Global Dental Braces Market Analysis By Product Type (Fixed Braces, Removable Braces (Clear Aligners, Retainers), Accessories), By Material (Ceramic Braces, Metal Braces, Biocompatible/Polymer-based Braces), By Position (External Braces, Lingual Braces), By End-User (Children (6–12 years), Teenagers (13–19 years), Adults (Above 20 years)) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 160655

- Number of Pages: 309

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

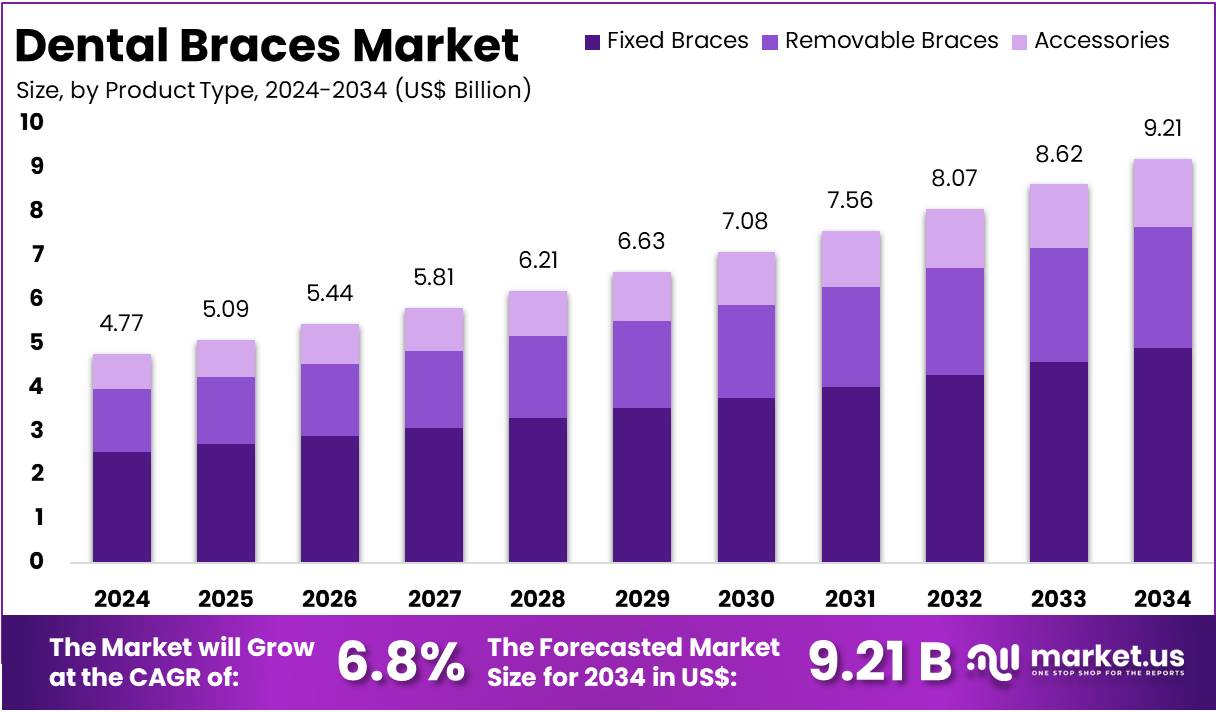

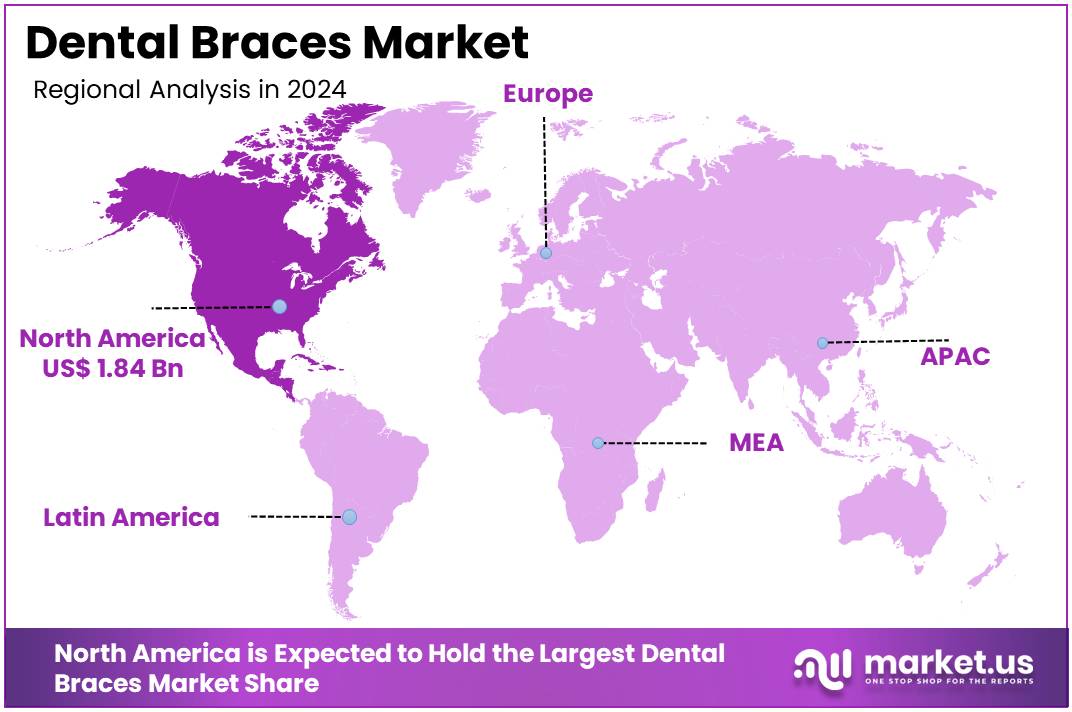

The Global Dental Braces Market size is expected to be worth around US$ 9.21 Billion by 2034, from US$ 4.77 Billion in 2024, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 38.5% share and valued at US$ 1.84 billion.

The dental braces market represents a growing segment of the global orthodontics industry. It includes traditional metal braces, ceramic variants, lingual systems, and clear aligners. According to the World Health Organization (WHO), oral diseases affect around 3.5 to 3.7 billion people, making them one of the most prevalent health concerns globally. Untreated tooth decay remains the most common condition worldwide. This persistent burden sustains high clinical demand for orthodontic correction.

Studies have shown that malocclusion in children and adolescents is highly prevalent across regions, creating a substantial pool of future orthodontic patients. For example, national surveys in China found that 35% of children had crowding in upper teeth and 31% in lower teeth. Similarly, in Brazil, school location and socioeconomic status were significant determinants of malocclusion risk. Such epidemiological patterns indicate consistent, medium-term demand for orthodontic devices.

Public health policies are reinforcing this demand by widening access to treatment. In the United Kingdom, the Index of Orthodontic Treatment Need (IOTN) is used to assess eligibility for publicly funded care. The National Health Service (NHS) provides orthodontic treatment to individuals with higher-need grades, ensuring equitable access. This structured system has made orthodontics a regular service line in public healthcare, securing patient inflows and stabilizing utilization for dental providers.

For instance, the NHS Business Services Authority consistently publishes orthodontic activity data. These reports confirm that orthodontic treatments are being delivered at scale, reflecting sustained national throughput. Similarly, in the United States, Federally Qualified Health Centers (FQHCs) expanded oral health services by nearly 40% between 2009 and 2014, increasing patient numbers from 3.4 million to 4.8 million. These institutional frameworks highlight the organized growth of orthodontic care under public programs.

Public Systems, Workforce, and Policy Momentum

Rising workforce capacity supports the continuous delivery of orthodontic services. According to the U.S. Bureau of Health Workforce, the number of dental assistants per dentist increased from 1.85 to 1.91 between 2011 and 2014. During the same period, the proportion of dental hygienists per dentist in U.S. FQHCs rose from 0.52 to 0.60. These improvements indicate enhanced operational efficiency and capacity for treatment starts across facilities.

Data show that nearly 50% of U.S. health centers provided oral health services to 11.5–27.3% of their patients, representing strong integration of dental care within community health. About 25% of dental assistants worked in expanded-function roles, such as applying sealants. This broad workforce engagement enhances preventive and orthodontic outcomes. Globally, WHO and Eurostat report that several European countries maintain dentist densities above 110 per 100,000 people, further supporting treatment accessibility.

Population health patterns continue to justify orthodontic expansion. Oro-dental trauma affects about 1 billion people, with 20% prevalence among children under 12. Braces reduce the risk of trauma by correcting protruding teeth. Moreover, the U.S. “Oral Health in America” report links oral health to over 60 systemic health conditions, underscoring its broader medical relevance. These findings reinforce orthodontic care as both preventive and functional.

Policy momentum remains strong. WHO’s 2021 World Health Assembly resolution, followed by its 2022 Global Strategy and 2023–2030 Action Plan, has integrated oral health into universal health coverage agendas. For example, the WHO’s oral health data portal now provides country-specific disease and workforce profiles to guide policy. In the United States, disparities persist, with 14% of low-income adolescents experiencing untreated cavities compared to 8% in higher-income groups. Only 43% of Americans reported a dental visit in 2015, emphasizing the need for equitable access.

Overall, the dental braces market benefits from expanding public coverage, strong workforce capacity, and policy-driven equity initiatives. These structural, clinical, and social factors together ensure steady growth for orthodontic devices and related digital technologies worldwide.

Key Takeaways

- The Global Dental Braces Market is projected to grow from USD 4.77 billion in 2024 to approximately USD 9.21 billion by 2034, reflecting a 6.8% CAGR.

- In 2024, Fixed Braces dominated the Product Type Segment, accounting for over 53.2% of total market share due to their high treatment effectiveness.

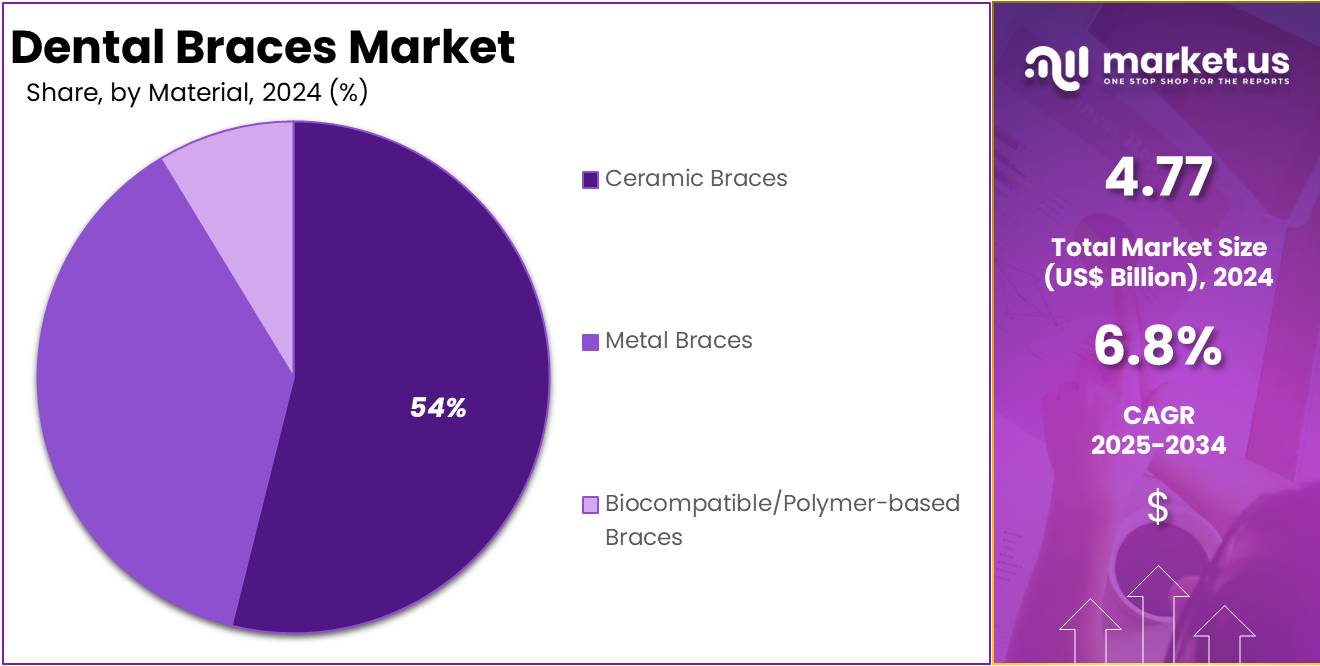

- Ceramic Braces led the Material Segment in 2024, capturing more than 53.9% market share, driven by rising preference for aesthetic and less-visible options.

- The External Braces category held a leading position in the Position Segment in 2024, representing over 65.5% of global revenue share.

- Teenagers aged 13–19 constituted the largest End-User Segment in 2024, holding more than a 61.3% market share owing to early orthodontic interventions.

- North America emerged as the dominant regional market in 2024, valued at USD 1.84 billion, accounting for more than 38.5% of the total market share.

Product Type Analysis

In 2024, the Fixed Braces section held a dominant market position in the Product Type Segment of the Dental Braces Market, and captured more than a 53.2% share. This dominance was supported by the wide use of traditional metal and ceramic braces. These products are often recommended by orthodontists for complex dental corrections. Their proven effectiveness, combined with a relatively lower cost compared to newer technologies, has ensured that fixed braces continue to lead the global market.

The Removable Braces segment, which includes clear aligners and retainers, has been recording strong growth. Clear aligners are gaining popularity due to their discreet appearance, comfort, and convenience. This trend is especially strong among adults and young patients who prefer aesthetic solutions. Retainers also hold a stable demand as they are essential for post-treatment maintenance. The rising consumer preference for flexible and less visible orthodontic solutions has been driving the expansion of this segment significantly.

Accessories form another important part of the market, covering products such as wires, brackets, bands, and adhesives. Demand for these accessories has been increasing in line with the adoption of both fixed and removable braces. Continuous improvements in product materials and design have enhanced treatment outcomes and durability. Accessories ensure that orthodontic procedures remain efficient and reliable. While fixed braces maintain the largest share, removable braces, particularly clear aligners, are expected to expand rapidly, reflecting changing consumer expectations for modern and advanced treatments.

Material Analysis

In 2024, the Ceramic Braces Section held a dominant market position in the Material Segment of the Dental Braces Market, and captured more than a 53.9% share. The dominance of ceramic braces can be attributed to their aesthetic appeal, as they blend more naturally with teeth compared to traditional metal braces. The rising preference for discreet orthodontic treatments among teenagers and adults further supported their demand. Higher adoption in urban regions and a growing number of dental clinics offering advanced cosmetic orthodontics contributed to their strong market position.

The Metal Braces Segment continued to maintain a substantial share of the market. Metal braces remained popular due to their affordability and durability. Their strong corrective ability in complex dental alignment cases reinforced their use, particularly in developing economies where cost sensitivity is higher. Despite their visibility, the demand persisted owing to the lower price point and effectiveness in long treatment durations.

The Biocompatible/Polymer-Based Braces Segment exhibited steady growth and is expected to record the fastest expansion rate over the forecast period. Increased awareness of biocompatible materials, along with rising concerns over metal allergies and comfort, drove the preference for polymer-based solutions. Their lightweight nature and enhanced patient comfort positioned them as a promising alternative, particularly among patients seeking hypoallergenic options. Innovation in polymer material strength and flexibility is further anticipated to accelerate their adoption in the coming years.

Position Analysis

In 2024, the External Braces section held a dominant market position in the Position Segment of the Dental Braces Market, and captured more than a 65.5% share. The growth of this segment can be attributed to its wide availability, cost-effectiveness, and established clinical acceptance. External braces are commonly preferred due to their proven efficiency in correcting complex dental misalignments. Their accessibility across both developed and emerging economies has further supported their higher adoption rates.

Lingual braces, in contrast, accounted for a smaller share of the market in 2024. Their placement on the inner surface of teeth provides better aesthetics compared to external braces. However, their higher treatment costs, longer adjustment periods, and need for specialized expertise have limited their adoption. Despite these challenges, gradual growth is anticipated in this segment. The rising demand for aesthetic orthodontic solutions and growing awareness among younger patients and working professionals are expected to create opportunities for lingual braces over the forecast period.

Overall, while external braces continue to dominate due to affordability and clinical reliability, the lingual braces segment is projected to expand at a steady pace. The adoption of advanced orthodontic technologies, combined with increasing disposable incomes and aesthetic preferences, is expected to support balanced growth across both position segments in the coming years.

End-User Analysis

In 2024, the Teenagers (13–19 years) section held a dominant market position in the End-User Segment of the Dental Braces Market, and captured more than a 61.3% share. The high share is mainly due to early orthodontic care and rising awareness of dental aesthetics among teenagers. Increasing parental spending on oral health and the influence of social media have also encouraged adoption. Orthodontists often recommend braces during this stage, making it the most common age group for treatment.

The Children (6–12 years) segment accounted for a significant portion of the market. Growth in this segment is driven by early diagnosis of dental issues and increased focus on preventive orthodontic treatment. Pediatric dental visits have become more frequent, leading to higher awareness among parents. The adoption of interceptive orthodontics has increased as a part of preventive care. However, the rising use of removable aligners in some cases has slightly reduced the use of traditional braces.

The Adults (above 20 years) segment has shown steady growth in recent years. The increase is supported by growing awareness of cosmetic dentistry and the availability of advanced orthodontic options. Many adults are opting for ceramic braces and invisible aligners for aesthetic reasons. Higher disposable incomes and the rise of dental tourism have also supported this demand. Although the share remains lower than teenagers, the segment offers strong potential for premium and customized orthodontic solutions.

Key Market Segments

By Product Type

- Fixed Braces

- Removable Braces

- Clear Aligners

- Retainers

- Accessories

By Material

- Ceramic Braces

- Metal Braces

- Biocompatible/Polymer-based Braces

By Position

- External Braces

- Lingual Braces

By End-User

- Children (6–12 years)

- Teenagers (13–19 years)

- Adults (Above 20 years)

Drivers

Rising Prevalence of Malocclusion and Growing Aesthetic Awareness

The growing focus on dental aesthetics and self-image among both adolescents and adults has become a key driver for the dental braces market. The increasing influence of social media and digital visibility has heightened awareness of physical appearance and self-confidence. As a result, individuals are more likely to pursue orthodontic treatments such as braces to enhance dental alignment and overall appearance. This societal emphasis on a confident smile and personal presentation has directly contributed to the consistent rise in demand for corrective dental solutions.

The prevalence of malocclusion, or misalignment of teeth, further strengthens the market potential for dental braces. A global meta-analysis indicates that malocclusion affects nearly 56% of populations worldwide (95% CI: 11–99%), emphasizing a widespread orthodontic need. Studies show Class I malocclusion accounts for approximately 72.74% of cases, while Class II and Class III represent around 23.11% and 3.98% respectively. This high prevalence signifies that a considerable share of global populations experiences conditions that necessitate orthodontic correction through braces or aligners.

Vertical malocclusion traits such as deep overbite and open bite also add to orthodontic treatment requirements. According to systematic reviews, deep overbite occurs in about 24.34% of cases, while open bite is seen in roughly 5.29% of examined populations. These vertical irregularities not only affect functionality but also aesthetics, prompting patients to opt for braces. Such diverse manifestations of malocclusion across dental structures underscore the broad base of potential consumers requiring orthodontic interventions globally.

In regional populations, the prevalence appears even more prominent. Among Chinese Zhuang children aged 7–8 years, malocclusion affects 58.5%. In clinical orthodontic settings, around 69% of adults present with crowding, 51% with deep overbite, and 3% with open bite. These figures demonstrate that orthodontic needs span across age groups and demographics. As awareness and access to orthodontic care improve, this structural and aesthetic demand is expected to sustain the global growth of the dental braces market.

Restraints

High Cost, Long Treatment Time, and Adoption Barriers

The dental braces market faces a significant restraint due to the high treatment cost and extended duration of correction procedures. Orthodontic treatments require long-term supervision and periodic adjustments by specialists. This continuous engagement increases both time and financial burden. For many middle- and low-income patients, such costs act as deterrents. Moreover, limited insurance coverage and lack of public subsidies further discourage treatment adoption, making affordability a persistent challenge for the wider population.

In orthodontic practices, the complexity of cases adds to time and cost barriers. Clinical observations reveal that around 69% of adult patients experience crowding, while 51% present deep overbite conditions. These multi-dimensional malocclusions demand combined correction techniques involving alignment and vertical control. Consequently, the overall treatment duration often extends up to two or more years. Among pediatric cases, multi-phase treatments—such as expansion, leveling, and finishing—can last between 1.5 to 3 years, further increasing time and expense commitments.

Financial constraints also restrict the adoption of advanced technologies in orthodontics. Studies show that the high cost of new digital or automated systems is a major barrier for orthodontists. Many practices view such investments as unfeasible when weighed against expected returns or patient volumes. In addition, overhead costs, including training and maintenance, limit digital transformation in smaller clinics. The absence of sufficient reimbursement structures further slows down the integration of high-end diagnostic and imaging solutions.

Beyond practice-level barriers, patient-side expenses remain substantial. In many markets, the out-of-pocket cost of orthodontic treatment continues to deter timely adoption. The affordability issue is amplified in regions with limited dental insurance or subsidy coverage. Similarly, high setup costs for AI-powered diagnostics and poor interoperability between dental software systems further hinder efficiency gains. Therefore, the combined effect of high financial burden, lengthy correction time, and limited digital adoption continues to restrain the overall growth of the dental braces market.

Opportunities

Advancements In Clear Aligners And Minimally Invasive Orthodontic Technologies

The dental braces market is witnessing strong opportunities through technological innovations such as clear aligners and 3D imaging. Transparent and removable aligners have transformed orthodontic treatment by offering aesthetic and comfortable alternatives to metal braces. These innovations allow dentists to attract patients who prioritize discretion and comfort. The adoption of minimally invasive technologies is expected to accelerate market growth, driven by increasing patient demand for personalized and visually appealing solutions in dental correction.

The integration of CAD/CAM systems, AI diagnostics, and hybrid care models provides a significant opportunity for enhancing orthodontic efficiency. AI-assisted teledentistry supports accurate diagnosis and remote monitoring, allowing orthodontists to evaluate treatment progress without frequent in-office visits. This hybrid approach increases accessibility and patient satisfaction while maintaining precision. The use of advanced design and imaging tools enables faster treatment planning, ultimately improving outcomes and expanding the patient base in both urban and rural settings.

Digital transformation in dentistry is progressing rapidly. A 2025 survey of German dentists revealed rising adoption of digital workflows, intraoral scanning, and AI tools. Although cost and infrastructure challenges remain, the momentum is clear. Initiatives like the OMNI dataset—with 4,166 multi-view images from 384 participants—demonstrate advancements in automated malocclusion diagnosis. Such deep-learning models enable early detection and improve treatment planning efficiency. These developments create a strong foundation for data-driven orthodontic care and continuous improvement in patient management systems.

In addition, hybrid and teledentistry models have shown measurable cost advantages and accessibility improvements. Studies indicate that patients with at least one teledentistry visit experienced 10% lower costs compared to those without remote consultations. This supports the scalability of orthodontic services across underserved regions. Combining AI image analysis with remote monitoring reduces patient burden while ensuring consistent care quality. These innovations collectively position the dental braces market for sustained growth and wider adoption of advanced orthodontic modalities.

Trends

Digital Transformation in Dental Braces through AI and Teledentistry

The dental braces segment is undergoing a strong digital transformation driven by the integration of intraoral scanners, artificial intelligence, and teledentistry. These technologies enhance treatment accuracy and improve patient convenience. Intraoral scanners and 3D imaging have replaced traditional impressions, making digital workflows a new standard. The adoption of these tools shortens chair time and allows orthodontists to design precise treatment plans remotely, resulting in faster turnaround times and improved patient satisfaction.

Artificial intelligence is increasingly being used for orthodontic diagnosis and treatment simulation. AI systems analyze dental datasets to identify malocclusions and forecast treatment outcomes. This data-driven precision enables orthodontists to create customized plans while minimizing manual adjustments. AI-supported monitoring also ensures early detection of treatment deviations. As algorithms mature, their use in progress tracking and predictive modeling is expected to become central to modern braces treatment workflows.

Teledentistry complements digital orthodontics by expanding access to care and enhancing efficiency. It allows remote consultations, diagnosis, and ongoing supervision, reducing the need for frequent in-office visits. Studies and reviews indicate that teledentistry bridges access gaps, particularly for patients in remote areas. Remote monitoring tools linked with digital imaging systems provide clinicians with real-time updates, improving patient compliance and outcomes. Consequently, hybrid care models are emerging as the preferred standard for orthodontic practices.

Despite the benefits, integration challenges remain. High capital costs for AI platforms, training deficits, and interoperability issues hinder seamless adoption. However, as digital workflows evolve, these barriers are gradually diminishing. The convergence of AI, telemonitoring, and digital imaging is driving the market toward a connected, patient-centric model. This digital shift in dental braces treatment signifies the industry’s transition from rigid, in-office methods to adaptive, technology-enabled orthodontic care.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 38.5% share and valued at US$ 1.84 billion. According to the U.S. Centers for Medicare & Medicaid Services, U.S. spending on dental services reached US$ 173.8 billion in 2023, representing about 4% of total national health spending. The market recorded 6.2% growth in 2023, supported by strong contributions from Medicare, out-of-pocket payments, and private insurance. High insurance coverage—92.5% of the population—continues to sustain steady orthodontic demand across the region.

Utilization patterns among older adults also reinforce this strength. A 2022 study found that 63.7% of Americans aged 65 and above visited a dentist in the previous year. For instance, visit rates were 69.6% among those with dental coverage, compared to 56.4% for the uninsured. These differences illustrate how income and insurance availability drive dental utilization, directly influencing referrals for malocclusion treatment and expanding the orthodontic patient base.

Underlying clinical need remains significant across the U.S. population. A study based on NHANES data revealed that nearly two-thirds of untreated U.S. adults exhibit clinically meaningful malocclusions. As awareness and screening rates continue to improve, this prevalence supports long-term demand for both braces and clear aligners. Continuous innovations in aesthetic orthodontics and patient-friendly devices further enhance adoption rates across age groups.

Public programs also shape orthodontic access. Medicaid and CHIP programs provide comprehensive dental benefits for children, standardized through CMS reporting mechanisms. Although adult dental coverage remains optional for states, expanding programs have increased access to preventive and corrective dental services. For example, policy revisions in several states have broadened eligibility, enhancing orthodontic service utilization, particularly among adolescents.

Canada further strengthens North America’s lead. The introduction of the Canadian Dental Care Plan (CDCP) has extended coverage to over 5 million residents, with millions already receiving care. This expansion has boosted routine dental visits and referrals to orthodontists. Together, high spending, robust insurance penetration, expanding public coverage, and large unmet clinical need continue to position North America as the largest and most stable market for dental braces worldwide.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The dental braces market demonstrates strong competition with continuous technological advancements and product innovation. Companies are increasingly focusing on digital orthodontics, aesthetic improvements, and patient comfort. Align Technology has established a comprehensive digital ecosystem with its Invisalign system, iTero scanners, and ClinCheck software. The firm’s collaboration with dental professionals and consumer marketing strategies strengthen its presence across major regions, including North America, Europe, and Asia-Pacific, thereby supporting sustained global growth in the clear aligners segment.

Straumann Group continues to broaden its orthodontic capabilities through acquisitions such as ClearCorrect and strategic investments in digital solutions. The company’s diverse product portfolio targets both premium and value market segments. Leveraging its global distribution strength and brand reputation, Straumann efficiently serves a wide customer base. Its emphasis on digital workflow integration enhances treatment precision and patient outcomes, positioning it competitively within the orthodontic devices market. Continuous expansion initiatives reinforce its presence in emerging and developed markets alike.

Henry Schein, Inc. contributes significantly through its extensive distribution and technology solutions. The company offers orthodontic products, digital dentistry systems, and support for small and medium-sized dental practices. Its strong partnerships and service network enhance product accessibility globally. Henry Schein’s integrated solutions enable practitioners to adopt advanced orthodontic technologies efficiently, promoting broader treatment availability. This approach supports market penetration and strengthens its role as a vital link between manufacturers and end users in the dental care ecosystem.

Dentsply Sirona and 3M Unitek focus on integrating innovation and precision into orthodontic treatments. Dentsply Sirona combines orthodontic solutions with digital imaging and CAD/CAM systems to enhance workflow efficiency. 3M Unitek advances material science in metal, ceramic, and self-ligating braces. Other key participants, including Envista Holdings, American Orthodontics, and emerging Asian manufacturers, emphasize cost-effective products and regional customization. Collectively, these players drive market dynamism, foster innovation, and expand access to modern orthodontic care worldwide.

Market Key Players

- Align Technology

- Straumann Group

- Henry Schein

- Dentsply Sirona

- 3M Unitek

- Envista Holdings Corporation

- Institut Straumann AG

- Dental Morelli

- Ormco Corporation

- American Orthodontics

- DB Orthodontics

- Patterson Dental

- Zhejiang Protect Medical

- Hangzhou Xingchen 3B Dental

- Other key players

Recent Developments

- In August 2024: Straumann signed a definitive agreement to divest its DrSmile clear aligner business to Impress Group (a Barcelona-based clear aligner provider), while retaining a 20 % minority stake in the combined entity. The move reflects a strategic shift: Straumann will refocus its orthodontics efforts more on the B2B channel (e.g. supplying clinicians) rather than direct-to-consumer.

- In January 2024: Align finalized its acquisition of Cubicure, a Vienna-based polymer / direct 3D-printing company, for approximately €79 million. The acquisition is intended to enable Align to scale its 3D printing operations toward direct printing of aligners, thereby reducing reliance on molds and improving manufacturing efficiency and sustainability in orthodontic device production.

- In October 2023: Dentsply Sirona introduced the SureSmile Simulator, a software application embedded within its DS Core platform, aimed at visualizing a patient’s potential post-treatment smile under aligner-based orthodontics. This tool uses 3D modeling, AI-driven tooth segmentation, and automated simulation to help clinicians and patients review treatment expectations in under 5 minutes.

- In May 2023: 3M (Unitek Orthodontic Products) received FDA clearance for 3M Clarity Aligners (Force and Flex versions) under 510(k) regulation. This product is intended to be used for aligning teeth (malocclusion correction) as an aesthetic alternative to traditional brackets and wires. The clearance involves a simplification in the number of formulations of the aligner material—both Clarity Aligners-Force and Clarity Aligners-Flex will use the same base material but differ in flexibility.

Report Scope

Report Features Description Market Value (2024) US$ 4.77 Billion Forecast Revenue (2034) US$ 9.21 Billion CAGR (2025-2034) 6.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Fixed Braces, Removable Braces (Clear Aligners, Retainers), Accessories), By Material (Ceramic Braces, Metal Braces, Biocompatible/Polymer-based Braces), By Position (External Braces, Lingual Braces), By End-User (Children (6–12 years), Teenagers (13–19 years), Adults (Above 20 years)) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Align Technology, Straumann Group, Henry Schein, Dentsply Sirona, 3M Unitek, Envista Holdings Corporation, Institut Straumann AG, Dental Morelli, Ormco Corporation, American Orthodontics, DB Orthodontics, Patterson Dental, Zhejiang Protect Medical, Hangzhou Xingchen 3B Dental, Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Align Technology

- Straumann Group

- Henry Schein

- Dentsply Sirona

- 3M Unitek

- Envista Holdings Corporation

- Institut Straumann AG

- Dental Morelli

- Ormco Corporation

- American Orthodontics

- DB Orthodontics

- Patterson Dental

- Zhejiang Protect Medical

- Hangzhou Xingchen 3B Dental

- Other key players