Global Ethoxyquin Market Size, Share, And Business Benefits By Product(Ethxyquin-95 Oil, Ethxyquin-66 Powder, Ethxyquin-33 Powder), By End-use (Animal Feed Industry, Agriculture, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: August 2025

- Report ID: 155321

- Number of Pages: 231

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

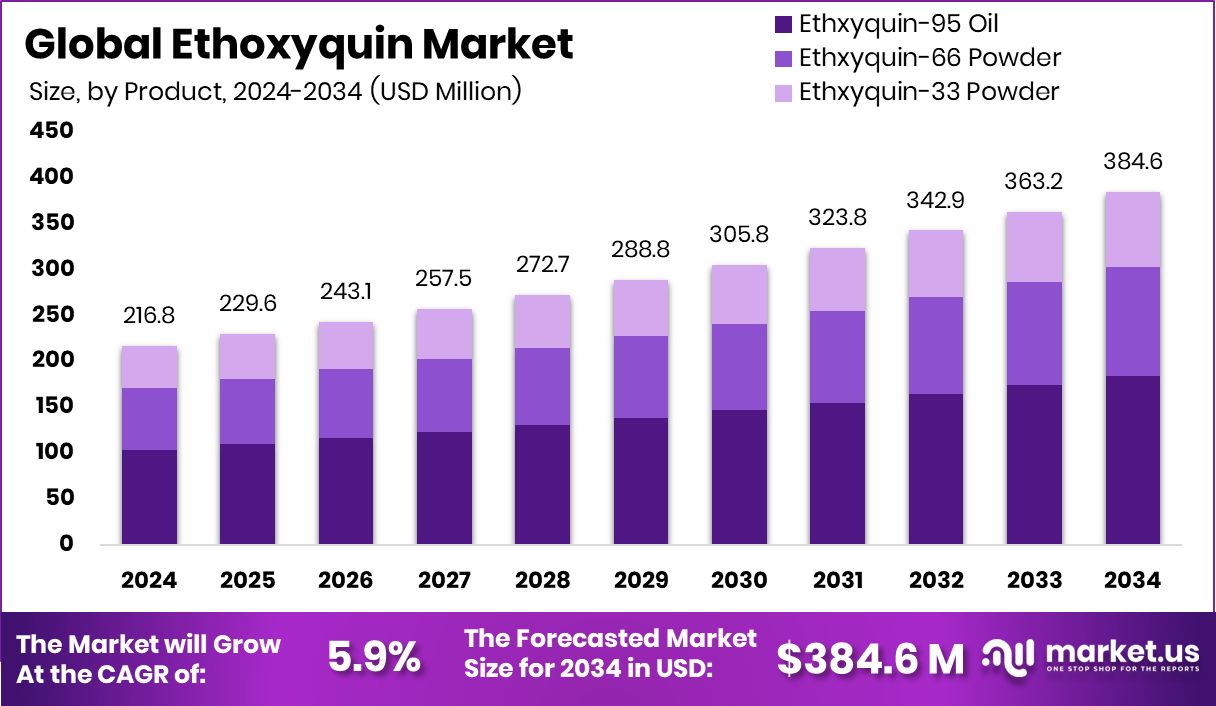

The Global Ethoxyquin Market is expected to be worth around USD 384.6 million by 2034, up from USD 216.8 million in 2024, and is projected to grow at a CAGR of 5.9% from 2025 to 2034. Strong aquaculture and livestock sectors drive the Asia Pacific’s 47.90% market growth.

Ethoxyquin is a synthetic antioxidant primarily used to prevent the oxidation of fats and pigments in animal feed, pet food, and certain agricultural products. It helps maintain nutritional value, color stability, and shelf life by slowing down the degradation caused by exposure to oxygen, light, and heat. Ethoxyquin is valued for its effectiveness at low concentrations, making it a cost-efficient preservative in feed manufacturing. While its use in human food is restricted in many regions, it remains an important additive in feed formulations for poultry, aquaculture, and livestock.

The Ethoxyquin market refers to the global trade, production, and consumption of this antioxidant, largely driven by the animal nutrition sector. Demand is closely tied to the growth of the livestock and aquaculture industries, where feed stability is crucial for maintaining quality during storage and transportation. Market activity is influenced by regulatory frameworks, regional feed demand, and shifts in protein consumption trends.

Growth factors include rising global meat and fish consumption, which increases the need for stable, nutrient-rich feed. Ethoxyquin helps prevent feed spoilage during long supply chains, particularly in humid or warm climates where oxidation risk is high.

Demand is supported by the expansion of aquaculture and commercial livestock farming, as producers seek reliable preservatives to maintain feed quality. Additionally, the trend toward intensive farming methods amplifies the need for antioxidants that ensure feed efficiency and nutritional retention.

Key Takeaways

- The Global Ethoxyquin Market is expected to be worth around USD 384.6 million by 2034, up from USD 216.8 million in 2024, and is projected to grow at a CAGR of 5.9% from 2025 to 2034.

- In 2024, Ethoxyquin-95 Oil led the Ethoxyquin market, capturing 47.9% due to its high efficiency.

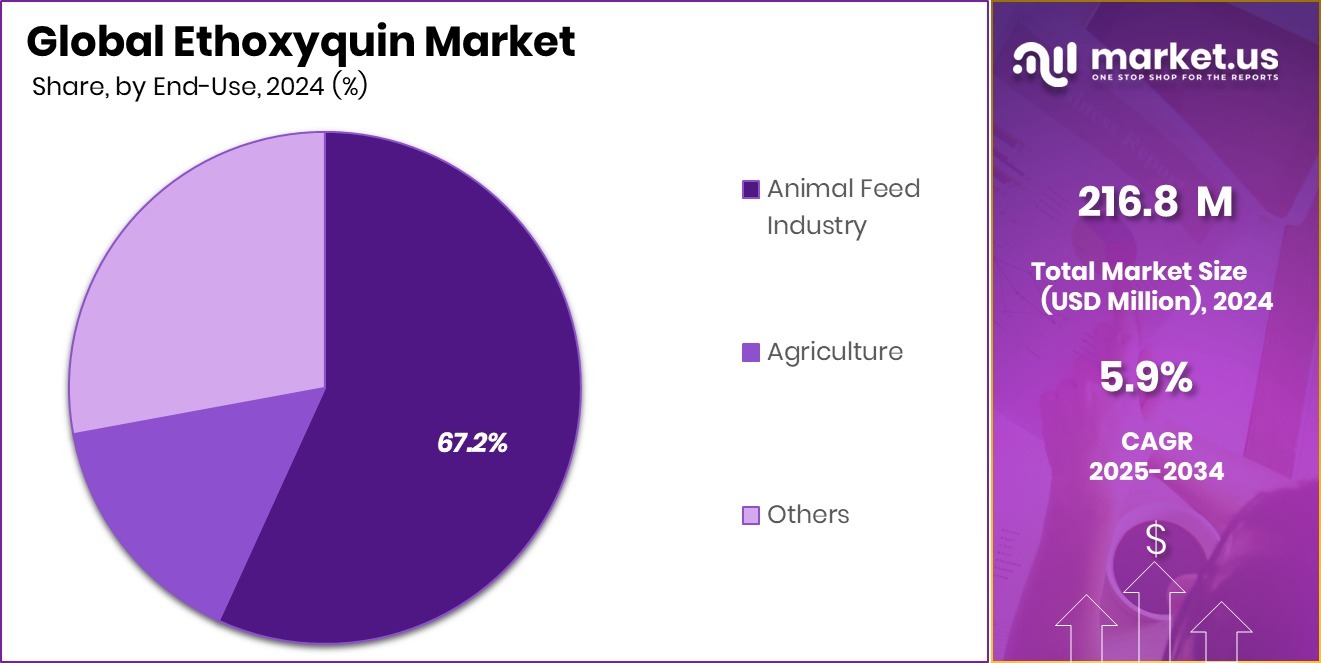

- The animal feed industry dominated the Ethoxyquin market in 2024, holding a 67.2% share driven by feed preservation needs.

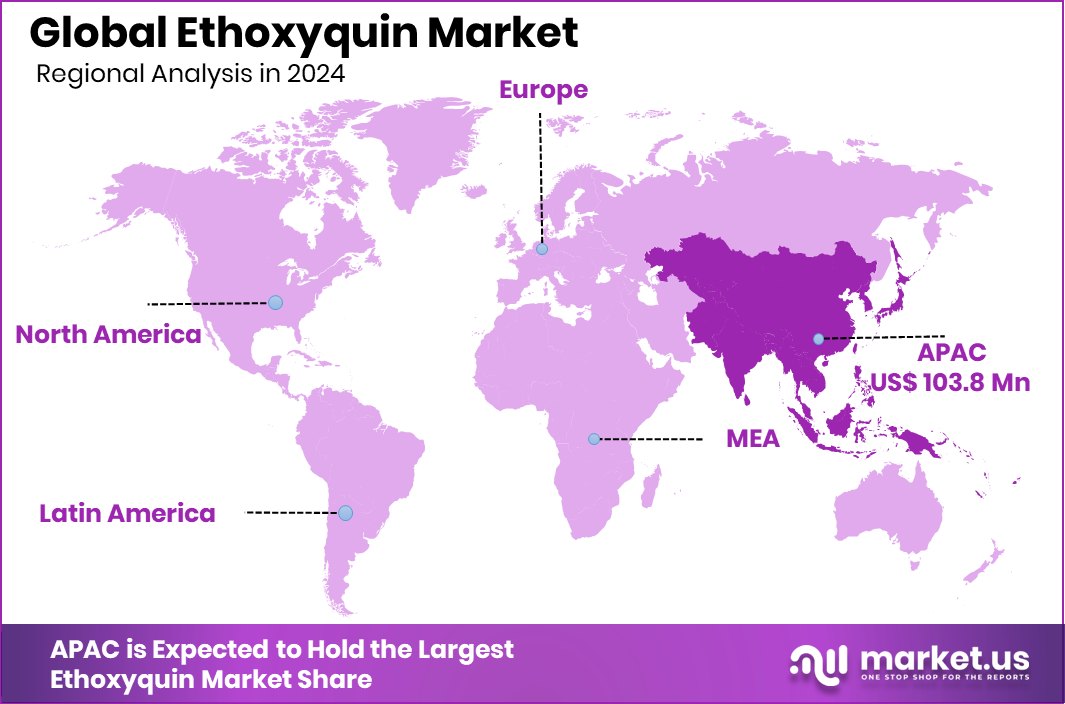

- The Asia Pacific Ethoxyquin market reached USD 103.8 million.

By Product Analysis

Ethoxyquin-95 Oil holds a 47.9% share, driving stability in the global Ethoxyquin Market.

In 2024, Ethoxyquin-95 Oil held a dominant market position in the By Product segment of the Ethoxyquin Market, capturing a substantial 47.9% share. This strong lead is primarily attributed to its high effectiveness as an antioxidant in preserving the quality of animal feed, especially in aquaculture, poultry, and livestock sectors.

Its oil-based formulation allows for better dispersion and uniform mixing in feed, ensuring consistent protection against oxidative degradation during storage and transportation. The segment’s growth is further supported by its proven stability under varying climatic conditions, making it highly suitable for regions with high humidity and temperature fluctuations.

The widespread adoption of Ethoxyquin-95 Oil is also linked to the increasing demand for feed products with extended shelf life, reducing losses from spoilage and maintaining nutritional integrity. Its cost-effectiveness at low dosage levels makes it an attractive choice for feed manufacturers aiming to optimize production efficiency without compromising quality.

Additionally, the steady rise in global protein consumption, particularly from meat and seafood, continues to drive the need for high-quality feed preservatives. With its strong performance profile and adaptability to diverse production environments, Ethoxyquin-95 Oil is expected to maintain its leadership in the product segment over the near term.

By End-use Analysis

The animal feed industry dominates with a 67.2% share in the expanding ethoxyquin market.

In 2024, the Animal Feed Industry held a dominant market position in the By End-use segment of the Ethoxyquin Market, with a commanding 67.2% share. This dominance is driven by the critical role Ethoxyquin plays in preventing oxidation of fats, oils, and pigments in feed, thereby preserving nutritional value and extending shelf life.

In the animal feed sector, consistent quality is essential to maintain livestock health, feed efficiency, and overall productivity, making antioxidants like Ethoxyquin indispensable. Its effectiveness at low inclusion rates offers both economic and functional benefits, reducing wastage and ensuring feed stability during storage and long-distance transportation.

The growth of this segment is further fueled by the rapid expansion of intensive livestock farming and aquaculture, where feed accounts for a major portion of production costs. In these systems, feed spoilage can directly affect profitability, making Ethoxyquin a cost-efficient safeguard. Additionally, rising global demand for meat, dairy, and fish products directly boosts feed production, thereby increasing the use of antioxidants.

The product’s proven reliability in various climatic conditions, especially in tropical and subtropical regions prone to faster oxidation, reinforces its preference among feed manufacturers. With strong market reliance and steady demand, the Animal Feed Industry is set to sustain its leadership position.

Key Market Segments

By Product

- Ethxyquin-95 Oil

- Ethxyquin-66 Powder

- Ethxyquin-33 Powder

By End-use

- Animal Feed Industry

- Agriculture

- Others

Driving Factors

Rising Demand for Quality Animal Feed Worldwide

One of the biggest driving factors for the Ethoxyquin market is the growing global demand for high-quality animal feed. As livestock and aquaculture industries expand to meet the rising need for meat, fish, eggs, and dairy, the focus on feed quality has become stronger. Ethoxyquin helps prevent the oxidation of fats, oils, and pigments in feed, keeping it fresh and nutrient-rich for longer periods.

This is especially important in regions with warm and humid climates, where feed spoilage happens faster. By protecting the feed’s nutritional value during storage and transport, Ethoxyquin supports better animal health and productivity. The push for longer shelf life and reduced wastage in feed production continues to boost its adoption worldwide.

Restraining Factors

Strict Regulations on Ethoxyquin Usage in Feed

A major restraining factor for the Ethoxyquin market is the presence of strict regulations in several countries regarding its usage in animal feed. Concerns about potential health and environmental impacts have led some regions to limit or ban its application, particularly in products linked to human food supply chains. Regulatory bodies often require detailed safety evaluations, residue monitoring, and compliance with maximum permitted levels, which can slow down product approvals and market expansion.

These restrictions create uncertainty for feed manufacturers, who may be cautious about investing in Ethoxyquin-based formulations. As a result, producers often need to explore alternative antioxidants or modify formulations to meet legal requirements, impacting overall growth potential in regulated markets.

Growth Opportunity

Expanding Aquaculture Industry Boosting Antioxidant Demand

A key growth opportunity for the Ethoxyquin market lies in the rapid expansion of the global aquaculture industry. Fish and seafood farming is increasing to meet rising protein demand, especially in the Asia-Pacific and Latin America. In aquaculture, feed quality is critical because fish feed often contains high levels of fats and oils, which are prone to oxidation.

Ethoxyquin helps maintain feed freshness, nutritional value, and color stability during long storage and transport periods, especially in hot and humid conditions. As more countries invest in aquaculture infrastructure and export-oriented seafood production, the need for reliable antioxidants will rise. This creates a strong opportunity for Ethoxyquin suppliers to meet growing feed preservation needs in this fast-expanding sector.

Latest Trends

Shift Towards Customized Ethoxyquin Feed Formulations

One of the latest trends in the Ethoxyquin market is the growing shift toward customized feed formulations that match specific livestock or aquaculture needs. Instead of using a single standard antioxidant solution, feed manufacturers are now working on tailored blends where Ethoxyquin is combined with other preservatives or additives for enhanced performance.

This approach helps address varied oxidation risks depending on the type of feed, fat content, storage duration, and regional climate. Such customization ensures better shelf life, nutrient retention, and cost efficiency for farmers. With advancements in feed technology and increasing awareness of targeted nutrition, this trend is gaining traction, allowing Ethoxyquin suppliers to offer more specialized and value-added solutions to their customers.

Regional Analysis

In 2024, the Asia Pacific held 47.90% market share.

In 2024, Asia Pacific emerged as the dominant region in the Ethoxyquin market, accounting for 47.90% of the global share, valued at USD 103.8 million. This leadership is largely driven by the region’s robust aquaculture and livestock industries, particularly in countries like China, India, Vietnam, and Indonesia, where demand for high-quality, oxidation-resistant feed is steadily increasing. The tropical and subtropical climate across much of the Asia Pacific accelerates feed spoilage, making antioxidants like Ethoxyquin essential for maintaining nutrient stability during storage and transport.

Growing meat and seafood consumption, coupled with expanding export-oriented aquaculture operations, further boosts demand. While Asia Pacific leads, North America and Europe also hold significant market positions, supported by advanced feed production technologies and strong regulatory compliance frameworks. The Middle East & Africa, along with Latin America, are witnessing gradual growth due to rising protein consumption and improving feed manufacturing capacities.

However, Asia Pacific’s combination of large-scale animal farming, climatic challenges, and strong feed production output ensures its continued dominance in the global Ethoxyquin market. This regional strength is expected to persist, supported by ongoing investments in aquaculture infrastructure and the increasing emphasis on reducing post-production feed losses.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BASF SE continues to strengthen its position through its advanced chemical manufacturing capabilities, offering high-quality Ethoxyquin solutions tailored for the animal feed industry. The company’s global reach and strong distribution network enable it to serve both developed and emerging markets efficiently, supporting feed preservation needs across diverse climatic conditions.

Perstorp Group focuses on specialty chemicals, with its Ethoxyquin offerings aligned to meet feed industry demands for antioxidant stability and long shelf life. Its commitment to product quality and adaptability to varying regional regulations enhances its competitive edge, especially in aquaculture-heavy markets. Perstorp’s expertise in sustainable chemical solutions also aligns with the industry’s gradual shift towards safer and more environmentally responsible additives.

Kemin Industries, Inc. remains a vital player through its emphasis on research-driven feed additives, ensuring that its Ethoxyquin products deliver consistent performance and nutritional protection. The company’s strong presence in both livestock and aquaculture sectors reflects its ability to adapt to evolving market needs. With manufacturing and innovation hubs strategically located worldwide, Kemin is well-positioned to respond quickly to market shifts.

Top Key Players in the Market

- BASF SE

- Perstorp Group

- Kemin Industries, Inc.

- Cargill

- Adisseo Group

- DSM Nutritional Products

- Zhejiang Medicine Co.Ltd.

- Impextraco NV

Recent Developments

- In January 2025, Adisseo reported double-digit growth, with +18% in revenue and +67% in gross profit, highlighting a particularly robust performance in specialty and performance product lines, such as methionine and vitamins.

- In October 2024, Perstorp Group announced the appointment of Ian Atterbury as Senior Vice President to lead its Animal Nutrition growth plan, effective January 2025. This reinforces their focus on nutrition solutions such as gut health and feed additives.

Report Scope

Report Features Description Market Value (2024) USD 216.8 Million Forecast Revenue (2034) USD 384.6 Million CAGR (2025-2034) 5.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product(Ethxyquin-95 Oil, Ethxyquin-66 Powder, Ethxyquin-33 Powder), By End-use (Animal Feed Industry, Agriculture, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF SE, Perstorp Group, Kemin Industries, Inc., Cargill, Adisseo Group, DSM Nutritional Products, Zhejiang Medicine Co.Ltd., Impextraco NV Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BASF SE

- Perstorp Group

- Kemin Industries, Inc.

- Cargill

- Adisseo Group

- DSM Nutritional Products

- Zhejiang Medicine Co.Ltd.

- Impextraco NV