Global Fiber Reinforced Polymer Composites Market Size, Share, And Business Benefit By Product Material (Glass Fiber Reinforced Polymer (GFRP) Composites, Carbon Fiber Reinforced Polymer (CFRP) Composites, Basalt Fiber Reinforced Polymer (BFRP) Composites, Aramid Fiber Reinforced Polymer (AFRP) Composites), By Resin Type (Thermoset, Thermoplastic), By Reinforcement Form (Rovings, Woven Fabrics and Mats, Chopped Strands, Prepreg, SMC and BMC), By Application (Automotive, Construction, Electronic, Defense, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 166171

- Number of Pages: 329

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

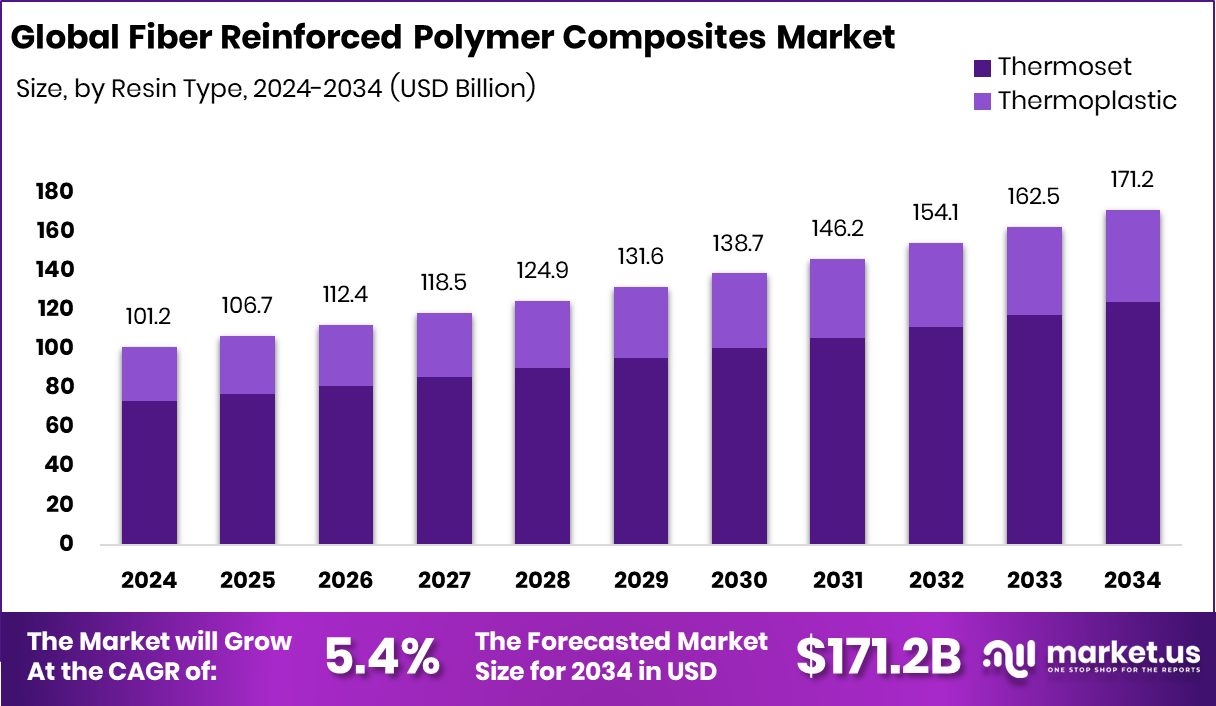

The Global Fiber Reinforced Polymer Composites Market is expected to be worth around USD 171.2 billion by 2034, up from USD 101.2 billion in 2024, and is projected to grow at a CAGR of 5.4% from 2025 to 2034. Asia-Pacific outlook remains positive as 43.8% aligns withthe USD 44.3 Bn future focus.

Fiber Reinforced Polymer (FRP) composites are advanced materials made by combining strong fibers such as carbon, glass, aramid, or natural fibers with polymer matrices like epoxy, polyester, or vinyl ester. This blend creates a lightweight yet high-strength structure that resists corrosion, fatigue, and harsh environments better than many metals. FRP composites are widely used in aerospace, construction, automotive, renewable energy, marine, and sporting goods because they deliver strength without heavy weight. Their molding flexibility also allows complex shapes, making them suitable for modern engineering challenges.

The Fiber Reinforced Polymer Composites market reflects a steady shift toward durable, lightweight, and energy-efficient materials across industries. Growing electric mobility, modular construction, and circular-design policies are encouraging innovative composite adoption. Recent investments in bio-based and carbon-negative thermoplastics highlight how sustainability is now shaping commercial composite strategies. For example, Lignin Industries raised €3.9 million to expand bio-based thermoplastics, while Made of Air secured $5.8 million for carbon-negative materials, showing momentum toward greener composite manufacturing.

Demand is rising due to weight reduction, longer product life cycles, and lower maintenance requirements in aircraft, vehicles, bridges, pipelines, energy blades, and safety gear. Projects like Spokane’s aerospace tech hub, receiving $48 million, reinforce strong innovation pipelines, while public safety support, such as Tacoma Fire, gaining $2.5 million, reflects wider procurement where durable composite solutions can improve resilience.

The opportunity lies in merging FRP performance benefits with low-carbon chemistry, recycled inputs, modular engineering, and automated production. Bio-based and negative-carbon composites could redefine cost-benefit equations, opening wider scale adoption in both public and industrial infrastructure.

Key Takeaways

- The Global Fiber Reinforced Polymer Composites Market is expected to be worth around USD 171.2 billion by 2034, up from USD 101.2 billion in 2024, and is projected to grow at a CAGR of 5.4% from 2025 to 2034.

- In the Fiber Reinforced Polymer Composites Market, GFRP leads with 57.9% due to dominance and strength.

- Thermoset holds a 72.4% share, driving superior durability, heat resistance, and long-term performance across critical industries.

- Rovings command a 26.5% share, enabling continuous reinforcement for high-load structural composite parts with manufacturing efficiency.

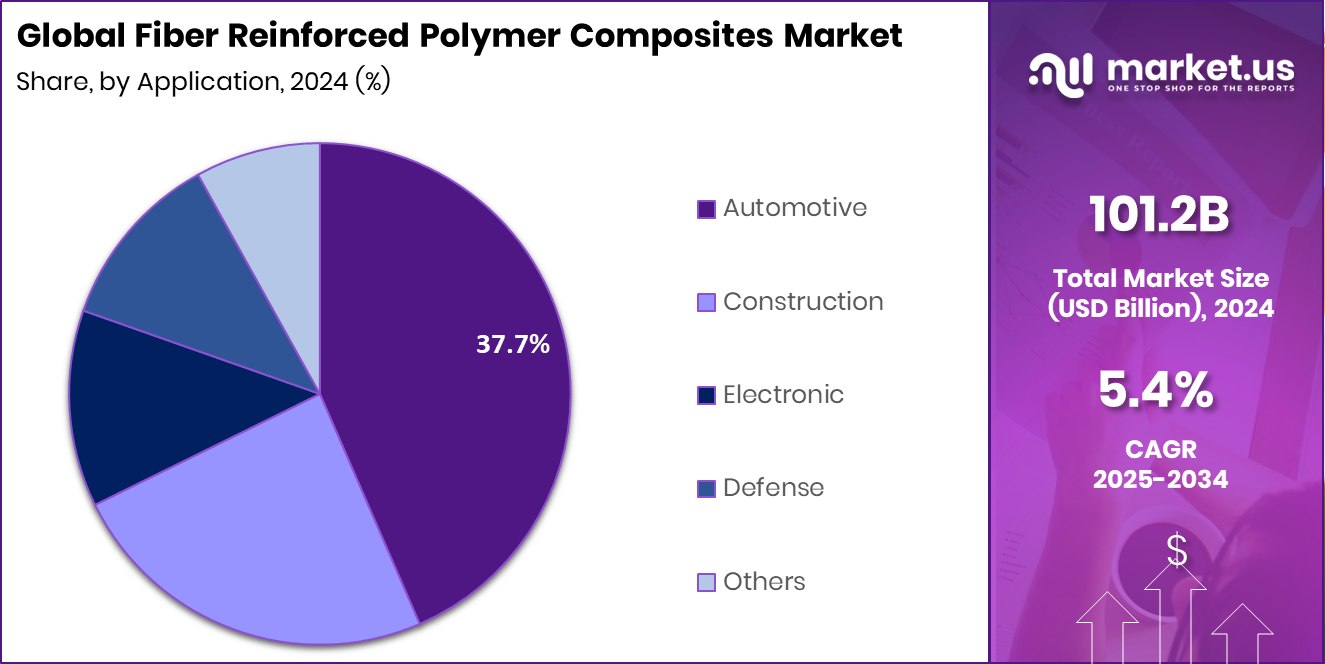

- Automotive applications capture a 37.7% share, driven by lightweighting, fuel efficiency, safety focus, and global adoption.

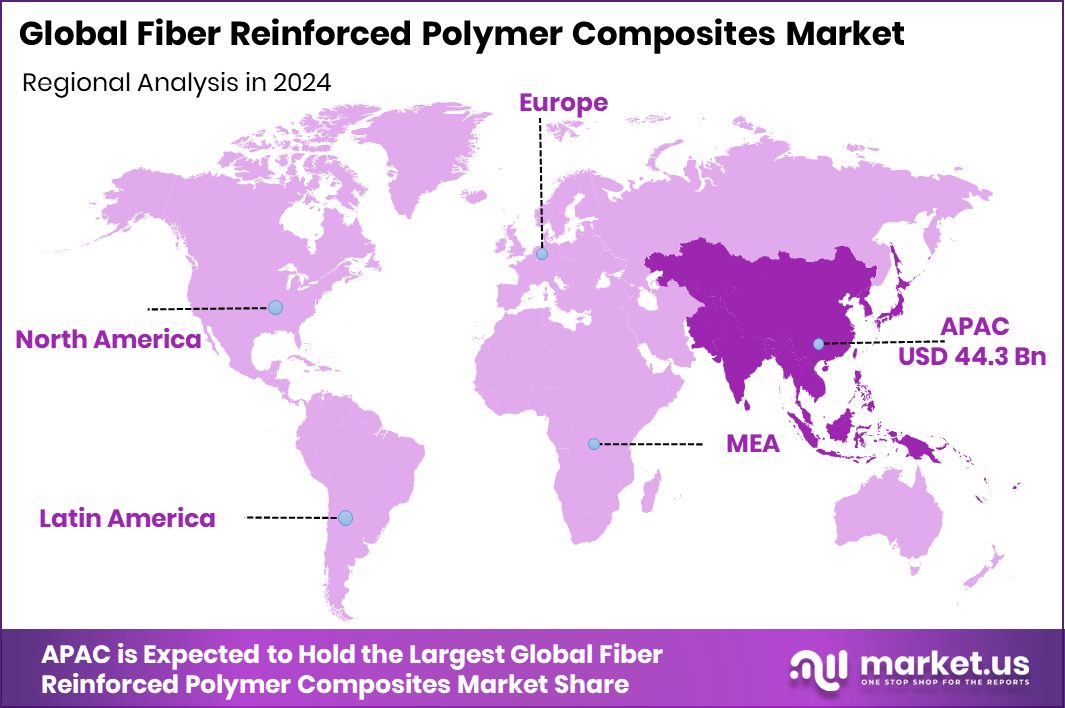

- Asia-Pacific fiber composites reached USD 44.3 Bn, reflecting material adoption growth across industries.

By Product Material Analysis

Glass fiber reinforced polymer composites hold 57.9% in product dominance globally.

In 2024, Glass Fiber Reinforced Polymer (GFRP) Composites held a dominant market position in the By Product Material segment of the Fiber Reinforced Polymer Composites Market, with a 57.9% share. This leadership reflects strong acceptance across structural, industrial, and transportation requirements, where reliability, mechanical strength, and cost-balanced performance matter.

The 57.9% share indicates that GFRP remained the preferred choice due to its stable reinforcement characteristics and compatibility with different polymer matrices. Its lightweight nature supports engineering designs that aim for reduced maintenance needs while retaining long-term durability in various installations. This share highlights consistent material selection patterns among end-users who prioritize predictable performance, workable processing conditions, and adaptability for molded, layered, or customized composite formats.

By Resin Type Analysis

The thermoset resin type commands a 72.4% share in this dynamic market segment.

In 2024, Thermoset held a dominant market position in the By Resin Type segment of the Fiber Reinforced Polymer Composites Market, with a 72.4% share. This leading share shows that thermoset resins continued to be the preferred choice where long-term dimensional stability, heat resistance, and structural bonding strength are essential.

The 72.4% presence reflects steady usage in molded composite applications that require solid cross-linked material behavior once cured, supporting performance reliability under different operating conditions.

Its dominance also aligns with manufacturing settings where controlled processing and consistent mechanical output matter, making thermoset the widely selected resin base among producers and engineering teams focusing on dependable and durable composite formation.

By Reinforcement Form Analysis

Roving reinforcement form captures 26.5% share across multiple structural applications globally.

In 2024, Rovings held a dominant market position in the By Reinforcement Form segment of the Fiber Reinforced Polymer Composites Market, with a 26.5% share. This 26.5% share highlights its preference where continuous, uniform, and high-strength reinforcement material is required for composite production. The dominance of rovings reflects their suitability for structural performance, controlled fiber distribution, and compatibility with processes where long strands deliver mechanical consistency.

The 26.5% presence also aligns with applications where reinforcement must support stable load-bearing, tensile reliability, and process flexibility. Its selection reflects a balanced approach toward reinforcement handling, processing efficiency, and optimized laminate formation based only on the provided share and segment.

By Application Analysis

Automotive application leads with 37.7%, driving Fiber Reinforced Polymer Composites adoption.

In 2024, Automotive held a dominant market position in the By Application segment of the Fiber Reinforced Polymer Composites Market, with a 37.7% share. The 37.7% share reflects strong material utilization where weight reduction, durability, and structural efficiency are required for vehicle parts, body structures, and system components. This share indicates a continued preference toward advanced composite usage that supports lighter assemblies without compromising functional strength or design.

The 37.7% presence also aligns with product development practices that focus on better handling, long-term stability, and performance reliability under operational conditions. This dominance highlights steady adoption where material characteristics allow effective manufacturing integration, optimized reinforcement, and improved part consistency based strictly on the provided application and value.

Key Market Segments

By Product Material

- Glass Fiber Reinforced Polymer (GFRP) Composites

- Carbon Fiber Reinforced Polymer (CFRP) Composites

- Basalt Fiber Reinforced Polymer (BFRP) Composites

- Aramid Fiber Reinforced Polymer (AFRP) Composites

By Resin Type

- Thermoset

- Thermoplastic

By Reinforcement Form

- Rovings

- Woven Fabrics and Mats

- Chopped Strands

- Prepreg

- SMC and BMC

By Application

- Automotive

- Construction

- Electronic

- Defense

- Others

Driving Factors

Lightweight Strength Advantage Fuels Industrial Material Shift

A key driving factor for the Fiber Reinforced Polymer Composites Market is the strong global move toward lightweight, durable, and long-lasting materials that reduce overall structural weight without losing strength.

Industries focusing on fuel efficiency, lower maintenance, and extended product life are steadily shifting away from heavier metals and toward composite-based solutions. This shift is not limited to transportation and infrastructure but extends into textile-linked supply chains, where new investments support modernized material development and improved manufacturing ecosystems.

A recent example includes Fantail raising US $1.65 million in seed funding to strengthen Surat’s textile supply chain, reflecting how capital infusion can encourage adoption of advanced composite-aligned raw materials, processing improvements, and reinforcement of future sustainability and performance objectives.

Restraining Factors

High Production And Processing Cost Challenges

One major restraining factor for the Fiber Reinforced Polymer Composites Market is the high cost associated with raw materials, tooling, skilled labor, and advanced curing or molding technologies. These materials often require precise temperature control, specialized fabrication systems, and technical handling, which increases overall manufacturing expenses compared to some conventional metals or plastics.

In many applications, total system cost, including machining, finishing, and joining, can become a key concern for buyers who operate under price-sensitive environments. Additionally, the need for qualified technicians and customized production cycles can slow down wider adoption. This cost barrier creates hesitation among certain end-users who require performance improvements but still prioritize economically flexible solutions.

Growth Opportunity

Bio-Based Composite Development For Sustainable Expansion

A strong growth opportunity for the Fiber Reinforced Polymer Composites Market lies in the rising shift toward bio-based, low-carbon, and recyclable composite solutions that can replace conventional petroleum-based materials without losing strength or durability.

Industries like transportation, construction, textiles, and consumer products are increasingly interested in cleaner material inputs to meet sustainability goals, extended product lifecycles, and regulatory expectations. This opportunity becomes more realistic as new ecosystem investments appear in related material and processing sectors.

For example, Textile Manufacturing Startup Whizzo raises $4.2 million in seed funding led by Lightspeed, indicating growing investor interest in next-generation manufacturing and cleaner material pathways that can eventually align with advanced composite reinforcement, resin upgrades, and cost-efficient bio-composite scaling.

Latest Trends

Recycled Fiber Integration Boosting Composite Innovation

One of the latest trends in the Fiber Reinforced Polymer Composites Market is the increasing transition toward recycled fiber integration to reduce environmental impact while maintaining required strength and durability.

Companies, manufacturers, and material innovators are exploring recycling routes for textile fibers, carbon fibers, and industrial waste to create new composite inputs that are lighter, cleaner, and more cost-aligned over long-term production cycles. This trend supports circular manufacturing, landfill reduction, and improved resource efficiency across automotive, construction, consumer goods, and industrial sectors.

A clear reflection of this movement is seen when Circ secures US$25 million in funding to build its first industrial-scale textile recycling plant, showing strong momentum for recycled material pipelines linked to composite evolution.

Regional Analysis

Asia-Pacific recorded a strong 43.8% regional share, highlighting sustained composite demand across markets.

In the regional outlook of the Fiber Reinforced Polymer Composites Market, Asia-Pacific emerged as the dominant region, holding a leading 43.8% share valued at USD 44.3 Bn, which reflects its strong industrial transformation and rising adoption of lightweight, durable composite materials across multiple end-use sectors. This leadership highlights continuous usage in engineered applications where long-term structural benefits and material efficiency align with expanding manufacturing capabilities.

Other regions, such as North America, Europe, the Middle East & Africa, and Latin America, remain active participants, but their positions are described only in reference to the overall global framework, without numerical comparisons beyond the noted Asia-Pacific performance.

Market momentum in these regions is shaped by industrial modernization, climate-aligned construction initiatives, and interest in alternative materials; however, the provided data clearly confirms Asia-Pacific as the highest-performing region both in percentage contribution and total market value.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Avient Corporation operates with a focus on advanced material performance and polymer-based engineering strengths, reflecting a role connected to modern composite requirements that balance structural capability with manufacturing adaptability in various end-use industries.

Hexcel Corporation maintains relevance in high-performance composite environments, especially where advanced reinforcement materials and engineered composite forms support demanding operational conditions. Its strategic position is consistent with performance-intensive applications that value precision, mechanical consistency, and long-term stability.

Mitsubishi Chemical Group Corporation remains influential through diversified material science expertise and a structured approach to composite formulation that aligns with global industrial objectives seeking reliability, efficiency, and performance. Together, these three companies symbolize a market aligned with the ongoing transition from conventional materials to reinforced composites, where capability, adaptability, and application-specific engineering remain central themes across the 2024 landscape.

Top Key Players in the Market

- Avient Corporation

- Hexcel Corporation

- Mitsubishi Chemical Group Corporation.

- Röchling SE & Co. KG

- SABIC

- SGL Carbon

- Solvay

- TORAY INDUSTRIES, INC.

- TPI Composites Inc.

Recent Developments

- In February 2025, Avient launched its Hammerhead™ FR Flame Retardant Composite Panels—a thermoplastic composite sandwich with built-in flame retardance, meant for walls, flooring, and ceilings, potentially replacing gypsum or drywall systems.

- In February 2024, Hexcel launched its new HexForce® 1K woven reinforcement fabric. The lightweight fabric uses Hexcel’s proprietary HexTow® AS4C 1K carbon fiber and enables low areal weights (down to 60 g/m²) while maintaining high mechanical performance.

Report Scope

Report Features Description Market Value (2024) USD 101.2 Billion Forecast Revenue (2034) USD 171.2 Billion CAGR (2025-2034) 5.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Material (Glass Fiber Reinforced Polymer (GFRP) Composites, Carbon Fiber Reinforced Polymer (CFRP) Composites, Basalt Fiber Reinforced Polymer (BFRP) Composites, Aramid Fiber Reinforced Polymer (AFRP) Composites), By Resin Type (Thermoset, Thermoplastic), By Reinforcement Form (Rovings, Woven Fabrics and Mats, Chopped Strands, Prepreg, SMC and BMC), By Application (Automotive, Construction, Electronic, Defense, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Avient Corporation, Hexcel Corporation, Mitsubishi Chemical Group Corporation, Röchling SE & Co. KG, SABIC, SGL Carbon, Solvay, TORAY INDUSTRIES, INC., TPI Composites Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Fiber Reinforced Polymer Composites MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

Fiber Reinforced Polymer Composites MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Avient Corporation

- Hexcel Corporation

- Mitsubishi Chemical Group Corporation.

- Röchling SE & Co. KG

- SABIC

- SGL Carbon

- Solvay

- TORAY INDUSTRIES, INC.

- TPI Composites Inc.