Global Drill Bit (Gas and Oil) Market Size, Share, Growth Analysis By Type (Roller Cone Cutter Bits, Fixed Cutter Bits), By Application (Onshore, Offshore) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 168464

- Number of Pages: 367

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

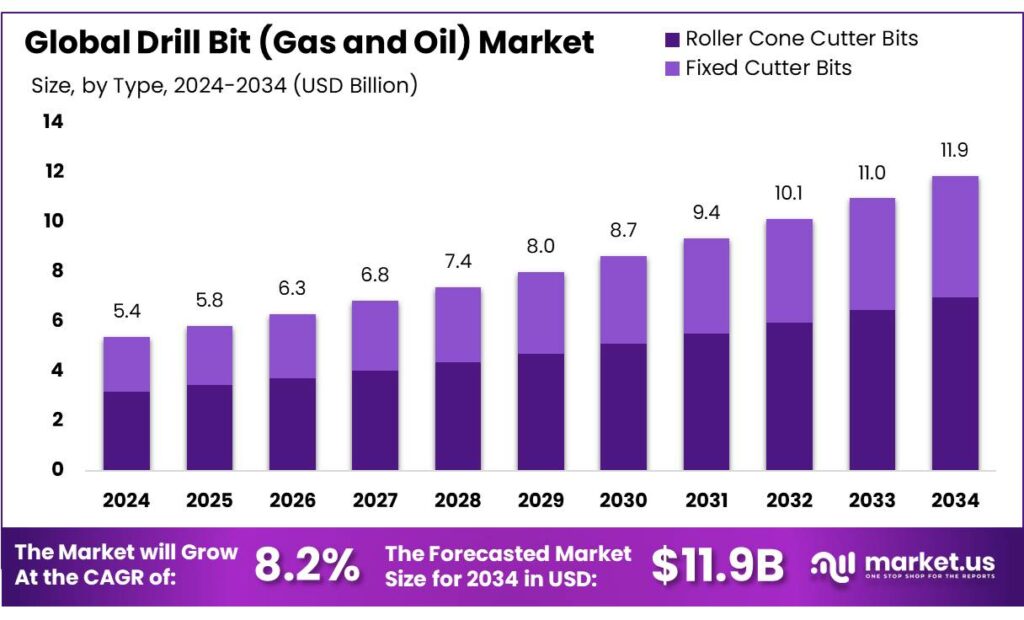

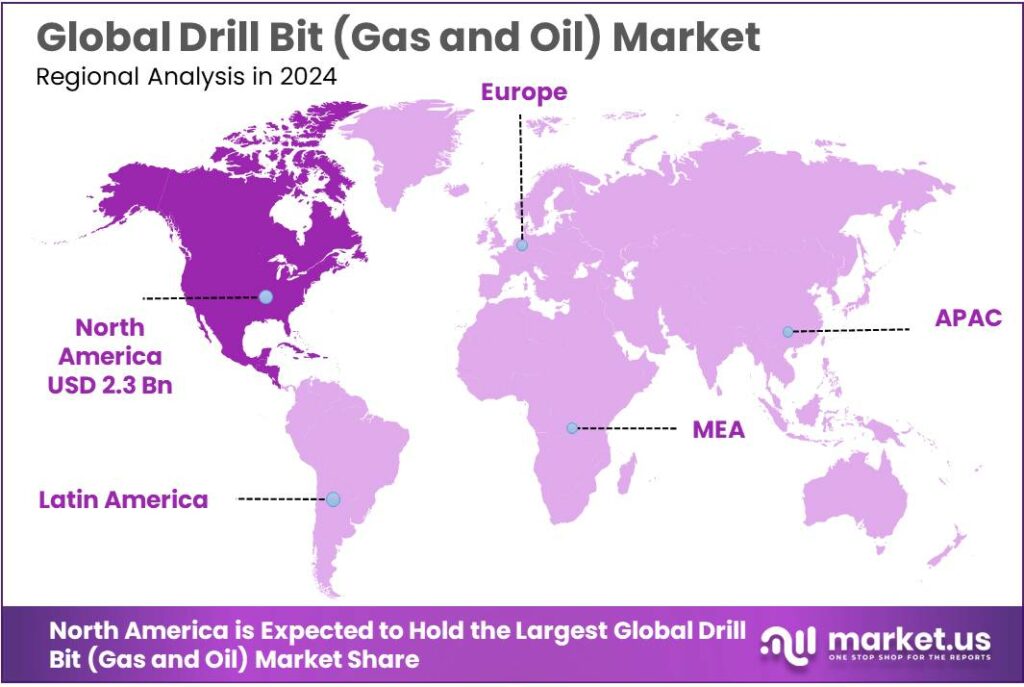

The Global Drill Bit (Gas and Oil) Market size is expected to be worth around USD 11.9 Billion by 2034, from USD 5.4 Billion in 2024, growing at a CAGR of 8.2% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 42.6% share, holding USD 2.3 Billion revenue.

Drill bits for oil and gas are core consumables in upstream operations, directly tied to the number, depth, and complexity of wells being drilled. As operators push into tighter formations, deeper offshore reservoirs, and high-pressure, high-temperature (HPHT) environments, demand is shifting toward premium polycrystalline diamond compact (PDC) and roller-cone bits that offer faster rates of penetration and longer run times. The Baker Hughes global rig count, widely used as a leading indicator for drill bit demand, tracks active drilling rigs across oil, gas, and geothermal, underlining how closely bit consumption follows rig activity and well complexity.

The industrial context is shaped by a strong, though more selective, upstream investment cycle. The International Energy Agency (IEA) estimates upstream oil and gas investment will rise by about 7% in 2024 to roughly USD 570 billion, after a 9% increase in 2023, led mainly by national oil companies in the Middle East and Asia.

World oil demand is forecast to reach around 103.9 million barrels per day in 2025, with demand growth of 1.1 million barrels per day year-on-year, keeping a substantial drilling backlog in both conventional and unconventional resources. Offshore remains a critical growth arena: Rystad Energy reports offshore oil production at about 28.4 million barrels per day in 2024—nearly one-third of global output—with roughly 550 mobile offshore drilling units on contract and marketed utilization around 88%, all of which directly sustain high-spec offshore bit demand.

Gas dynamics also support the drill bit industry. The IEA projects global natural gas demand to grow nearly 1.5% per year between 2024 and 2030, adding roughly 380 billion cubic metres over the period, driven by emerging Asia and new LNG supply. This outlook underpins sustained drilling for gas and condensate, particularly in LNG-linked basins, stimulating demand for bits optimized for long horizontals and abrasive formations. At the same time, clean-energy investment is rising quickly: the IEA expects global clean energy investment to reach about USD 2 trillion in 2024, versus roughly USD 1.1 trillion for fossil fuels, which includes the USD 570 billion upstream oil and gas spend.

Government licensing and policy decisions provide additional visibility for future drill bit demand. In the United States, Lease Sale 261 in the Gulf of Mexico attracted 352 bids on 311 tracts, covering about 1.73 million acres and generating roughly USD 382 million in high bids, signalling continued offshore interest that will translate into multi-year drilling campaigns and robust bit consumption. In India, the government’s Open Acreage Licensing Policy (OALP) Bid Round-IX, launched in January 2024, offered 28 blocks spanning approximately 136,596 square kilometres for exploration and development, again indicating a pipeline of future wells and associated drill bit requirements.

Key Takeaways

- Drill Bit (Gas and Oil) Market size is expected to be worth around USD 11.9 Billion by 2034, from USD 5.4 Billion in 2024, growing at a CAGR of 8.2%.

- Roller Cone Cutter Bits held a dominant market position, capturing more than a 58.9% share.

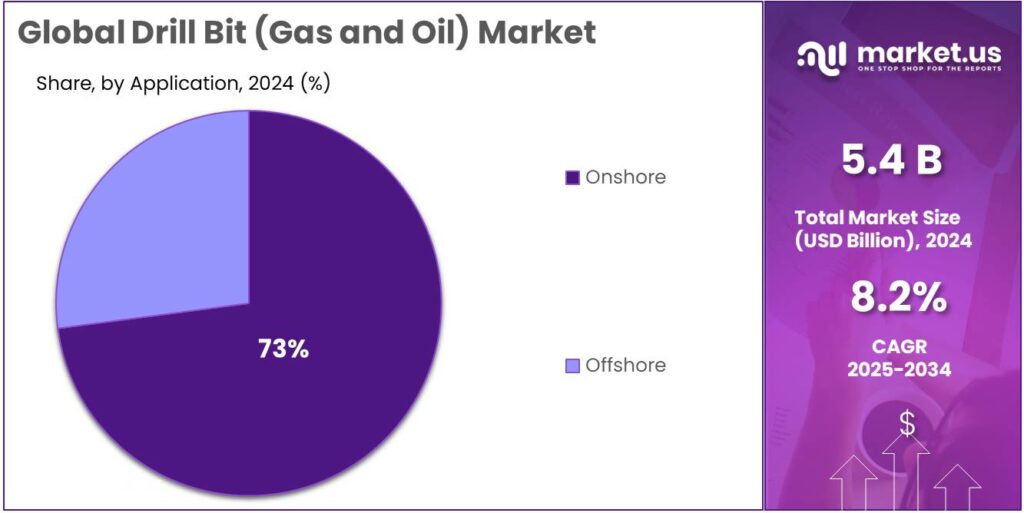

- Onshore held a dominant market position, capturing more than a 72.7% share of the global drill bit market.

- North America held a leading position in the global drill bit market for oil and gas, accounting for a substantial 42.6% share, equivalent to approximately USD 2.3 billion.

By Type Analysis

Roller Cone Cutter Bits dominate with 58.9% share due to their versatility and reliability

In 2024, Roller Cone Cutter Bits held a dominant market position, capturing more than a 58.9% share of the global drill bit market for oil and gas applications. This strong presence can be attributed to their ability to efficiently penetrate various rock formations, including medium to hard rocks, while maintaining operational stability. These bits are widely preferred in both onshore and offshore drilling, as they provide consistent performance and longer service life, reducing the frequency of replacements during extended drilling operations.

In 2025, demand for Roller Cone Cutter Bits is expected to remain robust, supported by ongoing exploration and production activities across conventional oil and gas reservoirs, as well as the continued need for cost-effective and reliable drilling solutions. Their adaptability to different drilling conditions and operational efficiency ensures they remain the first choice for many drilling operators worldwide.

By Application Analysis

Onshore drilling dominates with 72.7% share due to extensive land-based exploration

In 2024, Onshore held a dominant market position, capturing more than a 72.7% share of the global drill bit market for oil and gas. The strong preference for onshore drilling is driven by easier accessibility, lower operational costs, and faster project execution compared to offshore sites. Onshore wells are widely developed in regions with established oil and gas infrastructure, allowing operators to deploy drill bits efficiently across a variety of geological formations.

In 2025, the onshore segment is expected to continue leading the market, supported by sustained exploration in shale, tight gas, and conventional reservoirs. The consistent demand reflects the sector’s reliance on dependable drilling technologies to maximize output while minimizing downtime, making onshore drill bit applications a critical component of global oil and gas production.

Key Market Segments

By Type

- Roller Cone Cutter Bits

- Milled-Tooth Bits

- Tungsten Carbide Inserts

- Fixed Cutter Bits

- Diamond Impregnated

- Polycrystalline Diamond Compact (PDC)

By Application

- Onshore

- Offshore

Emerging Trends

Data-Driven, High-Efficiency Drilling Is Redefining How Bits Are Designed and Used

One of the strongest recent trends in the Drill Bit (Gas and Oil) space is the shift from “more rigs” to “smarter wells”. Operators are drilling fewer wells, but each well is longer, more productive, and more carefully planned using data and software. This is changing what they expect from a drill bit: instead of being just a consumable tool, it must now deliver high penetration rates, stay sharp over long horizontals, and integrate smoothly with digital drilling systems.

A clear signal comes from rig and productivity statistics. The U.S. Energy Information Administration (EIA) notes that the average number of active oil and gas rigs in the U.S. Lower 48 fell from about 750 rigs in December 2022 to 517 rigs in October 2025, yet production has stayed high because of better well productivity and drilling efficiency. In simple terms, fewer rigs now drill more effective wells. For drill bit manufacturers, this means the industry is willing to pay more for bits that last longer and help finish each well faster, because every hour of rig time is expensive.

- According to the EIA, the horizontal “lateral” length in the Permian Basin has grown from less than 4,000 feet in 2010 to more than 10,000 feet in 2022 on average. That is more than double the footage the bit must cut in a single run if the driller wants to avoid extra trips. In practice, this pushes demand for high-end polycrystalline diamond compact (PDC) bits and hybrid designs that can stay in the hole for tens of hours without losing cutting structure.

Drivers

Rising Oil and Gas Demand Continues to Drive Fresh Drilling Activity Worldwide

One of the strongest driving factors for the Drill Bit (Gas and Oil) industry is the continued need to meet rising global oil and natural gas demand, especially from power generation, transport, and industrial users. Despite the growth of renewables, governments and energy bodies confirm that oil and gas will remain essential for energy security for years ahead.

- According to the International Energy Agency (IEA), global oil demand is expected to average 103 million barrels per day in 2024, increasing further in 2025 as population and economic activity grow. To meet this supply requirement, operators must keep drilling new wells and maintaining existing fields, directly increasing consumption of drill bits, which are replaced multiple times per well.

Upstream investment plans strongly support this drilling cycle. The IEA estimates global upstream oil and gas investment reached around USD 570 billion in 2024, reflecting a year-on-year rise as national oil companies expand capacity to ensure long-term supply stability. Large investments at this scale require continuous drilling programs across onshore shale, offshore conventional fields, and deepwater developments. Drill bits, being consumable yet performance-critical tools, benefit immediately from any expansion in capital spending.

Government actions further reinforce this driver. In the United States, the Energy Information Administration (EIA) notes that crude oil production reached about 12.9 million barrels per day in 2024, maintaining the country’s position as the world’s largest producer. Sustaining such output requires constant drilling and redrilling across shale plays like the Permian Basin, where hard rock formations significantly increase drill bit wear rates.

Restraints

Energy Transition Policies and Capital Discipline Are Slowing New Drilling Decisions

One major restraining factor for the Drill Bit (Gas and Oil) industry is the growing impact of energy transition policies combined with stricter capital discipline by oil and gas producers. Governments across major economies are actively pushing emissions reduction targets, which directly affects long-term drilling plans. The International Energy Agency (IEA) has clearly stated that global clean energy investment is expected to reach about USD 2 trillion in 2024, while upstream oil and gas investment remains lower at around USD 570 billion.

Climate-focused regulations are adding further restraint. Under the European Union’s Fit for 55 package, member states are legally required to cut greenhouse gas emissions by 55% by 2030 compared to 1990 levels. These binding targets have resulted in delayed approvals for new oil and gas exploration licenses in several regions. Fewer approved projects translate directly into fewer wells drilled, reducing near-term demand for drill bits, especially in European offshore and frontier basins.

Natural gas markets face similar challenges. While gas demand is growing, new long-cycle projects face increasing scrutiny. The World Bank reports that over 60 countries have announced net-zero targets, many of which include restrictions on financing new oil and gas infrastructure. Multilateral lenders and development finance institutions are scaling back hydrocarbon funding, making it harder for emerging-market projects to secure capital. As a result, several planned drilling programs are postponed or reduced in scope, affecting drill bit orders.

Opportunity

Expansion of Deepwater, HPHT, and Complex Wells Creates Strong Demand for Advanced Drill Bits

One of the most promising growth opportunities for the Drill Bit (Gas and Oil) industry lies in the rapid expansion of deepwater, ultra-deepwater, and high-pressure, high-temperature (HPHT) drilling projects. As conventional onshore fields mature, governments and national oil companies are increasingly turning toward deeper and technically challenging reservoirs to secure long-term energy supply. These wells require high-performance drill bits that can withstand extreme pressure, heat, and abrasive rock formations, significantly raising value per well for drill bit suppliers.

Offshore drilling is a critical example. According to the International Energy Agency (IEA), offshore oil production stands at roughly 28 million barrels per day in 2024, accounting for nearly 30% of global oil supply. Maintaining and expanding this production requires continuous drilling of new subsea wells, particularly in deepwater regions such as Brazil’s pre-salt basin, the Gulf of Mexico, and offshore West Africa. Each deepwater well can require several premium drill bits during drilling campaigns, creating steady and high-margin demand.

- Government-led offshore investment further strengthens this opportunity. In Brazil, the national regulator ANP reported that offshore fields accounted for more than 95% of the country’s crude oil production in 2024, making offshore drilling a strategic priority. Similarly, the U.S. Bureau of Ocean Energy Management (BOEM) confirmed that the Gulf of Mexico contributed about 14% of total U.S. crude oil production in 2023–2024, supported by new lease awards and ongoing deepwater developments.

Natural gas expansion and LNG projects also support drill bit growth. The IEA estimates global natural gas demand will increase by about 380 billion cubic metres between 2024 and 2030, driven largely by Asia’s power and industrial needs. To supply this demand, new gas developments in deepwater and sour-gas fields are moving forward, particularly in the Middle East. These wells are typically long-reach or horizontal, increasing drill bit wear and consumption.

Regional Insights

North America dominates with 42.6% share, valued at USD 2.3 billion due to mature oil and gas infrastructure

In 2024, North America held a leading position in the global drill bit market for oil and gas, accounting for a substantial 42.6% share, equivalent to approximately USD 2.3 billion. The region’s dominance is largely driven by the presence of extensive oil and gas exploration and production infrastructure, particularly in the United States and Canada. Onshore shale formations, including the Permian Basin, Eagle Ford, and Bakken, have witnessed sustained drilling activities, which has significantly increased the demand for high-performance drill bits. Roller cone and fixed-cutter bits are widely deployed in these operations due to their efficiency in handling varied geological formations.

The North American market is supported by technological advancements in drill-bit design and materials, improving durability, rate of penetration, and operational efficiency. These innovations enable operators to reduce non-productive time and drilling costs, further reinforcing the preference for advanced drill bits. Government policies and regulatory frameworks encouraging energy self-sufficiency and optimized production from unconventional reserves have also contributed to consistent exploration and drilling activities across the region.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

SLB (Schlumberger) — SLB holds about 25% of the global oil & gas drill‑bit market by volume. Its strength arises from a broad portfolio covering PDC, roller‑cone and specialty bits, along with continuous investment in cutter technology and global service infrastructure. The company’s integrated service model and global footprint support stable supply and large‑scale deployment across onshore and offshore drilling projects.

Baker Hughes Company — Baker Hughes commands roughly 30% of global oil & gas drill‑bit market volume. In 2024, the company expanded its premium roller‑cone and fixed‑cutter bit offerings, including long‑life and hybrid designs suitable for complex geology. Its global delivery capacity and product diversity support its leading position in both conventional and unconventional drilling segments.

Varel International, Inc. — Varel International is recognized among the core drill‑bit suppliers in the global market and contributes through its specialized bit designs for oilfield applications. The company leverages nimble production cycles and flexible supply chain management to serve both standard and niche drilling demands across global oil and gas operations.

Top Key Players Outlook

- SLB

- Atlas Copco

- Baker Hughes Company

- Halliburton Company

- NOV

- Varel International, Inc.

- Sandvik AB

- Torquato Drilling Accessories, Inc.

- Ulterra Drilling Technologies, LP

- Kingdream Public Limited Company

Recent Industry Developments

In 2024 Varel International, under its audited financial statements, Varel reported borrowings of USD 69,057,000 (non-current) and USD 23,122,000 in current borrowings, with total borrowings amounting to USD 92,179,000 by year end.

In 2024, Sandvik delivered group revenues of SEK 123 billion, with approximately 41,000 employees worldwide. Within its business portfolio, the segment responsible for rock-drilling tools and related equipment — part of the “Mining & Rock Solutions” division — reported revenues of SEK 63,607 million in 2024.

In 2024, Halliburton recorded a total revenue of USD 22.94 billion, with its “Drilling & Evaluation” segment — which includes drill-bit supply, downhole tools and drilling services — contributing USD 9.69 billion, while its “Completion & Production” segment delivered USD 13.25 billion.

Report Scope

Report Features Description Market Value (2024) USD 5.4 Bn Forecast Revenue (2034) USD 11.9 Bn CAGR (2025-2034) 8.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Roller Cone Cutter Bits, Fixed Cutter Bits), By Application (Onshore, Offshore) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape SLB, Atlas Copco, Baker Hughes Company, Halliburton Company, NOV, Varel International, Inc., Sandvik AB, Torquato Drilling Accessories, Inc., Ulterra Drilling Technologies, LP, Kingdream Public Limited Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Drill Bit (Gas and Oil) MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Drill Bit (Gas and Oil) MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- SLB

- Atlas Copco

- Baker Hughes Company

- Halliburton Company

- NOV

- Varel International, Inc.

- Sandvik AB

- Torquato Drilling Accessories, Inc.

- Ulterra Drilling Technologies, LP

- Kingdream Public Limited Company