Global Floating LNG Power Vessel Market Size, Share, And Business Benefits By Vessel Type (Power Barge, Power Ship), By Component (Power Generation System (Gas Turbine and IC Engine, Steam Turbine and Generator), Power Distribution System), By Power Output (Small Scale (Up to 72 MW), Medium Scale (72 MW to 400 MW), Large Scale (Above 400 MW)), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150072

- Number of Pages: 199

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

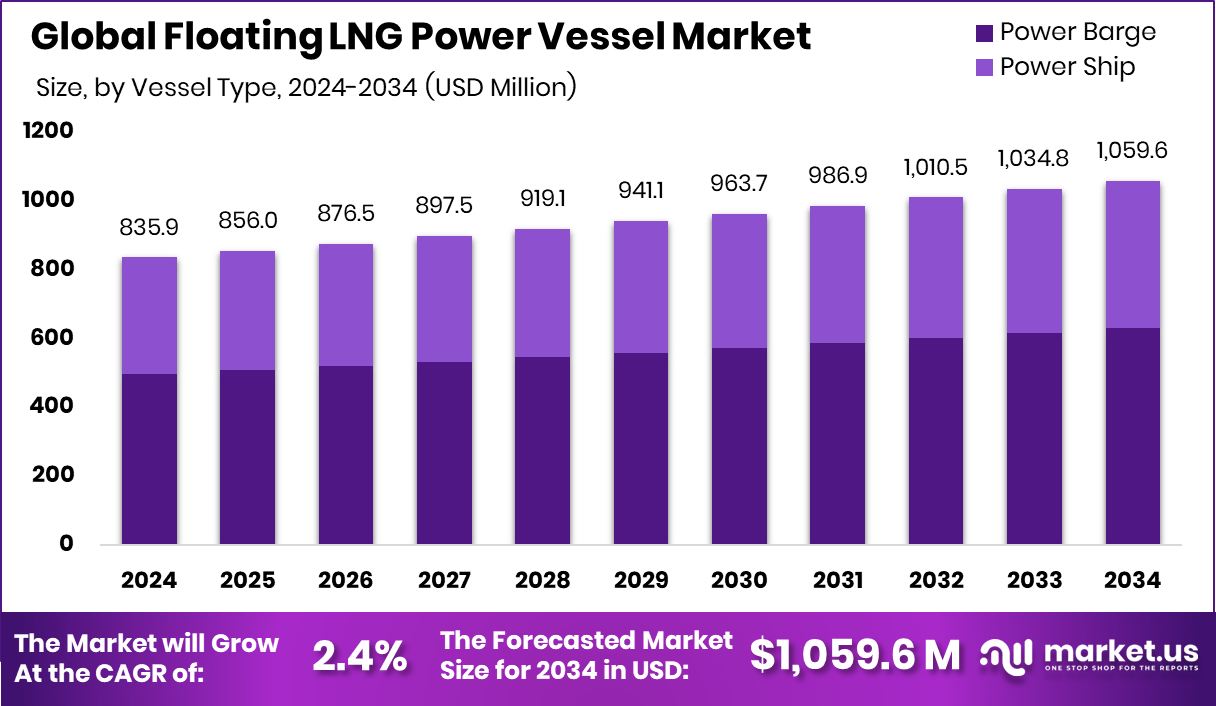

Global Floating LNG Power Vessel Market is expected to be worth around USD 1,059.6 Million by 2034, up from USD 835.9 Million in 2024, and grow at a CAGR of 2.4% from 2025 to 2034. High energy demand and coastal projects drove 37.4% market share in North America.

A Floating LNG Power Vessel is a specialized marine unit designed to generate electricity using liquefied natural gas (LNG) as its primary fuel. These vessels integrate LNG storage, regasification, and power generation systems all in one offshore or nearshore platform. The setup enables rapid deployment in regions lacking energy infrastructure or grid connectivity, providing a flexible and mobile power solution. Floating LNG Power Vessels are often anchored near coastal areas and supply electricity directly to local grids or industrial operations, making them especially valuable in island nations or remote coastal zones.

The Floating LNG Power Vessel Market revolves around the development, deployment, and operation of these mobile energy assets to meet global electricity demands. This market is driven by the growing need for clean, flexible, and decentralized power generation in regions with limited access to land-based infrastructure. Governments, utilities, and independent power producers are increasingly turning to floating solutions as an alternative to time-intensive onshore power plants.

Growth factors include rising electricity demand in off-grid and developing regions, along with stricter emissions standards pushing for low-carbon alternatives. LNG-fueled vessels emit significantly less CO₂ and particulate matter than diesel or coal-based power systems, aligning with many countries’ climate goals. Moreover, the relatively quick deployment timeline of floating LNG units offers a fast-track response to power shortages and disaster recovery efforts.

Demand is surging from Southeast Asia, Africa, and the Middle East, where land constraints, population growth, and industrialization strain local grids. These regions are looking for scalable, lower-cost alternatives to permanent infrastructure. Floating LNG vessels serve this need by reducing capital outlay, offering mobility, and bypassing lengthy permitting processes tied to land-based construction.

Key Takeaways

- Global Floating LNG Power Vessel Market is expected to be worth around USD 1,059.6 Million by 2034, up from USD 835.9 Million in 2024, and grow at a CAGR of 2.4% from 2025 to 2034.

- In 2024, Power Barges held a 59.6% share in the Floating LNG Power Vessel Market deployments.

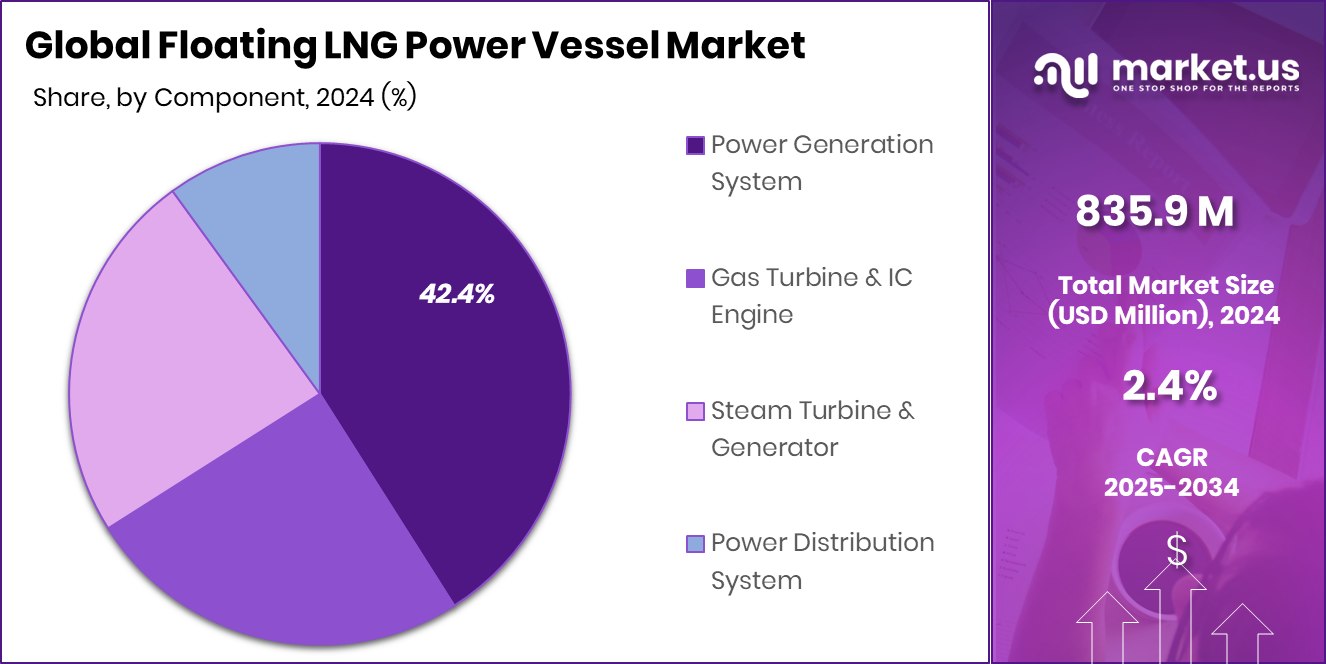

- Power Generation Systems contributed 42.4% of the market, leading the component segment with essential infrastructure needs.

- Medium-scale vessels (72 MW to 400 MW) dominated power output, capturing a 49.5% market share.

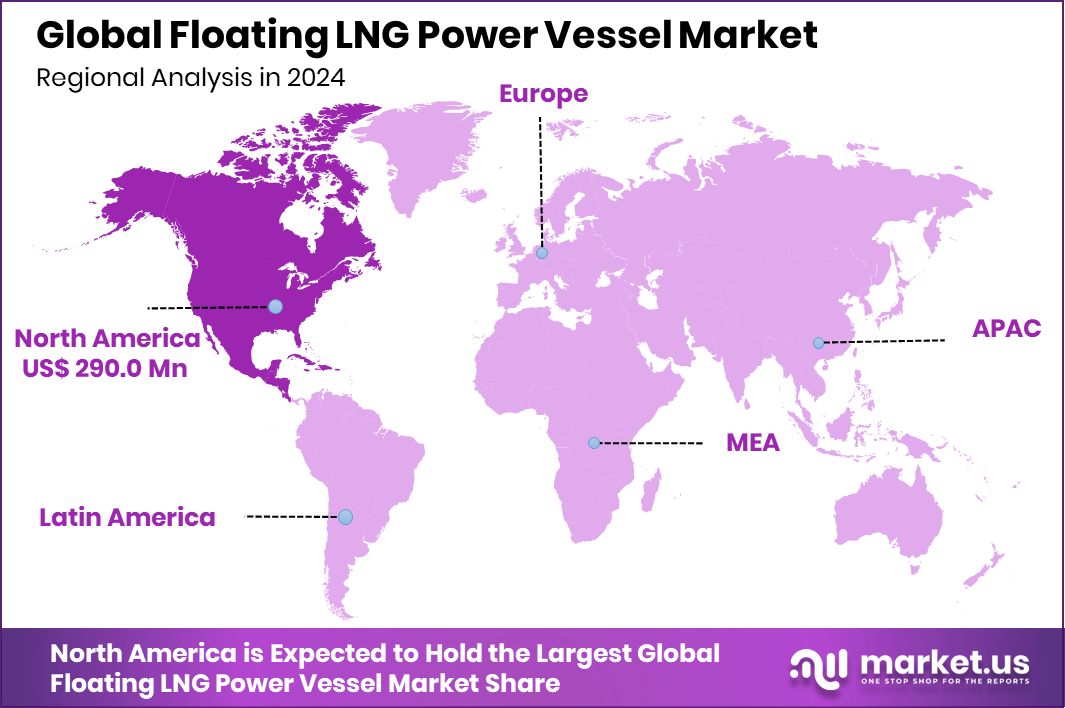

- North America’s market value reached USD 290 million in the Floating LNG power segment.

By Vessel Type Analysis

In 2024, Power Barge led with 59.6% in the vessel type segment.

In 2024, Power Barge held a dominant market position in the By Vessel Type segment of the Floating LNG Power Vessel Market, with a 59.6% share. This dominance is primarily attributed to the cost-efficiency, modularity, and quicker deployment time of power barges compared to other vessel types. Power barges, which are essentially floating power plants mounted on barges, have gained significant traction in regions facing acute electricity shortages and limited onshore infrastructure.

Their ability to be transported, anchored, and connected to a grid or facility with minimal civil work makes them highly favorable for temporary and emergency power solutions. Additionally, governments in developing nations and island economies are increasingly opting for power barges to bridge their energy gaps without the complexities of land acquisition or prolonged construction phases.

The 59.6% market share also reflects the vessel’s growing role in disaster response scenarios and as a transitional energy source during grid upgrades or expansions. Moreover, their compatibility with cleaner fuels like LNG aligns well with the global transition toward lower-emission power generation.

By Component Analysis

Power Generation System held 42.4% market share by component in 2024.

In 2024, Power Generation System held a dominant market position in the By Component segment of the Floating LNG Power Vessel Market, with a 42.4% share. This segment’s leadership is driven by its central role in converting regasified LNG into usable electricity onboard the vessel. The power generation system includes advanced turbines or engines specifically adapted to run on natural gas, which deliver efficient and continuous power output to meet diverse energy needs.

With the growing adoption of floating LNG solutions in areas lacking reliable grid infrastructure, there is a direct emphasis on robust and high-capacity onboard generation equipment. The 42.4% share also reflects the capital-intensive nature of this component, as it represents the core operational unit of any floating LNG power vessel.

Additionally, ongoing upgrades in gas-fired generation technologies are enhancing output efficiency and reducing emissions, making these systems increasingly attractive to government and private sector stakeholders.

As more countries look to LNG as a cleaner transitional fuel, the demand for reliable floating power generation infrastructure is expanding, particularly in Asia-Pacific, the Middle East, and parts of Africa. Consequently, the power generation system remains the cornerstone of vessel functionality and continues to drive investment within the segment.

By Power Output Analysis

Medium-scale output dominated at 49.5% in the power output category in 2024.

In 2024, Medium Scale (72 MW to 400 MW) held a dominant market position in By Power Output segment of the Floating LNG Power Vessel Market, with a 49.5% share. This segment’s prominence is largely due to its balanced capability to serve both regional grid demands and industrial requirements without incurring the high operational complexities of large-scale systems.

Medium-scale floating LNG power vessels are particularly well-suited for emerging economies and island nations where power needs are substantial but not extensive enough to warrant large installations. The 49.5% market share also highlights the preference for flexible, scalable, and cost-effective energy solutions that can be deployed quickly in critical locations. These vessels offer enough capacity to support cities, ports, and industrial zones, making them highly attractive to governments and utility providers aiming for energy resilience and grid stability.

Their relatively lower construction and operational costs compared to larger capacity vessels further contribute to their strong market penetration. As global power demand continues to increase in remote and infrastructure-challenged regions, medium-scale units remain the optimal choice for delivering dependable LNG-based electricity generation.

Key Market Segments

By Vessel Type

- Power Barge

- Power Ship

By Component

- Power Generation System

- Gas Turbine and IC Engine

- Steam Turbine and Generator

- Power Distribution System

By Power Output

- Small Scale (Up to 72 MW)

- Medium Scale (72 MW to 400 MW)

- Large Scale (Above 400 MW)

Driving Factors

Rising Demand for Quick Off-Grid Power Solutions

One of the main factors driving the Floating LNG Power Vessel Market is the growing need for fast and flexible power supply in areas without access to land-based power infrastructure. Many developing regions, island countries, and remote coastal areas lack consistent electricity due to weak grids or limited power generation. Floating LNG power vessels are a quick fix because they don’t need long construction timelines or large land areas.

These vessels can be towed and anchored near the shore, allowing power to be delivered rapidly. They are especially helpful during emergencies, natural disasters, or temporary energy shortages. As global electricity needs grow, these mobile solutions offer a reliable and cleaner alternative to traditional diesel generators.

Restraining Factors

High Initial Cost Limits Wider Market Adoption

A major factor holding back the Floating LNG Power Vessel Market is the high upfront cost required to build and operate these vessels. Designing a vessel that combines LNG storage, regasification, and power generation is expensive.

On top of that, safety systems, skilled crew, and regular maintenance add to the cost. For many developing countries or small utility providers, this large investment can be a big barrier, especially when cheaper alternatives like diesel generators are available in the short term.

Even though floating LNG solutions save money over time through fuel efficiency and lower emissions, the initial budget required can delay or cancel many potential projects. This cost challenge slows down market growth in price-sensitive regions.

Growth Opportunity

Hybrid Integration with Renewable Energy Creates Opportunities

A key growth opportunity in the Floating LNG Power Vessel Market lies in combining LNG power with renewable energy sources like solar or wind. In many regions, renewable power is growing fast but often faces issues like inconsistent sunlight or wind. Floating LNG power vessels can act as a stable backup, filling gaps when renewables fall short. This hybrid model ensures continuous power while keeping emissions low.

Countries aiming for clean energy transitions can benefit by pairing renewables with LNG vessels instead of relying on coal or diesel. It allows them to build flexible and eco-friendly energy systems. As governments push for greener grids, this renewable-LNG combination is likely to drive new investments and long-term market expansion.

Latest Trends

Hybrid Energy Solutions in Floating LNG Vessels

A significant trend in the Floating LNG Power Vessel Market is the integration of hybrid energy systems. These systems combine LNG power generation with renewable energy sources like solar and wind. This hybrid approach addresses the intermittent nature of renewables, ensuring a stable and continuous power supply. Floating LNG vessels equipped with hybrid systems can be rapidly deployed to areas with limited infrastructure, providing both immediate and sustainable energy solutions.

The flexibility and scalability of these hybrid systems make them attractive for regions aiming to reduce carbon emissions while meeting growing energy demands. As environmental regulations become more stringent, the adoption of hybrid energy solutions in floating LNG power vessels is expected to accelerate, offering a pathway to cleaner and more resilient energy systems.

Regional Analysis

In 2024, North America held a 37.4% share of the Floating LNG Power Vessel Market.

In 2024, North America emerged as the leading region in the Floating LNG Power Vessel Market, accounting for a significant 37.4% share, equivalent to a market value of USD 290 million. The region’s dominance is primarily driven by rising energy demands in coastal and offshore locations, combined with investments in flexible and low-emission power generation technologies.

Governments and energy developers in the United States and Canada are increasingly adopting floating LNG solutions to ensure a reliable electricity supply in remote or disaster-prone areas without relying on land-based infrastructure.

In contrast, Europe continues to explore LNG vessel integration mainly as part of its transition to cleaner fuels, while Asia Pacific is witnessing growing interest in floating LNG systems for energy access across island nations. The Middle East & Africa region is leveraging floating LNG vessels to address power generation gaps in industrial zones and oil-producing areas, whereas Latin America is exploring such solutions on a smaller scale for grid stabilization and emergency power needs.

Despite rising activity in other regions, North America remains the most dominant market in 2024, supported by favorable policy frameworks, strong LNG availability, and a focus on mobile, scalable energy systems that align with long-term decarbonization goals.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Shell continues to demonstrate its strategic commitment to the floating LNG sector by leveraging its expertise in integrated gas operations. As a pioneer in floating LNG through projects like Prelude FLNG, Shell’s operations focus on producing, liquefying, storing, and offloading natural gas from offshore fields. Although primarily centered on LNG production, Shell’s infrastructure and technical knowledge in floating platforms give it a strong foundation to support or integrate power generation capabilities where needed.

General Electric (GE), known for its power generation technologies, plays a vital role in supplying core equipment for floating LNG power vessels. GE’s gas turbines and combined cycle systems are often deployed within onboard power generation modules, making the company a key enabler in transforming LNG into usable electricity at sea. GE’s focus remains on delivering high-efficiency, low-emission power systems suited for offshore environments.

Excelerate Energy stands out with its active deployment of floating regasification and storage infrastructure. The company specializes in floating storage and regasification units (FSRUs), many of which are modified to support onboard power generation. Excelerate’s model enables rapid deployment in energy-scarce coastal areas, aligning with the global demand for mobile and cleaner power.

Top Key Players in the Market

- Shell

- General Electric

- Excelerate Energy

- Siemens

- DNV GL

- Black and Veatch

- Sempra Energy TotalEnergies

- Golar LNG

- Marubeni Corporation

- Bumi Armada

- TenneT

- Mitsubishi Corporation

- Wärtsilä

- KBR

Recent Developments

- In December 2024, Shell agreed with Argentina’s state-run oil company YPF to develop the country’s flagship LNG project. This multi-stage project aims to produce 10 million metric tons of LNG per year, with the first phase utilizing floating LNG vessels.

- In October 2024, GE Vernova announced the deployment of its advanced 7HA.03 gas turbines at Kansai Electric Power Company’s Nanko power station in Osaka, Japan. This initiative aims to replace aging LNG power generation assets, enhancing efficiency and reducing CO₂ emissions. The new turbines are expected to deliver up to 1.8 gigawatts of electricity, contributing significantly to Japan’s decarbonization goals.

Report Scope

Report Features Description Market Value (2024) USD 835.9 Million Forecast Revenue (2034) USD 1,059.6 Million CAGR (2025-2034) 2.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Vessel Type (Power Barge, Power Ship), By Component (Power Generation System (Gas Turbine and IC Engine, Steam Turbine and Generator), Power Distribution System), By Power Output (Small Scale (Up to 72 MW), Medium Scale (72 MW to 400 MW), Large Scale (Above 400 MW)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Shell, General Electric, Excelerate Energy, Siemens, DNV GL, Black and Veatch, Sempra Energy TotalEnergies, Golar LNG, Marubeni Corporation, Bumi Armada, TenneT, Mitsubishi Corporation, Wärtsilä, KBR Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Floating LNG Power Vessel MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Floating LNG Power Vessel MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Shell

- General Electric

- Excelerate Energy

- Siemens

- DNV GL

- Black and Veatch

- Sempra Energy TotalEnergies

- Golar LNG

- Marubeni Corporation

- Bumi Armada

- TenneT

- Mitsubishi Corporation

- Wärtsilä

- KBR