Global Food Preservatives Market Size, Share, And Business Benefits By Type (Natural (Salt, Sugar, Vinegar, Edible Oil, Rosemary Extracts, Natamycin, Others), Synthetic (Propionates, Sorbates, Benzoates, Others)), By Form (Powder, Liquid), By Function (Antimicrobials, Antioxidants, Others), By Application (Food (Bakery and Confectionery, Dairy and Dairy Products, Meat, Poultry, and Seafood, Animal Feed and Pet Food, Savory and Snacks, Others), Beverage (Carbonated Soft Drinks, Fruit Beverages, Sports Drinks, Alcoholic Beverages, Others)), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 16087

- Number of Pages: 398

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

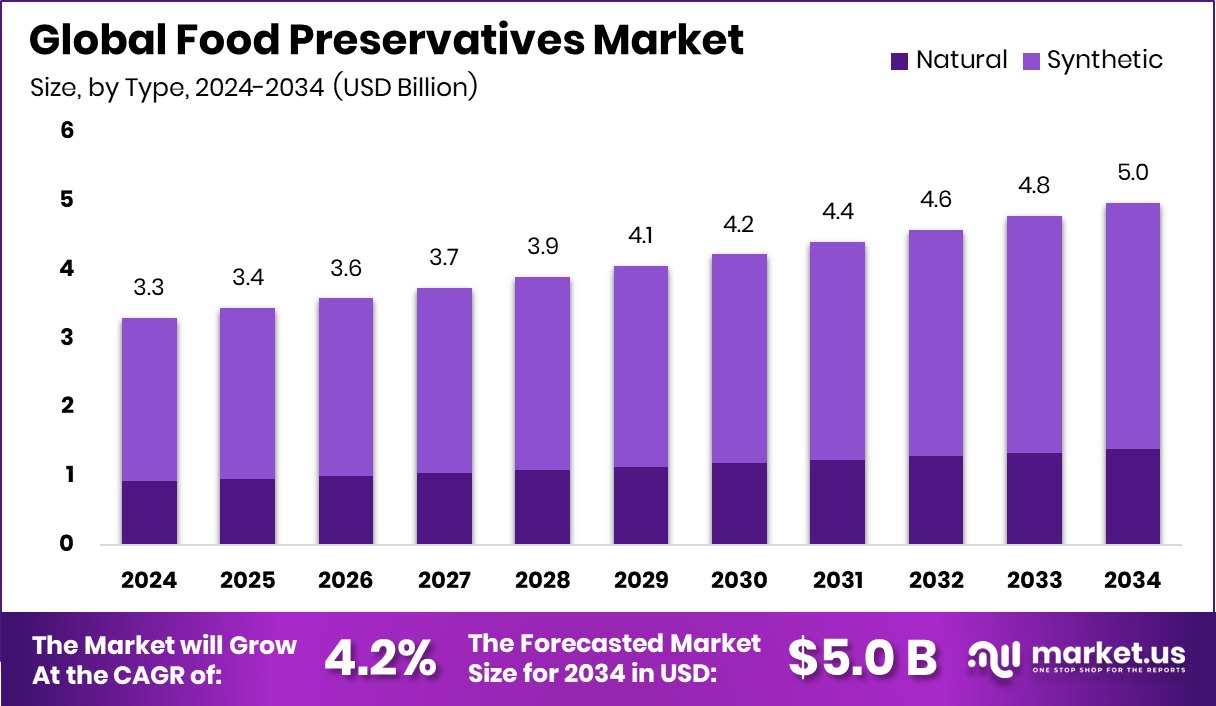

The Global Food Preservatives Market is expected to be worth around USD 5.0 billion by 2034, up from USD 3.3 billion in 2024, and grow at a CAGR of 4.2% from 2025 to 2034. North America’s 34.3% market share highlights its leadership in food preservatives usage.

Food preservatives are substances added to food products to prevent spoilage caused by microbial growth, oxidation, or other chemical changes. These can be natural, like salt, sugar, and vinegar, or synthetic, such as sorbates, benzoates, and nitrates. Their primary role is to extend shelf life, retain nutritional value, and ensure safety by reducing the risk of contamination during storage and transportation. Preservatives are used across various food categories such as bakery, dairy, meat, and ready-to-eat meals.

The food preservatives market refers to the global trade, production, and consumption of chemical and natural agents used to preserve food. This market includes a broad range of products that help maintain food quality and extend product longevity across diverse industries. The market is shaped by regulatory guidelines, consumer preferences for clean-label solutions, and food processing trends. Growing packaged food demand, supply chain expansion, and food waste reduction efforts are influencing its growth.

The growth of this market is largely driven by rising consumption of packaged and processed food. Urbanization and changing dietary habits have led to increased reliance on convenience food, which in turn demands better preservation techniques. Also, growing awareness around foodborne illnesses and safety standards supports the need for efficient preservatives. According to an industry report, Health-first food startup Troovy has raised Rs 20 crore in funding from investors.

There is a steady rise in demand for preservatives that can cater to both industrial food production and smaller-scale artisanal products. This demand is further supported by the global increase in food exports, which require long shelf life and stability during transit. According to an industry report, Chinova Bioworks has secured $6 million to advance its clean-label preservative solutions.

Key Takeaways

- The Global Food Preservatives Market is expected to be worth around USD 5.0 billion by 2034, up from USD 3.3 billion in 2024, and grow at a CAGR of 4.2% from 2025 to 2034.

- In the food preservatives market, synthetic preservatives accounted for a 72.2% share due to cost-effectiveness.

- Powder form dominated the market with a 63.4% share, offering easy mixing and longer shelf life.

- Antimicrobials held a 68.7% share, driven by their strong role in preventing bacterial and fungal contamination.

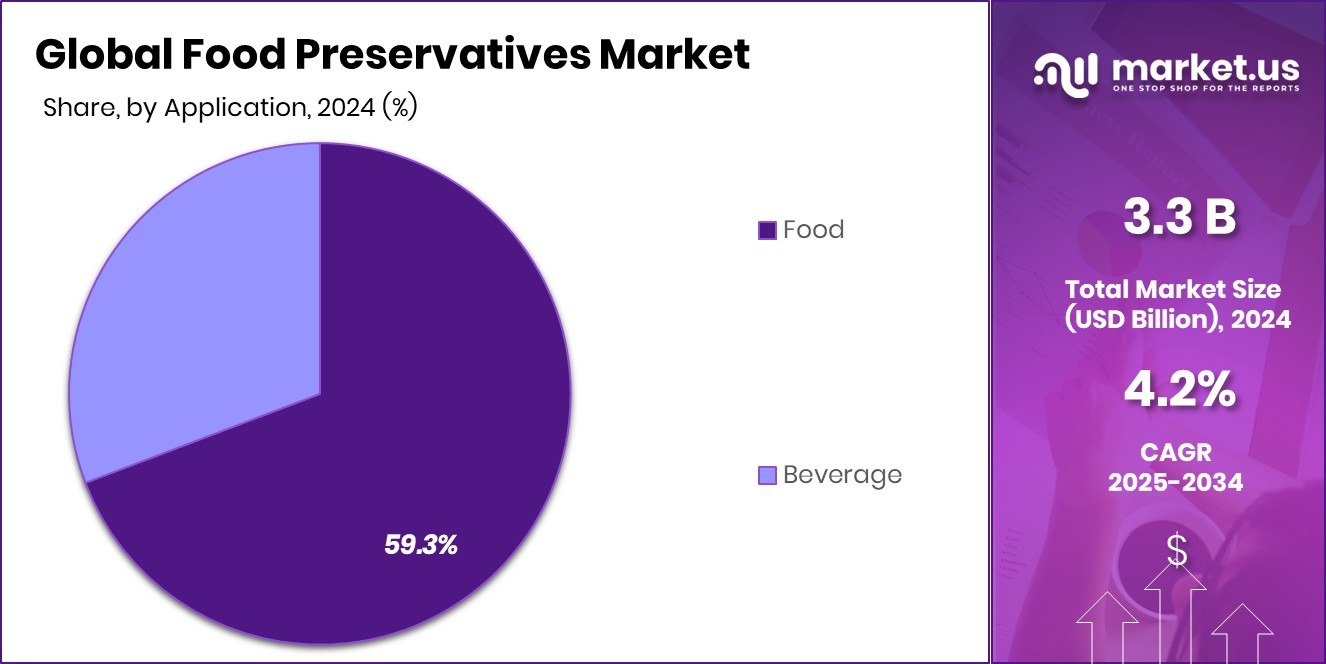

- The food segment led application use with a 59.3% share, reflecting growing packaged food and safety needs.

- Strong demand for packaged foods boosted North America’s USD 1.1 Bn market value.

By Type Analysis

Synthetic preservatives dominate the market, accounting for a 72.2% share globally.

In 2024, Synthetic held a dominant market position in the By Type segment of the Food Preservatives Market, with a 72.2% share, reflecting its continued preference among food manufacturers for consistent and cost-effective preservation solutions.

Synthetic preservatives, such as benzoates, sorbates, and nitrites, are widely used due to their proven efficacy in extending shelf life and inhibiting bacterial and fungal growth across a wide range of processed food categories. Their stability under various temperature and storage conditions makes them particularly suitable for large-scale food production and global distribution.

This dominance is also supported by regulatory approvals in many countries that allow controlled usage of synthetic preservatives per food safety standards. The ability to deliver reliable preservation performance at low concentrations further supports their widespread usage.

Despite ongoing discussions around natural alternatives, synthetic options remain the first choice for manufacturers aiming for scalability, consistency, and lower production costs. Their role is especially crucial in preserving high-risk foods such as meat products, baked goods, and beverages, where microbial stability is vital.

By Form Analysis

Powdered preservatives lead with 63.4%, preferred for easy blending and stability.

In 2024, Powder held a dominant market position in By Form segment of the Food Preservatives Market, with a 63.4% share, highlighting its broad acceptance and practicality across food processing applications. Powdered preservatives are preferred by manufacturers for their ease of handling, accurate dosing, extended shelf life, and high stability during transportation and storage.

The powdered form offers excellent solubility and dispersion characteristics, which support uniform application in dry mixes, seasonings, and processed food products. Their compatibility with automated dosing systems in industrial settings also contributes to their popularity, allowing streamlined integration into existing production lines without the need for specialized storage or mixing equipment. Moreover, powder preservatives are less prone to degradation, ensuring consistent antimicrobial or antioxidant function over time.

This segment’s dominance is further reinforced by its economic value, as powdered preservatives generally incur lower transportation costs due to their lighter weight and compact packaging. Manufacturers value these logistical advantages in both domestic and international supply chains.

By Function Analysis

Antimicrobial agents hold a 68.7% share, crucial in preventing microbial spoilage.

In 2024, Antimicrobials held a dominant market position in the By Function segment of the Food Preservatives Market, with a 68.7% share, reflecting their critical role in preventing spoilage and extending the shelf life of food products. Antimicrobial preservatives are widely used to inhibit the growth of bacteria, yeasts, and molds, which are the primary causes of foodborne illnesses and deterioration.

The high market share of antimicrobials in 2024 is attributed to their consistent performance in ensuring food safety during long storage and distribution periods. They are essential in maintaining the microbial quality of processed foods, especially in meat, dairy, and bakery products, where hygiene and safety are top priorities. Furthermore, their ability to meet regulatory standards while providing long-term protection without altering food taste or texture reinforces their preference.

Their dominance is also supported by the increasing global demand for packaged and ready-to-eat foods, where microbial control is non-negotiable. As a result, antimicrobial preservatives continue to be the cornerstone of preservation strategies, enabling producers to deliver safer products to consumers across varied geographies and shelf-life requirements.

By Application Analysis

Food applications contribute 59.3%, driven by demand in packaged consumables.

In 2024, Food held a dominant market position in the By Application segment of the Food Preservatives Market, with a 59.3% share, underlining the extensive use of preservatives in various food processing operations. The food segment includes a wide range of items such as baked goods, dairy, confectionery, and processed meals, where maintaining freshness, taste, and microbial stability is essential.

The use of preservatives in food applications is driven by the need to control spoilage and prevent contamination during storage and transportation. In mass food production, preservatives ensure product consistency and help manufacturers meet safety standards across large volumes. Their role becomes particularly important as food supply chains stretch across regions and continents, where preservation becomes a critical factor in minimizing waste and ensuring product reliability.

Furthermore, the integration of preservation technologies in food applications supports efficient inventory management and reduces the economic losses associated with spoilage. The 59.3% share recorded in 2024 confirms the food application’s strong reliance on preservation methods, which continue to be central in enabling high-volume, high-quality food distribution systems worldwide.

Key Market Segments

By Type

- Natural

- Salt

- Sugar

- Vinegar

- Edible Oil

- Rosemary Extracts

- Natamycin

- Others

- Synthetic

- Propionates

- Sorbates

- Benzoates

- Others

By Form

- Powder

- Liquid

By Function

- Antimicrobials

- Antioxidants

- Others

By Application

- Food

- Bakery and Confectionery

- Dairy and Dairy Products

- Meat, Poultry, and Seafood

- Animal Feed and Pet Food

- Savory and Snacks

- Others

- Beverage

- Carbonated Soft Drinks

- Fruit Beverages

- Sports Drinks

- Alcoholic Beverages

- Others

Driving Factors

Rising Demand for Longer Shelf Life Foods

One of the major driving factors for the food preservatives market is the growing demand for food products with longer shelf lives. As more people around the world consume packaged, ready-to-eat, and convenience foods, especially in urban areas, the need to keep these products fresh and safe for a longer time has become very important.

Preservatives help prevent spoilage caused by bacteria, mold, or oxidation, which allows food to stay edible during transport and storage. This is especially useful for foods that travel long distances before reaching the consumer. With rising global trade in food and busy lifestyles, manufacturers are using more preservatives to meet consumer expectations for taste, safety, and shelf life reliability in everyday food items.

Restraining Factors

Health Concerns Linked to Synthetic Preservative Use

A key restraining factor in the food preservatives market is the growing concern among consumers about the potential health effects of synthetic preservatives. Many people now read food labels carefully and avoid products that contain artificial additives such as benzoates, nitrates, or sulfites. These ingredients, although approved in controlled amounts, are often linked to allergies, asthma, or other health worries in public perception.

As awareness about natural and clean-label food rises, consumers are shifting toward minimally processed options. This change in behavior puts pressure on food companies to reduce or eliminate synthetic preservatives, which can be challenging due to cost and shelf-life limitations.

Growth Opportunity

Growing Demand for Natural Clean-Label Preservatives

A major growth opportunity in the food preservatives market is the increasing demand for natural and clean-label preservatives. Consumers today are more health-conscious and prefer food products with ingredients they can recognize and trust. This has led to a strong push for preservatives derived from natural sources like plant extracts, vinegar, rosemary, and citrus. These ingredients are seen as safer and healthier alternatives to artificial additives.

Food companies are now investing in research to develop effective natural preservatives that can match the performance of synthetic ones. As this trend continues to grow, especially in developed markets, it opens new doors for innovation and product development, allowing manufacturers to meet changing consumer preferences while maintaining food safety and shelf life.

Latest Trends

Blending Natural and Synthetic for Balanced Solutions

A key trend in the food preservatives market is the growing use of blended solutions, where both natural and synthetic preservatives are combined to balance safety, cost, and consumer preference. Many food manufacturers are finding that using only natural preservatives can limit shelf life or raise production costs.

To overcome this, they are using a mix of both types. This approach allows companies to maintain the required level of food protection while responding to consumer demand for cleaner labels.

For example, using a smaller amount of synthetic preservatives alongside natural extracts can reduce chemical usage without sacrificing product stability. This hybrid strategy is becoming popular, especially for packaged foods, as it offers flexibility, cost-efficiency, and better consumer acceptance in one solution.

Regional Analysis

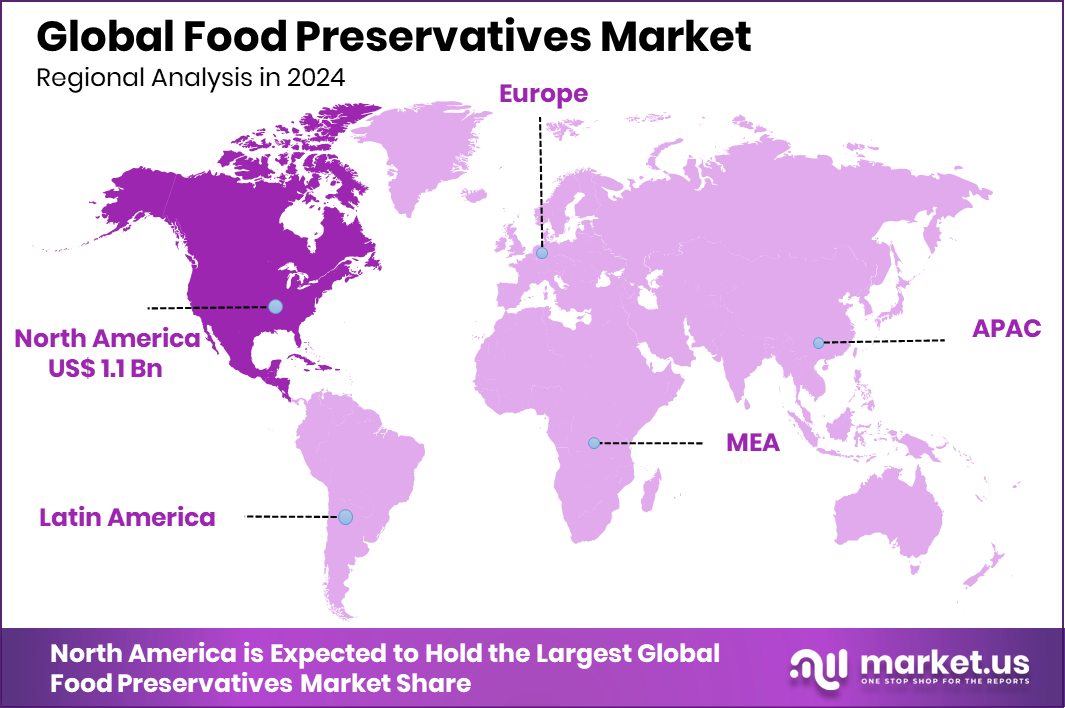

In 2024, North America led the market with a 34.3% share, USD 1.1 Bn.

In 2024, North America held the dominant position in the Food Preservatives Market, accounting for 34.3% of the global share and reaching a market value of USD 1.1 billion. The region’s dominance is supported by strong demand for packaged, frozen, and ready-to-eat foods, driven by busy lifestyles and high consumer awareness of food safety standards. Regulatory clarity and the widespread use of preservatives in processed food further reinforce North America’s leadership in this market.

In Europe, the demand for food preservatives continues steadily due to established food processing industries and growing consumer expectations around food quality and shelf life. Meanwhile, Asia Pacific is showing robust expansion potential, fueled by rising urban populations, increased food production, and changing consumption patterns across countries such as India and China.

Latin America and the Middle East & Africa regions are gradually adopting advanced preservation methods as the demand for processed foods grows, particularly in urban centers. However, these regions remain smaller in comparison to North America in terms of market share.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Cargill, Incorporated, BASF SE, Archer Daniels Midland Company, and Kerry Group each played a pivotal role in the global Food Preservatives Market. As an analyst, I observe distinct strengths and strategic positioning among these companies that shape their influence within the industry.

Cargill, Incorporated, has reinforced its market stature through a diversified product portfolio emphasizing both natural and synthetic preservative solutions. Its extensive supply chain integration enables efficient sourcing and distribution, particularly in regions such as North America and Europe. The company’s deep collaboration with food processors allows it to tailor preservative solutions for specific applications, delivering both functional efficacy and operational reliability.

BASF SE stands out through its strong research and development capabilities, focusing on novel preservative chemistries and regulatory compliance support. With a robust global R&D infrastructure, the company efficiently adapts its preservative formulations to meet evolving safety standards. BASF’s technical expertise and emphasis on quality assurance have made it a preferred partner for manufacturers seeking consistent performance and streamlined regulatory approval processes.

Archer Daniels Midland Company (ADM) benefits from vertically integrated operations, incorporating both raw material sourcing and preservative production. ADM’s scale allows cost-efficient manufacturing and the rapid introduction of innovative additives. By leveraging its agricultural commodity base, the company can respond swiftly to changes in raw material pricing, supporting stable supply and competitive cost offerings to manufacturers in the food and beverage sector.

Kerry Group has carved a niche by emphasizing natural, clean-label preservative systems that align with consumer trends. Its development of botanical extracts and fermentation-based solutions meets the rising demand for label transparency and minimal processing. Kerry’s strong technical service teams support customized applications, facilitating faster adoption of natural alternatives without compromising shelf life or quality.

Top Key Players in the Market

- Cargill, Incorporated

- BASF SE

- Archer Daniels Midland Company

- Kerry Group

- Kemin Industries, Inc.

- Tate & Lyle

- Corbion

- International Flavors & Fragrances Inc

- Givaudan

- Celanese Corporation

- Galactic S.A.

- Daesang Corporation

- KWANGIL CO., LTD. CO., LTD.

- Ingredion Incorporated

- Stepan Company

- Other Key Players

Recent Developments

- In May 2025, Cargill achieved full compliance with the WHO industrial trans-fat (iTFA) limits across its global edible oils portfolio. This marked its repositioning of food preservation by eliminating harmful fats and improving the overall safety and health profile of oils used as ingredient bases in preserved food items.

- In March 2024, BASF’s Isobionics® brand introduced Natural beta‑Caryophyllene 80, a fermentation-based flavor ingredient. This clean-label product provides herbal and citrus notes and is made from renewable sources without synthetic chemicals. It supports better taste profiles in preserved food and beverage applications.

Report Scope

Report Features Description Market Value (2024) USD 3.3 Billion Forecast Revenue (2034) USD 5.0 Billion CAGR (2025-2034) 4.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Natural (Salt, Sugar, Vinegar, Edible Oil, Rosemary Extracts, Natamycin, Others), Synthetic (Propionates, Sorbates, Benzoates, Others)), By Form (Powder, Liquid), By Function (Antimicrobials, Antioxidants, Others), By Application (Food (Bakery and Confectionery, Dairy and Dairy Products, Meat, Poultry, and Seafood, Animal Feed and Pet Food, Savory and Snacks, Others), Beverage (Carbonated Soft Drinks, Fruit Beverages, Sports Drinks, Alcoholic Beverages, Others)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Cargill, Incorporated, BASF SE, Archer Daniels Midland Company, Kerry Group, Kemin Industries, Inc., Tate & Lyle, Corbion, International Flavors & Fragrances Inc, Givaudan, Celanese Corporation, Galactic S.A., Daesang Corporation, KWANGIL CO., LTD. CO., LTD., Ingredion Incorporated, Stepan Company, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Cargill, Incorporated

- BASF SE

- Archer Daniels Midland Company

- Kerry Group

- Kemin Industries, Inc.

- Tate & Lyle

- Corbion

- International Flavors & Fragrances Inc

- Givaudan

- Celanese Corporation

- Galactic S.A.

- Daesang Corporation

- KWANGIL CO., LTD. CO., LTD.

- Ingredion Incorporated

- Stepan Company

- Other Key Players