Global Non-Alcoholic RTD Beverages Market Size, Share, And Enhanced Productivity By Product (Carbonated Soft Drinks, RTD Tea and Coffee, Functional Beverages, Juices, Dairy-based Beverages, Others), By Flavor (Citrus, Berry, Herbal, Spicy, Vanilla), By Distribution Channel (Hypermarkets and Supermarkets, Convenience Stores, Department Stores, Online, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 174697

- Number of Pages: 373

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

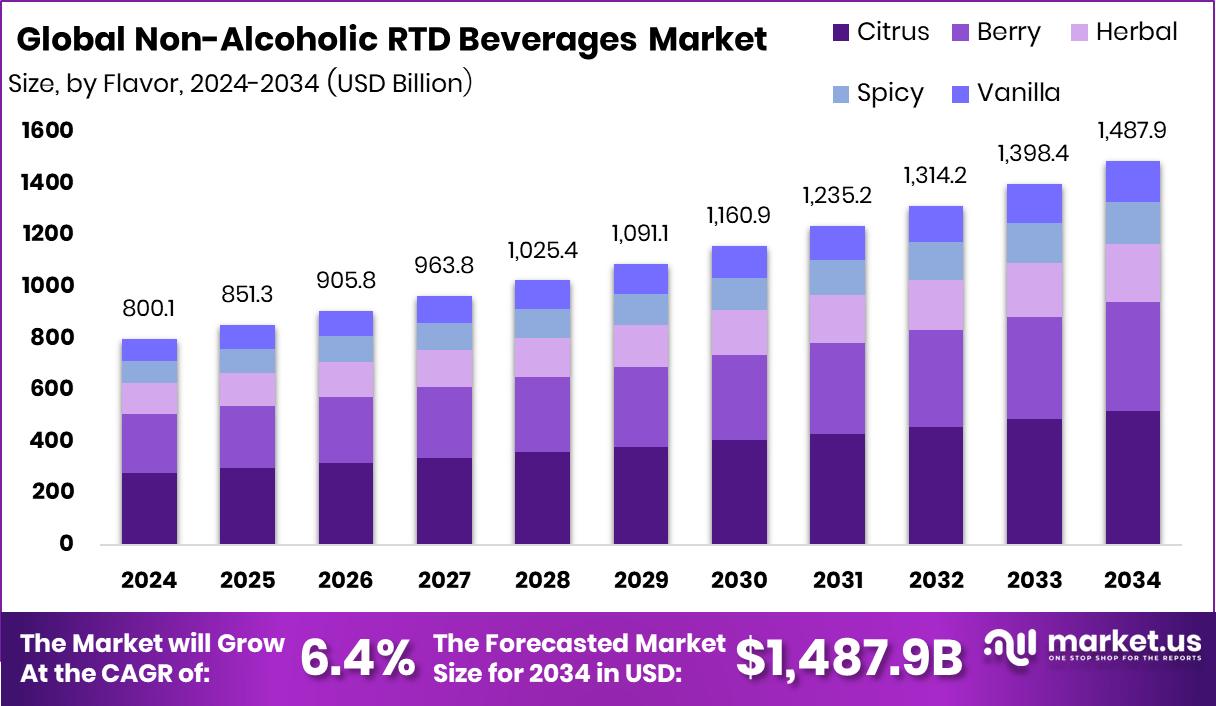

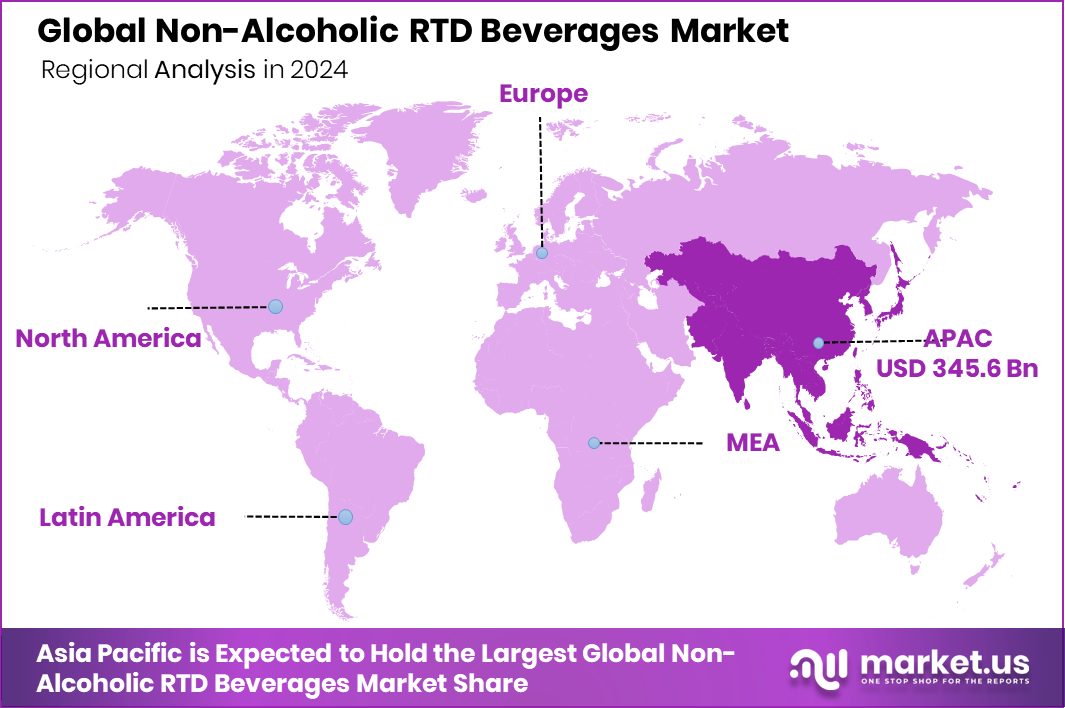

The Global Non-Alcoholic RTD Beverages Market is expected to be worth around USD 1,487.9 billion by 2034, up from USD 800.1 billion in 2024, and is projected to grow at a CAGR of 6.4% from 2025 to 2034. Asia Pacific continued dominating due to strong consumption trends supporting USD 345.6 Bn.

Non-Alcoholic RTD beverages are ready-to-drink products that contain no alcohol and are sold in convenient, pre-packaged formats. These drinks include sodas, flavored waters, teas, juices, energy drinks, functional beverages, and sparkling blends designed for on-the-go consumption. They appeal to consumers who prefer instant refreshment without preparation, making them ideal for work, travel, and leisure moments. Their convenience and wide flavor choices have helped them become one of the fastest-growing beverage categories across different age groups.

The Non-Alcoholic RTD Beverages Market refers to the entire commercial ecosystem that produces, distributes, and sells these ready-to-drink non-alcoholic products. This market grows on the back of rising urban lifestyles, high demand for portable refreshment, and consumers shifting toward healthier, quicker hydration choices. Companies across regions continue to innovate with new flavors, functional blends, and sugar-free options, increasing product accessibility through retail, online channels, and food service outlets.

Strong growth factors are emerging as consumers seek healthier on-the-go beverages. Large investments in modern soda and functional drink brands highlight this rising interest. For example, Culture Pop Soda secured $15 million in equity funding, supporting product expansion. These investments show confidence in brands that offer creative flavors and better-for-you beverage profiles.

Demand continues rising as consumers choose drinks that promise wellness benefits, natural ingredients, and refreshing experiences. Funding momentum also supports this trend, including Cove Soda raising $15 million in Series A funding to strengthen its presence in North America. These developments reflect an increasing appetite for beverages that blend taste and functional value.

The market offers substantial opportunities as emerging brands attract major investments. For instance, Lahori raised Rs 200 crore, boosting its valuation to Rs 2,800 crore, while Olipop reached valuations between $1.85 billion and nearly $2 billion following recent funding rounds. A modern soda brand also secured $50 million in funding led by J.P. Morgan Private Capital, showing how investor interest is reshaping innovation in the Non-Alcoholic RTD space.

Key Takeaways

- The Global Non-Alcoholic RTD Beverages Market is expected to be worth around USD 1,487.9 billion by 2034, up from USD 800.1 billion in 2024, and is projected to grow at a CAGR of 6.4% from 2025 to 2034.

- Carbonated soft drinks dominate the Non-Alcoholic RTD Beverages Market with 39.4% share globally today.

- Citrus flavor leads the Non-Alcoholic RTD Beverages Market, capturing 34.9% consumer preference worldwide currently overall.

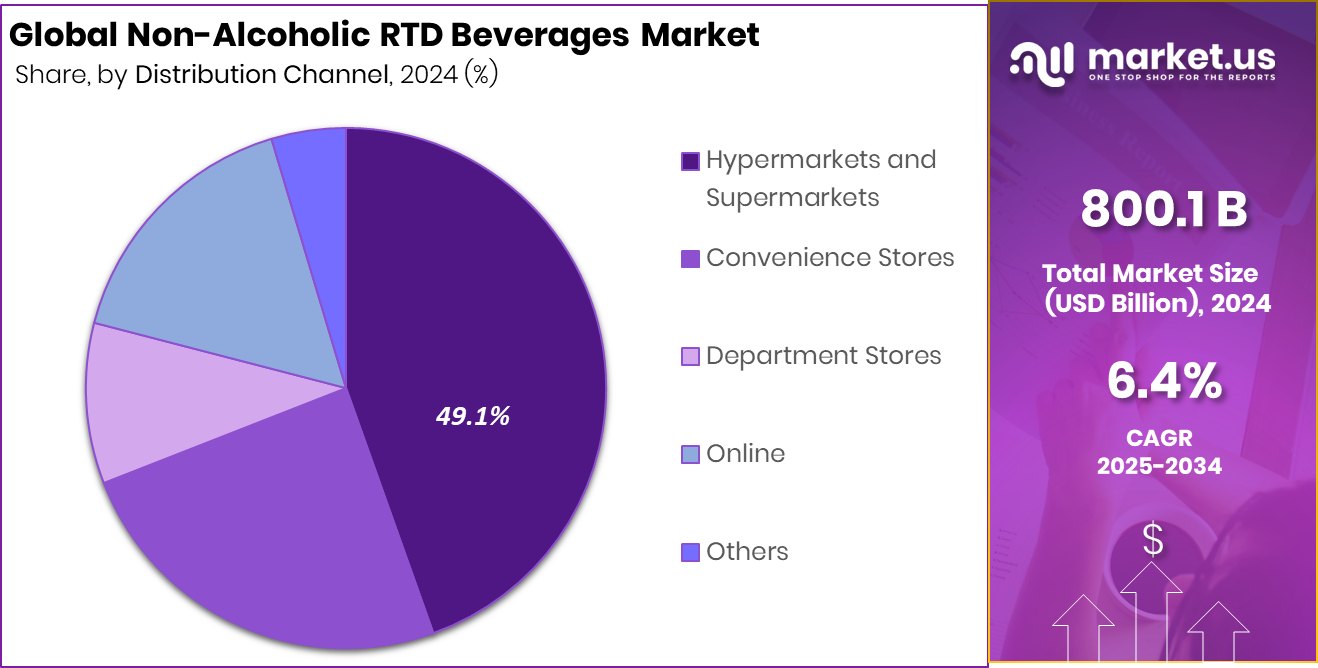

- Hypermarkets and supermarkets lead distribution in the Non-Alcoholic RTD Beverages Market with 49.1% share dominance.

- The Asia Pacific recorded a USD 345.6 Bn market value during 2024 overall.

By Product Analysis

Carbonated soft drinks held 39.4%, strengthening the Non-Alcoholic RTD Beverages Market.

In 2024, the Non-Alcoholic RTD Beverages Market saw Carbonated Soft Drinks hold a dominant position, capturing 39.4% of total product demand. This leadership was driven by strong consumer familiarity, wide brand availability, and consistent taste preferences across age groups. Carbonated RTD beverages continue to benefit from impulse purchases and high visibility in retail outlets. Urban consumers, in particular, favored these drinks for quick refreshment during work hours, travel, and social occasions.

Product innovation around reduced sugar, natural sweeteners, and functional carbonation also supported steady demand. Despite rising health awareness, carbonated soft drinks maintained relevance by adapting formulations and pack sizes. Their affordability and mass appeal allowed them to outperform other RTD categories, reinforcing their position as the most consumed product type within the non-alcoholic RTD beverage space during the year.

By Flavor Analysis

Citrus flavors captured 34.9%, driving fresh demand in RTD beverages.

In 2024, Citrus flavors emerged as the most preferred taste segment in the Non-Alcoholic RTD Beverages Market, accounting for 34.9% of overall flavor consumption. Lemon, orange, and mixed citrus profiles were widely chosen due to their refreshing taste and perceived natural freshness.

Consumers increasingly associate citrus flavors with hydration, energy, and a cleaner mouthfeel, making them suitable for daily consumption. These flavors performed well across carbonated drinks, flavored waters, and functional RTD beverages.

Seasonal demand spikes during warmer months further strengthened citrus dominance. Manufacturers continued to invest in citrus-based formulations because of their broad acceptance and flexibility for low-calorie and fortified variants. As a result, citrus flavors consistently outperformed berry, cola, and exotic flavor alternatives throughout the year.

By Distribution Channel Analysis

Hypermarkets and supermarkets secured 49.1%, dominating RTD beverage distribution globally.

In 2024, Hypermarkets and Supermarkets led the Non-Alcoholic RTD Beverages Market by distribution channel, securing a substantial 49.1% share. Their dominance was supported by extensive shelf space, strong promotional activity, and the ability to offer multiple brands and pack formats under one roof. Consumers preferred these outlets for bulk purchases, price discounts, and product comparisons.

High footfall and organized retail expansion in urban and semi-urban areas further boosted sales through this channel. In-store visibility, combo offers, and seasonal promotions played a key role in influencing buying decisions. While online and convenience stores continued to grow, hypermarkets and supermarkets remained the primary sales engine for non-alcoholic RTD beverages due to trust, accessibility, and purchasing convenience.

Key Market Segments

By Product

- Carbonated Soft Drinks

- RTD Tea and Coffee

- Functional Beverages

- Juices

- Dairy-based Beverages

- Others

By Flavor

By Distribution Channel

- Hypermarkets and Supermarkets

- Convenience Stores

- Department Stores

- Online

- Others

Driving Factors

Rising Demand for Convenient Functional Drinks Drives Growth

A major driving factor for the Non-Alcoholic RTD Beverages Market is the rising preference for convenient drinks that offer quick refreshment and simple functional benefits. Consumers want beverages they can enjoy on the go, and this shift supports strong product innovation. Funding activity in related sectors also signals stronger confidence in convenient, ready-to-drink beverage formats.

For example, UK-based SME lender Juice raised £25 million, helping small beverage producers improve production capacity and expand distribution. Such financial support indirectly boosts overall category momentum, as more brands can introduce new RTD variants and scale faster. With consumer lifestyles becoming busier and more health-focused, RTD beverages naturally gain traction, strengthening market growth across regions.

Restraining Factors

High Product Costs and Supply Challenges Slow Expansion

A key restraining factor in the Non-Alcoholic RTD Beverages Market is the challenge of rising production costs, especially for natural juice-based RTD drinks. Raw materials, packaging, and distribution expenses often push retail prices higher, limiting affordability for price-sensitive buyers. The situation becomes more complex as niche brands require funding to scale.

For instance, Alienkind raised $1.2 million in seed funding, while Nomva secured $3 million in the cold-pressed juice segment—both highlighting the financial pressure smaller players face just to remain competitive. These funding needs show that growth comes with significant cost burdens. When expenses rise, it becomes difficult for companies to maintain stable pricing, slowing wider market adoption.

Growth Opportunity

Growing Investment Boosts Functional and Premium RTD Development

A major growth opportunity for the Non-Alcoholic RTD Beverages Market comes from rising investor interest in premium and functional beverage concepts. These products attract consumers seeking healthier, refreshing options with added benefits. Funding trends strongly support this shift.

For example, Alienkind secured $1.2 million to reinvent India’s juice bar experience through modern, clean-label beverages. Additionally, Sanofi injected $625 million into its biotech investment arm, showing global confidence in wellness-focused innovations that could influence future RTD formulations.

As funding flows into health, nutrition, and beverage technology, brands gain the resources to experiment with new ingredients, improve processing methods, and design more appealing ready-to-drink products—creating substantial expansion opportunities.

Latest Trends

AI-Powered Innovations Transform Beverage Retail Experiences

A notable trend shaping the Non-Alcoholic RTD Beverages Market is the rapid integration of technology to improve business models and product accessibility. Digital systems help brands forecast demand, manage inventory, and personalize offerings. The shift is reinforced by strong funding activity in AI-driven platforms.

For example, Juice secured £25 million to address the UK’s £22 billion SME funding gap through AI-powered lending solutions. Such technological investments indirectly support beverage companies by giving them faster, smarter financial pathways to grow. As brands gain access to better digital tools and capital, they can focus on creating new RTD flavors, enhancing sustainable packaging, and improving supply chains—making tech-enabled growth a defining trend in the market.

Regional Analysis

Asia Pacific held 43.2% share in the Non-Alcoholic RTD Beverages Market.

In 2024, Asia Pacific dominated the Non-Alcoholic RTD Beverages Market, capturing a significant 43.2% share and reaching a value of USD 345.6 Bn. The region’s leadership was driven by strong urban consumption, rising preference for ready-to-drink formats, and expanding retail distribution. Growing demand for convenient, refreshing beverages across China, India, and Southeast Asia further strengthened its dominance.

North America maintained steady growth supported by high adoption of functional and flavored RTD beverages, with consumers favoring low-calorie and convenience-focused options. Europe followed closely, driven by increasing interest in natural ingredients, flavored carbonated drinks, and premium RTD formats across major economies. Latin America showed emerging potential as younger consumers increasingly shifted toward affordable, portable beverage choices.

Meanwhile, the Middle East & Africa region experienced gradual growth due to rising modern retail penetration and stronger demand for non-alcoholic beverage alternatives in culturally aligned markets. Collectively, all regions contributed to expanding global consumption, but Asia Pacific clearly led the market landscape with its strong 43.2% share and USD 345.6 Bn value.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, PepsiCo, Inc. continued to strengthen its presence in the global Non-Alcoholic RTD beverages market through a broad product portfolio and strong distribution capabilities. Its focus on flavor diversification and convenient packaging formats helped the brand maintain relevance across different consumer groups. PepsiCo’s wide market reach and consistent engagement in promotional activities supported its steady performance within the RTD category.

Nestlé S.A. leveraged its long-standing expertise in beverages to remain a key participant in the RTD landscape. With products spanning dairy-based drinks, ready-to-drink coffees, and functional hydration options, the company maintained strong traction. Its emphasis on quality, brand trust, and global availability enabled Nestlé to appeal to consumers seeking reliable and easily accessible beverage choices.

Keurig Dr Pepper Inc. held a competitive role in the market with its mix of flavored beverages, carbonated drinks, and innovative RTD offerings. The company’s established brand portfolio and experience in beverage formulation supported its influence across major regions. Keurig Dr Pepper’s strategic focus on taste variety and consumer convenience helped sustain demand for its RTD products. Collectively, these companies shaped market direction through strong product visibility, recognizable brands, and consistent alignment with evolving consumer preferences.

Top Key Players in the Market

- PepsiCo, Inc.

- Nestlé S.A.

- Keurig Dr. Pepper Inc.

- The Coca-Cola Company

- Suntory Beverage & Food Ltd.

- Asahi Group Holdings, Ltd.

- Red Bull GmbH

- Monster BevCorp

- Unilever PLC

Recent Developments

- In December 2024, Suntory Beverage & Food Ltd. announced it will expand its ready-to-drink portfolio in the U.S. with a new Japanese-inspired sparkling RTD cocktail called MARU-HI, set to debut in California in early 2025. This new product adds a unique sparkling beverage option to Suntory’s range of RTD drinks, aimed at consumers seeking light and refreshing choices.

- In September 2024, The Coca-Cola Company partnered with Bacardi Limited to launch a BACARDÍ & Coca-Cola ready-to-drink (RTD) pre-mixed cocktail. This new product combines Coca-Cola with BACARDÍ rum in a convenient canned form and is planned for rollout in Europe and Mexico in 2025. The drink targets adult consumers looking for a classic cocktail in a ready-to-drink format.

Report Scope

Report Features Description Market Value (2024) USD 800.1 Billion Forecast Revenue (2034) USD 1,487.9 Billion CAGR (2025-2034) 6.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Carbonated Soft Drinks, RTD Tea and Coffee, Functional Beverages, Juices, Dairy-based Beverages, Others), By Flavor (Citrus, Berry, Herbal, Spicy, Vanilla), By Distribution Channel (Hypermarkets and Supermarkets, Convenience Stores, Department Stores, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape PepsiCo, Inc., Nestlé S.A., Keurig Dr. Pepper Inc., The Coca-Cola Company, Suntory Beverage & Food Ltd., Asahi Group Holdings, Ltd., Red Bull GmbH, Monster BevCorp, Unilever PLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Non-Alcoholic RTD Beverages MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Non-Alcoholic RTD Beverages MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- PepsiCo, Inc.

- Nestlé S.A.

- Keurig Dr. Pepper Inc.

- The Coca-Cola Company

- Suntory Beverage & Food Ltd.

- Asahi Group Holdings, Ltd.

- Red Bull GmbH

- Monster BevCorp

- Unilever PLC