Global Polypropylene Multifilament Yarn Market Size, Share, And Business Benefits By Product Type (Multifilament Yarn, Monofilament, Textured, Spun), By Application (Packaging Materials, Home Textiles, Automotive Interiors, Construction Materials), By Process Type (FDY, POY, DTY, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 161499

- Number of Pages: 323

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

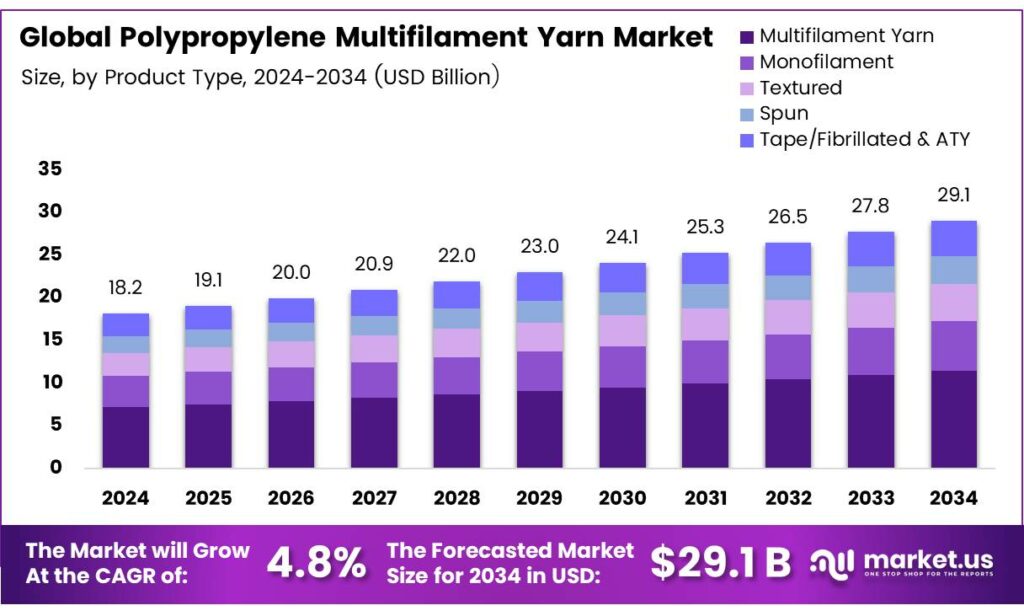

The Global Polypropylene Multifilament Yarn Market size is expected to be worth around USD 29.1 billion by 2034, from USD 18.2 billion in 2024, growing at a CAGR of 4.8% during the forecast period from 2025 to 2034.

Polypropylene yarn (PP) is the lightest and most versatile yarn in the textile industry, known for its simple, sterile structure that repels moisture, dirt, and stains. It efficiently wicks away sweat and dries quickly, making it ideal for various applications. Its eco-friendly nature and recyclability further enhance its appeal compared to other yarn types. PP yarn is highly adaptable, offering excellent strength when produced in the right proportions. Its durability and resilience make it a preferred choice for thin fabrics, household textiles, ropes, nets, and tapestries.

Polypropylene fibers are available in various types with tenacities ranging from 4.5-6.0 g/den for standard fabric applications to 9.0 g/den for high-strength products like ropes and nets. High-performance PP fibers, with enhanced strength and modulus, are also produced to meet specific industrial needs. Partially oriented yarn (POY) has low crystallinity up to 5% and high elongation capacity around 80%, resulting in significant shrinkage up to 70%.

This makes POY less stable but suitable for applications requiring flexibility. Its structure allows for further processing to meet specific textile requirements. Fully drawn yarn (FDY), with higher crystallinity up to 40% and lower elongation around 40%, offers greater stability and minimal shrinkage up to 12%. Used in high-strength textiles like sportswear, automotive fabrics, and sewing threads, FDY is available in semi-dull or bright lusters, with circular or trilobal cross-sections for applications like curtains, crepe, and lace fabrics.

High-performance PPMFY is expanding in composites, PP multifilament with carbon or glass for lightweight parts, smart textiles, conductive yarn coatings, and medical textiles, surgical meshes, and filtration. Rapid infrastructure growth in Asia, Latin America, and Africa boosts geotextile and industrial fabric demand. Bio-based and recycled PPMFY enhances sustainability for eco-conscious applications.

Key Takeaways

- The Global Polypropylene Multifilament Yarn Market is expected to grow from USD 18.2 billion in 2024 to USD 29.1 billion by 2034 at a CAGR of 4.8%.

- Multifilament Yarn led the By Product Type segment in 2024 with a 39.4% share due to its durability, chemical resistance, and lightweight properties.

- Packaging Materials dominated the By Application segment in 2024 with a 31.2% share, driven by high tensile strength and recyclability.

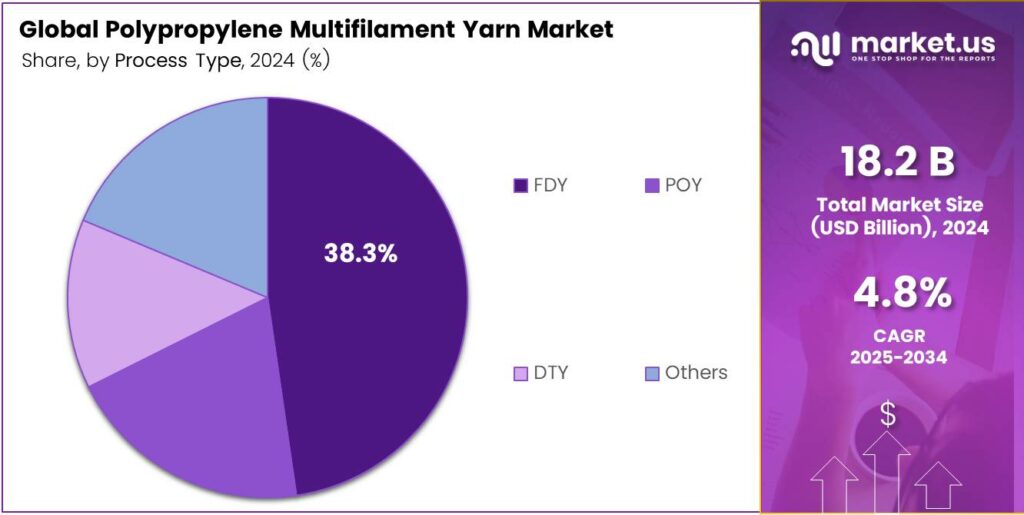

- FDY (Fully Drawn Yarn) held a 38.3% share in the By Process Type segment in 2024, valued for its tenacity and uniform texture.

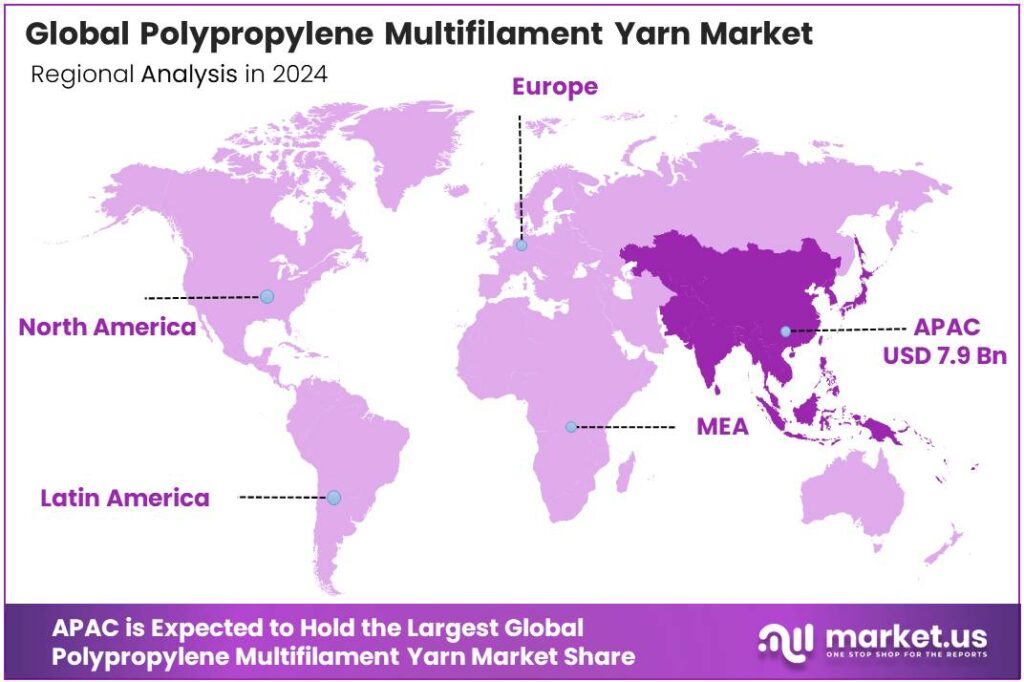

- Asia-Pacific led the global market in 2024 with a 43.9% share, valued at USD 7.9 billion, fueled by industrialization and textile infrastructure.

By Product Type Analysis

Multifilament Yarn dominates with 39.4% due to its superior strength and diverse industrial usage.

In 2024, Multifilament Yarn held a dominant market position in the By Product Type segment of the Polypropylene Multifilament Yarn Market, with a 39.4% share. This type is widely favored for its excellent durability, chemical resistance, and lightweight properties. It is commonly used in ropes, nets, geotextiles, and packaging due to its consistent filament structure that enhances strength and flexibility.

The Monofilament yarn segment follows, gaining demand for use in filtration fabrics and technical textiles. Its single-strand structure offers excellent tensile strength and chemical stability, making it ideal for industrial sewing threads, fishing lines, and protective textiles. Monofilament’s smooth surface and low moisture absorption contribute to its reliability in demanding environments.

The Textured yarn category has grown as manufacturers focus on comfort-oriented textiles. These yarns provide softness, bulkiness, and high elasticity, supporting applications in upholstery and home furnishings. The textured process enhances feel and insulation, aligning with consumer demand for value-added fabrics. Spun and Tape, and Fibrillated/ATY yarns are gaining niche traction in woven sacks, artificial grass, and industrial webbing.

By Application Analysis

Packaging Materials leads with 31.2% driven by expanding food, logistics, and e-commerce sectors.

In 2024, Packaging Materials held a dominant market position in the By Application segment of the Polypropylene Multifilament Yarn Market, with a 31.2% share. These yarns are extensively used in flexible packaging, woven sacks, and bulk bags. Their high tensile strength and moisture resistance enhance packaging durability and recyclability, making them essential for sustainable logistics solutions.

The Home Textiles segment benefits from the growing use of polypropylene in carpets, curtains, and furnishing fabrics. Its affordability, stain resistance, and lightweight nature make it a preferred alternative to cotton or polyester, particularly in emerging markets focused on durable interior materials. Polypropylene yarns support seat covers, trunk liners, and floor mats.

Their resistance to wear and heat provides performance and longevity, aligning with vehicle light-weighting trends. Manufacturers increasingly blend these yarns with other fibers to improve texture and comfort. The Construction Materials category uses polypropylene yarns in geotextiles, ropes, and scaffolding nets. Their high mechanical strength and UV stability help enhance structural integrity and soil reinforcement.

By Process Type Analysis

FDY dominates with 38.3% owing to its high efficiency and consistent yarn quality.

In 2024, FDY (Fully Drawn Yarn) held a dominant market position in the By Process Type segment of the Polypropylene Multifilament Yarn Market, with a 38.3% share. FDY is valued for its superior tenacity and uniform texture, making it suitable for weaving and knitting in industrial and apparel applications. Its ability to produce fine-denier yarns with excellent mechanical properties ensures strong demand across textile sectors.

The POY (Partially Oriented Yarn) segment is expanding due to its flexibility in post-processing. POY is often used as feedstock for DTY or textured yarn production, serving as a versatile base for customized fabrics. Its adaptability and cost efficiency make it vital for manufacturers aiming to balance quality with productivity.

Meanwhile, DTY (Draw Textured Yarn) provides softness, stretchability, and bulkiness, key features for home furnishings and activewear. It is increasingly preferred in upholstery and mattress fabrics. The Others category, comprising specialty yarn processes, includes innovations in high-strength and eco-modified PP yarns that address sustainability goals while offering niche performance benefits in industrial uses.

Key Market Segments

By Product Type

- Multifilament Yarn

- Dope-dyed

- Color-dyed

- High-tenacity

- UV-stabilized

- Monofilament

- Textured

- Spun

- Tape and Fibrillated and ATY

By Application

- Packaging Materials

- Home Textiles

- Carpets and Rugs

- Mattress and Linens

- Upholstery

- Curtains and Blinds

- Automotive Interiors

- Construction Materials

- Medical Textiles

- Sports and Activewear

- Industrial and PPE, and Filtration

By Process Type

- FDY

- POY

- DTY

- Others

Drivers

Growing demand in the food & rigid packaging sector

PP that offers good barrier properties, chemical resistance, and food safety compliance. PP is already used widely in yogurt cups, food trays, containers, and closures. Governments and regulators are also pushing stricter food contact and recycling standards. Many regulatory bodies require that packaging for food must be inert, non-toxic, and able to withstand sterilisation or thermal cycles.

The fact that PP is considered safe and nonreactive for many food contact uses supports its use. Because packaging is a major user of plastic globally (about 36% of total plastic production is for packaging), UNEP – UN Environment Programme, the shift in food and beverage packaging toward polypropylene supports higher demand for PP yarns in woven or rigid packaging forms.

As brands aim for lighter, recyclable, and consumer-safe packaging, more PP multifilament yarns will be used in woven sacks, bag forms, and reinforcement layers. Thus, the growth in the food packaging sector, regulatory emphasis on safety and recyclability, and the advantages of PP in packaging combine to fuel demand for multifilament PP yarn. That makes it a robust driver across multiple value chains.

Restraints

Environmental regulations and plastic waste backlash pressure usage

One significant restraint is the growing regulatory and public pressure to reduce plastic waste and pollution. According to UNEP, only 9% of plastic waste globally is actually recycled; the rest is landfilled, incinerated, or pollutes ecosystems. In fact, 46% of plastic waste is landfilled, and 22% becomes litter.

These alarming figures have led many governments to enact stringent plastic bans, taxes, or extended producer responsibility (EPR) frameworks. UNEP is promoting EPR guidelines globally to reduce plastic pollution and push manufacturers to design for recyclability. When plastics are viewed negatively, industries may hesitate to expand polypropylene use, especially in consumer and packaging segments.

Moreover, consumer sentiment is shifting. Increasing media coverage of microplastics in soil, water, and food, and demands for more sustainable materials, put pressure on suppliers. Some countries are banning single-use plastics or restricting certain polymer types. For example, Nigeria is planning a ban on single-use plastics.

Opportunity

Circular economy & recycling innovation in plastics

A key opportunity lies in coupling polypropylene multifilament yarn with advanced recycling and circular economy models. Currently, only 9% of plastics are recycled globally. But innovation in mechanical recycling, chemical recycling, and upcycling is accelerating. Some studies project that by 2040, chemical recycling could handle up to 70% of hard-to-recycle plastic packaging and textiles if infrastructure improvements are made.

Governments and supranational bodies are also backing circular policies. UNEP’s roadmap calls for raising the economically recyclable share of plastics from 21% to 50%. When manufacturers of PP multifilament yarn can incorporate higher proportions of recycled feedstock and offer traceable, eco-certified yarns, they can meet both regulatory and consumer demand for greener textiles.

In the food packaging and woven sack segments, brands are seeking materials that are not just performance-oriented but also sustainable. Yarn producers that invest in closed-loop recycling, take-back systems, or partnerships with waste collection can tap into premium markets.

Also, in regions where waste collection infrastructure is improving, new supply chains for recycled PP feedstock will emerge. That creates a growth window for yarn makers that can integrate recycled PP into multifilament products without sacrificing quality. Hence, gaining a foothold in circular, recycled-based PP multifilament yarn gives firms a strategic edge in an evolving marketplace.

Trends

Focus on bio-based & monomer recycling innovations

One emerging trend is the development of bio-based polypropylene or polymer modifications that allow better recyclability or a lower carbon footprint. Although PP is typically fossil-derived, research is underway to incorporate bio-derived monomers or co-polymers that reduce dependency on petroleum.

Another trend is monomer recycling (also called chemical recycling) to break down used PP into monomers for reuse. As packaging and textile waste rise, chemical recycling may turn a liability into a resource. Reports suggest chemical recycling could reclaim a large share of mixed plastic waste by 2040.

Furthermore, design-for-recyclability is gaining momentum. UNEP and allied initiatives emphasize that products should be engineered from the start for ease of recycling or reuse. This means yarn and fabric producers are rethinking additives, colorants, and composite constructions so polypropylene multifilament yarns can be more readily recovered.

There’s a trend toward integrating smart or conductive yarns into technical textiles, coating PP multifilament yarn with conductive layers for sensors or wearable tech. The base fiber needs durability and stability, which PP offers. These trends signal a shift: it’s no longer enough for yarn to be strong or cheap; sustainability, recyclability, and adaptability to future textile innovations are now part of the game.

Regional Analysis

Asia-Pacific leads with a 43.9% share and a USD 7.9 Billion market value.

In 2024, Asia-Pacific emerged as the dominant region in the global Polypropylene Multifilament Yarn (PPMFY) market, accounting for 43.9% of the total share, valued at around USD 7.9 billion. The region’s leadership stems from rapid industrialization, strong textile manufacturing infrastructure, and expanding applications in geotextiles, packaging, and home furnishings.

Countries such as China, India, Japan, and South Korea remain key contributors due to their high production capacity, lower manufacturing costs, and increasing exports of technical textiles and industrial yarns. China’s government-backed programs under the Made in China 2025 initiative and India’s Production Linked Incentive (PLI) schemes for technical textiles have accelerated the development of modern spinning facilities and synthetic fiber plants.

The region’s construction boom and growing demand for nonwoven geotextiles in infrastructure projects are boosting the use of PPMFY in soil stabilization and reinforcement. The region also benefits from expanding automotive and filtration industries, where lightweight and high-tenacity yarns are replacing traditional fibers for improved strength and fuel efficiency.

Asia-Pacific leads the global polypropylene multifilament yarn market, driven by eco-friendly and recyclable yarn trends, supported by Japan’s Green Growth Strategy and India’s Sustainable Textile Mission. Integrated feedstock and fabric production enhances cost efficiency and innovation, fueled by strong demand and sustainable textile infrastructure investments.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Antex leverages extensive manufacturing expertise and a diverse product portfolio to serve various industries, from textiles to technical applications. Their strength lies in consistent quality, innovation in yarn engineering, and a robust international distribution network. This established presence allows them to cater to large-volume buyers and niche markets alike, making them a dominant and reliable force in the polypropylene multifilament yarn supply chain.

Agropoli has carved a significant niche, particularly within the European market, by specializing in high-performance polypropylene yarns. Their focus is on developing solutions for demanding sectors like technical textiles, geotextiles, and agricultural applications. By prioritizing product durability, UV resistance, and specific functional properties, Agropoli positions itself as a key supplier for industrial and commercial clients who require specialized yarn performance rather than commodity-grade products.

Barnet’s strategy is built on vertical integration and a strong domestic footprint. They control aspects of the production process, ensuring supply chain reliability and cost-effectiveness. Their product range caters to both traditional applications like carpet backing and upholstery, as well as newer industrial uses. This control over manufacturing allows them to offer competitive pricing and maintain a loyal customer base in their core markets.

Top Key Players in the Market

- Antex

- Agropoli

- Barnet

- BR Group a.s.

- Chemosvit Fibrochem

- Cordex

- Essegomma

- Filatex India Ltd

- Lotte Chemical Corporation

- Lankhorst Yarns

Recent Developments

- In 2024, Barnet established a new distribution hub in the Asia-Pacific region in late 2024 to meet rising demand for PPMFY in textiles and automotive sectors, improving supply chain efficiency into 2024-2025. This supports multifilament yarn exports for geotextiles and composites.

- In 2025, Antex partnered with Reju and Utexa to validate and commercially adopt Reju Polyester in multifilament yarn production at its Girona facility. This initiative targets sustainable textile applications, with yarns scheduled for garment development by brand partners, enhancing supply chain efficiency and environmental performance.

Report Scope

Report Features Description Market Value (2024) USD 18.2 Billion Forecast Revenue (2034) USD 29.1 Billion CAGR (2025-2034) 4.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Multifilament Yarn, Monofilament, Textured, Spun, Tape, and Fibrillated and ATY), By Application (Packaging Materials, Home Textiles, Automotive Interiors, Construction Materials, Medical Textiles, Sports and Activewear, Industrial and PPE, and Filtration), By Process Type (FDY, POY, DTY, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Antex, Agropoli, Barnet, BR Group a.s., Chemosvit Fibrochem, Cordex, Essegomma, Filatex India Ltd, Lotte Chemical Corporation, Lankhorst Yarns Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Polypropylene Multifilament Yarn MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample

Polypropylene Multifilament Yarn MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Antex

- Agropoli

- Barnet

- BR Group a.s.

- Chemosvit Fibrochem

- Cordex

- Essegomma

- Filatex India Ltd

- Lotte Chemical Corporation

- Lankhorst Yarns