Global Biological Safety Testing Products and Services Market By Product Type (Reagents & Kits, Services, and Instruments), By Application (Vaccines & Therapeutics (Vaccines, Recombinant Protein, and Monoclonal Antibodies), Tissue & Tissue-based Products, Stem Cell, Gene Therapy, and Blood & Blood-based Products), By Test Type (Endotoxin Tests, Bioburden Tests, Cell Line Authentication & Characterization Tests, Sterility Tests, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 147993

- Number of Pages: 368

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

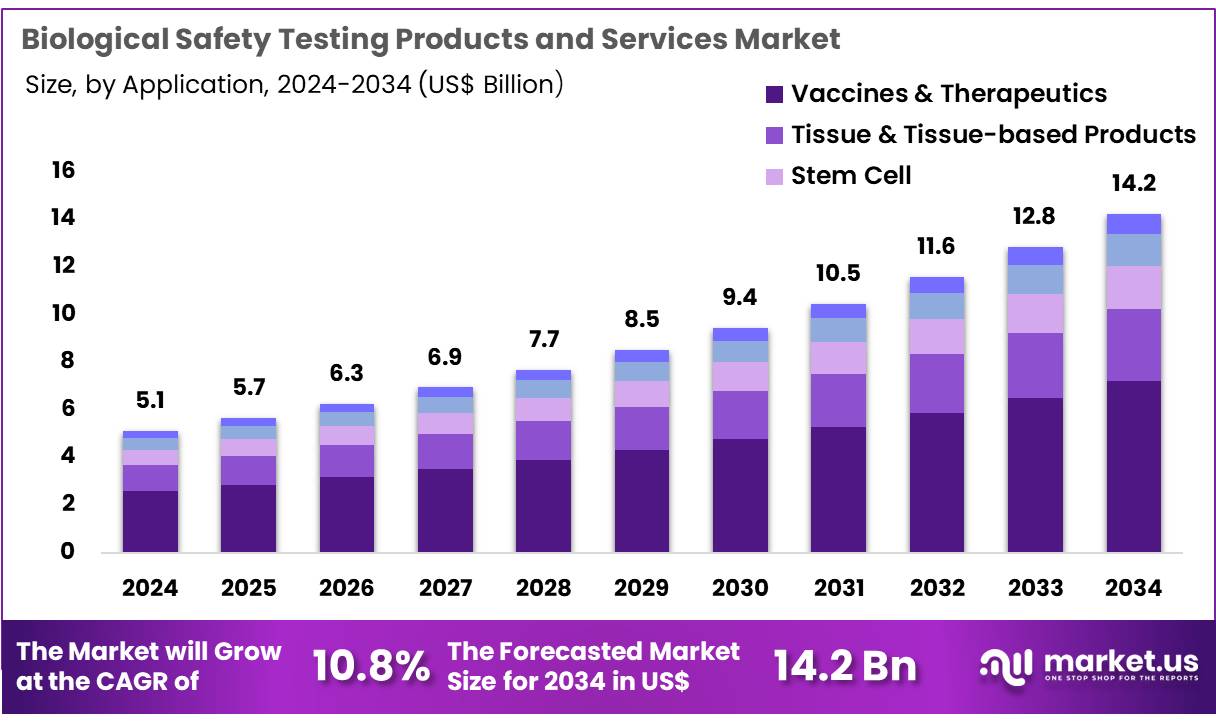

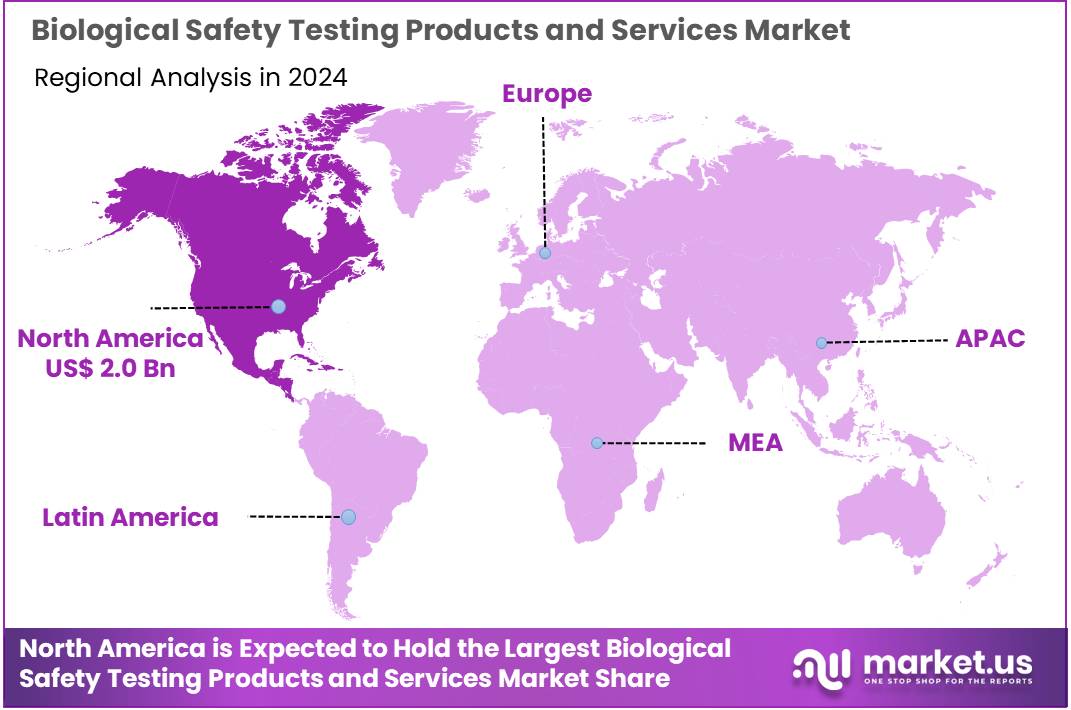

Global Biological Safety Testing Products and Services Market size is expected to be worth around US$ 14.2 billion by 2034 from US$ 5.1 billion in 2024, growing at a CAGR of 10.8% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 38.3% share with a revenue of US$ 2.0 Billion.

Increasing focus on healthcare safety and regulatory standards is driving significant growth in the biological safety testing products and services market. These products, which include reagents, kits, instruments, and testing services, are crucial in ensuring the safety and efficacy of biological materials, such as vaccines, therapeutics, and cell-based therapies. Rising investments in biotechnology, pharmaceutical research, and the growing demand for innovative treatments create ample opportunities for market expansion.

Additionally, ongoing advancements in testing technologies, such as endotoxin tests, bioburden tests, and cell line authentication, are enhancing the accuracy and efficiency of safety evaluations. In May 2023, Merck KGaA announced a US$ 37.7 million investment into biosafety testing at its facilities in Glasgow and Stirling, Scotland, reinforcing its commitment to improving global testing capabilities. The increasing adoption of biologics, coupled with stringent regulatory requirements, fuels the demand for robust biological safety testing.

Furthermore, the rise of personalized medicine and gene therapies presents new challenges and opportunities for biological safety testing services. Testing solutions are becoming more integrated with advanced data analytics, enabling more precise results and faster turnaround times.

The emphasis on quality control and compliance in biotechnology and pharmaceuticals continues to shape the market’s trajectory, positioning biological safety testing as an indispensable part of the drug development process. As research in genetics and cellular therapies advances, the need for comprehensive safety evaluations across various therapeutic areas will continue to drive market demand.

Key Takeaways

- In 2024, the market for biological safety testing products and services generated a revenue of US$ 5.1 billion, with a CAGR of 10.8%, and is expected to reach US$ 14.2 billion by the year 2033.

- The product type segment is divided into reagents & kits, services, and instruments, with reagents & kits taking the lead in 2024 with a market share of 45.3%.

- Considering application, the market is divided into vaccines & therapeutics, tissue & tissue-based products, stem cell, gene therapy, and blood & blood-based products. Among these, vaccines & therapeutics held a significant share of 50.6%.

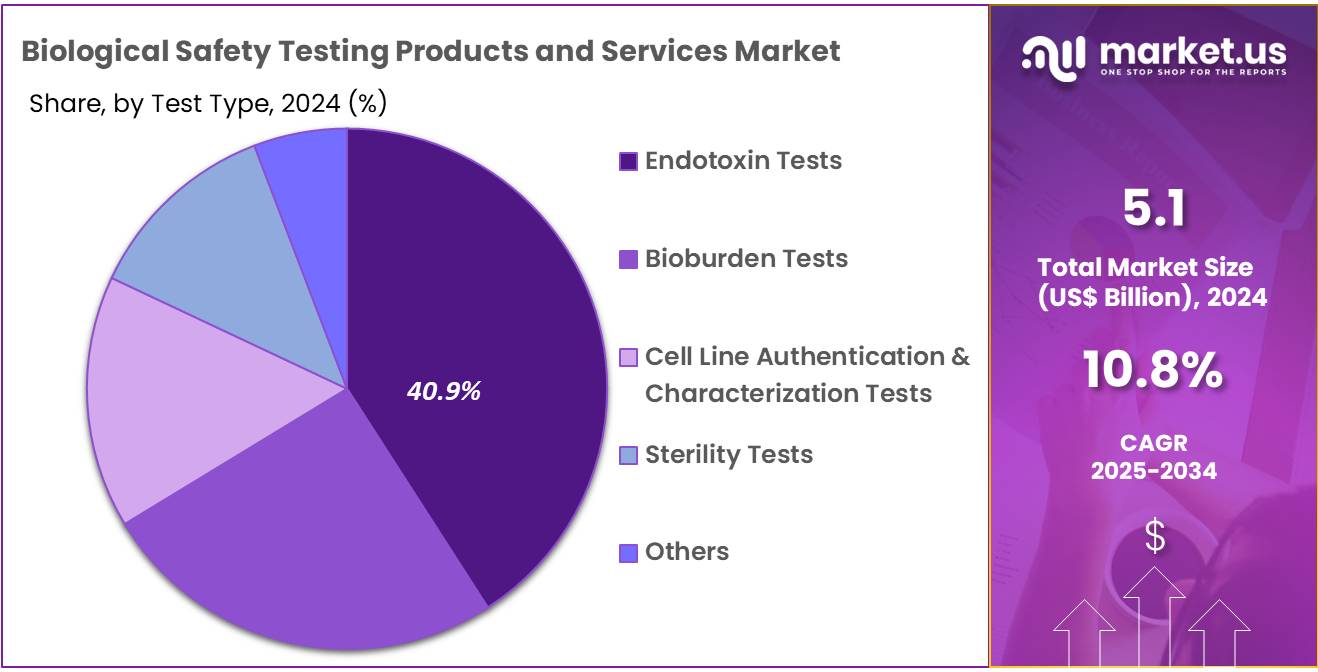

- Furthermore, concerning the test type segment, the market is segregated into endotoxin tests, bioburden tests, cell line authentication & characterization tests, sterility tests, and others. The endotoxin tests sector stands out as the dominant player, holding the largest revenue share of 40.9% in the biological safety testing products and services market.

- North America led the market by securing a market share of 38.3% in 2024.

Product Type Analysis

The reagents & kits segment led in 2024, claiming a market share of 45.3% owing to the rising need for accurate and rapid diagnostics in the pharmaceutical and biotechnology sectors. The shift towards precision medicine and personalized therapies is anticipated to fuel the growth of reagents and kits as they play a crucial role in various testing procedures.

Additionally, advancements in reagents and kits, which offer higher sensitivity and specificity, are projected to support the segment’s expansion. The growing emphasis on safety and quality assurance within drug development and manufacturing is likely to drive the increased adoption of these testing tools, further enhancing the demand for reagents and kits in the market.

Application Analysis

The vaccines & therapeutics held a significant share of 50.6% due to the increasing focus on vaccine development and therapeutic treatments for emerging diseases. The global rise in infectious diseases, including the COVID-19 pandemic, has highlighted the need for robust testing systems for vaccines and therapeutics.

As a result, pharmaceutical companies are projected to invest more in biological safety testing to ensure the efficacy and safety of vaccines. The segment is also expected to benefit from the growth in biologics, such as monoclonal antibodies, which require extensive safety testing. The rapid pace of innovation in vaccine and therapeutic development is likely to increase demand for testing services, driving the segment’s growth in the market.

Test Type Analysis

The endotoxin tests segment had a tremendous growth rate, with a revenue share of 40.9% owing to the rising demand for endotoxin detection in pharmaceutical and medical device manufacturing. Endotoxin contamination is a critical concern, especially in injectable drugs, implants, and surgical devices, which require rigorous safety testing to ensure patient safety. With the increasing regulatory requirements and emphasis on the safety of injectable drugs, the demand for endotoxin testing is expected to rise.

Furthermore, the growing production of biologics and biosimilars, which necessitate stringent endotoxin testing, is likely to drive the growth of this segment. Advancements in endotoxin detection methods, offering greater accuracy and efficiency, are also anticipated to contribute to the segment’s continued growth.

Key Market Segments

Product Type

- Reagents & Kits

- Services

- Instruments

Application

- Vaccines & Therapeutics

- Vaccines

- Recombinant Protein

- Monoclonal Antibodies

- Tissue & Tissue-based Products

- Stem Cell

- Gene Therapy

- Blood & Blood-based Products

Test Type

- Endotoxin Tests

- Bioburden Tests

- Cell Line Authentication & Characterization Tests

- Sterility Tests

- Others

Drivers

Increasing biopharmaceutical development is driving the market

Increasing biopharmaceutical development is driving the biological safety testing products and services market. As biotechnology companies develop more complex protein-based therapeutics, vaccines, and gene therapies, they require rigorous testing to ensure these products are free from contaminants like viruses, bacteria, and mycoplasma. Regulatory bodies mandate comprehensive biological safety testing throughout the drug development and manufacturing process, from raw materials to the final product.

This escalating pipeline of biologic drugs directly translates into a higher demand for specialized testing products, such as cell culture media, reagents, and detection kits, as well as related services offered by contract testing organizations. The complexity of these novel therapeutics often necessitates advanced testing methodologies, further fueling market growth.

For instance, the US Food and Drug Administration (FDA) and the European Medicines Agency (EMA) together approved a significant number of new biological drugs in 2023, with the FDA’s Center for Drug Evaluation and Research (CDER) approving 51 new molecular entities and new therapeutic biologicals by the second half of November 2023 alone, indicating a strong and growing pipeline requiring extensive safety evaluation.

Restraints

Regulatory complexity is restraining the market

Regulatory complexity is restraining the biological safety testing products and services market. The constantly evolving global regulatory landscape presents challenges for manufacturers and testing service providers navigating diverse requirements across different regions. Agencies like the FDA and EMA frequently update guidelines for biological product testing, requiring companies to invest continuously in new technologies and expertise to remain compliant.

Ensuring adherence to these stringent and sometimes divergent standards increases operational costs and can slow down the testing process. The need for specialized knowledge to interpret and implement complex testing protocols also poses a challenge, requiring significant investment in training and skilled personnel.

While regulations ensure product safety, their intricate nature and frequent updates can create hurdles for market players. Navigating these complexities requires dedicated resources and expertise, impacting efficiency and potentially limiting market expansion for smaller entities.

Opportunities

Growing investment in emerging biotechnology hubs is creating growth opportunities

Growing investment in emerging biotechnology hubs is creating growth opportunities in the biological safety testing products and services market. Countries in Asia Pacific, for example, are rapidly expanding their biopharmaceutical manufacturing capabilities and research activities, increasing the local demand for biological safety testing.

Governments in these regions are actively supporting the biotechnology sector through funding and initiatives aimed at fostering innovation and building infrastructure. This leads to a greater need for readily available testing products and services to support local manufacturing and research needs. Establishing testing facilities and distributing products within these growing markets presents significant opportunities for companies in the biological safety testing field.

For instance, the Department of Biotechnology (DBT) in India is actively promoting biotechnology research and entrepreneurship, with initiatives like the Bio-RIDE scheme approved in September 2024 with INR 1500 crore (approximately US$180 million) in funding, signaling a supportive environment for biotech growth that will drive demand for associated testing.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors exert a significant influence on the biological safety testing market. Inflationary pressures, such as the US experiencing rates of 4.1% in 2023 and 2.9% in 2024 as reported by the St. Louis Federal Reserve, increase the cost of raw materials, reagents, and labor for companies manufacturing testing products and providing services.

Geopolitical tensions can disrupt global supply chains for essential laboratory supplies and equipment, potentially leading to delays and increased costs for testing providers. Uncertainty in the global economy may also impact investment levels in the biotechnology sector, indirectly affecting the demand for safety testing services. However, a heightened global focus on pandemic preparedness and biosecurity, often stemming from geopolitical events, drives increased government funding and initiatives in related areas, creating a positive demand for robust safety testing capabilities to ensure public health security.

Current US tariff policies also impact the market for biological safety testing products and services. Tariffs on imported laboratory equipment, reagents, and other critical testing components increase the cost of these essential inputs for testing laboratories and biopharmaceutical manufacturers in the US. This can lead to higher operational expenses for testing providers, potentially affecting pricing for their services. Companies relying on imported materials subject to tariffs may face challenges in maintaining cost competitiveness.

The complex nature of tariff regulations also adds administrative burden to businesses involved in international trade of testing products. Conversely, tariffs can incentivize domestic manufacturing of biological safety testing supplies and equipment, potentially leading to a more secure and resilient domestic supply chain for these critical products, ultimately benefiting the market by reducing reliance on potentially unstable foreign sources.

Latest Trends

Increased outsourcing of biological safety testing services is a recent trend driving the market

Increased outsourcing of biological safety testing services is a recent trend driving the biological safety testing products and services market. Biopharmaceutical companies are increasingly partnering with contract research organizations (CROs) and contract manufacturing organizations (CMOs) for various stages of drug development and manufacturing, including essential safety testing.

This trend allows drug developers to focus on their core competencies while leveraging the specialized expertise, infrastructure, and regulatory knowledge offered by dedicated testing service providers. Outsourcing can also provide cost efficiencies and faster turnaround times for testing, accelerating the overall development timeline.

This shift towards externalizing testing needs is driving the growth of the biological safety testing services segment of the market. The rising complexity of testing for advanced therapies like cell and gene therapies further encourages outsourcing to specialized laboratories possessing the necessary technical capabilities and regulatory experience.

Regional Analysis

North America is leading the Biological Safety Testing Products and Services Market

North America dominated the market with the highest revenue share of 38.3% owing to the stringent regulatory landscape and the increasing volume of biopharmaceutical development and manufacturing activities within the region. The Food and Drug Administration (FDA) in the US continues to enforce rigorous guidelines for product safety and sterility, compelling manufacturers to invest more in advanced testing solutions.

For instance, the FDA issued numerous guidance documents in 2023 focusing on sterile drug products and processes to prevent microbial contamination, as detailed on their official website. Furthermore, the significant investments in research and development of novel biologics, including cell and gene therapies, in North America have amplified the demand for sophisticated testing services to ensure their safety and efficacy.

According to the NIH Data Book, in Fiscal Year 2023, the NIH allocated US$34.92 billion in extramural research grants across 58,951 awards to various institutions. This substantial investment in biological research underscores the strong foundation for the growth of the biological safety testing market in North America throughout 2024.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to the expanding biopharmaceutical industry and increasing healthcare investments across the region. Countries like China and India are anticipated to witness significant growth in their biomanufacturing capabilities, driving the demand for comprehensive testing services to meet international quality standards.

The Indian government’s “Make in India” initiative, launched in September 2014 and detailed on the official “Make in India” website, aims to promote domestic pharmaceutical production and is expected to further boost the need for robust safety testing protocols as manufacturing scales up. Moreover, the increasing prevalence of infectious diseases in the Asia Pacific region is likely to necessitate greater investment in diagnostic and safety testing measures.

Regulatory bodies in the region are also progressively aligning their standards with international norms, which is anticipated to drive the adoption of advanced safety testing products and services. This combination of a burgeoning biopharmaceutical sector, increasing healthcare expenditure, and evolving regulatory frameworks suggests a strong growth trajectory for the biological safety testing market in Asia Pacific in the coming years.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the biological safety testing market focus on expanding their product offerings, forming strategic partnerships, and investing in advanced technologies to stay competitive. They emphasize enhancing product quality and developing innovative testing solutions to meet regulatory demands. Companies also focus on geographical expansion, especially in emerging markets, to cater to the growing demand for safety testing in pharmaceuticals and biotechnology sectors.

By focusing on continuous innovation and improving their service delivery, they aim to strengthen their market position and capture larger shares. Acquisitions of complementary companies also form a part of their growth strategies, allowing them to diversify their portfolios.

One of the key players in this market is Merck KGaA, a global leader in science and technology. The company specializes in providing integrated solutions for testing, including a wide range of reagents, kits, and instruments. Merck KGaA has been actively expanding its portfolio by investing in research and development, particularly in biosafety testing. Their acquisition of several smaller companies and continuous investment in innovation have reinforced their leadership in the biological safety testing industry.

Top Key Players

- Sartorius AG

- Samsung Biologics

- Merck KGaA

- Eurofins Scientific

- Charles River Laboratories

- BSL Bioservice

- BIOMÉRIEUX

- Thermo Fisher Scientific Inc.

Recent Developments

- In January 2023, Charles River Laboratories, Inc. expanded its portfolio by acquiring SAMDI Tech, Inc., a firm focused on high-throughput screening (HTS) solutions. This acquisition is intended to accelerate the drug discovery process by utilizing SAMDI Tech’s advanced technologies to streamline the identification of potential drug candidates.

- In September 2022, Thermo Fisher Scientific, Inc. introduced the Thermo Scientific 1500 Series Biological Safety Cabinet (BSC), designed to meet the diverse needs of laboratories. This state-of-the-art system provides robust protection against biological hazards and contaminants.

Report Scope

Report Features Description Market Value (2024) US$ 5.1 Billion Forecast Revenue (2034) US$ 14.2 Billion CAGR (2025-2034) 10.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Reagents & Kits, Services, and Instruments), By Application (Vaccines & Therapeutics (Vaccines, Recombinant Protein, and Monoclonal Antibodies), Tissue & Tissue-based Products, Stem Cell, Gene Therapy, and Blood & Blood-based Products), By Test Type (Endotoxin Tests, Bioburden Tests, Cell Line Authentication & Characterization Tests, Sterility Tests, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Sartorius AG, Samsung Biologics, Merck KGaA, Eurofins Scientific, Charles River Laboratories, BSL Bioservice, BIOMÉRIEUX, and Thermo Fisher Scientific Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Biological Safety Testing Products and Services MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample

Biological Safety Testing Products and Services MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Sartorius AG

- Samsung Biologics

- Merck KGaA

- Eurofins Scientific

- Charles River Laboratories

- BSL Bioservice

- BIOMÉRIEUX

- Thermo Fisher Scientific Inc.