Global Rechargeable Poly Lithium-ion Battery Market Size, Share Report By Structure (Cylindrical, Prismatic, Pouch), By Capacity (Below 1000 mAh, 1000 mAh to 2500 mAh, 2500 mAh to 5000 mAh, Above 5000 mAh), By Voltage (Up to 3.7 V, 5 V – 7 V, Above 7 V), By Chemistry (Lithium Cobalt Oxide (LCO), Lithium Nickel Manganese Cobalt Oxide (NMC), Lithium Iron Phosphate (LFP), Lithium Nickel Cobalt Aluminum Oxide (NCA)) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 154722

- Number of Pages: 334

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

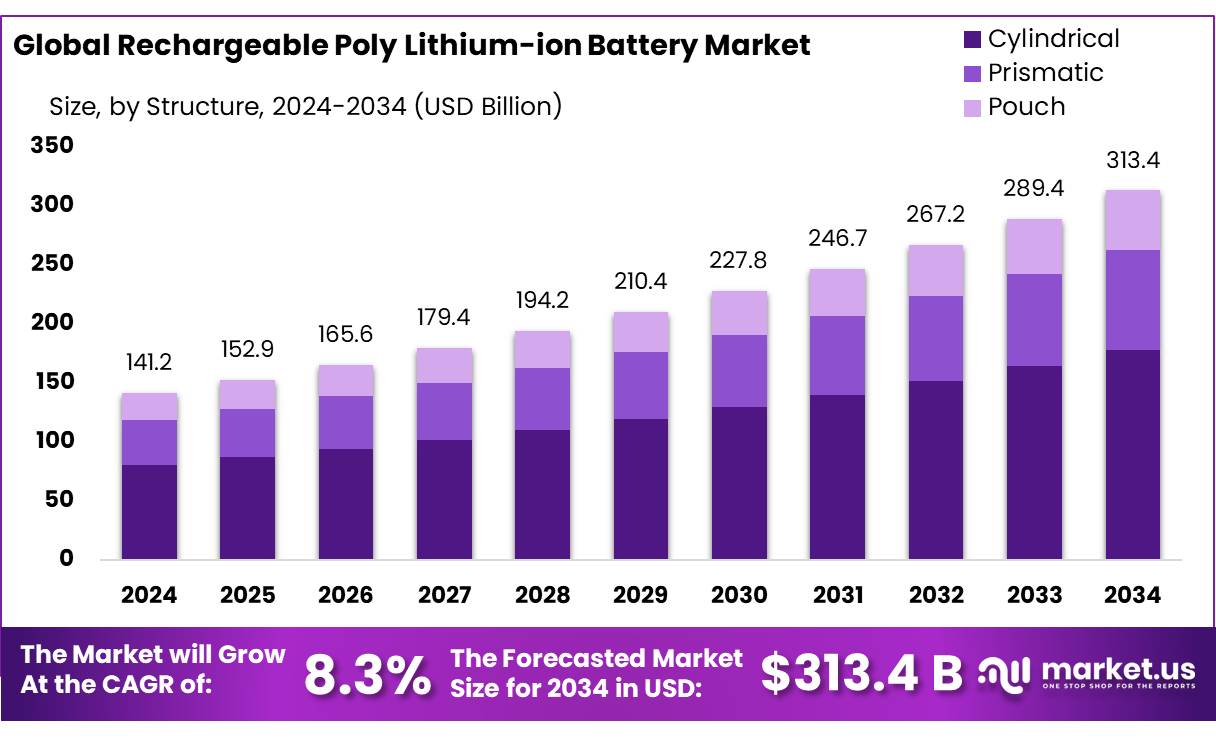

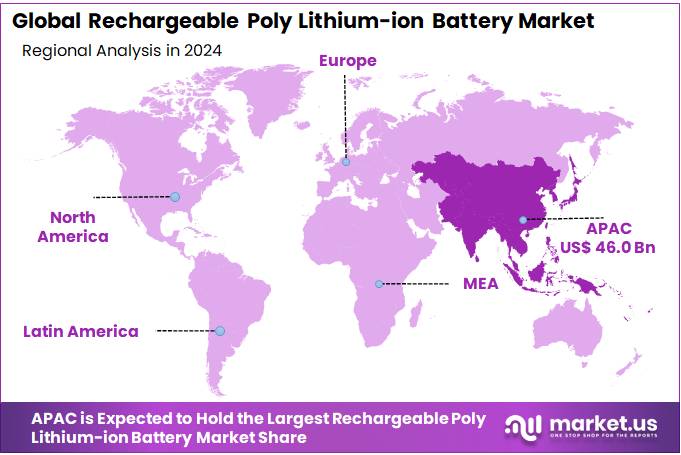

The Global Rechargeable Poly Lithium-ion Battery Market size is expected to be worth around USD 313.4 Billion by 2034, from USD 141.2 Billion in 2024, growing at a CAGR of 8.3% during the forecast period from 2025 to 2034. In 2024, APAC held a dominant market position, capturing more than a 32.6% share, holding USD 46.0 Billion in revenue.

Rechargeable poly lithium-ion battery concentrates are integral to the development of advanced battery technologies, particularly in the context of electric vehicles (EVs) and renewable energy storage systems. These concentrates, comprising high-purity lithium compounds, serve as essential components in the manufacturing of lithium-ion batteries, which are pivotal for energy storage solutions.

In addition to the PLI scheme, the National Critical Mineral Mission has been launched with a budget allocation of ₹16,300 crore. This mission aims to secure the supply of critical minerals, including lithium, by facilitating exploration, mining, and processing activities. The establishment of Khanij Bidesh India Limited (KABIL) under the Ministry of Mines further supports these objectives by acquiring lithium resources from international markets.

The demand for lithium-ion batteries in India is projected to surge, particularly in the EV sector. According to S&P Global Mobility, the demand for EV lithium batteries in India is expected to escalate from 4 GWh in 2023 to nearly 139 GWh by 2035. This exponential growth underscores the necessity for scaling up domestic production of battery components, including concentrates.

The Indian government has also introduced several initiatives to bolster the battery manufacturing sector. The Union Budget for FY2025-26 exempted 35 additional capital goods for EV battery manufacturing from Basic Customs Duty (BCD), aiming to reduce production costs and encourage domestic manufacturing. Furthermore, the Electric Mobility Promotion Scheme 2024 (EMPS 2024) has been launched with an allocation of INR 500 crore to promote electric vehicles, offering subsidies to consumers and manufacturers to accelerate EV adoption.

Government policy‑led initiatives in India include the PLI (Production Linked Incentive) scheme targeting domestic cell capacity of 50 GWh by 2030. At central and state levels, schemes such as FAME‑II, launched by the Ministry of Heavy Industry in 2019, provide purchase incentives for EVs and fund charging infrastructure; the Go Electric campaign (since 2021) waives vehicle registration fees and promotes tax benefits. Maharashtra state offers road‑tax exemptions and subsidies for EVs and charging stations; Uttar Pradesh targets 1 million EVs by December 2024, with 207 charging stations under FAME II in nine cities, and EV sales comprising over 16% of India’s total in Q4 FY23‑24.

Key Takeaways

- Rechargeable Poly Lithium-ion Battery Market size is expected to be worth around USD 313.4 Billion by 2034, from USD 141.2 Billion in 2024, growing at a CAGR of 8.3%.

- Cylindrical held a dominant market position, capturing more than a 56.8% share in the rechargeable poly lithium-ion battery market.

- 2500 mAh to 5000 mAh held a dominant market position, capturing more than a 41.2% share in the rechargeable poly lithium-ion battery market.

- 5 V – 7 V held a dominant market position, capturing more than a 44.4% share in the rechargeable poly lithium-ion battery market.

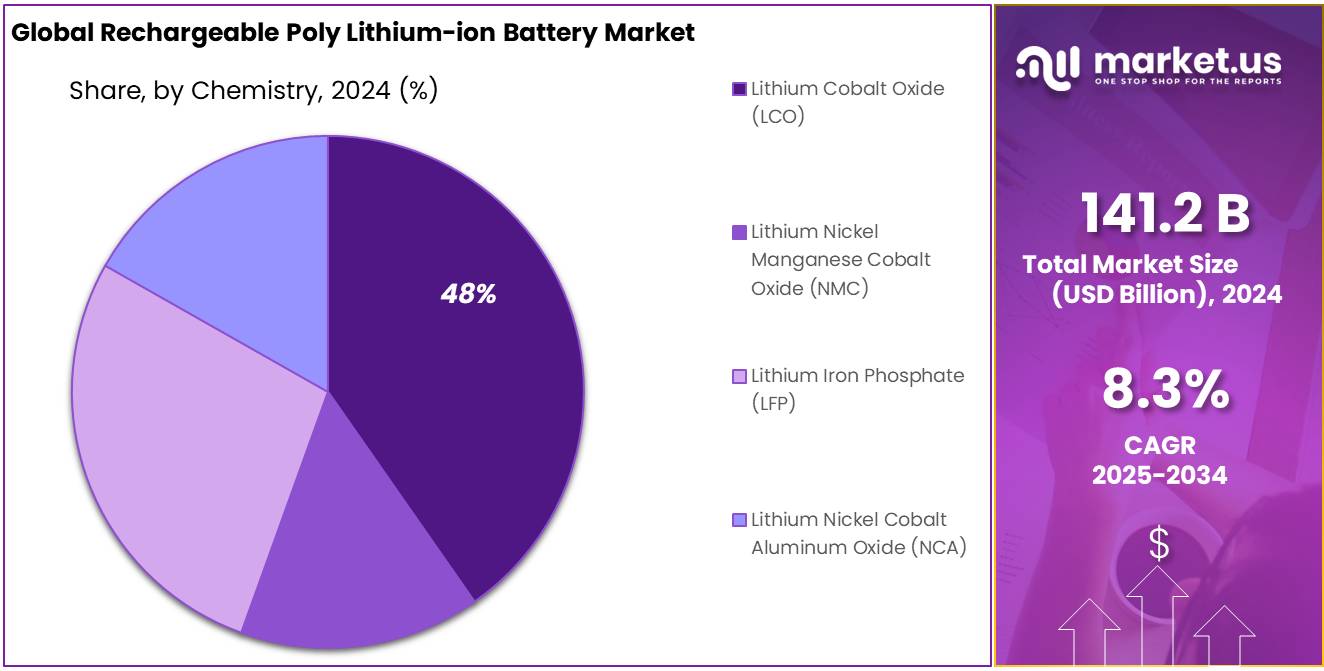

- Lithium Cobalt Oxide (LCO) held a dominant market position, capturing more than a 48.1% share in the rechargeable poly lithium-ion battery market.

- APAC region accounted for approximately 32.6% share, contributing around USD 46.0 billion.

By Structure Analysis

Cylindrical Batteries dominate with 56.8% share due to strong demand in consumer electronics and power tools.

In 2024, Cylindrical held a dominant market position, capturing more than a 56.8% share in the rechargeable poly lithium-ion battery market. This structure type remains highly favored due to its well-established manufacturing processes, strong mechanical stability, and wide compatibility across devices. The demand for cylindrical cells has remained steady from sectors such as laptops, power tools, and electric two-wheelers, where durability and ease of integration are critical.

Their robust design also makes them suitable for high-load applications, especially in industrial handheld devices and low-range EVs. As industries continue to scale up production for these segments, cylindrical batteries are expected to maintain a leading position into 2025, supported by efficient thermal management and cost-effectiveness in high-volume manufacturing.

By Capacity Analysis

2500 mAh to 5000 mAh batteries lead with 41.2% share, driven by rising demand in smartphones and portable gadgets.

In 2024, 2500 mAh to 5000 mAh held a dominant market position, capturing more than a 41.2% share in the rechargeable poly lithium-ion battery market. This capacity range has become the standard for a wide range of consumer electronics, especially smartphones, tablets, wireless speakers, and fitness trackers, where compact size and reliable power are essential.

These batteries offer a balanced performance in terms of energy density, charge cycles, and weight, making them highly suitable for daily-use portable devices. As personal electronics continue to evolve with higher processing power and longer usage times, the demand for batteries in this specific capacity range has remained consistently strong. The market momentum is expected to carry into 2025, with manufacturers focusing on improved safety and faster charging within this widely accepted capacity segment.

By Voltage Analysis

5 V – 7 V batteries dominate with 44.4% share, favored for their compatibility with mid-power electronics and tools.

In 2024, 5 V – 7 V held a dominant market position, capturing more than a 44.4% share in the rechargeable poly lithium-ion battery market. This voltage range has become a preferred choice across several applications, including medical devices, handheld electronics, smart wearables, and cordless tools, where stable mid-level power is essential.

These batteries offer the right balance between safety and performance, ensuring efficient energy output without overheating or rapid discharge. Their widespread usage in compact gadgets and battery-powered appliances has played a key role in securing their strong market presence. As device manufacturers continue to prioritize energy efficiency and safety, the 5 V – 7 V segment is expected to remain a critical component of battery design through 2025.

By Chemistry Analysis

Lithium Cobalt Oxide (LCO) leads with 48.1% share, mainly due to its strong use in smartphones and compact electronics.

In 2024, Lithium Cobalt Oxide (LCO) held a dominant market position, capturing more than a 48.1% share in the rechargeable poly lithium-ion battery market. LCO chemistry is widely used in mobile phones, tablets, digital cameras, and other compact electronic devices due to its high energy density and stable performance.

Its ability to deliver a reliable voltage and lightweight design makes it ideal for space-constrained applications. Despite concerns over cobalt sourcing, LCO batteries continue to see strong demand in the consumer electronics segment where long runtime and compact size are critical. Looking ahead to 2025, the segment is expected to maintain its momentum, supported by consistent demand for smartphones and portable gadgets that rely heavily on this chemistry for dependable performance.

Key Market Segments

By Structure

- Cylindrical

- Prismatic

- Pouch

By Capacity

- Below 1000 mAh

- 1000 mAh to 2500 mAh

- 2500 mAh to 5000 mAh

- Above 5000 mAh

By Voltage

- Up to 3.7 V

- 5 V – 7 V

- Above 7 V

By Chemistry

- Lithium Cobalt Oxide (LCO)

- Lithium Nickel Manganese Cobalt Oxide (NMC)

- Lithium Iron Phosphate (LFP)

- Lithium Nickel Cobalt Aluminum Oxide (NCA)

Emerging Trends

Advancements in Lithium-Ion Battery Technology: Impact on the Food Industry

The food industry is increasingly adopting lithium-ion (Li-ion) batteries to enhance operational efficiency and sustainability. A notable example is a leading dairy and ice cream producer in the U.S. This company operates 13 manufacturing plants across the country, utilizing Li-ion-powered forklifts in temperature-controlled warehouses. These forklifts, equipped with OneCharge FROST batteries, are designed to perform in extreme temperatures, ranging from -20°F to +70°F. The use of Li-ion batteries has eliminated the need for mid-shift battery changes, a common issue with traditional lead-acid batteries, thereby improving operational efficiency.

Government initiatives are also supporting the adoption of Li-ion battery technology. For instance, the Indian government reduced the tariff on industrial lithium-ion batteries from 21% to 13% in the Union Budget 2023, promoting the ‘Make in India’ scheme and encouraging domestic manufacturing. Additionally, the ‘Mission LiFE’ program was launched to facilitate the transfer of cost-effective lithium-ion battery recycling technology to startups and recycling firms.

These developments indicate a transformative shift in the food industry, where the integration of advanced battery technologies is leading to more efficient and sustainable operations. As the demand for energy storage solutions continues to rise, the food sector’s adoption of Li-ion batteries is expected to play a crucial role in enhancing productivity and reducing environmental impact.

Drivers

Government Initiatives Driving the Growth of Rechargeable Poly Lithium-Ion Batteries in India

The Indian government’s proactive policies are significantly accelerating the development of the rechargeable poly lithium-ion battery sector, a crucial component for electric vehicles (EVs) and renewable energy storage. These initiatives aim to reduce import dependency, foster domestic manufacturing, and support the transition to sustainable energy solutions.

A cornerstone of this strategy is the National Programme on Advanced Chemistry Cell (ACC) Battery Storage, approved by the Union Cabinet in May 2021. With a substantial outlay of INR 18,100 crore (approximately USD 2.2 billion), the scheme targets the establishment of 50 GWh of advanced battery manufacturing capacity in India. By incentivizing both domestic and global companies, the program seeks to enhance local production capabilities and minimize reliance on imported cells. Notable beneficiaries include Reliance New Energy Solar Limited, Ola Electric Mobility Private Limited, Hyundai Global Motors Company Limited, and Rajesh Exports Limited.

Complementing the ACC scheme, the Union Budget for FY2025-26 introduced measures to bolster the EV ecosystem. The government fully exempted Basic Customs Duty (BCD) on 35 additional capital goods essential for EV battery manufacturing, such as cobalt powder and lithium-ion battery scrap. This move aims to reduce production costs and encourage domestic manufacturing of key components.

Further supporting the adoption of electric mobility, the Ministry of Heavy Industries launched the Electric Mobility Promotion Scheme (EMPS) 2024. With an allocation of INR 500 crore, the scheme provides demand incentives for electric two-wheelers and three-wheelers, including e-rickshaws and e-carts. The initiative, operational from April 1 to July 31, 2024, aims to accelerate the adoption of green mobility solutions and strengthen the EV manufacturing ecosystem in the country.

Restraints

Limited Access to Critical Raw Materials

A significant challenge hindering the growth of India’s rechargeable poly lithium-ion battery industry is the limited access to essential raw materials such as lithium, cobalt, nickel, and graphite. These materials are fundamental for manufacturing high-performance batteries used in electric vehicles (EVs) and renewable energy storage systems.

India currently imports over 95% of its lithium-ion batteries, with more than 80% of these imports originating from China and Hong Kong. In the financial year 2023-24, India’s lithium-ion battery imports surged by 69% compared to 2021-22, reaching ₹24,346 crores. This growing dependency exposes the domestic battery industry to price fluctuations and potential supply disruptions.

The situation is further complicated by India’s limited domestic reserves of critical minerals. While the country discovered 5.9 million tonnes of lithium ore in Jammu and Kashmir in 2023, these deposits are in clay, and commercial extraction has not yet been proven. Additionally, India lacks substantial reserves of cobalt and nickel, which are primarily sourced from countries like the Democratic Republic of Congo and Indonesia.

To mitigate these challenges, India has initiated several measures. The government has launched the National Programme on Advanced Chemistry Cell (ACC) Battery Storage, with an outlay of ₹18,100 crore, aiming to establish 50 GWh of advanced battery manufacturing capacity in the country. Moreover, the Union Budget for FY2025-26 introduced measures to bolster the EV ecosystem, including full exemption of Basic Customs Duty on 35 additional capital goods essential for EV battery manufacturing.

Opportunity

Government Support and Infrastructure Development

The Indian government’s proactive initiatives have significantly bolstered the growth of the food industry, creating a conducive environment for businesses to thrive. Programs like the Production Linked Incentive Scheme for Food Processing Industries (PLISFPI) and the Pradhan Mantri Kisan Sampada Yojana (PMKSY) have been instrumental in enhancing food processing capabilities and infrastructure. As of October 2024, 1,079 projects under PMKSY have been completed, and 171 applications approved under PLISFPI, with beneficiaries investing US$ 1.07 billion and receiving US$ 130.6 million in incentives.

These initiatives have not only improved the efficiency of food processing but also facilitated the expansion of the food industry into new markets, both domestically and internationally. The government’s focus on infrastructure development, such as the establishment of food parks and cold chain facilities, has addressed logistical challenges, ensuring timely delivery and reduced wastage. Additionally, the implementation of the Goods and Services Tax (GST) has streamlined tax structures, making it easier for businesses to operate across states.

Furthermore, the government’s emphasis on promoting exports has opened new avenues for growth. India’s agricultural and processed food exports reached approximately US$ 46.4 billion in the fiscal year 2023-24, with processed food products accounting for US$ 10.88 billion, representing 23.4% of the total agri-food exports. This focus on export diversification and quality assurance has enhanced India’s position in the global food market.

Regional Insights

Asia‑Pacific (APAC) leads with 32.6% share, accounting for USD 46.0 billion in revenue.

In 2025, the APAC region accounted for approximately 32.6% share, contributing around USD 46.0 billion in the rechargeable poly lithium‑ion battery market. This dominant position is attributable to well‑established manufacturing hubs in China, Japan, South Korea, and emerging production in Southeast Asia and India. APAC remains the central force in global battery cell production, supported by a mature supply chain of raw materials, cathode/anode processing, and scale efficiencies

China alone produced over 940 GWh of lithium‑ion cell capacity by 2023, representing approximately 73% of the 316 GWh global total in earlier years and reinforcing APAC’s dominance in battery manufacturing. Projections indicate that Asia‑Pacific will maintain its leading position through 2025 and beyond, as government policies and private investments focus on battery production, EV integration, and energy storage infrastructure.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Sony continues to play a significant role in the rechargeable poly lithium-ion battery space, particularly through its legacy in high-performance battery technology for consumer electronics. The company supplies lithium-ion batteries widely used in digital cameras, smartphones, and gaming devices. Sony’s focus on safety, compact size, and high energy density has helped maintain its relevance in portable power applications. It continues to collaborate with OEMs and focuses on improving charge cycles and thermal stability in its battery offerings.

Fujifilm relies heavily on rechargeable poly lithium-ion batteries to power its range of digital cameras and imaging equipment. Its battery packs, like the NP-W series, support long shooting times and quick recharging, which are essential for professional and consumer users alike. Fujifilm emphasizes compact, lightweight designs while maintaining high energy output and safety. The company’s R&D also focuses on optimizing battery integration for performance in high-resolution and 4K imaging devices, reinforcing its market presence in portable battery applications.

Motorola utilizes rechargeable poly lithium-ion batteries across its smartphone lineup, including mid-range and premium models. Its batteries are known for supporting fast charging and maintaining long battery life, essential in today’s mobile usage patterns. Motorola has adopted advanced battery management systems to enhance safety and energy efficiency. In recent years, the company has also invested in improving battery capacity without increasing device weight, making its devices competitive in performance and durability across global smartphone markets.

Top Key Players Outlook

- Sony

- Nikon

- Fujifilm

- Motorola

- 3M

- Koninklijke Philips N.V.

- Kodak

- Maxell

- Nippon Chemicals

- YOK Energy

- Shenzhen Honcell Energy Co. Ltd.

- LiPol Battery Co. Ltd.

Recent Industry Developments

Motorola integrates rechargeable poly lithium‑ion batteries extensively in 2024 smartphone lineup, including models such as the Edge 50 Fusion, Neo, Pro, Ultra, Razr 50, and Moto G Power 5G. Each device features battery capacities ranging from 4,000 mAh to 5,000 mAh, with fast charging support.

In 2024, Nikon offered the EN‑EL15c battery rated at 7.0 V and 2,280 mAh, tailored for models like Z6 II, Z7 II, and D850, delivering reliable performance and consistent power output.

Report Scope

Report Features Description Market Value (2024) USD 141.2 Bn Forecast Revenue (2034) USD 313.4 Bn CAGR (2025-2034) 8.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Structure (Cylindrical, Prismatic, Pouch), By Capacity (Below 1000 mAh, 1000 mAh to 2500 mAh, 2500 mAh to 5000 mAh, Above 5000 mAh), By Voltage (Up to 3.7 V, 5 V – 7 V, Above 7 V), By Chemistry (Lithium Cobalt Oxide (LCO), Lithium Nickel Manganese Cobalt Oxide (NMC), Lithium Iron Phosphate (LFP), Lithium Nickel Cobalt Aluminum Oxide (NCA)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Sony, Nikon, Fujifilm, Motorola, 3M, Koninklijke Philips N.V., Kodak, Maxell, Nippon Chemicals, YOK Energy, Shenzhen Honcell Energy Co. Ltd., LiPol Battery Co. Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Rechargeable Poly Lithium-ion Battery MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Rechargeable Poly Lithium-ion Battery MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Sony

- Nikon

- Fujifilm

- Motorola

- 3M

- Koninklijke Philips N.V.

- Kodak

- Maxell

- Nippon Chemicals

- YOK Energy

- Shenzhen Honcell Energy Co. Ltd.

- LiPol Battery Co. Ltd.