Global Lime Market Size, Share, And Business Benefits By Type (Quick Lime, Hydrated Lime, Calcined Lime, Dolomitic, Others), By Application (Construction, Agriculture, Building Material, Mining and Metallurgy, Water Treatment, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151008

- Number of Pages: 340

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

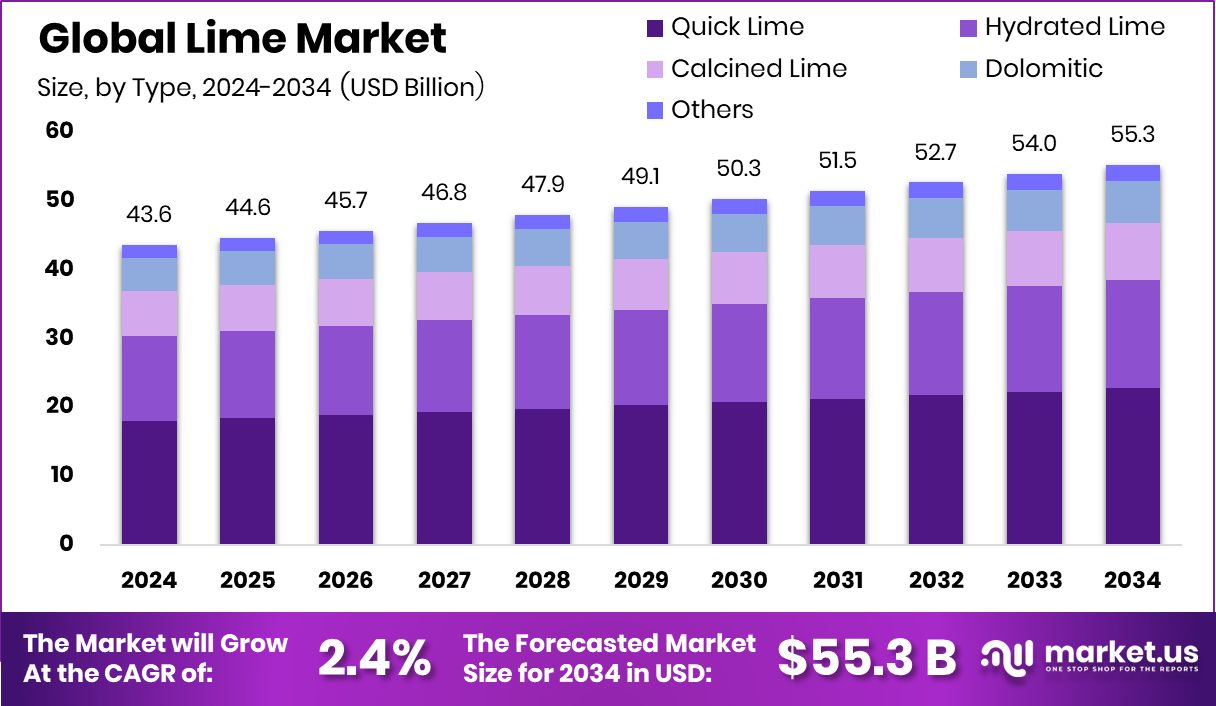

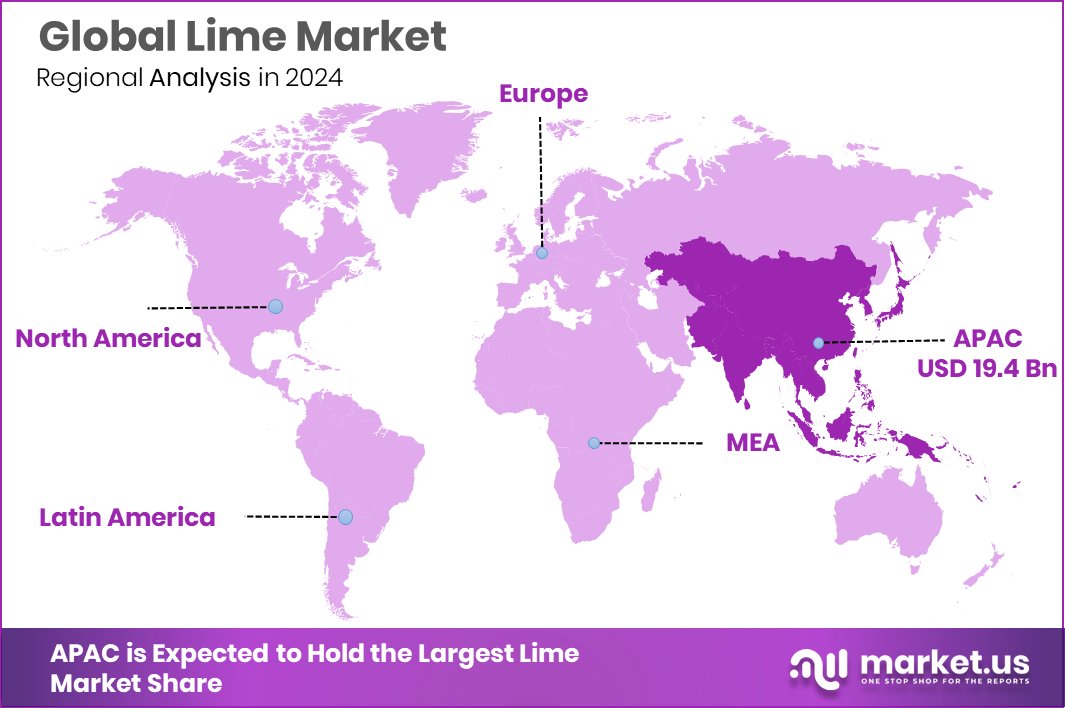

Global Lime Market is expected to be worth around USD 55.3 billion by 2034, up from USD 43.6 billion in 2024, and grow at a CAGR of 2.4% from 2025 to 2034. High infrastructure growth in Asia-Pacific boosts lime demand, reaching USD 19.4 billion.

Lime is a versatile fruit known for its vibrant green color, tart flavor, and rich nutritional profile. Commonly used in culinary dishes, beverages, and natural remedies, lime is a staple in households and industries alike. Its high vitamin C content and antioxidant properties make it popular in health-conscious lifestyles. Beyond food, lime is also valued in the cosmetic and cleaning sectors due to its natural acidity and refreshing scent.

Lime Market refers to the global and local trade of lime fruit and its by-products, including lime juice, lime oil, dried lime, and concentrates. It includes farming, processing, packaging, and distribution activities. The market is deeply influenced by agriculture trends, climate conditions, and consumer demand across various sectors like food & beverage, cosmetics, pharmaceuticals, and cleaning products.

Growth factors for the lime market include increasing health awareness, rising preference for natural and organic products, and the growing popularity of ethnic and fusion cuisines that use lime as a key ingredient. Consumers are actively seeking foods with functional benefits, giving lime a strong place in modern diets.

Demand for lime is also rising due to its role in immunity-boosting drinks, detox products, and natural remedies. Urban lifestyles and the shift towards healthier food habits continue to support this upward trend.

Key Takeaways

- Global Lime Market is expected to be worth around USD 55.3 billion by 2034, up from USD 43.6 billion in 2024, and grow at a CAGR of 2.4% from 2025 to 2034.

- Quick lime dominates the lime market, holding a 41.3% share due to industrial applications.

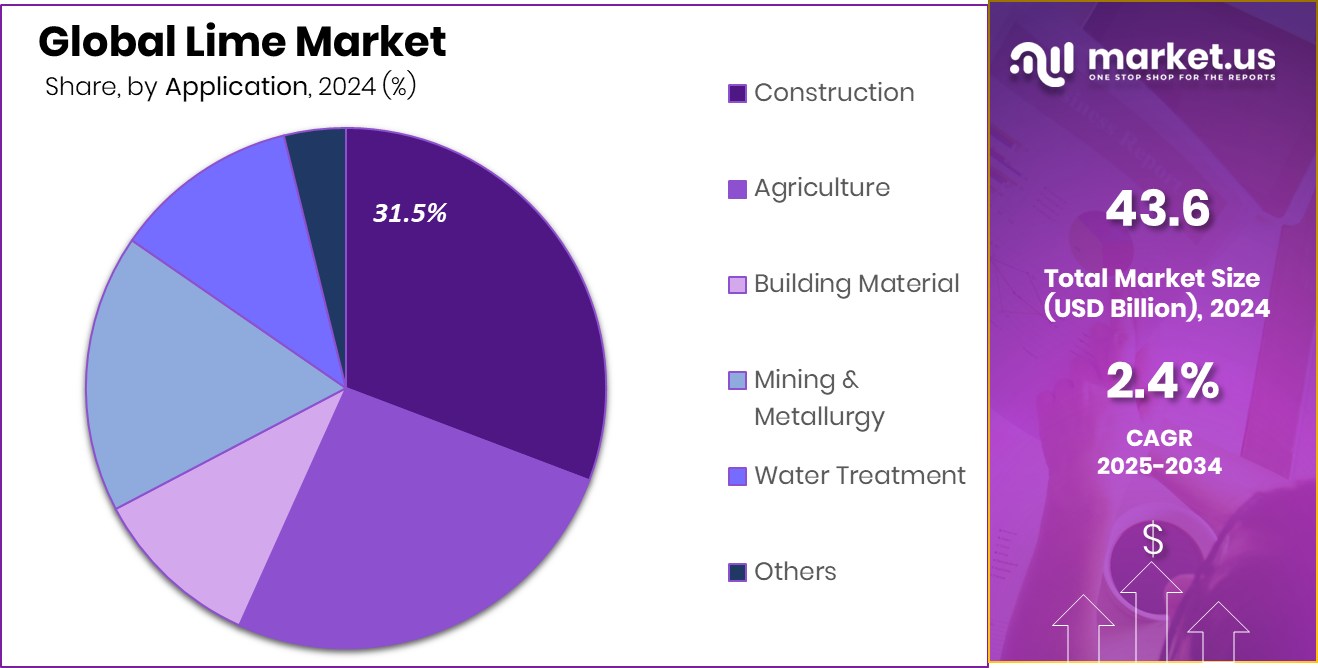

- Construction leads lime market applications with a 31.5% share, driven by infrastructure growth and urban development.

- The Asia-Pacific lime market was valued at USD 19.4 billion in 2024.

By Type Analysis

Quick lime dominates the lime market with a 41.3% strong industry share.

In 2024, Quick Lime held a dominant market position in the By Type segment of the Lime Market, with a 41.3% share. This significant lead can be attributed to its wide-ranging applications across construction, metallurgy, and chemical industries. Quick Lime, known for its high reactivity, is extensively used in steel manufacturing and flue gas treatment, where efficiency and performance are critical.

The consistent industrial growth and infrastructure development, particularly in emerging economies, have bolstered the need for Quick Lime. Its cost-efficiency and availability make it a preferred choice for both large-scale industrial operations and localized applications. Moreover, Quick Lime’s adaptability across multiple industrial processes supports its market dominance.

With a focus on environmental regulations and sustainable practices, industries are turning to Quick Lime for its role in emission control and waste treatment, aligning with green compliance strategies. This market behavior continues to support Quick Lime’s leading position in the segment, making it a critical driver of overall growth within the Lime Market.

By Application Analysis

The construction sector leads the lime market application with 31.5% usage globally.

In 2024, Construction held a dominant market position in the By Application segment of the Lime Market, with a 31.5% share. This leadership is primarily driven by the increasing use of lime in soil stabilization, asphalt modification, and the production of building materials such as cement and plaster. Lime plays a critical role in enhancing the durability and strength of construction materials, making it an essential component in modern infrastructure projects.

The demand for lime in the construction sector remains strong due to ongoing urban development, road building, and large-scale infrastructure projects. Its effectiveness in improving soil quality for foundations and roadbeds makes it indispensable in both urban and rural construction efforts. Additionally, lime’s role in water treatment for construction sites and its use in masonry work further contribute to its high consumption in this segment.

The 31.5% share held by the construction application underlines the sector’s reliance on lime as a strategic material for structural integrity and long-term performance. This dominance reflects not only the volume of lime required in the construction industry but also its value as a multifunctional material supporting sustainable and efficient building practices.

Key Market Segments

By Type

- Quick Lime

- Hydrated Lime

- Calcined Lime

- Dolomitic

- Others

By Application

- Construction

- Agriculture

- Building Material

- Mining and Metallurgy

- Water Treatment

- Others

Driving Factors

Growing Use of Lime in Construction Projects

One of the top driving factors for the lime market is its increasing use in construction activities. Lime is widely used to improve soil strength, stabilize roads, and make strong building materials like cement and plaster. As cities expand and new roads, bridges, and buildings are built, the demand for lime keeps rising. It helps construction work last longer and perform better, especially in areas with poor soil.

Governments and private companies are investing more in infrastructure projects, which creates more need for lime. Because of its useful properties and affordable cost, lime has become a key material in the construction industry. This growing demand strongly supports the steady growth of the lime market.

Restraining Factors

Environmental Concerns and Pollution from Lime Production

A major restraining factor for the lime market is the environmental impact caused during its production. Making lime involves heating limestone at very high temperatures, which releases large amounts of carbon dioxide (CO₂) into the air. This process contributes to air pollution and climate change, raising concerns among environmental groups and government bodies.

As a result, stricter rules and regulations are being introduced to reduce emissions, which can increase production costs for lime manufacturers. Companies may also need to invest in cleaner technology or pay penalties, which affects their profits.

Growth Opportunity

Expansion Through Value‑Added Lime Products and Services

The top growth opportunity in the lime market lies in offering value-added products and services that go beyond just raw lime. Businesses can innovate by creating packaged solutions like lime blends, powdered and pre-mixed forms, and specialty additives for specific industries.

These ready-to-use products save time and effort for customers, making them more appealing in sectors such as agriculture, water treatment, and construction. Additionally, companies can offer services like technical support, application training, and customized product development.

This added support helps customers use lime more effectively and builds long-term loyalty. By differentiating through enhanced offerings and support, lime producers can tap into new customer segments, increase their profitability, and grow beyond basic commodity sales.

Latest Trends

Rise of Eco-Friendly Lime Production Techniques

A key latest trend in the lime market is the shift towards eco-friendly production methods. Producers are increasingly adopting cleaner technologies such as wet scrubbers, energy-efficient kilns, and advanced carbon capture systems. These tools help cut down the CO₂ and other emissions released during the lime-making process.

This approach not only helps protect the planet but also improves a company’s image and opens doors to markets that prefer environmentally responsible suppliers. As more firms embrace sustainable practices, eco-friendly lime production is becoming the norm, driving innovation and future growth in the lime industry.

Regional Analysis

In Asia-Pacific, the lime market held a strong 44.5% regional share.

In 2024, the lime market showed varied performance across different regions, with Asia-Pacific emerging as the dominant region, accounting for 44.5% of the global market and reaching a value of USD 19.4 billion. This leadership is supported by strong demand from the construction, steel, and chemical industries across rapidly developing economies. High urbanization and infrastructure development projects have significantly boosted lime consumption in this region.

In North America, the market remains stable, driven by steady demand in construction and environmental applications, with a focus on sustainable production methods. Europe also holds a notable share due to stringent environmental standards and a strong industrial base, supporting consistent lime usage in steel and water treatment sectors. The Middle East & Africa reflect growing potential, particularly in construction and agriculture, as urban expansion and soil conditioning needs rise.

Latin America shows moderate growth, mainly led by industrial usage and regional development activities. Among all, Asia-Pacific leads not only in volume but also in market value, indicating its strong influence on global lime trends. The region’s rapid industrialization and rising investment in infrastructure continue to place it at the forefront of lime market growth globally.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, key players such as Afrimat, Brookville Lime, and Cape Lime (Pty) Ltd. continued to demonstrate strong strategic positioning in the global lime market through regional strength, operational specialization, and customer-centric approaches.

Afrimat, known for its diversified presence across industrial minerals, has maintained a resilient performance, particularly in meeting construction and infrastructure-driven demand in key markets. Its integration of mining and processing operations allows for cost efficiency and product consistency, giving it a steady foothold in both domestic and international supply chains.

Brookville Lime has upheld its reputation for quality and reliability, especially in agricultural lime applications. Its regional focus enables it to provide tailored solutions, meeting local soil conditioning and land treatment needs. Brookville Lime’s continued investment in refining production methods supports environmental compliance and long-term operational sustainability, which are increasingly critical in the evolving market landscape.

Cape Lime (Pty) Ltd., with its South African roots, plays a significant role in supplying lime to the steel, water treatment, and construction industries. Its strategic location and quality reserves offer a competitive edge. The company’s ability to maintain stable supply and serve multiple end-use sectors ensures its relevance in both local and export markets.

Top Key Players in the Market

- Afrimat

- Brookville Lime

- Cape Lime (Pty) Ltd.

- Carmeuse

- Cheney Lime & Cement Company

- Cornish Lime

- GP Group

- Graymont Limited

- Lhoist

- Linwood Mining & Minerals Corporation

- Minerals Technologies, Inc.

- Pete Lien & Sons, Inc.

- Sigma Minerals Ltd

- United States Lime & Minerals, Inc.

Recent Developments

- In April 2025, Graymont announced a major investment to expand its Traralgon lime plant and nearby limestone quarry in Victoria, Australia. This expansion aims to boost lime production for key industries such as construction, mining, and agriculture. Additionally, plans include a new logistics terminal in Melbourne—expected to be operational in late 2025—to improve regional supply chains.

- In July 2024, Carmeuse commissioned an oxyfuel pilot kiln at its Seilles plant as part of its “Butterfly” carbon capture project. This kiln is the first step toward cutting CO₂ emissions from lime production.

Report Scope

Report Features Description Market Value (2024) USD 43.6 Billion Forecast Revenue (2034) USD 55.3 Billion CAGR (2025-2034) 2.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Quick Lime, Hydrated Lime, Calcined Lime, Dolomitic, Others), By Application (Construction, Agriculture, Building Material, Mining and Metallurgy, Water Treatment, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Afrimat, Brookville Lime, Cape Lime (Pty) Ltd., Carmeuse, Cheney Lime & Cement Company, Cornish Lime, GP Group, Graymont Limited, Lhoist, Linwood Mining & Minerals Corporation, Minerals Technologies, Inc., Pete Lien & Sons, Inc., Sigma Minerals Ltd, United States Lime & Minerals, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Afrimat

- Brookville Lime

- Cape Lime (Pty) Ltd.

- Carmeuse

- Cheney Lime & Cement Company

- Cornish Lime

- GP Group

- Graymont Limited

- Lhoist

- Linwood Mining & Minerals Corporation

- Minerals Technologies, Inc.

- Pete Lien & Sons, Inc.

- Sigma Minerals Ltd

- United States Lime & Minerals, Inc.