Homeopathy Product Market By Product (Dilutions, Tablets, Tincture, and Others), By Application (Analgesic & Antipyretic, Neurology, Respiratory, and Others), By Source (Animals, Plants, and Minerals), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 133105

- Number of Pages: 250

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

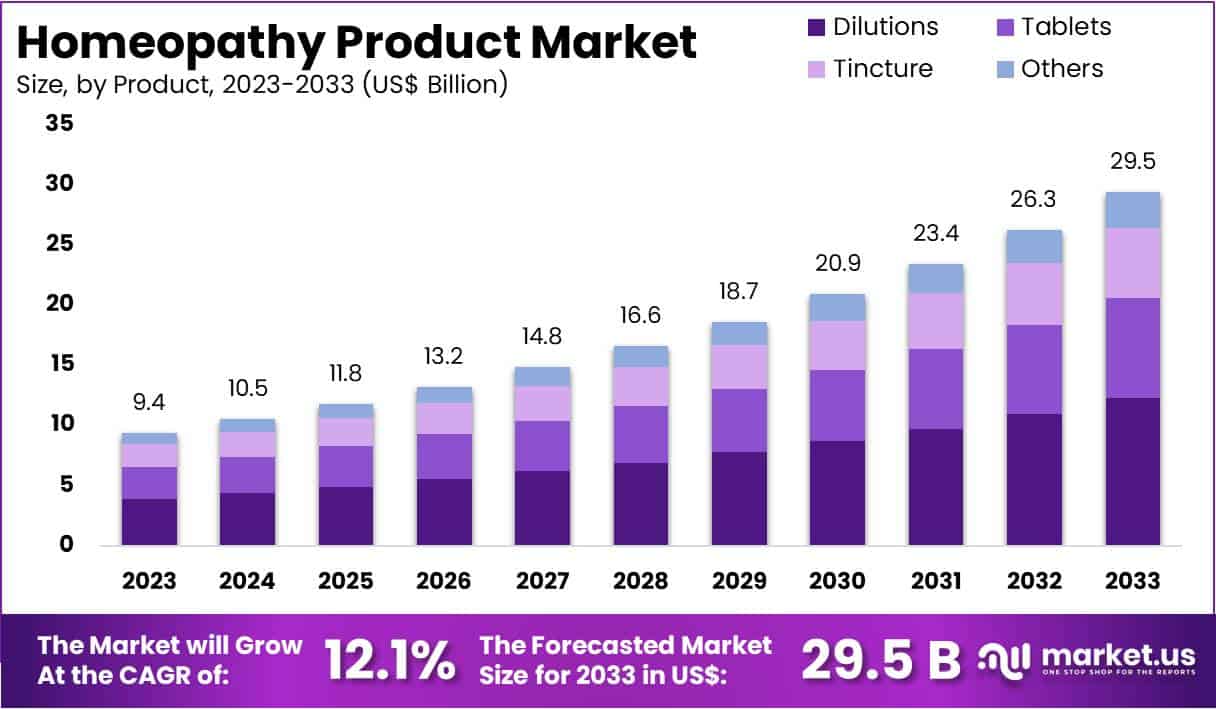

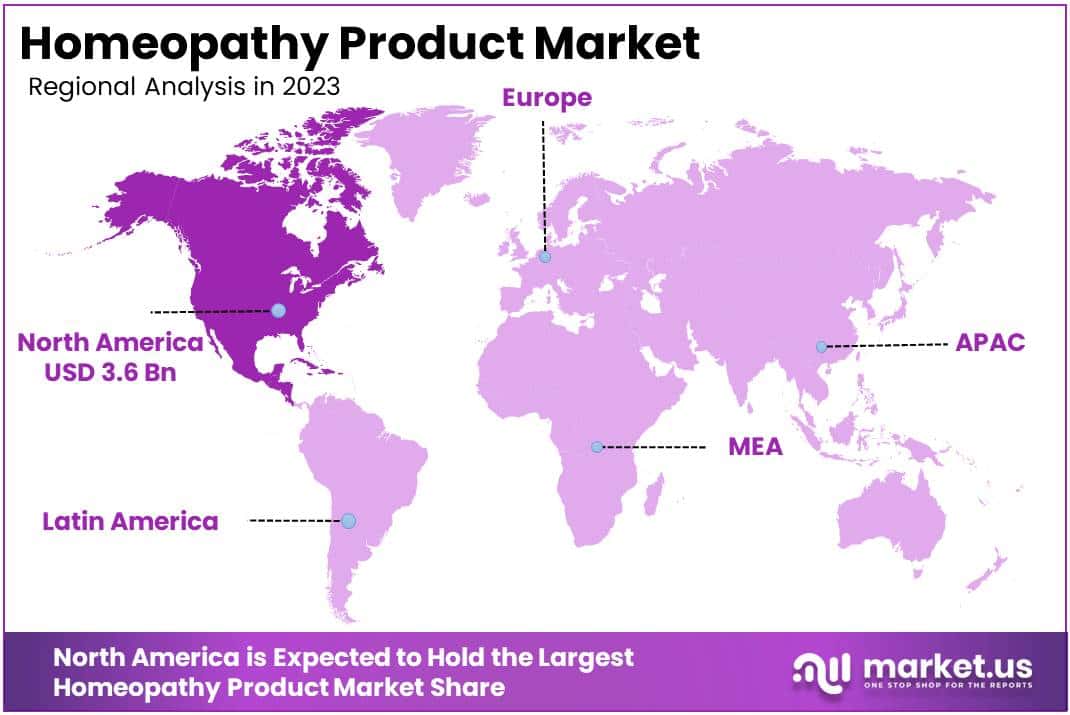

The Global Homeopathy Product Market Size is expected to be worth around US$ 29.5 Billion by 2033, from US$ 9.4 Billion in 2023, growing at a CAGR of 12.1% during the forecast period from 2024 to 2033. North America led the market, securing the highest revenue share at 37.8%. This dominance underscores the region’s robust market activities and strategic initiatives.

Growing interest in alternative medicine drives the homeopathy product market, as consumers seek natural and holistic approaches to health and wellness. Homeopathy products, used in treating a variety of conditions such as allergies, respiratory illnesses, and chronic pain, offer individualized solutions with minimal side effects.

A study published in the Complementary Medical Research Journal in September 2021 highlighted the efficacy of homeopathic treatment for SARS-CoV-2 patients, showing rapid improvement in moderately to severely ill individuals, particularly when conventional treatments fell short. Recent trends in the market include the development of combination remedies that target multiple symptoms simultaneously, enhancing convenience and compliance.

Opportunities also arise from increasing awareness of homeopathy’s potential in managing stress, anxiety, and sleep disorders, aligning with the growing focus on mental health. Innovations in delivery methods, such as dissolvable tablets and sprays, further expand the market by improving patient experience.

Key Takeaways

- In 2023, the market for homeopathy product generated a revenue of US$ 9.4 billion, with a CAGR of 12.1%, and is expected to reach US$ 29.5 billion by the year 2033.

- The product segment is divided into dilutions, tablets, tincture, and others, with dilutions taking the lead in 2023 with a market share of 41.6%.

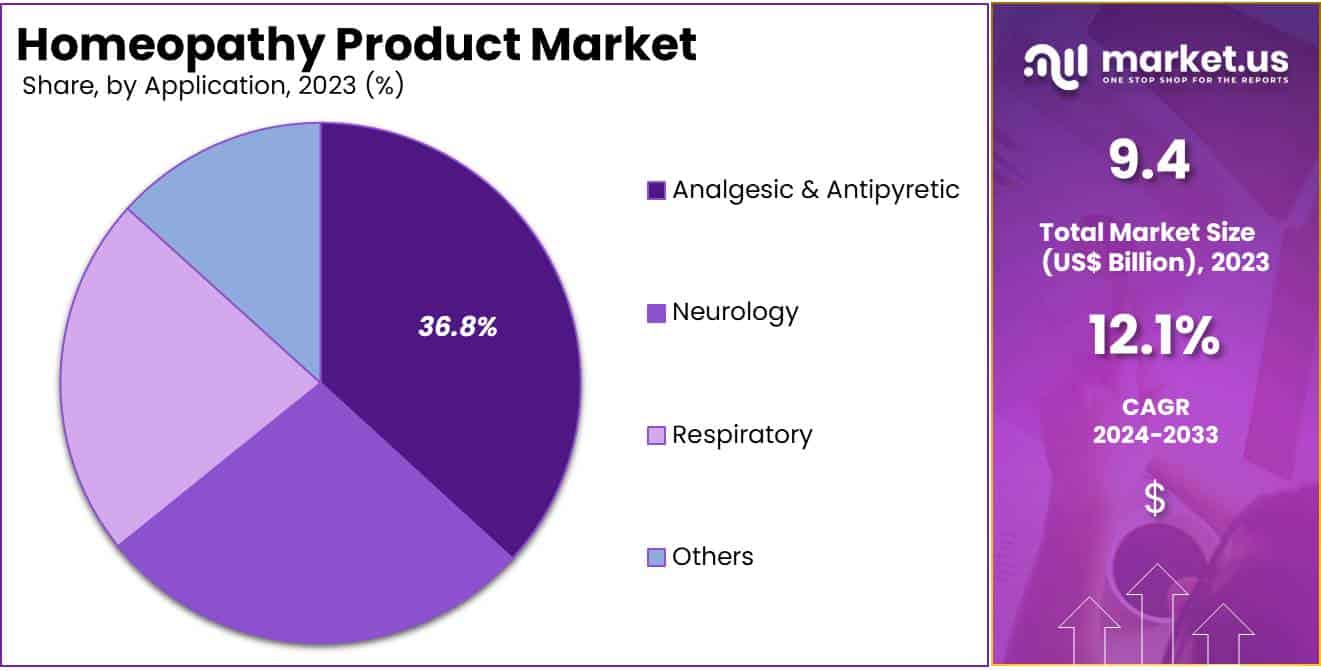

- Considering application, the market is divided into analgesic & antipyretic, neurology, respiratory, and others. Among these, analgesic & antipyretic held a significant share of 36.8%.

- Furthermore, concerning the source segment, the market is segregated into animals, plants, and minerals. The plants sector stands out as the dominant player, holding the largest revenue share of 53.7% in the homeopathy product market.

- North America led the market by securing a market share of 37.8% in 2023.

Product Analysis

The dilutions segment led in 2023, claiming a market share of 41.6% owing to the central role dilutions play in homeopathic treatment, where potency is directly linked to efficacy. Consumers and practitioners increasingly prefer dilutions due to their broad applicability across various conditions, including chronic diseases and acute ailments.

Rising awareness of homeopathy’s personalized approach and its minimal side effects further boosts demand for dilutions. Additionally, advancements in manufacturing processes ensure precise and consistent preparation, enhancing their reliability. The growing acceptance of complementary and alternative medicine in both developed and emerging markets also supports the segment’s expansion.

As more individuals seek natural and holistic treatment options, the dilutions segment is projected to dominate the homeopathy product market.

Application Analysis

The analgesic & antipyretic held a significant share of 36.8% due to the increasing prevalence of conditions such as headaches, migraines, and fever, which are commonly managed using homeopathic remedies. Consumers prefer homeopathic analgesics and antipyretics due to their ability to provide relief without the side effects associated with conventional medications.

Rising awareness about the benefits of homeopathy in managing pain and inflammation naturally supports the adoption of these products. Healthcare providers increasingly recommend homeopathic alternatives for patients seeking long-term management of chronic pain.

Additionally, the growing focus on holistic health and wellness contributes to the segment’s growth. As demand for natural pain and fever management solutions rises, the analgesic and antipyretic segment is anticipated to expand significantly.

Source Analysis

The plants segment had a tremendous growth rate, with a revenue share of 53.7% owing to the widespread use of plant-based ingredients in homeopathic formulations, which are often preferred for their natural origin and therapeutic properties. Consumers increasingly seek plant-derived remedies due to their association with safety, sustainability, and minimal side effects.

The rising popularity of herbal and plant-based medicines globally further supports this trend. Additionally, advancements in the extraction and preparation of plant-based compounds enhance the efficacy and availability of these products. Regulatory approvals for plant-derived homeopathic remedies in various regions also contribute to the segment’s growth. As demand for natural and eco-friendly health solutions continues to rise, the plants segment is likely to dominate the homeopathy product market.

Key Market Segments

By Product

- Dilutions

- Tablets

- Tincture

- Others

By Application

- Analgesic and Antipyretic

- Neurology

- Respiratory

- Others

By Source

- Animals

- Plants

- Minerals

Drivers

Increasing Research in Homeopathy

Increasing research in homeopathy significantly drives the homeopathy product market by enhancing scientific credibility and expanding its therapeutic applications. Recent studies explore the efficacy of ultra-diluted solutions in treating various conditions, bolstering the confidence of healthcare professionals and patients.

An article published in the National Library of Medicine in June 2021 highlighted that serially succussed and diluted solutions of specific drugs/toxins exhibit biological and physicochemical properties beyond Avogadro’s limit. These solutions demonstrate hormesis, where low doses produce therapeutic effects, forming the scientific basis for their use in homeopathy.

Researchers continually investigate the mechanisms underlying these effects, leading to advancements in formulation and new product development. As evidence supporting homeopathy grows, regulatory approvals and public acceptance increase. This rising body of research is anticipated to drive market growth by addressing skepticism and promoting wider adoption of homeopathic remedies.

Restraints

Rising Skepticism About Effectiveness

Rising skepticism about the effectiveness of homeopathic treatments significantly hampers the growth of the homeopathy product market. Critics often question the scientific basis of homeopathy, arguing that its remedies lack sufficient active ingredients to produce meaningful therapeutic outcomes. This skepticism stems from the limited number of large-scale clinical trials providing robust evidence for homeopathy’s efficacy compared to conventional medicine.

Regulatory bodies and healthcare professionals in some regions remain hesitant to endorse or recommend homeopathic products, further impeding market expansion. Additionally, widespread misconceptions about homeopathy being purely placebo-based reduce consumer trust. The lack of universal regulatory standards also fosters doubts about product quality and consistency.

These factors are anticipated to restrain market growth, particularly in regions where scientific validation strongly influences healthcare decisions. Addressing these concerns through rigorous research and transparent communication remains critical for overcoming this restraint.

Opportunities

Growing Outreach of Homeopathic Treatments

Growing outreach of homeopathic treatments presents a significant opportunity for the homeopathy product market as accessibility improves and awareness increases. In April 2022, Dr. Batra’s Clinic announced plans to expand its network to 225 centers, focusing on smaller cities and towns to reach underserved populations.

This expansion underscores a broader trend where homeopathic care extends beyond urban centers, making treatments available to a wider demographic. As more clinics and practitioners establish themselves in emerging markets, the demand for homeopathy products is anticipated to rise.

Public health campaigns and community education initiatives further enhance awareness about the benefits of homeopathy, fostering trust and acceptance. This trend aligns with the increasing preference for personalized and holistic healthcare solutions. The expanding footprint of homeopathy practitioners and clinics is projected to drive product adoption, creating a favorable growth environment for the market.

Impact of Macroeconomic / Geopolitical Factors

Economic growth in developed regions significantly enhances consumer purchasing power, leading to increased expenditure on alternative medicines, including homeopathic remedies. This uptick in spending is driven by higher incomes, which allow consumers to invest in non-traditional health solutions. However, in emerging markets, economic downturns coupled with inflationary pressures can restrict disposable income, thereby reducing the demand for non-essential healthcare products like homeopathy.

Geopolitical tensions and trade restrictions pose significant challenges for the homeopathy product market by disrupting global supply chains. These disruptions result in delays and increased costs for obtaining raw materials crucial for manufacturing homeopathic products. This situation complicates production schedules and escalates operational expenses, affecting overall market dynamics.

The regulatory environment for homeopathic products varies significantly across different regions, which poses compliance challenges and affects market entry and product availability. Despite these hurdles, a rising awareness of natural and holistic health approaches drives consumer interest in homeopathy. Furthermore, supportive government initiatives and expanding healthcare infrastructures in several countries offer growth opportunities, encouraging innovation and investment within the sector.

Trends

Impact of Rising R&D Activities on the Homeopathy Product Market

Rising research and development activities are anticipated to drive growth in the homeopathy product market. In September 2021, Dr. Batra’s Healthcare introduced homeopathic remedies targeting allergies related to food, skin, and respiratory conditions. This initiative enhances product availability and increases the number of players operating within this segment, thereby boosting demand for homeopathic medicine.

Growing investment in clinical trials and scientific studies aims to validate the efficacy of homeopathic treatments, fostering greater acceptance among healthcare professionals and consumers. Additionally, collaborations between research institutions and homeopathic manufacturers facilitate the development of innovative formulations addressing a broader range of health conditions. As R&D efforts intensify, the market is likely to experience sustained growth, offering consumers more effective and diverse homeopathic solutions.

Regional Analysis

North America is leading the Homeopathy Product Market

North America dominated the market with the highest revenue share of 37.8% owing to increasing consumer interest in natural and alternative medicines. The Academy of Homeopathy Education, in collaboration with the American Institute of Homeopathy, launched the Acute Care Homeopathy course for medical professionals in August 2022.

This hybrid educational program aimed to enhance practitioners’ skills in managing pain and reducing antibiotic overuse through FDA-regulated homeopathic remedies. Such initiatives have expanded the acceptance and integration of homeopathic treatments within conventional healthcare settings. Additionally, the rising prevalence of chronic conditions and a growing preference for holistic health approaches have contributed to the market’s expansion.

The availability of over-the-counter homeopathic products and increased retail distribution channels have further facilitated consumer access, supporting the market’s upward trajectory.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to the rising prevalence of chronic diseases and a growing preference for alternative medicine. According to the International Diabetes Federation, India had approximately 74 million individuals with diabetes in 2021, with projections estimating an increase to nearly 93 million by 2030.

Similarly, China reported around 141 million diabetes cases in 2021, expected to reach over 164 million by 2030. This escalating burden of chronic diseases has led to a heightened demand for complementary therapies, including homeopathy, as patients seek holistic and personalized treatment options. Government initiatives promoting traditional and alternative medicine systems, along with increased investments in healthcare infrastructure, are anticipated to further propel the market’s growth.

The expansion of e-commerce platforms and the availability of a diverse range of homeopathic products are also expected to enhance consumer accessibility and adoption across the region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Major players in the homeopathy product market are actively developing and launching innovative products. They aim to enhance their competitive position through strategic initiatives. Expanding product portfolios allows these companies to address various ailments, including chronic and lifestyle-related conditions. Significant investments in research and development help improve product efficacy and ensure compliance with regulatory standards.

To increase their market presence, companies are strengthening distribution networks both online and through retail outlets. Targeting emerging markets with growing alternative medicine awareness allows them to reach new customer segments. Additionally, educational campaigns and collaborations with healthcare practitioners are enhancing consumer trust and encouraging the adoption of homeopathic treatments.

Top Key Players in the Homeopathy Product Market

- SBL

- Mediral International Inc

- Kaps3 Lifesciences Pvt Ltd

- Homeocaninc.

- Hahnemann Laboratories

- Boiron USA

- Biologische Heilmittel Heel GmbH

- Ainsworths Ltd.

Recent Developments

- In April 2022: Gujarat-based Kaps3 Lifesciences Pvt Ltd. introduced its ‘Kaps3 Homeopathy Division’ to cater to the increasing demand for homeopathic products in India. This strategic move strengthens the company’s position in the homeopathy sector by broadening its product portfolio and meeting the rising consumer interest in holistic and alternative healthcare options.

Report Scope

Report Features Description Market Value (2023) US$ 9.4 billion Forecast Revenue (2033) US$ 29.5 billion CAGR (2024-2033) 12.1% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Dilutions, Tablets, Tincture, and Others), By Application (Analgesic & Antipyretic, Neurology, Respiratory, and Others), By Source (Animals, Plants, and Minerals) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape SBL, Mediral International Inc, Kaps3 Lifesciences Pvt Ltd, Homeocaninc., Hahnemann Laboratories, BoironUSA, BiologischeHeilmittel Heel GmbH, and AinsworthsLtd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- SBL

- Mediral International Inc

- Kaps3 Lifesciences Pvt Ltd

- Homeocaninc.

- Hahnemann Laboratories

- Boiron USA

- Biologische Heilmittel Heel GmbH

- Ainsworths Ltd.