Global Nurse Call Systems Market By Type (Button-Based Systems, Integrated Communication Systems, Mobile Systems, Intercom Systems, Basic Audio/Visual Systems) By Technology (Wired Communication, Wireless Communication, Hybrid Systems) By Application (Alarms & Communications, Wanderer Control, Workflow Optimization, Fall Detection & Prevention, Visitor Management) By End-User (Hospitals, Ambulatory Surgery Centers (ASCs), Nursing Homes & Assisted Living Centers, Clinics & Physician Offices, Rehabilitation Centers & Outpatient Departments) By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 159396

- Number of Pages: 296

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

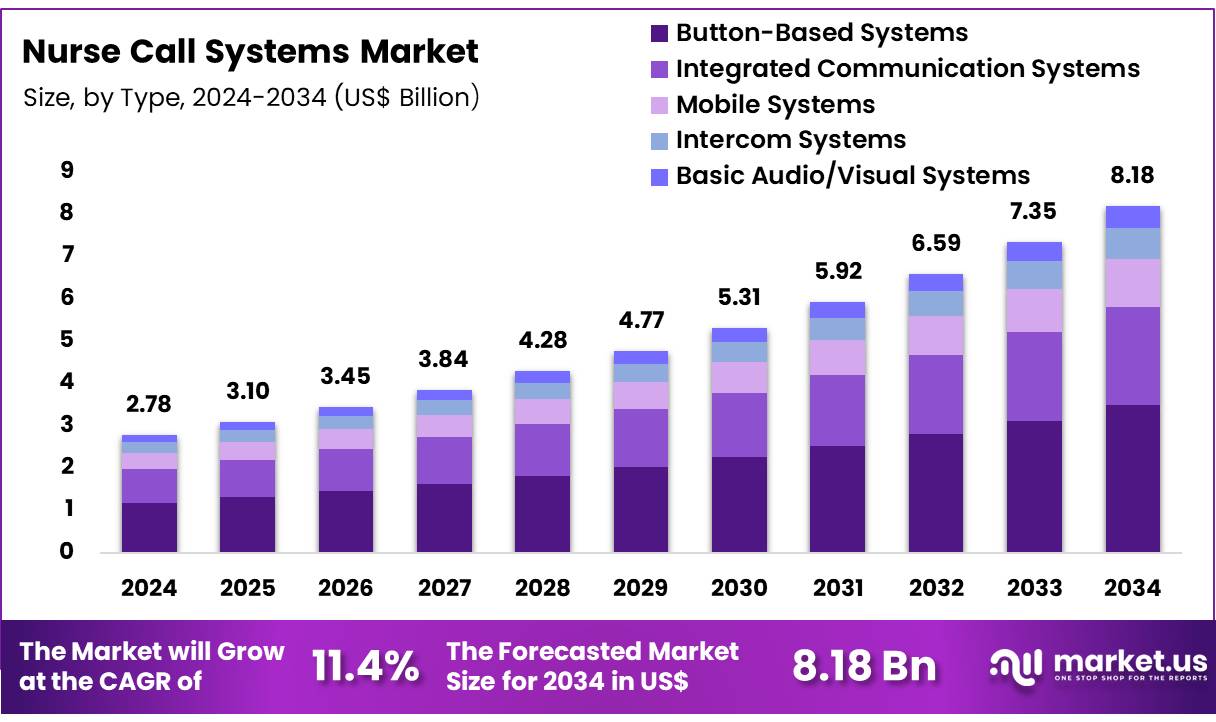

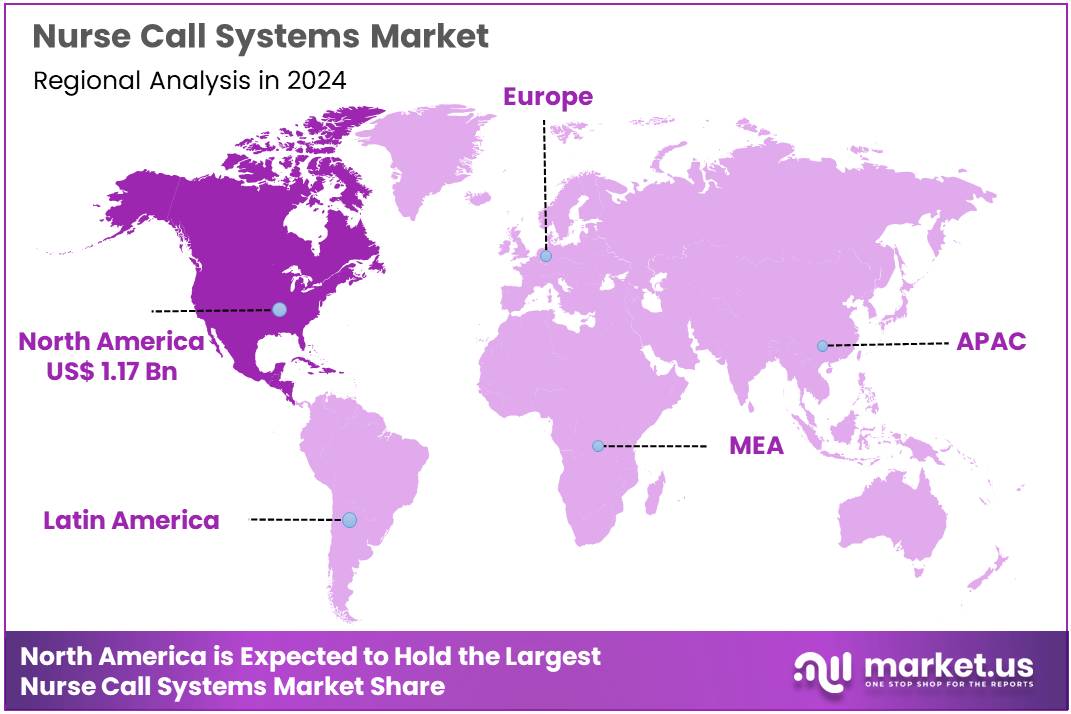

Global Nurse Call Systems Market size is expected to be worth around US$ 8.18 Billion by 2034 from US$ 2.78 Billion in 2024, growing at a CAGR of 11.4% during the forecast period from 2025 to 2034. In 2024, North America led the market, achieving over 42.3% share with a revenue of US$ 1.17 Billion.

The landscape of healthcare communication is evolving rapidly, as hospitals and care facilities increasingly adopt advanced nurse call systems to enhance patient safety, streamline workflows, and improve response times. A nurse call system is a critical tool enabling patients to summon nursing staff directly, typically via bedside buttons or wireless devices, facilitating timely clinical intervention.

In residential care settings, traditional nurse call systems rely on patient-initiated alerts. Emerging wireless nurse call systems (WNCSs), by contrast, integrate automated detection of hazardous events (such as falls) and support multifaceted communication among patients, caregivers, and facility management. These systems are now being adopted more broadly in hospital environments to elevate quality of care.

Recent technological innovations position modern nurse call platforms as smart communication hubs. Next-generation solutions support plug-and-play integration with medical devices, real-time analytics on staff response times, and seamless escalation workflows. These capabilities help reduce alarm fatigue, optimize staff allocation, and deliver measurable operational efficiencies across nursing units.

In parallel, technology providers assert that digital and wireless deployments are emerging segments with accelerated adoption potential. Regionally, North America commands a major share of current implementations, yet Asia-Pacific is expected to see strong growth driven by investment in healthcare upgrades.

Key drivers fueling growth include the increasing elderly population, prevalence of chronic diseases, and demand for more efficient hospital operations under constrained staffing. At the same time, challenges such as system interoperability, initial deployment cost, and clinical acceptance remain.

Key Takeaways

- Market Size: Global Nurse Call Systems Market size is expected to be worth around US$ 8.18 Billion by 2034 from US$ 2.78 Billion in 2024.

- Market Growth: The market growing at a CAGR of 11.4% during the forecast period from 2025 to 2034.

- Type Analysis: Button-based systems dominate the market in 2024, accounting for 42.5% of the total market share.

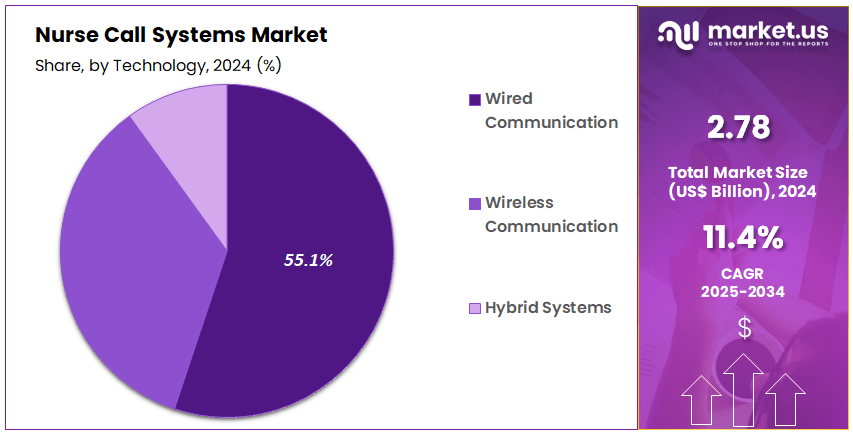

- Technology Analysis: In 2024, wired communication systems dominate the market with a 55.12% share.

- Application Analysis: In 2024, alarms & communications represent the dominant segment, holding a 38.8% market share.

- End-Use Analysis: In 2024, hospitals emerged as the leading end-user segment, commanding a 38.9% market share.

- Regional Analysis: In 2024, North America held a dominant market position, capturing more than a 42.3% share and holding a market value of US$ 1.17 Billion for the year.

Type Analysis

The global nurse call systems market is segmented by type into button-based systems, integrated communication systems, mobile systems, intercom systems, and basic audio/visual systems. Among these, button-based systems dominate the market in 2024, accounting for 42.5% of the total market share. This leadership can be attributed to their widespread adoption in hospitals, nursing homes, and assisted living facilities due to ease of installation, affordability, and reliability. Their functionality in providing immediate patient-to-nurse communication continues to drive strong demand.

Integrated communication systems represent the second most significant segment. These solutions offer enhanced interoperability with electronic health records and hospital management systems, enabling streamlined workflows and reduced response times. Their increasing deployment in advanced healthcare infrastructures supports steady market expansion.

Mobile systems are projected to gain traction owing to the growing use of smartphones and wireless devices in healthcare facilities. These systems facilitate real-time alerts and mobility for caregivers, improving efficiency in patient monitoring. Intercom systems hold a moderate share, primarily in smaller healthcare facilities, where cost considerations limit the adoption of advanced integrated or mobile solutions.

Basic audio/visual systems occupy a niche segment, used in settings with minimal communication requirements. However, their growth potential is constrained due to limited features compared with advanced systems.

Overall, the market demonstrates a clear dominance of button-based systems, while integrated and mobile systems indicate promising opportunities driven by technological advancements and digital transformation in healthcare.

Technology Analysis

Technology Segment deviced into wired communication, wireless communication, and hybrid systems. In 2024, wired communication systems dominate the market with a 55.12% share, maintaining their leading position due to high reliability, minimal interference, and proven performance in critical healthcare environments. Wired systems are widely preferred in hospitals and large healthcare institutions, where uninterrupted connectivity and compliance with stringent safety standards are essential. Their lower risk of network disruptions compared to wireless systems continues to sustain their strong adoption rate.

Wireless communication systems are experiencing notable growth, supported by the increasing digitization of healthcare infrastructure and the rising preference for mobility in patient care. These systems enable caregivers to receive alerts on mobile devices or pagers, improving responsiveness and flexibility. The scalability and ease of installation of wireless solutions make them attractive for facilities undergoing modernization or expansion, particularly in developed markets.

Hybrid systems, which combine the reliability of wired connections with the flexibility of wireless networks, are gradually gaining acceptance. These solutions are particularly suitable for healthcare facilities seeking a balanced approach, offering dependable performance while also enabling mobility. Hybrid models are expected to witness steady adoption in medium to large healthcare institutions looking to upgrade without fully transitioning to wireless infrastructure.

Overall, while wired systems dominate the market in 2024, wireless and hybrid solutions are forecasted to drive the next phase of growth, propelled by the need for mobility, scalability, and digital integration in healthcare services.

Application Analysis

The nurse call systems market is segmented by application into alarms & communications, wanderer control, workflow optimization, fall detection & prevention, and visitor management. In 2024, alarms & communications represent the dominant segment, holding a 38.8% market share. This segment’s prominence is driven by the critical role of real-time communication in healthcare facilities, where timely alerts between patients and caregivers directly influence patient safety and quality of care. The demand for reliable alarm and communication systems remains strong in hospitals, nursing homes, and long-term care centers.

Wanderer control systems constitute an important segment, particularly in facilities specializing in elderly care or dementia treatment. These systems are increasingly adopted to monitor patient movement, prevent unauthorized exits, and enhance safety for vulnerable populations. Workflow optimization applications are gaining traction as healthcare providers focus on improving staff efficiency and resource utilization. By integrating nurse call systems with hospital management solutions, facilities are able to streamline operations and reduce response times.

Fall detection and prevention solutions are emerging as a critical application, particularly with the growing geriatric population. These systems leverage sensors and monitoring devices to alert caregivers to potential fall risks, thus reducing adverse events and improving patient outcomes. Visitor management applications represent a smaller yet expanding segment, driven by the need for enhanced security and regulated access within healthcare environments.

End-User Analysis

In 2024, hospitals emerged as the leading end-user segment, commanding a 38.9% market share. The dominance of this segment can be attributed to the large-scale deployment of nurse call systems to streamline communication between patients and caregivers, reduce response times, and ensure patient safety in high-volume and acute care settings. The integration of advanced systems with electronic health records (EHRs) and real-time location systems (RTLS) has further strengthened adoption within hospitals.

Ambulatory Surgery Centers (ASCs) represent a rapidly growing segment, driven by the rising demand for cost-effective, outpatient surgical procedures. Nurse call systems in ASCs play a vital role in enhancing patient experience, improving workflow efficiency, and ensuring regulatory compliance with safety standards.

Nursing Homes and Assisted Living Centers account for a significant portion of demand, primarily due to the aging population and the rising prevalence of chronic diseases. The increasing need for fall detection, emergency alerts, and mobility support solutions has boosted the use of nurse call systems in these facilities. Clinics and Physician Offices have demonstrated steady adoption, particularly small and mid-sized practices aiming to enhance patient management and streamline staff communication.

Rehabilitation Centers and Outpatient Departments are also contributing to market growth, as they increasingly utilize nurse call systems to manage post-acute care patients, ensure timely intervention, and optimize rehabilitation outcomes. Collectively, these segments complement hospital demand, creating a diversified and expanding end-user landscape for nurse call systems globally.

Key Market Segments

By Type

- Button-Based Systems

- Integrated Communication Systems

- Mobile Systems

- Intercom Systems

- Basic Audio/Visual Systems

By Technology

- Wired Communication

- Wireless Communication

- Hybrid Systems

By Application

- Alarms & Communications

- Wanderer Control

- Workflow Optimization

- Fall Detection & Prevention

- Visitor Management

By End-User

- Hospitals

- Ambulatory Surgery Centers (ASCs)

- Nursing Homes & Assisted Living Centers

- Clinics & Physician Offices

- Rehabilitation Centers & Outpatient Departments

Driving Factors

The growth of the nurse call systems market is being driven by the rising demand for improved patient safety and efficient communication in healthcare facilities. Increasing patient admissions, particularly among the growing elderly population, have created a critical need for advanced nurse call solutions. Hospitals and long-term care centers are adopting these systems to enhance workflow efficiency, reduce response times, and improve patient outcomes.

Furthermore, regulatory emphasis on patient safety and government investments in healthcare infrastructure are supporting adoption. The rising incidence of chronic diseases also fuels the demand for continuous monitoring and effective communication tools. These factors collectively accelerate the deployment of nurse call systems in hospitals, nursing homes, and assisted living facilities.

Trending Factors

A key trend shaping the nurse call systems market is the integration of digital technologies such as wireless communication, IoT, and cloud-based platforms. Modern nurse call systems are evolving from basic alert mechanisms to advanced communication hubs capable of real-time monitoring, data analytics, and remote access. Wireless solutions are gaining traction due to their flexibility, scalability, and reduced installation costs.

In addition, mobile applications and smart devices are being connected with nurse call systems to improve staff mobility and responsiveness. Healthcare facilities are increasingly favoring integrated platforms that combine nurse call functionalities with electronic health records and alarm management systems, thereby creating a shift toward smarter, technology-driven patient care environments.

Restraining Factors

The expansion of the nurse call systems market is constrained by high installation and maintenance costs. Advanced systems with wireless, cloud-based, and integrated features require significant upfront capital investment, which can be challenging for small and medium healthcare facilities. Budgetary limitations in underdeveloped regions further restrict adoption.

Moreover, system downtime, technical glitches, or cybersecurity risks associated with connected devices can disrupt critical patient care communication. Lack of standardized protocols across healthcare settings may also hinder interoperability, making integration with existing hospital infrastructure complex. These financial and technical barriers, combined with training requirements for healthcare staff, act as restraints to the widespread deployment of nurse call systems globally.

Opportunity Factors

Significant opportunities exist in the nurse call systems market through the increasing adoption of smart hospitals and aging-in-place solutions. Rising healthcare digitalization and government funding for modern infrastructure are expected to create demand for advanced communication systems. The growing elderly population and the rising need for long-term care facilities open avenues for adoption of wireless and remote monitoring-enabled nurse call solutions.

Expansion in emerging markets, where healthcare infrastructure is rapidly developing, also provides untapped potential. Furthermore, integration of artificial intelligence and predictive analytics into nurse call systems can enhance workflow optimization and proactive patient care, thereby creating value-added opportunities for healthcare providers and technology developers alike.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 42.3% share and holding a market value of US$ 1.17 Billion for the year. The growth of the North American market was supported by advanced healthcare infrastructure and higher adoption of digital communication systems in hospitals and long-term care facilities. The region has a well-established network of hospitals, nursing homes, and assisted living centers, which has created a strong demand for reliable nurse call solutions.

The adoption of modern technologies such as wireless communication, integrated alarms, and real-time patient monitoring systems has further strengthened the market position in the region. Increased healthcare spending, combined with a strong focus on patient safety, has encouraged healthcare providers to invest in advanced nurse call systems.

The prevalence of chronic illnesses and the rise in the geriatric population have also contributed to the demand. These factors have created a higher need for efficient communication between patients and caregivers in both acute care and long-term care facilities.

Government support for healthcare digitization and strong presence of key manufacturers in the United States have provided an additional advantage. The emphasis on reducing response times, improving workflow, and enhancing overall patient outcomes has made nurse call systems a critical part of North American healthcare operations.

As a result, North America is expected to continue holding a significant share in the global nurse call systems market, with growth driven by technological advancements, aging demographics, and continuous investment in healthcare modernization.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The nurse call systems market is characterized by intense competition, with several established and emerging players contributing to innovation and growth. The market landscape is shaped by manufacturers focusing on the integration of advanced technologies such as wireless connectivity, Internet of Things (IoT), and real-time patient monitoring.

Strategies such as product portfolio expansion, regional penetration, and partnerships with healthcare facilities are being adopted to strengthen market presence. Companies are emphasizing the development of solutions that enhance communication efficiency, patient safety, and workflow optimization within healthcare environments. A strong emphasis is also placed on compliance with regulatory standards, which plays a critical role in adoption across hospitals and long-term care facilities.

Furthermore, growing investments in research and development are accelerating the shift toward smart, integrated platforms, while service differentiation through training and support is being leveraged as a competitive advantage. Overall, the market is defined by technological innovation, customization, and value-added services.

Market Key Players

- Rauland (AMETEK, Inc.)

- Ascom Holding AG

- Austco Healthcare

- Honeywell International Inc.

- Johnson Controls

- Hill-Rom Services Inc. (now part of Baxter International Inc.)

- STANLEY Healthcare (now Securitas Healthcare)

- West-Com Nurse Call Systems, Inc.

- Azure Healthcare Limited

- Cornell Communications

- Critical Alert Systems LLC

- Televic Healthcare

- Other key players

Recent Developments

- Rauland (AMETEK, Inc.) — In February 2017, AMETEK completed the acquisition of Rauland-Borg (Rauland), a leading provider of hospital communications and nurse call systems, for USD 340 million, plus up to USD 30 million in contingent payments.

- Ascom Holding AG — In August 2024, Ascom launched Telligence 7, a next-generation nurse call system designed for acute care environments. Telligence 7 introduces seven new capabilities that enhance security, adaptability, and ease of deployment.

- Austco Healthcare — In May 2024, Austco Healthcare completed the acquisition of Amentco Enterprise Group Ltd, an Australian systems integrator and certified nurse call reseller. The deal was structured with a cash component (AUD 5 million) and issuance of Austco shares (10.256 million shares subject to escrow) to Amentco shareholders.

- Hill-Rom Services Inc.— In December 2021, Baxter International completed its acquisition of Hillrom, creating a medtech leader with a combined enterprise value of approximately USD 12.5 billion. The acquisition was first agreed in September 2021 (Baxter to acquire Hillrom for USD 156 per share) and closed in December.

Report Scope

Report Features Description Market Value (2024) US$ 2.78 Billion Forecast Revenue (2034) US$ 8.18 Billion CAGR (2025-2034) 11.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Button-Based Systems, Integrated Communication Systems, Mobile Systems, Intercom Systems, Basic Audio/Visual Systems) By Technology (Wired Communication, Wireless Communication, Hybrid Systems) By Application (Alarms & Communications, Wanderer Control, Workflow Optimization, Fall Detection & Prevention, Visitor Management) By End-User (Hospitals, Ambulatory Surgery Centers (ASCs), Nursing Homes & Assisted Living Centers, Clinics & Physician Offices, Rehabilitation Centers & Outpatient Departments) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Rauland (AMETEK, Inc.), Ascom Holding AG, Austco Healthcare, Honeywell International Inc., Johnson Controls, Hill-Rom Services Inc. (now part of Baxter International Inc.), STANLEY Healthcare (now Securitas Healthcare), West-Com Nurse Call Systems, Inc., Azure Healthcare Limited, Cornell Communications, Critical Alert Systems LLC, Televic Healthcare, Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Rauland (AMETEK, Inc.)

- Ascom Holding AG

- Austco Healthcare

- Honeywell International Inc.

- Johnson Controls

- Hill-Rom Services Inc. (now part of Baxter International Inc.)

- STANLEY Healthcare (now Securitas Healthcare)

- West-Com Nurse Call Systems, Inc.

- Azure Healthcare Limited

- Cornell Communications

- Critical Alert Systems LLC

- Televic Healthcare

- Other key players