Global Decorative Concrete Market Size, Share Analysis Report By Type (Stamped Concrete, Stained Concrete, Concrete Overlays, Colored Concrete, Polished Concrete, Ероху Concrete, Others), By Application (Floors, Walls, Driveways And sidewalks, Patios, Pool decks, Others), By End-Use (Residential, Non-residential) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 159781

- Number of Pages: 316

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

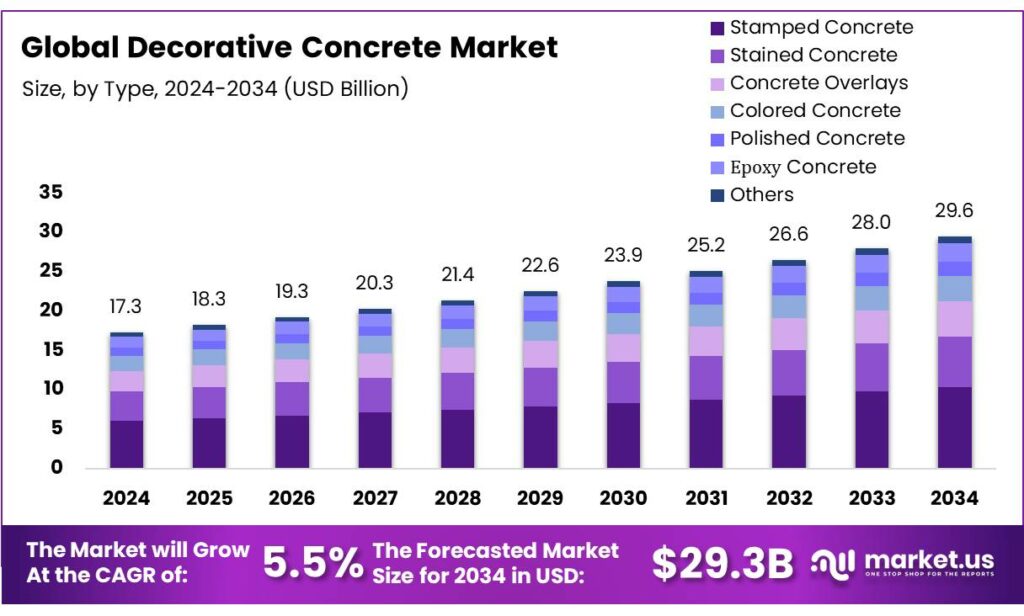

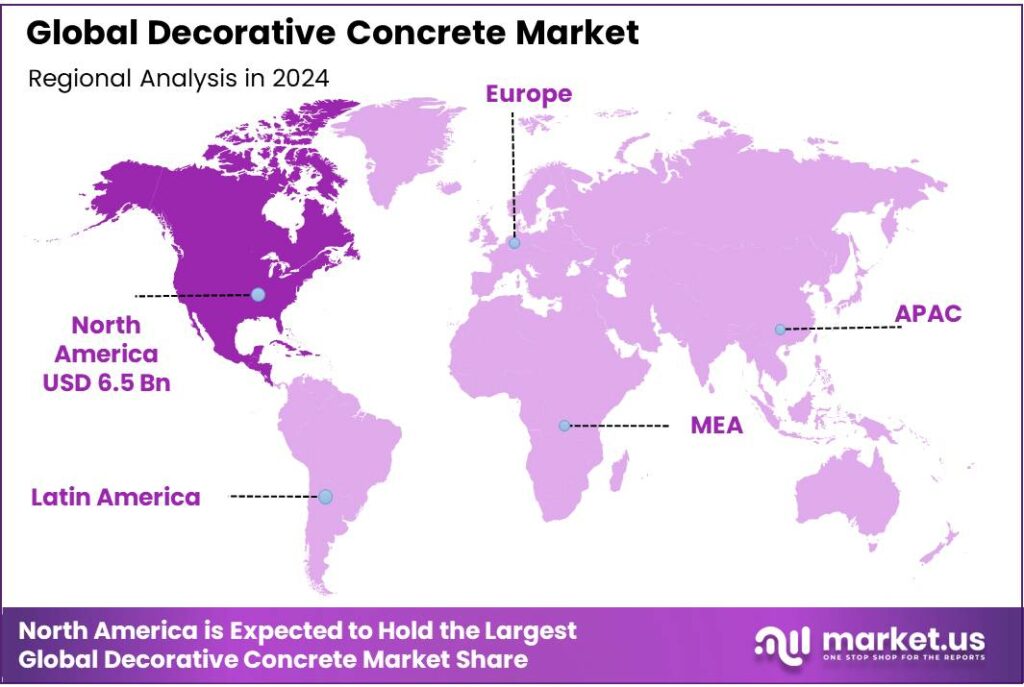

The Global Decorative Concrete Market size is expected to be worth around USD 29.6 Billion by 2034, from USD 17.3 Billion in 2024, growing at a CAGR of 5.5% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 37.80% share, holding USD 6.5 Billion in revenue.

Decorative concrete refers to concrete that is placed, finished, or treated to achieve specific visual effects—such as integral color, stains, polished and exposed surfaces, stamped or embossed textures, thin overlays, and seeded aggregates—while still delivering structural performance. Technical guidance from the American Concrete Institute (ACI 310R-19) codifies these methods for cast-in-place flatwork and overlays, linking aesthetics to specifications for mix design, curing, sealing, and long-term protection in pedestrian and vehicular environments.

Industrial demand is rooted in broader cement and construction activity. In the United States, the U.S. Geological Survey reported 2022 portland cement output at ~92 million metric tons across 96 plants—an indicator of the base material available for architectural and hardscape applications such as plazas, streetscapes, retail shells, and hospitality floors where decorative finishes are specified. At the same time, sustainability pressures are reshaping specifications: the IEA notes that the cement sector’s direct CO₂ intensity was roughly flat and even ticked up ~1% in 2022, whereas a ~4% annual decline to 2030 is required to align with net-zero pathways.

Government programs are a major driver of installed decorative concrete in public realm projects (streets, transit forecourts, waterfronts, parks) and institutional buildings. In the U.S., the Bipartisan Infrastructure Law authorizes roughly $1.2 trillion in infrastructure spending, including $550 billion in new funding, which is flowing into roads, sidewalks, stations, and civic plazas where stamped, colored, and exposed-aggregate concrete improves durability and wayfinding. In the European Union, the Renovation Wave targets the upgrade of 35 million buildings by 2030, a scale that favors interior polished/terrazzo-like concrete and low-maintenance exterior flatwork in courtyards and pedestrian zones.

Key Takeaways

- Decorative Concrete Market size is expected to be worth around USD 29.6 Billion by 2034, from USD 17.3 Billion in 2024, growing at a CAGR of 5.5%.

- Stamped Concrete held a dominant market position, capturing more than a 34.9% share of the decorative concrete market.

- Floors held a dominant market position, capturing more than a 32.2% share of the decorative concrete market.

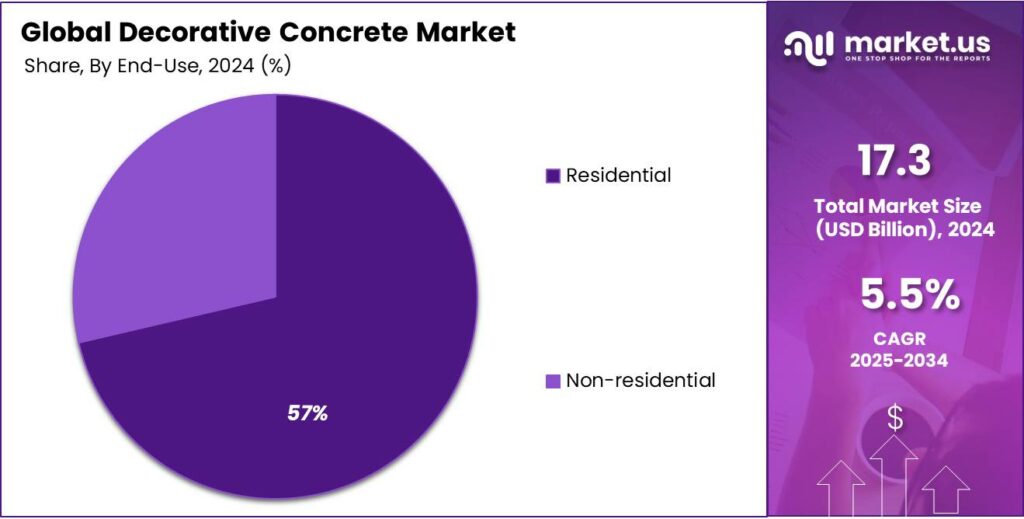

- Residential held a dominant market position, capturing more than a 57.3% share of the decorative concrete market.

- In North America, the decorative concrete market held a commanding position in 2024, representing approximately 37.80% of the global market, with market value close to USD 6.5 billion.

By Type Analysis

Stamped Concrete captures over 34.9% share in 2024, leading the decorative concrete types

In 2024, Stamped Concrete held a dominant market position, capturing more than a 34.9% share of the decorative concrete market by type. This leadership is tied to its ability to mimic premium materials such as stone, brick, or tile at significantly lower costs, which has made it a preferred choice in both new construction and renovation projects. Its use in driveways, patios, sidewalks, and pool decks has particularly supported this strong share.

The expectations are that Stamped Concrete will maintain its leading position. Its share is projected to remain around or slightly above the mid-30% range, owing to sustained demand in residential outdoor living spaces and increased infrastructure and public space projects where aesthetic surface finishes are required. The segment is also benefiting from innovations in stamping tools, digital patterning, and more durable sealing systems.

By Application Analysis

Floors lead decorative concrete applications with 32.2% share in 2024

In 2024, Floors held a dominant market position, capturing more than a 32.2% share of the decorative concrete market by application. The segment’s strength was driven by the rising use of decorative finishes in residential, commercial, and industrial flooring, where durability and low maintenance are paired with aesthetic appeal. Polished, stamped, and stained floor systems have gained widespread adoption in malls, offices, educational institutions, and modern housing projects due to their ability to replicate high-end finishes at a fraction of the cost.

Looking ahead, 2025 is expected to sustain this dominance, with Floors projected to maintain or slightly increase their share as demand for stylish yet durable flooring expands. Advancements in eco-friendly concrete mixes and sealants, as well as wider acceptance of sustainable building practices, are also expected to support segment growth.

By End-Use Analysis

Residential dominates decorative concrete end-use with 57.3% share in 2024

In 2024, Residential held a dominant market position, capturing more than a 57.3% share of the decorative concrete market by end user. This leadership was supported by strong demand in home construction and renovation projects, where decorative finishes such as stamped driveways, polished floors, colored patios, and textured pool decks have become increasingly popular. Homeowners are opting for decorative concrete due to its ability to combine durability with aesthetic appeal, offering a cost-effective alternative to natural stone, tile, or wood.

The residential segment is expected to maintain its leading position, with demand supported by ongoing urbanization, housing construction, and remodeling activities. Decorative concrete’s adaptability to modern interior and exterior design preferences will continue to fuel its adoption, ensuring that the residential end-user category remains the backbone of the market.

Key Market Segments

By Type

- Stamped Concrete

- Stained Concrete

- Concrete Overlays

- Colored Concrete

- Polished Concrete

- Ероху Concrete

- Others

By Application

- Floors

- Walls

- Driveways & sidewalks

- Patios

- Pool decks

- Others

By End-Use

- Residential

- Non-residential

Emerging Trends

Integration of Anti‑microbial & Self‑Sanitizing Decorative Concrete Systems

One of the most cutting‑edge trends sweeping the decorative concrete space—especially in food processing —is the development and adoption of anti‑microbial, self‑sanitizing, or “smart” decorative concrete coatings. These are no longer just about aesthetics; the technology is evolving so that the surface itself helps in maintaining hygiene without constant chemical intervention.

In food processing plants, hygiene is mission critical. Floors, walls, and drain channels need to resist bacterial growth, moisture, chemical washdowns, and residue. Traditional coatings (plain epoxy, sealed concrete) have limits—microcracks, delamination, or porosity can become breeding grounds. The new wave is to embed anti-microbial agents (like silver ions, quaternary ammonium compounds, photocatalytic nanoparticles) into decorative concrete overlays or coatings so that microbes are inhibited continuously.

In practice, companies are now advertising ≥ 99.9 % bacterial reduction on surfaces treated with antimicrobial decorative overlays under controlled conditions. While that figure is often cited in promotional literature, its presence indicates how aggressively the industry is pushing this direction (for example, coatings vendors boast such effectiveness).

Under government backing, schemes like PLISFPI (Production Linked Incentive Scheme for Food Processing Industries) have supported 171 food processing companies so far, disbursing incentives of ₹1,155.296 crore, with over 2.89 lakh jobs generated. When government or export programs raise quality expectations, they indirectly push demand for advanced floor systems, including antimicrobial decorative concrete.

Drivers

Rising Hygiene & Sanitary Standards in Food & Beverage Facilities

One of the strongest growth engines behind the decorative concrete market is the increasing demand for USDA‑compliant / food‑grade concrete flooring systems in food processing and beverage facilities. As food safety regulations tighten, especially in the United States and other developed markets, operators are compelled to adopt floor surfaces that are seamless, nonporous, resistant to moisture, and easy to sanitize.

For instance, USDA’s sanitation performance standards require floors in meat and poultry plants to be built of durable materials impervious to moisture, and be cleaned and sanitized as necessary to prevent adulteration of product. Concrete surfaces with decorative coatings or overlays are often engineered to meet exactly these requirements—they are seamless (no grout lines), crack‑resistant, and engineered to resist chemical cleaning agents and microbial growth.

Decorative concrete systems—such as urethane concrete overlays, epoxy-modified concrete, or polished decorative concrete with antimicrobial additives—fit this bill better than conventional concrete or tile in many cases.

Surfaces Solutions, a coatings provider, notes that urethane concrete is a preferred option in food and beverage plants because it resists abrasion, chemical attack, and microbial growth, while remaining moisture‑impervious and easy to clean. In many installations, the antimicrobial additives in the decorative concrete tops can reduce viable bacteria counts by up to 99.9 % on the surface.

Restraints

High Upfront & Lifecycle Cost Burden on Food Facilities

Even though decorative concrete systems offer aesthetic appeal and functional benefits, one of the strongest restraints hampering their wider adoption—especially in the food and beverage sector—is the high upfront and lifecycle cost burden. For many food plants, the long‑term savings may not justify the heavy capital outlay or risk of maintenance over time.

In food processing operations, flooring is not just a cosmetic surface—it must endure constant washdowns, caustic chemicals, thermal shock (hot water, steam, cold zones), heavy loads, and regulatory hygiene demands. A decorative concrete overlay or coating system must be robust enough to resist cracking, delamination, or damage under those conditions. But ensuring that level of durability demands more expensive materials, thicker overlays, specialized surface prep, and often more labor-intensive installation.

- To put some numbers to it: in industrial plants, resinous floor covering or high-performance coatings can cost between USD 3,500 and USD 18,000 per project in U.S. food processing settings. Also, failures due to moisture or poor preparation lead to rework or replacement costs. StandardPoly notes that moisture vapor emission through concrete must not exceed 3 lb per 1,000 ft² per 24 h (as per ASTM F 1869) or relative humidity inside a slab should remain under 75% (ASTM F 2170) to avoid coating failures.

This cost burden includes not just materials, but labor (surface prep, grinding, shot blasting, curing time), downtime for production, warranty commitments, and periodic maintenance or repair. For many food plants—especially in developing economies or smaller scale operations—the capital capacity to absorb such investment is limited. When margins are already tight, management often opts for lower‑cost flooring alternatives (such as ceramic tile, sealed plain concrete, or vinyl systems), even at the expense of some durability or hygiene advantages.

Opportunity

Expansion of Food Processing Infrastructure in Emerging Markets

One of the biggest growth levers for decorative concrete lies in the rapid expansion of food processing infrastructure, especially in emerging economies such as India. As more food processing plants, cold‑chain facilities, and food parks are built or upgraded, there is a strong opportunity for decorative concrete systems to be specified in these projects—because they can combine functionality (hygiene, durability) with aesthetics (clean, modern floors and walls).

In India, for example, the government has committed to pushing the food processing sector aggressively. The infrastructure and investment support program under the Ministry of Food Processing reports that agriculture & processed food exports reached about USD 49.4 billion in FY 2024‑25, and that processed food exports now account for 20.4 % of agricultural exports. Also, among registered food processing units, about 2.23 million workers are employed according to the Annual Survey of Industries 2022‑23. These numbers show how large, how rapidly the food processing field is scaling—and new plants need better building materials, including advanced flooring and wall finishes.

- According to IBEF, the sector is estimated to reach USD 1,274 billion by 2027 (from USD 866 billion in 2022) under current growth trajectories. As this expansion happens, many new processing units, packaging facilities, cold storages, and logistics hubs will be constructed. That offers a runway for decorative concrete vendors to propose solutions that are hygienic, durable, seamless, and visually appealing.

Regional Insights

North America leads with ~37.80% share, approx. USD 6.5 Billion in market value

In North America, the decorative concrete market held a commanding position in 2024, representing approximately 37.80% of the global market, with market value close to USD 6.5 billion. This dominance is grounded in mature construction sectors in the United States and Canada, high disposable incomes, rising home-improvement trends, and strict regulatory requirements for durability and aesthetics in both residential and non-residential buildings.

Driving factors include strong demand for stamped concrete in outdoor applications, polished concrete in commercial interiors, and overlays and staining in residential renovations. The flourishing demand is especially noticeable in major U.S. states with significant single-family home construction and in urban centres with renovation and commercial fit-out activity. Infrastructure investment and public space beautification programs also contribute, as municipalities specify decorative concrete in sidewalks, plazas, and other pedestrian areas.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Sika AG, headquartered in Switzerland, is a global leader in specialty chemicals with a strong presence in decorative concrete solutions, including admixtures, sealants, and surface finishes. The company has expanded its decorative offerings through acquisitions and product innovations aimed at durable and aesthetic flooring systems. In 2024, Sika reported sales of CHF 11.2 billion, with construction chemicals being the core revenue driver. Its emphasis on sustainability and low-carbon concrete technologies strengthens its competitive position in decorative applications.

HeidelbergCement AG, based in Germany, is one of the world’s largest integrated suppliers of building materials, with significant influence in decorative concrete through its cement, aggregates, and ready-mix concrete operations. In 2024, the company generated revenues exceeding EUR 21 billion, supported by steady construction demand. Decorative concrete applications are advanced via its ready-mix segment, which provides colored, textured, and specialty finishes. With sustainability commitments, including carbon neutrality by 2050, HeidelbergCement is investing in low-emission decorative solutions for urban and residential markets.

Boral Limited, headquartered in Australia, is a significant producer of construction materials, with decorative concrete forming an essential part of its product mix. The company supplies colored, polished, and patterned concrete across residential and infrastructure applications. In FY2024, Boral reported AUD 3.8 billion in revenue, with strong demand from urban housing and government infrastructure works. Its investment in advanced admixtures and eco-friendly concrete technologies positions Boral competitively, as the company leverages sustainability and aesthetic innovation to drive adoption in decorative surfaces.

Top Key Players Outlook

- Sika AG

- HeidelbergCement AG

- LafargeHolcim Ltd

- Boral Limited

- Bomanite India

- BASF SE

- Mcknight Custom Concrete, Inc.

- Deco-Crete, LLC

- Seacoast Concrete

- ARDEX

Recent Industry Developments

In 2024, Sika achieved net sales of CHF 11,763.1 million (up 4.7 % over 2023) and EBITDA of CHF 2,269.5 million (an 11.0 % increase) with an EBITDA margin of 19.3 %.

In 2024, Boral Limited, an Australian building and construction materials company, reported a revenue of AUD 3.46 billion (approximately USD 2.29 billion), marking a 17.1% increase from the previous year.

Report Scope

Report Features Description Market Value (2024) USD 17.3 Bn Forecast Revenue (2034) USD 29.6 Bn CAGR (2025-2034) 5.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Stamped Concrete, Stained Concrete, Concrete Overlays, Colored Concrete, Polished Concrete, Ероху Concrete, Others), By Application (Floors, Walls, Driveways And sidewalks, Patios, Pool decks, Others), By End-Use (Residential, Non-residential) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Sika AG, HeidelbergCement AG, LafargeHolcim Ltd, Boral Limited, Bomanite India, BASF SE, Mcknight Custom Concrete, Inc., Deco-Crete, LLC, Seacoast Concrete, ARDEX Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Sika AG

- HeidelbergCement AG

- LafargeHolcim Ltd

- Boral Limited

- Bomanite India

- BASF SE

- Mcknight Custom Concrete, Inc.

- Deco-Crete, LLC

- Seacoast Concrete

- ARDEX