Global Deep Hole Drilling Market Size, Share, And Business Benefits By Type (BTA Machines, Gun Drilling Machines, Skiving and Burnishing Machines), By Operation (CNC, Non-CNC), By End-user (Automotive, Oil and Gas, Medical, Construction and Mining, Energy, Aerospace, Military and Defense, Others), By Distribution Channel (Original Equipment Manufacturer (OEM), Aftermarket), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: August 2025

- Report ID: 154627

- Number of Pages: 329

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

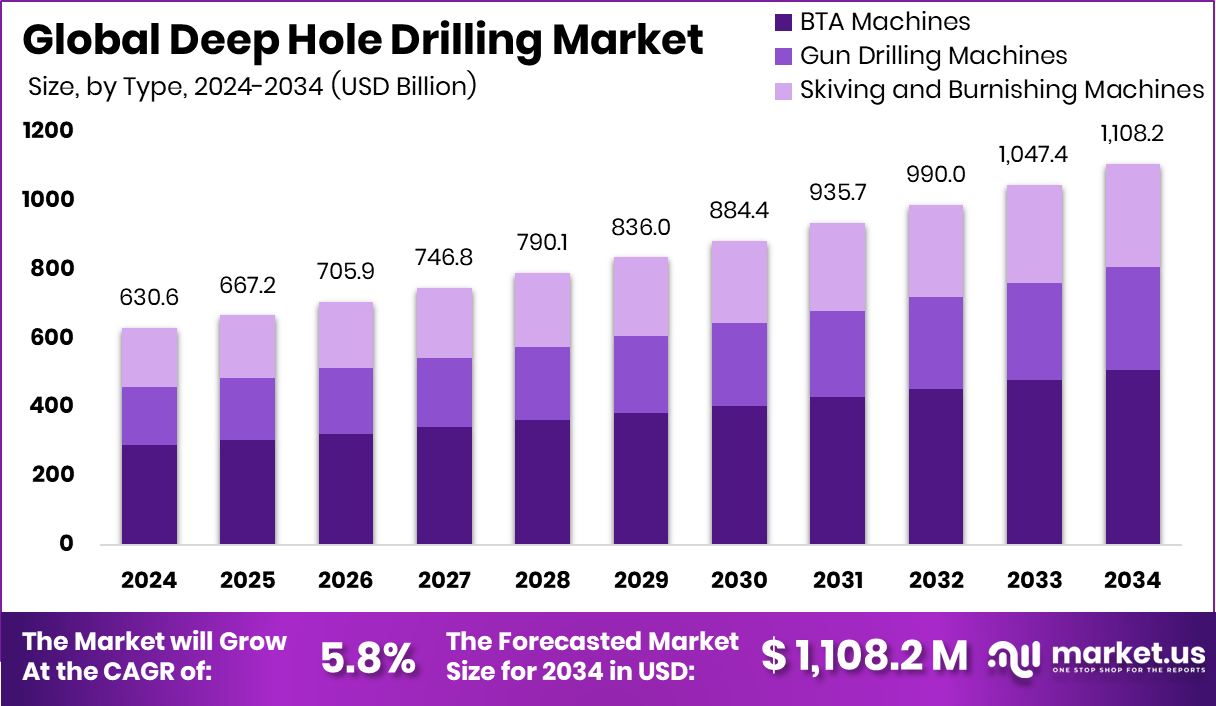

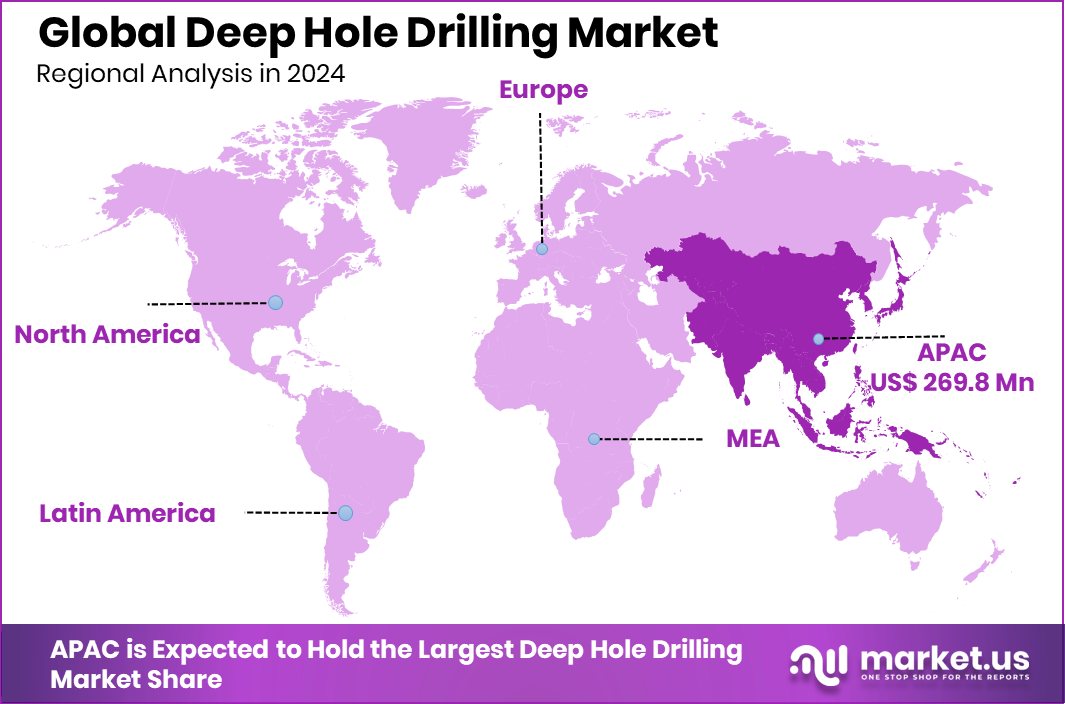

The Global Deep Hole Drilling Market is expected to be worth around USD 1,108.2 million by 2034, up from USD 630.6 million in 2024, and is projected to grow at a CAGR of 5.8% from 2025 to 2034. Strong manufacturing growth in Asia-Pacific supported its 42.80% market dominance this year.

Deep hole drilling is a specialized machining process used to create holes that are significantly deeper than their diameter, usually greater than ten times the diameter of the hole. This process requires highly precise tools and techniques to ensure accuracy, straightness, and smooth surface finish over extended depths. It is commonly used in manufacturing components such as crankshafts, hydraulic cylinders, fuel injectors, and molds, where traditional drilling methods are inadequate.

The deep hole drilling market comprises machinery, tools, and services involved in the precision drilling of deep and narrow holes for industrial use. This market serves critical sectors such as aerospace, automotive, oil & gas, medical devices, and energy. As manufacturers increasingly demand parts with complex geometries and deep bores, the need for deep hole drilling solutions continues to rise. According to the industry, Geothermal drilling automation firm Borobotics secures CHF 1.3 million in funding.

The growth of the deep hole drilling market is driven by increased demand for high-precision engineering components in sectors such as defense, heavy machinery, and energy infrastructure. These sectors require exacting specifications and deep hole machining for their core components, pushing manufacturers to adopt advanced drilling systems. Moreover, with industries focusing on reducing downtime and increasing productivity, there is a rising shift toward automated and high-speed deep hole drilling technologies. According to the industry, Western Mines receives $440 government grant to expand the oldfields drilling program.

The rising demand for complex machined parts used in aerospace, automotive, and oilfield equipment is fueling the need for deep hole drilling. Components such as engine blocks, fuel systems, and transmission systems often involve deep cavity structures that require precise internal machining. The trend toward miniaturization of parts with intricate internal features is also boosting the demand for specialized drilling methods, ensuring dimensional accuracy and surface integrity. According to the industry, Quaise, a geothermal startup, has raised $40 million for ultra-deep drilling efforts.

Key Takeaways

- The Global Deep Hole Drilling Market is expected to be worth around USD 1,108.2 million by 2034, up from USD 630.6 million in 2024, and is projected to grow at a CAGR of 5.8% from 2025 to 2034.

- In the Deep Hole Drilling Market, BTA machines account for a dominant 45.8% type-wise share.

- CNC operations lead the market with a 78.4% share, enabling precision and automation in deep drilling.

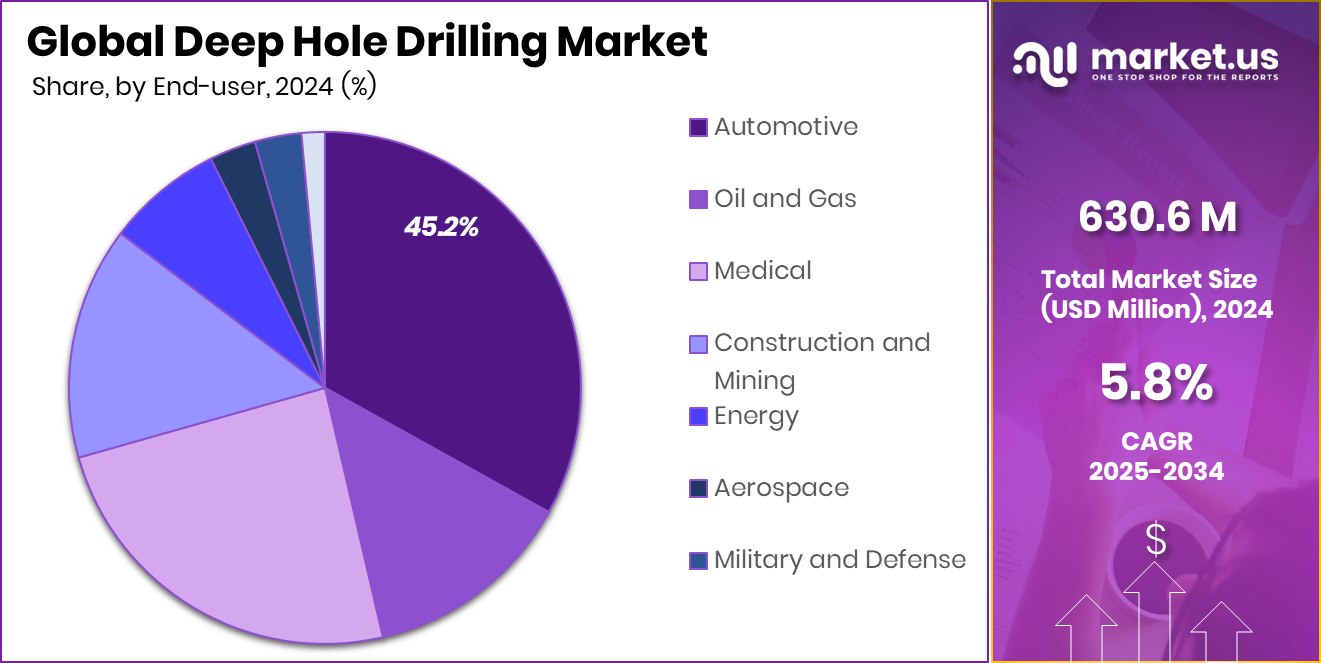

- The automotive sector dominates end-user demand, contributing a significant 45.2% share in 2024.

- OEM distribution channels hold a major 71.2% market share, reflecting direct demand from equipment manufacturers.

- The Asia-Pacific market reached a total value of USD 269.8 million in 2024.

By Type Analysis

BTA machines hold a 45.8% share in deep hole drilling.

In 2024, BTA Machines held a dominant market position in the By Type segment of the Deep Hole Drilling Market, with a 45.8% share. This dominance can be attributed to their high efficiency in producing deep bores with larger diameters, particularly in heavy-duty industrial applications.

BTA (Boring and Trepanning Association) machines are preferred for their superior chip evacuation, stability, and ability to handle longer drilling depths with minimal deviation. Their consistent performance in large-scale manufacturing, especially where deep and precise holes are critical, has positioned them as the most reliable solution among available drilling technologies.

The strong demand for BTA machines is further supported by industries such as oil & gas, heavy machinery, and energy equipment manufacturing, where robust and accurate deep drilling is essential. These machines offer a high level of productivity and surface finish, reducing secondary operations and overall production time.

Their compatibility with both CNC systems and large-scale workpieces makes them highly versatile across multiple industrial use cases. As a result, BTA machines have not only maintained their leadership in the market but also continue to see steady adoption in new and expanding production facilities globally. The 45.8% share reflects both their technological advantages and industry-wide acceptance.

By Operation Analysis

CNC operations dominate with 78.4% market share in 2024.

In 2024, CNC held a dominant market position in the By Operation segment of the Deep Hole Drilling Market, with a 78.4% share. This significant market share reflects the growing preference for computer numerical control systems in precision drilling operations. CNC deep hole drilling machines offer higher accuracy, repeatability, and process consistency compared to conventional methods, making them essential for industries requiring tight tolerances and complex geometries.

The dominance of CNC in this segment is largely driven by the demand for automation and higher throughput in modern manufacturing. These systems enable operators to control multiple drilling parameters with minimal manual intervention, leading to reduced cycle times and improved operational efficiency. Additionally, CNC machines support advanced features such as multi-axis control, real-time feedback, and integration with digital production systems, which are highly valued in precision-driven sectors.

Industries increasingly require deep hole drilling operations that can adapt to diverse materials and component sizes, and CNC machines meet this need with greater flexibility and ease of programming. The 78.4% market share indicates not only the technological edge of CNC systems but also their widespread adoption as a standard in high-precision, high-volume production environments across various industrial domains.

By End-user Analysis

The automotive sector contributes 45.2% to the deep hole drilling demand.

In 2024, Automotive held a dominant market position in the By End-user segment of the Deep Hole Drilling Market, with a 45.2% share. This strong presence is driven by the automotive industry’s continuous demand for precision components such as crankshafts, fuel injection systems, and transmission parts, all of which require deep hole drilling to meet exact dimensional and performance specifications.

The high-volume production environment in the automotive industry favors deep hole drilling solutions that can deliver speed, accuracy, and repeatability. Manufacturers are increasingly using automated deep hole drilling systems to maintain consistency in mass production while minimizing waste and downtime. The 45.2% share reflects how integral this machining process is within the automotive manufacturing chain.

Moreover, as vehicle platforms become more compact and performance-focused, there is greater emphasis on complex internal geometries in metal components. This has further reinforced the reliance on high-precision deep drilling technologies. The automotive sector’s substantial market share underscores its role as a key driver for the adoption and development of deep hole drilling solutions in 2024.

By Distribution Channel Analysis

OEM distribution accounts for 71.2% of market-wide equipment sales.

In 2024, Original Equipment Manufacturer (OEM) held a dominant market position in the By Distribution Channel segment of the Deep Hole Drilling Market, with a 71.2% share. This leadership is largely attributed to the direct integration of deep hole drilling equipment and systems into production lines by OEMs, who seek customized solutions tailored to their specific operational requirements.

The 71.2% market share reflects the growing reliance on OEM channels for precision equipment that aligns with in-house manufacturing processes. OEMs often prioritize performance consistency, machine longevity, and post-sale services, which are better addressed through direct engagement with equipment producers. This direct procurement model also allows for the implementation of tailored configurations and upgrades, enabling better control over quality standards and production efficiency.

Furthermore, OEM distribution supports seamless integration with advanced automation and digital control systems, which are increasingly important in high-precision machining environments. The strong preference for OEM channels underlines the importance of reliability, after-sales service, and technological compatibility in purchasing decisions.

Key Market Segments

By Type

- BTA Machines

- Gun Drilling Machines

- Skiving and Burnishing Machines

By Operation

- CNC

- Non-CNC

By End-user

- Automotive

- Oil and Gas

- Medical

- Construction and Mining

- Energy

- Aerospace

- Military and Defense

- Others

By Distribution Channel

- Original Equipment Manufacturer (OEM)

- Aftermarket

Driving Factors

Rising Demand for Precision in Metal Components

One of the main driving factors for the deep hole drilling market is the growing need for high-precision metal components across various industries. Sectors such as automotive, aerospace, energy, and medical devices require parts with accurate internal geometries and smooth finishes to ensure high performance, safety, and durability. Components like engine blocks, crankshafts, and fuel systems often involve deep, narrow holes that standard drilling methods cannot produce reliably.

Deep hole drilling technology helps achieve the required depth, straightness, and surface quality without compromising on structural integrity. As the demand for compact, high-efficiency, and lightweight parts increases globally, manufacturers are adopting deep hole drilling solutions to meet tight tolerances and improve production quality, driving steady growth in the market.

Restraining Factors

High Equipment Cost Limits Small Manufacturer Adoption

A key restraining factor for the deep hole drilling market is the high cost of advanced drilling machines and related equipment. These machines require specialized tools, high-precision controls, and automation features, which significantly increase their price. Small and medium-sized manufacturers often struggle to afford such investments, especially in regions with limited access to financing or technical support.

Additionally, maintenance costs and the need for skilled operators further add to the overall operational expense. This financial barrier restricts the widespread adoption of deep hole drilling technology in smaller workshops and emerging markets. As a result, the growth potential of the market may be slowed down by limited access among cost-sensitive users and businesses with low capital budgets.

Growth Opportunity

Expansion in the Developing Industry with Modernization

A significant growth opportunity for the deep hole drilling market lies in the modernization of manufacturing sectors across developing regions. Many industrial facilities in emerging markets are transitioning from traditional machining methods to modern, automated deep hole drilling systems. This shift is driven by the need to improve precision, increase throughput, and reduce waste in production processes.

As industries such as automotive, energy, and heavy machinery seek better quality and efficiency, they are investing in equipment capable of handling complex deep drilling tasks with minimal error. Additionally, government initiatives supporting industrial innovation and digital transformation further accelerate equipment adoption. By targeting these regions with tailored solutions, training support, and financing options, deep hole drilling technology providers can tap into new demand and foster long-term market growth.

Latest Trends

Increasing Use of Smart Drilling with Sensors and IoT

A notable trend in the deep hole drilling market is the rising adoption of smart drilling systems equipped with sensors and IoT connectivity. These advanced machines can monitor temperature, vibration, tool wear, and cutting forces in real time, allowing operators to adjust settings on the fly and prevent tool breakage or product defects. Insight from data analytics ensures greater accuracy and consistency while reducing downtime and scrap rates.

With IoT-enabled systems, maintenance can be predictive rather than reactive, improving overall machine uptime. This shift toward connected, data-driven drilling solutions helps manufacturers better manage the entire deep hole drilling process. The trend supports enhanced productivity, cost savings, and higher product quality, aligning well with the goals of modern smart factories.

Regional Analysis

In 2024, the Asia-Pacific led the deep hole drilling market with a 42.80% share.

In 2024, Asia-Pacific emerged as the dominant region in the Deep Hole Drilling Market, accounting for 42.80% of the global share, valued at USD 269.8 million. The region’s leadership is driven by the strong presence of manufacturing hubs and ongoing industrial expansion in countries such as China, India, South Korea, and Japan.

Rapid growth in automotive, aerospace, and heavy machinery production has increased the demand for precision machining technologies, including deep hole drilling systems. Asia-Pacific’s cost-effective labor force, favorable government policies, and infrastructure development have further supported the uptake of advanced drilling equipment across various industries.

In comparison, North America and Europe are established markets with steady adoption rates, benefiting from mature automotive and aerospace sectors that consistently require high-precision components. The Middle East & Africa region is gradually incorporating deep hole drilling technologies, particularly in energy-related applications such as oilfield equipment and pipeline components.

Latin America, while holding a smaller share, shows gradual progress as industrial activities expand and manufacturing practices modernize. Although these regions contribute to the overall market landscape, Asia-Pacific maintains a clear lead both in terms of revenue and technological adoption.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Entrust Manufacturing Technologies, Inc. is expected to present advanced deep hole drilling solutions with an emphasis on precision engineering. The company’s product portfolio appears to focus on delivering reliable machine performance and high accuracy, aimed at industries that require deep bore machining capabilities and consistent quality control. Easy integration into existing production systems further enhances its appeal among manufacturing users.

HONG JI Precision Machinery Ltd. is recognized for its specialization in precision mechanical components and drilling equipment. Its reputation is built on combining machine robusticity and effective chip evacuation in high‑depth drilling applications. The firm’s emphasis on machine stability and flexibility positions it as a dependable option for sectors demanding long‑reach drilling with minimal deviation and sustained productivity.

Dsgundrill is noted for offering modular deep hole drilling systems adaptable to a range of bore diameters. Its solutions seem to balance portability with high drilling precision, making its equipment suitable for both workshop and on‑site industrial environments. The company’s focus on user‑friendly setups and consistent surface finish quality supports effective deployment across diverse industrial use cases.

Mollart Engineering Limited is acknowledged for its expertise in deep hole drilling machinery engineered for demanding manufacturing contexts. It appears to deliver high‑accuracy systems capable of handling extended drilling depths while maintaining tight tolerances. The vendor’s commitment to durability and repeatable performance renders its machines well suited to industries where deep bore precision is mission‑critical.

Top Key Players in the Market

- Entrust Manufacturing Technologies, Inc

- HONG JI Precision Machinery Ltd.

- Dsgundrill

- Mollart Engineering Limited

- TBT Tiefbohrtechnik GmbH + Co.

- TIBO Tiefbohrtechnik GmbH

- Cheto Corporation S.A.

- Galbiati Costruzioni Meccaniche S.r.l.

- Loch Präzisions Bohrtechnik GmbH

Recent Developments

- In April 2024, Century Tool (part of Tooling Tech Group) invested in the Cheto IXN 3000, a 7‑axis CNC machine combining deep hole drilling and milling. The machine offers up to 6,000 rpm, 60,000‑pound capacity, and drilling depths up to 98 inches. It supports long unattended operation and tool wear monitoring, boosting productivity for mold-making applications.

- In March 2024, TBT released new single-lip and double-lip drill tools featuring refined cutting-edge geometry designed to improve bore quality and process reliability. These tools support higher feed speeds—up to five times compared with conventional carbide drills—and are tailored for demanding deep-hole applications requiring concentricity and smooth finishes.

Report Scope

Report Features Description Market Value (2024) USD 630.6 Million Forecast Revenue (2034) USD 1,108.2 Million CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (BTA Machines, Gun Drilling Machines, Skiving and Burnishing Machines), By Operation (CNC, Non-CNC), By End-user (Automotive, Oil and Gas, Medical, Construction and Mining, Energy, Aerospace, Military and Defense, Others), By Distribution Channel (Original Equipment Manufacturer (OEM), Aftermarket) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Entrust Manufacturing Technologies, Inc, HONG JI Precision Machinery Ltd., Dsgundrill, Mollart Engineering Limited, TBT Tiefbohrtechnik GmbH + Co., TIBO Tiefbohrtechnik GmbH, Cheto Corporation S.A., Galbiati Costruzioni Meccaniche S.r.l., Loch Präzisions Bohrtechnik GmbH Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Deep Hole Drilling MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

Deep Hole Drilling MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Entrust Manufacturing Technologies, Inc

- HONG JI Precision Machinery Ltd.

- Dsgundrill

- Mollart Engineering Limited

- TBT Tiefbohrtechnik GmbH + Co.

- TIBO Tiefbohrtechnik GmbH

- Cheto Corporation S.A.

- Galbiati Costruzioni Meccaniche S.r.l.

- Loch Präzisions Bohrtechnik GmbH