Global Oxidized Polyethylene Wax Market By Product (High-Density Oxidized PE Wax and Low-Density Oxidized PE Wax), By Form (Solid and Liquid), By Application (Plastic & Polymer, Coatings & Inks, Rubber, Metals Processing, Adhesives & Sealants, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 160293

- Number of Pages: 387

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overviews

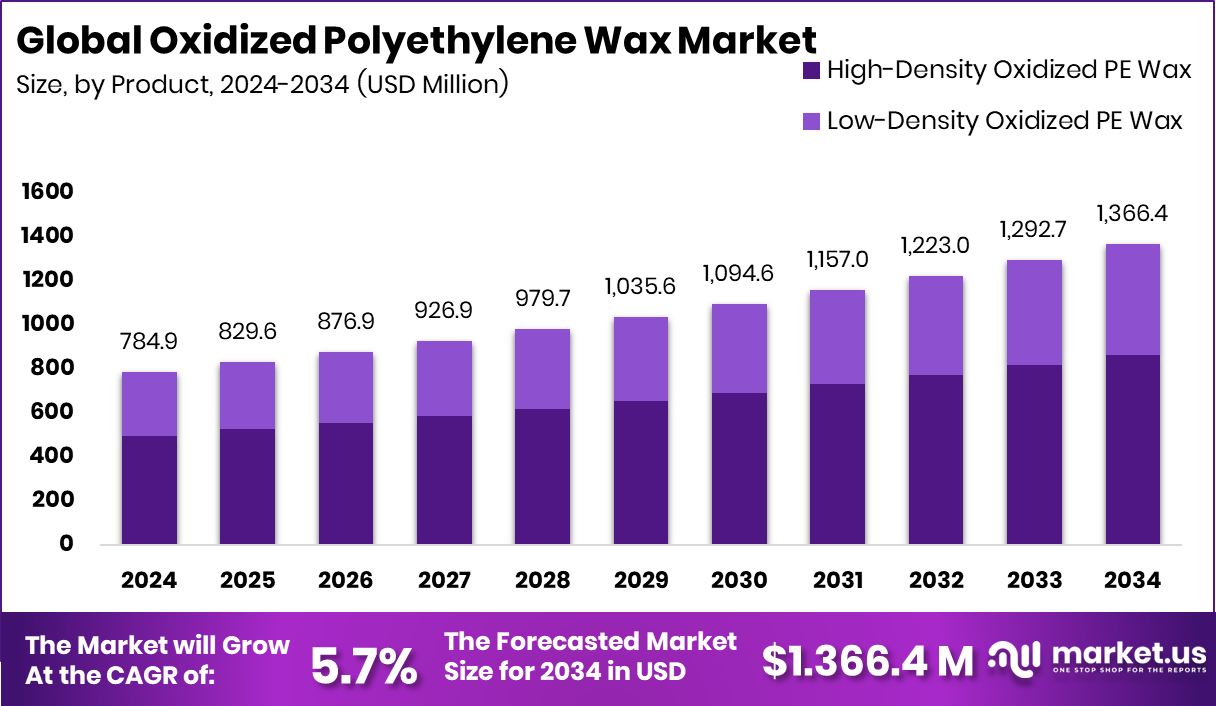

In 2024, the Global Oxidized Polyethylene Wax Market was valued at US$784.9 million, and between 2025 and 2034, it is estimated to register a CAGR of 5.7%, reaching approximately US$1.366.4 million by 2034.

Oxidized polyethylene wax (OPE) is a polyethylene wax that has undergone an oxidation process, introducing polar functional groups, such as carbonyl and hydroxyl, into its molecular structure. This modification significantly improves its properties, giving it increased polarity, better emulsification, superior compatibility with polar materials, and enhanced lubrication and dispersion capabilities compared to standard PE wax.

It is a widely used additive in various industries, including plastics, coatings, inks, adhesives, and polishes, to improve product performance and processing efficiency. One of the major drivers of the market is the plastic manufacturing industry. Additionally, its various applications, such as electronics and cosmetics, boost the market. Despite the advantages, the market faces competition from several waxes, such as polypropylene wax and Fischer-Tropsch wax.

- In 2023, plastic production reached approximately 413.8 metric tons worldwide annually, an increase of 3.3% from 2022. Out of total plastic production, polyethylene alone comprised around 12.2% of the production.

Key Takeaways

- The global oxidized polyethylene wax market was valued at US$784.9 million in 2024.

- The global oxidized polyethylene wax market is projected to grow at a CAGR of 5.7% and is estimated to reach US$ 1.366.4 million by 2034.

- Based on product, high-density oxidized polyethylene wax dominated the market in 2024, comprising about 63.2% share of the total global market.

- Solid oxidized polyethylene wax dominated the market with approximately 76.3% of the total market share.

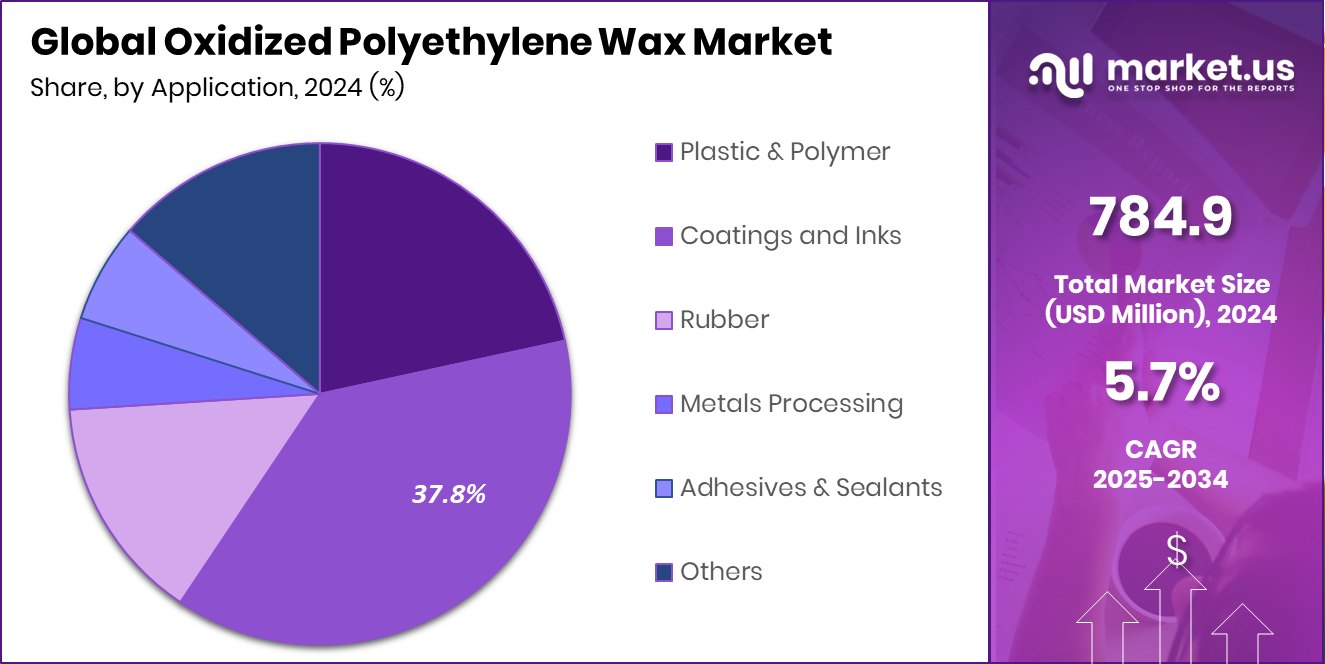

- Among the applications of oxidized polyethylene wax, the plastic processing industry dominated the market in 2024, accounting for around 37.8% of the market share.

- North America was the largest market for oxidized polyethylene wax in 2024, accounting for around 54.3% of the total global consumption.

Product Analysis

High-Density Oxidized Polyethylene Wax Dominated the Market

On the basis of products, the market is segmented into high-density oxidized PE wax and low-density oxidized PE wax. High-density oxidized polyethylene wax dominated the market in 2024 with a market share of 63.2%. High-density oxidized polyethylene (HD-OPE) wax is more widely utilized than low-density oxidized polyethylene (LD-OPE) due to its superior thermal stability, hardness, and abrasion resistance, making it better suited for demanding industrial applications.

HD-OPE wax has a more crystalline structure and higher melting point, which enhances its performance in high-temperature processes such as extrusion, injection molding, and hot-melt adhesives.

Additionally, its excellent lubricating and dispersing properties make it a preferred additive in PVC processing, coatings, and inks. In contrast, low-density variants, while softer and more flexible, offer lower mechanical strength and heat resistance, limiting their applicability in rigorous processing environments where durability and stability are essential.

Form Analysis

Solid Oxidized Polyethylene Wax Emerged as a Leading Segment in the Market in 2024.

Based on the forms of oxidized polyethylene wax, the market is divided into solid and liquid forms. Solid oxidized polyethylene wax dominated the market in 2024 with a market share of 76.3%. Solid oxidized polyethylene wax is more commonly used than its liquid form due to its superior versatility, higher melting point, and better performance in a wide range of industrial applications.

Solid OPE wax provides excellent lubrication, hardness, and abrasion resistance, making it ideal for use in plastics processing, coatings, printing inks, and master batches. Its solid form allows for easy blending with resins and other additives during high-temperature processes like extrusion and compounding.

Additionally, it offers improved storage stability and longer shelf life compared to liquid variants, which may require special handling or stabilizers. These properties make solid OPE wax more suitable for applications demanding structural consistency and thermal resistance.

Application Analysis

The Oxidized Polyethylene Wax Market was Primarily Driven by the Plastic & Polymer Industry.

Among the applications of oxidized polyethylene wax, the coatings and inks industry was at the forefront of the market, with a total global market share of 37.8%. Some other applications include plastic & polymer, rubber, metals processing, adhesives & sealants, and others. The plastic processing industry consumes more oxidized polyethylene wax than other sectors due to its critical role in enhancing processing efficiency and product quality.

OPE wax acts as an internal and external lubricant in plastic formulations, especially in PVC and polyolefin processing, where it reduces friction, prevents sticking, and improves mold release. Its ability to improve melt flow, stabilize thermal behavior, and disperse fillers or pigments makes it essential for high-speed extrusion, injection molding, and film production.

While industries such as paints, rubber, and adhesives use OPE wax for surface properties or blending, plastic processing demands larger volumes consistently, as the wax directly impacts production throughput, energy consumption, and final product performance.

Key Market Segments

By Product

- High-Density Oxidized PE Wax

- Low-Density Oxidized PE Wax

By Form

- Solid

- Liquid

By Application

- Plastic and Polymer

- Paints and Coatings

- Rubber

- Metals Processing

- Adhesives and Sealants

- Others

Drivers

Growing Demand from the Plastics Industry Drives the Oxidized Polyethylene Wax Market.

The oxidized polyethylene wax market is witnessing significant momentum, primarily driven by increasing demand from the plastics industry. For instance, in the plastics sector, OPE wax serves as an effective lubricant and dispersing agent, enhancing flow properties during extrusion and injection molding. This is particularly important in the production of PVC pipes, films, and profiles, where processing efficiency and surface finish are critical. The worldwide production of polyvinyl chloride reached around 57 million tons in 2024.

Additionally, in paints & coatings, OPE wax improves abrasion resistance, gloss control, and anti-blocking properties, making it valuable in both architectural and industrial applications. For instance, water-based coatings that incorporate OPE wax demonstrate enhanced durability and reduced friction, which are essential in high-performance environments.

According to industry usage patterns, a large proportion of OPE wax consumption, over 60%, is attributed to these two sectors. The continued expansion of construction and automotive manufacturing globally further amplifies demand, reinforcing OPE wax’s role as a critical performance additive across these applications.

Restraints

Intense Competition from Alternative Waxes and Polymers Poses a Significant Challenge in the Oxidized Polyethylene Wax Market.

The oxidized polyethylene wax market faces significant challenges due to intense competition from alternative waxes and polymers that offer similar or enhanced performance characteristics. Materials such as Fischer-Tropsch wax and polypropylene (PP) wax are increasingly being adopted across industries for their unique properties.

For instance, Fischer-Tropsch wax provides a higher melting point and greater hardness, making it preferable in high-temperature applications such as hot-melt adhesives and industrial coatings. Similarly, PP wax offers excellent scratch resistance and compatibility with polyolefins, making it a strong contender in plastic processing.

In the cosmetics and food packaging sectors, natural waxes are often favored due to their biodegradable and non-toxic nature, aligning with consumer preferences for sustainable and eco-friendly products. This diversification of options has made end-users more selective, compelling OPE wax manufacturers to innovate and differentiate their products to maintain market relevance in the face of growing substitution threats.

Opportunity

Increased Application in Electronic Components Boosts the Oxidized Polyethylene Wax Market.

The expanding use of oxidized polyethylene wax in electronic components is opening new avenues for manufacturers and suppliers in the market. As electronic devices become more compact and sophisticated, the demand for advanced materials that offer thermal stability, chemical resistance, and surface protection has grown.

OPE wax is increasingly utilized in the production of cable insulation, circuit board coatings, and electronic encapsulation materials due to its excellent lubrication, anti-static properties, and compatibility with polymer systems.

For instance, in cable manufacturing, OPE wax is used to reduce friction during extrusion and improve insulation performance. Additionally, in printed circuit boards (PCBs), it enhances the dispersion of fillers and pigments in coatings, contributing to improved durability and electrical insulation. These components are then used in various devices such as smartphones, laptops, and washing machines.

Trends

Increased Demand from the Cosmetics Industry.

The cosmetics industry has emerged as a notable end-user of oxidized polyethylene wax, with demand steadily increasing due to its beneficial properties in formulation and product performance. OPE wax is valued in cosmetic applications for its smooth texture, emollient properties, and ability to enhance the consistency and stability of products such as lipsticks, creams, lotions, and sunscreens. It acts as a thickening agent, stabilizer, and moisture barrier, contributing to a pleasant skin feel and improved product longevity.

For instance, in lipsticks and balms, OPE wax provides a glossy finish and helps maintain structural integrity under varying temperatures. Similarly, in skincare formulations, it enhances spreadability and absorption without leaving a greasy residue. The cosmetic and personal care applications now constitute a growing segment of total OPE wax consumption globally.

Geopolitical Impact Analysis

Geopolitical Tensions Leading to Supply Chain Disruptions in the Oxidized Polyethylene Wax Market.

Geopolitical tensions have a notable impact on the oxidized polyethylene wax market, particularly through disruptions in global supply chains, trade restrictions, and fluctuating raw material availability. OPE wax production relies heavily on petrochemical derivatives, and instability in oil-producing regions, such as the Middle East or Eastern Europe, can result in unpredictable feedstock prices and constrained supply. For instance, in late 2022, after the war broke out between Russia and Ukraine, the U.S. and the European Union imposed trade restrictions on Russia.

The Russian gas supply ban has put pressure on European polymer producers, potentially impacting the oxidized polyethylene market within the region. Similarly, the trade wars between the regions have significantly impacted the oxidized polyethylene market. The U.S. exported 2.4 million tons of PE to China in 2024, about 16.8% of total U.S. PE exports. However, due to the increasing tariffs, the exports saw a declining trend. Such geopolitical uncertainties make it difficult for companies to plan long-term strategies, often leading to reduced investment and increased volatility in the OPE wax market.

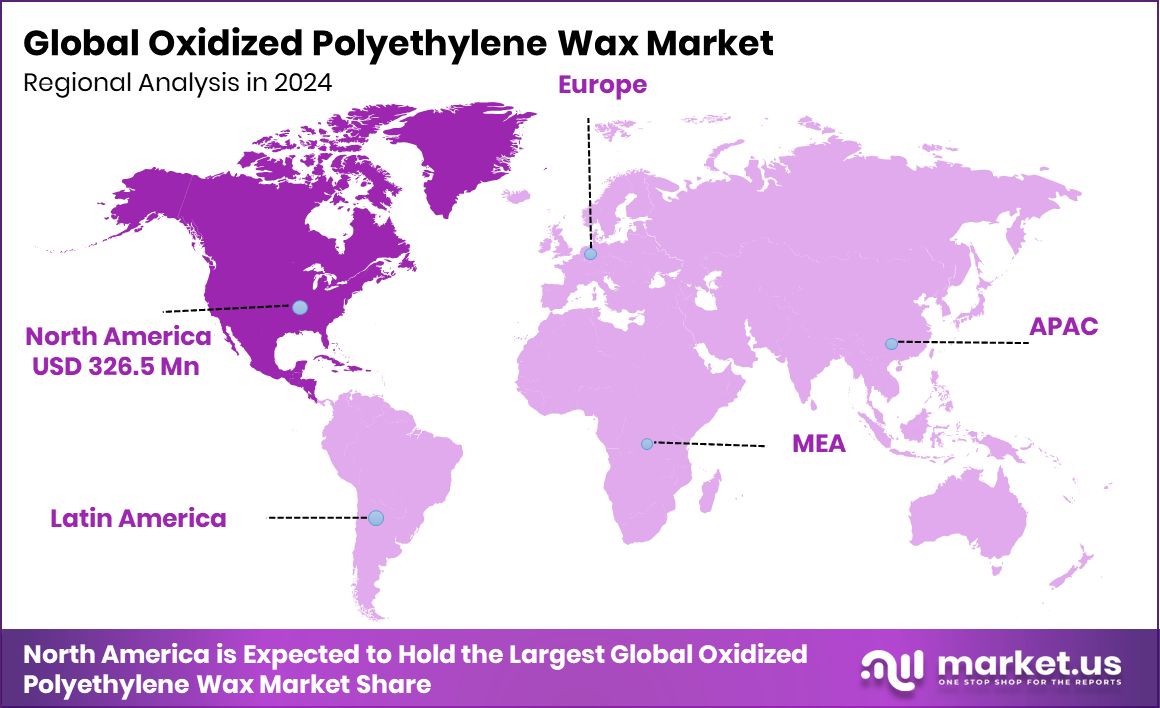

Regional Analysis

North America was the Largest Market for Oxidized Polyethylene Wax in 2024.

North America held the major share of the global oxidized polyethylene wax market, valued at around US$326.5 million, commanding an estimated 41.6% of the total revenue share. The region has established itself as the largest market for OPE wax, supported by its advanced industrial base, strong manufacturing infrastructure, and high demand across key end-use sectors. The region hosts a robust plastics industry, with the United States being one of the world’s leading producers and consumers of PVC products, where OPE wax is extensively used as a lubricant and processing aid.

In 2024, the United States exported polyvinyl chloride worth approximately US$2.54 billion.

Additionally, North America’s well-developed paints and coatings sector, driven by construction, automotive, and aerospace industries, relies on OPE wax to enhance surface properties, including abrasion resistance and gloss control. Similarly, the presence of leading cosmetics and personal care brands contributes to consistent demand, as OPE wax is used in various formulations to improve texture and stability.

Furthermore, the region’s focus on technological innovation has spurred the adoption of OPE wax in electronics and 3D printing materials. With such diverse applications and strong industrial demand, North America remains a key hub for OPE wax consumption.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The major global companies in the oxidized polyethylene (OPE) wax market—such as Palmer Holland, The Lubrizol Corporation, SCG Chemicals, Marcus Oil, Münzing Chemie GmbH, Honeywell International, Cosmic Petrochem, Micro Powders, DEUREX AG, Sanyo Chemical Industries, & others—are pursuing strategies focused on product innovation, regional expansion, and application diversification to strengthen market presence.

These firms emphasize research and development to enhance performance characteristics like lubrication, dispersibility, and thermal stability, while also targeting eco-friendly and sustainable formulations. Strategic partnerships, acquisitions, and distribution agreements are leveraged to expand customer reach, particularly in coatings, adhesives, plastics, and rubber processing industries worldwide.

Lubrizol Corporation is a major supplier of specialty chemicals and additives, including oxidized polyethylene wax. The company leverages advanced technology to meet customer demands in sectors ranging from packaging to automotive.

SCG Chemicals (SCGC) is a leading Thai petrochemical company and a major producer of synthetic waxes, including oxidized polyethylene wax. SCGC leverages proprietary manufacturing processes, advanced technology, and stringent quality control to produce a diversified portfolio of polyethylene waxes, including its oxidized wax for specific performance applications.

Honeywell International Inc. is a U.S.-based multinational technology and manufacturing company operating in various industries. The company produces oxidized polyethylene waxes through its advanced materials division, sold under brands like ACumist with products such as A-C 629.

Top Key Players in the Market

- Palmer Holland, Inc.

- The Lubrizol Corp.

- SCG Chemicals Co., Ltd.

- Marcus Oil

- Munzing Chemie GmbH

- Honeywell International Inc.

- Cosmic Petrochem Pvt. Ltd.

- Micro Powders Inc.

- DEUREX AG

- Sanyo Chemical Industries Ltd.

- Other Players

Recent Developments

- In August 2023, Braskem, the leading global biopolymer producer, and SCG Chemicals, a leading petrochemical company, signed a joint venture (JV) agreement to create Braskem Siam Company Limited, which aims to produce bio-ethylene from bio-ethanol dehydration and to commercialize bio-based PE, using the EtE EverGreen technology.

Report Scope

Report Features Description Market Value (2024) USD 784.9 Million Forecast Revenue (2034) USD 1.366.4 Million CAGR (2025-2034) 5.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (High-Density Oxidized PE Wax, Low-Density Oxidized PE Wax), By Form (Solid, Liquid), By Application (Plastic & Polymer, Coatings and Inks, Rubber, Metals Processing, Adhesives & Sealants, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Palmer Holland, The Lubrizol Corp., SCG Chemicals, Marcus Oil, Munzing Chemie GmbH, Honeywell International, Cosmic Petrochem, Micro Powders, DEUREX AG, and Sanyo Chemical Industries, Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Oxidized Polyethylene Wax MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample

Oxidized Polyethylene Wax MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Palmer Holland, Inc.

- The Lubrizol Corp.

- SCG Chemicals Co., Ltd.

- Marcus Oil

- Munzing Chemie GmbH

- Honeywell International Inc.

- Cosmic Petrochem Pvt. Ltd.

- Micro Powders Inc.

- DEUREX AG

- Sanyo Chemical Industries Ltd.

- Other Players