Global Pet Food Extrusion Market Size, Share, And Industry Analysis Report By Product Type (Dry Pet Food, Semi Moist Pet Food, Treats and Snacks, Veterinary Diets), By Animal Type (Dog, Cat, Fish, Birds, Others), By Extruder Type (Twin Screw Extrusion, Single Screw Extrusion), By Ingredient Type (Animal Based, Plant Based, Functional Ingredients, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 174754

- Number of Pages: 388

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

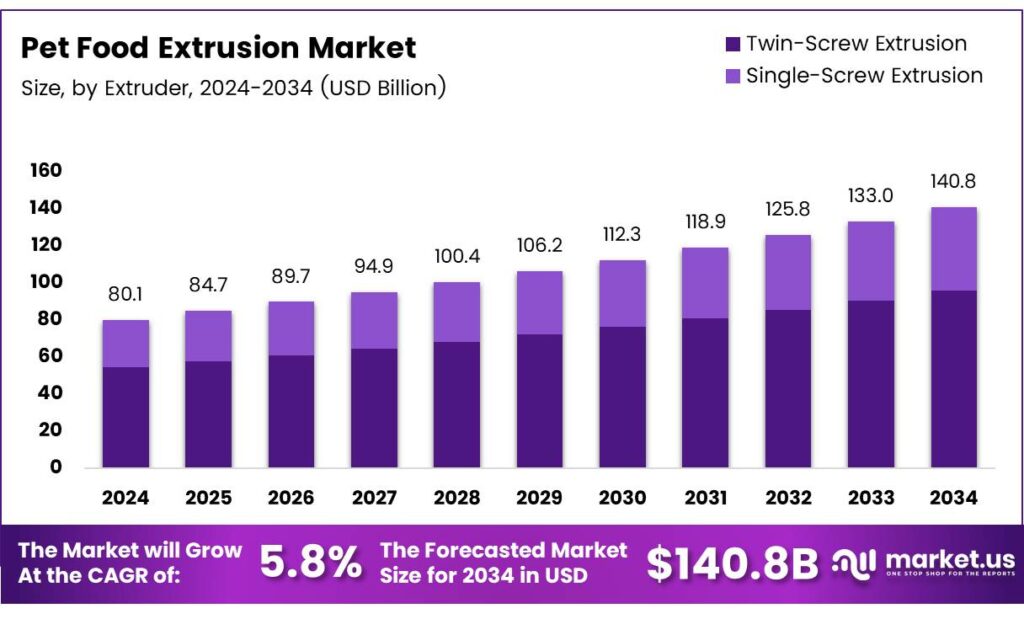

The Global Pet Food Extrusion Market size is expected to be worth around USD 140.8 billion by 2034, from USD 80.1 billion in 2024, growing at a CAGR of 5.8% during the forecast period from 2025 to 2034.

The Pet Food Extrusion Market represents the industrial process of shaping, cooking, and texturizing pet diets using high-temperature and high-pressure extrusion systems. This method enables consistent quality, improved digestibility, and customizable formulations, making it essential for dry kibble, snacks, and specialized functional pet foods in global production systems.

Premium nutrition demand and the shift toward functional and grain-free recipes. Extrusion supports ingredient flexibility, enabling manufacturers to incorporate proteins, fibers, and specialty additives. As consumer expectations evolve, producers increasingly rely on advanced extrusion technologies to ensure uniformity, safety, and shelf stability.

The aquafeed sector indirectly boosts technological advancements in extrusion due to shared processing needs. Aquafeed formulations consist of 29.2% fish-based, 26.6% wheat-based, 15.6% soy-based, 9.8% miscellaneous, 6.9% protein meals, 6.1% corn-based, 2% legumes, 1.5% oils and fats, 1.2% starches, 0.7% potato-based, and 0.3% barley-based ingredients.

- Pet food composition shapes extrusion demand. Pet diets contain 28.3% corn-based, 23.9% protein meals, 16.7% oils and fats, 11.6% soy-based, 5.8% wheat-based, 5.8% miscellaneous, 2.9% fish-based, 2.9% rice-based, and 2.2% potato-based ingredients. These ingredient structures drive consistent investment in extrusion lines optimized for varied density, moisture, and expansion levels.

The market benefits from expanding opportunities across Asia, Europe, and Latin America as households adopt modern pet care habits. Governments also encourage safer feed processes through updated hygiene regulations and technology-adoption incentives. These policies accelerate investment in extrusion equipment, energy-efficient systems, and automated quality control frameworks.

Rising attention toward food security and sustainable protein use strengthens market momentum. Producers explore alternative raw materials, plant proteins, and circular ingredients to meet environmental objectives. This shift encourages R&D spending in extrusion optimization, throughput improvement, and ingredient integration, supporting a more resilient and innovation-driven supply chain.

Key Takeaways

- The Global Pet Food Extrusion Market is projected to grow from USD 80.1 billion in 2024 to USD 140.8 billion by 2034, registering a 5.8% CAGR during 2025–2034.

- Dry Pet Food dominates the market by product type, accounting for 62.3% share due to shelf stability and extrusion compatibility.

- Dog Food leads with a 49.2% market share, driven by high global dog ownership and demand for balanced nutrition.

- Twin-Screw Extrusion is the leading extruder technology, holding 68.5% share because of superior mixing and formulation flexibility.

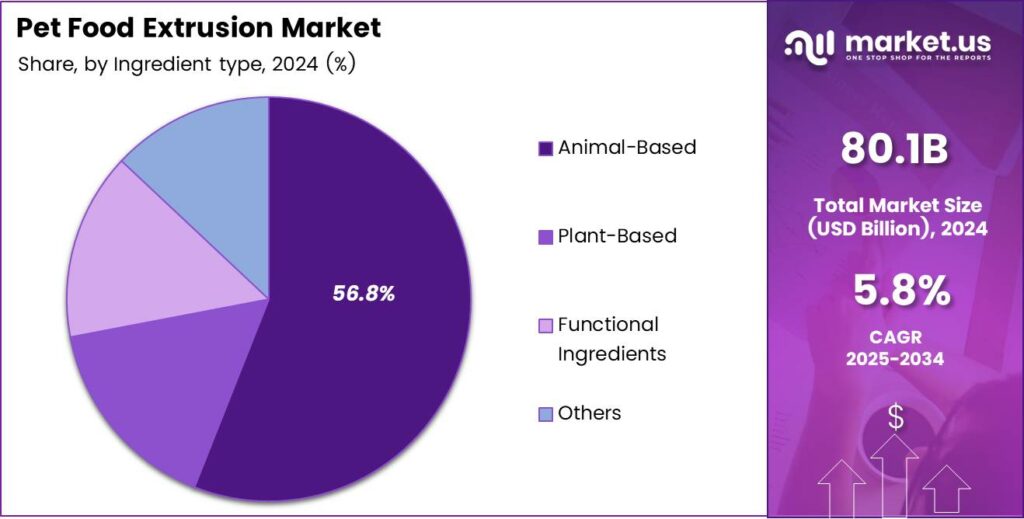

- Animal-Based Ingredients remain the largest ingredient segment with 56.8% share, reflecting a strong preference for protein-rich diets.

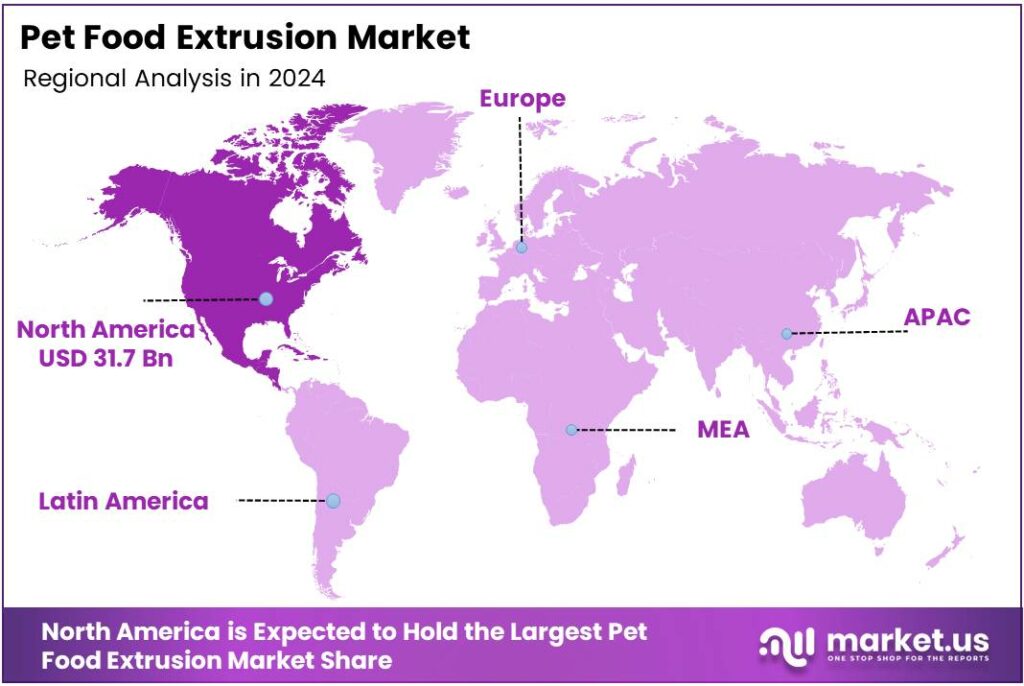

- North America is the dominant region, capturing 39.7% of the market and valued at USD 31.7 billion.

By Product Type Analysis

Dry Pet Food dominates with 62.3% due to its long shelf life, affordability, and compatibility with extrusion technologies.

In 2025, Dry Pet Food held a dominant market position in the By Product Type Analysis segment of the Pet Food Extrusion Market, with a 62.3% share. This segment continues to lead as manufacturers adopt extrusion for producing uniform, shelf-stable kibble while meeting demand for convenient and nutrient-rich daily pet meals.

Semi-moist pet food sustained steady demand as pet owners increasingly prefer soft textures for their aging pets. This segment benefits from extrusion, which supports controlled moisture levels and enhances palatability. Innovations in semi-moist formulations continue to expand adoption among consumers who seek alternatives between dry and wet pet food formats.

Treats and Snacks expanded as owners prioritize reward-based feeding behaviors. Extrusion enables customized shapes, flavors, and nutrient additions, driving its adoption. The segment also grows through rising premiumization, where pet snacks are fortified with functional additives such as probiotics, joint-support ingredients, and natural flavors, enhancing their overall appeal.

Veterinary Diets advanced gradually as veterinary-prescribed nutrition became integral to managing chronic conditions. Extrusion facilitates specialized formulations, including hypoallergenic, digestive-support, and metabolic diets. This segment gains traction as pet owners increasingly follow veterinarian guidance for long-term therapeutic feeding solutions supported by science-based nutrition.

By Animal Type Analysis

Dog Food dominates with 49.2% as dogs remain the largest consumer group of commercial extruded diets.

In 2025, Dog held a dominant market position in the By Animal Type Analysis segment of the Pet Food Extrusion Market, with a 49.2% share. Demand rises as dog owners prioritize balanced nutrition, functional treats, and premium formulations. Extrusion supports these needs by delivering consistent quality, digestibility, and nutrient retention.

Cat food maintained strong growth due to rising cat ownership and higher spending on feline-specific nutrition. Extruders enable the production of palatable kibble tailored for carnivorous needs, including high-protein and taurine-rich blends. This segment continues expanding as cats require nutrient-dense meals with specialized textural preferences.

Fish pet food witnessed a gradual uptake as aquaculture hobbyists sought nutritionally complete pellets. Extrusion technology creates floating and sinking feeds with controlled density and stability. The segment expands with increasing demand for ornamental fish nutrition worldwide, emphasizing formulated diets that enhance color, immunity, and growth.

Birds’ pet food progressed with interest in extruded pellets offering balanced micronutrients compared to seed mixes. Extrusion enhances digestibility and uniformity, supporting healthier feeding outcomes. Growth continues as bird owners shift to complete dietary blends for parrots, canaries, and small birds.

By Extruder Type Analysis

Twin-Screw Extrusion dominates with 68.5% due to superior mixing, flexibility, and precision in pet food production.

In 2025, Twin-Screw Extrusion held a dominant market position in the By Extruder Type Analysis segment of the Pet Food Extrusion Market, with a 68.5% share. This technology thrives due to its ability to handle diverse ingredients, deliver high-quality textures, and support advanced formulations across premium and functional pet food categories.

Single-Screw Extrusion continued to support cost-efficient production for standard pet foods. It remains preferred by small and mid-scale manufacturers due to lower operational costs and simplified process control. Although less versatile than twin-screw systems, it consistently delivers reliable outputs for conventional kibble and snack formulations.

By Ingredient Type Analysis

Animal-Based Ingredients dominate with 56.8% because pets prefer meat-rich formulations aligned with natural dietary patterns.

In 2025, Animal-Based ingredients held a dominant market position in the By Ingredient Type Analysis segment of the Pet Food Extrusion Market, with a 56.8% share. Extrusion supports the incorporation of meats, fats, and proteins that enhance palatability and nutrient density, driving continued reliance on animal-derived components.

Plant-Based ingredients advanced steadily as owners seek sustainable and allergy-friendly options. Extrusion enables efficient use of legumes, grains, and vegetable proteins, improving digestibility. This segment expands with rising interest in vegan and flexitarian pet feeding approaches, emphasizing eco-friendly ingredient sourcing.

Functional Ingredients grew as consumers emphasized preventive pet health. Extruders incorporate probiotics, omega-3s, antioxidants, and joint-support additives into kibble and treats. Increased focus on digestive health, immunity, and skin-care nutrition has propelled this segment’s importance in formulated diets.

Key Market Segments

By Product Type

- Dry Pet Food

- Semi-Moist Pet Food

- Treats and Snacks

- Veterinary Diets

By Animal Type

- Dog

- Cat

- Fish

- Birds

- Others

By Extruder Type

- Twin-Screw Extrusion

- Single-Screw Extrusion

By Ingredient Type

- Animal-Based

- Plant-Based

- Functional Ingredients

- Others

Emerging Trends

Rising Popularity of Clean-Label and High-Protein Pet Foods Shapes Market Trends

Clean-label pet food trends are gaining momentum as consumers prefer simple, transparent ingredient lists. Extrusion technology allows manufacturers to use natural binders and reduce artificial additives, supporting this major market shift. High-protein diets are also trending, especially among dog owners seeking performance or muscle-supporting nutrition.

- In Europe alone, annual pet food sales are reported at €29.2 billion, with production volume around 9.1 million tonnes, big enough for processors to invest in by-product sourcing, quality controls, and standardized ingredient specs. Extruders help incorporate large protein levels while maintaining texture and digestibility, making them central to this trend.

Pet owners increasingly look for crunchy treats, dual-texture snacks, and customized kibble shapes. Extrusion enables brands to develop unique textures that improve palatability and engagement. The growth of online pet food sales has also influenced formulation trends. Manufacturers optimize extruded products for packaging stability and longer shelf life, meeting logistics needs.

Drivers

Rising Shift Toward Premium and Nutritional Pet Diets Fuels Market Growth

The Pet Food Extrusion Market is growing mainly because pet owners are choosing healthier and premium food for their animals. As people see pets as part of the family, demand for high-protein, grain-free, and functional diets continues to rise. Extrusion technology supports this shift by offering consistent quality and better nutrient retention.

- The rising pet adoption across many regions. More households are adding pets, which increases the need for dry food, treats, and specialized diets. In the United States, 71% of households—about 94 million families own a pet, based on APPA’s national pet owners survey figures summarized by the Insurance Information Institute.

Extrusion systems allow manufacturers to scale production efficiently, ensuring a stable supply of formulated feed. The process reduces moisture and prevents microbial growth, making products safer. Additionally, the flexibility of extrusion enables brands to innovate textures and shapes, meeting consumer expectations for variety.

Restraints

High Equipment Costs and Energy Consumption Limit Market Expansion

One of the major restraints in the Pet Food Extrusion Market is the high initial investment required for extrusion equipment. Many small and mid-size manufacturers find it difficult to afford advanced systems, slowing adoption in developing markets. Energy consumption is another challenge. Extrusion machines require continuous heating and mechanical pressure, increasing operational costs.

- The need for skilled technicians creates constraints. Properly operating and maintaining extrusion systems demands trained staff, and the shortage of such expertise affects production efficiency. In the U.S., the EPA highlights a national 2030 target to cut food waste by 50%, and frames it as a per-person reduction goal to 164 pounds per person.

Raw material price fluctuations also put pressure on the industry. Ingredients like meat meals, vegetable proteins, and functional additives often experience supply-side volatility. When prices rise, producers must either absorb the impact or pass it on to consumers, which affects competitiveness.

Growth Factors

Growing Demand for Functional and Specialized Pet Diets Creates New Opportunities

The increasing demand for functional pet foods such as digestive-health diets, weight-management formulas, and age-specific nutrition opens strong opportunities for extrusion-based production. Extrusion supports precise nutrient delivery, making it ideal for these high-value formulations.

There is also a rising opportunity in plant-based and alternative-protein pet diets. As sustainability concerns grow, manufacturers are exploring insect protein, novel grains, and pea-based ingredients. Extruders can handle these materials efficiently, helping brands innovate eco-friendly recipes.

Export opportunities are expanding, especially in Asia and Latin America. These regions show growing pet ownership and rising interest in premium diets. Companies adopting extrusion technology can scale quickly to meet international demand. Private-label pet food growth in supermarkets and e-commerce also creates openings.

Regional Analysis

North America Dominates the Pet Food Extrusion Market with a Market Share of 39.7%, Valued at USD 31.7 Billion

North America leads the Pet Food Extrusion Market, supported by strong demand for premium, nutrient-rich pet diets and a mature pet ownership culture. The region’s dominance, with a 39.7% share and a valuation of USD 31.7 billion, is driven by rising adoption of high-quality extruded products and continuous innovation in pet nutrition. Strong manufacturing capabilities and consumer preference for clean-label, protein-dense pet foods further boost market expansion.

Europe shows steady progress, driven by stringent pet food safety regulations and a rising shift toward natural and sustainable ingredients. Consumers in the region increasingly prefer extruded diets due to enhanced digestibility and customized nutritional profiles. Growth also benefits from expanding premium pet food categories and heightened spending on companion animal well-being.

Asia Pacific is emerging as one of the fastest-growing regions, fueled by rapid urbanization, increasing pet adoption, and rising disposable incomes. Demand for affordable yet nutritionally balanced extruded pet food continues to grow, especially in China, India, and Southeast Asian nations. Local manufacturing expansion and improved retail access further support market acceleration.

The U.S. remains the core contributor within North America, benefiting from robust premium pet food adoption and a strong culture of pet humanization. Continuous innovation in functional, grain-free, and protein-rich extruded products strengthens market penetration. High consumer spending on pet nutrition and established manufacturing infrastructure keep the U.S. at the forefront of market expansion.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The global Pet Food Extrusion Market in 2025 continues to strengthen as leading manufacturers expand production capabilities, improve ingredient handling, and invest in advanced extrusion lines. Market momentum is shaped significantly by the strategic direction of major firms that dominate product development, formulation innovation, and supply-chain stability.

Mars, Incorporated remains a central force in shaping the global pet nutrition space, supported by its strong multi-brand portfolio and deep R&D capabilities. The company continues to focus on high-quality extruded kibble and treats, emphasizing digestibility and premium protein blends. Its scale, long-standing retail relationships, and ongoing automation upgrades reinforce its leadership.

Nestlé Purina PetCare maintains a powerful footprint in the extrusion market with its commitment to nutrient-dense dry food and enhanced palatability systems. The company consistently strengthens formulations through proprietary research into pet metabolism and ingredient performance. Its drive toward efficiency and sustainability in extrusion operations enhances its competitive influence.

Colgate-Palmolive, through its Hill’s Pet Nutrition division, continues advancing science-based diets that rely heavily on precision extrusion technology. Its focus on clinical nutrition and therapeutic dietary solutions boosts demand for consistent, high-stability extruded products. The company’s investment in new production facilities supports steady market expansion.

ADM Animal Nutrition plays a crucial enabling role by supplying high-grade ingredients, functional additives, and tailored nutrition systems used in extruded pet food. Its integration across agricultural inputs and specialty blends provides manufacturers with improved formulation reliability. ADM’s emphasis on protein innovation and ingredient purity strengthens its position as a key extrusion ecosystem partner.

Top Key Players in the Market

- Mars, Incorporated

- Nestlé Purina PetCare

- Colgate-Palmolive

- ADM Animal Nutrition

- Kemin Industries, Inc.

- Brabender

- Andritz Group

- Bühler Group

- Kahl Group

- Clextral

Recent Developments

- In 2025, Mars Petcare partnered with Big Idea Ventures to launch the 2025 Next Generation Pet Food Program, selecting three startups focused on biotech-based ingredients, essential nutrients, and circular feed innovations to promote sustainability in pet nutrition.

- In 2025, the Purina Foundation, a U.S. nonprofit supporting animal welfare, will focus on strengthening the human-animal bond, improving access to pet care, and veterinary services. Nestlé Purina invested in five U.S.-based pet care startups through its ninth annual Pet Care Innovation Prize.

Report Scope

Report Features Description Market Value (2024) USD 80.1 Billion Forecast Revenue (2034) USD 140.8 Billion CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Dry Pet Food, Semi-Moist Pet Food, Treats and Snacks, Veterinary Diets), By Animal Type (Dog, Cat, Fish, Birds, Others), By Extruder Type (Twin-Screw Extrusion, Single-Screw Extrusion), By Ingredient Type (Animal-Based, Plant-Based, Functional Ingredients, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Mars, Incorporated, Nestlé Purina PetCare, Colgate-Palmolive, ADM Animal Nutrition, Kemin Industries, Inc., Brabender, Andritz Group, Bühler Group, Kahl Group, Clextral Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Pet Food Extrusion MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Pet Food Extrusion MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Mars, Incorporated

- Nestlé Purina PetCare

- Colgate-Palmolive

- ADM Animal Nutrition

- Kemin Industries, Inc.

- Brabender

- Andritz Group

- Bühler Group

- Kahl Group

- Clextral