Global Soft Covering Flooring Market Size, Share, And Business Benefits By Product (Carpet Tiles, Broadloom), By Application (Commercial, Residential), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 159909

- Number of Pages: 274

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

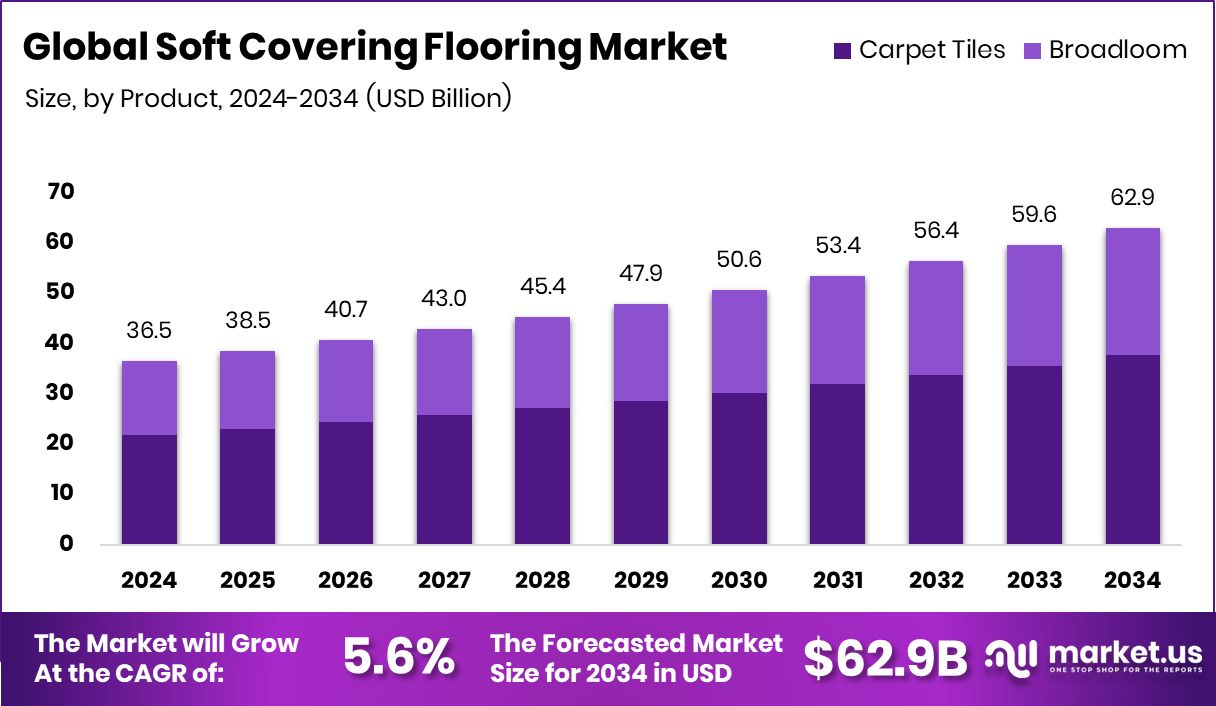

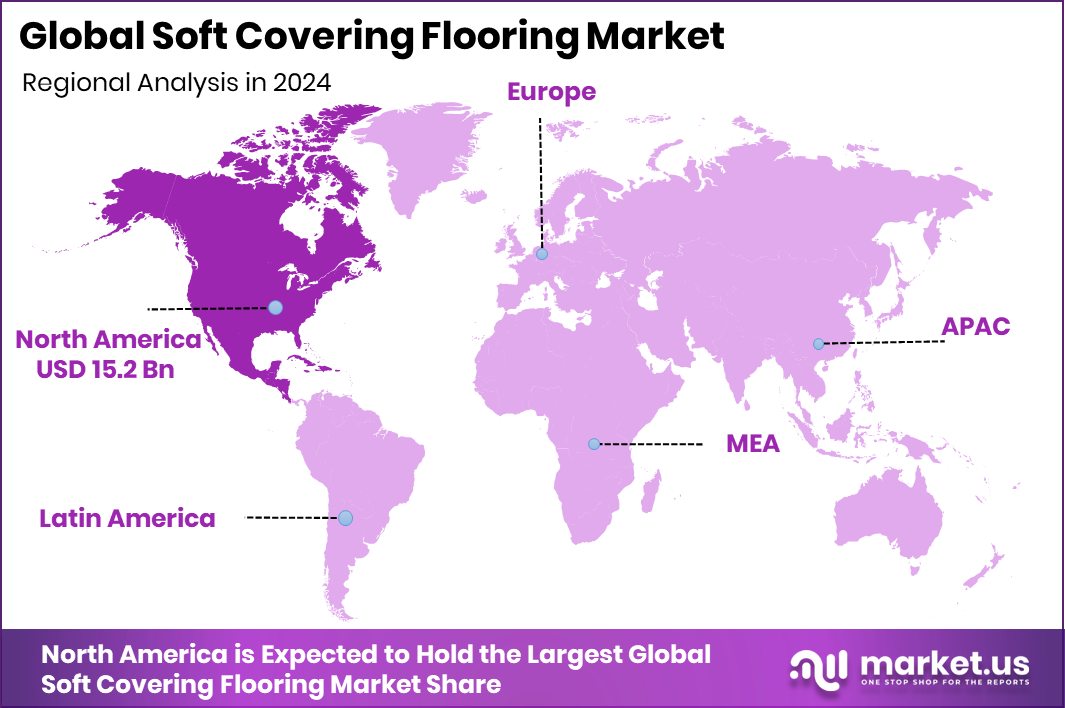

The Global Soft Covering Flooring Market is expected to be worth around USD 62.9 billion by 2034, up from USD 36.5 billion in 2024, and is projected to grow at a CAGR of 5.6% from 2025 to 2034. North America’s strong housing and commercial projects in North America supported USD 15.2 Bn in value.

Soft covering flooring refers to materials like carpets, rugs, and textile-based floor finishes that bring comfort, warmth, and style into living or commercial spaces. Unlike hard surfaces, these coverings provide a cushioned feel underfoot and also enhance indoor acoustics by reducing noise levels. They are widely used in residential homes, offices, hospitality, and educational institutions because of their versatility and the comfort they provide.

The soft covering flooring market is steadily growing as consumers increasingly seek design flexibility and a homely atmosphere in interiors. With options ranging from luxury textiles to eco-friendly fibers, the demand is expanding across both developed and emerging economies. This growth is also supported by urban housing projects and rising disposable incomes that allow people to invest more in interior aesthetics.

A key growth factor lies in the health and comfort benefits of soft coverings. Their ability to insulate rooms, improve air quality by trapping dust, and reduce sound pollution makes them attractive for modern lifestyles. As more families and businesses pay attention to well-being, the preference for cushioned and noise-reducing flooring is expected to climb.

Demand is also fueled by innovation and funding in related sectors. For instance, EDA recommends $550,000 in Main Street grants to revitalize building spaces, while companies like Aisti have secured €29 million to develop sustainable acoustic tiles. These kinds of investments indirectly boost flooring adoption by creating environments that value design, comfort, and sustainability.

Opportunities are opening up through capital inflows into flooring and tile manufacturing. Motilal Oswal and others recently invested $66 million in a tile venture, and Kajaria Ramesh Tiles secured Rs. 3 billion in funding, showing confidence in construction and finishing materials. As funding flows into adjacent industries, the ripple effect strengthens the growth potential for soft covering flooring, especially where modern housing and commercial projects are expanding.

Key Takeaways

- The Global Soft Covering Flooring Market is expected to be worth around USD 62.9 billion by 2034, up from USD 36.5 billion in 2024, and is projected to grow at a CAGR of 5.6% from 2025 to 2034.

- Carpet tiles dominate the soft covering flooring market, capturing 59.8% share due to flexibility and easy installation.

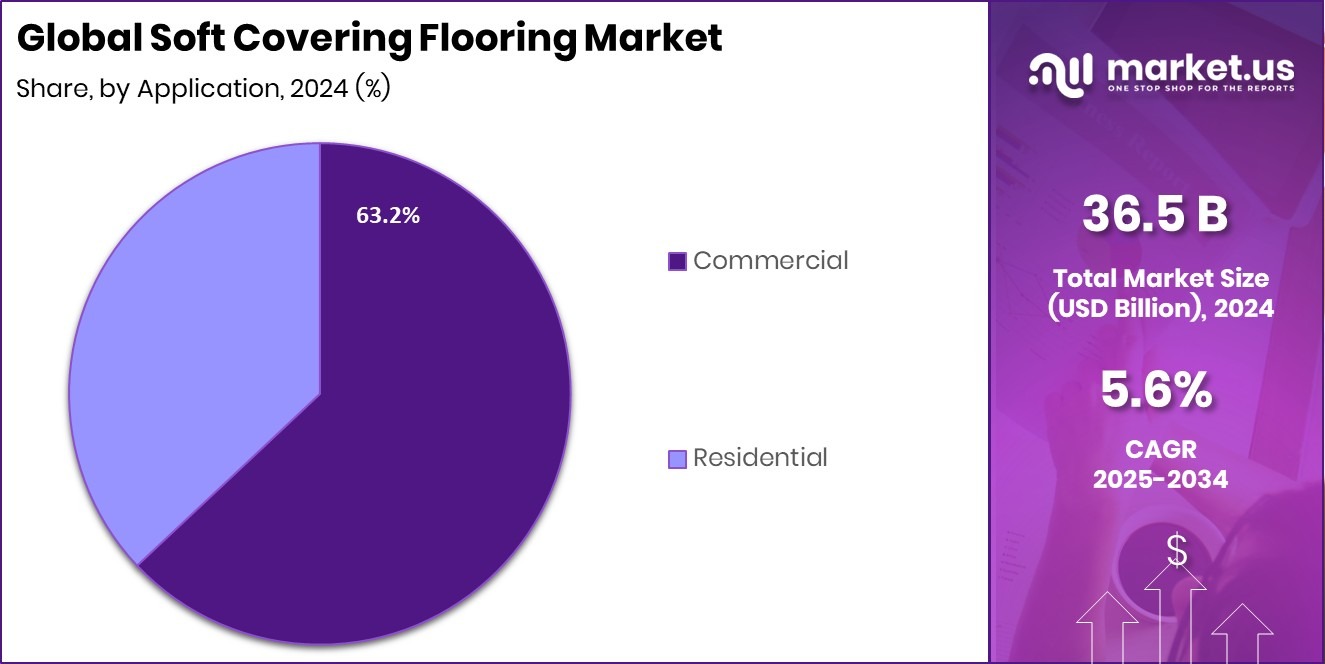

- The commercial sector leads applications, holding a 63.2% share, driven by offices, hotels, and institutional flooring demand.

- With a 41.80% share, North America remained dominant in the flooring market growth.

By Product Analysis

Carpet tiles hold a 59.8% share in the soft covering flooring market.

In 2024, Carpet Tiles held a dominant market position in the by-product segment of the soft covering flooring market, with a 59.8% share. This strong presence highlights the increasing preference for modular and flexible flooring solutions that offer both functionality and design appeal.Carpet tiles are widely chosen in commercial and residential spaces due to their ease of installation and maintenance, and their ability to be replaced individually without disturbing the entire floor. Their adaptability to modern interior layouts and the growing focus on comfort and aesthetics have reinforced their leading role. The 59.8% share reflects how carpet tiles continue to set the standard in the soft covering flooring industry.

By Application Analysis

Commercial spaces dominate with a 63.2% share in the soft covering flooring market.

In 2024, Commercial held a dominant market position in the By Application segment of the Soft Covering Flooring Market, with a 63.2% share. This reflects the widespread adoption of soft covering flooring across offices, retail spaces, hospitality, and institutional buildings where durability, comfort, and aesthetic appeal are essential. The preference for such flooring in commercial environments is driven by its ability to enhance acoustics, provide a professional appearance, and ensure ease of maintenance in high-traffic areas.

The 63.2% share underlines the significance of commercial demand as the core growth driver, with businesses increasingly investing in flooring solutions that balance functionality with design flexibility.

Key Market Segments

By Product

- Carpet Tiles

- Broadloom

By Application

- Commercial

- Residential

Driving Factors

Rising Urbanization and Housing Demand Boost Flooring

One of the main driving factors for the soft covering flooring market is the rapid pace of urbanization and the growing demand for modern housing spaces. As cities expand and more people move into urban areas, there is a strong need for comfortable, stylish, and functional interiors. Soft covering flooring, such as carpets and tiles, fits this demand perfectly by offering warmth, noise reduction, and design flexibility.

Residential buyers and commercial developers prefer these solutions for creating welcoming spaces that are both practical and appealing. Adding to this momentum, HomeLane has announced plans to acquire Design Cafe while raising $30 million in fresh funding, signaling strong investor confidence in home- and interior-related industries.

Restraining Factors

High Maintenance and Cleaning Needs Limit Growth

A major restraining factor for the soft covering flooring market is the high maintenance and cleaning effort required to keep these products in good condition. Unlike hard surfaces, carpets and rugs can easily trap dust, stains, and allergens, making them more difficult to clean. This becomes a challenge for households with children or pets and in commercial areas with heavy foot traffic.

Frequent vacuuming, professional cleaning, and stain treatment add to the overall cost of ownership. For many buyers, this ongoing maintenance reduces the appeal of soft flooring, especially when alternatives offer easier upkeep. As a result, the demand can slow down in markets where convenience and low maintenance are a top priority.

Growth Opportunity

Growing Preference for Sustainable and Eco-Friendly Flooring

A key growth opportunity for the soft covering flooring market lies in the rising consumer preference for sustainable and eco-friendly products. With increasing awareness about environmental impact, many households and businesses are looking for flooring made from recycled fibers, natural materials, and low-emission production processes. This shift not only supports healthier indoor environments but also aligns with global sustainability goals.

Companies that invest in green innovations are likely to see stronger demand as buyers prioritize eco-conscious choices. Adding context to the industry’s financial landscape, the IT department recently detected Rs 220 crore of black income after raids on a Tamil Nadu-based tiles manufacturer, highlighting the need for greater transparency and compliance as the sector grows.

Latest Trends

Rising Focus on Carpet Recycling and Reuse

One of the latest trends shaping the soft covering flooring market is the growing focus on recycling and reusing carpets to reduce waste. With millions of square meters of carpet replaced every year, disposal has become a major environmental concern. Recycling initiatives aim to recover fibers, backing materials, and other components for reuse in new products, lowering landfill pressure and supporting sustainability goals. This trend is gaining traction as governments, organizations, and consumers push for greener solutions in home and commercial spaces.

Supporting this movement, CARE announced $2.4 million in grant awards for carpet recycling, further encouraging innovation and partnerships that make recycling processes more efficient and widely adopted in the flooring industry.

Regional Analysis

In 2024, North America held a 41.80% share, worth USD 15.2 Bn.

The Soft Covering Flooring Market demonstrates notable regional variation, with North America emerging as the dominant region in 2024. Holding a 41.80% share and valued at USD 15.2 billion, North America leads due to strong demand from residential and commercial projects, driven by advanced construction practices and a preference for comfort-oriented flooring solutions.

Europe follows closely, supported by a mature construction industry and rising interest in sustainable interior products. The Asia Pacific region, marked by rapid urbanization and growing disposable incomes, continues to show promising growth opportunities as consumers invest in modern housing and stylish interiors.

Meanwhile, the Middle East & Africa region reflects steady adoption, supported by expanding infrastructure and urban development programs, though on a smaller scale compared to leading regions. Latin America also shows consistent demand, particularly in urban centers where rising middle-class incomes are driving residential upgrades.

Overall, North America remains the clear leader with its 41.80% market share, while Europe and the Asia Pacific contribute significantly to global expansion, highlighting a balance between established and emerging markets in shaping the industry’s trajectory. This distribution underscores the critical role of regional dynamics in the growth of soft covering flooring.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Mohawk Industries, Inc. maintains its strong presence by leveraging a broad product portfolio and advanced manufacturing capabilities. The company’s focus on offering durable and design-forward flooring solutions has allowed it to remain a preferred choice in both residential and commercial applications. Its continuous investment in technology and efficiency strengthens its global competitiveness.

Shaw Industries Group Inc. reinforces its market leadership through customer-centric strategies and design innovation. Known for providing comfortable, stylish, and practical flooring options, Shaw maintains deep connections with contractors, retailers, and end-users. Its emphasis on sustainability and reliable distribution further enhances its reputation across developed markets.

Tarkett, on the other hand, demonstrates global strength by balancing regional diversity with innovative flooring solutions. With its wide reach across Europe, North America, and Asia, Tarkett emphasizes flexibility in design, sustainability practices, and consistent quality. Its ability to adapt to changing consumer demands makes it an important global contender.

Top Key Players in the Market

- Mohawk Industries, Inc.

- Shaw Industries Group Inc.

- Tarkett

- Forbo Management SA

- BASF SE

- Gerflor

- Interface Inc.,

- Beaulieu International Group

- Sika India Pvt. Ltd.

- Fosroc Inc.,

Recent Developments

- In April 2025, Tarkett introduced new playful collections targeting educational spaces—Angled in Enrichment, High Frequency, and updates from Grounded Harmony—across carpet tile and hybrid offerings.

- In March 2025, BASF, in partnership with Sika, launched Baxxodur® EC 151, an epoxy hardener optimized for flooring and coatings. It enables low-VOC formulations, better flow, and faster curing—attributes useful in interior floor systems and overlay coatings.

Report Scope

Report Features Description Market Value (2024) USD 36.5 Billion Forecast Revenue (2034) USD 62.9 Billion CAGR (2025-2034) 5.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Carpet Tiles, Broadloom), By Application (Commercial, Residential) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Mohawk Industries, Inc., Shaw Industries Group Inc., Tarkett, Forbo Management SA, BASF SE, Gerflor, Interface Inc.,, Beaulieu International Group, Sika India Pvt. Ltd., Fosroc Inc., Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Soft Covering Flooring MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample

Soft Covering Flooring MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Mohawk Industries, Inc.

- Shaw Industries Group Inc.

- Tarkett

- Forbo Management SA

- BASF SE

- Gerflor

- Interface Inc.,

- Beaulieu International Group

- Sika India Pvt. Ltd.

- Fosroc Inc.,