Global Healthcare Analytical Testing Services Market By Type (Pharmaceutical Analytical Testing Services (Bioanalytical Testing (PK/PD, Bioavailability, Biomarkers), Method Development and Validation, Stability Testing, Raw Material & Excipient Testing, Batch Release Testing and Others) and Medical Device Analytical Testing Services (Extractable and Leachable (E&L), Material Characterization, Physical Testing, Bioburden & Sterility Testing and Others)), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 178789

- Number of Pages: 330

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

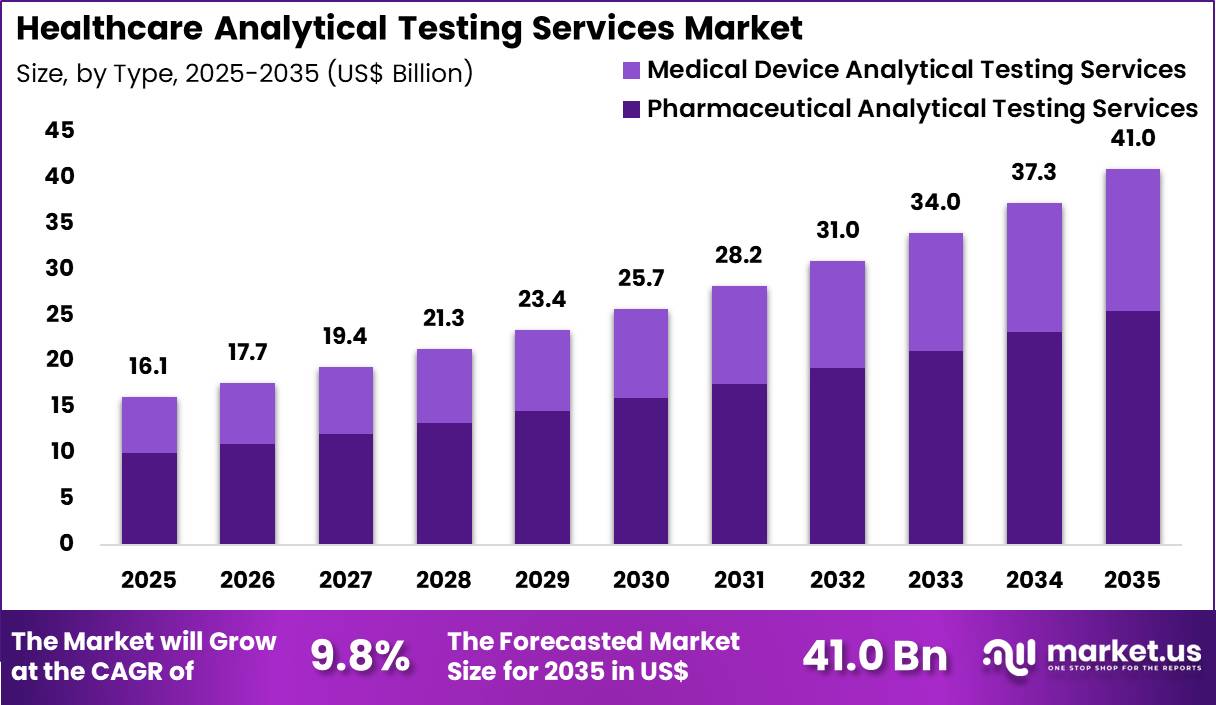

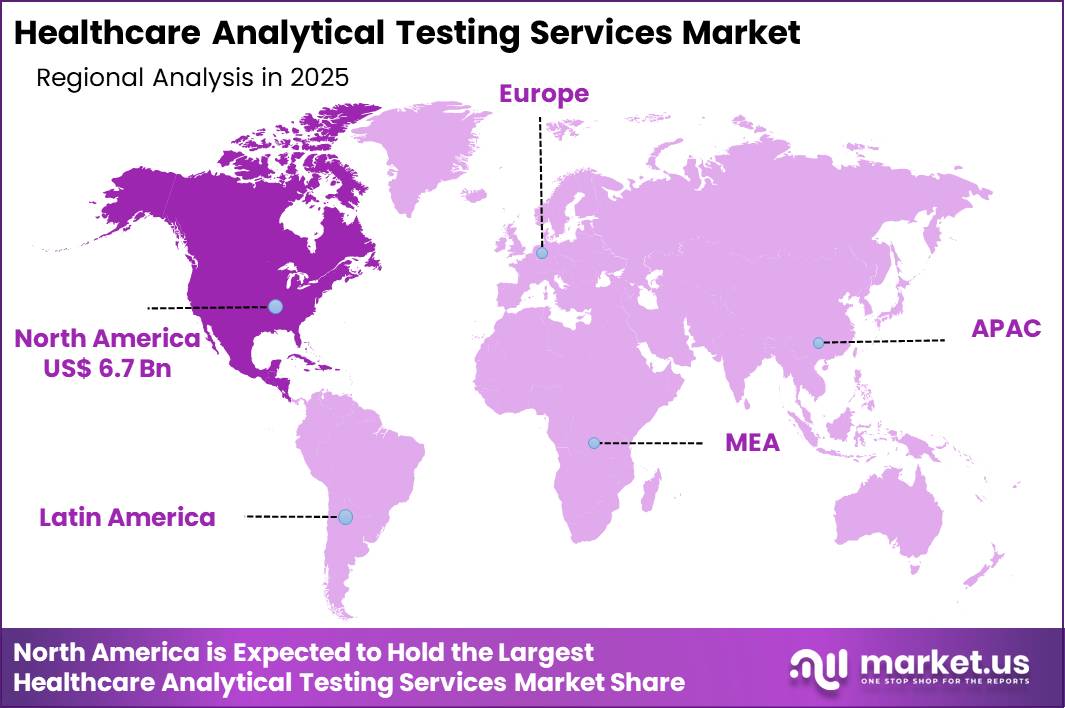

The Global Healthcare Analytical Testing Services Market size is expected to be worth around US$ 41.0 Billion by 2035 from US$ 16.1 Billion in 2025, growing at a CAGR of 9.8% during the forecast period 2026-2035. In 2025, North America led the market, achieving over 41.5% share with a revenue of US$ ### Billion.

Rising regulatory complexity and the expansion of advanced therapeutics compel pharmaceutical and biotechnology companies to increasingly outsource healthcare analytical testing services that deliver specialized expertise, accelerated timelines, and compliance assurance.

Contract laboratories increasingly perform extractables and leachables studies on primary packaging components for injectables and prefilled syringes, identifying potential chemical migrants that could compromise product safety or stability.

These services support impurity profiling in biologics manufacturing, where high-resolution mass spectrometry detects host cell proteins, residual DNA, and process-related contaminants to meet stringent purity specifications. Analytical testing organizations conduct forced degradation studies on small-molecule drugs, elucidating degradation pathways to inform shelf-life determination and formulation robustness.

They also execute method validation and transfer for biosimilars, demonstrating analytical similarity through comparative physicochemical and functional assessments against reference products. In addition, these providers handle stability testing under accelerated and long-term conditions, generating data packages essential for regulatory submissions across diverse dosage forms.

Contract testing firms seize opportunities to integrate advanced analytical platforms such as next-generation sequencing and multi-attribute monitoring, expanding applications in gene therapy and cell-based product characterization where precise identity, purity, and potency verification remains critical.

Providers advance real-time release testing capabilities through process analytical technology, enabling continuous monitoring of critical quality attributes during manufacturing of monoclonal antibodies and viral vectors. These developments facilitate faster batch disposition and reduced inventory holding costs.

Opportunities emerge in supporting companion diagnostic development, where analytical testing validates biomarker assays for patient stratification in precision oncology. Companies invest in high-throughput automation and digital data management systems that enhance reproducibility and traceability across global submissions.

Recent trends emphasize risk-based testing strategies and sustainability-focused methods that minimize solvent use, positioning healthcare analytical testing services as strategic partners in efficient, compliant, and innovative product development.

Key Takeaways

- In 2025, the market generated a revenue of US$ 16.1 billion, with a CAGR of 9.8%, and is expected to reach US$ 41.0 billion by the year 2035.

- The type segment is divided into pharmaceutical analytical testing services and medical device analytical testing services, with pharmaceutical analytical testing services taking the lead with a market share of 62.3%.

- North America led the market by securing a market share of 41.5%.

Type Analysis

Pharmaceutical analytical testing services accounted for 62.3% of growth within type and led the healthcare analytical testing services market due to rising drug development activity and stringent regulatory expectations. Pharmaceutical sponsors rely on specialized laboratories to conduct impurity profiling, stability assessments, and bioequivalence studies.

Expanding biologics and complex formulations increase analytical complexity, which strengthens outsourcing demand. Regulatory agencies enforce detailed documentation and validated methodologies, which drives consistent testing requirements across development stages.

Growth accelerates as global pipelines expand in oncology, rare diseases, and advanced therapies. Companies prioritize external expertise to manage high sample volumes and evolving analytical standards.

Cost optimization strategies encourage outsourcing rather than building internal laboratories. Increasing cross-border clinical trials further support centralized analytical services. The segment is expected to remain dominant as pharmaceutical innovation and regulatory scrutiny continue to intensify.

Key Market Segments

By Type

- Pharmaceutical Analytical Testing Services

- Bioanalytical Testing (PK/PD, Bioavailability, Biomarkers)

- Method Development and Validation

- Stability Testing

- Raw Material & Excipient Testing

- Batch Release Testing

- Others

- Medical Device Analytical Testing Services

- Extractable and Leachable (E&L)

- Material Characterization

- Physical Testing

- Bioburden & Sterility Testing

- Others

Drivers

Increasing outsourcing of analytical testing by pharmaceutical companies is driving the market.

The growing reliance on outsourced analytical testing services by pharmaceutical companies has significantly expanded the market by allowing firms to focus on core R&D while ensuring regulatory compliance through specialized providers. Enhanced quality assurance needs in drug development have led to more frequent engagements with testing services for bioanalytical and stability studies.

Healthcare analytical testing services enable faster time-to-market for new drugs by providing expert method validation and raw material analysis. The correlation between rising biopharmaceutical pipelines and the need for external testing underscores this market growth.

Government regulatory bodies are encouraging outsourcing to meet stringent safety standards without internal capacity constraints. Analytical testing services offer scalable solutions for small and mid-sized pharma companies lacking in-house labs.

National policies on drug approval emphasize third-party verification, prompting broader adoption. Key service providers are scaling operations to handle this surge in outsourced activities. This driver fosters innovation in testing methodologies for complex biologics. The global pharmaceutical analytical testing outsourcing market size was valued at $8.3 billion in 2023.

Restraints

High operational costs and stringent regulatory requirements are restraining the market.

The elevated expenses associated with maintaining state-of-the-art analytical testing facilities and equipment pose significant barriers to market expansion for service providers. Complex regulatory standards from health authorities require extensive validation processes, increasing compliance burdens.

Healthcare analytical testing services must invest heavily in quality management systems to meet international guidelines, straining financial resources. The correlation between regulatory scrutiny and operational overheads further constrains profitability.

Government agencies enforce rigorous data integrity rules, adding administrative costs for audits and documentation. Providers may limit service offerings to high-margin areas to manage expenses. This restraint is particularly acute in regions with evolving pharmaceutical regulations.

Industry efforts to automate processes provide partial relief but do not fully offset costs. Despite demand, economic pressures slow capacity expansions. High operational costs and stringent regulatory requirements act as a key market restraint.

Opportunities

Advancements in cell and gene therapies is creating growth opportunities.

The rapid progress in cell and gene therapy development presents substantial potential for healthcare analytical testing services to provide specialized bioanalytical support for these advanced modalities. Governmental investments in regenerative medicine encourage the expansion of testing capabilities for potency and purity assessments.

Increasing clinical trials for gene therapies amplify the need for customized analytical methods in outsourced labs. Partnerships with biopharma innovators facilitate the adaptation of testing services to novel therapeutic formats.

The large pipeline of cell-based treatments magnifies prospects for service diversification. Educational programs for lab personnel promote expertise in advanced therapy testing. This opportunity enables providers to enter high-growth segments beyond traditional pharmaceuticals.

Key companies are investing in dedicated facilities for gene therapy analytics. Overall, cell and gene advancements align with efforts to accelerate personalized medicine. Advancements in cell and gene therapies are a key growth opportunity.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic conditions influence the healthcare analytical testing services market by shaping pharmaceutical R&D spending, regulatory compliance budgets, and quality control priorities. Inflation increases laboratory operating expenses for reagents, reference standards, utilities, and skilled labor, which tightens margins for service providers.

Higher interest rates reduce access to capital for smaller biotech firms, which slows outsourcing volumes and project timelines. Geopolitical tensions disrupt global supply chains for specialty chemicals, testing instruments, and calibration materials, creating scheduling uncertainty.

Current US tariffs on imported analytical equipment and laboratory components raise acquisition and maintenance costs, which affect contract pricing structures. These financial pressures can delay capacity expansion and limit investments in advanced testing technologies.

At the same time, regulatory scrutiny and product safety requirements continue to drive mandatory testing demand across drug and device markets. With disciplined cost control, diversified sourcing, and automation adoption, the sector maintains a solid foundation for steady long term growth.

Latest Trends

Emergence of AI-integrated testing processes is a recent trend in the market.

In 2024, the incorporation of artificial intelligence in analytical testing workflows has advanced predictive analytics for method optimization and data interpretation. These systems utilize machine learning to automate routine quality control tasks, improving throughput in labs. Manufacturers have focused on AI tools for anomaly detection in chromatographic data.

Clinical labs benefit from faster turnaround times with AI-driven result validation. The emergence of AI-integrated testing processes is a key market trend. This innovation addresses challenges in handling large datasets from high-volume testing. The trend emphasizes interoperability with laboratory information management systems.

Regulatory adaptations have supported AI use with validation protocols. Industry collaborations refine algorithms for enhanced accuracy in bioanalytical assays. These developments aim to elevate efficiency while maintaining compliance in testing services.

Regional Analysis

North America is leading the Healthcare Analytical Testing Services Market

North America accounted for a 41.5% share of the Healthcare Analytical Testing Services market in 2024, reflecting sustained demand from pharmaceutical, biotechnology, and medical device manufacturers. Drug sponsors expanded outsourcing of bioanalytical, stability, and microbiological testing to meet strict regulatory submission timelines.

Growth in complex biologics and cell and gene therapies increased the need for advanced characterization, impurity profiling, and sterility validation. Regulatory scrutiny around quality assurance encouraged manufacturers to rely on accredited third party laboratories for compliance support.

Rising clinical trial activity also strengthened demand for sample analysis and pharmacokinetic testing services. Investments in high sensitivity instruments and data integrity systems improved turnaround times and reliability.

A strong supporting indicator comes from the US Food and Drug Administration, which reported 55 novel drug approvals through its CDER program in 2023, underscoring robust development activity that directly drives laboratory testing requirements.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Healthcare Analytical Testing Services market in Asia Pacific is expected to grow steadily during the forecast period as regional pharmaceutical production and biosimilar development expand. Governments strengthen quality regulations and Good Manufacturing Practice enforcement to align with global standards.

Local drug manufacturers increasingly outsource specialized analytical workflows to improve efficiency and reduce capital expenditure. Rising clinical research activity generates higher volumes of bioanalytical sample testing across contract laboratories.

Academic and government research institutes also increase demand for advanced molecular and microbiological analysis. Regional service providers invest in high throughput platforms and trained scientific staff to meet global compliance benchmarks.

A verifiable signal of expanding production capacity appears in 2023 data from India’s Ministry of Chemicals and Fertilizers, which highlights India’s role as one of the largest suppliers of generic medicines worldwide, reinforcing sustained analytical testing demand across Asia Pacific.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key competitors in the healthcare analytical testing services market grow by broadening their scope of assays, enhancing throughput, and adopting cutting-edge technologies such as mass spectrometry and next-generation sequencing that deliver faster and more precise data for pharmaceutical, clinical, and regulatory clients.

They also strengthen customer value by embedding rigorous quality management systems, ISO and CAP accreditations, and electronic reporting platforms that support compliance and interoperability with sponsor databases.

Firms pursue strategic partnerships with biopharma innovators, contract research organizations, and diagnostic developers to align testing workflows with evolving drug and device pipelines while securing long-term service contracts. Geographic expansion into North America, Europe, and emerging Asia Pacific markets diversifies revenue and captures rising demand for outsourced testing amid global healthcare investment growth.

Eurofins Scientific SE exemplifies a global life sciences testing leader with a vast network of specialized laboratories, comprehensive analytical capabilities across multiple healthcare segments, and a coordinated commercial strategy that aligns technical expertise with client needs.

The company advances performance through disciplined funding for technology upgrades, targeted acquisitions that expand its service footprint, and a customer-centric approach that translates stringent scientific standards into reliable operational delivery.

Top Key Players

- Thermo Fisher Scientific, Inc.

- SGS SA

- Charles River Laboratories International, Inc.

- LabCorp

- Eurofins Scientific

- ICON plc

- Toxikon, Inc. (Acquired by Nelson Labs/Sotera)

- Syneos Health

- Pace Analytical Services, LLC

- Intertek Group

- WuXi AppTec

- Almac Group

- BioAgilytix Labs

- QPS Holdings

Recent Developments

- In July 2025, Alliance Pharma strengthened its development support infrastructure by acquiring Drug Development Solutions in the United Kingdom. The deal broadens its analytical testing and bioanalytical service scope while increasing laboratory capacity to support pharmaceutical clients across various stages of product development.

- In March 2024, Merck committed €14 million toward expanding its Shanghai-based M Lab Collaboration Center. The upgrade introduced new facilities focused on biological applications, upstream processing, and hands-on process development training. These additions deepen the site’s technical capabilities and enhance regional collaboration in life sciences research and manufacturing innovation.

Report Scope

Report Features Description Market Value (2025) US$ 16.1 Billion Forecast Revenue (2035) US$ 41.0 Billion CAGR (2026-2035) 9.8% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Pharmaceutical Analytical Testing Services (Bioanalytical Testing (PK/PD, Bioavailability, Biomarkers), Method Development and Validation, Stability Testing, Raw Material & Excipient Testing, Batch Release Testing and Others) and Medical Device Analytical Testing Services (Extractable and Leachable (E&L), Material Characterization, Physical Testing, Bioburden & Sterility Testing and Others)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fisher Scientific, SGS SA, Charles River Laboratories, LabCorp, Eurofins Scientific, ICON plc, Toxikon, Syneos Health, Pace Analytical, Intertek, WuXi AppTec, Almac Group, BioAgilytix, QPS Holdings. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Healthcare Analytical Testing Services MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Healthcare Analytical Testing Services MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Thermo Fisher Scientific, Inc.

- SGS SA

- Charles River Laboratories International, Inc.

- LabCorp

- Eurofins Scientific

- ICON plc

- Toxikon, Inc. (Acquired by Nelson Labs/Sotera)

- Syneos Health

- Pace Analytical Services, LLC

- Intertek Group

- WuXi AppTec

- Almac Group

- BioAgilytix Labs

- QPS Holdings