Global Power Plant Feedwater Heaters Market Size, Share, And Industry Analysis Report By Type (Low-Pressure Feedwater Heaters, High-Pressure Feedwater Heaters), By Material (Carbon Steel, Stainless Steel, Alloy Steel, Others), By Application (Coal-Fired Power Plants, Nuclear Power Plants, Gas-Fired Power Plants, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 170724

- Number of Pages: 321

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

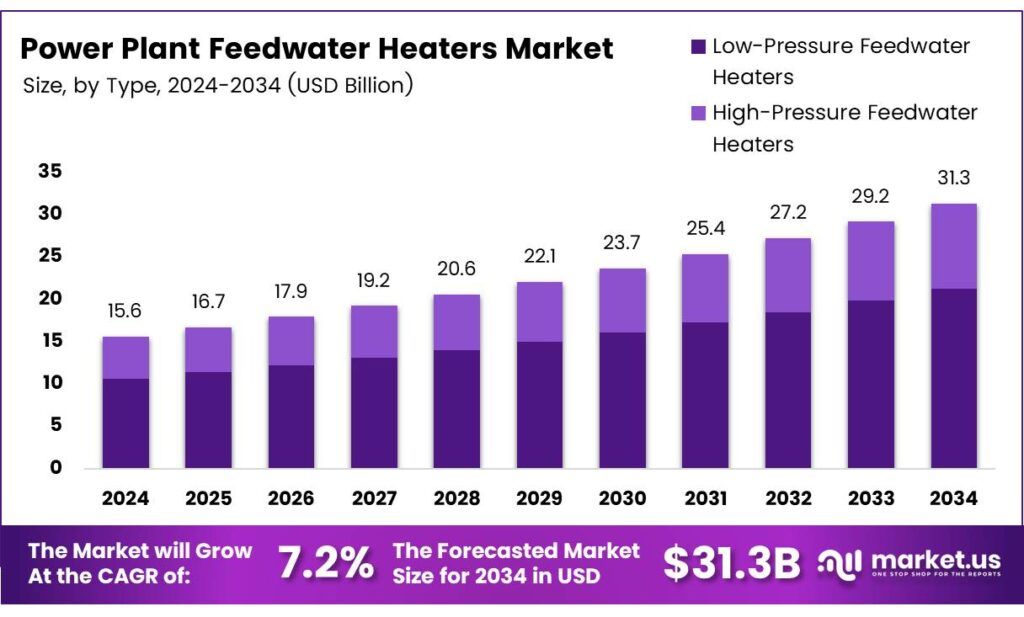

The Global Power Plant Feedwater Heaters Market size is expected to be worth around USD 31.3 billion by 2034, from USD 15.6 billion in 2024, growing at a CAGR of 7.2% during the forecast period from 2025 to 2034.

The Power Plant Feedwater Heaters Market covers equipment used to preheat boiler feedwater using extracted steam, improving thermal efficiency and fuel utilization. In power generation value chains, feedwater heaters support stable operations, reduce heat losses, and protect boilers. As utilities prioritize efficiency upgrades, demand steadily strengthens across thermal and nuclear plants.

Power plant feedwater heaters are critical balance-of-plant components that recover waste heat before water enters the boiler. Plants achieve higher cycle efficiency, lower fuel consumption, and reduced emissions intensity. With aging power infrastructure worldwide, utilities increasingly focus on refurbishment, corrosion control, and lifecycle optimization of feedwater heating systems.

Thermal power plants continue to deliver nearly 60% of global electricity, supporting baseload demand despite accelerating decarbonization efforts. As coal, gas, and nuclear fleets age, operators prioritize efficiency upgrades, creating steady retrofit demand for feedwater heaters. Natural-gas turbine exhaust can reach a sulfur dew point near 140°F, where condensation and sulfuric acid formation intensify corrosion, driving adoption of higher-grade materials and tighter temperature control.

- An EPRI final report hosted by the U.S. DOE OSTI notes a survey of 57 U.S. utilities covering 175 generating units averaging above 500 MW, and 1,635 feedwater heaters. This installed base underlines long-term aftermarket demand, refurbishment spending, and technology upgrades across the power plant feedwater heaters market.

Reliability data reinforces the replacement opportunity. According to the Nuclear Plant Reliability Data System and Equipment Performance and Information Exchange records from 1976–1996, 166 feedwater-heater-related incidents were identified in nuclear plants. Tube leakage accounted for 144 incidents, or 87%, clearly establishing tube failures as the dominant risk factor.

Key Takeaways

- The Global Power Plant Feedwater Heaters Market is projected to grow from USD 15.6 billion in 2024 to USD 31.3 billion by 2034, at a 7.2% CAGR.

- Low-pressure feedwater heaters dominate the market by type, holding a leading share of 59.2% in 2024.

- Carbon steel is the most widely used material segment, accounting for a 51.9% market share.

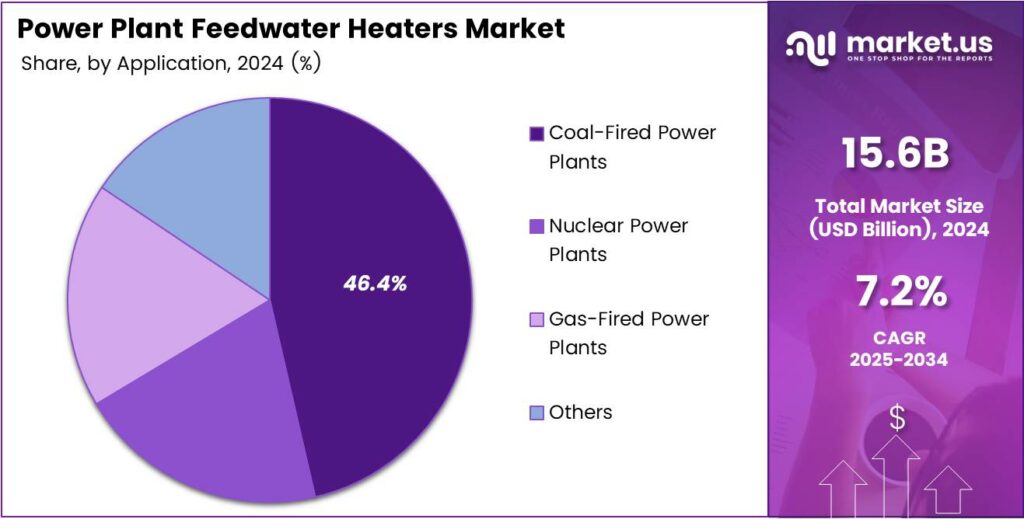

- Coal-fired power plants represent the largest application segment, accounting for 46.4% of the total market demand.

- Thermal power plants continue to generate nearly 60% of global electricity, sustaining long-term demand for feedwater heaters.

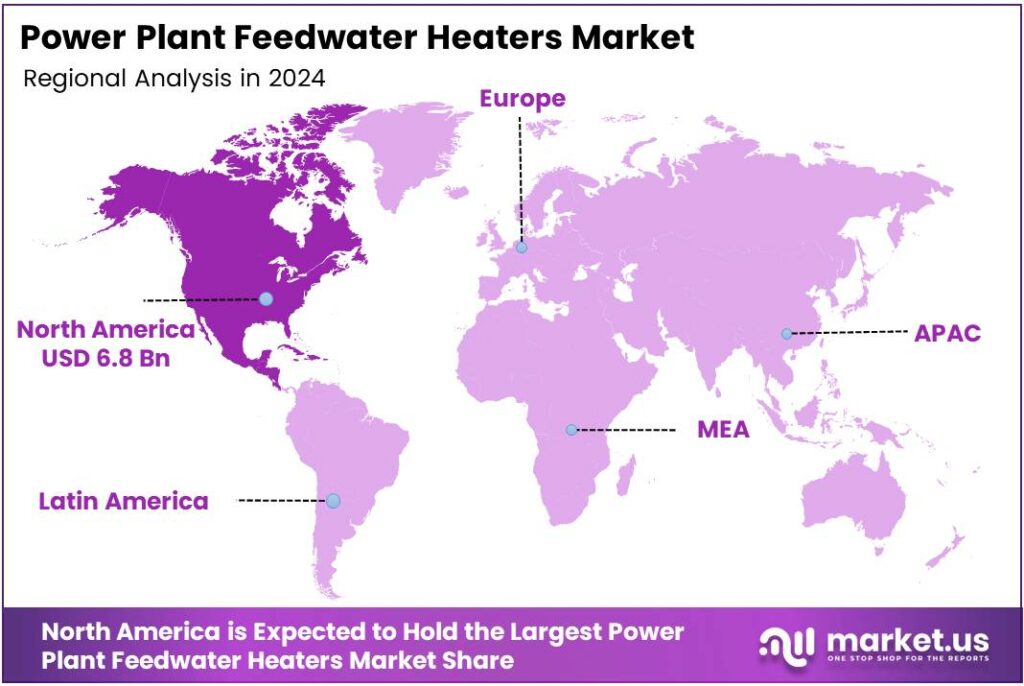

- North America is the dominant regional market with a share of 43.9%, valued at USD 6.8 billion.

By Type Analysis

Low-pressure feedwater Heaters dominate with 59.2% due to their critical role in improving thermal efficiency and reducing turbine steam extraction losses.

In 2024, Low-Pressure Feedwater Heaters held a dominant market position in the By Type Analysis segment of the Power Plant Feedwater Heaters Market, with a 59.2% share. These heaters operate at early feedwater stages and recover low-grade heat. As a result, they improve cycle efficiency and support cost-effective plant performance.

High-Pressure Feedwater Heaters serve later feedwater stages and operate under elevated temperatures and pressures. Although their share is lower, they remain essential for boosting boiler efficiency. Moreover, utilities deploy them to optimize fuel usage and enhance long-term reliability in large thermal power plants.

By Material Analysis

Carbon Steel dominates with 51.9% owing to its cost efficiency, mechanical strength, and widespread use in conventional thermal power systems.

In 2024, Carbon Steel held a dominant market position in the By Material Analysis segment of the Power Plant Feedwater Heaters Market, with a 51.9% share. This material offers strong thermal conductivity and affordability. Consequently, it remains the preferred choice for standard operating environments in coal-based and gas-based plants.

Stainless Steel feedwater heaters are adopted where corrosion resistance is critical. They perform well under fluctuating temperatures and moisture exposure. Therefore, operators favor them in plants facing aggressive water chemistry or strict maintenance requirements.

Alloy Steel heaters provide enhanced strength at higher temperatures and pressures. These materials support extended service life in demanding operating conditions. As a result, they are selected for high-capacity units seeking durability and thermal stability.

By Application Analysis

Coal-fired power Plants dominate with 46.4% due to their large installed base and continuous requirement for efficiency upgrades.

In 2024, Coal-Fired Power Plants held a dominant market position in the By Application Analysis segment of the Power Plant Feedwater Heaters Market, with a 46.4% share. These plants rely heavily on feedwater heaters to improve heat rates. Consequently, replacement and retrofitting demand remains steady.

Nuclear Power Plants use feedwater heaters to ensure precise thermal control and operational safety. Although deployment volumes are lower, performance reliability is critical. Therefore, utilities prioritize high-quality heater systems for long-term plant stability.

Gas-fired power Plants apply feedwater heaters to enhance combined-cycle efficiency. These systems help recover exhaust heat and reduce fuel consumption. As a result, adoption supports flexible generation and fast ramp-up operations. Others include biomass and industrial captive power plants. These facilities integrate feedwater heaters to optimize energy recovery.

Key Market Segments

By Type

- Low-Pressure Feedwater Heaters

- High-Pressure Feedwater Heaters

By Material

- Carbon Steel

- Stainless Steel

- Alloy Steel

- Others

By Application

- Coal-Fired Power Plants

- Nuclear Power Plants

- Gas-Fired Power Plants

- Others

Emerging Trends

Advanced Materials and Digital Monitoring Shape Trends

Power plant feedwater heaters are increasingly shaped by the global push for higher efficiency in thermal power generation. Power plant operators are focusing on improving heat rates to reduce fuel use and operating costs. Feedwater heaters help recover waste heat from steam cycles, making them a priority during plant upgrades and performance optimization programs.

- Sensors and condition-monitoring systems help operators detect leaks, fouling, or efficiency loss early. Power plants are being pushed to run in a more stop-start way as grids add more variable solar and wind. In the U.S., developers planned 62.8 GW of new utility-scale generating capacity in 2024, and the EIA expected solar 58% and battery storage 23% to make up most of it.

There is also a trend toward compact and modular heater designs. These designs simplify installation during retrofits and reduce space requirements. Together, material innovation and smart monitoring continue to reshape how feedwater heaters are designed, operated, and maintained in modern power plants.

Drivers

Rising Need for Thermal Efficiency Drives Market Growth

Power plant feedwater heaters are mainly driven by the growing focus on improving thermal efficiency in power generation. Utilities aim to reduce fuel consumption while producing the same amount of electricity. Feedwater heaters help preheat boiler water, which lowers heat losses and improves overall plant performance. This makes them essential in both new and existing thermal power plants.

- Even as renewable energy expands, many countries continue to rely on thermal plants for stable baseload power. A heat rate of 7,500 Btu per kWh corresponds to roughly 45% efficiency, while 10,500 Btu per kWh is only about 33% efficient. These plants require periodic upgrades, where feedwater heaters are replaced or refurbished to maintain efficiency and safety standards.

Rising fuel costs push plant operators to invest in efficiency-enhancing equipment. Feedwater heaters support better heat recovery from steam extraction, helping plants reduce operational expenses over time. This cost-saving benefit continues to support steady demand.

Restraints

High Maintenance and Capital Costs Limit Adoption

The power plant feedwater heaters market faces high installation and maintenance costs. These systems involve complex heat exchange equipment that must withstand high-pressure and temperature conditions. The initial investment can be significant, especially for smaller or aging power plants.

- Feedwater heaters are prone to corrosion, tube leakage, and scaling due to continuous exposure to hot water and steam. Regular inspection and repair increase downtime and operating expenses, which some plant operators try to avoid. The IEA expects renewables’ share in the electricity sector to grow from 30% to 46%, and it tracks global annual renewable capacity additions rising from 666 GW (2024) toward nearly 935 GW (2030).

The slow pace of new thermal power plant construction in some regions. Environmental concerns and strict emission regulations reduce investments in coal-based plants. This limits new equipment demand and shifts focus mainly toward replacement rather than expansion.

Growth Factors

Power Plant Retrofit Projects Create New Opportunities

Growth opportunities mainly come from retrofit and modernization projects in existing power plants. Many thermal power stations are upgrading equipment to improve efficiency and comply with stricter environmental norms. Feedwater heaters play a key role in such upgrades by reducing fuel use and emissions.

Emerging economies also present opportunities as electricity demand continues to rise. Countries expanding coal, gas, or nuclear capacity require reliable heat recovery systems. Feedwater heaters support stable operations and long-term efficiency, making them a preferred choice in new installations.

In addition, advancements in materials and design improve corrosion resistance and operating life. These innovations encourage utilities to replace older heaters with modern, high-performance units, supporting market expansion through replacement demand.

Regional Analysis

North America Dominates the Power Plant Feedwater Heaters Market with a Market Share of 43.9%, Valued at USD 6.8 billion

North America leads the market due to its large installed base of thermal power plants and continuous efficiency upgrade programs. Aging coal, gas, and nuclear facilities are investing in feedwater heater retrofits to improve heat rate performance and extend asset life. The region’s strict operational standards and focus on reducing fuel consumption further support demand, keeping North America at a dominant 43.9% share with a value of USD 6.8 billion.

Europe shows steady demand driven by plant modernization and compliance with tightening efficiency and emission regulations. Operators focus on replacing older heat exchangers with advanced designs to improve thermal efficiency. The transition phase of energy systems still relies on conventional power plants, sustaining replacement and maintenance demand across the region.

Asia Pacific is witnessing strong growth supported by rising electricity demand and ongoing investments in large-scale thermal power projects. Rapid industrialization and urban expansion are increasing baseload power needs. Alongside new installations, efficiency upgrades in existing plants are boosting the adoption of advanced feedwater heating systems.

The U.S. market benefits from ongoing life-extension programs for large thermal power units. Utilities emphasize heat rate improvement, corrosion control, and operational reliability. Replacement of legacy equipment with high-efficiency feedwater heaters continues to support consistent market activity across the country.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BWX Technologies Inc. remains closely tied to the nuclear-side replacement cycle, where feedwater heaters must meet strict reliability and materials expectations. In 2024, its positioning benefits from a utility focus on life-extension programs, outage planning discipline, and component refurbishment demand. The company’s niche strength is delivering engineered equipment that fits tight plant constraints and quality documentation needs.

Westinghouse Electric Company LLC is advantaged by its deep integration with nuclear plant service ecosystems, where feedwater heater work often sits inside broader modernization and performance packages. During 2024, operators prioritize higher availability and predictable maintenance windows, supporting steady retrofit activity. Westinghouse’s value typically shows up in specification support, compatibility with installed systems, and long-term service relationships.

KNM Group Berhad plays into the fabrication and project execution layer, where timely delivery and cost control matter as much as technical compliance. In 2024, opportunities improve when plant owners pursue staged upgrades instead of full unit overhauls, creating more discrete equipment orders. The company’s competitiveness tends to hinge on manufacturing throughput, welding quality, and responsiveness to customized designs.

Shanghai Electric Group Co. Ltd benefits from scale in thermal power equipment supply chains, especially where capacity additions, refurbishments, and efficiency upgrades run in parallel. In 2024, demand is supported by the need to improve heat rate and reliability in aging fleets while keeping capex disciplined. Its edge is bundling feedwater heater solutions with broader boiler-turbine island offerings and project delivery depth.

Top Key Players in the Market

- BWX Technologies Inc

- Westinghouse Electric Company LLC

- KNM Group Berhad

- Shanghai Electric Group Co. Ltd

- Mitsubishi Heavy Industries Ltd

- Larsen and Toubro Limited

- Dongfang Electric Corp. Ltd

- Toshiba

- Doosan Corporation

- Korea Electric Power Corporation

- General Electric

Recent Developments

- In 2025, BWX Technologies Inc. continues advancing nuclear components relevant to power plant operations, including heat exchangers that support feedwater systems. The company received regulatory approval for a new generation of high-pressure feedwater heaters designed for enhanced safety and lifespan in nuclear projects, with potential orders estimated.

- In 2025, Westinghouse provides balance-of-plant services for power plants, including design changes for feedwater heaters, moisture separator re-heater upgrades, and feedwater control system enhancements to regulate flow during operations. The company offers digital feedwater control upgrades for at-power efficiency in nuclear facilities.

Report Scope

Report Features Description Market Value (2024) USD 15.6 billion Forecast Revenue (2034) USD 31.3 billion CAGR (2025-2034) 7.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Low-Pressure Feedwater Heaters, High-Pressure Feedwater Heaters), By Material (Carbon Steel, Stainless Steel, Alloy Steel, Others), By Application (Coal-Fired Power Plants, Nuclear Power Plants, Gas-Fired Power Plants, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape BWX Technologies Inc., Westinghouse Electric Company LLC, KNM Group Berhad, Shanghai Electric Group Co. Ltd, Mitsubishi Heavy Industries Ltd, Larsen and Toubro Limited, Dongfang Electric Corp. Ltd, Toshiba, Doosan Corporation, Korea Electric Power Corporation, General Electric Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Power Plant Feedwater Heaters MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Power Plant Feedwater Heaters MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BWX Technologies Inc

- Westinghouse Electric Company LLC

- KNM Group Berhad

- Shanghai Electric Group Co. Ltd

- Mitsubishi Heavy Industries Ltd

- Larsen and Toubro Limited

- Dongfang Electric Corp. Ltd

- Toshiba

- Doosan Corporation

- Korea Electric Power Corporation

- General Electric