Global Flexible AC Transmission Systems Market Size, Share, And Enhanced Productivity By Compensation Type (Shunt Compensation, Series Compensation, Combined Compensation), By Generation Type (First Generation, Second Generation), By Functions (Voltage Control, Network Stabilization, Transmission Capacity, Harmonic Suppression), By Application (Voltage Control, Power Control), By Vertical (Utilities, Renewables, Industrial, Railways), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 169875

- Number of Pages: 390

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

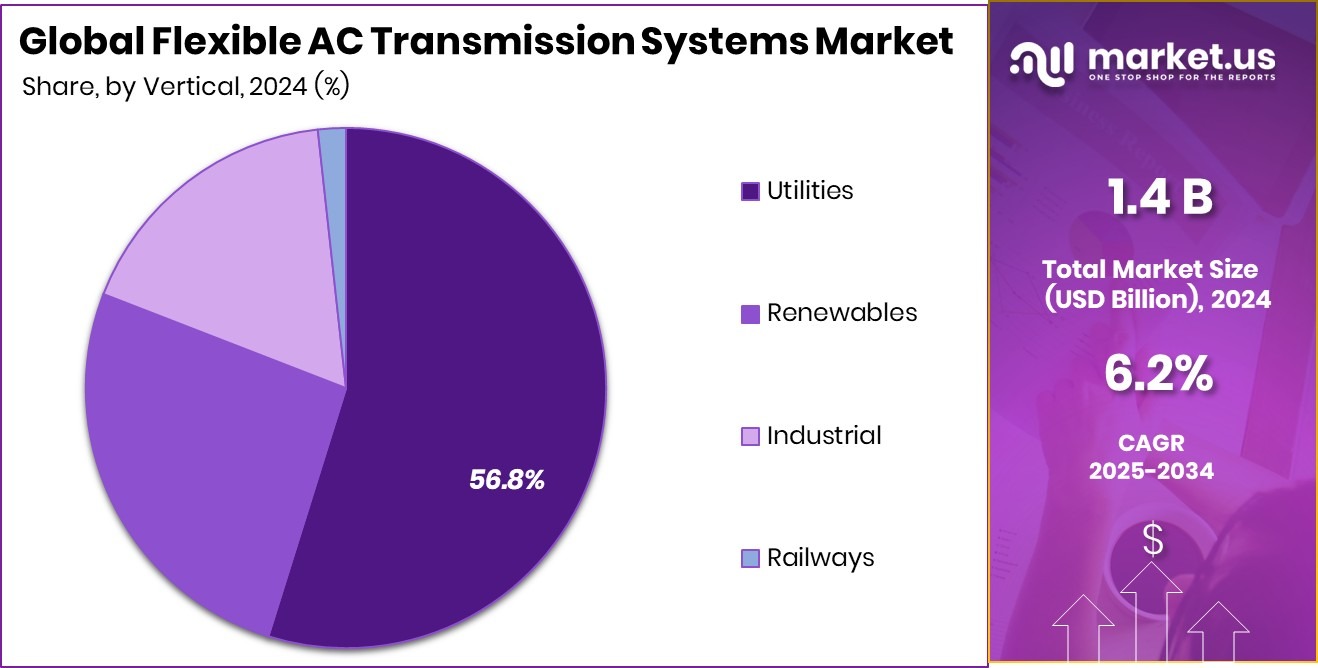

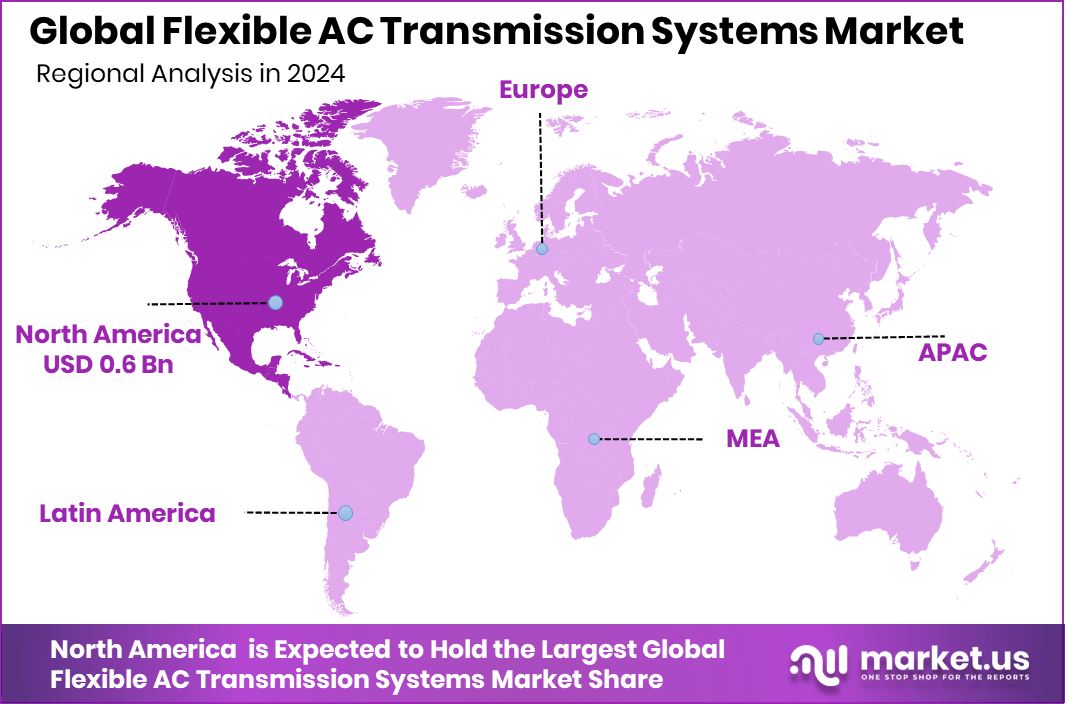

The Global Flexible AC Transmission Systems Market is expected to be worth around USD 2.6 billion by 2034, up from USD 1.4 billion in 2024, and is projected to grow at a CAGR of 6.2% from 2025 to 2034. North America represents Flexible AC Transmission leadership with a 43.90% share totalling USD 0.6 Bn.

Flexible AC Transmission Systems (FACTS) are advanced power-electronics-based solutions used in electricity networks to control voltage, power flow, and system stability in real time. They help transmission grids operate more efficiently by reducing losses, managing congestion, and improving reliability. FACTS technologies are especially important for balancing variable power flows caused by renewable energy sources such as wind and solar, which put new technical stress on conventional grids.

The Flexible AC Transmission Systems Market represents the growing deployment of these solutions across national and regional power networks. As countries expand renewable capacity and electrification, utilities are upgrading grids to handle higher loads and variable generation. By June 2025, India had already installed 235.7 GW of non-fossil capacity, including 226.9 GW from renewables and 8.8 GW from nuclear, creating strong structural demand for grid-stabilising technologies like FACTS.

Growth is supported by manufacturing expansion and system deployment investments. Around INR 1,400 million ($16 million) has been allocated to expand HVDC and FACTS manufacturing and testing facilities in India, while another ₹140 crore has been committed to strengthen domestic power-equipment production. These investments improve local sourcing and reduce deployment timelines for advanced grid solutions.

Demand is also rising from project execution and capital markets. Orders such as ₹19.7 crore for FACTS reactors and ₹75.19 crore for European FACTS system supplies highlight increasing adoption. An ₹859-crore initial public offering further reflects investor confidence in grid-transition equipment, while a ₹20 billion green-energy investment strengthens the renewable pipeline that ultimately drives FACTS demand.

- $11 million from the U.S. Department of Energy for high-voltage transmission projects, including $3.3 million for next-generation technology development.

- PLN 4.15 billion (USD 1.14 billion) allocated by Poland’s Modernisation Fund for energy-storage and grid projects supporting system flexibility.

Key Takeaways

- The Global Flexible AC Transmission Systems Market is expected to be worth around USD 2.6 billion by 2034, up from USD 1.4 billion in 2024, and is projected to grow at a CAGR of 6.2% from 2025 to 2034.

- Shunt Compensation leads the Flexible AC Transmission Systems Market with a 49.7% share due to effective voltage stability control.

- Second Generation dominates the Flexible AC Transmission Systems Market, holding a 65.2% share for reliable transmission performance.

- Voltage Control drives the Flexible AC Transmission Systems Market with a 58.5% share, supporting stable grid operations.

- Utilities command the Flexible AC Transmission Systems Market with a 56.8% share through wide-scale transmission management.

- North America dominates the Flexible AC Transmission market, holding a 43.90% share and generating USD 0.6 Bn.

By Compensation Type Analysis

Shunt Compensation leads the Flexible AC Transmission Systems Market with a 49.7% share globally.

In 2024, Shunt Compensation held a dominant market position in the By Compensation Type segment of the Flexible AC Transmission Systems Market, with a 49.7% share. This dominance reflects the wide adoption of shunt-based solutions for improving voltage stability and reactive power control across transmission networks. Utilities rely on shunt compensation to maintain steady voltage levels during fluctuating load conditions, making it a practical and efficient choice within FACTS deployments.

Shunt compensation technologies are valued for their ability to enhance transmission efficiency without major structural changes to existing grid infrastructure. By dynamically managing reactive power, these systems help reduce transmission losses and improve overall network reliability. The 49.7% share highlights how operators continue to prioritise shunt compensation as a core solution for managing grid stress, especially in networks experiencing variable power flows, reinforcing its strong position within the compensation type segment.

By Generation Type Analysis

Second Generation dominates the Flexible AC Transmission Systems Market, holding a 65.2% share.

In 2024, Second Generation held a dominant market position in the By Generation Type segment of the Flexible AC Transmission Systems Market, with a 65.2% share. This strong share reflects the widespread deployment of second-generation FACTS solutions that offer proven performance in voltage regulation and power flow control. Grid operators continue to prefer these systems due to their operational reliability, mature design, and compatibility with existing transmission infrastructure.

Second-generation technologies are well-established and widely accepted for managing grid stability under varying load conditions. Their ability to deliver consistent performance with relatively predictable operation supports continued adoption across transmission networks. The 65.2% share highlights how utilities prioritise dependable and field-tested FACTS solutions to balance grid efficiency and operational confidence, maintaining this generation’s dominant position within the generation type segment.

By Application Analysis

Voltage Control drives the Flexible AC Transmission Systems Market with a 58.5% share.

In 2024, Voltage Control held a dominant market position in the By Application segment of the Flexible AC Transmission Systems Market, with a 58.5% share. This leadership is driven by the essential role of voltage stability in maintaining reliable transmission operations. Voltage control applications enable utilities to manage fluctuations across power networks, ensuring consistent electricity delivery under changing load conditions.

The strong 58.5% share reflects the growing reliance on voltage control solutions to improve power quality and reduce operational risks in transmission systems. These applications support efficient grid performance by maintaining voltage within defined limits, which is critical for preventing equipment stress and system imbalance. As transmission networks become more complex, voltage control continues to represent a core application focus within the FACTS market.

By Vertical Analysis

Utilities dominate the Flexible AC Transmission Systems Market verticals, holding a 56.8% share.

In 2024, Utilities held a dominant market position in the By Vertical segment of the Flexible AC Transmission Systems Market, with a 56.8% share. This dominance reflects the central role utilities play in managing national and regional transmission networks. Utilities remain the primary adopters of FACTS solutions to ensure grid stability, control power flows, and maintain a reliable electricity supply across large service areas.

The 56.8% share highlights how utilities continue to prioritise flexible transmission technologies to strengthen system performance and reduce operational disruptions. FACTS deployments support utilities in responding to load variations and maintaining voltage balance across interconnected networks. As grid complexity increases, utilities sustain their dominant position by relying on FACTS applications that enhance overall transmission efficiency and reliability.

Key Market Segments

By Compensation Type

- Shunt Compensation

- Series Compensation

- Combined Compensation

By Generation Type

- First Generation

- Second Generation

By Functions

- Voltage Control

- Network Stabilization

- Transmission Capacity

- Harmonic Suppression

By Application

- Voltage Control

- Power Control

By Vertical

- Utilities

- Renewables

- Industrial

- Railways

Driving Factors

Accelerating Renewable Energy Integration Drives FACTS Demand

The biggest driving factor for the Flexible AC Transmission Systems Market is the rapid growth of renewable energy projects and the urgent need to integrate them smoothly into existing power grids. Solar and wind power create fluctuating electricity flows, which can cause voltage instability and grid stress. FACTS solutions help manage these variations in real time, making grids more stable, efficient, and reliable. As more large-scale renewable projects come online, grid operators increasingly depend on FACTS to avoid congestion, reduce losses, and ensure uninterrupted power delivery.

Project-level financing is directly strengthening this demand. Serentica Renewables has secured $100 million in debt financing from Rabobank and Société Générale to develop a 300 MW solar project in Rajasthan. Such utility-scale renewable additions require advanced grid-control technologies, creating sustained demand for FACTS across transmission networks.

- £50 million secured mezzanine finance raised by AMPYR Distributed Energy to support renewable energy projects and acquisitions

Restraining Factors

High Capital Risk From Project Financing Failures

A major restraining factor for the Flexible AC Transmission Systems Market is the high financial risk linked to large renewable and grid projects. FACTS installations require heavy upfront investment, long planning cycles, and stable project execution. When projects fail or face financial stress, spending on advanced grid technologies is often delayed or cancelled. The collapse of high-profile renewable ventures weakens investor confidence and makes lenders more cautious, slowing approvals for related transmission upgrades. For grid operators, uncertainty around project completion increases hesitation in adopting complex systems like FACTS, despite their technical benefits.

Recent funding failures clearly show this risk. A solar empire collapse involving $300 million in grants and $79 million in debt highlights how financial instability can disrupt energy infrastructure plans. Such setbacks tighten financing conditions across the power sector, indirectly restricting FACTS adoption even where grid modernisation is urgently needed.

Growth Opportunity

Circular Solar Economy Creates New FACTS Opportunities

A strong growth opportunity for the Flexible AC Transmission Systems Market is emerging from the shift toward a circular solar economy. As solar panels are reused, refurbished, and recycled, grid-connected solar assets remain active for longer periods. This extends variability in power flow and increases the need for advanced voltage control and grid stability solutions. FACTS technologies help manage older and newer solar assets together, ensuring safe and efficient power transmission across mixed-age infrastructure.

Funding focused on circular models strengthens this opportunity. Beyond Renewables & Recycling raised ₹5 crore in pre-seed funding to advance India’s circular solar economy. Such initiatives support sustainable solar deployment while keeping generation capacity connected to the grid longer. As circular solar projects scale, transmission networks must adapt to sustained and fluctuating output, opening long-term demand for FACTS solutions that improve flexibility, reliability, and system life without major grid rebuilds.

Latest Trends

Large Hybrid Renewable Projects Shape FACTS Adoption

A key latest trend in the Flexible AC Transmission Systems Market is the rapid development of large, grid-scale hybrid renewable projects that combine solar, wind, and storage. These projects create complex power flows and frequent voltage fluctuations, especially when generation shifts between sources. FACTS solutions are increasingly used to stabilise transmission lines, manage reactive power, and ensure smooth grid operations. As hybrid projects grow in size and capacity, utilities prefer flexible control systems rather than costly new transmission lines, making FACTS a practical and scalable choice.

- REC sanctioned ₹7,500 crore in funding for a large hybrid renewable project in Kurnool, reinforcing demand for advanced grid-control technologies.

In parallel, Juniper Green Energy secured ₹1,739 crore in debt funding from IREDA for renewable projects, further increasing the need for grid flexibility and real-time voltage regulation solutions.

Regional Analysis

North America leads the Flexible AC Transmission market at 43.90% share worth USD 0.6 Bn.

North America dominates the Flexible AC Transmission Systems market, holding a leading 43.90% share and generating around USD 0.6 Bn in value. This strong position is supported by the region’s mature power grid, high electricity demand, and ongoing upgrades of transmission infrastructure. Utilities across North America focus on improving grid reliability and managing fluctuating power loads, which steadily supports FACTS adoption. Advanced grid planning practices and early acceptance of power electronics further reinforce North America’s dominant status in this market.

Europe represents a stable and technically advanced regional market for Flexible AC Transmission Systems. The region emphasises efficient power transmission, cross-border electricity trade, and grid stability, which encourages the use of FACTS solutions. Ageing grid infrastructure and the need for better load balancing continue to support consistent demand across major European economies.

Asia Pacific shows strong structural potential for FACTS systems, driven by rapid grid expansion and high electricity consumption growth. Large-scale transmission networks and increasing system complexity make flexible transmission technologies increasingly relevant across the region.

Middle East & Africa reflect emerging adoption, where FACTS systems support grid modernisation and voltage control across expanding transmission networks.

Latin America demonstrates a gradual uptake, as utilities prioritise transmission efficiency and network stability improvements.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Siemens continues to play a critical role in the global Flexible AC Transmission Systems market through its strong engineering depth and long-standing presence in power transmission technologies. In 2024, the company focuses on delivering advanced FACTS solutions that support grid stability, voltage regulation, and efficient power flow control. Siemens benefits from its integrated approach, combining hardware, digital monitoring, and grid automation capabilities, which allows utilities to manage complex transmission networks more effectively.

General Electric remains a key contributor to the FACTS market by leveraging its expertise in power electronics and grid solutions. During 2024, GE emphasises flexible transmission systems that help utilities optimise existing grid assets rather than building new lines. The company’s strength lies in adaptable system designs and strong after-sales support, enabling utilities to improve grid performance, reduce congestion, and enhance operational reliability. GE’s global project execution experience also supports its steady position in this market.

ABB Ltd. holds a strong analyst outlook in the FACTS market due to its deep specialisation in high-voltage and power quality solutions. In 2024, ABB focuses on technologies that enhance grid efficiency and dynamic load management. Its ability to integrate FACTS with broader substation and automation systems strengthens its competitive positioning.

Top Key Players in the Market

- Siemens

- General Electric

- ABB Ltd.

- NR Electric Co., Ltd.

- CG Power and Industrial Solutions Limited.

- Alstom SA

- Mitsubishi Electric Corporation

- Adani Power Ltd

- Eaton Corporation

- Hyosung Corporation

Recent Developments

- In November 2025, Siemens unveiled a new “flexibility software” called Gridscale X, designed to increase grid capacity by up to 20%, enabling better management of loads and constraints without building new lines.

- In September 2025, ABB committed to a large manufacturing and R&D investment in the United States—~US$110 million—to expand its electrification equipment production, targeting growing demand from utilities, data centres, and grid infrastructure rebuilds.

- In May 2025, GE Vernova announced a ~$16 million investment to expand its manufacturing and engineering footprint in India (in Chennai and Noida). This expansion targets increased capacity for HVDC and FACTS technologies—signalling GE’s commitment to serving growing demand for advanced grid infrastructure in Asia.

Report Scope

Report Features Description Market Value (2024) USD 1.4 Billion Forecast Revenue (2034) USD 2.6 Billion CAGR (2025-2034) 6.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Compensation Type (Shunt Compensation, Series Compensation, Combined Compensation), By Generation Type (First Generation, Second Generation), By Functions (Voltage Control, Network Stabilisation, Transmission Capacity, Harmonic Suppression), By Application (Voltage Control, Power Control), By Vertical (Utilities, Renewables, Industrial, Railways) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Siemens, General Electric, ABB Ltd., NR Electric Co., Ltd., CG Power and Industrial Solutions Limited, Alstom SA, Mitsubishi Electric Corporation, Adani Power Ltd, Eaton Corporation, Hyosung Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Flexible AC Transmission Systems MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Flexible AC Transmission Systems MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Siemens

- General Electric

- ABB Ltd.

- NR Electric Co., Ltd.

- CG Power and Industrial Solutions Limited.

- Alstom SA

- Mitsubishi Electric Corporation

- Adani Power Ltd

- Eaton Corporation

- Hyosung Corporation