’s industrial PPAs and residential solar services to deliver surplus renewable electricity, supporting Japan’s carbon neutrality goals.

Report Scope

Report Features Description Market Value (2024) USD 331.6 Billion Forecast Revenue (2034) USD 1566.9 Billion CAGR (2025-2034) 16.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Connectivity (On Grid, Off Grid), By Mounting Type (Ground Mounted, Roof Top), By End Use (Utility, Residential, Commercial and Industrial) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape RENESOLA, KYOCERA Corporation, Hanwha Group, REC Solar, Inc., Jinko Solar, JA SOLAR Technology Co., Ltd., First Solar, Wuxi Suntech Power Co., Ltd., Canadian Solar, Trinasolar Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- RENESOLA

- KYOCERA Corporation

- Hanwha Group

- REC Solar, Inc.

- Jinko Solar

- JA SOLAR Technology Co., Ltd.

- First Solar

- Wuxi Suntech Power Co., Ltd.

- Canadian Solar

- Trinasolar