Global Methyl Tert-Butyl Ether Market Size, Share, And Business Benefits By Grade (Industrial Grade, Pharmaceutical Grade), By Application (Gasoline Additives, Isobutene, Solvents, Others), By End-user (Automotive, Oil and Gas, Chemicals, Pharmaceuticals, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 164006

- Number of Pages: 281

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

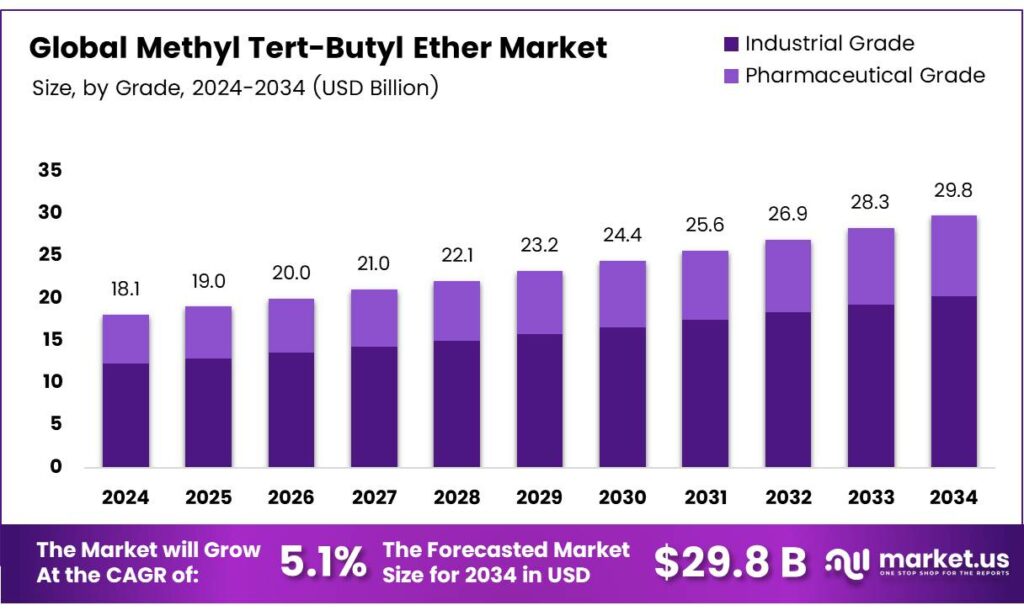

The Global Methyl Tert-Butyl Ether Market size is expected to be worth around USD 29.8 Billion by 2034, from USD 18.1 Billion in 2024, growing at a CAGR of 5.1% during the forecast period from 2025 to 2034.

Methyl tert-butyl ether (MTBE), also known as tert-butyl methyl ether, is a colorless, flammable liquid with a distinctive, disagreeable, or anesthetic-like odor. Its chemical formula is C5H12O, with a molecular weight of 88.15 g/mol. It has a vapor pressure of 245 mmHg at 25°C, a log octanol/water partition coefficient (log Kow) of 1.24, and is less dense than water, while being moderately soluble in it.

Vapors are heavier than air, narcotic in nature, and the liquid has a flash point lower than most ambient temperatures, making it highly ignitable. MTBE is produced by blending isobutylene and methanol and functions chemically as an ether with methyl and tert-butyl alkyl groups. It serves as a non-polar solvent, fuel additive, and metabolite.

Nearly all MTBE produced in the United States is used as an additive in unleaded gasoline to boost octane levels, promote more efficient burning, and reduce carbon monoxide emissions. It was previously used to produce isobutene and has been a component of gasoline since the 1980s. Additionally, MTBE is used medically to dissolve cholesterol gallstones, delivered directly to the gallbladder via surgically inserted tubes.

- At 20 °C, methyl tert-butyl ether (MTBE) is a clear, colorless liquid with an ethereal odor. It freezes at –110 °C, boils at 55–56 °C, and is highly flammable (flash point –33 °C, auto-ignition 374 °C). Vapor pressure is 279.2 hPa, density 0.74 g/cm³ (25 °C). Insoluble in water (hydrophobic), with log Pow 1.77 (moderate lipophilicity). Explosive limits: 1.60–15.10% in air.

MTBE exposure mainly occurs via inhaling auto exhaust, gasoline fumes during refueling, or in workplaces; also from medical gallstone dissolution. Effects: respiratory irritation, dizziness, disorientation, drowsiness. Animal chronic inhalation studies show CNS effects, respiratory irritation, liver/kidney damage, reduced weight gain, and developmental issues in rats/mice. EPA has not classified MTBE for carcinogenicity.

Key Takeaways

- The Global MTBE Market is projected to grow from USD 18.1 billion in 2024 to USD 29.8 billion by 2034 at a 5.1% CAGR.

- Industrial Grade dominated the By Grade segment in 2024 with 89.4% share due to cost-efficiency in fuel blending.

- Gasoline Additives led by the Application segment in 2024, with a 67.9% share for improving combustion and reducing emissions.

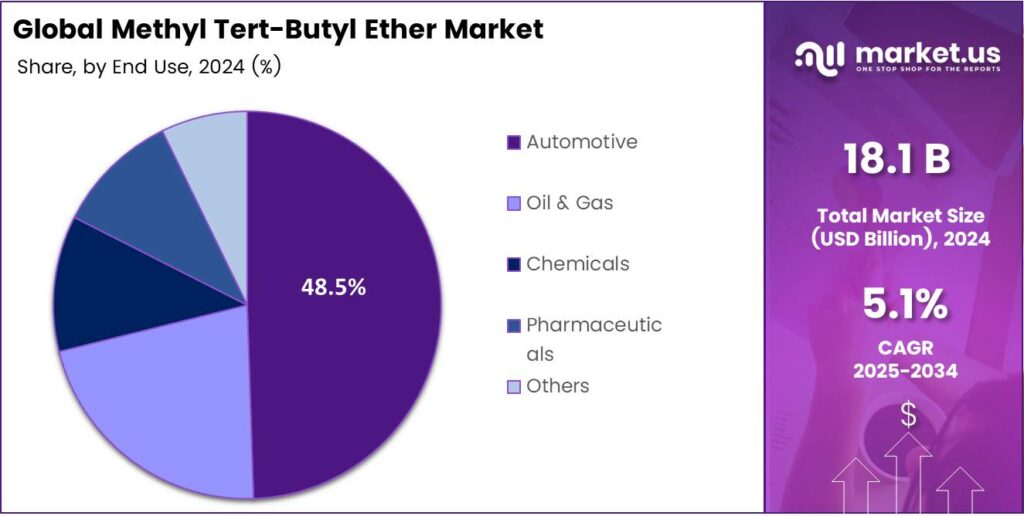

- The automotive sector held the top position by end-user in 2024 with a 48.5% share, using MTBE to prevent knocking and meet emission norms.

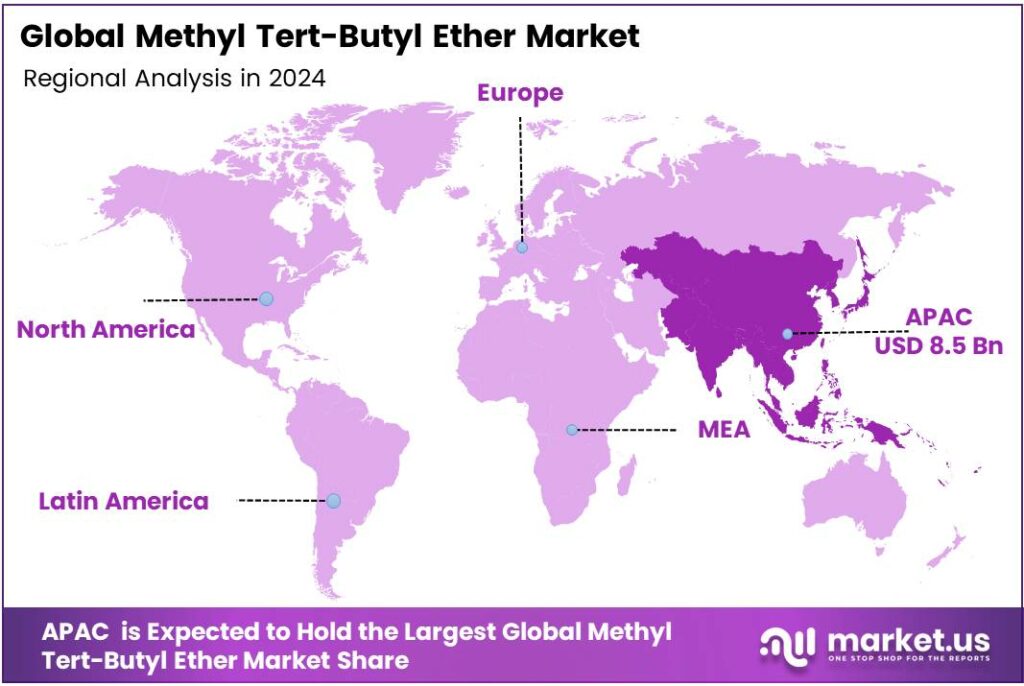

- Asia-Pacific commanded 47.3% market share in 2024, USD 8.5 billion, fueled by expanding refining, petrochemicals, and high-octane gasoline demand.

By Grade

Industrial Grade dominates with 89.4% due to its essential role in large-scale fuel production.

In 2024, Industrial Grade held a dominant market position in the By Grade Analysis segment of the Methyl Tert-Butyl Ether Market, with an 89.4% share. This grade thrives because it meets the high-volume needs of the fuel sector. Manufacturers prefer it for its cost-efficiency and reliable performance in blending processes.

As global demand for cleaner gasoline rises, Industrial Grade secures its lead by supporting widespread octane enhancement. It integrates seamlessly into existing refineries, driving steady adoption across regions. The Pharmaceutical Grade, though smaller, plays a vital role in specialized applications.

It ensures high purity levels required for medical formulations and extractions. This sub-segment grows steadily as the pharmaceutical industries expand, seeking safe solvents. While it lacks the volume of Industrial Grade, its precision demands foster innovation in production techniques. Overall, it contributes to diverse uses beyond fuel, highlighting MTBE’s versatility.

By Application

Gasoline Additives dominate with 67.9% due to rising demand for high-octane fuels.

In 2024, Gasoline Additives held a dominant market position in the By Application Analysis segment of the Methyl Tert-Butyl Ether Market, with a 67.9% share. This application excels by improving fuel combustion and reducing emissions effectively. Refineries blend it to meet stringent environmental standards, boosting vehicle performance worldwide. As electric vehicles rise, traditional engines still rely on such additives, ensuring sustained growth.

Its proven efficacy in enhancing octane ratings cements its top spot in the market. Isobutene production represents a key secondary use, extracting valuable chemicals for polymers and rubbers. This sub-segment supports industries like tire manufacturing, where high-purity isobutene proves essential. It transitions smoothly from MTBE processing, adding value through efficient recovery methods. Though not the leader, it drives innovation in chemical synthesis.

Solvents find niche applications in cleaning and extraction processes across various sectors. They dissolve stubborn residues in labs and factories, offering low-toxicity benefits. This segment grows as industries seek greener alternatives, integrating MTBE solvents into sustainable practices. Its adaptability ensures steady demand, complementing larger applications in the ecosystem.

By End-User

Automotive dominates with 48.5% due to its critical role in fuel enhancement.

In 2024, Automotive held a dominant market position in the By End-user Analysis segment of the Methyl Tert-Butyl Ether Market, with a 48.5% share. This sector leverages MTBE to optimize engine efficiency and comply with emission norms. Car makers incorporate it in fuels to prevent knocking, extending vehicle life. With rising global vehicle fleets, the Automotive industry drives bulk consumption, fostering partnerships with oil suppliers.

Its influence shapes fuel standards, securing long-term dominance. The Oil and Gas industry utilizes MTBE for refining and pipeline maintenance tasks. It acts as a stabilizer during extraction, minimizing corrosion risks effectively. This end-user benefits from MTBE’s compatibility with crude processes, enhancing output quality. As exploration expands in emerging regions, demand surges, bridging traditional energy needs with modern additives.

The chemicals sector employs MTBE in the synthesis of resins and adhesives, promoting reaction efficiency. It serves as a building block for advanced materials, supporting electronics and coatings. This sub-segment innovates through R&D, adapting MTBE for eco-friendly formulations. Though smaller, it fuels diversification, linking energy with manufacturing advances.

Key Market Segments

By Grade

- Industrial Grade

- Pharmaceutical Grade

By Application

- Gasoline Additives

- Isobutene

- Solvents

- Others

By End-user

- Automotive

- Oil and Gas

- Chemicals

- Pharmaceuticals

- Others

Emerging Trends

Octane boosting while cutting aromatics and sulfur

An important trend in methyl tert-butyl ether (MTBE) is its continued role as an octane booster in regions tightening gasoline quality, especially where ethanol logistics are complex. Refiners need octane without pushing up toxic aromatics or sulfur. Europe’s fuel-quality rules set a hard cap of 1% benzene by volume and 35% aromatics by volume in petrol, pushing blenders toward oxygenates like MTBE to meet octane targets without violating these limits.

- The EU completed its transition to sulfur-free fuels (≤10 ppm sulfur), further narrowing the blending space for easy octane from high-sulfur streams and reinforcing demand for cleaner octane components such as MTBE. Supply has kept pace in MTBE-friendly markets across the Middle East. Qatar Fuel Additives Company (QAFAC) reported 505,756 tons of MTBE production.

This supply security matters while the broader oil system flattens out: the International Energy Agency (IEA) notes global oil consumption rose 0.8% in 2024 to 193 EJ, with growth slowing as EVs expand, but gasoline pool quality still needs to meet stricter specs, keeping octane solutions in focus.

Drivers

Stronger Fuel Quality and Emissions Regulations

A major driving factor for the use of Methyl tert‑butyl ether (MTBE) is the push by governments for cleaner-burning gasoline and reduced vehicle emissions. For instance, in the United States, under the Environmental Protection Agency (EPA)’s regulations, oxygenates such as MTBE have been allowed in gasoline blends since as early as support reformulated gasoline that meets stricter air-quality standards.

MTBE has an octane rating of about 110, making it an effective octane booster and cleaner-burning oxygenate. With stricter fuel standards, refiners face higher demands to reduce aromatic hydrocarbons, benzene, sulfur contents, and other harmful emissions precursors.

MTBE’s chemistry supports adding oxygenates like MTBE, gasoline can burn more completely, thus reducing tailpipe emissions of carbon monoxide, unburned hydrocarbons, and particulates. Under the U.S. Clean Air Act Amendments, areas designated for reformulated gasoline (RFG) had to include a minimum oxygenate content; MTBE was one of the leading choices.

Restraints

Significant Environmental & Regulatory Hurdles

A major restraint for the use of Methyl tert‑butyl ether (MTBE) lies in its persistence in groundwater and widespread contamination concerns, which have prompted regulatory restrictions and bans in several jurisdictions. MTBE is highly soluble in water and resistant to natural degradation, which means that when gasoline containing MTBE leaks from storage tanks or pipelines.

The chemical can migrate rapidly into aquifers. One EPA fact sheet notes that pure MTBE can reach an equilibrium concentration in water of approximately 48,000 mg/L, highlighting its mobility in groundwater. Because of this behaviour, states such as New Hampshire adopted a maximum contaminant level (MCL) of 13 µg/L for MTBE in drinking water.

- In monitoring done by the United States Geological Survey (USGS) and state agencies, the presence of MTBE in public- and private-well water (above 0.5 µg/L) rose from 12.7% to 15.1% in New Hampshire. Because of these contamination issues, regulatory initiatives have been triggered. In the U.S., no fewer than 23 states instituted partial or complete bans of MTBE in motor gasoline due to concerns about groundwater pollution.

Opportunity

Growing Gasoline Consumption in Emerging Economies

One major growth factor for the use of Methyl tert‑butyl ether (MTBE) is the rapid rise in vehicle ownership and gasoline demand in the Asia-Pacific and other emerging regions. As urban populations swell and economies expand, more people are buying cars, and more fuel is being burned. In the United States, MTBE demand rose from 83,000 barrels per day to 161,000 barrels per day, then jumped to 269,000 barrels per day.

Governments play a big role in this growth. The U.S. Clean Air Act Amendments of 1990 required more oxygenates in gasoline to reduce carbon monoxide and ozone-forming emissions — a rule that helped expand MTBE use as an oxygenate. In emerging economies, similar drives for cleaner transportation fuels and higher-octane gasoline mean that additives like MTBE become attractive because they boost octane and help meet emissions standards.

In the near term, the surge of gasoline demand in non-OECD regions gives MTBE a meaningful growth tailwind. As refineries expand and upgrade to meet higher quality fuels, MTBE remains a ready solution for blending into gasoline. Combined with more recent global volume estimates, these illustrate that increasing fuel volumes and stricter fuel quality regulations go hand-in-hand, and this feeds demand for MTBE.

Regional Analysis

Asia-Pacific leads with a 47.3% share and a USD 8.5 Billion market value.

In 2024, Asia-Pacific held a dominant position in the global Methyl Tert-Butyl Ether (MTBE) market, capturing a substantial 47.3% share valued at around USD 8.5 billion. The region’s leadership is driven by its rapidly expanding refining and petrochemical industries, coupled with a strong demand for high-octane, cleaner-burning gasoline.

China remains the largest producer and consumer, accounting for a major portion of regional MTBE output due to its extensive refinery integration and government policies aimed at improving air quality in metropolitan centers. Countries like India, South Korea, Singapore, and Japan also contribute significantly, using MTBE as a preferred gasoline oxygenate to meet tightening emission norms and maintain fuel efficiency.

Governmental efforts to reduce carbon monoxide and particulate emissions have reinforced the use of oxygenates such as MTBE in the regional fuel mix. China’s National VI emission standards, aligned with Euro VI norms, have pushed refineries to include MTBE in premium fuel grades to achieve octane targets without raising aromatic content.

Asia-Pacific’s dominance in the MTBE market is expected to continue through the forecast period, driven by rising vehicle ownership, expanding fuel demand, and ongoing refinery modernization projects that prioritize environmentally compliant blending components and consistent fuel quality standards.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

CNPC holds a dominant position in the regional Methyl Tert-Butyl Ether (MTBE) market. Its extensive production capacity is integrated with vast refining operations, ensuring a consistent and cost-effective supply. CNPC leverages its strong domestic distribution network and government alignment to serve growing Asian demand, particularly from the gasoline blending sector. Its strategic focus on petrochemical integration and scale makes it a formidable and stable force in the market.

Eni S.p.A is a significant global player in the MTBE market. Its strength lies in its advanced refining technology and a strong international presence, particularly in Europe and the Mediterranean. Eni produces high-quality MTBE as a valuable by-product of its integrated refining and chemical processes, often targeting premium markets. The company’s commitment to transitioning towards bio-based alternatives also positions it for future regulatory changes.

ENOC Company is a pivotal player in the Middle Eastern MTBE landscape. The company benefits from its strategic location, providing easy access to both Asian and European markets. Its production is closely tied to the region’s abundant feedstock and expanding refining capabilities. ENOC primarily serves the robust gasoline blending demand within the UAE and for export, leveraging its strong logistics and storage infrastructure.

Top Key Players in the Market

- BP plc

- Chevron Phillips Chemical Company LLC

- China Petrochemical Corporation

- CNPC

- Eni S.p.A

- ENOC Company

- Enterprise Products Partners L.P.

- ETRONAS Chemicals Group Berhad

- Evonik Industries AG

- Exxon Mobil Corporation

Recent Developments

- In 2024, Eni’s Enilive subsidiary (dedicated to mobility products) reached a biorefining capacity, significantly up from prior years. This includes increased sustainable aviation fuel (SAF) production, positioning bio-ethers as MTBE alternatives. The Livorno refinery conversion to hydrotreated vegetable oil (HVO) production.

- In 2024, ENOC launched three new service stations in Dubai as part of its expansion goal, focusing on EV charging and low-emission fuels—potentially reducing long-term MTBE reliance. The MOU with Sharjah National Oil Corporation (SNOC) explores new opportunities in gas processing, which could indirectly benefit MTBE feedstock.

Report Scope

Report Features Description Market Value (2024) USD 18.1 Billion Forecast Revenue (2034) USD 29.8 Billion CAGR (2025-2034) 5.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Grade (Industrial Grade, Pharmaceutical Grade), By Application (Gasoline Additives, Isobutene, Solvents, Others), By End-user (Automotive, Oil and Gas, Chemicals, Pharmaceuticals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BP plc, Chevron Phillips Chemical Company LLC, China Petrochemical Corporation, CNPC, Eni S.p.A., ENOC Company, Enterprise Products Partners L.P., ETRONAS Chemicals Group Berhad, Evonik Industries AG, Exxon Mobil Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Methyl Tert-Butyl Ether MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

Methyl Tert-Butyl Ether MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BP plc

- Chevron Phillips Chemical Company LLC

- China Petrochemical Corporation

- CNPC

- Eni S.p.A

- ENOC Company

- Enterprise Products Partners L.P.

- ETRONAS Chemicals Group Berhad

- Evonik Industries AG

- Exxon Mobil Corporation