Global Soil Conditioners Market Size, Share, Analysis Report By Product Type (Organic, Inorganic), By Formulation (Dry, Liquid, Granular, Others), By Form (Water Soluble, Hydrogels), By Soil Type (Loam, Sand, Peat, Silt, Clay, Others), By Crop Type (Cereals and Grains, Fruits and Vegetables, Oilseeds and Pulses, Others), By Application (Agriculture, Constructions and Mining, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 156090

- Number of Pages: 329

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

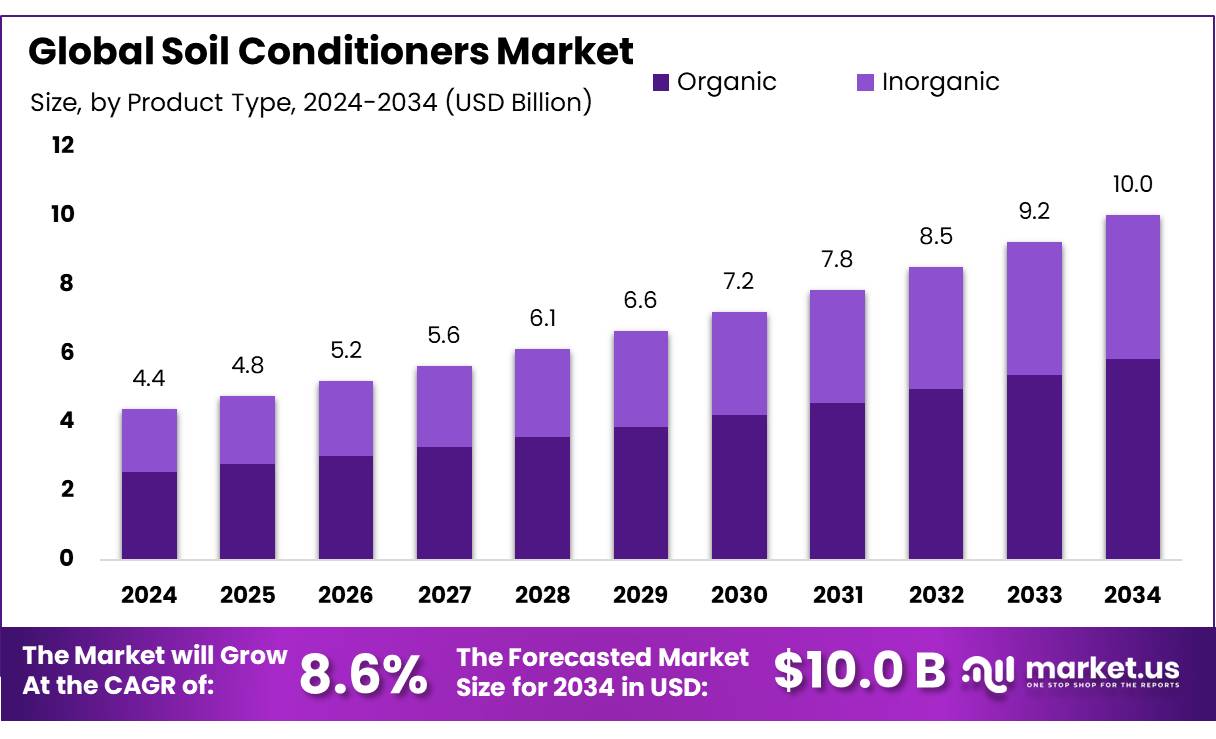

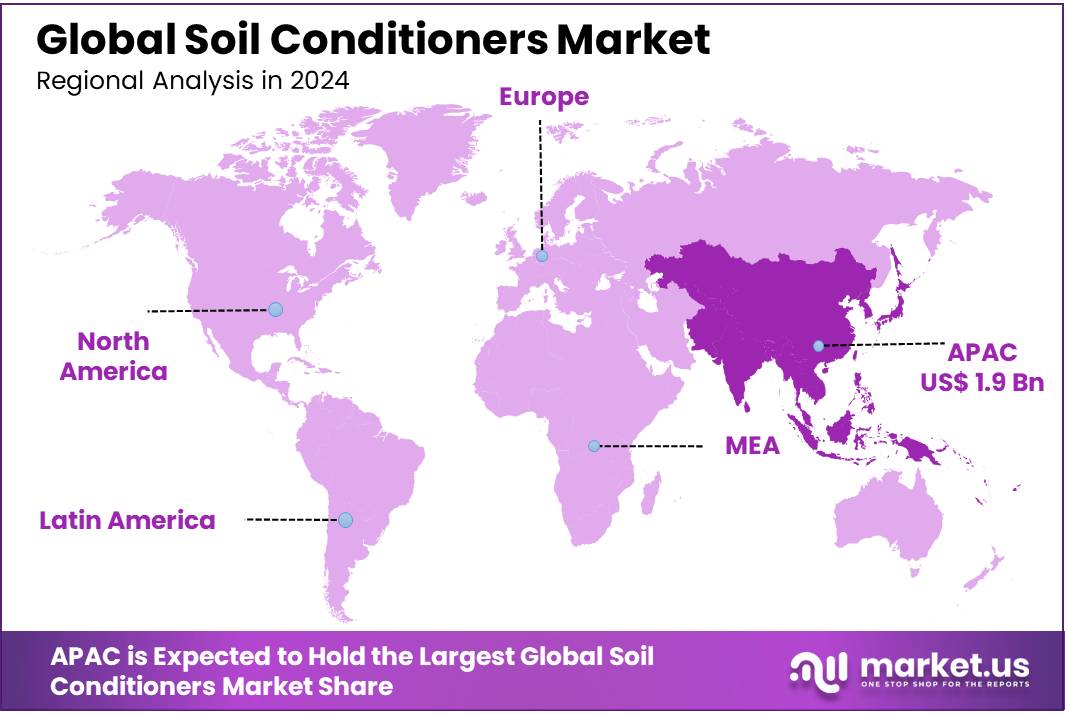

The Global Soil Conditioners Market size is expected to be worth around USD 10.0 Billion by 2034, from USD 4.4 Billion in 2024, growing at a CAGR of 8.6% during the forecast period from 2025 to 2034. In 2024, Asia Pacific held a dominant market position, capturing more than a 43.20% share, holding USD 1.9 Billion revenue.

Soil conditioners concentrates include mineral and organic amendments—such as gypsum/lime granules, humic substances, compost-derived concentrates, and biochar—formulated for efficient application to improve structure, organic matter, infiltration, and nutrient availability. The industrial context is shaped by the scale of soil degradation and by policy-led soil health programs. The UN system estimates that roughly one-third of the world’s soils are already degraded and up to 40% of land shows signs of degradation, putting food systems and water resources at risk; this underpins steady demand for conditioners that rebuild aggregate stability and organic matter.

India’s agricultural sector faces pressing issues such as declining soil fertility, overuse of chemical fertilizers, and water scarcity. To combat these challenges, the government has implemented several initiatives. The Soil Health Card Scheme, launched in 2015, aims to provide farmers with soil health assessments and recommendations for balanced fertilizer usage. As of March 2025, over 24.84 crore Soil Health Cards have been issued to farmers, promoting judicious use of inputs and enhancing soil health management.

Additionally, the National Mission for Sustainable Agriculture (NMSA) focuses on promoting integrated nutrient management, organic farming, and soil health management practices. Under this mission, financial assistance of ₹2,500 per hectare is provided to farmers for adopting recommended practices, including the use of biochar as a soil amendment. These efforts align with the government’s broader objectives of enhancing agricultural productivity and sustainability.

Key Takeaways

- Soil Conditioners Market size is expected to be worth around USD 10.0 Billion by 2034, from USD 4.4 Billion in 2024, growing at a CAGR of 8.6%.

- Organic held a dominant market position, capturing more than a 58.2% share in the Soil Conditioners Market.

- Dry held a dominant market position, capturing more than a 45.8% share in the Soil Conditioners Market.

- Water Soluble held a dominant market position, capturing more than a 69.5% share in the Soil Conditioners Market.

- Loam held a dominant market position, capturing more than a 33.1% share in the Soil Conditioners Market.

- Cereals and Grains held a dominant market position, capturing more than a 44.6% share in the Soil Conditioners Market.

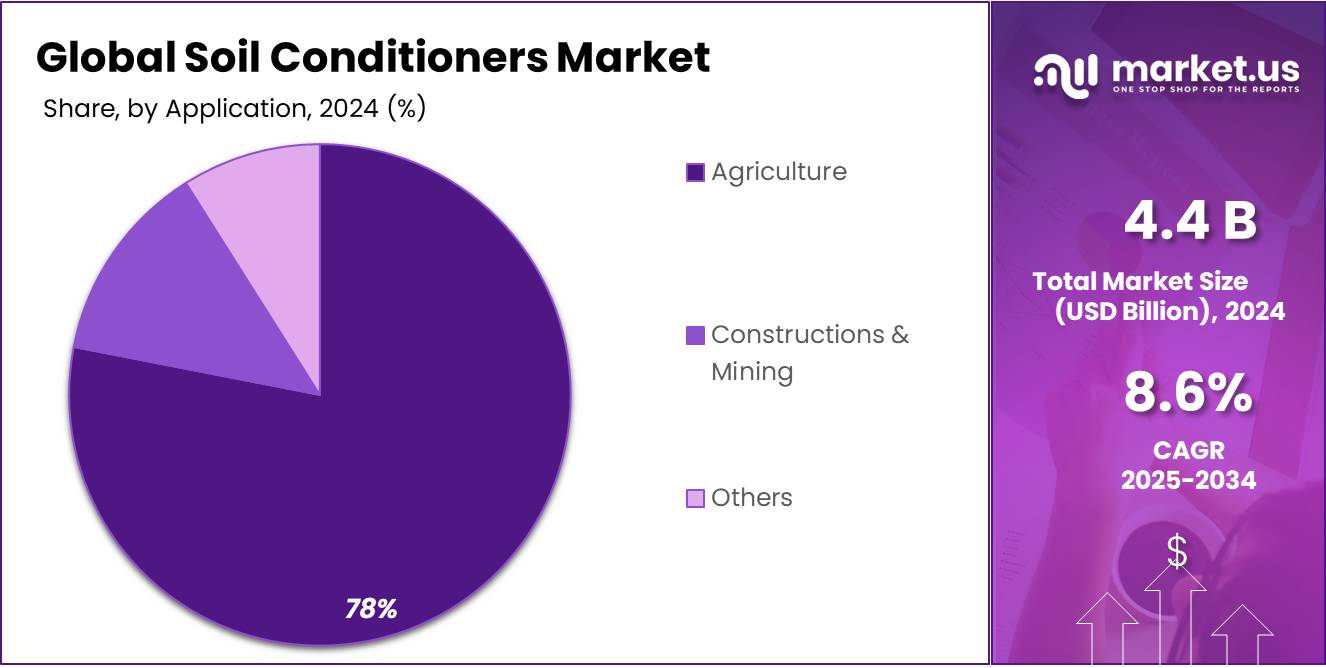

- Agriculture held a dominant market position, capturing more than a 78.3% share in the Soil Conditioners Market.

- Asia Pacific emerged as the undisputed powerhouse of the soil conditioners market, commanding a robust 43.20% of global demand and contributing approximately USD 1.9 billion.

By Product Type Analysis

Organic dominates with 58.2% due to its natural soil enrichment benefits

In 2024, Organic held a dominant market position, capturing more than a 58.2% share in the Soil Conditioners Market by product type. This strong preference is largely due to the rising global shift toward sustainable and eco-friendly farming practices. Organic soil conditioners, made from humic substances, compost, biochar, manure, and other natural inputs, are favored for improving soil fertility without causing long-term environmental harm. Farmers are increasingly adopting these products as they enhance soil structure, boost microbial activity, and increase water-holding capacity, which directly supports higher crop yields under challenging climatic conditions.

By Formulation Analysis

Dry leads the market with 45.8% owing to its ease of application and storage

In 2024, Dry held a dominant market position, capturing more than a 45.8% share in the Soil Conditioners Market by formulation. The strong uptake of dry formulations is driven by their longer shelf life, easy handling, and cost-effectiveness compared to liquid forms. Farmers often prefer dry conditioners such as granules, pellets, and powders because they can be applied through traditional spreading equipment and stored in bulk without the need for specialized storage conditions. This makes them particularly suitable for large-scale farming operations where convenience and durability are key factors.

By Form Analysis

Water Soluble dominates with 69.5% due to its quick absorption and higher efficiency

In 2024, Water Soluble held a dominant market position, capturing more than a 69.5% share in the Soil Conditioners Market by form. This dominance is supported by the growing demand for fast-acting solutions that can be easily absorbed by plants and soils. Water soluble conditioners are widely used because they dissolve quickly, enabling even distribution of nutrients and organic matter across the field through irrigation systems or foliar applications. Farmers favor this form as it ensures immediate results in terms of improved soil aeration, water retention, and nutrient uptake, which are critical for high-value crops grown under intensive cultivation.

By Soil Type Analysis

Loam leads the market with 33.1% owing to its balanced texture and wide cultivation use

In 2024, Loam held a dominant market position, capturing more than a 33.1% share in the Soil Conditioners Market by soil type. Loam is often considered the most fertile soil due to its balanced mixture of sand, silt, and clay, making it ideal for a wide range of crops. Farmers frequently use soil conditioners on loamy soils to maintain their natural structure, enhance organic content, and prevent nutrient depletion under intensive cultivation. The versatility of loam across cereals, vegetables, and fruits has made it the most widely managed soil type, supporting its leading share in the market.

By Crop Type Analysis

Cereals and Grains dominate with 44.6% due to their large-scale global cultivation

In 2024, Cereals and Grains held a dominant market position, capturing more than a 44.6% share in the Soil Conditioners Market by crop type. This dominance is primarily driven by the vast global cultivation of staple crops such as wheat, rice, maize, and barley, which together account for the bulk of human caloric intake worldwide. Farmers are increasingly adopting soil conditioners for cereal and grain fields to improve soil structure, enhance nutrient absorption, and secure higher yields under intensive farming practices. Since these crops require consistent soil fertility and water management, conditioners are widely used to maintain productivity and reduce soil degradation.

By Application Analysis

Agriculture dominates with 78.3% due to its critical role in soil fertility and crop productivity

In 2024, Agriculture held a dominant market position, capturing more than a 78.3% share in the Soil Conditioners Market by application. The high reliance on soil conditioners in farming stems from the urgent need to restore soil fertility, enhance nutrient efficiency, and maintain productivity in large-scale cultivation systems. Farmers across major agricultural regions are adopting conditioners such as compost, humic substances, gypsum, and biochar to address soil degradation, which threatens both crop yields and long-term sustainability. With cereals, grains, fruits, and vegetables accounting for a majority of global food demand, conditioners are becoming essential tools for improving soil structure, boosting microbial activity, and ensuring consistent crop output.

Key Market Segments

By Product Type

- Organic

- Compost

- Green and Farmyard Manure

- Peat

- Others

- Inorganic

- Polymers

- Gypsum

By Formulation

- Dry

- Liquid

- Granular

- Others

By Form

- Water Soluble

- Hydrogels

By Soil Type

- Loam

- Sand

- Peat

- Silt

- Clay

- Others

By Crop Type

- Cereals and Grains

- Fruits and Vegetables

- Oilseeds and Pulses

- Others

By Application

- Agriculture

- Constructions & Mining

- Others

Emerging Trends

Integration of Digital Tools and Smart Agriculture

A significant trend shaping the soil conditioner market is the integration of digital tools and smart agriculture practices. Governments and agricultural organizations are actively promoting soil health initiatives, with policies and subsidies encouraging the use of soil conditioners. These advancements are transforming traditional farming methods, enabling more precise and efficient soil management.

In India, the Soil Health Card (SHC) Scheme has been instrumental in promoting soil health awareness among farmers. As of July 2025, over 25 crore (250 million) SHCs have been distributed, providing farmers with detailed insights into their soil’s nutrient status. This initiative has led to a reported increase in crop yields by 5–6% due to the balanced use of fertilizers and micro-nutrients as per the SHC recommendations.

The SHC Scheme has also been integrated into the Rashtriya Krishi Vikas Yojana (RKVY) from the year 2022–23, now known as ‘Soil Health and Fertility,’ further emphasizing the government’s commitment to sustainable agriculture.

These government-led initiatives, coupled with technological advancements, are creating a conducive environment for the growth of the soil conditioner market. Farmers are increasingly adopting digital tools and smart agriculture practices to enhance soil health and improve productivity, aligning with global trends towards sustainable and efficient farming.

Drivers

Increasing Demand for Sustainable Agriculture Practices

Soil conditioners play a vital role in improving soil health and ensuring sustainable agricultural practices, which have become increasingly essential due to growing concerns over food security, environmental sustainability, and climate change. One of the major driving factors in the soil conditioners market is the increasing demand for sustainable farming practices.

According to a report by the Food and Agriculture Organization (FAO), around 33% of global soils are degraded, making the use of soil conditioners critical in reversing this trend. This degradation is often a result of intense agricultural activities, over-farming, and the loss of organic matter in the soil. The adoption of sustainable practices, such as the use of soil conditioners, is essential to improving soil health and boosting crop productivity in the long run.

Furthermore, the global rise in organic farming also significantly contributes to the growth of the soil conditioners market. Organic farming practices, which avoid synthetic fertilizers and pesticides, rely heavily on soil conditioners to maintain soil health and fertility. In 2024, the area of organic agricultural land worldwide reached approximately 75 million hectares, and this trend is expected to continue, as consumers demand more organic produce.

Government initiatives also play a crucial role in driving the market for soil conditioners. Many countries have introduced policies to encourage sustainable farming practices. For instance, the European Union’s Common Agricultural Policy (CAP) includes incentives for farmers who use environmentally friendly practices, including soil health improvement measures.

Similarly, the U.S. Department of Agriculture (USDA) supports various programs that focus on soil health, such as the Conservation Stewardship Program (CSP), which encourages farmers to adopt practices that improve soil quality, including the use of soil conditioners. These government-backed initiatives are expected to increase the adoption of soil conditioners in agricultural practices globally.

- According to the USDA’s Natural Resources Conservation Service (NRCS), the use of organic amendments, which include soil conditioners like compost, is a critical practice for improving soil health. As of 2024, it is estimated that over 80% of U.S. farmers are adopting at least one soil health management practice, with soil conditioners playing a key role in this transition.

Restraints

High Initial Costs and Financial Constraints

One of the significant challenges hindering the widespread adoption of soil conditioners is the high initial investment required for their application. Farmers, especially those operating on a small scale, often face financial constraints that make it difficult to invest in soil health improvements. These financial barriers are compounded by the perception that the benefits of using soil conditioners, such as improved soil structure and increased crop yields, may not be immediately realized, leading to reluctance in adopting such practices.

According to a study published in Sustainable Food Systems, critical barriers to the adoption of soil greenhouse gas mitigation practices include economic challenges, personal mindset, on-farm complications, and the need to reconcile different stakeholders’ rates of adoption. These barriers are particularly pronounced among farmers who are risk-averse and have limited access to capital. The study emphasizes that a lack of awareness among farmers about their soil’s greenhouse gas production further complicates the adoption of soil health practices.

Similarly, research published in Sustainable Agriculture identifies economic barriers as a significant impediment to the adoption of sustainable soil management practices. The study highlights that initial investment costs, potential short-term profit reductions, unfavorable market demand, and limited access to credit are major factors deterring farmers from implementing practices like organic fertilization and soil cover maintenance. These economic challenges are particularly acute for conventional farmers who may perceive the transition to sustainable practices as financially risky.

In response to these challenges, various government initiatives have been introduced to support farmers in adopting soil health practices. For instance, the U.S. Department of Agriculture’s Environmental Quality Incentives Program (EQIP) provides technical and financial assistance to agricultural producers and forest landowners to address natural resource concerns, including improved soil health. This program aims to reduce the financial burden on farmers and encourage the adoption of sustainable practices.

Opportunity

Government-Led Soil Health Initiatives

A significant growth opportunity for soil conditioners lies in the widespread adoption of government-led soil health initiatives, particularly the Soil Health Card (SHC) Scheme in India. Launched in 2015, this initiative aims to provide farmers with detailed insights into their soil’s nutrient status, enabling them to apply appropriate fertilizers and amendments for improved productivity and sustainability.

As of July 2025, over 25 crore (250 million) Soil Health Cards have been distributed to farmers across India. The government has allocated ₹1,706.18 crore to support this scheme, underscoring its commitment to enhancing soil health and agricultural productivity.

These initiatives not only promote the balanced use of fertilizers but also encourage the adoption of soil conditioners to improve soil structure, fertility, and water retention. By aligning with these government programs, manufacturers and suppliers of soil conditioners can tap into a vast and growing market, contributing to sustainable agriculture and benefiting from increased demand for their products.

Regional Insights

Asia Pacific shines with 43.20% regional share, generating USD 1.9 billion in 2024

In 2024, Asia Pacific emerged as the undisputed powerhouse of the soil conditioners market, commanding a robust 43.20% of global demand and contributing approximately USD 1.9 billion in regional revenue. This commanding lead reflects both the sheer scale of agricultural activity across key countries—like China, India, Australia, and Southeast Asian economies—and the mounting urgency to restore soil health amid decades of intensive farming, erosion, and nutrient depletion.

Governments across the region are actively responding: China’s “Zero Growth of Fertilizer Use” policy is shifting farmer preference toward organic conditioners, while India’s National Mission for Sustainable Agriculture integrates soil health management into its core agricultural strategy.

Moreover, sub‑regional pressures—ranging from urbanization and deforestation to climate change—have spurred adoption of soil conditioners in both traditional rural croplands and emerging peri‑urban farming zones. Australia, grappling with saline and arid soils, is turning to conditioners such as hydrogels and compost to boost water retention and organic content. At the same time, nations like Japan and South Korea are experimenting with high‑tech solutions, including biodegradable polymers and nano‑enhancers, to meet growing demand for ultra‑clean, export‑quality produce.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

TIMAC AGRO International stands out as a pioneer in sustainable agriculture, offering soil improvers, fertilizers, and biostimulants rooted in “Inspired by Nature” innovation. With over 84 production units, 4,000 field representatives, and a diversified, adaptive manufacturing network, the company delivers tailored, high-quality solutions across formats—from granules to liquids. Their close partnership with farmers ensures on-the-ground insights drive research, resulting in agronomic products crafted for real-world soils and crops.

Based in Hyderabad, Varsha Bioscience delivers microbial-based soil conditioners—like their Varsha Vermirich—to improve organic matter and fertility. ISO 9001-certified, their bio-based formulations support organic, intensive, and integrated farming. These solutions boost soil health while enhancing flowering, fruiting, water retention, and nutrient uptake—especially suited for diverse crops from paddy and groundnut to vegetables and plantation crops.

Founded in 1997, Zydex Group is a specialty chemicals innovator offering soil conditioners and biofertilizers under its Zytonic platform. These products enhance soil porosity, water-holding capacity, and root zone activity. Zytonic-M in particular helps cut chemical fertilizer use by up to 100% over several seasons, while increasing yields by 15–50%, reducing irrigation needs by 20–30%, and cutting pesticide use by 20–40%, reviving soil biology and offering practical eco-friendly benefits.

Top Key Players Outlook

- TIMAC AGRO International

- Varsha Bioscience and Technology India Pvt Ltd.

- Zydex Group

- Vijaya Agro Industries.

- T. STANES AND COMPANY LIMITED

- Borregaard AS

- Gujarat State Fertilizers & Chemicals Limited

Recent Industry Developments

In 2024, TIMAC AGRO International stood out in the soil conditioners arena by marrying deep agronomic insight with innovation that feels truly grounded on the farm. The company operates 84 production units and employs around 7,400 people, backed by 4,000 field representatives who bring advice and products right to the farm gate—solid proof of its hands-on, farmer-first approach.

In 2024, Borregaard AS quietly strengthened its role in sustainable agriculture through its BioSolutions division, which contributed 55% of its total segment revenue—a sign of how its bio-based products (like lignin-derived conditioners) are gaining ground in soil health solutions.

Report Scope

Report Features Description Market Value (2024) USD 4.4 Bn Forecast Revenue (2034) USD 10.0 Bn CAGR (2025-2034) 8.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Organic, Inorganic), By Formulation (Dry, Liquid, Granular, Others), By Form (Water Soluble, Hydrogels), By Soil Type (Loam, Sand, Peat, Silt, Clay, Others), By Crop Type (Cereals and Grains, Fruits and Vegetables, Oilseeds and Pulses, Others), By Application (Agriculture, Constructions and Mining, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape TIMAC AGRO International, Varsha Bioscience and Technology India Pvt Ltd., Zydex Group, Vijaya Agro Industries., T. STANES AND COMPANY LIMITED, Borregaard AS, Gujarat State Fertilizers & Chemicals Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- TIMAC AGRO International

- Varsha Bioscience and Technology India Pvt Ltd.

- Zydex Group

- Vijaya Agro Industries.

- T. STANES AND COMPANY LIMITED

- Borregaard AS

- Gujarat State Fertilizers & Chemicals Limited