Global Next-Generation Advanced Batteries Market Size, Share, And Industry Analysis Report By Technology (Solid Electrolyte Battery, Magnesium Ion Battery, Next-generation Flow Battery, Metal-Air Battery, Lithium-Sulfur Battery), By End-User (Transportation, Consumer Electronics, Energy Storage), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 167265

- Number of Pages: 337

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

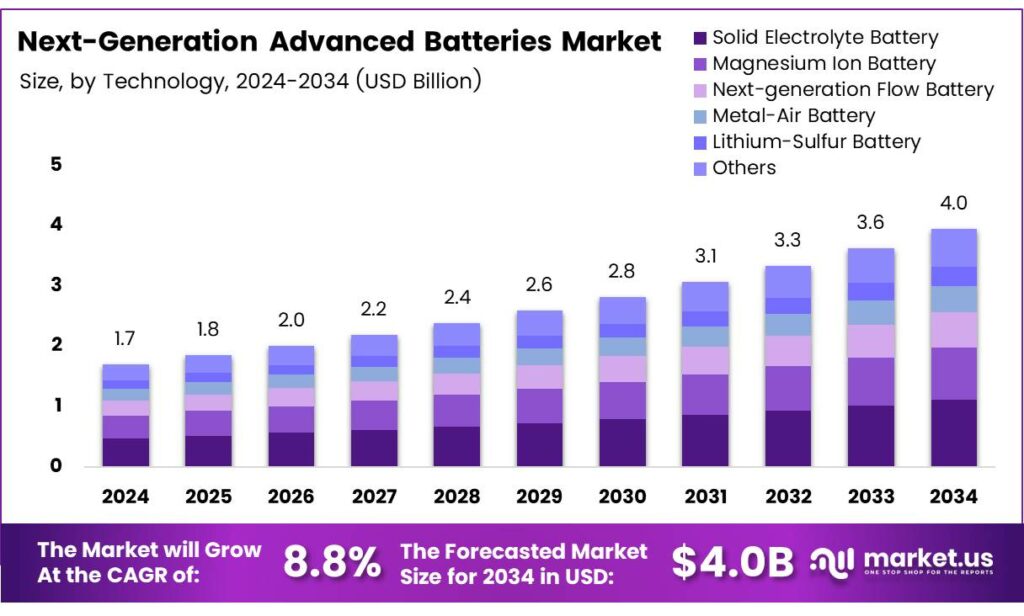

The Global Next-Generation Advanced Batteries Market size is expected to be worth around USD 4.0 billion by 2034, from USD 1.7 billion in 2024, growing at a CAGR of 8.8% during the forecast period from 2025 to 2034.

The Next-Generation Advanced Batteries Market focuses on technologies beyond traditional lithium-ion, including solid-state, sodium-ion, metal-air, lithium-sulfur, and flow batteries. These innovations aim to deliver higher safety, longer lifecycle, lower cost, and improved energy density, supporting applications in electric vehicles, consumer electronics, grid-scale storage, aerospace, and defence. The market is shaped by rapid R&D, sustainability goals, and rising electrification trends.

However, challenges remain during commercialisation. The U.S. Department of Energy, despite ongoing innovation, practical energy density in many next-generation chemistries currently remains around 250–300 Wh/kg, which is significantly below theoretical thresholds. This gap limits their use in long-range EVs and demanding storage environments.

Fast charging still increases safety risks through lithium plating, affecting stability and long-term durability. Technical constraints add complexity. The U.S. National Renewable Energy Laboratory (NREL), lithium-ion-based systems typically degrade after 1000–3000 charge cycles, driven by electrolyte breakdown, dendrite growth, and mechanical stress. This degradation reduces reliability and performance, creating a barrier for sectors that require long operational life and durability.

Furthermore, opportunities expand as industries prioritise circular economy practices and battery recycling. Solid-state and sodium-ion solutions are gaining commercial visibility due to benefits like enhanced thermal stability and resource availability. Meanwhile, aerospace and defence sectors explore metal-air and advanced lithium-based systems for lightweight and high-density power applications. With scaling and standardisation, manufacturing cost reductions are expected to influence future competitiveness.

Key Takeaways

- The Global Next-Generation Advanced Batteries Market is projected to reach a value of USD 1.7 billion in 2024, USD 4.0 billion by 2034, growing at a CAGR of 8.8%.

- Solid Electrolyte Batteries dominated the technology segment with a 38.2% share in 2024.

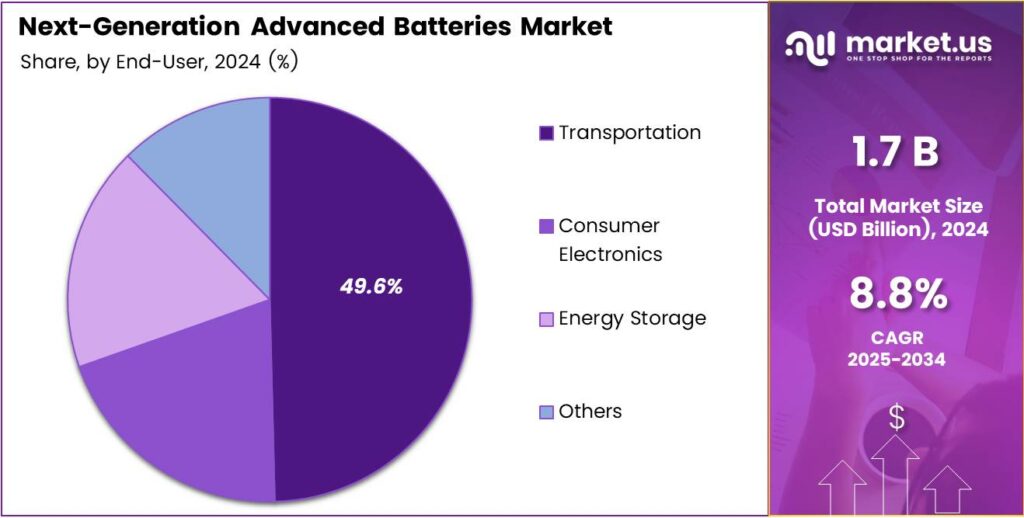

- Transportation was the leading end-user segment, accounting for a 49.6% market share in 2024.

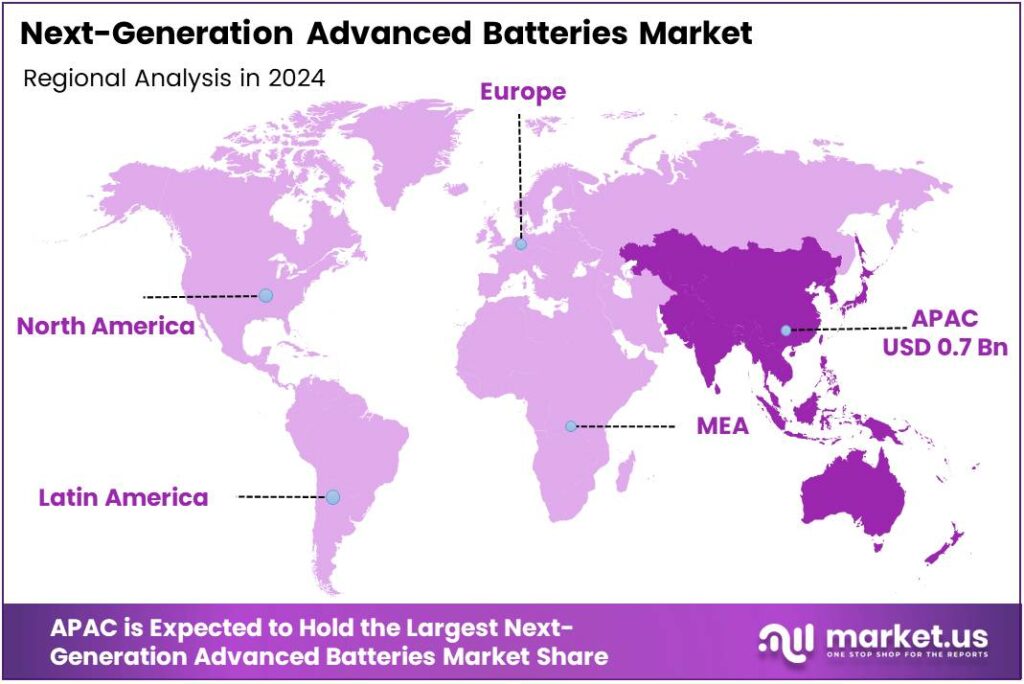

- Asia-Pacific led globally with a 43.9% share, valued at USD 0.7 billion in 2024.

By Technology Analysis

Solid Electrolyte Battery dominates with 38.2% due to strong safety and higher energy density benefits.

In 2024, Solid Electrolyte Battery held a dominant market position in the By Technology segment of the Next-Generation Advanced Batteries Market, with a 38.2% share. This technology gained attention because it reduces fire risks and supports longer lifecycle stability. It is preferred for electric mobility and emerging high-density energy applications.

Magnesium-ion battery continued gaining traction due to its higher volumetric capacity potential and lower material cost. Even without a stated percentage, magnesium offers resource advantages over lithium. Companies and research bodies are focusing on commercialisation because scalability and raw material access make magnesium attractive for grid and automotive storage.

Next-Generation Flow Battery emerged as a viable solution for long-duration energy storage needs. It allows decoupled energy and power configuration, making it suitable for renewable energy integration. Its long cycle stability supports commercial and utility sectors, especially where long discharge duration and operational safety outperform conventional lithium-ion solutions.

Metal-Air Battery received interest due to its extremely high theoretical energy density. Although still under development, it is seen as a pathway to longer-range EV performance. Lightweight metal inputs make it appealing for aviation and defence applications, but manufacturing and recharge limitations remain key barriers.

By End-User Analysis

Transportation leads with a 49.6% share driven by EV expansion and decarbonization efforts.

Transportation held a dominant market position in the end-user segment of the Next-Generation Advanced Batteries Market, with a 49.6% share. Growing EV adoption, rising fuel cost concerns, and zero-emission targets pushed automotive, aerospace, and marine sectors toward advanced battery solutions supporting range and safety enhancement.

Consumer Electronics continued to progress as demand for lightweight and longer-lasting portable devices expanded. Innovations in wearables, AR/VR systems, and premium smartphones encouraged faster adoption of emerging battery chemistries. Performance consistency, rapid charge capability, and material safety remain core purchasing drivers among manufacturers and end-users.

Energy Storage saw rising deployment through renewable infrastructures, including solar and wind farms. Grid operators explored next-generation batteries to solve intermittency challenges and reduce fossil backup reliance. Long-duration storage markets benefited from flow batteries, lithium-sulfur models, and solid-state systems gaining field validation.

Others represented diverse usage, including defence, industrial automation, robotics, and medical power systems. These sectors require reliability, higher discharge capability, and durability. Although smaller in share, these specialised applications accelerate niche innovation and offer opportunities for commercial pilot deployment across multiple industries.

Key Market Segments

By Technology

- Solid Electrolyte Battery

- Magnesium Ion Battery

- Next-generation Flow Battery

- Metal-Air Battery

- Lithium-Sulfur Battery

- Others

By End-User

- Transportation

- Consumer Electronics

- Energy Storage

- Others

Emerging Trends

Rising Demand for High-Density Energy Storage Boosts Market Momentum

One key trend shaping the Next-Generation Advanced Batteries market is the growing shift toward higher energy density solutions. Industries such as electric mobility, renewable energy storage, and aerospace are now looking for batteries that store more power in smaller and lighter designs. This demand is pushing companies to explore solid-state, lithium-sulfur, and metal-air technologies because they offer better capacity and longer performance than conventional lithium-ion cells.

- Traditional batteries face overheating, fire risk, and degradation after repeated charging. Next-generation batteries aim to reduce these risks by using solid electrolytes, flexible materials, and stable chemical structures. The International Energy Agency (IEA) notes that current battery storage must scale up 14-fold to reach about 1200 GW of battery storage under its Net Zero Emissions scenario.

Sustainability is also influencing development. Governments and manufacturers are looking for eco-friendly materials, recyclable designs, and battery chemistries that reduce reliance on scarce resources like cobalt. As recycling technology improves, circular battery ecosystems are gaining attention.

Drivers

Growing Electric Mobility Adoption Drives Market Expansion

The Next-Generation Advanced Batteries market is gaining strong momentum as electric mobility becomes a global priority. Countries are shifting from combustion engines to cleaner transport, and this transition requires batteries with better energy density, longer life, and faster charging capability. Many governments are supporting electric vehicle manufacturing through subsidies and infrastructure plans, which creates steady demand for advanced battery solutions.

- At the same time, automakers and battery manufacturers are investing heavily in research to move beyond traditional lithium-ion technology. Solid-state, metal-air, lithium-sulfur, and sodium-based systems are being explored because they offer longer driving range and improved safety. Battery technologies are no longer just niche or automotive-only—they are becoming core to how power systems will operate. The IEA executive summary states that battery storage deployment needs to grow by around 25% per year on average until 2030.

Energy storage for renewable power is also accelerating demand. As solar and wind energy scale, next-generation batteries are required to stabilise the power supply and support grid storage systems. Together, these trends position the market for long-term growth as innovation continues and adoption increases.

Restraints

High Production Costs Restrain Next-Generation Advanced Batteries Adoption

High production cost remains one of the biggest restraints in the Next-Generation Advanced Batteries market. Many technologies, such as solid-state, lithium-sulfur, and metal-air batteries, need rare materials, advanced electrolytes, and specialised manufacturing lines. These processes are still not optimised for mass production, making battery prices higher than conventional lithium-ion batteries.

- Performance consistency also slows market progress. Some next-generation chemistries struggle with durability, cycle efficiency, and stability under extreme conditions. The IEA reports that upfront costs for four-hour utility-scale battery storage are projected to drop from around USD 290/kWh to about USD 175/kWh by 2030, a decline of 40%.

Regulatory delays further limit momentum. Governments are still defining safety rules for emerging chemistries, especially for high-energy solid-state and metal-air systems. Without established safety frameworks, commercialisation becomes slower and riskier for manufacturers.

Growth Factors

Growing Demand for Electric Mobility Creates Strong Market Opportunities

Rising global interest in electric vehicles is opening new opportunities for next-generation advanced batteries. Governments are promoting clean transportation through subsidies, and automotive companies are exploring batteries with higher energy density and faster charging. This shift creates space for solid-state, metal-air, and lithium-sulfur technologies to replace traditional options and support long-distance mobility.

Rising electronics and smart device adoption further strengthen the opportunity landscape. New applications like wearables, drones, robotics, and medical sensors need lighter, safer, and flexible battery designs. This pushes manufacturers to invest in research and pilot production lines targeting compact and high-performance storage solutions.

Growing investment in research funding and partnerships between universities, startups, and manufacturers supports technology development. These collaborations help reduce production costs and accelerate commercialisation. As scaling improves, these advanced batteries may achieve broader adoption across automotive, aerospace, consumer electronics, and industrial energy systems.

Regional Analysis

Asia-Pacific Leads the Next-Generation Advanced Batteries Market with 43.9% Share Valued at USD 0.7 Billion

Asia-Pacific holds the leading position in the Next-Generation Advanced Batteries Market, driven by expanding electric mobility, strong manufacturing capabilities, and supportive clean-energy policies. With a dominant market share of 43.9% valued at USD 0.7 billion, the region benefits from the rapid adoption of EVs, renewable energy storage, and grid-scale battery projects. Government incentives and large-scale industrialisation further strengthen the region’s leadership in the sector.

North America shows steady growth supported by increasing investment in battery innovation and energy storage infrastructure. The region is benefitting from rising EV penetration, large-scale renewable energy additions, and supportive regulatory frameworks. Expansion of solid-state and metal-air battery research also contributes to long-term growth prospects in the region.

Europe continues to progress due to strong policy mandates promoting electrification, sustainability, and local battery manufacturing ecosystems. The region’s push for carbon neutrality and dependency reduction on imported energy storage systems supports ongoing development. Growing demand from mobility, aerospace, and grid-scale storage applications accelerates market potential across the region.

The U.S. is advancing rapidly due to federal funding, R&D leadership, and strong EV adoption trends. Large-scale energy storage systems and next-generation chemistries like solid-state and metal-air batteries continue to gain momentum. The country also focuses on supply chain independence and critical mineral sourcing to strengthen market competitiveness.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The global Next-Generation Advanced Batteries Market in 2024 is being shaped by a mix of established energy storage leaders and innovation-driven emerging companies. Each player brings a unique strategic approach focused on areas such as solid-state, lithium-metal, lithium-sulfur, and beyond-lithium battery platforms.

Pathion Holding Inc. continues positioning itself around high-performance battery materials with a focus on improving thermal stability and extending lifecycle efficiency. Their approach reflects a shift toward safer chemistries aligned with grid storage and defence-grade applications.

GS Yuasa Corporation maintains strong momentum through advancements in solid-state technology and improved electrode chemistry. The company is strategically balancing R&D with commercial deployments, especially in mobility and aerospace storage systems.

Johnson Matthey PLC remains active through innovations in sustainable cathode materials and next-generation metal-based chemistries. Their direction signals a long-term commitment to low-carbon battery supply chains and recycling-integrated manufacturing.

PolyPlus Battery Co. Inc. continues to gain attention for its work in lithium-metal and lithium-air platforms, especially for high-density applications such as defence and maritime energy storage. Their roadmap shows clear potential for breakthrough commercialisation.

Top Key Players in the Market

- Pathion Holding Inc.

- GS Yuasa Corporation

- Johnson Matthey PLC

- PolyPlus Battery Co. Inc.

- Ilika PLC

- LG Chem Ltd

- Saft Groupe SA

- Contemporary Amperex Technology Co., Ltd

Recent Developments

- In 2025, Pathion completed a merger/acquisition with Spider9, enhancing its capabilities in battery management and optimisation systems. This integration aims to improve real-time energy storage efficiency for grid-facing applications, such as demand response and frequency regulation, potentially reducing demand charges.

- In 2025, GS Yuasa’s high-performance lithium-ion batteries were launched aboard Japan’s HTV-X1 cargo vehicle from Tanegashima Space Centre, in collaboration with JAXA. These batteries support extreme environments, highlighting advancements in reliability for space missions.

Report Scope

Report Features Description Market Value (2024) USD 1.7 billion Forecast Revenue (2034) USD 4.0 billion CAGR (2025-2034) 8.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Technology (Solid Electrolyte Battery, Magnesium Ion Battery, Next-generation Flow Battery, Metal-Air Battery, Lithium-Sulfur Battery, Others), By End-User (Transportation, Consumer Electronics, Energy Storage, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Pathion Holding Inc., GS Yuasa Corporation, Johnson Matthey PLC, PolyPlus Battery Co. Inc., Ilika PLC, LG Chem Ltd, Saft Groupe SA, Contemporary Amperex Technology Co. Ltd Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Next-Generation Advanced Batteries MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

Next-Generation Advanced Batteries MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Pathion Holding Inc.

- GS Yuasa Corporation

- Johnson Matthey PLC

- PolyPlus Battery Co. Inc.

- Ilika PLC

- LG Chem Ltd

- Saft Groupe SA

- Contemporary Amperex Technology Co., Ltd