Global Fucoidan Market Size, Share, And Business Benefits By Form (Powder, Capsule, Others), By Application (Health Care Products, Pharmaceuticals, Cosmetics, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: August 2025

- Report ID: 155086

- Number of Pages: 209

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

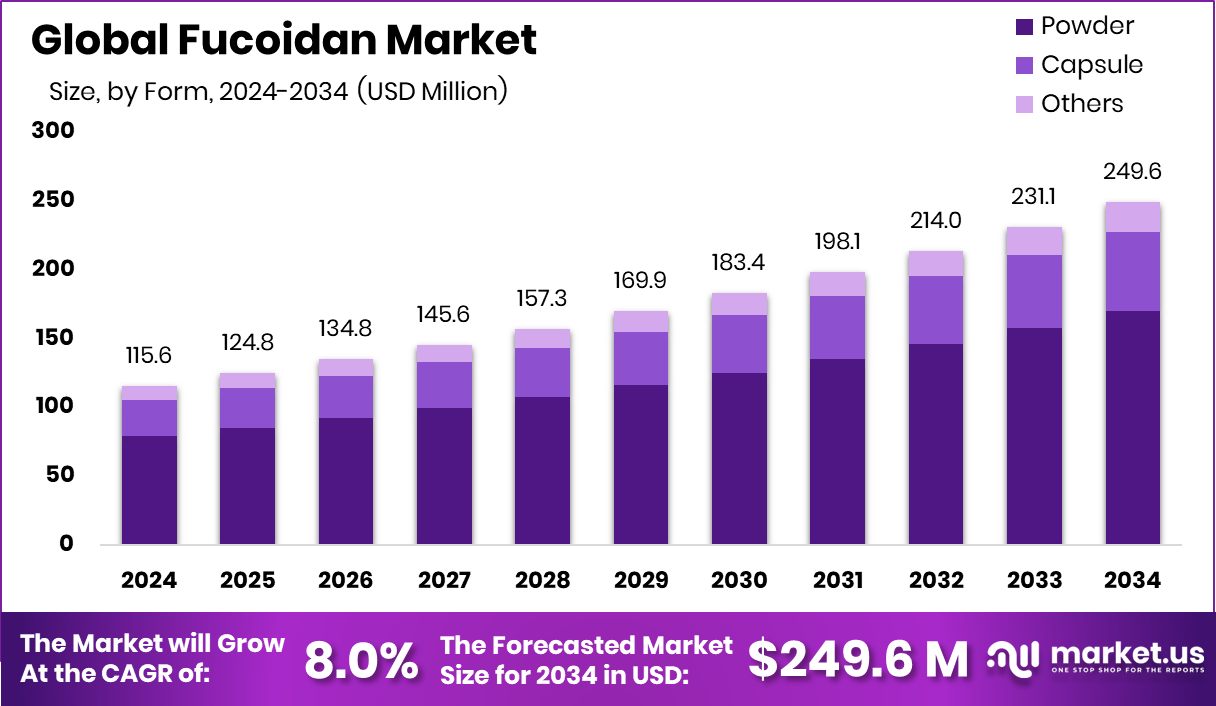

The Global Fucoidan Market is expected to be worth around USD 249.6 million by 2034, up from USD 115.6 million in 2024, and is projected to grow at a CAGR of 8.0% from 2025 to 2034. Rising health awareness drives fucoidan demand in the Asia-Pacific by 43.3%.

Fucoidan is a natural sulfated polysaccharide mainly found in various species of brown seaweed, such as wakame, mozuku, and kombu. It has attracted attention for its potential health benefits, including immune system support, anti-inflammatory effects, and possible anti-cancer properties. Traditionally consumed in certain Asian diets, fucoidan is now used in dietary supplements, functional foods, and cosmetics, reflecting its growing popularity in wellness and preventive healthcare sectors.

The fucoidan market is the global industry that produces, processes, and distributes fucoidan-based products for nutraceutical, pharmaceutical, cosmetic, and food applications. Demand has been rising as consumers seek natural, plant-based, and marine-derived ingredients with proven bioactive properties. Its versatility allows it to be used in capsules, powders, skincare formulations, and fortified beverages, creating a broad customer base.

Rising awareness of marine-based bioactive compounds and the shift toward natural health solutions are driving market growth. Research highlighting fucoidan’s potential in supporting cardiovascular health, immunity, and skin regeneration is encouraging wider adoption. Additionally, clean-label trends and sustainability concerns favor seaweed-derived ingredients.

According to an industry report, Seaweed-based supplement, cosmetic, and food ingredient startup BioMara has obtained $150,000 in funding to boost fucoidan production and cater to rising demand.

Key Takeaways

- The Global Fucoidan Market is expected to be worth around USD 249.6 million by 2034, up from USD 115.6 million in 2024, and is projected to grow at a CAGR of 8.0% from 2025 to 2034.

- Powder dominates the fucoidan market with a 68.2% share, driven by easy integration and storage.

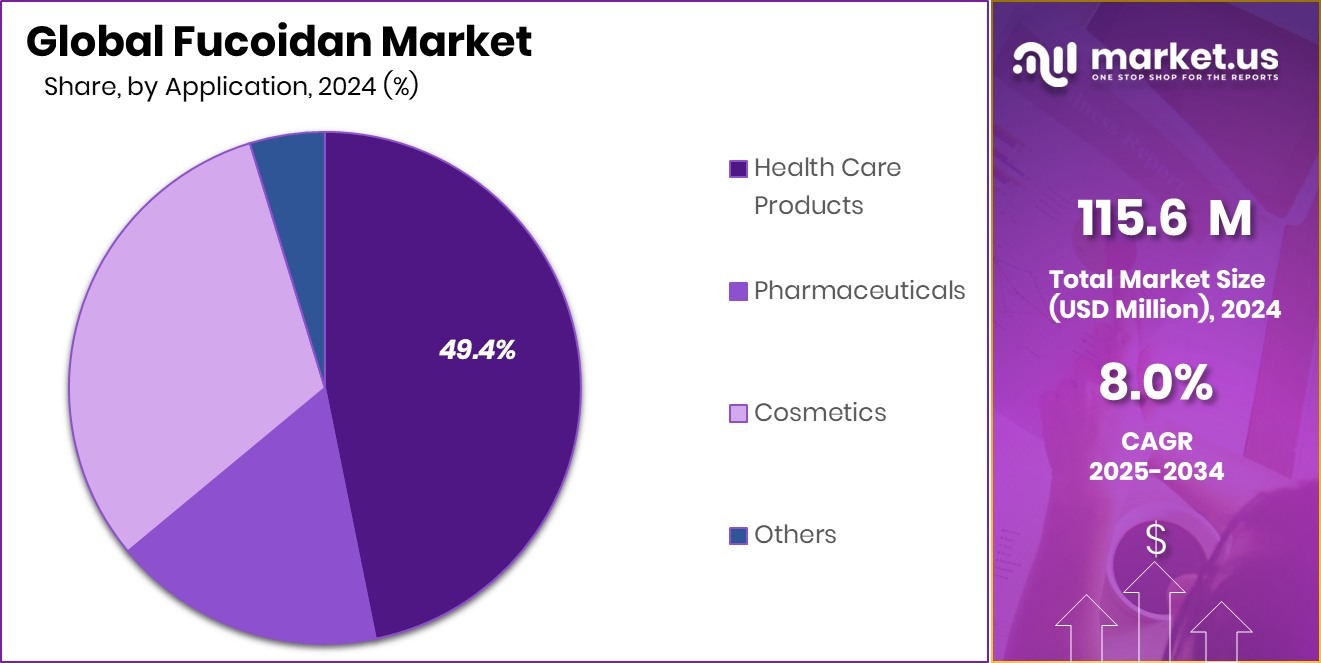

- Health care products lead with a 49.4% share, supported by rising demand for natural wellness supplements.

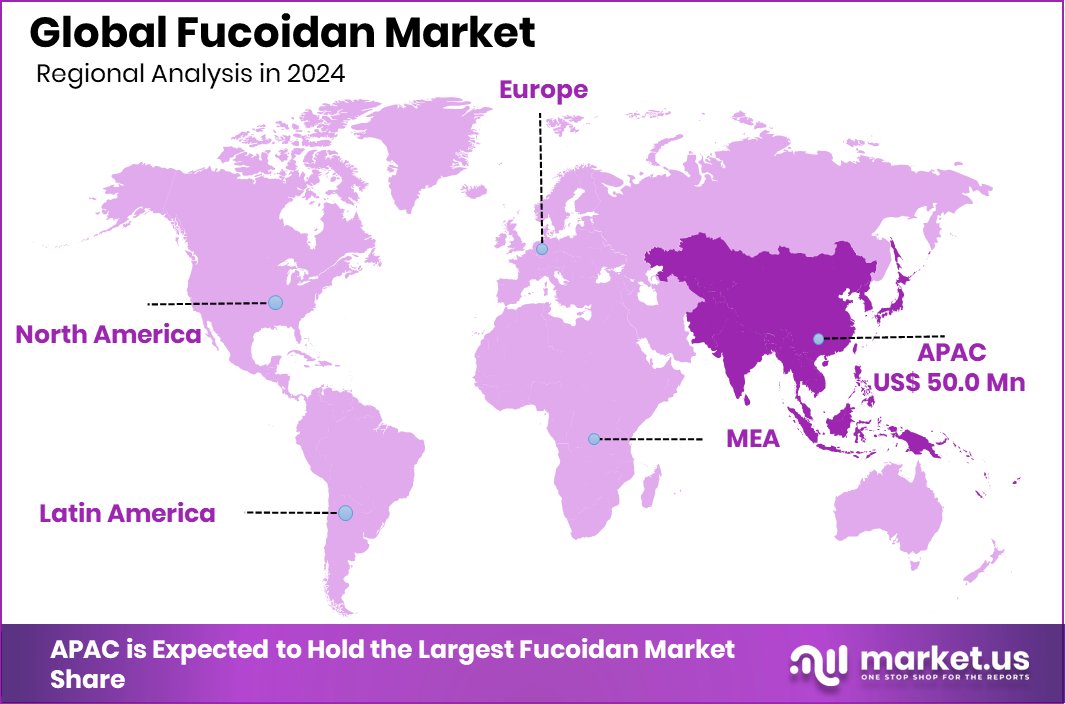

- Strong seaweed resources boost Asia-Pacific’s USD 50.0 Mn fucoidan market growth.

By Form Analysis

Powder form holds a 68.2% share in the Fucoidan Market.

In 2024, Powder held a dominant market position in the By Form segment of the Fucoidan Market, with a 68.2% share. This strong presence can be attributed to its versatility, longer shelf life, and ease of incorporation into various applications such as dietary supplements, functional foods, and nutraceutical formulations. Powdered fucoidan is favored for its stability during storage and transportation, making it suitable for bulk handling and global distribution.

Its fine consistency allows easy blending with other ingredients in capsules, tablets, smoothies, and health drinks, enabling manufacturers to meet diverse consumer preferences. The powdered form also offers higher concentration and purity levels, ensuring effective dosage delivery for health benefits such as immune system support, anti-inflammatory action, and antioxidant properties.

Growing consumer demand for convenient, high-quality marine-based supplements has further supported the popularity of powdered fucoidan. Additionally, advancements in extraction and drying technologies have enhanced product quality while preserving the bioactive compounds, making the powder form more appealing for premium health and wellness products.

By Application Analysis

Healthcare products lead applications with 49.4% market share.

In 2024, Health Care Products held a dominant market position in the By Application segment of the Fucoidan Market, with a 49.4% share. This leadership is driven by the growing consumer focus on natural, marine-derived ingredients for preventive healthcare and overall wellness. Fucoidan’s bioactive properties, including immune system support, anti-inflammatory benefits, and antioxidant activity, have made it a sought-after ingredient in dietary supplements, capsules, and functional health formulations.

Its use in healthcare products is supported by increasing awareness of the role of natural compounds in managing lifestyle-related conditions such as cardiovascular issues, weakened immunity, and inflammation. The clean-label and plant-based trends have also boosted fucoidan’s acceptance among health-conscious consumers looking for safe and sustainable alternatives to synthetic ingredients.

Advancements in scientific research highlighting fucoidan’s potential in promoting cell health, supporting recovery, and aiding in chronic disease prevention have strengthened its adoption in premium health supplements. Furthermore, the expansion of e-commerce and direct-to-consumer channels has made fucoidan-based healthcare products more accessible globally.

Key Market Segments

By Form

- Powder

- Capsule

- Others

By Application

- Health Care Products

- Pharmaceuticals

- Cosmetics

- Others

Driving Factors

Rising Demand for Natural and Marine-Based Ingredients

One of the key driving factors for the fucoidan market is the growing consumer shift toward natural and marine-based ingredients for health and wellness. People are increasingly looking for safe, plant-based, and sustainable sources of nutrition, and fucoidan, extracted from brown seaweed, fits this trend perfectly. Its potential health benefits, such as boosting immunity, reducing inflammation, and providing antioxidants, make it a preferred choice in supplements and functional foods.

The global move toward preventive healthcare has further strengthened its demand, as more consumers choose natural products to support long-term well-being. With increasing awareness about its benefits and clean-label appeal, fucoidan continues to gain traction across healthcare, nutraceutical, and cosmetic applications, driving consistent market growth worldwide.

Restraining Factors

High Production Costs and Limited Raw Material Supply

A major restraining factor for the fucoidan market is its high production cost, driven by the complex extraction process and the limited availability of quality raw materials. Fucoidan is primarily sourced from specific types of brown seaweed, which are harvested in controlled regions. Seasonal availability, environmental changes, and sustainability concerns can limit the supply, making raw materials expensive.

Additionally, advanced extraction technologies are required to maintain fucoidan’s bioactive properties, further increasing production expenses. These factors can lead to higher product prices, making fucoidan-based items less affordable for some consumers. The combination of limited supply and high costs poses a challenge for large-scale commercialization, especially in price-sensitive markets, potentially slowing down the market’s growth pace.

Growth Opportunity

Expanding Applications in Skincare and Cosmetic Products

A major growth opportunity for the fucoidan market lies in its expanding use within skincare and cosmetic products. Fucoidan’s natural properties, such as promoting skin hydration, reducing inflammation, and supporting collagen production, make it highly attractive for anti-aging, soothing, and skin-repair formulations. With the rising global demand for clean, marine-based, and chemical-free beauty products, fucoidan offers a unique selling point for cosmetic brands targeting health-conscious consumers.

The trend toward premium natural skincare and the popularity of seaweed-based ingredients in Asian beauty markets are further fueling interest. As research continues to highlight fucoidan’s skin-protective benefits, more cosmetic companies are likely to adopt it, creating significant growth potential in both mainstream and niche beauty segments worldwide.

Latest Trends

Rising Popularity of Functional and Fortified Beverages

One of the latest trends in the fucoidan market is its growing use in functional and fortified beverages. Manufacturers are incorporating fucoidan into drinks such as smoothies, health tonics, and energy beverages to offer added immune support, antioxidant benefits, and overall wellness enhancement. This trend is fueled by consumers seeking convenient, ready-to-drink health solutions that fit into busy lifestyles.

The clean-label movement and interest in marine-based superfoods have further boosted the appeal of fucoidan-infused drinks. In Asia, where seaweed has long been part of the diet, such beverages are gaining quick acceptance, while Western markets are also showing rising curiosity. This shift toward functional beverages is opening new product development opportunities for fucoidan in the wellness sector.

Regional Analysis

Asia-Pacific holds a 43.3% share, reaching USD 50.0 Mn.

In 2024, Asia-Pacific emerged as the leading region in the global fucoidan market, capturing 43.3% of the share, equivalent to USD 50.0 million. This dominance is driven by the region’s abundant availability of brown seaweed species, particularly in countries such as Japan, China, and South Korea, which are key sources for fucoidan extraction. Strong cultural familiarity with seaweed-based foods and supplements has supported widespread acceptance of fucoidan in both traditional and modern health applications.

North America is witnessing steady growth, supported by rising demand for natural health ingredients and the expanding nutraceutical sector. Europe is also experiencing increased adoption due to consumer preference for clean-label, marine-derived products. Meanwhile, the Middle East & Africa and Latin America are emerging markets where awareness of fucoidan’s health benefits is gradually increasing, driven by the growth of the dietary supplements industry and rising urban health-conscious populations.

With Asia-Pacific maintaining a substantial lead, its established seaweed harvesting industry, coupled with strong domestic consumption and export potential, positions it as the central hub for fucoidan production and innovation. The region’s dominance is expected to continue as global demand for marine-based functional ingredients rises.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ABLY, Inc. leveraged its expertise in marine bioactives to enhance fucoidan extraction processes, ensuring higher purity and potency for use in premium health supplements and functional food products. Its emphasis on sustainable sourcing practices aligns with growing consumer demand for eco-friendly and traceable marine ingredients.

Biosynth Ltd. continued to expand its bioactive compound portfolio, integrating fucoidan into its specialized product lines for nutraceutical and pharmaceutical applications. By focusing on rigorous quality control and consistent supply, the company has positioned itself as a reliable supplier to industries demanding high-standard ingredients.

Champion Co., Ltd. capitalized on its strong regional seaweed supply network to maintain stable production while innovating in fucoidan-based product formulations. Its active involvement in research collaborations has supported the development of new applications, particularly in skincare and wellness.

Fucoidan USA.com concentrated on direct-to-consumer channels, promoting fucoidan’s health benefits through targeted marketing campaigns and educational outreach. The company’s efforts to offer varied dosage forms, including powders and capsules, have helped broaden its consumer base.

Top Key Players in the Market

- ABLY, Inc.

- Biosynth Ltd.

- Champion Co., Ltd.

- Fucoidan USA.com

- Hi Q Marine Biotech International Ltd.

- Hongo Co.,Ltd.

- Inaba Foods USA Inc.

- International Flavors and Fragrances Inc.

- KANEHIDE BIO Co.Ltd.

- Lemandou Chemicals

Recent Developments

- In July 2025, Champion Co., Ltd. participated in BIO Asia–Taiwan, specifically in the Asia Healthcare & Medical Cosmetology Expo in Taipei, where they showcased their fucoidan products among other ingredients. Champion served as the exhibitor host for Marinova’s fucoidan extracts at booth #i316, offering attendees hands‑on engagement with their marine-based bioactive offerings.

Report Scope

Report Features Description Market Value (2024) USD 115.6 Million Forecast Revenue (2034) USD 249.6 Million CAGR (2025-2034) 8.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Powder, Capsule, Others), By Application (Health Care Products, Pharmaceuticals, Cosmetics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ABLY, Inc., Biosynth Ltd., Champion Co., Ltd., Fucoidan USA.com, Hi Q Marine Biotech International Ltd., Hongo Co.,Ltd., Inaba Foods USA Inc., International Flavors and Fragrances Inc., KANEHIDE BIO Co.Ltd., Lemandou Chemicals Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ABLY, Inc.

- Biosynth Ltd.

- Champion Co., Ltd.

- Fucoidan USA.com

- Hi Q Marine Biotech International Ltd.

- Hongo Co.,Ltd.

- Inaba Foods USA Inc.

- International Flavors and Fragrances Inc.

- KANEHIDE BIO Co.Ltd.

- Lemandou Chemicals