Global Fatty Acid Supplements Market Size, Share, And Business Benefits By Source (Marine Oil, Algal Oil, Flaxseed Oil, Others), By Application (Dietary Supplements, Functional Food, Beverages, Infant Formula, Pharmaceuticals, Others), By Distribution Channel (Supermarket and Hypermarket, Department Stores, Drug Stores, Online, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 156738

- Number of Pages: 317

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

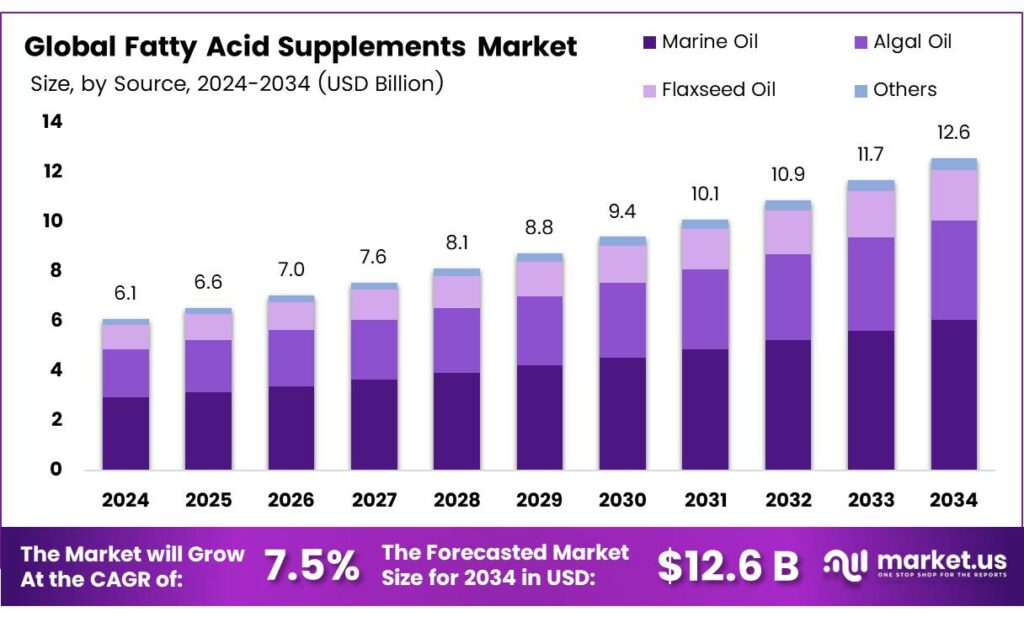

The Global Fatty Acid Supplements Market size is expected to be worth around USD 12.6 billion by 2034, from USD 6.1 billion in 2024, growing at a CAGR of 7.5% during the forecast period from 2025 to 2034.

Polyunsaturated fatty acids (PUFAs) are divided into two main classes: omega-3 and omega-6 fatty acids. Like all fatty acids, they are made up of long carbon chains with a carboxyl group at one end and a methyl group at the other. What sets PUFAs apart from saturated and monounsaturated fatty acids is the presence of two or more double bonds along the carbon chain.

Omega-3 fatty acids are a key type of PUFA, with their first carbon–carbon double bond located three carbons from the methyl end of the chain. Also called n-3s, they are found in foods such as flaxseed and fish, as well as in fish oil supplements. Among the several omega-3s, three are the most studied: alpha-linolenic acid (ALA), eicosapentaenoic acid (EPA), and docosahexaenoic acid (DHA). ALA has 18 carbon atoms, while EPA and DHA are long-chain omega-3s with 20 and 22 carbons, respectively.

The human body cannot form double bonds beyond the ninth carbon from the methyl end, making both ALA and linoleic acid essential fatty acids that must come from the diet. While ALA can be converted into EPA and then DHA, this process occurs mostly in the liver and is very limited, with conversion rates reported at less than 15%. Because of this, directly consuming EPA and DHA from food or supplements is the most effective way to raise their levels in the body.

Absorption of omega-3s is highly efficient, with a rate of about 95%, similar to other dietary fats. In the intestines, free fatty acids are absorbed into cells, packaged into chylomicrons, and transported into the bloodstream through the lymphatic system. Nutrient intake guidelines for fatty acids are established by the Dietary Reference Intakes (DRIs), developed by the Food and Nutrition Board of the Institute of Medicine, now known as the National Academy of Medicine.

The Recommended Dietary Allowance (RDA), which meets the needs of 97%–98% of healthy individuals; Adequate Intake (AI), set when evidence is not sufficient for an RDA but ensures adequacy; the Estimated Average Requirement (EAR), which meets the needs of 50% of individuals and is often used to assess groups; and the Tolerable Upper Intake Level (UL), which is the maximum intake unlikely to cause harmful effects.

Key Takeaways

- The Global Fatty Acid Supplements Market is projected to grow from USD 6.1 billion in 2024 to USD 12.6 billion by 2034, at a CAGR of 7.5%.

- Marine Oil led the market in 2024 with a 48.2% share, driven by the popularity of fish and krill oil for omega-3 benefits.

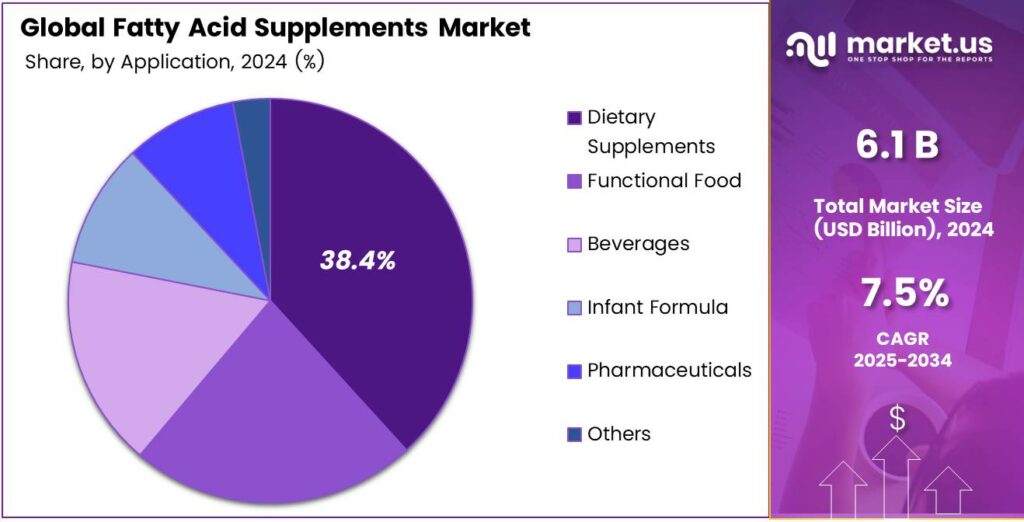

- Dietary Supplements held a 38.4% market share in 2024, fueled by demand for convenient formats like soft gels and gummies.

- Supermarkets and Hypermarkets captured a 38.6% share in 2024, favored for their wide variety of supplement brands.

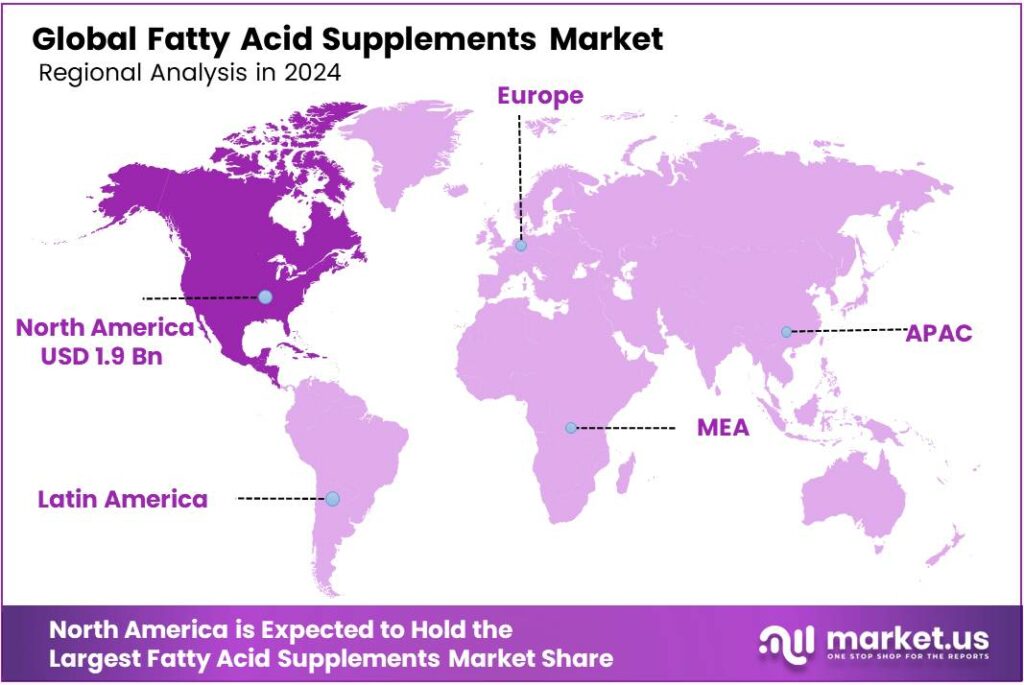

- North America dominated with a 32.6% revenue share in 2024, valued at USD 1.9 billion, due to high consumer awareness and robust retail infrastructure.

Analyst Viewpoint

The Fatty Acid Supplements Market, particularly omega-3 and omega-6 products, is buzzing with potential for investors, driven by growing consumer demand for health-focused solutions. People are increasingly aware of the benefits of fatty acids, like supporting heart health, reducing inflammation, and boosting brain function, which has fueled a surge in demand for dietary supplements and functional foods.

Investment opportunities shine in plant-based innovations, like algae-derived omega-3s, catering to the rising vegan and sustainability-conscious crowd. E-commerce is another goldmine, as online platforms make it easier for brands to reach health-savvy consumers globally. However, risks lurk in the shadows. Price volatility of raw materials like fish oil, coupled with overfishing concerns, could squeeze margins.

On the flip side, technological advancements are a game-changer, with innovations like microencapsulation improving bioavailability and tackling the dreaded fishy aftertaste, which could broaden consumer appeal. Regulatory hurdles, though, are a real challenge. Strict guidelines in regions like the EU demand rigorous proof of health claims, which can delay product launches and hike costs.

By Source

Marine Oil Leads with 48.2% Market Share

In 2024, Marine Oil held a dominant market position, capturing more than a 48.2% share in the global fatty acid supplements market. This strong presence comes from the wide use of fish oil and krill oil as primary sources of omega-3 fatty acids, particularly EPA and DHA, which are well recognized for supporting heart health, cognitive function, and reducing inflammation.

The demand for marine-derived fatty acids is further driven by the increasing prevalence of cardiovascular diseases worldwide, with the World Health Organization reporting cardiovascular conditions as the leading cause of mortality. The marine oil segment is expected to maintain its leadership position as consumers continue to prioritize high-quality natural sources of fatty acids.

Growing awareness about preventive health care, coupled with the rising popularity of supplements for brain and eye health, is expected to fuel consumption. Additionally, advancements in sustainable fishing practices and growing investments in aquaculture are ensuring a steady supply of raw materials, supporting consistent growth for the marine oil category.

By Application

Dietary Supplements Lead with 38.4% Market Share

In 2024, Dietary Supplements held a dominant market position, capturing more than a 38.4% share of the global fatty acid supplements market. This dominance is largely due to the increasing consumer preference for convenient, easy-to-consume formats such as soft gels, capsules, and gummies.

Growing awareness of the health benefits of fatty acids, particularly omega-3, omega-6, and omega-9, has positioned dietary supplements as a reliable solution for managing heart health, brain function, and immunity. Rising cases of lifestyle-related illnesses and nutrient deficiencies have further pushed individuals to adopt supplements as part of their daily routines.

The dietary supplements segment is expected to expand steadily, supported by the global shift toward preventive healthcare and self-directed nutrition. Younger demographics are also showing higher interest in wellness products, creating new opportunities for flavored, plant-based, and vegan-friendly fatty acid supplements.

By Distribution Channel

Supermarkets and Hypermarkets Dominate with 38.6% Market Share

In 2024, Supermarket and Hypermarket held a dominant market position, capturing more than a 38.6% share of the global fatty acid supplements market. This leadership stems from their ability to offer consumers a wide variety of supplement brands and product formats under one roof, making them a preferred choice for bulk and convenient purchases.

The visibility of fatty acid supplements on shelves, coupled with promotional offers and discounts, has significantly influenced consumer buying behavior. Shoppers often rely on these retail formats not only for accessibility but also for trust in established distribution channels.

Supermarkets and hypermarkets are expected to maintain their strong position as urbanization and rising middle-class incomes continue to drive foot traffic in these stores. The growing trend of health-conscious shopping, where consumers actively seek supplements alongside regular groceries, further strengthens the role of these outlets. Additionally, the expansion of global retail chains into emerging markets is likely to increase product penetration and boost sales volumes.

Key Market Segments

By Source

- Marine Oil

- Algal Oil

- Flaxseed Oil

- Others

By Application

- Dietary Supplements

- Functional Food

- Beverages

- Infant Formula

- Pharmaceuticals

- Others

By Distribution Channel

- Supermarket and Hypermarket

- Department Stores

- Drug Stores

- Online

- Others

Drivers

Growing Recognition of Omega-3 Fatty Acids in Heart Health

In 2025, one of the most powerful drivers behind the rising demand for fatty acid supplements, especially omega‑3s, stems from strong backing by trusted health authorities and governments. People are becoming more aware that omega‑3s play a critical role in supporting heart health and lowering the risks linked to cardiovascular diseases.

For instance, a study published in the Journal of the American Heart Association found that taking 3 grams per day of combined EPA and DHA (the key omega‑3 fatty acids commonly found in fish oil) may help reduce blood pressure, a major risk factor for heart disease.

This is a clear, evidence-based recommendation from a reputable source that resonates well with consumers and adds substantial credibility to the benefits of omega‑3 supplementation. This is a clear, evidence-based recommendation from a reputable source that resonates well with consumers and adds substantial credibility to the benefits of omega‑3 supplementation.

Restraints

Safety Concerns Over High-Dose Intake

One key restraint in the fatty acid supplements market stems from safety concerns around consuming too much EPA and DHA, especially when supplements exceed recommended limits. Trusted organizations and government agencies caution that high intake levels may lead to adverse health effects, such as impaired immune function or increased bleeding risks.

From a human perspective, these safety limits matter deeply. People don’t want to feel like common sense takes a back seat to health trends. The fact that respected governmental bodies draw clear lines 2 g via supplements, 3 g total, and around 5 g upper limit is a signal that moderation isn’t just smart, it’s necessary.

Because of these concerns, many consumers proceed with caution. They speak with their doctors before starting supplements, especially when they’re on other medications or managing health conditions. That extra step slows market growth. It also means brands and producers need to offer clarity labels should clearly state dosage, and consumers should have access to professional advice.

Opportunity

Rising Awareness of EPA & DHA Benefits in Heart Health

In 2025, one of the biggest growth drivers for the fatty acid supplements market is the growing awareness and strong recommendations from trusted health organizations regarding the benefits of EPA and DHA, two important omega‑3 fatty acids, for heart health.

The American Heart Association (AHA) recommends that people with existing coronary heart disease, such as those recovering from a heart attack, aim for approximately 1 gram per day of EPA plus DHA. Supplements are an option under medical advice. Moreover, for individuals dealing with high triglyceride levels, prescription omega‑3s at 4 grams per day have been shown to effectively lower these fats when used alone or alongside other lipid-lowering medications.

Even in the general population, efforts to boost omega‑3 intake are gaining traction. The U.S. Dietary Guidelines encourage consuming about eight ounces of seafood per week, which translates to approximately 250 mg per day of EPA and DHA. Yet, actual intake remains low. A study highlighted that only 15% of the global population receives that level of EPA and DHA through current consumption of fish and supplements combined.

Trends

Growing Popularity of Algae-Based Omega-3 as a Sustainable Source

In 2025, one of the most exciting emerging trends in the fatty acid supplements market is the rising demand for algae‑based omega‑3. This shift is driven by growing environmental awareness and a clear push from trusted health and sustainability sources toward more plant-based, eco-friendly alternatives.

From a human standpoint, people increasingly want supplements that are effective and kind to the planet. They’re asking, “Can I get my omega‑3 without harming fish stocks or the environment?” Algae oil answers that. It bypasses fish entirely yet delivers the same vital fats, EPA and DHA, that our bodies need.

Leading institutions also back the health value. For example, public health authorities often recommend 250 mg per day of EPA plus DHA for adults, and even upwards of 300 mg per day for pregnant or lactating women. Algae-based supplements can easily help meet these guidelines in a clean, plant-based package.

Regional Analysis

North America Dominates with 32.6%, USD 1.9 Billion Market Share

The North American region is the dominant force in the global fatty acid supplements market, holding a commanding revenue share of approximately 32.6%, which equated to a market value of nearly USD 1.9 billion in 2024. This preeminent position is fueled by several key factors, including high consumer awareness of the health benefits associated with Omega-3s and a well-established retail and e-commerce infrastructure for dietary supplements.

The United States is the primary driver within the region, characterized by a strong culture of preventative healthcare and a high prevalence of lifestyle-related conditions such as cardiovascular diseases, which propel demand for heart-healthy supplements.

Market growth is further supported by continuous product innovation, including the development of specialized formulations, delivery formats like gummies and emulsions, and a growing emphasis on sustainability and purity in sourcing.

While the market is mature, it continues to exhibit steady growth, driven by expanding applications in cognitive health, prenatal nutrition, and anti-inflammatory support. The region’s stringent regulatory framework, governed by the FDA, also instills consumer confidence in product quality and labeling claims, solidifying its leadership status in the global landscape.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Koninklijke DSM N.V. leverages its extensive nutritional expertise to be a frontrunner in the fatty acid supplements market. Following its merger with Firmenich, it operates as DSM-Firmenich, strengthening its position in precision fermentation and biotechnology. The company is a major supplier of high-quality, sustainably sourced marine and algal Omega-3 ingredients.

Arista Industries operates as a specialized, high-quality supplier of pure botanical oils and fatty acid concentrates. The company distinguishes itself by focusing on purity, customization, and a diverse portfolio that includes Omega-3, 6, 7, and 9 from sources like fish, flaxseed, borage, and sea buckthorn. Arista’s strength lies in its contract manufacturing and private label services, providing tailored solutions for other brands.

Croda International Plc, through its Health Care division, is a premier supplier of innovative lipid-based ingredients. Its acquisition of Incotec and Avanti Polar Lipids underscores a strategic focus on advanced drug delivery and bioavailability enhancement. Croda provides highly purified Omega-3s and other lipid systems used in pharmaceuticals, nutraceuticals, and clinical nutrition.

Top Key Players in the Market

- Koninklijke DSM N.V.

- Arista Industries

- Croda Health Care

- Copeinca AS

- Glaxo Smith Kline plc

- EFG Elbe Fetthandel GmbH

- Epax AS

- KANCOR

- Mahashian Di Hatti Pvt., Ltd.

- Ajinomoto Co. Inc

Recent Developments

- In 2024, DSM announced a merger with Firmenich, forming DSM-Firmenich. This merger enhances DSM’s capabilities in nutrition and health, including fatty acid supplements, by combining expertise in flavors, fragrances, and nutritional ingredients. The new entity focuses on sustainable and innovative solutions for omega-3 and other lipid-based products.

- In 2024, Arista Industries expanded its offerings of plant-based omega-3 supplements, particularly algal DHA oils, in response to growing consumer demand for sustainable alternatives to fish oil. The company partnered with suppliers to ensure a steady supply of non-GMO algal oils for dietary supplements.

Report Scope

Report Features Description Market Value (2024) USD 6.1 Billion Forecast Revenue (2034) USD 12.6 Billion CAGR (2025-2034) 7.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Marine Oil, Algal Oil, Flaxseed Oil, Others), By Application (Dietary Supplements, Functional Food, Beverages, Infant Formula, Pharmaceuticals, Others), By Distribution Channel (Supermarket and Hypermarket, Department Stores, Drug Stores, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Koninklijke DSM N.V., Arista Industries, Croda Health Care, Copeinca AS, Glaxo Smith Kline plc, EFG Elbe Fetthandel GmbH, Epax AS, KANCOR, Mahashian Di Hatti Pvt., Ltd., Ajinomoto Co. Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Fatty Acid Supplements MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample

Fatty Acid Supplements MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Koninklijke DSM N.V.

- Arista Industries

- Croda Health Care

- Copeinca AS

- Glaxo Smith Kline plc

- EFG Elbe Fetthandel GmbH

- Epax AS

- KANCOR

- Mahashian Di Hatti Pvt., Ltd.

- Ajinomoto Co. Inc