Global Hydrogen Storage Market Size, Share Analysis Report By Physical State (Liquid, Gas), By Type (Cylinder, Merchant/Bulk, On-site, On-board), By Technology (Compression, Liquefaction, Material Based), By Application (Chemicals, Oil Refineries, Metalworking, Automotive and Transportation, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 153470

- Number of Pages: 362

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

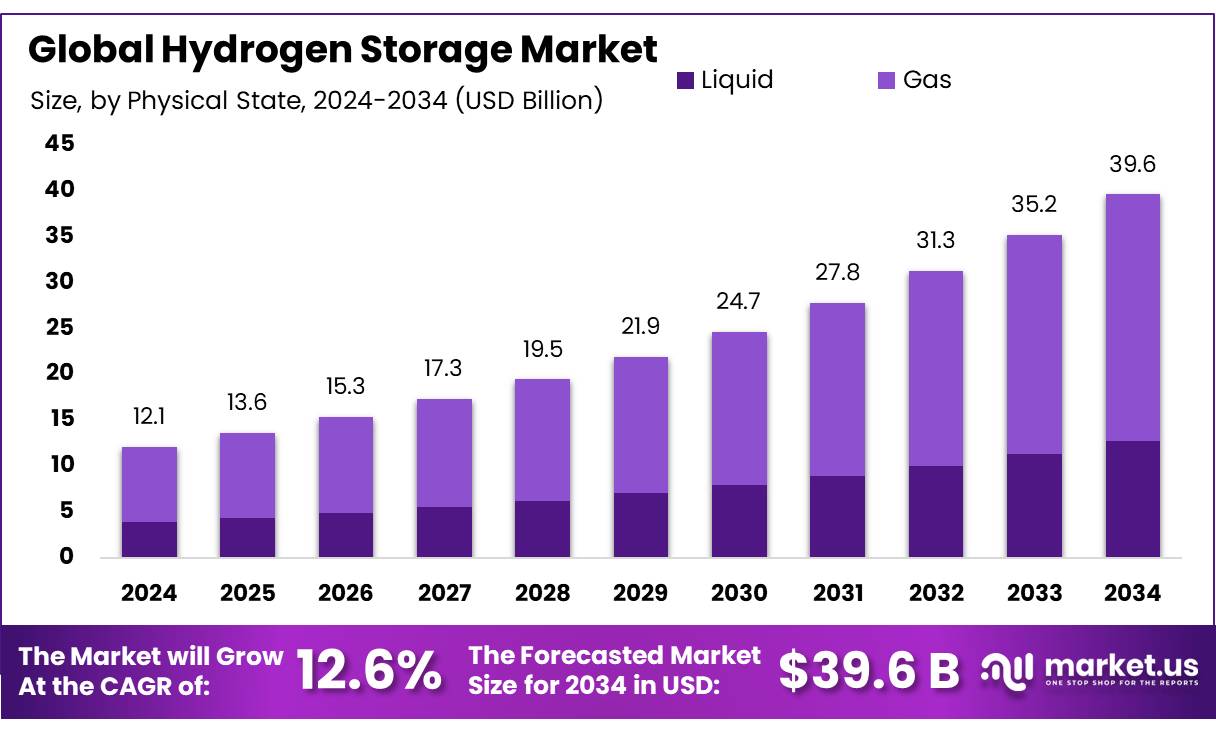

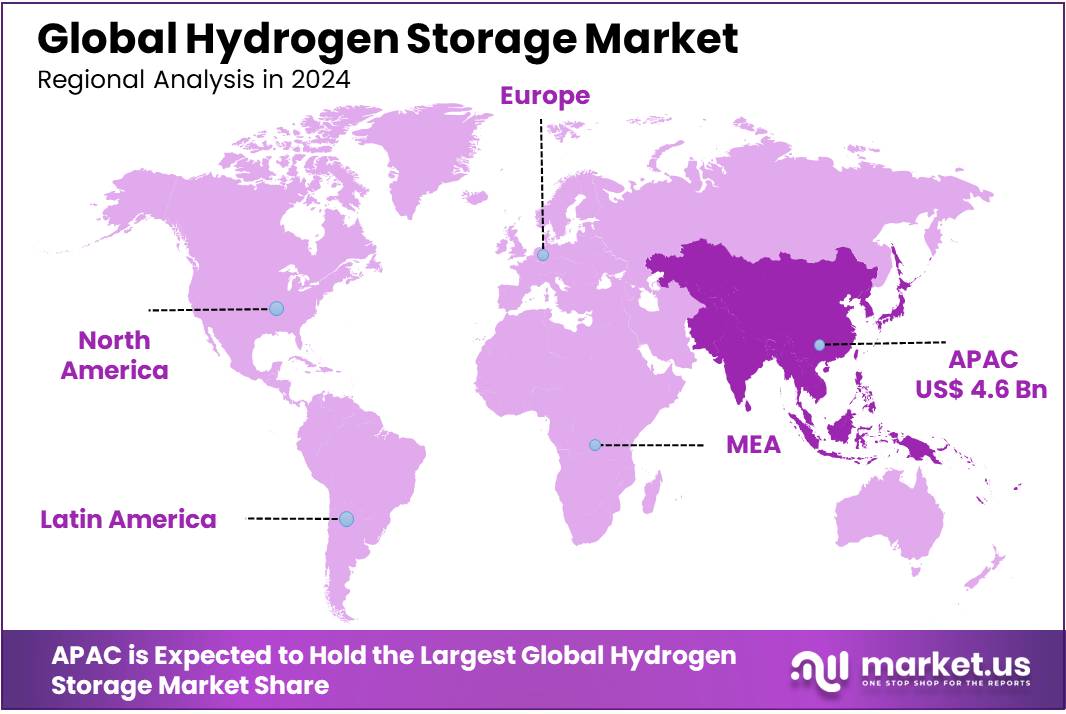

The Global Hydrogen Storage Market size is expected to be worth around USD 39.6 Billion by 2034, from USD 12.1 Billion in 2024, growing at a CAGR of 12.6% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific (APAC) held a dominant market position, capturing more than a 38.6% share, holding USD 4.6 Billion revenue.

Hydrogen storage is a pivotal component in the transition to a low-carbon energy future, facilitating the efficient utilization and transportation of hydrogen across various sectors, including energy, transportation, and industrial applications. The technology encompasses methods such as compressed gas storage, liquid hydrogen, and advanced materials-based storage, each catering to specific needs concerning energy density, safety, and cost-effectiveness. In India, the development of hydrogen storage infrastructure is gaining momentum, driven by both governmental initiatives and private sector investments.

Government initiatives play a pivotal role in accelerating the adoption of hydrogen storage technologies. In India, the National Green Hydrogen Mission, launched in January 2023, aims to establish the country as a global leader in green hydrogen production and utilization. The mission includes provisions such as the waiver of interstate transmission charges for renewable energy used in hydrogen production, facilitating easier integration into the grid. Additionally, the establishment of Hydrogen Valleys in cities like Pune, Jodhpur, Bhubaneswar, and Kerala, each receiving USD 50 crore in funding, is designed to create regional hubs for green hydrogen production, storage, and utilization.

Internationally, countries like the United States and Australia are also making significant strides in hydrogen storage. The U.S. has outlined a National Hydrogen Strategy and Roadmap, focusing on large-scale production and use of hydrogen across various sectors, including transportation and industry. Australia’s National Hydrogen Strategy envisions up to $300 billion in investment for local projects, aiming to position the country as a significant player in the global hydrogen market by 2030.

Key Takeaways

- The Hydrogen Storage Market is projected to reach USD 39.6 billion by 2034, growing from USD 12.1 billion in 2024, at a CAGR of 12.6%.

- By physical state, gas held the leading position in 2024, capturing more than 67.9% of the market share.

- By type, cylinder-based storage dominated the market in 2024 with a share exceeding 42.2%.

- By technology, compression was the most widely adopted method in 2024, holding over 58.3% of the market share.

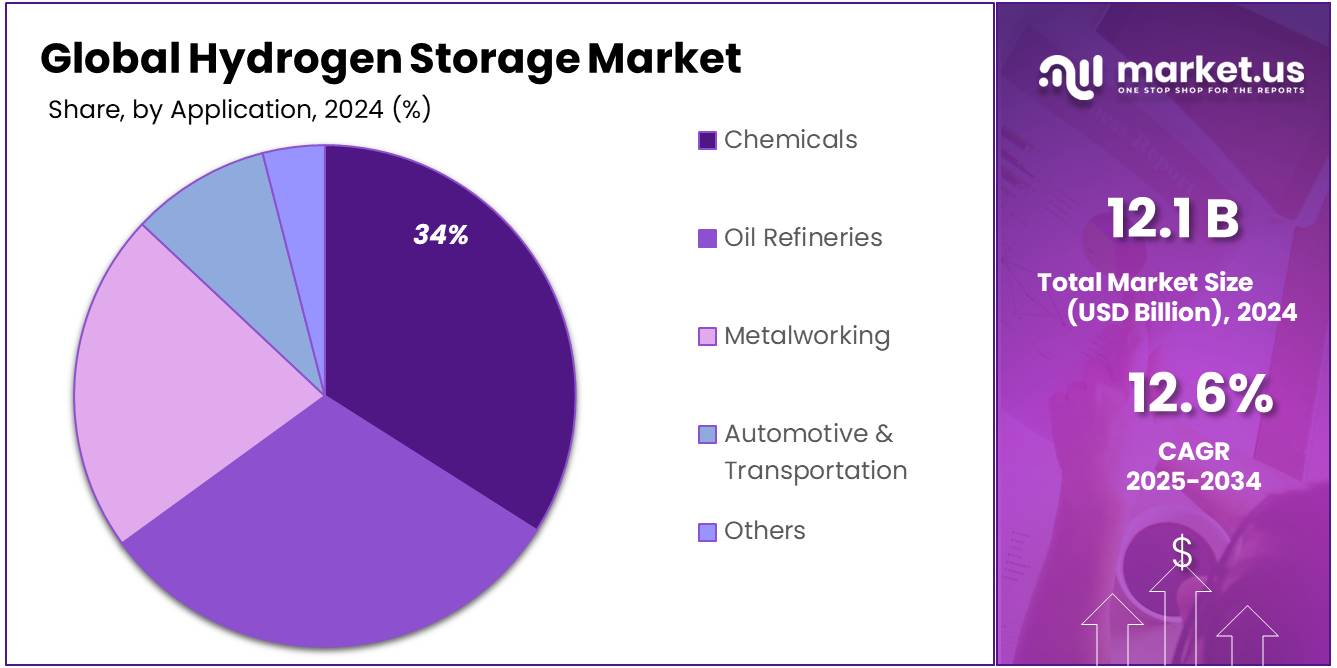

- By application, the chemicals segment accounted for the largest portion in 2024, securing more than 34.8% of the total market.

- Asia-Pacific (APAC) emerged as the leading regional market in 2024, contributing 38.6% of global share and generating approximately USD 4.6 billion in revenue.

By Physical State Analysis

Gas dominates with 67.9% in 2024 due to its efficiency and infrastructure readiness.

In 2024, gas held a dominant market position in the hydrogen storage market by physical state, capturing more than a 67.9% share. This strong performance can be attributed to the widespread availability of compressed hydrogen storage systems and their compatibility with existing hydrogen production and transportation infrastructure. Gas storage is favored for its simplicity and established technology, making it a practical solution for industrial applications, mobility solutions, and energy storage.

The use of high-pressure tanks and cylinders allows hydrogen to be stored at 350 to 700 bar, offering a scalable and flexible approach suited to both stationary and mobile systems. Additionally, the cost-efficiency and relatively easier handling of gaseous hydrogen—compared to more complex options like liquid or solid-state storage—further strengthen its market dominance. As the demand for hydrogen grows in sectors such as transportation, power generation, and refining, gas storage is expected to retain its lead due to lower infrastructure modification requirements and rapid deployability across developed and developing regions.

By Type Analysis

Cylinder dominates with 42.2% in 2024 due to its reliability and widespread industrial use.

In 2024, cylinder held a dominant market position in the hydrogen storage market by type, capturing more than a 42.2% share. This leadership is mainly driven by the practicality and proven performance of cylinder-based storage across a wide range of applications. Cylinders are commonly used for storing compressed hydrogen at high pressures, often between 200 and 700 bar, making them suitable for both stationary setups and mobile uses such as fuel cell vehicles and backup power systems.

Their ease of handling, reusability, and established regulatory standards have made them the go-to option in laboratories, industrial sites, and pilot hydrogen infrastructure projects. The adaptability of cylinders also plays a key role in their continued demand, as they support both small- and medium-scale hydrogen distribution systems. In a year when hydrogen use is accelerating in transportation and decentralized energy systems, the familiar and accessible nature of cylinders has helped maintain their leading share in the market.

By Technology Analysis

Compression dominates with 58.3% in 2024 due to its cost-efficiency and technical maturity.

In 2024, compression held a dominant market position in the hydrogen storage market by technology, capturing more than a 58.3% share. This strong performance is largely due to the reliability, simplicity, and relatively lower cost of compressing hydrogen gas for storage. Compression technology allows hydrogen to be stored at high pressures—typically between 350 and 700 bar—which makes it ideal for transport applications like fuel cell vehicles, as well as for industrial and backup energy systems.

The widespread adoption of compressed hydrogen tanks in refueling stations and storage hubs further reinforces the preference for this method. Compression systems also benefit from established supply chains and infrastructure, which reduce installation and operating costs. As the push for decarbonization grows and hydrogen becomes more central to energy transition plans, compression continues to be the most accessible and scalable storage method, helping it maintain a leading share in the market throughout 2024.

By Application Analysis

Chemicals lead with 34.8% in 2024, driven by high hydrogen demand in industrial processes.

In 2024, chemicals held a dominant market position in the hydrogen storage market by application, capturing more than a 34.8% share. This strong share reflects the significant role hydrogen plays as a key feedstock in various chemical manufacturing processes. Industries such as ammonia production, methanol synthesis, and refining rely heavily on consistent hydrogen supply, making efficient storage solutions a critical part of operations.

The demand from these sectors continues to grow as global efforts toward cleaner production methods intensify. Stored hydrogen ensures uninterrupted supply for continuous chemical reactions, especially in regions with variable production from renewable energy. Additionally, many chemical facilities are incorporating low-emission or green hydrogen sources, which further highlights the need for reliable storage systems. As industrial decarbonization becomes a stronger priority globally, the chemical sector remains at the forefront of hydrogen usage, maintaining its leadership in storage application throughout 2024.

Key Market Segments

By Physical State

- Liquid

- Gas

By Type

- Cylinder

- Merchant/Bulk

- On-site

- On-board

By Technology

- Compression

- Liquefaction

- Material Based

By Application

- Chemicals

- Oil Refineries

- Metalworking

- Automotive & Transportation

- Others

Emerging Trends

Rise of Material-Based Hydrogen Storage Solutions

A notable trend in hydrogen storage is the increasing interest in material-based storage methods, particularly metal hydrides and liquid organic hydrogen carriers (LOHCs). These approaches offer higher volumetric energy densities and enhanced safety compared to traditional high-pressure or cryogenic storage systems. For instance, metal hydrides can absorb hydrogen gas to form stable, solid compounds, which can be released upon heating. This solid-state storage reduces the risks associated with high-pressure gas storage and is particularly advantageous for applications requiring compact and safe storage solutions.

The U.S. Department of Energy (DOE) has recognized the potential of these technologies, allocating up to $46 million in 2024 to accelerate the research, development, and demonstration of affordable hydrogen and fuel cell technologies, including material-based storage solutions. This funding aims to improve the performance of technologies for hydrogen production, infrastructure, and fuel cells, demonstrating hydrogen and fuel cells in new, high-impact applications.

In addition to federal support, regional initiatives are also driving advancements in material-based hydrogen storage. For example, the New York State Energy Research and Development Authority (NYSERDA) announced more than $16 million in 2024 to advance innovation in clean hydrogen through the Hydrogen and Clean Fuel Program. This funding supports research, development, and demonstration projects, promoting the use of clean hydrogen in industrial processes, clean transportation, energy storage, and grid support.

Drivers

Growing Demand for Renewable Energy

One of the major driving factors for the hydrogen storage market is the increasing demand for renewable energy solutions. As global efforts intensify to reduce greenhouse gas emissions, hydrogen has emerged as a clean alternative to traditional fossil fuels. Governments and industries are actively investing in hydrogen technologies to decarbonize energy systems and meet climate targets. Hydrogen storage plays a crucial role in this transition by enabling the efficient and safe storage of hydrogen for later use in energy production.

The International Renewable Energy Agency (IRENA) reports that hydrogen could account for up to 12% of global energy demand by 2050. This would significantly contribute to achieving net-zero emissions, especially in sectors where direct electrification is challenging, such as heavy industries and transportation. The push for hydrogen as a green fuel source is also supported by various government initiatives.

- For instance, the European Union’s “Hydrogen Strategy for a Climate-Neutral Europe” aims to produce up to 10 million tonnes of renewable hydrogen by 2030. Similarly, the U.S. Department of Energy has set aside billions in funding to advance hydrogen storage technologies, highlighting the importance of energy storage in the broader clean energy transition.

As renewable energy production, such as solar and wind, becomes more widespread, hydrogen storage provides a reliable solution to address the intermittent nature of these sources. When energy generation exceeds demand, excess electricity can be used to produce hydrogen, which can then be stored and utilized during periods of low energy supply. This creates a more flexible and resilient energy system, driving further adoption of hydrogen storage technologies.

Restraints

High Costs of Hydrogen Storage Infrastructure

One of the primary restraining factors for the growth of the hydrogen storage market is the high costs associated with the development and maintenance of storage infrastructure. Hydrogen storage requires advanced technologies and materials, which can be expensive to manufacture and deploy on a large scale. This includes the need for specialized tanks and high-pressure systems that can safely store hydrogen at the necessary pressures, often requiring significant upfront investment.

According to the U.S. Department of Energy, hydrogen storage systems, particularly those designed for large-scale use, can be expensive, with costs often reaching millions of dollars for a single large facility. For instance, the cost of compressing hydrogen to high pressures for storage in tanks can range between US$30 to US$70 per kilogram of hydrogen, which is significantly higher than traditional fuels. This makes hydrogen storage systems less competitive compared to conventional energy storage solutions like batteries.

Furthermore, while governments worldwide are investing in hydrogen infrastructure, the pace of these investments remains slow in comparison to other energy sectors. In Europe, for example, the European Commission has committed to investing €470 million in hydrogen projects under its Clean Hydrogen Partnership, yet the challenge of scaling up these technologies remains. Many hydrogen storage solutions are still in their early stages, and a lack of cost-effective mass production technologies further limits their potential.

Despite these challenges, governments and industries continue to push for cost reductions. Initiatives like the U.S. Department of Energy’s Hydrogen and Fuel Cell Technologies Office are focused on advancing research to lower hydrogen storage costs, with the goal of achieving a 50% reduction by 2030. Until then, the high capital expenditures required for hydrogen storage remain a significant barrier.

Opportunity

Expansion of Hydrogen Infrastructure for Industrial Applications

A significant growth opportunity for the hydrogen storage market lies in the expansion of hydrogen infrastructure for industrial applications. As industries worldwide strive to meet decarbonization goals, hydrogen is emerging as a key enabler, particularly in sectors like steel production, chemical manufacturing, and heavy transport. The adoption of hydrogen as a clean energy source is expected to grow rapidly, especially in sectors that are traditionally reliant on fossil fuels and have limited options for electrification.

According to the International Energy Agency (IEA), hydrogen could potentially account for 18% of global industrial energy use by 2050. This provides a substantial opportunity for the hydrogen storage market to scale, as industries need efficient and cost-effective storage solutions to manage their hydrogen supply. In particular, the steel industry, one of the highest emitters of carbon dioxide, is increasingly looking to adopt hydrogen as a cleaner alternative to coal. The European Union has set a target to reduce the carbon footprint of its steel sector by 30% by 2030, with hydrogen playing a critical role in this transformation.

Moreover, the U.S. Department of Energy (DOE) is actively funding initiatives to integrate hydrogen into key industrial processes. The DOE’s “Hydrogen Energy Earthshot” aims to reduce hydrogen production and storage costs by 80% by 2030, which could significantly drive down the price of hydrogen for industrial use. As the technology matures and production scales up, the costs of hydrogen storage systems are expected to decrease, making them more accessible to a broader range of industries.

Regional Insights

APAC dominates with 38.6% share and approximately USD 4.6 billion market value

In 2024, the Asia-Pacific (APAC) region emerged as the dominant player in the hydrogen storage market, accounting for a substantial 38.6% market share and generating revenues close to USD 4.6 billion. This leadership position is supported by a combination of regional industrial expansion, government backing, and heavy investment in hydrogen infrastructure.

In addition, technological innovation and cost reductions within the region accelerate adoption. APAC is at the forefront of deploying solid-state and compressed hydrogen storage technologies, which offer enhanced safety and scalability. Governments are also providing financial incentives and funding to develop compression and liquefaction capacities, reducing barriers for early adopters.

The growing electrification of industries and transportation—particularly in heavy-duty sectors—adds further momentum. As industries seek alternatives to fossil fuels, hydrogen storage becomes critical to reliable supply chains and energy security. APAC’s leading position in 2024 is expected to extend into 2025 and beyond, backed by policy commitments, infrastructure growth, and rising demand across industrial, mobility, and energy sectors.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Air Liquide plays a key role in the hydrogen storage market through its global network of hydrogen production and distribution infrastructure. The company is actively involved in developing high-pressure gaseous and cryogenic liquid hydrogen storage systems to support mobility, industry, and energy applications. In 2024, Air Liquide continued expanding hydrogen refueling stations in Europe and Asia, aligning with its goal of investing over €8 billion in the low-carbon hydrogen value chain by 2035, reinforcing its position as a leading hydrogen solutions provider.

Engie is actively engaged in hydrogen storage as part of its broader strategy to transition toward low-carbon energy. The company is investing in renewable hydrogen hubs across Europe, including projects with underground and compressed hydrogen storage components. In 2024, Engie expanded its HyNetherlands and Hyflexpower projects, integrating storage solutions with green hydrogen production from renewables. Through partnerships and cross-sector initiatives, Engie is developing reliable storage frameworks to support grid balancing and sector coupling in the hydrogen economy.

ITM Power focuses on electrolyzer manufacturing but also contributes to hydrogen storage through system integration for on-site production and storage. In 2024, the company continued supplying PEM electrolyzers paired with high-pressure storage for mobility and industrial clients in the UK and Germany. ITM’s modular systems are tailored for decentralized hydrogen generation and storage, supporting hydrogen refueling stations and microgrid applications. Their involvement in joint ventures and pilot projects reflects ITM Power’s role in enabling distributed hydrogen infrastructure.

Top Key Players Outlook

- Air Liquide

- Air Products Inc.

- Cummins Inc.

- Engie

- ITM Power

- Iwatani Corporation

- Linde plc

- Nedstack Fuel Cell Technology BV

- Nel ASA

- Steelhead Composites Inc.

Recent Industry Developments

In 2024, Air-Liquide strengthened its role in the hydrogen storage market by advancing multiple high-profile projects and substantial investments. The company allocated €50 million to build a renewable hydrogen packaging and delivery supply chain along France’s Seine axis, supporting up to 500 trucks and 10,000 light vehicles with low-carbon hydrogen.

In 2024, ITM-Power emerged as a strong player in the hydrogen storage and electrolysis sector, recording a revenue of £16.5 million—an impressive 217% increase over the previous year—and ending the year with £230 million in cash reserves.

Report Scope

Report Features Description Market Value (2024) USD 12.1 Bn Forecast Revenue (2034) USD 39.6 Bn CAGR (2025-2034) 12.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Physical State (Liquid, Gas), By Type (Cylinder, Merchant/Bulk, On-site, On-board), By Technology (Compression, Liquefaction, Material Based), By Application (Chemicals, Oil Refineries, Metalworking, Automotive and Transportation, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Air Liquide, Air Products Inc., Cummins Inc., Engie, ITM Power, Iwatani Corporation, Linde plc, Nedstack Fuel Cell Technology BV, Nel ASA, Steelhead Composites Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Air Liquide

- Air Products Inc.

- Cummins Inc.

- Engie

- ITM Power

- Iwatani Corporation

- Linde plc

- Nedstack Fuel Cell Technology BV

- Nel ASA

- Steelhead Composites Inc.