Global Household Cleaning Products Market Size, Share, And Business Benefits By Product Type(Laundry Deterrent, Surface Cleaner, Dish Cleaner, Toilet Cleaner, Glass Cleaner, Others), By Ingredients(Natural, Chemical), By Form(Liquid, Powder, Spray, Bars, Others), By Distribution Channel(Supermarkets/Hypermarkets, Convenience Stores, Online, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 146294

- Number of Pages: 224

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- US Tariff Impact Analysis

- By Product Type Analysis

- By Ingredients Analysis

- By Form Analysis

- By Distribution Channel Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

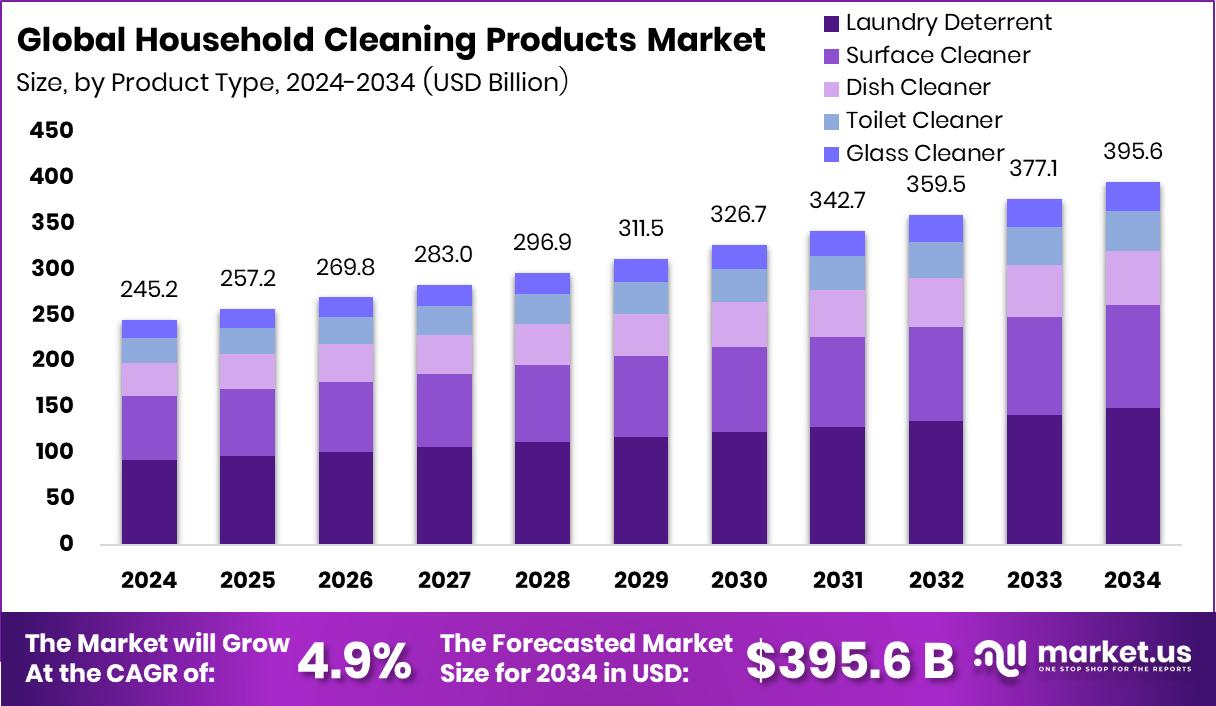

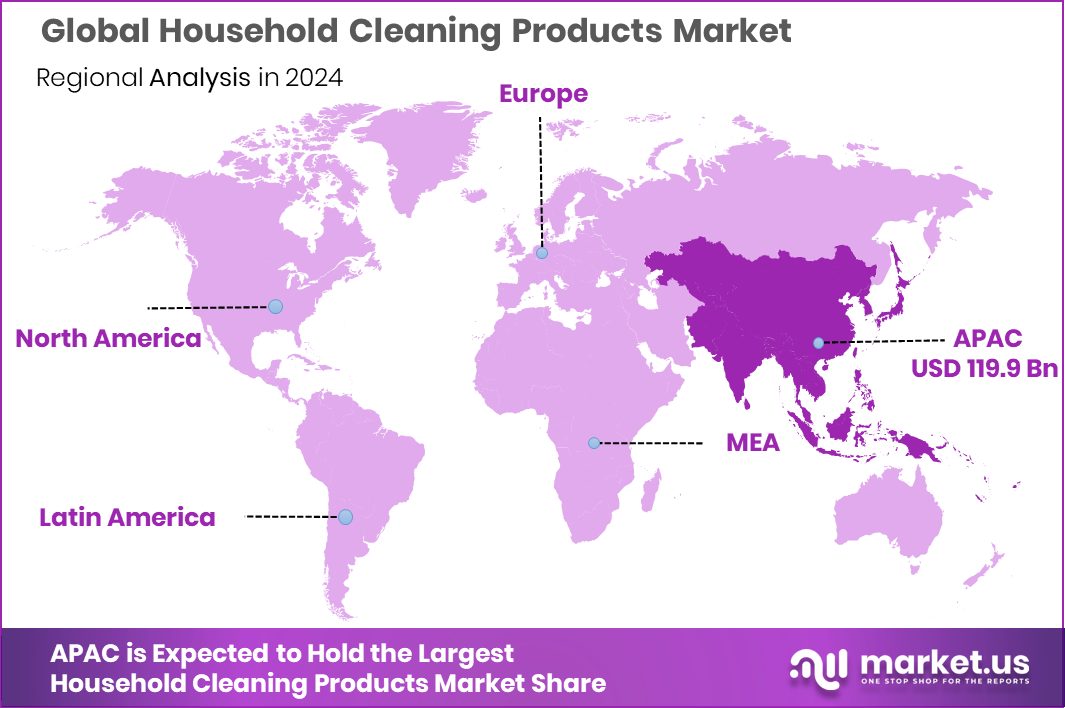

Global Household Cleaning Products Market is expected to be worth around USD 395.6 billion by 2034, up from USD 245.2 billion in 2024, and grow at a CAGR of 4.9% from 2025 to 2034. Rising hygiene awareness in Asia-Pacific drives 48.90% market share, totaling USD 119.9 Bn.

Household cleaning products encompass a variety of substances designed to keep our living environments sanitary and appealing. These products include everything from detergents and soaps to bleaches, disinfectants, and specialized cleaners for floors, surfaces, and appliances. They play a crucial role in maintaining hygiene, preventing the spread of infectious diseases, and providing a comfortable, clean living space.

The market for household cleaning products is driven by a growing global emphasis on cleanliness and hygiene, especially heightened by recent public health concerns. Increased consumer awareness about the health and environmental impacts of cleaning products has also spurred demand for eco-friendly and sustainable products, which are seen as safer for both humans and the planet.

One significant growth factor is the innovation in product formulations and packaging, which aims to enhance product efficiency and reduce environmental impact. Developments in biodegradable and plant-based ingredients are particularly appealing to health-conscious consumers.

The demand for household cleaning products is consistently strong, as cleanliness is a routine necessity. The market sees regular consumption due to the essential nature of maintaining clean living and working environments. This sector is further boosted by urbanization, as higher population density often leads to quicker accumulation of pollutants and waste.

Opportunities in the household cleaning products market are vast, especially in developing regions where awareness and adoption are still growing. There’s potential in expanding the range of all-natural and chemical-free products that cater to an increasing consumer preference for sustainability.

Key Takeaways

- Global Household Cleaning Products Market is expected to be worth around USD 395.6 billion by 2034, up from USD 245.2 billion in 2024, and grow at a CAGR of 4.9% from 2025 to 2034.

- Laundry detergents lead the product types with a significant market share of 37.6%.

- Natural ingredients dominate, preferred by 76.4% of the market for their eco-friendly appeal.

- Liquid forms are the most popular in the market, holding a majority of 56.3%.

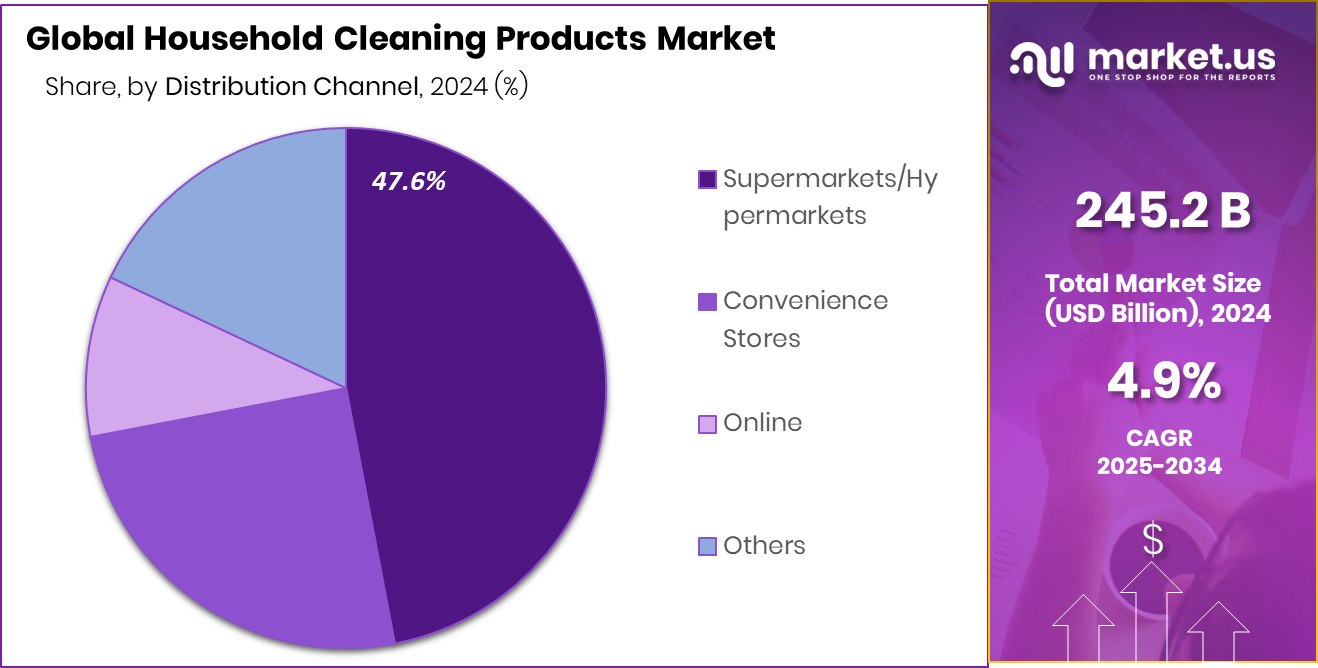

- Supermarkets and hypermarkets are the primary distribution channels, accounting for 47.6% of sales.

- Rapid urbanization in Asia-Pacific boosts demand, capturing 48.90%, worth USD 119.9 Bn.

US Tariff Impact Analysis

Plastics Products: The USITC estimated a 12.4% increase in the price of U.S. imports from China for plastics products in 2021 due to Section 301 tariffs. This category includes packaging and containers commonly used for household cleaning products.

Chemicals Industry: The U.S. chemicals sector, which supplies ingredients for cleaning products, was significantly affected by the tariffs, impacting almost three-quarters, or $20 billion, of U.S. chemicals industry imports.

Import Costs and Consumer Prices: The Tax Foundation reported that the imposed and scheduled tariffs amounted to an average tax increase of about $1,280 per U.S. household in 2025, reflecting higher costs for imported goods, including household items.

By Product Type Analysis

Laundry detergents lead, holding 37.6% of the household cleaning products market.

In 2024, Laundry Detergent held a dominant market position in the “By Product Type” segment of the Household Cleaning Products Market, capturing a 37.6% share. This leading position reflects the continued importance of laundry detergents in the everyday cleaning routines of consumers globally. The product category benefits from its wide application, ranging from liquid detergents to powder-based and pod variants, which cater to diverse consumer preferences.

The growth of the laundry detergent segment is driven by increasing consumer demand for convenience and effectiveness in cleaning products. The continued innovation within the category, such as eco-friendly and high-efficiency formulations, further strengthens the appeal of laundry detergents among environmentally-conscious consumers. Moreover, the rising disposable incomes, particularly in emerging markets, contribute to the growth of premium products, which has allowed this segment to maintain its leading position.

By Ingredients Analysis

Natural ingredients dominate, comprising 76.4% of the market’s preferred formulations.

In 2024, Natural held a dominant market position in the “By Ingredients” segment of the Household Cleaning Products Market, securing a 76.4% share. This strong performance highlights the growing consumer preference for eco-friendly and non-toxic cleaning solutions.

The demand for natural ingredients, such as plant-based compounds, essential oils, and biodegradable materials, has surged due to increased awareness about the environmental and health impacts of synthetic chemicals found in traditional cleaning products.

The natural segment’s dominance is fueled by several key factors, including the rising trend of sustainability and the preference for products that are safer for both human health and the environment. Consumers are increasingly inclined toward cleaning products that align with their values of environmental stewardship and wellness, which has driven brands to innovate with natural formulations.

Moreover, the shift toward natural products is further supported by regulatory pressure as governments and organizations emphasize safer chemical use in household products. The availability of natural cleaning alternatives across various categories, from surface cleaners to laundry detergents, has significantly contributed to this market shift.

By Form Analysis

Liquid forms are favored, capturing 56.3% of the household cleaners market.

In 2024, Liquid held a dominant market position in the “By Form” segment of the Household Cleaning Products Market, capturing a 56.3% share. This leading position underscores the widespread consumer preference for liquid-based cleaning products due to their ease of use, versatility, and effectiveness across a range of cleaning tasks. Liquid formulations, whether in the form of all-purpose cleaners, detergents, or specialized products like glass or floor cleaners, have become a staple in households globally.

The popularity of liquid cleaning products is driven by their convenient application, which allows for precise dosing and easy spreadability on surfaces. Additionally, liquid products are often preferred for their ability to dissolve stains more effectively, providing superior cleaning results. The ability to create various formulations, including eco-friendly and concentrated options, has further enhanced the appeal of liquid-based products.

The continued growth in the liquid segment is also supported by the rising demand for multipurpose products and the increasing popularity of refillable packaging, which aligns with consumer interest in sustainability.

By Distribution Channel Analysis

Supermarkets and hypermarkets distribute 47.6%, the most common sales channels for cleaners.

In 2024, Supermarkets/Hypermarkets held a dominant market position in the “By Distribution Channel” segment of the Household Cleaning Products Market, capturing a 47.6% share. This significant market share highlights the central role that large retail chains play in the distribution of household cleaning products. Supermarkets and hypermarkets continue to be the primary shopping destinations for consumers due to their wide product selection, competitive pricing, and convenience.

The dominance of supermarkets/hypermarkets can be attributed to their extensive reach and accessibility, providing a one-stop shopping experience where consumers can find a variety of household cleaning products under one roof. These retail outlets offer consumers the ability to compare different brands and formulations, which drives purchasing decisions. Furthermore, promotions, discounts, and loyalty programs frequently offered by these retailers encourage bulk buying, leading to higher sales volumes.

Additionally, the increasing trend of one-stop shopping and the growing preference for in-person shopping experiences in these retail environments continue to support their leading position in the distribution of household cleaning products.

Key Market Segments

By Product Type

- Laundry Deterrent

- Surface Cleaner

- Dish Cleaner

- Toilet Cleaner

- Glass Cleaner

- Others

By Ingredients

- Natural

- Chemical

By Form

- Liquid

- Powder

- Spray

- Bars

- Others

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online

- Others

Driving Factors

Eco-Friendly Products Are Boosting Market Growth Worldwide

One big driving factor in the household cleaning products market is the rising demand for eco-friendly solutions. Consumers today are becoming more conscious about the environment and the health effects of harsh chemicals. This shift is pushing manufacturers to offer plant-based, biodegradable, and toxin-free cleaning products.

Many brands are now using natural ingredients like vinegar, baking soda, and essential oils to attract health-conscious buyers. Even supermarkets are giving more shelf space to green cleaning brands. Governments are also promoting sustainable home care products through regulations and certifications.

Restraining Factors

Rising Raw Material Costs Are Slowing Growth

One key restraining factor in the household cleaning products market is the rising cost of raw materials. Ingredients like surfactants, fragrances, and packaging materials have seen price hikes due to supply chain disruptions and global inflation.

Many of these components are petroleum-based, and any fluctuation in oil prices directly affects manufacturing costs. Companies are often forced to either reduce their profit margins or increase product prices.

This price rise makes products less affordable for low-income consumers, especially in price-sensitive markets. As a result, people may shift to cheaper or local alternatives. The rising costs not only pressure manufacturers but also slow down market expansion, especially in developing regions where affordability is a major concern.

Growth Opportunity

Growing Demand in Developing Countries Drives Market Expansion

A major opportunity in the household cleaning products market is the increasing demand from developing countries. As urban areas grow and more people move to cities, there is a greater need for cleaning products to maintain hygiene in homes. Rising incomes in countries like India, China, and Brazil mean that more families can afford to buy branded cleaning products.

Additionally, increased awareness about health and cleanliness, especially after the COVID-19 pandemic, has led to higher usage of cleaning products. Companies are also expanding their distribution networks, making products more available in rural and semi-urban areas.

Latest Trends

Smart Cleaning Gadgets Are Changing Home Cleaning

A major trend in the household cleaning products market is the rise of smart cleaning gadgets. People are now using advanced tools like robotic vacuum cleaners and mops that can clean floors automatically. These devices often come with features like scheduling, remote control via smartphone apps, and even voice commands through virtual assistants.

This technology makes cleaning easier and saves time, especially for busy families. As more people look for convenient solutions, companies are developing new smart cleaning products to meet this demand.

The popularity of these gadgets is growing, and they are becoming more affordable and accessible to a wider range of consumers. This trend is expected to continue, making home cleaning more efficient and user-friendly.

Regional Analysis

Asia-Pacific leads Household Cleaning Products Market with 48.90%, valued at USD 119.9 Bn.

In 2024, Asia-Pacific held a dominant position in the global Household Cleaning Products Market, accounting for 48.90% of the total share, with a market value of USD 119.9 billion. The region’s growth is driven by rapid urbanization, rising disposable incomes, and increasing hygiene awareness among consumers across countries such as China, India, and Southeast Asian nations. The preference for liquid cleaners, natural ingredients, and convenience-based packaging is also rising, contributing to regional expansion.

North America and Europe followed as mature markets, where product innovation and sustainability are key demand drivers. While specific regional values were not provided for these markets, both regions benefit from high brand awareness and established retail distribution.

Latin America and the Middle East & Africa showed steady growth, supported by rising urban populations and growing middle-class households. However, their market shares remain lower in comparison to the Asia-Pacific.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Procter & Gamble (P&G) continued to demonstrate strong leadership in the global household cleaning products market. Known for its extensive product portfolio across fabric care, dish care, and surface care, P&G maintained a firm market presence through consistent brand loyalty and wide distribution. The company has been focusing on sustainable innovation, offering plant-based and recyclable packaging solutions to appeal to environmentally conscious consumers.

Unilever PLC, with its broad suite of well-known brands, also retained a competitive edge in the market. The company’s approach centers around affordability and accessibility in both developed and emerging markets. In 2024, Unilever emphasized reducing its carbon footprint by investing in eco-friendly formulations and increasing supply chain transparency. The company’s strategies align well with rising consumer demand for clean-label and sustainable home care products.

Henkel AG & Co. KGaA maintained a solid position with its focus on high-performance cleaning solutions, particularly in Europe and North America. Henkel has consistently worked on digitalizing its customer engagement and strengthening e-commerce channels. In 2024, the company expanded its offerings in concentrated formulas and refill systems, aligning with market trends in waste reduction and cost efficiency.

Top Key Players in the Market

- Procter & Gamble

- Unilever PLC

- Henkel AG & Co. KGaA

- Reckitt Benckiser Group PLC

- Colgate-Palmolive Company

- Kao Corporation

- The Clorox Company

- Church & Dwight Co., Inc.

- S.C. Johnson & Son Inc.

- McBride PLC

- Godrej Consumer Products Limited

- Goodmaid Chemicals Corporation

- Freudenberg Group

- Galaxy Surfactants Ltd.

- Spectrum Brands Holdings, Inc.

- Other Key Players

Recent Developments

- In August 2024, Unilever launched Sunlight Plus, a dishwashing liquid utilizing 100% plant-based RhamnoClean technology, offering superior cleaning performance with biodegradable ingredients.

- In August 2024, Colgate-Palmolive introduced Fabuloso 2X, a concentrated multi-purpose cleaner with twice the active ingredients and 50% less plastic, promoting sustainability and efficiency.

Report Scope

Report Features Description Market Value (2024) USD 245.2 Billion Forecast Revenue (2034) USD 395.6 Billion CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type(Laundry Deterrent, Surface Cleaner, Dish Cleaner, Toilet Cleaner, Glass Cleaner, Others), By Ingredients(Natural, Chemical), By Form(Liquid, Powder, Spray, Bars, Others), By Distribution Channel(Supermarkets/Hypermarkets, Convenience Stores, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Procter & Gamble, Unilever PLC, Henkel AG & Co. KGaA, Reckitt Benckiser Group PLC, Colgate-Palmolive Company, Kao Corporation, The Clorox Company, Church & Dwight Co., Inc., S.C. Johnson & Son Inc., McBride PLC, Godrej Consumer Products Limited, Goodmaid Chemicals Corporation, Freudenberg Group, Galaxy Surfactants Ltd., Spectrum Brands Holdings, Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Household Cleaning Products MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Household Cleaning Products MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Procter & Gamble

- Unilever PLC

- Henkel AG & Co. KGaA

- Reckitt Benckiser Group PLC

- Colgate-Palmolive Company

- Kao Corporation

- The Clorox Company

- Church & Dwight Co., Inc.

- S.C. Johnson & Son Inc.

- McBride PLC

- Godrej Consumer Products Limited

- Goodmaid Chemicals Corporation

- Freudenberg Group

- Galaxy Surfactants Ltd.

- Spectrum Brands Holdings, Inc.

- Other Key Players