Global Diisopropyl Ether Market Size, Share, And Business Benefits By Purity Level (99% Purity, less than 99% Purity), By Application (Solvent, Fuel Additive, Pharmaceutical Intermediate, Laboratory Reagent), By End-Use (Pharmaceuticals, Petrochemicals, Paints and Coatings, Agrochemicals), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 163910

- Number of Pages: 302

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

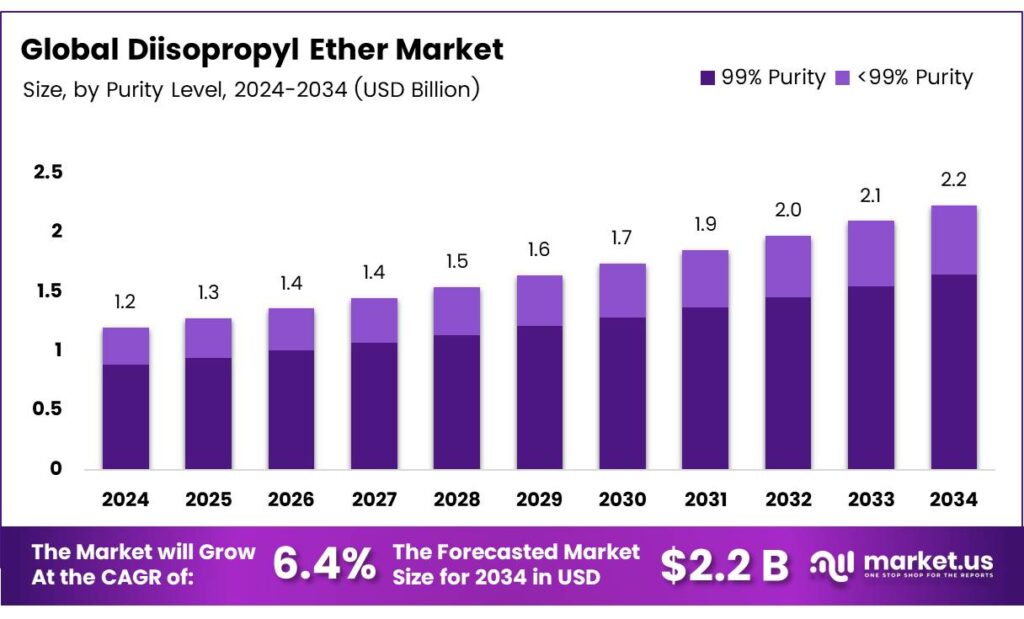

The Global Diisopropyl Ether Market size is expected to be worth around USD 2.2 billion by 2034, from USD 1.2 billion in 2024, growing at a CAGR of 6.4% during the forecast period from 2025 to 2034.

Diisopropyl ether, also known by synonyms such as glycidyl isopropyl ether and isopropyl epoxypropyl ether, is an organic compound characterized by its ether functional group and isopropyl substituents. It appears as a clear, colorless liquid with a sharp, sweet, ethereal odor. The compound is highly flammable, with a flash point of -18 °F, and will burn in air if ignited. It is less dense than water, with vapors heavier than air, and is poorly soluble in water but miscible with many organic solvents.

Diisopropyl ether boils at 68.5 °C and freezes at −60 °C. It can be prepared via acid-catalyzed ether synthesis from isopropanol and serves as a solvent for organic reactions. Due to its hazards, it is difficult to acquire from chemical suppliers. Diisopropyl ether poses significant safety risks, primarily due to its tendency to form explosive peroxides upon prolonged contact with air, a reaction that proceeds more readily than with ethyl ether because of the secondary carbon adjacent to the oxygen atom.

Stored solvent should be tested for peroxides every 3 months, compared to every 12 months for diethyl ether. Unlike other ethers, diisopropyl ether may explode without concentration if peroxide levels are sufficiently high, making old bottles particularly dangerous. For safe storage, diisopropyl ether should be kept in glass bottles in a dry, cold place away from heat sources. To inhibit peroxide formation, additives such as BHT, para-benzylaminophenol, or copper wire can be included.

- Diisopropyl ether meets high purity standards with an assay of ≥ 99% and presents as a clear, colorless liquid with an ethereal, slightly sweet odor. It has a boiling point of 68–70 °C and a melting point of −60 °C. The compound has a density of 0.725 g/cm³ at 20 °C and is insoluble in water but fully soluble in alcohol and ether. Its viscosity is 0.37 mPa·s at 25 °C, and it exhibits a flash point of −28 °C closed cup.

Disposal of diisopropyl ether can be achieved by burning, provided no peroxides are present. If peroxide tests are positive but no precipitate is visible, dissolved peroxides can be neutralized using excess reducing agents such as ferrous sulfate, sodium bisulfite, or metabisulfite. The ether must be retested afterward; if peroxides are absent, it may then be safely burned.

Key Takeaways

- The Global Diisopropyl Ether Market is expected to grow from USD 1.2 billion in 2024 to USD 2.2 billion by 2034 at a 6.4% CAGR (2025-2034).

- 99% Purity segment dominates with 73.9% share in 2024, driving innovation in purification for sensitive applications.

- Solvent application leads with 37.3% share in 2024, boosting productivity in extraction and industrial processes.

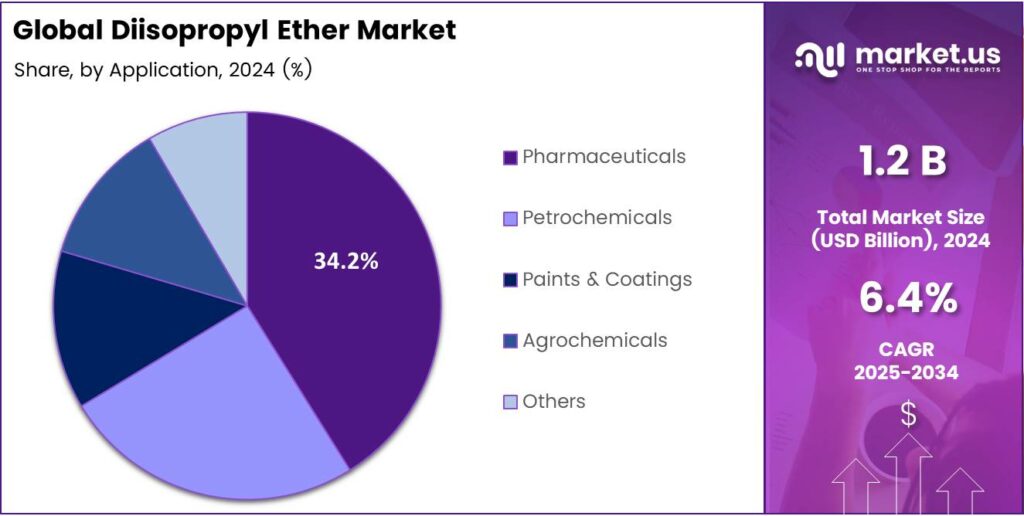

- Pharmaceuticals end-use holds a 34.2% share in 2024, favored for strict purity in safe drug production.

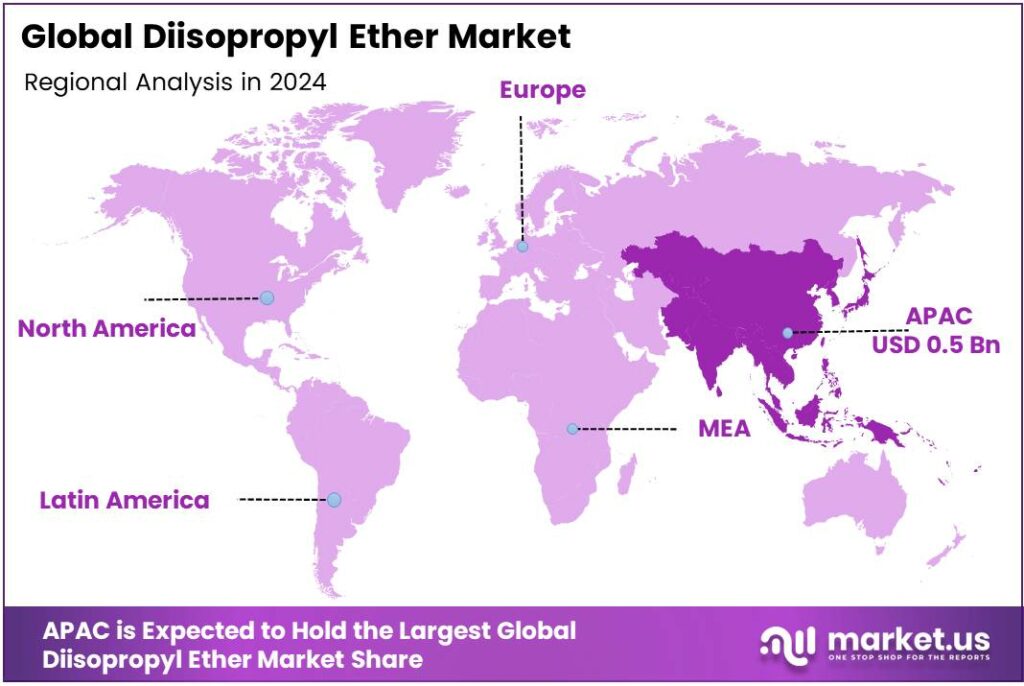

- Asia-Pacific dominates with a 43.9% share of USD 0.5 billion in 2024, driven by expanding petrochemicals and demand for high-octane fuels/solvents.

By Purity Level

99% Purity dominates with 73.9% due to its essential role in precision-demanding industries.

In 2024, 99% Purity held a dominant market position in the By Purity Level Analysis segment of the Diisopropyl Ether Market, with a 73.9% share. This high-grade variant excels in applications requiring minimal impurities. Manufacturers prioritize it for superior performance in sensitive processes. Thus, it drives innovation in purification techniques. Overall, this segment fuels market expansion through quality focus.

The <99% Purity segment complements the market by offering cost-effective options. It suits less stringent uses, like basic solvents. Producers leverage it for broad accessibility. Consequently, it supports diverse industrial needs. This approach balances affordability with functionality, ensuring steady demand.

By Application

Solvent dominates with 37.3% due to its versatile extraction capabilities.

In 2024, Solvent held a dominant market position in the By Application Analysis segment of the Diisopropyl Ether Market, with a 37.3% share. It shines in dissolving compounds efficiently. Industries rely on it for extraction tasks. Hence, it boosts productivity across sectors. This versatility propels its leading status. The Fuel Additive segment enhances combustion efficiency.

It reduces emissions in engines. Automakers adopt it for cleaner fuels. Therefore, it aligns with environmental regulations. This role strengthens its growth potential. Pharmaceutical Intermediate supports drug synthesis precisely. It acts as a key building block. Pharma firms value its reactivity. As a result, it advances medical innovations. This application underscores its critical importance.

By End-Use

Pharmaceuticals dominate with 34.2% due to rigorous quality standards.

In 2024, Pharmaceuticals held a dominant market position in the By End-Use Analysis segment of the Diisopropyl Ether Market, with a 34.2% share. It ensures safe drug production. Strict purity norms favor it heavily. Thus, it accelerates therapeutic developments. This dominance reflects healthcare priorities. The Petrochemicals segment utilizes it in refining processes.

It aids polymer creation effectively. Energy sectors integrate it seamlessly. Consequently, it supports fuel advancements. This end-use drives industrial scalability. Paints and Coatings benefit from its solvent properties. It improves formulation stability. Construction demands rise with it. Therefore, it enhances durability in products. This segment expands aesthetic applications.

Key Market Segments

By Purity Level

- 99% Purity

- <99% Purity

By Application

- Solvent

- Fuel Additive

- Pharmaceutical Intermediate

- Laboratory Reagent

- Others

By End-Use

- Pharmaceuticals

- Petrochemicals

- Paints and Coatings

- Agrochemicals

- Others

Emerging Trends

Increased Adoption of DIPE as a Gasoline Oxygenate to Boost Combustion Efficiency and Cut Emissions

One major emerging trend in the world of Diisopropyl ether (DIPE) is its growing use as an oxygenated additive in gasoline blends to enhance engine performance and reduce harmful tailpipe emissions. Recent engine-bench experiments show that blending DIPE into conventional gasoline can deliver measurable improvements.

- DIPE reduced hydrocarbon (HC) emissions by 27.6%, cut carbon monoxide (CO) emissions by 25%, and improved brake thermal efficiency (BTE) by 3.5% compared with neat gasoline. These numbers highlight DIPE’s potential in helping refineries and fuel manufacturers respond to tightening emission regulations globally, while offering a pathway to maintain or even improve engine efficiency.

DIPE’s rise as a gasoline oxygenate presents a clear emerging trend driven by regulatory push for cleaner fuels, demonstrable performance benefits, and the broader move toward higher-octane, lower-emission gasoline. It’s a trend that touches refiners, fuel marketers, vehicle owners, and urban air-quality enthusiasts alike.

Drivers

Clean-gasoline rules are boosting oxygenate demand

Tighter fuel-quality standards are pushing refineries and blenders to use high-octane oxygenates—where diisopropyl ether (DIPE) fits naturally alongside other ethers to meet octane and emissions goals without raising aromatics. Across major markets, regulators now cap gasoline sulfur at 10 ppm.

The U.S. Tier 3 program set the 10-ppm ceiling, linking cleaner fuel with tailpipe standards. That tighter cap raises octane management pressure in the pool, encouraging oxygenates for dilution and volatility control. In Europe, sulfur-free petrol (≤ 10 ppm S) became mandatory, locking in a long-term need for octane while keeping aromatics down—another space where ethers like DIPE are technically useful.

- India aligned with these limits under BS VI, also at 10 ppm sulfur, which reshaped refinery blending strategies toward cleaner components. On top of sulfur caps, oxygen content programs, and biofuel mandates keep oxygenates in focus. The U.S. oxygenated-gasoline rule historically required 2.7% oxygen by weight in certain seasons/areas, quantifying the role of oxygenates in meeting air-quality targets.

Restraints

Fire and peroxide risk limit the usage of diisopropyl ether

One significant restraint for the use of Diisopropyl ether (DIPE) in industrial settings is its high flammability, susceptibility to peroxide formation, and the consequential stringent regulatory and handling requirements. DIPE is classified as a highly flammable liquid and vapour and may cause drowsiness or dizziness under the EU’s CLP regulation.

The SDS notes that DIPE may form explosive peroxides, meaning that it must be stored with special stabilisers and tested periodically for peroxide accumulation. From a regulatory and operational perspective, these hazards translate into elevated costs, extra process-safety controls such as inerting, vapour recovery, explosion-proof equipment, and limitations on where and how much the chemical can be stored/handled.

- The SDS shows that the vapour pressure for DIPE is about 227 hPa at 25 °C, showing it readily volatilises under ambient conditions and hence increases the vapour-hazard potential. DIPE falls under the class of volatile organic compounds (VOCs) used in solvents and fuel additives, and governments increasingly regulate VOC emissions. The contribution of solvents and industrial processes to global anthropogenic VOC emissions rose from approximately 35% to about 63% in recent years.

Opportunity

Expanding use in high-octane gasoline blending

One key growth driver for Diisopropyl ether (DIPE) is the increasing global demand for higher-octane gasoline blends, particularly as automakers push toward higher compression, turbocharging, and downsizing, requiring fuels with better knock resistance.

- Studies show that DIPE, when used as an oxygenated additive in gasoline, can boost performance: one research article noted that blending DIPE (alongside ethanol or isopropanol) improved the octane and combustion behaviour of gasoline fuels. In the blend study, adding DIPE at 8% by volume increased the Research Octane Number (RON) by up to 23.9 points in one scenario.

Governments worldwide are supporting cleaner fuel and higher-efficiency vehicle programmes that indirectly favour octane-enhancing additives like DIPE. The United States Environmental Protection Agency (EPA) recognises fuel oxygenates as key components in reformulated gasoline to reduce emissions and improve engine performance.

Regional Analysis

Asia-Pacific leads with a 43.9% share and a USD 0.5 Billion market value.

In 2024, Asia-Pacific held a dominant 43.9% market share, valued at approximately USD 0.5 billion, establishing itself as the largest regional contributor to the global Diisopropyl Ether (DIPE) market. This leadership stems from the region’s expanding petrochemical which collectively drives strong demand for high-octane fuel components and industrial solvents.

Countries such as China, India, Japan, and South Korea have been progressively increasing production capacities for oxygenates and clean fuel additives to align with tightening emission norms. The Government of India’s BS VI emission standards, effective nationwide, encourage the blending of ether-based oxygenates like DIPE to meet octane and volatility requirements efficiently.

The rise in ethanol and alternative fuel policies across ASEAN economies complements the use of mixed oxygenates, maintaining DIPE’s market relevance. Industrial applications beyond fuels, such as pharmaceuticals, adhesives, and extraction solvents, are also expanding in the Asia-Pacific due to rapid urbanization and manufacturing growth.

Ongoing government-backed investments in clean energy, infrastructure, and chemical manufacturing further reinforce Asia-Pacific’s leadership. With rising automotive ownership, sustained refinery modernization, and growing domestic chemical production, the region is expected to retain its dominance in the Diisopropyl Ether market over the coming decade.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Eastman Chemical Company integrated manufacturing and a strong technological portfolio to supply high-purity diisopropyl ether. Its focus on innovation and diverse end-use markets, including solvents and chemical intermediates, provides a competitive edge. With a robust distribution network and strategic focus on specialty chemicals, Eastman maintains a significant market position.

LG Chem Ltd. commands a significant presence in the diisopropyl ether market through its advanced petrochemical infrastructure. The company’s strength lies in its large-scale, efficient production capabilities and strong R&D focus, ensuring consistent quality. Its extensive supply chain and strategic partnerships across Asia and globally facilitate widespread distribution.

Sasol Limited is a key player, utilizing its unique coal-to-liquid (CTL) and gas-to-liquid (GTL) technology for production. This proprietary process provides a distinct advantage in feedstock flexibility. As an integrated energy and chemical company, Sasol supplies diisopropyl ether to various applications, including fuels and solvents. It has a strong footprint in Africa and an expanding global reach.

Top Key Players in the Market

- Eastman Chemical Company

- LG Chem Ltd.

- Sasol Limited

- Dow Chemical Company

- Mitsubishi Chemical Corporation

- ExxonMobil Corporation

- LyondellBasell Industries N.V.

- Others

Recent Developments

- In 2024, Eastman introduced a high-purity IPA solvent as part of its EastaPure portfolio, designed to meet semiconductor industry standards for purity and reliability. This U.S.-sourced product addresses growing demand in electronics manufacturing, where IPA serves as a critical cleaning agent and precursor for ethers like DIPE.

- In 2024, LG Chem introduced an innovative, eco-friendly IPA solvent tailored for the personal care industry, focusing on biodegradability and reduced environmental impact. This aligns with growing demand for green solvents in cosmetics and cleaning products, where IPA serves as a base for ethers like DIPE.

Report Scope

Report Features Description Market Value (2024) USD 1.2 Billion Forecast Revenue (2034) USD 2.2 Billion CAGR (2025-2034) 6.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Purity Level (99% Purity, <99% Purity), By Application (Solvent, Fuel Additive, Pharmaceutical Intermediate, Laboratory Reagent, Others), By End-Use (Pharmaceuticals, Petrochemicals, Paints and Coatings, Agrochemicals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Eastman Chemical Company, LG Chem Ltd., Sasol Limited, Dow Chemical Company, Mitsubishi Chemical Corporation, ExxonMobil Corporation, LyondellBasell Industries N.V., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Diisopropyl Ether MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

Diisopropyl Ether MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Eastman Chemical Company

- LG Chem Ltd.

- Sasol Limited

- Dow Chemical Company

- Mitsubishi Chemical Corporation

- ExxonMobil Corporation

- LyondellBasell Industries N.V.

- Others