Global IT Outsourcing In Capital Market Size, Industry Analysis Report By Service Type (Application Development and Maintenance, Infrastructure Management, Business Process Outsourcing, Others), By End-User Industry (BFSI, Healthcare, Retail, Manufacturing, IT and Telecommunications, Others), By Enterprise Size (Small and Medium Enterprises, Large Enterprises), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sept. 2025

- Report ID: 157799

- Number of Pages: 214

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Insight Summary

- Analysts’ Viewpoint

- Role of Generative AI

- Investment and Business Benefits

- US Market Size

- Emerging Trends

- Growth Factors

- By Service Type Analysis

- By End-User Industry

- Enterprise Size

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

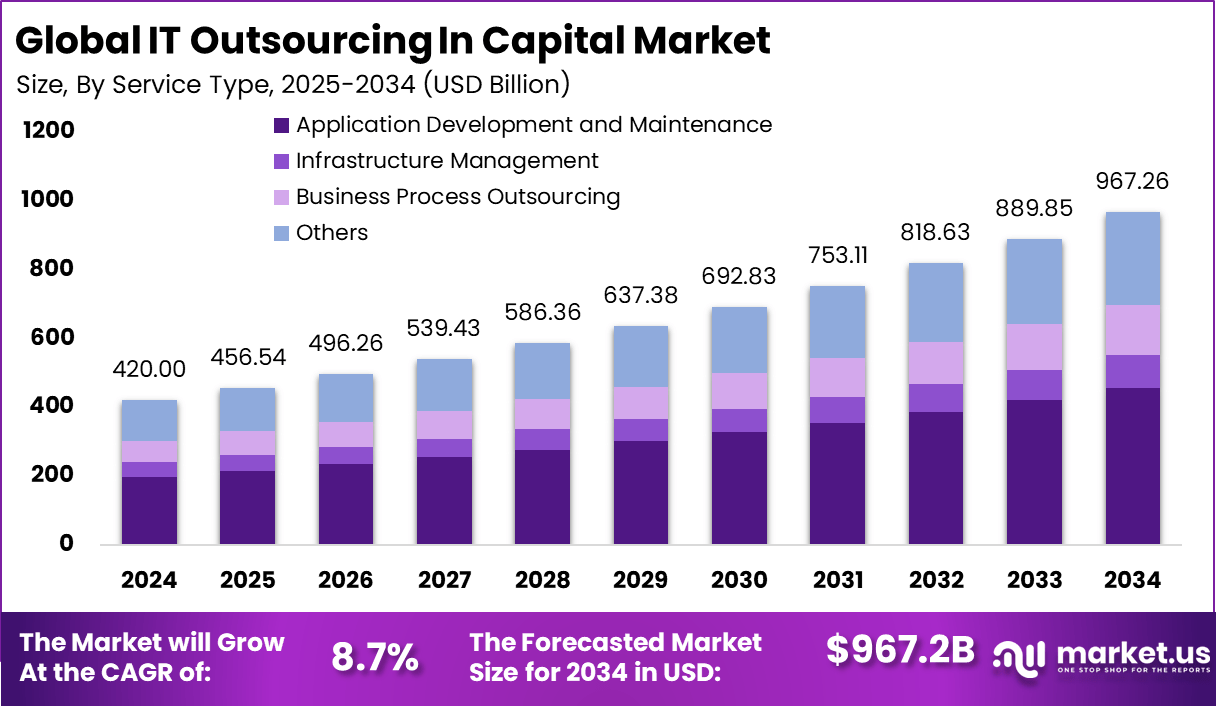

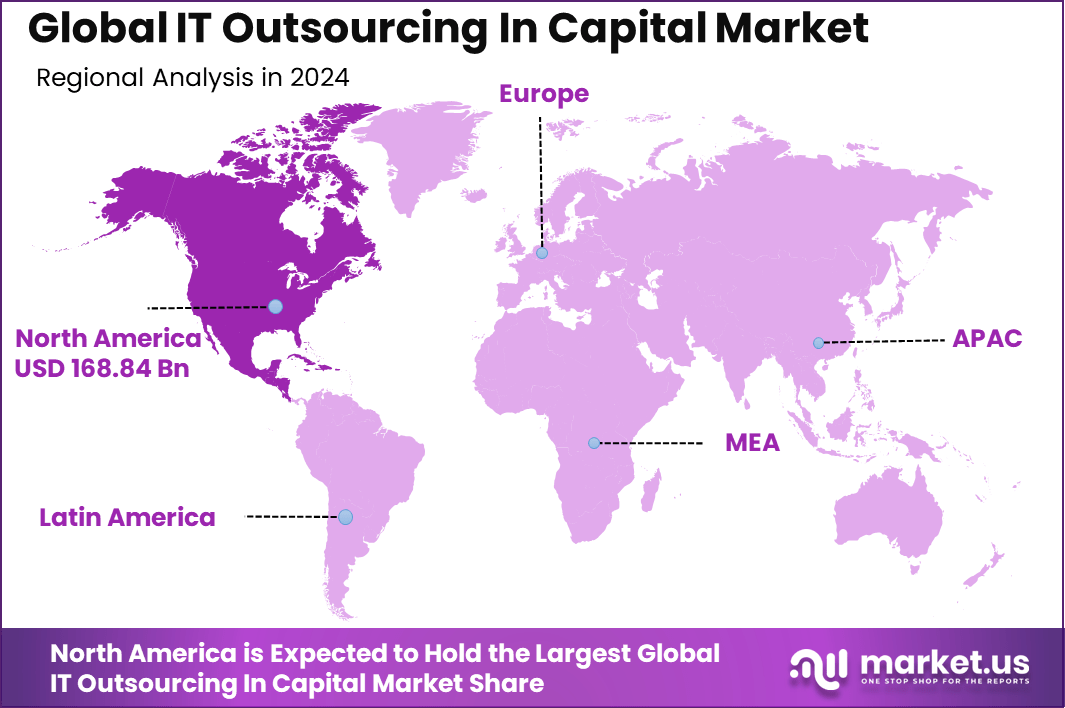

The Global IT Outsourcing In Capital Market size is expected to be worth around USD 967.2 Billion By 2034, from USD 420 billion in 2024, growing at a CAGR of 8.7% during the forecast period from 2025 to 2034. In 2024, North America held a dominan market position, capturing more than a 40.2% share, holding USD 168.84 Billion revenue.

IT outsourcing in the capital market refers to the practice where financial institutions delegate their IT-related functions and services to third-party providers. This approach helps these organizations focus more on their core capital market activities while leveraging external expertise to handle software development, system maintenance, data management, and compliance technologies.

According to Market.us, The Global IT Outsourcing Market is projected to grow strongly, reaching about USD 1,094.9 Billion by 2033, rising from USD 471.1 Billion in 2023, with a CAGR of 8.80% between 2024 and 2033. This growth reflects the increasing reliance of enterprises on external service providers to optimize costs, enhance efficiency, and access advanced digital expertise.

One of the top driving factors behind IT outsourcing in the capital market is cost efficiency. Firms face increasing pressure to reduce operational costs alongside managing complex IT infrastructure and regulatory compliance requirements. Outsourcing enables them to avoid heavy investments in technology and personnel, while still gaining access to advanced IT capabilities.

According to connectbit, outsourcing continues to be a critical strategy for enterprises, with 81% of organizations delegating cybersecurity functions to external providers. Cost reduction remains a strong driver, influencing 57% of outsourcing decisions, while 27% of enterprises focus on efficiency gains, particularly in IT services. However, cultural fit is also a factor, with 22% of executives considering it when selecting outsourcing partners.

Key Insight Summary

- By service type, Application Development and Maintenance dominated with 47.2% share.

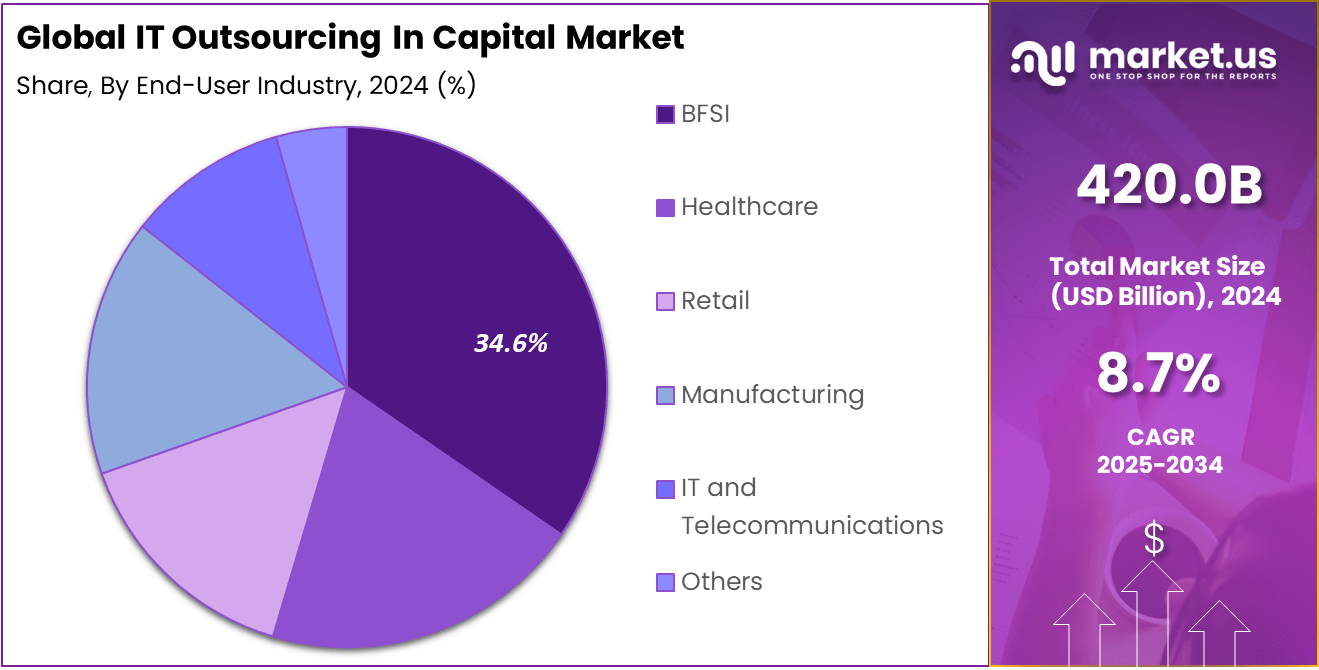

- By end-user industry, BFSI led the market, accounting for 34.6% share.

- Large Enterprises were the primary adopters, holding 72.6% share.

- Regionally, North America captured 40.2% share of the global market.

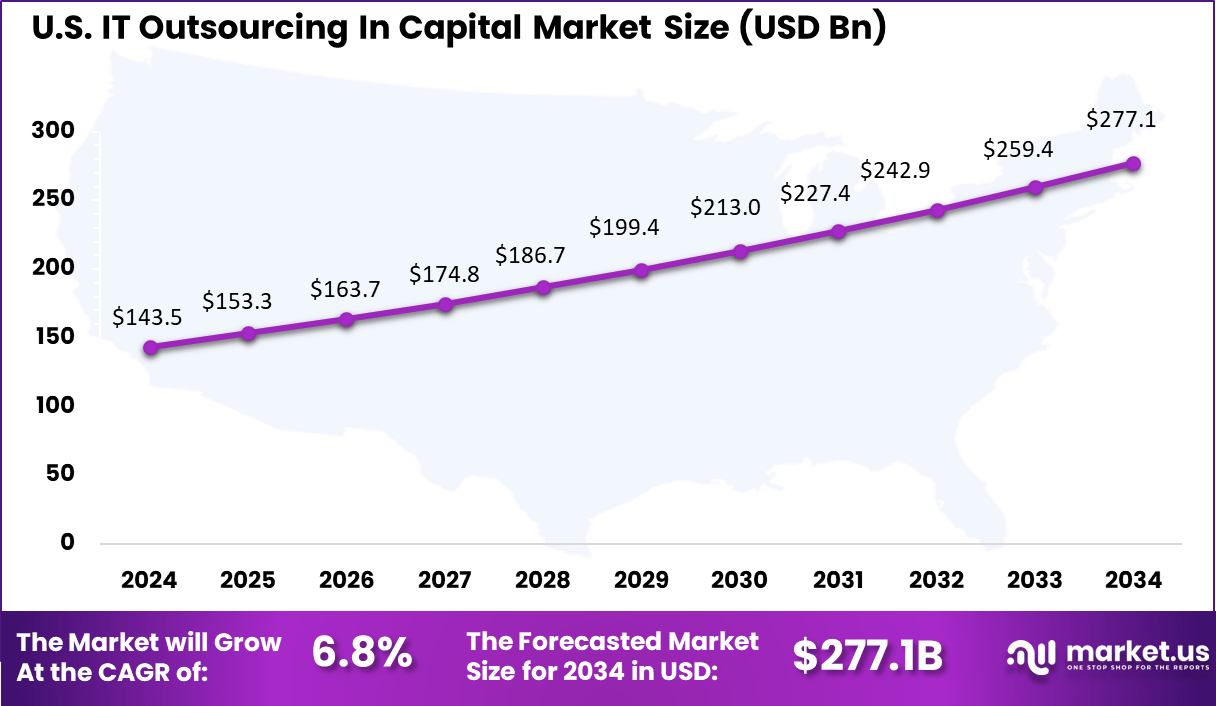

- The U.S. market was valued at USD 143.51 Billion, growing at a steady 6.80% CAGR.

Analysts’ Viewpoint

Demand for IT outsourcing in capital markets is rising due to the growing complexity of regulations, increasing volume of financial transactions, and the rapid pace of technology evolution. Financial institutions require sophisticated IT solutions to maintain compliance, enhance data security, and improve trade processing efficiency.

Emerging technologies play a significant role in this trend. Financial firms are increasingly adopting cloud computing, artificial intelligence, machine learning, blockchain, and automation technologies through outsourced IT services. These technologies improve transaction transparency, speed up data processing, and enable predictive analytics for better decision-making.

The key reasons for adopting IT outsourcing include cost savings, access to specialized expertise, and the ability to quickly implement new technologies. Outsourcing also reduces the challenges related to IT recruitment, training, and infrastructure management. By partnering with experienced providers, firms gain operational resilience, improved regulatory compliance, and risk mitigation capabilities that would be more resource-intensive to build internally.

Role of Generative AI

Key Points Description Automating Repetitive Tasks Generative AI automates high-volume, rule-based tasks like data entry and routine customer service, improving efficiency and reducing human error. Enhancing Customer Service AI-powered chatbots and virtual assistants provide immediate and 24/7 responses, improving customer satisfaction and freeing human agents for complex issues. Predictive Analytics Generative AI analyzes large datasets to forecast trends, optimize resource allocation, and improve service quality in outsourcing operations. Content Creation & Reporting AI can generate emails, reports, marketing content, and training materials, reducing workload and speeding up communication processes. Cost Reduction & Innovation By automating complex processes and enabling innovation through AI-generated solutions, companies reduce labor costs and enhance service customization. Investment and Business Benefits

Investment opportunities in IT outsourcing within capital markets are broad and growing. Investors can explore areas like cloud infrastructure services, cybersecurity offerings, AI-driven analytics platforms, and blockchain integration solutions. The expanding need for digital transformation in financial services fuels these investment prospects, with technology providers innovating to meet evolving market and regulatory requirements.

Business benefits of IT outsourcing in capital markets are substantial. Firms gain cost control, operational efficiency, enhanced innovation capability, and a stronger security posture. Outsourcing also allows companies to shift from fixed to variable IT costs, improving financial flexibility. Additionally, process standardization and vendor expertise improve service quality and reduce time to market for new financial products and services.

The regulatory environment heavily impacts IT outsourcing decisions in capital markets. Financial firms must follow strict regulations around data security, privacy, and operational resilience. Outsourcing providers with deep knowledge of these rules help clients maintain compliance while managing third-party risks. Globally, regulatory authorities require firms to have robust outsourcing governance frameworks, including risk assessments, continuous monitoring, and clear contractual safeguards.

US Market Size

The U.S. IT Outsourcing In Capital Market was valued at USD 143.5 Billion in 2024 and is anticipated to reach approximately USD 277.1 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 6.8% during the forecast period from 2025 to 2034.

In 2024, North America held a dominant market position, capturing more than 40.2% share and generating USD 168.84 billion in revenue in the IT outsourcing in capital market segment. The region’s leadership is largely driven by the strong presence of global financial hubs such as New York, Chicago, and Toronto, where demand for advanced IT solutions in trading, risk management, and compliance remains consistently high.

North America’s dominance is further supported by its regulatory environment, which places heavy emphasis on transparency, data security, and compliance. To meet these requirements, financial institutions are increasingly partnering with IT service providers that can deliver robust, scalable, and compliant solutions.

Emerging Trends

Key Points Description Shift to Value-Driven Engagements Companies focus on outcome-based contracts emphasizing value beyond cost savings. Regionalization & Nearshoring Preference for nearshoring to close time zones for better collaboration and cultural alignment, especially in Latin America and Eastern Europe. AI, Automation & DevOps Integration Increased adoption of advanced technologies like AI, RPA, and DevOps for streamlining IT services and boosting productivity. Sustainability and Ethical Outsourcing Growing demand for providers who follow ethical labor practices and minimize environmental impact. Specialized Niche Providers Rising focus on outsourcing firms with domain expertise offering tailored services and measurable results. Growth Factors

Key Points Description Digital Transformation Demand Accelerated digitalization across industries drives need for external IT expertise. Cost Efficiency & Resource Optimization Outsourcing reduces operational costs and mitigates talent shortages. Increasing Cybersecurity Threats Specialized IT outsourcing providers manage complex security requirements and compliance. Cloud Adoption & Managed Services Rising cloud migration increases demand for managed cloud services outsourcing. Remote Work and Hybrid Models Growing remote workforce leads to more demand for outsourced IT support and collaboration tools. By Service Type Analysis

In 2024, Application Development and Maintenance (ADM) is the leading service type within IT outsourcing in the capital markets, accounting for 47.2% of the segment. This service encompasses the creation, updating, and ongoing management of software applications critical to capital market operations, such as trading platforms, risk management systems, and compliance monitoring tools.

ADM outsourcing allows capital market firms to keep their technology current, improve system performance, and reduce downtime with expert external help. Outsourcing ADM helps firms address evolving market demands and regulatory requirements efficiently by leveraging external technical expertise and advanced development methodologies.

It also provides scalability and flexibility in managing resource-intensive projects without the burden of permanent staffing. This focus on ADM reflects the capital markets’ need for agile and resilient technological infrastructures that can support complex, high-volume transactions reliably.

By End-User Industry

In 2024, the Banking, Financial Services, and Insurance (BFSI) industry constitutes 34.6% of the IT outsourcing capital market sector. BFSI firms are highly dependent on robust IT infrastructure for transaction processing, risk analysis, fraud detection, and regulatory compliance.

Outsourcing IT services enables these institutions to enhance operational efficiency and concentrate on core banking and financial operations while accessing specialized IT skills. The BFSI sector’s large IT budgets and increasing digital transformation initiatives drive strong demand for outsourcing partnerships.

These alliances help BFSI firms implement new technologies such as blockchain, artificial intelligence, and cloud computing faster and with less risk. Given the critical nature of security and compliance in BFSI, outsourcing providers often offer tailored solutions focused on privacy and data protection, making BFSI a core customer segment in the IT outsourcing market.

Enterprise Size

In 2024, Large enterprises dominate the IT outsourcing market in capital markets, representing 72.6% of the market share. These organizations usually require sophisticated IT solutions to manage vast volumes of data, complex transactions, and stringent regulatory reporting standards. Their outsourcing engagements tend to be long-term and comprehensive, covering a wide range of IT functions from infrastructure to software development.

Large enterprises benefit from outsourcing by gaining access to a global talent pool, cost efficiencies, and enhanced scalability while focusing internal resources on strategic growth areas. The high dependency on IT across capital market operations means that continued investments in outsourced IT services by large firms will maintain their dominance in this segment over the coming years.

Key Market Segments

By Service Type

- Application Development and Maintenance

- Infrastructure Management

- Business Process Outsourcing

- Others

By End-User Industry

- BFSI

- Healthcare

- Retail

- Manufacturing

- IT and Telecommunications

- Others

By Enterprise Size

- Small and Medium Enterprises

- Large Enterprises

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Cost Efficiency and Operational Flexibility

One of the main drivers for IT outsourcing in capital markets is the significant reduction in operational costs. Instead of investing heavily in expensive hardware and software infrastructure upfront, companies convert fixed capital expenditures into manageable operational expenses.

This switch allows firms to better control budgets through predictable monthly payments while outsourcing providers handle upgrades and maintenance. This flexibility helps capital market firms operate with reduced financial pressure and adapt quickly to market demands.

Outsourcing also reduces internal personnel costs, including salaries, training, and recruitment challenges. By delegating IT functions to specialized service providers, capital market firms can focus resources on core business activities without the burden of managing complex IT systems. This organizational efficiency serves as a strong motivation for outsourcing decisions in the capital market sector.

Restraint

Data Security and Regulatory Compliance Risks

A key restraint in IT outsourcing for capital markets is the rising concern over data security and compliance with strict financial regulations. Sensitive data handled by external providers exposes firms to potential breaches or mishandling, which can lead to significant reputational and financial damage.

Regulatory environments in capital markets are rigorous and constantly evolving, making third-party compliance complex and costly to monitor. Additionally, the loss of direct control over IT processes can make it harder to enforce compliance stringently. This hesitancy to outsource critical IT functions stems from fear of penalties, such as fines for inadequate data governance, as seen in some recent industry cases.

Opportunity

Technological Innovation and Market Expansion

The IT outsourcing trend in capital markets presents a strong opportunity for firms to access advanced technologies like Artificial Intelligence, Machine Learning, and blockchain. Outsourcing providers often have the expertise to integrate these tools faster and more efficiently than in-house teams, enabling clients to improve operational efficiency, automate routine tasks, and enhance compliance monitoring.

Furthermore, as the capital markets industry grows globally, outsourcing offers scalability that allows firms to quickly expand their IT capabilities and market reach without heavy upfront investment. This flexibility supports entry into new markets and increased transaction volumes, giving firms a competitive edge through innovation and agility.

Challenge

Managing Vendor Dependence and Hidden Costs

One critical challenge in IT outsourcing is the risk of over-dependence on service providers. Capital market firms may face operational disruptions if the vendor suffers financial difficulties, service failures, or does not meet quality standards. This dependency can limit the firm’s ability to switch providers without significant transition costs or disruptions.

Hidden costs are another concern, including fees for additional services, integration complexities, and long-term contract commitments that do not easily allow flexibility. These financial surprises can offset some of the anticipated cost savings, making budgeting difficult. Firms must carefully manage vendor relationships and contracts to mitigate these risks and maintain control over outsourced IT functions.

Competitive Analysis

The IT Outsourcing in Capital Market is driven by large technology leaders. IBM, Accenture, and TCS hold strong positions with deep expertise and global presence. Cognizant and Infosys add strength through digital transformation and cost efficiency solutions. These companies act as strategic partners for capital market operations.

Indian providers such as Wipro, HCL, and Tech Mahindra are growing fast. Their competitive pricing and strong delivery centers attract many clients. Capgemini and DXC add value with end-to-end outsourcing. NTT DATA and Fujitsu strengthen the market with integration expertise and strong presence in Asia.

Specialized firms add flexibility to the market. Atos, CGI, and EPAM focus on niche outsourcing needs. LTI, Mindtree, and Virtusa expand with agile models. Syntel and Genpact bring automation and process outsourcing. Other regional players add competition and innovation, making the market highly dynamic.

Top Key Players in the Market

- IBM Corporation

- Accenture plc

- Tata Consultancy Services Limited (TCS)

- Cognizant Technology Solutions Corporation

- Infosys Limited

- Wipro Limited

- Capgemini SE

- HCL Technologies Limited

- DXC Technology Company

- NTT DATA Corporation

- Fujitsu Limited

- Tech Mahindra Limited

- Atos SE

- CGI Inc.

- EPAM Systems, Inc.

- Larsen & Toubro Infotech Limited (LTI)

- Mindtree Limited

- Virtusa Corporation

- Syntel, Inc.

- Genpact Limited

- Others

Recent Developments

- June 2025, Infosys Limited: Reported sustained hiring momentum with plans to onboard 20,000 college graduates in 2025 to meet growing IT outsourcing demand in Europe and other regions.

- June 2024, Cognizant Technology Solutions Corporation: Acquired Belcan, a digital engineering firm focused on aerospace and defense, for $1.3 billion to strengthen engineering capabilities and expand aerospace, defense, space, and marine sector services.

- Wipro Limited, Secured a strategic 10-year outsourcing engagement worth $112 million with ATCO Ltd., continuing through December 2024, focused on advancing IT infrastructure and services for the client.

Report Scope

Report Features Description Market Value (2024) USD 420 Bn Forecast Revenue (2034) USD 967.26 Bn CAGR(2025-2034) 8.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Service Type (Application Development and Maintenance, Infrastructure Management, Business Process Outsourcing, Others), By End-User Industry (BFSI, Healthcare, Retail, Manufacturing, IT and Telecommunications, Others), By Enterprise Size (Small and Medium Enterprises, Large Enterprises) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape IBM Corporation, Accenture plc, Tata Consultancy Services Limited (TCS), Cognizant Technology Solutions Corporation, Infosys Limited, Wipro Limited, Capgemini SE, HCL Technologies Limited, DXC Technology Company, NTT DATA Corporation, Fujitsu Limited, Tech Mahindra Limited, Atos SE, CGI Inc., EPAM Systems, Inc., Larsen & Toubro Infotech Limited (LTI), Mindtree Limited, Virtusa Corporation, Syntel, Inc., Genpact Limited, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  IT Outsourcing In Capital MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample

IT Outsourcing In Capital MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- IBM Corporation

- Accenture plc

- Tata Consultancy Services Limited (TCS)

- Cognizant Technology Solutions Corporation

- Infosys Limited

- Wipro Limited

- Capgemini SE

- HCL Technologies Limited

- DXC Technology Company

- NTT DATA Corporation

- Fujitsu Limited

- Tech Mahindra Limited

- Atos SE

- CGI Inc.

- EPAM Systems, Inc.

- Larsen & Toubro Infotech Limited (LTI)

- Mindtree Limited

- Virtusa Corporation

- Syntel, Inc.

- Genpact Limited

- Others